Abstract:Libertex regulation by CySEC ensures EU investor protection and licensed trading across multiple markets.

Libertex operates under CySEC oversight through its entity Indication Investments Ltd, providing a layer of EU regulatory protection for traders. This setup allows access to licensed trading in forex, CFDs, and other assets, though complaints highlight execution risks.

Libertex CySEC Regulation Details

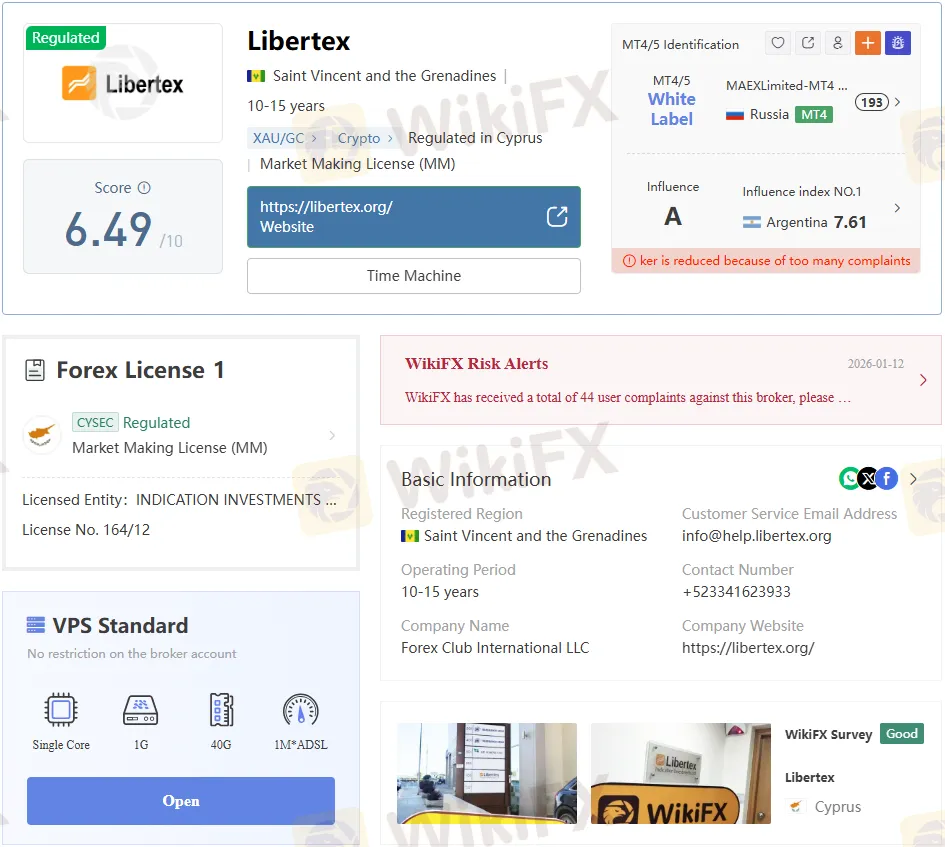

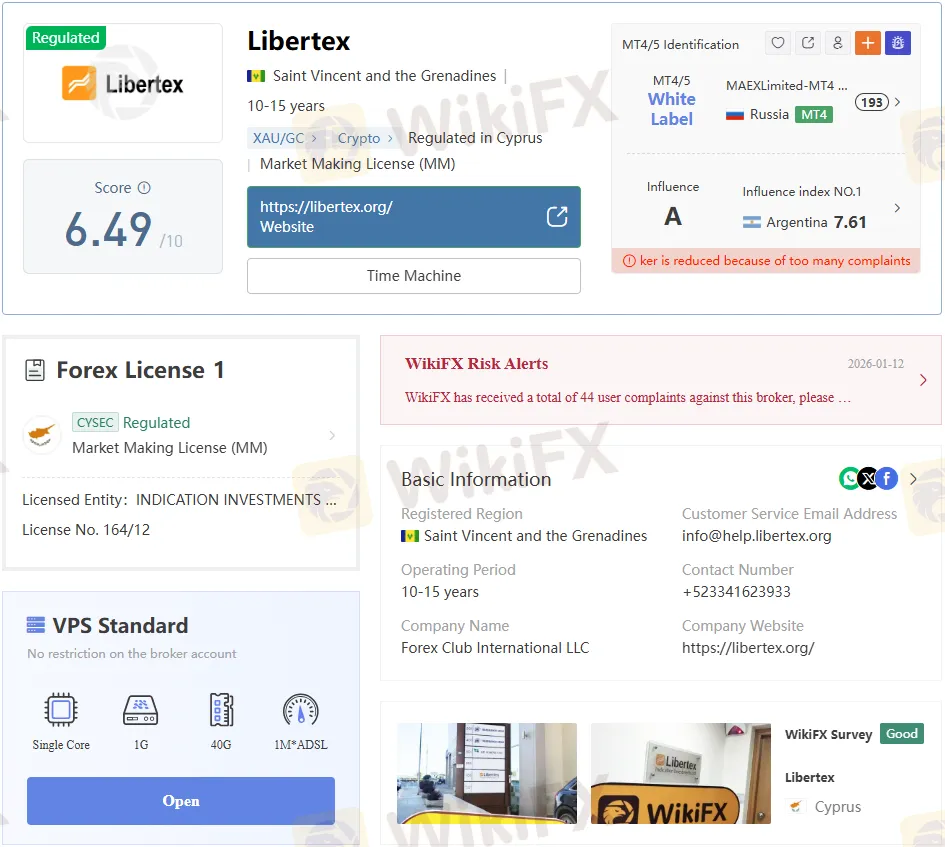

Cyprus Securities and Exchange Commission (CySEC) regulates Libertex via Indication Investments Ltd, holding a Market Maker (MM) license numbered 164/12. The licensed entity lists its address at 116 Gladstonos Street, Michael Kyprianou building, with contact via support@help.libertex.com and phone 357 22 025 100. A 2020 physical verification confirmed an office at the Cyprus regulatory address, bolstering claims of operational transparency.

