Abstract:When choosing a broker, every trader needs to ask one key question: Is my capital safe, and is this company legitimate? The question of Adam Capitals regulation is at the heart of this safety check. Based on public records from 2025, the clear answer is that Adam Capitals does not have a valid financial license from any major, trusted regulatory authority.

The company, called AdamFxCapitals Ltd, is registered as an International Business Company (IBC) in Saint Vincent and the Grenadines (SVG). However, this registration is not equivalent to financial regulation. As a result, the broker is classified as "High potential risk" and receives low trust scores from industry verification services. This guide will break down the broker's regulatory claims, look at how it operates and what platform it uses, and explain the risks for potential investors. The goal is to give you clear, fact-based information to help you decide if your capital would be safe with them.

Introduction: The Most Important Safety Question

When choosing a broker, every trader needs to ask one key question: Is my capital safe, and is this company legitimate? The question of Adam Capitals regulation is at the heart of this safety check. Based on public records from 2025, the clear answer is that Adam Capitals does not have a valid financial license from any major, trusted regulatory authority.

The company, called AdamFxCapitals Ltd, is registered as an International Business Company (IBC) in Saint Vincent and the Grenadines (SVG). However, this registration is not equivalent to financial regulation. As a result, the broker is classified as “High potential risk” and receives low trust scores from industry verification services. This guide will break down the broker's regulatory claims, look at how it operates and what platform it uses, and explain the risks for potential investors. The goal is to give you clear, fact-based information to help you decide if your capital would be safe with them.

Adam Capitals Basic Information

To give you a clear picture, here are the key facts about Adam Capitals. This information comes from public sources and serves as a starting point for the detailed analysis that follows.

*Note: The information above is for reference only and comes from public sources as of early 2025. Traders should always do their own checking for the most current details.*

Registration vs. Regulation: Understanding the Difference

To understand Adam Capitals regulation status, you need to know the important difference between simple business registration and a real financial license. Many offshore brokers use this confusion to look more trustworthy than they actually are. This section explains what the broker's SVG registration really means for trader safety.

What SVG Registration Actually Means

Adam Capitals is registered as an International Business Company (IBC) in Saint Lucia. This is common for offshore forex brokers. However, you need to understand that the SVG Financial Services Authority (FSA) has clearly and repeatedly stated that it does not regulate, license, or supervise forex and CFD brokers. The FSA only acts as a company registrar, similar to registering any other type of business.

This registration gives them a legal business name but provides zero financial oversight. It does not require the broker to follow any specific operating standards, keep enough money in reserve, or use fair trading practices. For traders, this means there is no local authority to help with disputes, no one monitoring the broker's financial health, and no rules about how the broker handles client money. Basically, the SVG registration provides a mailing address and a company name, but no investor protection at all.

What “No Regulation” Really Means

The term “No Valid Regulation” is a clear statement. It means that after thorough checking, Adam Capitals has not been found to have a license from any respected major regulatory body (like the UK's FCA, Australia's ASIC, or the EU's CySEC) or any credible smaller authorities. The “Suspicious Regulatory License” tag often given to such brokers means they may make misleading claims about being regulated or operate from a place known for its lack of oversight.

When trading with an unregulated broker like Adam Capitals, clients lose important safety protections that are standard in regulated markets. These missing safeguards include:

· Separate Client Money: Regulated brokers must keep client money in separate bank accounts from their own business money. This prevents the broker from using client money for business expenses and protects it if the broker goes bankrupt. Unregulated brokers have no such legal requirement.

· Negative Balance Protection: Many regulatory systems require that retail clients cannot lose more than the capital in their account. Unregulated brokers don't have to offer this, meaning traders could potentially owe the broker money after a big market move against their position.

· Compensation Programs: In regulated areas, investor compensation funds (like the FSCS in the UK or the ICF in Cyprus) exist to pay back clients up to a certain amount if their broker becomes insolvent. Traders with an unregulated company have no access to such safety nets.

· Access to a Financial Ombudsman: If a dispute happens over trade execution, a withdrawal, or pricing, clients of regulated brokers can appeal to an independent financial ombudsman service for a fair and binding solution. With an unregulated broker, the only option is to deal directly with the company, which holds all the power.

Trading Conditions Review

While the regulatory status is the most important factor, it's also useful to look at the trading conditions and platform that Adam Capitals offers. This gives a complete picture of what a trader can expect, weighing the advertised features against the basic risks.

The MT5 Platform

Adam Capitals gives its clients the MetaTrader 5 (MT5) platform, noting it has a “Full License.” This is a positive feature, as MT5 is a powerful and widely respected multi-asset trading platform developed by MetaQuotes Software. It offers advanced charting tools, a wide range of technical indicators, and support for automated trading through Expert Advisors (EAs).

