Abstract:This in-depth overview will conduct a thorough Uniglobe Markets regulatory status and financial authority check. By dissecting data from regulatory bodies, corporate registries, and user-reported experiences, we will provide a clear, data-driven analysis of the protections—or lack thereof—afforded to clients. The central question we aim to answer is whether Uniglobe Markets meets the stringent safety standards required by serious, long-term traders.

For experienced traders, the process of selecting a broker extends far beyond a simple comparison of spreads and leverage. The foundational pillar of a long-term trading relationship is trust, which is built upon verifiable regulatory oversight and a demonstrable commitment to client fund security. Uniglobe Markets, a broker with an operational history spanning over five years, presents itself with a suite of attractive features, including multiple account types and access to the popular MetaTrader platforms. However, a professional assessment demands a rigorous examination of its corporate structure and, most critically, its regulatory credentials.

This in-depth overview will conduct a thorough Uniglobe Markets regulatory status and financial authority check. By dissecting data from regulatory bodies, corporate registries, and user-reported experiences, we will provide a clear, data-driven analysis of the protections—or lack thereof—afforded to clients. The central question we aim to answer is whether Uniglobe Markets meets the stringent safety standards required by serious, long-term traders.

Uniglobe Markets: A Façade of International Presence

At first glance, Uniglobe Markets projects the image of an established international brokerage. With a history dating back to 2014, it offers a wide spectrum of trading accounts, from Micro and ECN variants to VIP tiers, suggesting a capacity to cater to diverse trader profiles. The provision of maximum leverage up to 1:500 and a minimum deposit of $100 are common features designed to attract a broad client base, from beginners to seasoned professionals.

The brokers digital footprint further complicates its identity. WikiFX data indicates its “Registered Region” as the United Kingdom, a detail that might imply a connection to one of the world's most respected financial hubs. However, the official contact address listed is on the ground floor of The Sotheby Building in Rodney Bay, Saint Lucia—an offshore jurisdiction known for its significantly lighter regulatory touch.

This immediate discrepancy between a claimed UK registration and an operational base in the Caribbean is a classic red flag that warrants deeper investigation. For any experienced trader, such inconsistencies in a broker's foundational identity are the first signal that a more granular due diligence process is not just recommended, but essential.

The Core Issue: A Verifiable Lack of Valid Regulation

The single most critical factor in evaluating a broker's trustworthiness is its regulatory status. Reputable brokers are authorized and supervised by stringent financial authorities in the jurisdictions where they operate. This oversight compels them to adhere to strict standards regarding capital adequacy, client fund segregation, and fair business practices.

Our comprehensive Uniglobe Markets regulation and license overview reveals a deeply concerning reality: the broker currently holds no valid financial services regulation from any credible authority.

WikiFX, a global broker regulation inquiry platform, states this unequivocally: “It has been verified that this broker currently has no valid forex regulation. Please be aware of the risk!” The platform assigns Uniglobe Markets an extremely low score and issues a stark warning to “please stay away,” categorizing its license status as “Suspicious” and the overall risk as “High.”

Let's deconstruct the misleading elements of its corporate presentation:

1. The Misleading UK Connection: While the brokers profile may mention the United Kingdom, this appears to be a superficial link. A UK company registration (via Companies House) is a simple administrative process and is fundamentally different from being authorized and regulated by the Financial Conduct Authority (FCA). The FCA is the body that grants licenses for financial services, and Uniglobe Markets does not possess one.

2. The Offshore Base in Saint Lucia: Operating from Saint Lucia places the broker outside the purview of Tier-1 regulators. While some offshore regulators exist, their oversight, enforcement capabilities, and requirements for client protection are vastly inferior to those of the FCA (UK), CySEC (Cyprus), or ASIC (Australia). Furthermore, investigations by other third-party review sites have failed to find any record of Uniglobe Markets or its parent company being registered with the Financial Services Regulatory Authority (FSRA) of Saint Lucia, casting doubt on even this minimal level of claimed legitimacy.

3. The Deregistered Corporate Entity: Perhaps the most damning piece of evidence is the status of its associated company. WikiFX data links Uniglobe Markets' MT5 servers to a UK-based entity named UNI SMART SOLUTIONS LTD (Registration No. 13579888). A check of this company reveals its status as “Deregistered.” This means the legal entity tied to its trading infrastructure is officially defunct. Operating a financial service through a dissolved company is an alarming and unacceptable business practice that exposes clients to immense counterparty risk.

Corroborating Evidence: Warnings from Global Financial Authorities

The lack of regulation is not merely a passive finding; it has been actively confirmed by warnings from two major European financial watchdogs that have identified Uniglobe Markets as an unauthorized entity targeting their residents.

