Abstract:FXC (also known as FXCentrum) is a brokerage firm established in 2020 with its headquarters in Seychelles. While the broker offers accessible entry points for new traders and high leverage options, its overall reliability profile is mixed. FXC currently holds a WikiFX Score of 3.93, which is considered a low-to-average score, indicating potential risks that traders should consider before opening an account.

FXC (also known as FXCentrum) is a brokerage firm established in 2020 with its headquarters in Seychelles. While the broker offers accessible entry points for new traders and high leverage options, its overall reliability profile is mixed. FXC currently holds a WikiFX Score of 3.93, which is considered a low-to-average score, indicating potential risks that traders should consider before opening an account.

Pros and Cons of FXC

- ✅ Regulated: Authorized by the Seychelles Financial Services Authority (FSA).

- ✅ Low Entry Barrier: Minimum deposit starts at just $10 USD.

- ✅ High Leverage: Offers leverage up to 1:1000 on specific account types.

- ❌ Regulatory Warning: Flagged by the CNMV (Spain) as unauthorized.

- ❌ Platform Limitations: Relies on a self-developed platform; reports indicate a lack of support for IOS, Windows, and MacOS.

- ❌ Low Trust Score: A WikiFX score of 3.93 reflects accumulated risks and lack of Tier-1 regulation.

- ❌ User Complaints: Multiple recent reports regarding withdrawal issues and hidden fees.

Is FXC Safe? Regulatory Analysis

When evaluating the safety of FXC, it is essential to look at both its active license and regulatory warnings issued by other authorities.

Seychelles Financial Services Authority (FSA)

FXC (operating under WTG LTD) is regulated by the Seychelles Financial Services Authority under regulation number SD055.

- License Type: Offshore Regulation.

- Implications: While this confirms the broker is a legal entity in Seychelles, offshore regulations generally offer fewer investor protections (such as compensation funds) compared to Tier-1 regulators like the FCA (UK) or ASIC (Australia).

Regulatory Warning (CNMV)

The National Securities Market Commission (CNMV) of Spain has issued a warning regarding FXC.

- Disclosure: On October 14, 2024, the CNMV warned that FXCentrum is not authorized to provide investment services in Spain. The regulator explicitly stated that the broker is offering services restricted under the Securities Markets and Investment Services Act without proper registration.

