简体中文

繁體中文

English

Pусский

日本語

ภาษาไทย

Tiếng Việt

Bahasa Indonesia

Español

हिन्दी

Filippiiniläinen

Français

Deutsch

Português

Türkçe

한국어

العربية

IC Investing Review: WikiFX Risk Warning, Regulatory Alerts, and Logo Misuse Concerns

Abstract:WikiFX review of IC Investing: an unlicensed broker with warnings from ASIC and AFM, and concerns over website credibility and logo misuse.

IC Investing claims to offer online investment and trading services. However, based on WikiFX investigations and disclosures from multiple financial regulators, the broker shows significant risk signals that investors should not ignore.

According to available information, IC Investing does not hold any valid regulatory license, has been publicly warned against by authorities, and is associated with misleading website branding, including the unauthorized use of a third-party application logo.

This article reviews IC Investing from a risk-control perspective, focusing on regulation, official warnings, and credibility issues identified during verification.

WikiFX Risk Warning

WikiFX has issued a risk warning on IC Investing due to its overall low safety score and the absence of valid regulatory authorization. According to WikiFXs assessment, the broker does not meet the basic standards expected of a legitimate forex or investment service provider.

The warning highlights two core issues. First, IC Investing lacks valid forex regulation, meaning it operates outside any recognized supervisory framework. Second, current information indicates that the broker does not provide a verifiable trading software environment, further increasing uncertainty for users.

Operating without a license means the platform is not subject to regulatory oversight, client fund protection requirements, or formal dispute-resolution mechanisms. For investors, this translates into limited protection if problems arise, including potential difficulties related to withdrawals, account disputes, or service transparency. Taken together, these factors significantly elevate the operational and investor risk associated with the platform.

