简体中文

繁體中文

English

Pусский

日本語

ภาษาไทย

Tiếng Việt

Bahasa Indonesia

Español

हिन्दी

Filippiiniläinen

Français

Deutsch

Português

Türkçe

한국어

العربية

Classic Global Ltd Review 2026: User Complaints & Scam Allegations Exposed

Abstract:This review will be direct and honest. We will show you the evidence, step by step, to prove how dangerous this platform is for your money. We will examine their false claims about licenses, look at patterns in real user complaints, and give you tools to spot and avoid such tricks. Our goal is to give you the facts you need to make a smart choice and, most importantly, to keep your money safe.

Is Classic Global Ltd safe or scam? This is the important question that investors need to answer when they come across this company, usually through unwanted messages on social media. After carefully studying how they work, checking their claimed licenses, and reading many user reviews, our answer is clear. The proof strongly shows that Classic Global Ltd is a dangerous, risky business that has all the typical signs of a clever financial scam. It is not a real investment company.

This review will be direct and honest. We will show you the evidence, step by step, to prove how dangerous this platform is for your money. We will examine their false claims about licenses, look at patterns in real user complaints, and give you tools to spot and avoid such tricks. Our goal is to give you the facts you need to make a smart choice and, most importantly, to keep your money safe.

The Verdict at a Glance

For those who want a straight answer, this section covers the most serious warning signs. The difference between a real financial company and Classic Global Ltd is huge and obvious. These are not small rule-breaking issues; they are major problems that show this is a fake operation.

Key Findings Summary

A quick comparison shows the extreme risk. We have compared what real licensed investment companies do with what people report about Classic Global Ltd. The difference is not about quality, but about real versus fake.

| Feature | Legit Broker Standard | Classic Global Ltd's Reality |

| Regulation | Authorized by a Tier-1 regulator (e.g., FCA, ASIC). | No verifiable financial regulation. |

| Fund Security | Client funds held in segregated bank accounts. | Deposits directed to personal accounts/crypto wallets. |

| Transparency | Clear physical address, corporate phone support. | No physical address; frequently changing websites. |

| Withdrawal Process | Clear, timely, and processed to the source. | Widespread complaints of inability to withdraw funds. |

| Reputation | Positive or mixed reviews on trusted platforms. | Extremely low scores; flagged as a scam broker. |