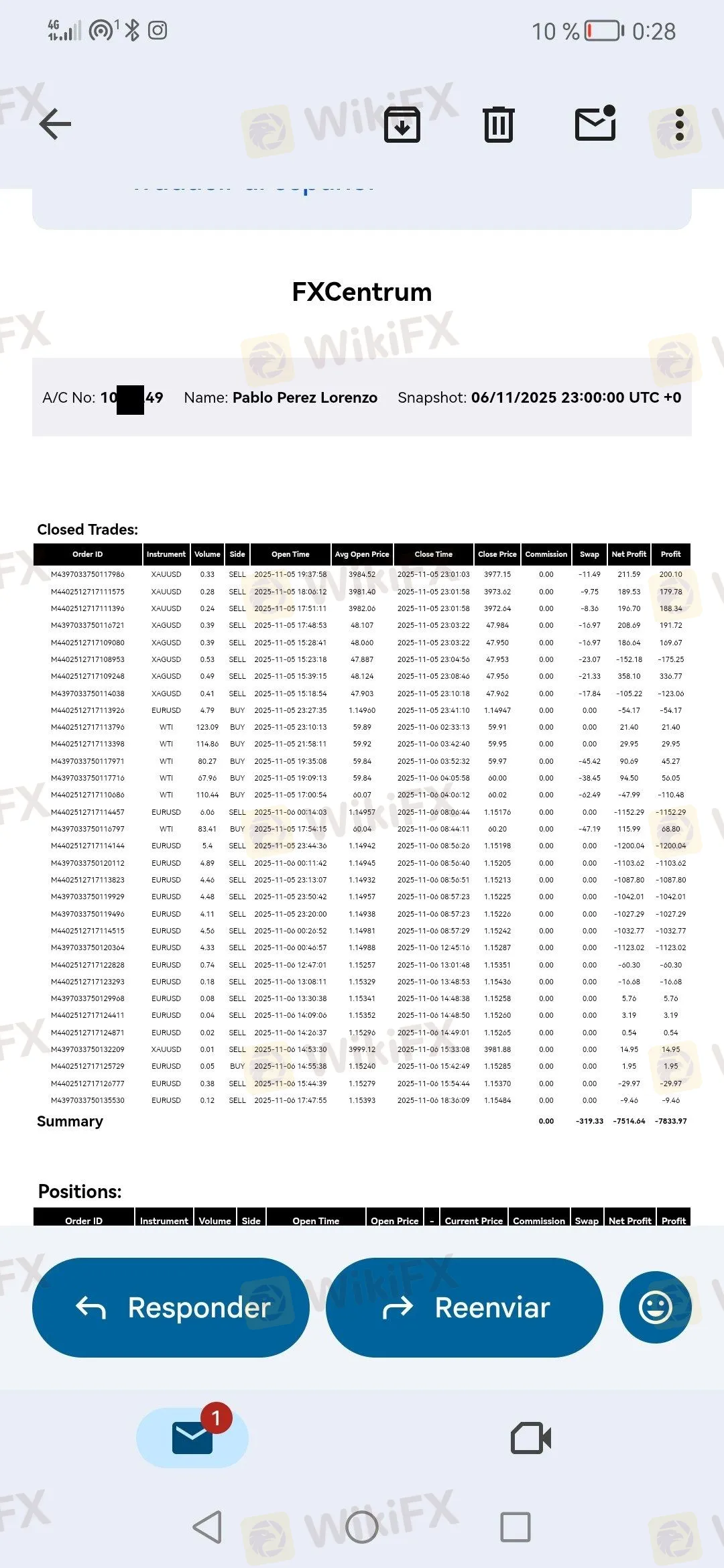

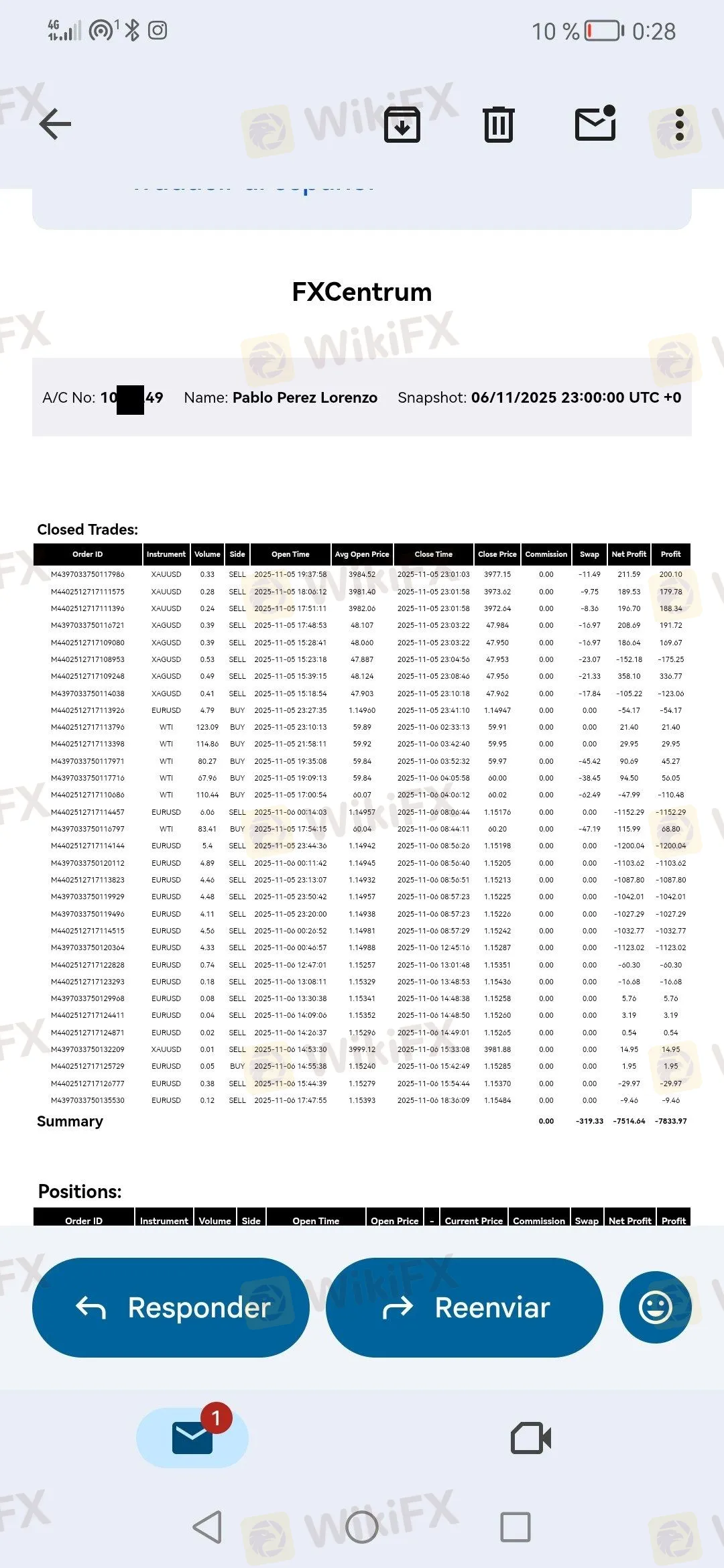

Real User Feedback and Complaints

In the last three months, WikiFX has received 6 complaints regarding FXC. While there are some positive reviews regarding platform speed, significant negative patterns have emerged.