However, it's important to understand what this license represents. It's a software license purchased from MetaQuotes, showing that the broker has the technical ability to offer the platform. This license is in no way a substitute for financial regulation. A broker can operate a legitimate, fully licensed MT5 platform while still being completely unregulated and high-risk from a financial safety standpoint. The platform's quality does not guarantee the broker's honesty.

Accounts, Leverage, and Spreads

Adam Capitals offers different account types designed for different levels of investment. The three main account types are shown below.

Available Trading Instruments

One of the broker's strengths is its wide range of trading instruments. With over 275+ assets available, it provides broad market access. The instrument types include:

· Forex

· CFDs

· Stocks

· Indices

· Metals

· Energies

This diverse offering allows traders to use various strategies across different markets from a single platform. However, the variety of products does not reduce the underlying risks associated with the broker's unregulated status.

User Experience and Risks

Combining the factual data with reported user experiences gives a practical understanding of the real risks involved in dealing with Adam Capitals. The abstract concept of “no regulation” translates into concrete operational concerns and potential dangers for traders.

Main Unregulated Broker Risks

The primary risks of putting money with an unregulated broker like Adam Capitals can be summarized as follows:

· Risk to Money: Without the requirement for separate accounts, there is no legal guarantee that the clients capital is safe or that it will be returned when requested. The broker could, in theory, use client deposits for its own purposes.

· No Help Available: In case of a dispute—such as problems with withdrawals, price manipulation, or sudden account closure—traders have no independent body to appeal to. The broker makes the final decision, creating a major conflict of interest.

· Potential for Unfair Practices: Regulatory oversight exists to prevent brokers from using unfair practices. An unregulated company operates without this supervision, increasing the risk of non-market-based price feeds, unfavorable slippage, and unclear terms and conditions.

To stay protected, it's important to verify any broker's claims independently. For detailed and constantly updated regulatory status, traders can check the broker's profile on verification platforms such as WikiFX.

Reported User Warning Signs

Several aspects of the user experience raise further warning signs. First, traders have reported the absence of a demo account. This is a major drawback, as a demo account is a standard industry tool that allows potential clients to test a broker's platform, execution speeds, and spread behavior in a risk-free environment before putting in real capital.

Second, important information about deposit and withdrawal methods is clearly missing from the broker's public information. For any financial service, being open about how clients can move their money in and out is basic. The lack of this information makes it impossible for a potential client to assess transaction fees, processing times, or available options. This lack of transparency is a major concern and aligns with the general wariness expressed by traders who have investigated the firm. Given the absence of regulation and the lack of public information, many traders are hesitant to trust the firm with funds.

Advantages vs Disadvantages

To provide a balanced summary, here is a final assessment of Adam Capitals' offerings.

Final Thoughts and Recommendations

The investigation into Adam Capitals regulation leads to a clear and straightforward conclusion: Adam Capitals is an unregulated forex and CFD broker. Its registration in Saint Lucia is a business formality that offers no financial oversight or investor protection. This single fact is the most important element for any potential client to consider.

The risks coming from this lack of regulation are serious. They include a direct threat to the safety of client capital, a complete lack of help in case of disputes, and the potential for a trading environment that is not transparent or fair. While the broker promotes some attractive features, such as the MT5 platform, a wide instrument range, and high leverage, these are heavily overshadowed by the basic and non-negotiable risks associated with its unregulated status. The inconsistencies in its advertised spreads and the lack of basic information on funding methods further damage its credibility.

Before considering any broker, especially one with a similar profile, doing your own research is absolutely necessary. You can view the complete and verified profile of Adam Capitals on WikiFX to help in your final decision-making process.