Financial Conduct Authority (FCA) Warning

On February 21, 2024, the UK's Financial Conduct Authority (FCA) issued a public warning against Uniglobe Markets. The regulator stated that the firm “may be providing financial services or products in the UK without our authorisation.” The FCAs warning is a direct and official refutation of any legitimacy the broker might try to imply through its supposed UK connection. It serves as a clear instruction to UK residents to avoid dealing with the firm entirely.

Cyprus Securities and Exchange Commission (CySEC) Warning

Similarly, on October 26, 2023, the Cyprus Securities and Exchange Commission (CySEC) added Uniglobe Markets to its list of non-authorized websites. CySEC warned investors that the company is not permitted to provide investment services in the country. This warning is particularly significant given that WikiFX data identifies Cyprus as one of the top countries from which Uniglobe Markets' website receives traffic. This suggests the broker is actively soliciting clients in a jurisdiction where it has been explicitly blacklisted by the national regulator.

These official warnings from Tier-1 regulators transform the assessment of Uniglobe Markets from one of caution to one of outright alarm. It is no longer a matter of weak regulation, but of a firm actively operating in defiance of established financial laws.

What “Unregulated” Means for Trader Protection

For a trader, the term “unregulated” is not an abstract concept; it translates into a tangible and total loss of the safety nets that are standard in the industry. With Uniglobe Markets, traders are exposed to the following risks:

• No Segregation of Client Funds: Regulated brokers are legally required to hold client deposits in segregated bank accounts, separate from the firm's operational capital. This ensures that in the event of the broker's insolvency, client money is protected and can be returned. An unregulated broker like Uniglobe Markets has no such obligation. Client funds can be mixed with company funds to pay for business expenses, or simply vanish, with no legal protection framework for the client.

• No Access to Investor Compensation Schemes: Traders who use brokers regulated in jurisdictions like the UK or Cyprus are protected by investor compensation schemes (e.g., the FSCS or ICF). These schemes can compensate clients up to a certain limit if their broker becomes insolvent. With Uniglobe Markets, no such safety net exists. If the broker fails or disappears, client capital is gone for good.

• No Independent Dispute Resolution: If a dispute arises over pricing, execution, or a withdrawal request, traders with regulated brokers can turn to an independent financial ombudsman service. This provides a fair and impartial avenue for resolving conflicts. With an unregulated entity, the broker itself is the judge, jury, and executioner. There is no higher authority to appeal to, leaving the trader with no leverage.

• No Negative Balance Protection: While not universal, many reputable regulators mandate negative balance protection, ensuring that a trader cannot lose more than their account balance. Offshore brokers often do not provide this, exposing traders to the theoretical risk of owing money to the broker after a volatile market event.

A Pattern of User Complaints: The Inevitable Consequence

The predictable result of a complete lack of regulatory oversight and accountability is a poor client experience, particularly when it comes to the most critical function: accessing funds. The “Exposure” section on Uniglobe Markets' profile paints a grim and consistent picture of client grievances.

Multiple reports from traders across different countries (Taiwan, Bangladesh, Pakistan) detail a recurring theme: the inability to withdraw funds. Users describe depositing money, sometimes trading profitably, and then finding their withdrawal requests ignored or indefinitely delayed. Customer service, which may be responsive during the deposit phase, reportedly becomes unreachable once a withdrawal is requested.

One particularly troubling report comes from an Introducing Broker (IB) in Pakistan who claims to have brought over 1,300 clients to the platform, only to have their IB account blocked without reason. This suggests a predatory business model aimed at confiscating funds from both clients and business partners once a certain threshold is reached.

While a single positive review from an IB in India is noted, it stands as a stark outlier against a significant volume of serious, consistent, and verifiable complaints centered on the denial of withdrawals. The pattern of grievances, particularly concerning withdrawals and account access, is extensively documented. Experienced traders can visit WikiFX to review the detailed exposure reports and assess the consistency of these complaints for themselves.

Analyzing the Trading Infrastructure: A Deceptive Polish

Proponents of the broker might point to its use of a “Full License MT5” as a sign of legitimacy. It is true that acquiring a full MetaTrader license requires a financial investment and a degree of technical setup. However, it is crucial for traders to understand what this license represents.

A MetaTrader license is a software license from MetaQuotes Software Corp. It is not a financial services license from a government regulator. It signifies that the broker has paid for the platform, but it offers zero assurance regarding the broker's business ethics, financial stability, or handling of client funds. In this case, it is merely a tool used by an unregulated entity. The fact that the MT5 servers are linked back to the deregistered UK company, UNI SMART SOLUTIONS LTD, further undermines any confidence this technical aspect might have inspired.