Withdrawal Issues

Several users have reported severe difficulties in accessing their funds.

- Case 1 (Spain): A user detailed a distressing experience involving harassment and the inability to withdraw €9,000. The user claimed they were promised a 100% bonus which was never received, and eventually, their funds were withheld.

Case 2 & 6: Users from India and Uganda reported simple “unable to withdraw” scenarios, with one user stating they were forced to trade for at least two months before being allowed to withdraw only profits.

Allegations of Hidden Fees

- Case 4 (Pakistan): A user described the broker as a “scam,” citing hidden costs. The complaint alleges a $45 withdrawal fee, a $30 daily swap fee, and an extra 10% withdrawal fee. The user also noted the lack of standard MT4/MT5 platforms.

Trading Conditions and Fees

FXC offers a trading environment that is accessible to low-capital traders but utilizes proprietary technology rather than industry-standard software.

Account Types

The broker offers two primary account structures:

- Margin Bonus: Requires a minimum deposit of $10.

- Scalping Margin Bonus: Requires a minimum deposit of $1,000.

Leverage

FXC offers aggressive leverage options:

- Maximum Leverage: Up to 1:1000 for the Margin Bonus account.

- Risk Note: While high leverage can amplify profits, it significantly increases the risk of rapid capital loss, especially within an offshore regulatory framework.

