Mazi Finance Scam Exposure: A Warning to Indian Traders

Latest India Mazi Finance scam: Failed XAUUSD execution despite margin, costing $675—fake “insufficient balance” excuse. Protect funds, read the full report now!

简体中文

繁體中文

English

Pусский

日本語

ภาษาไทย

Tiếng Việt

Bahasa Indonesia

Español

हिन्दी

Filippiiniläinen

Français

Deutsch

Português

Türkçe

한국어

العربية

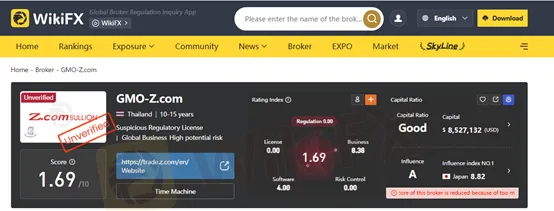

Abstract:Is GMO-Z.com a legit forex broker or a potential scam? Is it easy to log in to GMO-Z.com? This article reviews GMO-Z.com’s regulations, trading conditions, complaints, and safety in 2025.

Is GMO-Z.com a legit forex broker or a potential scam? Is it easy to log in to GMO-Z.com? This article reviews GMO-Z.coms regulations, trading conditions, complaints, and safety in 2025.

GMO-Z.com refers to several related entities under the GMO brand offering online trading services, including forex, commodities, and CFDs. The groups roots go back to GMO CLICK, widely known in Japan for internet finance and FX trading services. Over time, several international subsidiaries were established to serve markets in the UK, Hong Kong, and beyond. Previously, WikiFX has released a relevant article about this broker. click this link to see more information.

Regulatory Status

Bottom Line: Regulatory coverage exists in parts, but changes in licensing (revocations) and unclear current statuses mean you should verify the current regulatory status directly with the authorities before trading.

Traders can access popular trading software like MetaTrader 4 (MT4), alongside some proprietary platforms, depending on the region and entity. MT4 remains one of the industrys standard platforms for forex and CFD trading.

Reported spreads can be competitive on major instruments.

Flexible leverage is often available (e.g., up to 1:200 or higher for certain markets).

However, information on fees (commissions, withdrawal costs, etc.) is reported to be unclear or poorly documented on some versions of the platform — a red flag in broker transparency.

Across multiple user-generated reviews and commentary platforms:

Common Issues Reported

Customer service responsiveness: Reports describe slow or unhelpful customer support, especially around complaints and financial requests.

GMO-branded brokers generally claim to segregate client funds from company operating capital, which is a standard practice in well-regulated markets. However:

Pros

Cons

| Feature | GMO-Z.com | Typical Tier-1 Regulated Broker (FCA / ASIC / CFTC) |

| Regulatory Status | Mixed; some entities regulated in Asia, FCA license reportedly revoked. | Fully regulated by top-tier authorities (FCA, ASIC, CFTC, NFA) |

| Investor Protection | Limited or unclear, depending on the entity | Strong investor protection schemes (e.g., FSCS in the UK) |

| Fund Segregation | Claimed, but transparency varies | Mandatory and strictly audited |

| Negative Balance Protection | Not clearly disclosed | Usually mandatory for retail clients |

| Trading Platforms | MT4 and proprietary platforms | MT4, MT5, cTrader, proprietary platforms |

| Product Transparency | Trading conditions are not always clearly published | Full disclosure of spreads, commissions, and risks |

| Leverage Limits | Can be higher (region-dependent) | Strict caps (e.g., 1:30 for retail traders) |

| Withdrawal Process | User complaints reported | Generally smooth and rule-based |

| Customer Support | Mixed reviews, slow response reported | Regulated response timelines and complaint handling |

| Regulatory Audits | Not clearly disclosed | Frequent and mandatory audits |

| Suitability Checks | Limited or unclear | Mandatory client suitability and risk assessments |

Before opening an account, always verify the brokers license directly with the regulator and avoid sending funds to unverified platforms. We suggest that traders who think of this broker make themselves comfortable before making a decision.

Disclaimer:

The views in this article only represent the author's personal views, and do not constitute investment advice on this platform. This platform does not guarantee the accuracy, completeness and timeliness of the information in the article, and will not be liable for any loss caused by the use of or reliance on the information in the article.

Latest India Mazi Finance scam: Failed XAUUSD execution despite margin, costing $675—fake “insufficient balance” excuse. Protect funds, read the full report now!

Does Pemaxx prevent you from withdrawing funds once you make profits? Has the Mauritius-based forex broker disabled your trading account upon your withdrawal request? Do you fail to withdraw funds despite meeting the trading lot requirements? These scam-like trading activities have allegedly become a part of the broker’s operation, as many traders have complained about them online. In this Pemaxx review article, we have highlighted their comments against the forex broker. Keep reading!

Did Fortune Prime Global deduct all your profits by accusing you of market manipulation? Are you struggling to access withdrawals for months? Has the forex broker disabled your forex trading account upon the withdrawal application? Does the broker stipulate tax payments as a condition for fund withdrawals? You are not alone! In this Fortune Prime Global review article, we have highlighted these complaints. Read on!

WikiFX is launching the "Safe Trade with WikiFX" exclusive interview series, featuring members of the WikiFX Elite Club. This series delivers in-depth industry insights on trading safety, the establishment of industry standards, and regional market dynamics, aiming to foster deeper understanding of local markets and jointly advance transparency across the industry.