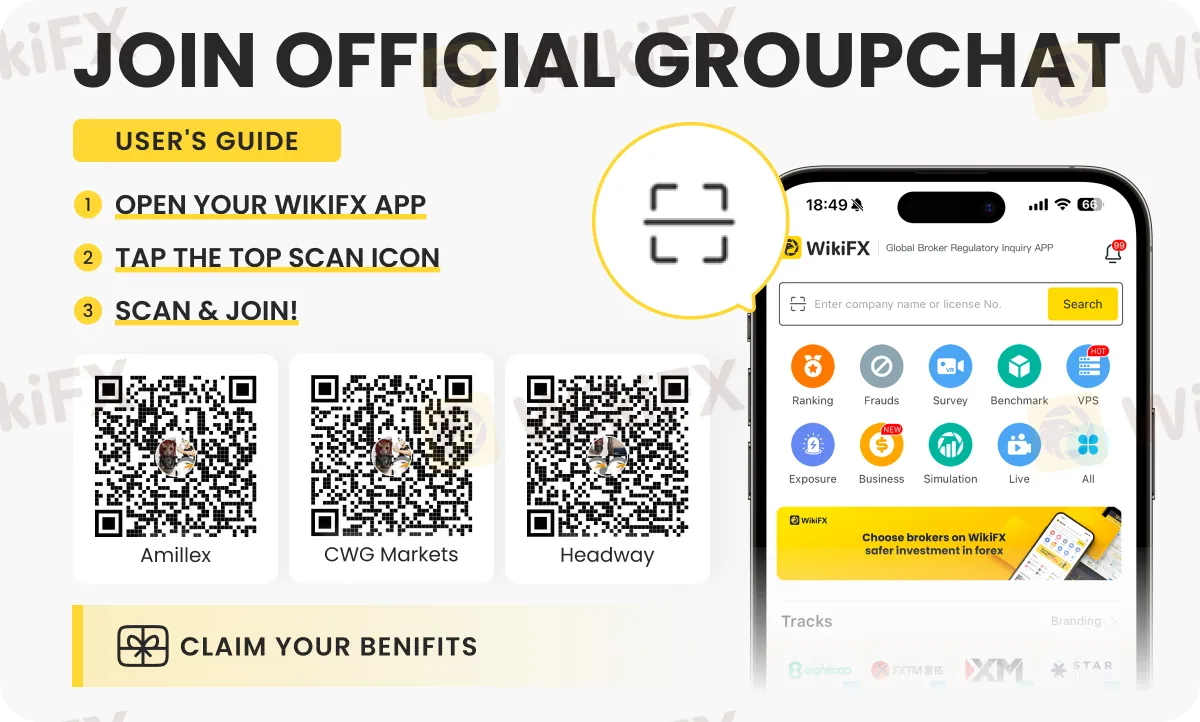

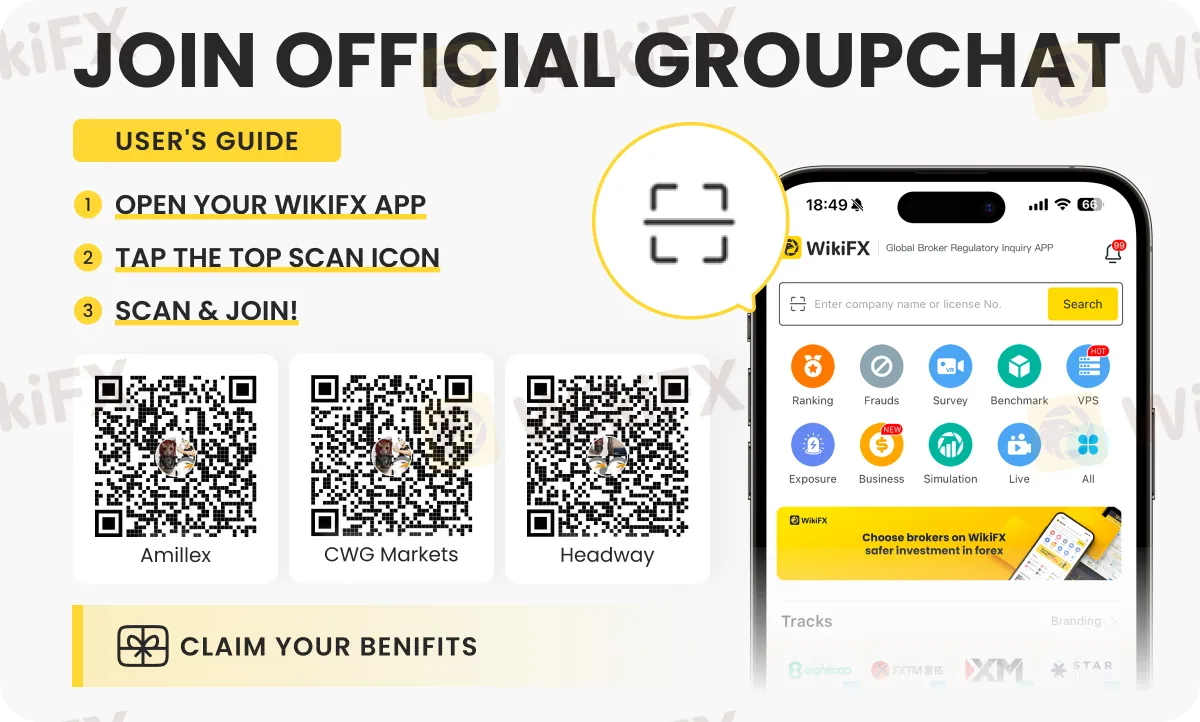

Want to join a community where forex remains central? Be part of these special chat groups (OIFSYYXKC3, 403M82PDMX or W2LRJZXB7G). Joining instructions are shown below.