Conclusion: An Unacceptable Risk for Long-Term Traders

After a thorough Uniglobe Markets regulation and license overview, the conclusion is unambiguous. This broker represents an unacceptably high-risk proposition for any trader who values their capitals safety.

The evidence is overwhelming and points in a single direction:

• Zero Valid Regulation: The broker is not authorized by any credible financial authority.

• Official Regulatory Warnings: It has been publicly blacklisted by the FCA in the UK and CySEC in Cyprus for operating illegally.

• Opaque and Defunct Corporate Structure: It operates through a deregistered UK company, a clear sign of a deceptive and unstable foundation.

• Consistent History of Withdrawal Issues: A significant volume of user complaints corroborates the risks, highlighting a pattern of clients being unable to access their funds.

For the experienced trader, the decision is clear. The attractive leverage and account variety are nothing more than a veneer for a high-risk operation. The fundamental pillars of trust—regulation, transparency, and fund security—are completely absent. Engaging with Uniglobe Markets is not trading; it is gambling on the hope that an unregulated, blacklisted entity will honor a withdrawal request, a gamble that data suggests is heavily stacked against the client.

Given the multitude of red flags—from regulatory warnings to a defunct corporate entity—traders must exercise extreme caution. Before committing funds to any broker, and especially one with a profile like this, it is crucial to consult independent verification platforms; for example, cautious readers can check WikiFX to get a structured overview of a broker's regulatory status, operational history, and verified user feedback. In the world of forex and CFD trading, long-term success is built on managing risks, and the first and most important risk to eliminate is that of a predatory broker.

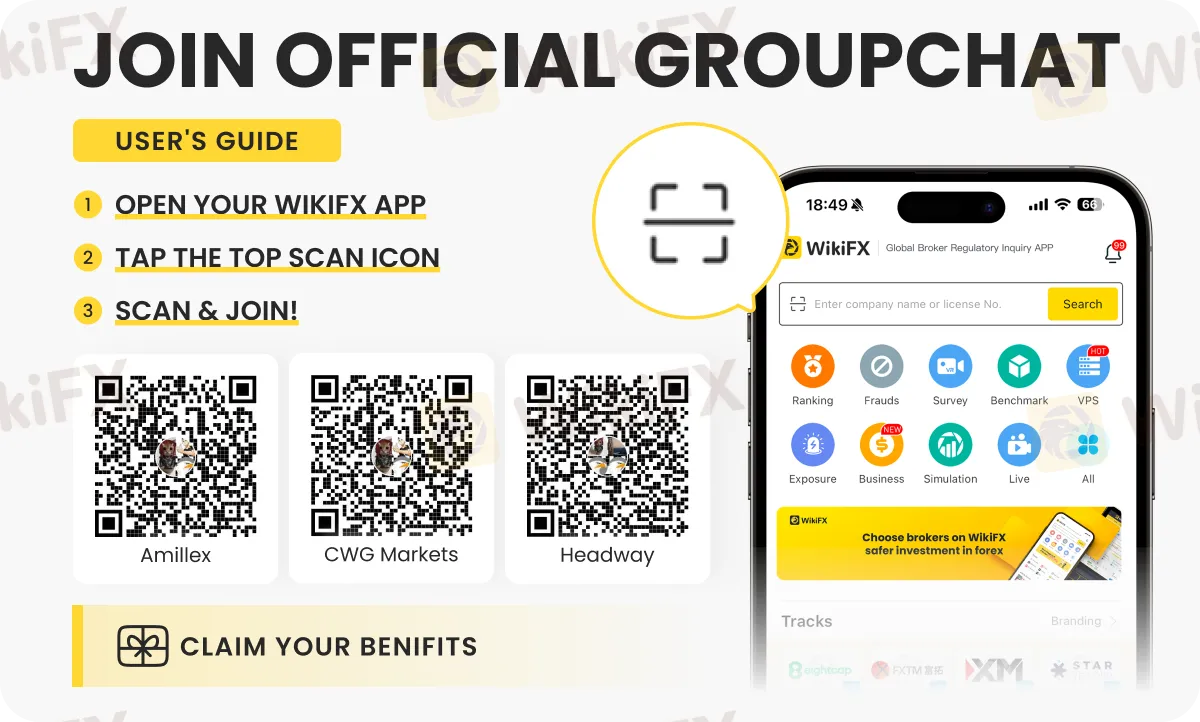

Check the latest forex updates on any of these special chat groups (OIFSYYXKC3, 403M82PDMX or W2LRJZXB7G). Join now!