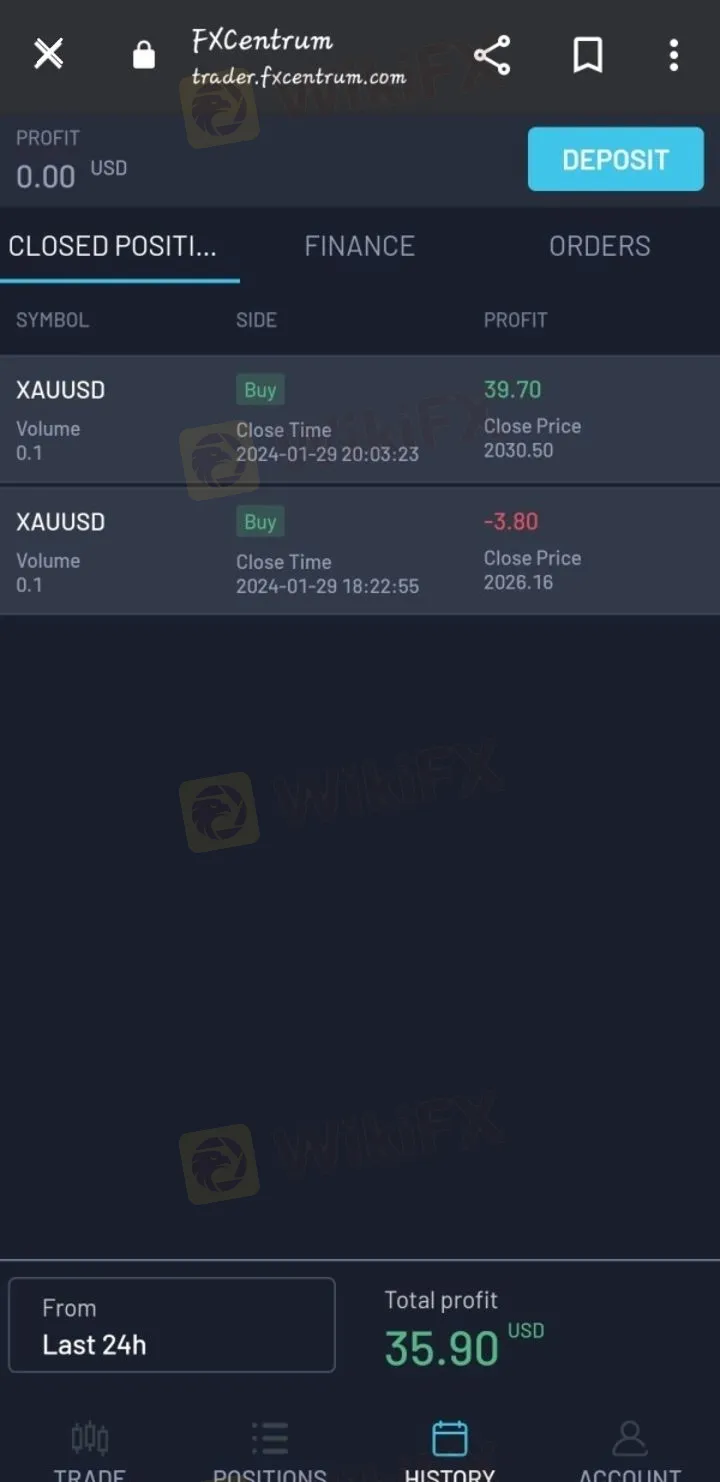

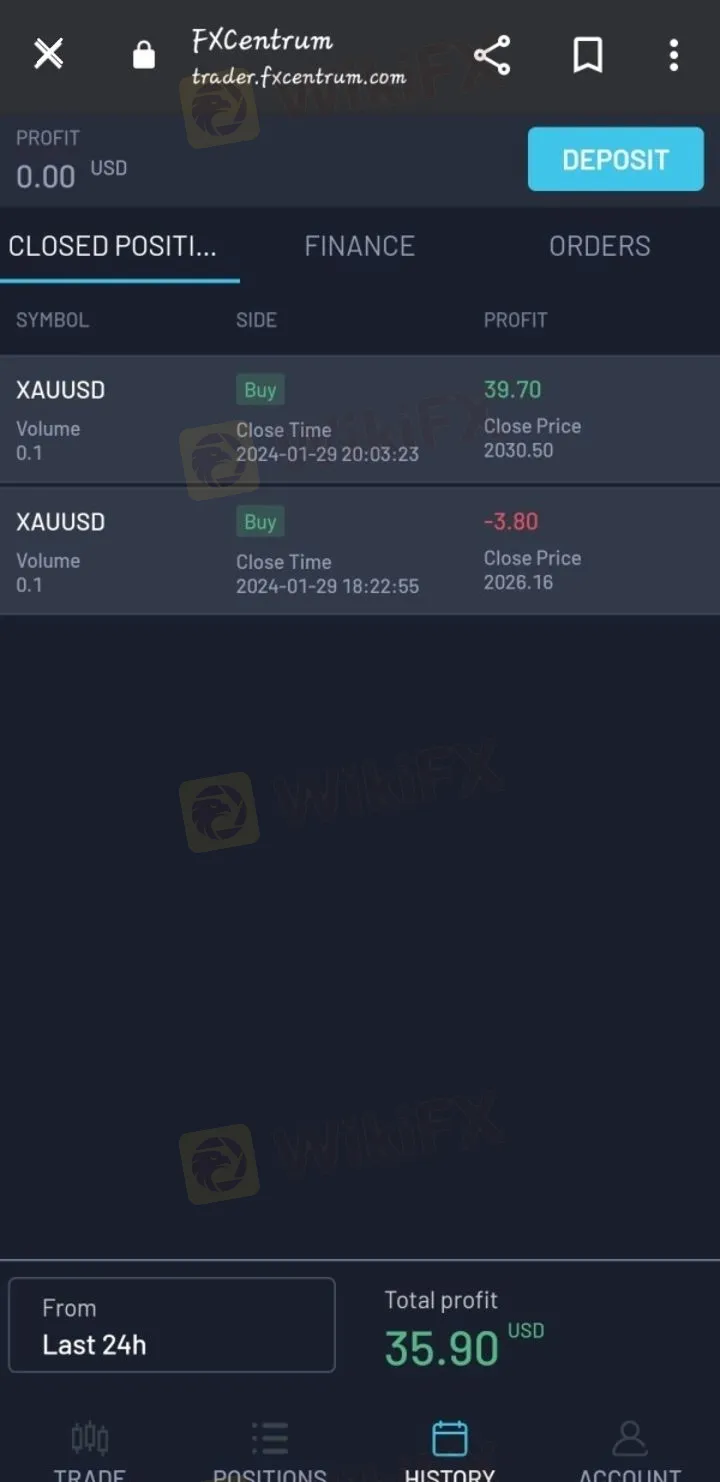

Platforms

Review data indicates that FXC utilizes a self-developed trading platform (FXC Trader).

- Availability: The summary indicates support for Android mobile devices.

- Limitations: The broker reportedly does not support IOS, Windows, MacOS, or Web-based trading, limiting accessibility for desktop traders.

Final Verdict

FXC presents itself as an accessible broker with high leverage and low minimum deposits. However, the safety profile is concerning. The broker operates under offshore regulation (Seychelles FSA) and has received an official warning from the CNMV (Spain) for unauthorized activities. Furthermore, valid user complaints regarding withdrawal denials and hidden fees contribute to its low WikiFX Score of 3.93.

Traders should exercise extreme caution, particularly given the lack of Tier-1 regulatory oversight and the limitations of its proprietary platform.

To stay safe and view the latest regulatory certificates, check FXC on the WikiFX App.