The WikiFX Warning Signal

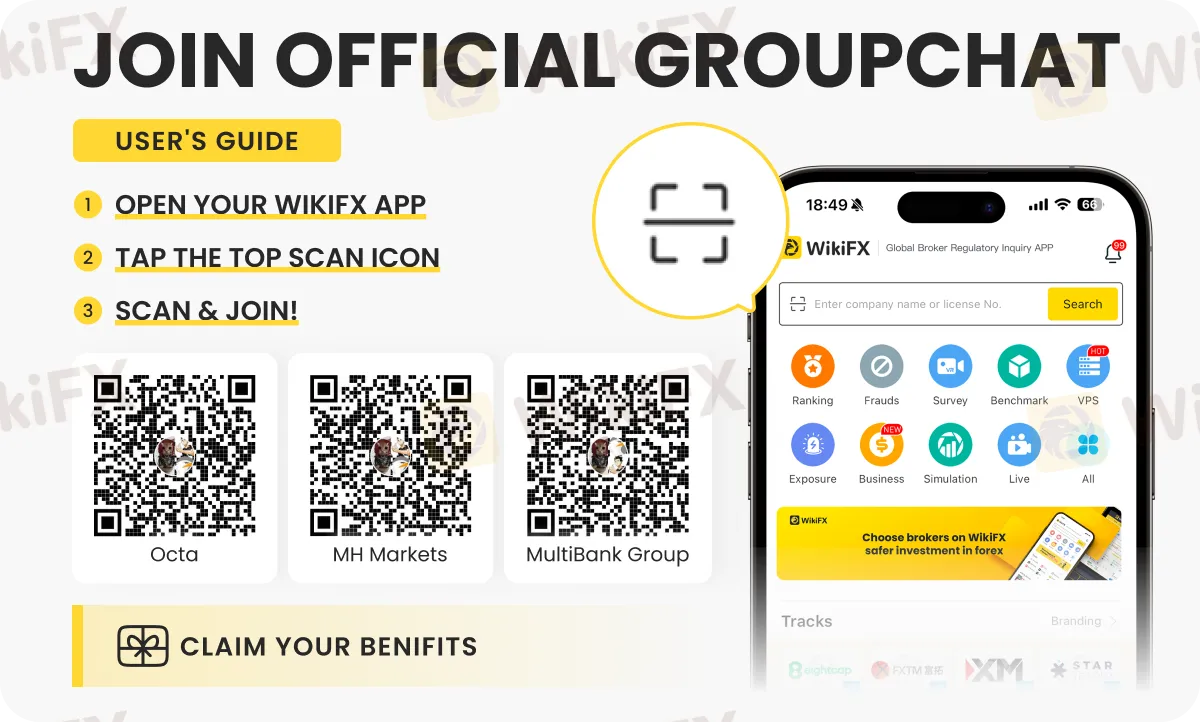

Independent checking platforms are an investor's first protection. The score given to Classic Global Ltd by WikiFX, a third-party company that checks licenses and investment firms, is one of the most serious pieces of evidence. The platform has a very low score of 1.14 out of 10. This score, in the worst possible range, comes with a clear warning: “This broker has a low score, please stay away!” This is not a suggestion; it is a serious alert based on checking their missing licenses, questionable business methods, and user feedback. You can see the full risk report and lack of proper licenses for yourself on the Classic Global Ltd page on WikiFX.

Breaking Down the Lies

Scam operations work by creating a thin layer of fake trustworthiness. Classic Global Ltd uses several common but effective tricks to fool investors who don't know much about financial rules. By breaking down these claims, we can expose the fake foundation of their entire operation.

The NFA “Non-Member” Trick

• Claim: Classic Global Ltd often suggests it is registered or connected with the US National Futures Association (NFA).

• Reality: This is a deliberate and common lie. Our investigation confirms they only have a tracking ID as a “Non-Member” of the NFA. This status provides zero oversight, zero investor protection, and does not give them any legal right to offer forex or trading to US residents or others. Only “NFA Members” are regulated companies. Claiming NFA registration based on a non-member ID is a fake claim designed to trick uninformed investors into feeling safe.

Misleading UK & Canadian Registrations

This pattern of lies extends to other countries where the platform tries to create a paper trail that looks real.

• UK Registration: The company CLASSIC GLOBAL LTD is indeed registered with the UK's Companies House (company number 13066363). However, this is not a financial license. A basic company registration in the UK can be done online for a small fee and provides no permission from the Financial Conduct Authority (FCA). To legally offer financial services in or from the UK, a firm must be fully authorized by the FCA. Classic Global Ltd has no such permission, making any UK-based financial activities illegal.

• Canadian Registration: The platform has also been linked to claims of a FINTRAC registration in Canada. Again, this is misleading. A Money Services Business (MSB) registration with FINTRAC is for anti-money laundering and anti-terrorist financing reporting purposes only. It is not a license to work as a forex or CFD broker and offers no client fund protection or oversight of trading activities.

How Real Regulation is Different

The gap between Classic Global Ltd's fake claims and the protections offered by a truly regulated broker is huge. The following table shows what real investor safety looks like, and what this platform fails to provide.

| Protection Mechanism | Classic Global Ltd | Genuinely Regulated Broker (FCA/ASIC) |

| Regulatory Body | None | Financial Conduct Authority (FCA), etc. |

| Fund Segregation | No (Funds go to personal/private accounts) | Yes (Client funds held separately from company funds) |

| Leverage Limits | High (1:500+), used as a lure | Capped (e.g., 1:30 for majors) to protect retail clients |

| Negative Balance Protection | No | Yes (Clients cannot lose more than their deposit) |

| Dispute Resolution Scheme | None | Yes (e.g., Financial Ombudsman Service) |

Checking Regulation is Essential

Never take a broker's word for it. These lying tactics are exactly why independent checking is essential for your financial safety. Scammers count on the fact that most people won't check the main source. Use a tool like WikiFX to instantly check the actual status of a broker's license with regulators like the FCA or NFA, cutting through the lies and giving you a clear picture of their true standing.

