简体中文

繁體中文

English

Pусский

日本語

ภาษาไทย

Tiếng Việt

Bahasa Indonesia

Español

हिन्दी

Filippiiniläinen

Français

Deutsch

Português

Türkçe

한국어

العربية

Trading Suspended at CME Group Today due to Cooling Issue

Abstract:Trading of futures and options on the Chicago Mercantile Exchange (CME) was halted for several hours, affecting stocks, currencies, bonds, and commodities. The pause occurred due to a cooling system issue at a CyrusOne data center in Chicago.

On November 28, 2025, global financial markets experienced an unusual disruption when CME Group, the worlds largest futures and derivatives exchange, suddenly came to a standstill. Trading of futures and options on the Chicago Mercantile Exchange (CME) was halted for several hours, affecting stocks, currencies, bonds, and commodities. The pause occurred due to a cooling system issue at a CyrusOne data center in Chicago.

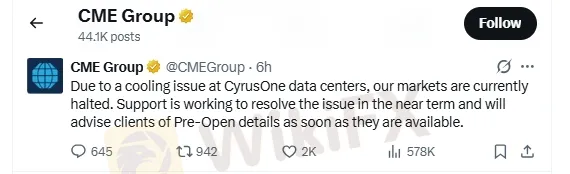

CME Group posted on X (Twitter)

“Due to a cooling issue at CyrusOne data centers, our markets are currently halted. Support is working to resolve the issue in the near term and will advise clients of Pre-Open details as soon as they are available.”

A CyrusOne spokesperson added:

“Our engineering teams, along with specialized mechanical contractors, are on-site working to restore full cooling capacity. We have successfully restarted several chillers at limited capacity and deployed temporary cooling equipment to supplement our permanent systems.”

CME Group Provides Update on Market Halt

After This Disruption , CME Group informs its clients and wrote on X

“BrokerTec EU markets are open and trading. All other CME Group markets remain halted due to a data center cooling issue at CyrusOne. We will provide updates as they are available.”

Investor‘s Reactions on this disruption

We reviewed comments on CME Group’s official X (Twitter) post, and investors are reacting in various ways.

• Romik Rai wrote: “So they all got cooling issues together at the same time? Please share some proof. Else its just banks (market makers) faking a force majeure event on settlement; to loot their clients as always.”

• Many users are demanding compensation for investors, while others are calling the company liars or accusing CME Group of market manipulation.

• KP asked: “Who will bear my losses?”

• BB Brownie wrote: “You‘re lying. Silver got dangerously close to breaking you and your short bank buddies. It’s game over.”

• Henry commented: “Or just tell us if youre going to take the whole day, or the entire weekend.”

• Andre wrote patiently: “Just keep them halted until Sunday open. Figure things out carefully so this doesnt happen again, please.”

What is CME ?

The Chicago Mercantile Exchange (CME) is one of the worlds largest and most important financial exchanges, where traders buy and sell futures and options contracts on a wide range of assets. These include stocks, currencies, interest rates, commodities like oil, gold, and agricultural products, as well as cryptocurrencies. CME provides a regulated platform for investors and institutions to hedge risks, speculate on price movements, and manage financial exposure. It is known for its advanced electronic trading system, which allows markets to operate globally almost 24/7, making it a key hub in the world of finance and derivatives trading.

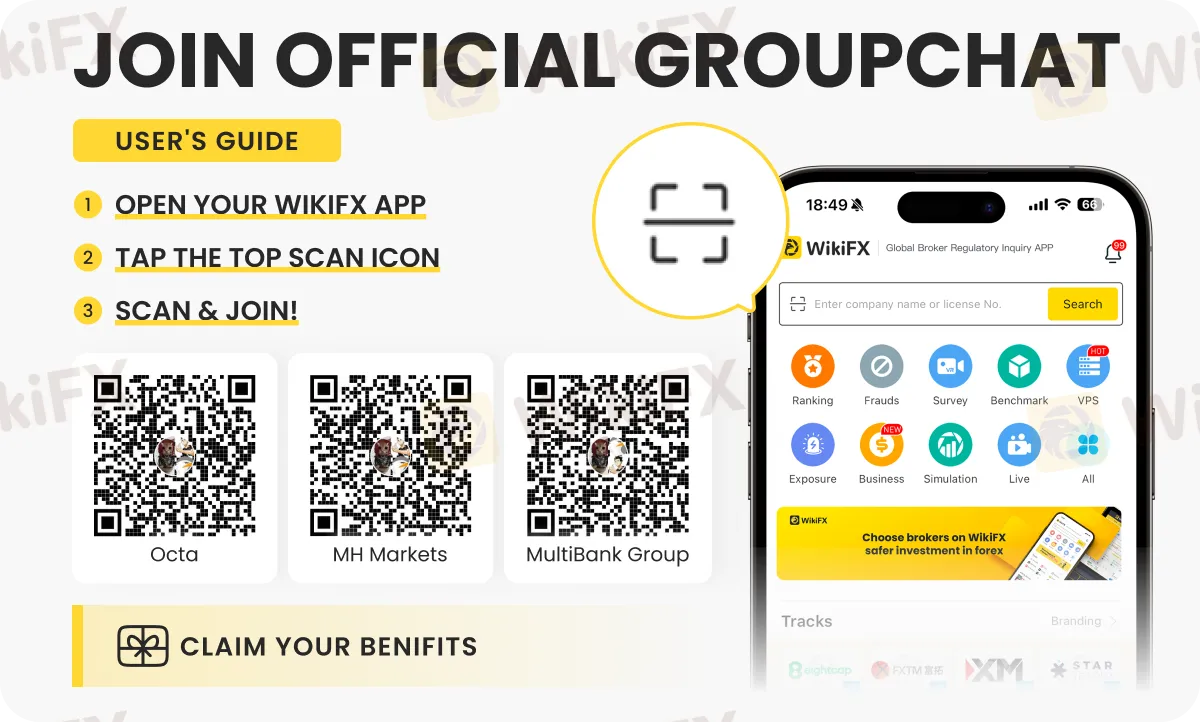

Join official Broker community! Now

You can join the group by scanning the QR code below.

Benefits of Joining This Group

1. Connect with passionate traders – Be part of a small, active community of like-minded investors.

2. Exclusive competitions and contests – Participate in fun trading challenges with exciting rewards.

3. Stay updated – Get the latest daily market news, broker updates, and insights shared within the group.

4. Learn and share – Exchange trading ideas, strategies, and experiences with fellow members.

Disclaimer:

The views in this article only represent the author's personal views, and do not constitute investment advice on this platform. This platform does not guarantee the accuracy, completeness and timeliness of the information in the article, and will not be liable for any loss caused by the use of or reliance on the information in the article.

WikiFX Broker

Latest News

HFM Review 2026: Is this Forex Broker Legit or a Scam?

ESMA Tightens Derivative Rules: Crypto 'Perpetuals' Face Strict CFD Leverage Caps

INFINOX Analysis Report

Dukascopy Triples MetaTrader 5 Asset Suite to Surpass 400 Instruments

Scope Prime Strengthens Institutional Liquidity Infrastructure with Ultency Integration

NAGA Earnings Signal Industry Stress Amid Low FX Volatility

What Will US-Iran War Affect Stock Market: A Comprehensive Investor's Guide to 2026

Equity Volatility Signals Risk-Off Shift as Prime Broker IPO Stalls

European Retail FX Brokers Pivot to Futures Amid Regulatory Crackdown

UK Retail Sentiment: Inflation Reality Check Damps Appetite for Cash

Currency Calculator