Regulatory Warnings from ASIC and AFM

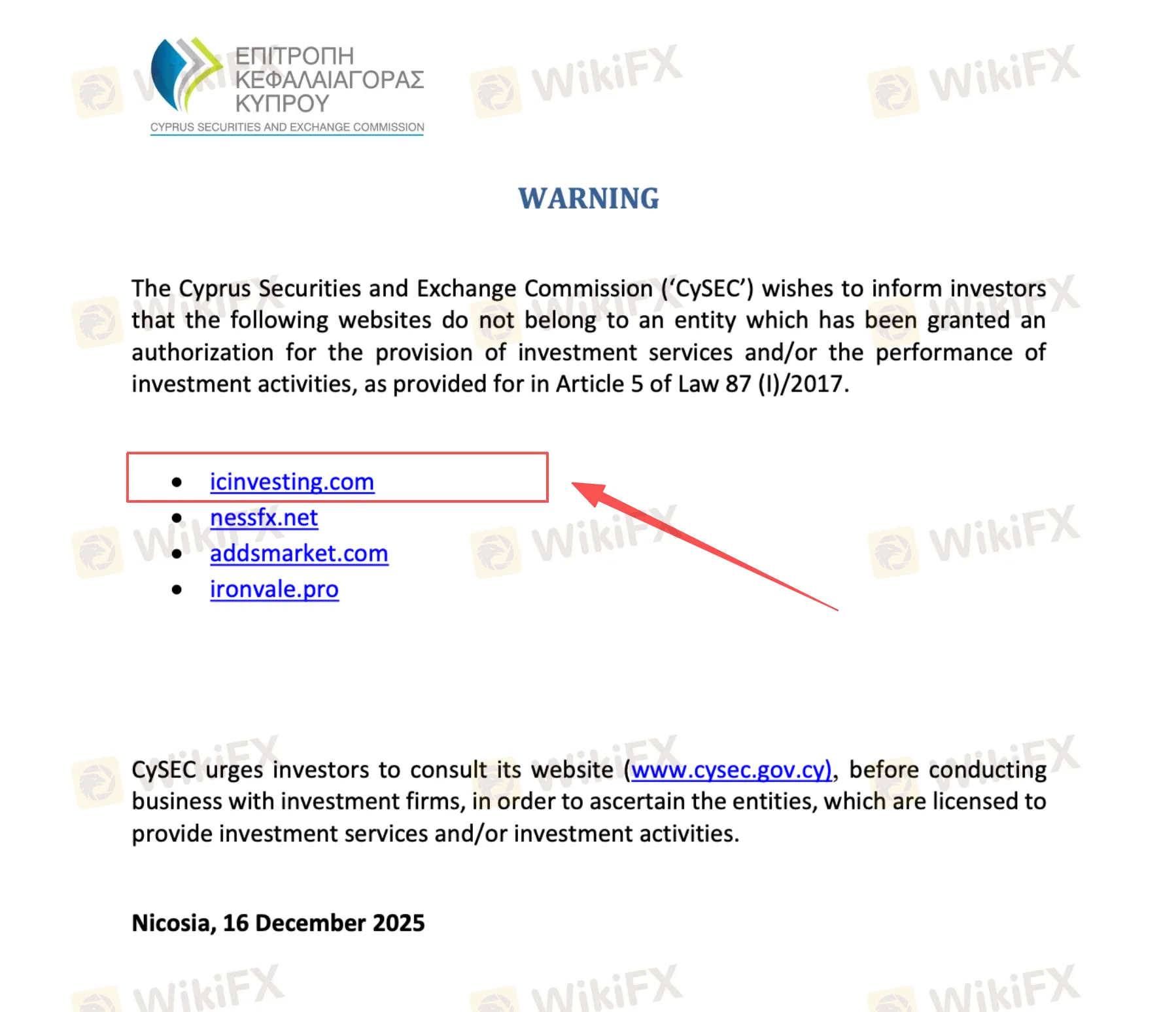

Beyond the absence of a license, IC Investing has been explicitly named in regulatory warnings.

The Australian Securities and Investments Commission (ASIC) has warned investors that IC Investing is not authorized to provide financial services. Such warnings are typically issued when an entity targets investors without approval or operates outside the regulatory framework.

In addition, the Netherlands Authority for the Financial Markets (AFM) has published a warning stating that IC Investing does not hold an AFM license or a European passport. AFM disclosures indicate that the platform has approached individuals with unsolicited investment offers, a pattern commonly associated with high-risk or fraudulent schemes.

These warnings serve as official signals that investors should exercise extreme caution.

