简体中文

繁體中文

English

Pусский

日本語

ภาษาไทย

Tiếng Việt

Bahasa Indonesia

Español

हिन्दी

Filippiiniläinen

Français

Deutsch

Português

Türkçe

한국어

العربية

Truth About Radex Markets Withdrawals: Complaints & Demo Account Issues

Abstract:Radex Markets broker is an offshore broker registered in Saint Vincent and the Grenadines, a location known for its lenient rules for financial service providers. Brokers registered in this jurisdiction typically do not operate under strict regulations like those offered by top-tier authorities such as the FCA (UK), ASIC (Australia), or SEBI (India).

Radex Markets broker is an offshore broker registered in Saint Vincent and the Grenadines, a location known for its lenient rules for financial service providers. Brokers registered in this jurisdiction typically do not operate under strict regulations like those offered by top-tier authorities such as the FCA (UK), ASIC (Australia), or SEBI (India). In this article, we highlight several concerns raised by users regarding Radex Markets broker —especially withdrawal issues, customer service problems, and other major complaints.

Major Complaints Reported by Users

To review any broker, reading real user reviews is the best approach. Here, we have collected many Radex Markets Trustpilot reviews. We have gathered these reviews so traders can stay aware — have a look.

1. Ask to Remove Negative Reviews & Slow Withdrawals

One user claimed that his experience with Radex Markets broker was poor due to slow customer service. He said the broker rejected his withdrawal request and allegedly asked him to remove his negative review before processing it.

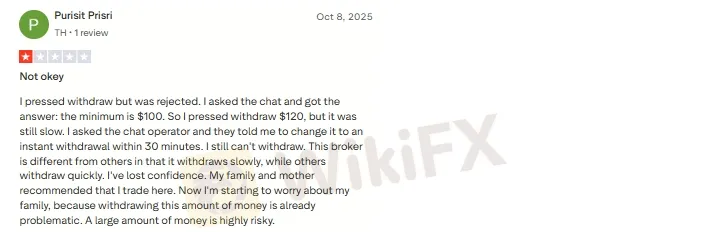

2. Withdrawal Process Not Working Properly

Another user reported that after pressing the withdrawal button on Radex Markets broker, the request was not accepted. Customer support allegedly told him only $100 could be withdrawn, but even that did not process.

He stated that withdrawals with other brokers were instant for him, but Radex Markets withdrawal process was problematic. This made him suspicious and worried about withdrawing larger amounts.

3. Withdrawal Refused — Loss of $65,000

A user claimed he lost $65,000 because Radex Markets broker allegedly locked his funds and refused his withdrawal request. He mentioned that the broker encouraged him to trade, but when he stopped and requested a withdrawal, they allegedly stopped responding. He also stated that the trading results seemed unrealistic and manipulated. He warned others to stay away from the broker.

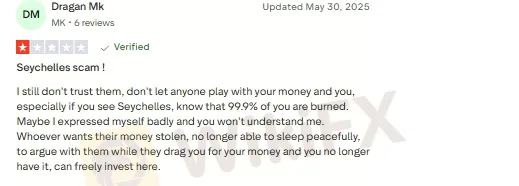

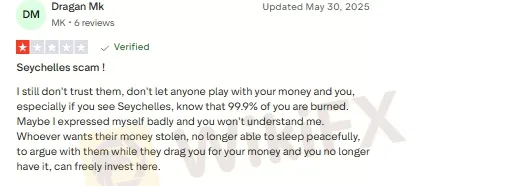

4. Offshore Regulation Concerns

Another reviewer advised traders about Radex Markets broker not to trust brokers regulated in locations like Seychelles or Saint Vincent, claiming such brokers can be risky. He alleged that the broker “stole money” from him, although this is his personal claim.

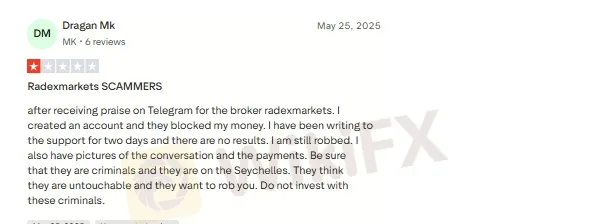

5. Unresponsive Customer Support

One trader said he invested with Radex Market broker after seeing positive posts on Telegram. According to him, the broker created his account and then blocked his funds.He reported that customer support has not responded to him since then and issued a warning to others, calling the behavior “criminal.”