From “Profits” to Pain

The most convincing evidence against Classic Global Ltd comes from the people who have lost money. The stories shared by users form a consistent and disturbing pattern. These are not isolated cases of customer dissatisfaction; they are a playbook for a specific type of investment fraud.

Case Study 1: The Romance Scam

This is the most frequently reported method of trapping victims, commonly known as a “pig-butchering” scam. It uses emotion and trust, and the process is frighteningly consistent across dozens of victim reports.

1. The Approach: The victim is contacted on a social media or dating app like Instagram, WhatsApp, or Tinder by an attractive and friendly person.

2. Building “Trust”: The scammer spends weeks, sometimes months, building a relationship. They have daily conversations, sharing personal stories and creating the illusion of a real friendship or romantic interest.

3. The Pitch: Once trust is built, the “friend” casually introduces a “secret” or “guaranteed” way they make lots of money through investing with Classic Global Ltd. They often show screenshots of a trading account with huge profits.

4. The Bait: The victim is encouraged to start small. They make an initial deposit (e.g., $1,000) and are guided through a few “winning” trades. Importantly, they are often allowed to make a small, successful withdrawal to prove the system is real and build confidence.

5. The Trap: Convinced of the opportunity, the victim is pressured to invest a much larger sum (e.g., $50,000 or more) to “maximize a rare opportunity.”

6. The End: When the victim tries to withdraw their large principal or profits, the trap springs. The account is suddenly frozen. Customer service, and the “friend,” claim there is a problem, such as “tax evasion” or “suspicion of money laundering.” To unlock the funds, the victim is told they must deposit even more money—typically a 20-50% “fee,” “tax,” or “security deposit.” Once it becomes clear the victim will not or cannot pay more, the scammer and the platform disappear.

Case Study 2: The Withdrawal Black Hole

For users who invest outside of the romance scam story, the endpoint is the same: the inability to access their funds. When a withdrawal request is made, a wall of excuses and fake fees appears. These are designed to get more money from the victim before cutting them off completely.

Users report being faced with an endless series of demands, including:

• A 20% “Personal Income Tax” that must be paid upfront.

• A “Risk Margin” or “Security Deposit” to prove the funds are legitimate.

• An “Account Unfreezing Fee” following a fake security alert.

• A fee to upgrade to a “VIP Withdrawal Channel” for faster processing.

Paying any of these fees is pointless. It is simply the final stage of the scam. The money is never returned, and each payment only serves to increase the victim's losses.

Case Study 3: Fake Markets and Price Manipulation

A key technical aspect of this scam involves the trading platform itself. Users report that Classic Global Ltd often uses a stolen or unlicensed “white-label” version of the MT4 or MT5 trading terminal.

This is important because it means the platform is not connected to the live, global financial markets. It is a closed-loop simulation controlled entirely by the scammer. They can change the price data at will. Victims describe seeing chart data on Classic Global's platform that does not match the real market prices seen on legitimate sources. They report sudden, unnatural price movements—often described as “a giant red candle”—that appear from nowhere and conveniently liquidate their entire account balance, creating a “loss” that explains where their money went.

Your Defense Against Deception

While this review focuses on Classic Global Ltd, the tactics they use are not unique. Empowering yourself with knowledge is the best defense. Use this checklist to evaluate any broker you encounter in the future. The presence of even one of these red flags should be cause for extreme caution.