Questionable Website Identity and Logo Misuse

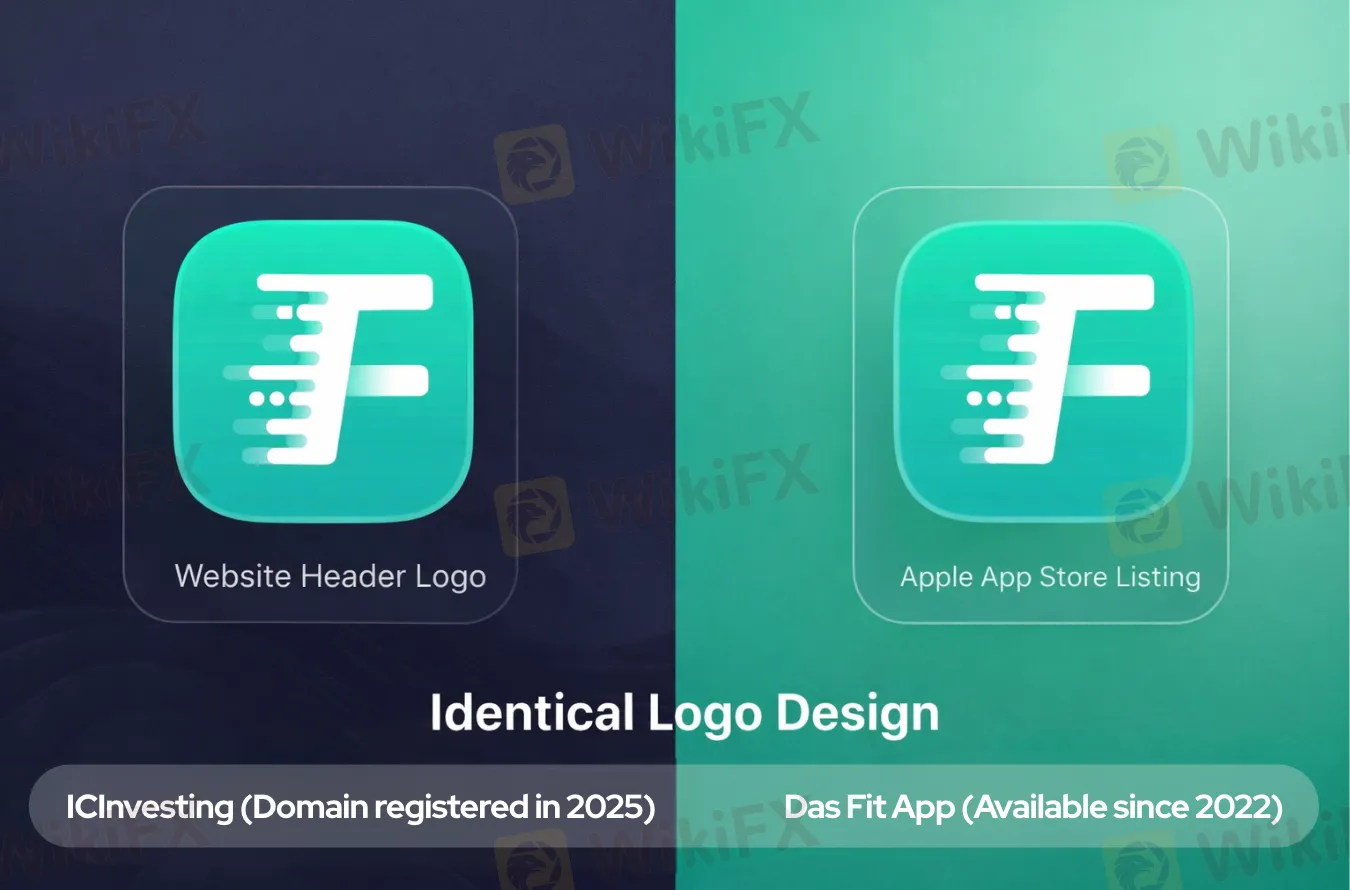

Another issue raising concern is IC Investings website branding.

Further investigation shows that the logo used by IC Investing is identical to the logo of “Das Fit,” a lifestyle application that has been available since 2022. Domain records indicate that icinvesting.com was only registered in 2025. There is no publicly available evidence showing any authorization or partnership between the two. Such inconsistencies raise concerns about the platforms credibility and brand authenticity.

Risk Assessment Summary

Taken together, the findings point to a high-risk profile:

- No valid regulatory license

- Official warnings from ASIC and AFM

- WikiFX risk alert and low safety score

- Misuse of a third-party application logo

- Recently registered website with limited transparency

These factors suggest that IC Investing lacks the basic credibility and compliance standards expected from a legitimate broker.

Conclusion

Based on WikiFX verification results, regulatory warnings, and branding inconsistencies, IC Investing presents clear risks to investors. Platforms that operate without regulation and adopt misleading identities often expose users to unnecessary financial and legal dangers.

Investors are strongly advised to verify a brokers license, review regulatory warnings, and avoid platforms with unclear ownership or questionable branding practices.

Choosing a regulated broker with transparent credentials remains the most effective way to reduce trading risk.

Disclaimer:

The views in this article only represent the author's personal views, and do not constitute investment advice on this platform. This platform does not guarantee the accuracy, completeness and timeliness of the information in the article, and will not be liable for any loss caused by the use of or reliance on the information in the article.

WikiFX Broker

Latest News

BitPania Review 2026: Is this Broker Safe?

Kudotrade Review 2026: Is this Forex Broker Legit or a Scam?

Is EXTREDE Regulated? A 2026 Investigation into Warning Signs and Licensing Claims

XTB Analysis Report

GFS Review: Reported Allegations of Fund Scams & Withdrawal Denials

Key Events This Week: PPI, Iran Talks, Nvidia Earnings, Fed Speakers Galore And State Of The Union

What Causes Stagflation?

EU Says Trump's Tariff Workaround Violates Trade Deal

Spotware Refines cTrader Infrastructure as Broker Ecosystem Expands

CME Group Moves to 24/7 Trading for Digital Asset Derivatives

Currency Calculator