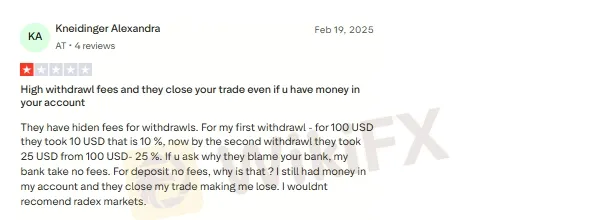

6. Hidden Fees During Withdrawals

Some users complained about hidden withdrawal fees. One user stated that for his first $100 withdrawal, the broker deducted $10 (10%), and on the second withdrawal, they deducted $25 (25%). He said he would not recommend the Radex Markets broker to anyone based on this experience.

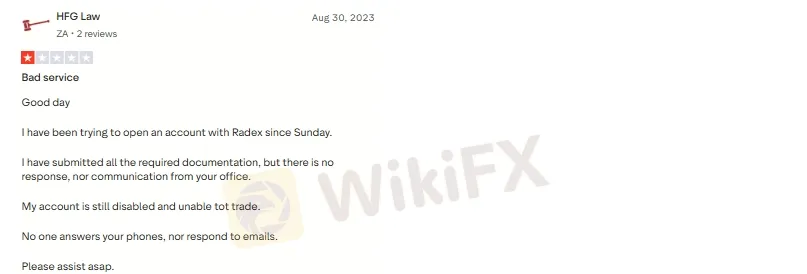

7. No Response After Submitting Documents

Another user reported that he tried to open an account with Radex Markets broker and submitted all the required documentation, but the company never replied. He said phone calls and emails also went unanswered, leaving him without any update.

Radex Markets offers demo account?

Yes, Radex Markets broker offers a demo account option. Their website has a “Demo Account” page offering a practice account with “real-time spreads and charts,” plus access to trading products on both MetaTrader 4 (MT4) and MetaTrader 5 (MT5).

Essential Criteria for Selecting Trusted Broker

Instead of Radex Markets broker, choose another trustworthy broker. When choosing a safe and trustworthy broker, you should look for strong regulation from reputable financial authorities, such as the FCA, ASIC, or CySEC, since regulated brokers must follow strict rules that protect your funds. A reliable broker will keep client money in segregated accounts, provide negative balance protection, and offer clear, transparent information about fees, spreads, and withdrawal policies. It‘s also important to check the broker’s reputation, including user reviews, years in operation, and any history of regulatory issues. A trustworthy broker should have a stable trading platform, fast and hassle-free withdrawals, and responsive customer support. By focusing on these factors, you greatly reduce the risk of dealing with a scam or unreliable trading service.

Join official Broker community! Now

You can join the group by scanning the QR code below.

Benefits of Joining This Group

1. Connect with passionate traders – Be part of a small, active community of like-minded investors.

2. Exclusive competitions and contests – Participate in fun trading challenges with exciting rewards.

3. Stay updated – Get the latest daily market news, broker updates, and insights shared within the group.

4. Learn and share – Exchange trading ideas, strategies, and experiences with fellow members.

Disclaimer:

The views in this article only represent the author's personal views, and do not constitute investment advice on this platform. This platform does not guarantee the accuracy, completeness and timeliness of the information in the article, and will not be liable for any loss caused by the use of or reliance on the information in the article.

WikiFX Broker

Latest News

Arena Capitals User Reputation: Looking at Real User Reviews and Common Problems

Stop Letting Your Trading Rewards Gather Dust: A Limited-Time 30% Opportunity

Is FINOWIZ Safe or Scam? 2026 Deep Dive into Its Reputation and User Complaints

What Will US-Iran War Affect Stock Market: A Comprehensive Investor's Guide to 2026

FX Deep Dive: Dollar King Returns as Energy Shock Splits G10 Currencies

The 25-Day Tipping Point: Energy Markets Stare Down a Hormuz Blockade

Middle East Escalation Rocks Markets: Oil Surges while Brokers Tighten Leverage

Eightcap Review: Understanding Fees, Features, and Important User Warnings

Exnova Review 2026: Is this Forex Broker Legit or a Scam?

Moneycorp Problems Exposed: Fund Transfer Failures & Customer Support Complaints

Currency Calculator