The 6 Red Flags to Watch For

1. Guarantees of High or Easy Profits. Legitimate finance and trading always involve risk. Any person or platform promising guaranteed, high, or risk-free returns is lying. This is the oldest and most reliable sign of a scam.

2. Pressure to Deposit via Social Media. Professional financial firms conduct business through official, secure channels. They do not ask for investments or manage accounts through WhatsApp, Instagram DMs, or Telegram.

3. Unusual Deposit Methods. This is a critical red flag. If a broker asks you to send funds to a personal bank account or through untraceable cryptocurrency (like a direct USDT wallet transfer), it is a scam. Legitimate brokers use corporate accounts and regulated payment systems.

4. Vague or Misleading License Info. As seen with Classic Global Ltd, if you cannot find a clear, verifiable license number on the official public register of a major regulator's website, assume the broker is unregulated and unsafe.

5. Fees Required for Withdrawal. This is a non-negotiable deal-breaker. Legitimate brokers take any applicable fees from your withdrawal balance. They will never ask you to deposit more money to get your own money out.

6. Poor Website and No Contact Info. A professional financial firm invests in its infrastructure. A cheap, template-based website with grammar errors, broken links, and a lack of a physical address or corporate phone number is a sign of a temporary, fly-by-night operation.

Final Verdict and How to Secure Your Investments

The evidence is clear and points in only one direction. This platform is a danger to investors.

Conclusion: An Unsafe Platform

Due to the complete absence of valid financial regulation, the use of deceptive marketing tactics mimicking NFA and UK registration, and the overwhelming volume of Classic Global Ltd complaints detailing “pig-butchering” schemes and withdrawal failures, Classic Global Ltd cannot be considered a safe or legitimate platform. We assess it as a fraudulent operation with the sole purpose of stealing depositor funds. Any engagement with this entity presents a near-certain risk of total financial loss.

Your First Step: Always Verify

Protecting yourself is simple. Before you even consider creating an account or depositing a single dollar with any broker, make it a non-negotiable rule to check their profile on a verification tool. We strongly recommend using WikiFX. A five-minute check on their platform will reveal a broker's true regulatory status, operational history, and real user reviews. This simple action is the single most effective way to identify and avoid scams like Classic Global Ltd before they can cause you harm.

What If You've Already Deposited?

If you have already sent funds to Classic Global Ltd, the most important step is to stop all further payments immediately. Do not pay any “taxes,” “fees,” or “deposits,” regardless of the threats or promises made. They are lies designed to get more money. Gather all evidence of your interactions, including chat logs, email correspondence, transaction receipts, and screenshots of the platform. Report the incident to your local law enforcement, your bank's fraud department, and your country's national fraud reporting center. It is important to have realistic expectations; recovering funds from unregulated, anonymous offshore entities is extremely difficult, but reporting is a crucial step.

Disclaimer:

The views in this article only represent the author's personal views, and do not constitute investment advice on this platform. This platform does not guarantee the accuracy, completeness and timeliness of the information in the article, and will not be liable for any loss caused by the use of or reliance on the information in the article.

WikiFX Broker

Latest News

Spotware Refines cTrader Infrastructure as Broker Ecosystem Expands

CME Group Moves to 24/7 Trading for Digital Asset Derivatives

Is The US Dollar About to Crash?

Is AssetsFX Safe or Scam: Looking at Real User Feedback and Complaints

Trump Defies Supreme Court with 15% Global Tariff; Record Retail Flows Buffer Market Impact

Retail FX Insight: Volatility Squeeze and Regulatory Risks Persist as iFOREX Eyes IPO

$128M Crypto Scam: Chinese Suspect Nabbed in Thailand

Is Cabana Capital Safe or Scam: Looking at Real User Reviews and Common Problems

The Trading Pit Launches Regulated Brokerage Unit 'TTP Markets' in Strategic Pivot

Prop Trading Industry Pivots to Futures to Secure US Market Access

Currency Calculator