This Libertex regulation aligns with EU standards, mandating client fund segregation and compensation via the Investor Compensation Fund up to €20,000 per client in case of broker insolvency. Documents like Annex 1, Annex 2, and Annex 3 verify the license, active since around 2012. Traders in restricted zones—Russia, USA, Japan, Brazil, and high-risk FATF jurisdictions—face exclusions.

Company Background and Domain Facts

Libertex traces to Forex Club International LLC, founded in 2016, with primary registration in Saint Vincent and the Grenadines for non-EU operations. The domain libertex.org was registered on July 6, 2016, expires July 6, 2025, and was updated on June 10, 2024, under status “client transfer prohibited” with Cloudflare nameservers. Servers operate from Mauritius (LibertexMU-MT4/MT5) with leverage up to 1:1000 and low ping times around 1-2 ms.

WikiFX scores Libertex at 6.49/10, noting its regulated status in Cyprus alongside offshore elements like a Saint Vincent setup. Influence ranks high in Argentina at 7.61, but the “Time Machine” score dips due to complaint volume. No major domain red flags appear, though regional servers suggest tailored global access.

Trading Platforms and Instruments

Libertex supports MT4, MT5, and its proprietary Libertex platform, with white-label MT4/MT5 options across 25 servers—18 MT4, 7 MT5. Average execution speed hits 191.54 ms, rated “perfect” for reliability. Traders access stock CFDs, cryptocurrencies, forex, metals, indices, commodities, ETFs, and bonds, with spreads from 0.0 pips and leverage to 1:1999.

No swap fees, inactivity fees, margin calls, or forced stop losses apply, plus fractional shares from 0.01 and dividend payouts. Demo accounts exist, minimum deposit starts at $10 via bank cards or e-wallets. Platforms suit beginners (MT4 web/mobile) to experts (MT5), with real market execution noted.

Fees, Deposits, and Withdrawals

Deposits start at $10-$50 equivalent, processed instantly for cards (Visa/Mastercard, 1-2.5% fee), WebMoney (0.8-1.8%, unavailable in Asia), Skrill/Neteller (except EU wallets, ~0.5-1.9%), and Perfect Money (0.5%). Bank transfers take 2-5 days; bank fees apply.

Withdrawals mirror deposits: cards 2 mins to 5 days, banks 2-5 days post-14:00 GMT processing, no minimum stated, but verification may delay. P2P card transfers hit 30 minutes typically. No trade, swap, or inactivity fees enhance cost appeal.

Pros and Cons of Libertex Regulation

Pros:

- CySEC license (164/12) offers EU protections like segregated funds and ICF coverage.

- Low barriers: $10 min deposit, 0.0 pips spreads, high leverage 1:1999.

- Verified Cyprus office and fast execution (191 ms).

- Diverse instruments (crypto to bonds) on mature MT4/MT5 platforms.

Cons:

- Offshore registration in Saint Vincent raises leverage/access flags for some.

- Withdrawal delays are reported, tied to verification or banks.

- Regional bans limit global reach (e.g., USA, Russia).

- WikiFX score 6.49 reflects the complaint impact.

Reported Trader Complaints Examined

Multiple unverified complaints surface, including withdrawal blocks (“They stole my money, wont let me withdraw” from Colombia), undelivered $200 bonuses, and extortion claims. One trader alleged a Libertex advisor pushed a $10,000 loss via a guided trade, urging loans with recovery promises—unresolved per report. Another from Argentina cited scam calls leading to total savings wipeout, demanding call investigations without response.

These cluster around aggressive sales, bonus issues, and support lags, concentrated in Latin America within the last year. Positive notes exist, like quick $200 withdrawals praised by a Colombian user. High complaint volume trimmed WikiFXs Time Machine score.

Libertex vs Competitor Brokers

Libertexs CySEC tier outshines pure offshore peers like those solely in Saint Vincent, matching EU brokers on protections but exceeding leverage (1:1999 vs typical 1:30-500). Compared to eToro or Plus500 (fellow CySEC), Libertex adds a proprietary platform and crypto depth, but trails in social/copy trading.

Domain maturity (since 2016) rivals competitors, but Mauritius servers echo hybrid models like XM.

Account Types and Support Options

Details on tiered accounts are sparse, but min $10 suits casual traders; leverage scales to pros. Support spans live chat, email (info@help.libertex.org), and region-specific phones (e.g., Mexico +52 33 4162-3933, global +44 7456 417828). Latin America, Vietnam, and Thailand get dedicated lines.

No explicit VIP tiers noted, but loyalty perks cut commissions/swaps. Restrictions bar high-risk nation clients, enforcing AML.

Bottom Line on Libertex Regulation

Libertex regulation by CySEC via Indication Investments Ltd delivers credible EU safeguards amid offshore flexibility, ideal for high-leverage seekers eyeing diverse markets. Traders weigh strong tech (MT4/MT5, 0 pips) against complaint patterns on withdrawals and sales tactics—verify personally via demo. For legitimacy-focused users, physical Cyprus presence and license docs affirm standing, though offshore roots demand caution versus pure Tier-1 brokers.