简体中文

繁體中文

English

Pусский

日本語

ภาษาไทย

Tiếng Việt

Bahasa Indonesia

Español

हिन्दी

Filippiiniläinen

Français

Deutsch

Português

Türkçe

한국어

العربية

Core CPI Prints Cooler Than Expected In December, Near 5 Year Lows

Abstract:On the heels of 'solid' labor market data from BLS (lower unemployment), ADP (weekly employment chan

On the heels of 'solid' labor market data from BLS (lower unemployment), ADP (weekly employment change remaining positive), and a rebound in Small Business Optimism; this morning we get a glimpse of the other side of The Fed's mandate as the last CPI print for 2025 prints. From what we can tell, President Trump did not drop any hints this time ahead of the release which was expected to be flat from November's prints.

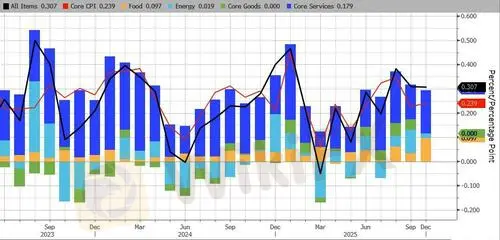

The headline CPI print rose 0.3% MoM (vs +0.3% MoM exp) driving prices up 2.7% on a YoY basis (vs +2.7% YoY exp)...

Source: Bloomberg

Many expected a December pickup due to the unwinding of distortions from data-collection disruptions during the government shutdown, which amplified seasonal discounting in November.

Under the hood, Goods inflation was unch while Services and Food led the price increases...

Source: Bloomberg

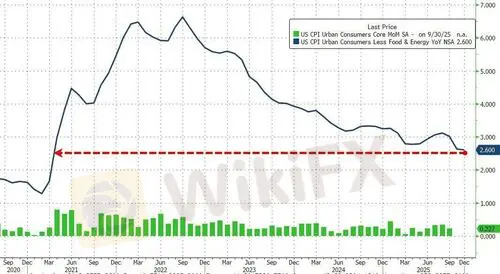

The more stable (and most watched) Core CPI was expected to rise from +2.6% YoY to +2.7% YoY but was surprisingly cooler up just 0.2% MoM and steady at +2.6% YoY - the lowest since March 2021...

Source: Bloomberg

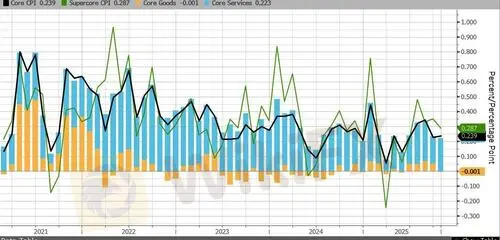

Core Goodssaw deflation on a MoM basis while Services prices accelerated a little...

Source: Bloomberg

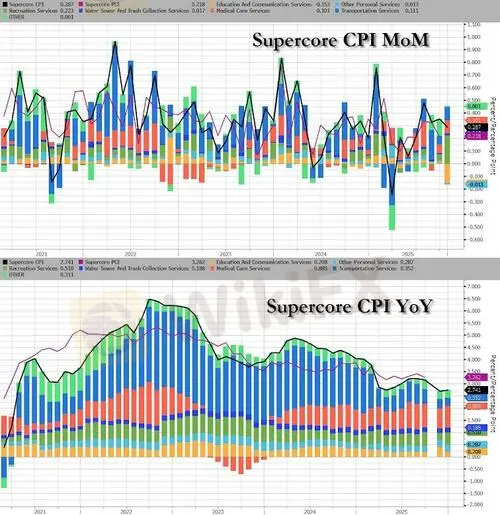

The Fed's 'old favorite' inflation signal - SupreCore (Services Ex-Shelter) - slowed once again on a YoY basis, now at its slowest since Sept 2021...

Source: Bloomberg

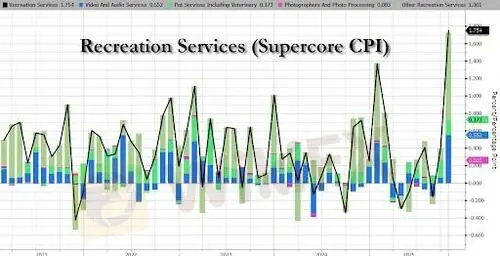

Recreation Services saw a significant jump on a MoM basis while Education Services saw notable deflation MoM...

Source: Bloomberg

And if you want someone to blame for higher prices - it's your vet!

Source: Bloomberg

This is clearly a more convincing sign that inflation is on a downward pathafter November's shutdown-distorted data.

According to JPM's Market Intel team, this is the market reaction matrix,and probability:

- Core MoM prints above 0.45%. SPX loses 1.25% - 2.5%: Probability 5.0%

- Core MoM prints between 0.40% - 0.45%. SPX gains 0.25% to loses 75bps: Probability 32.5%

- Core MoM prints between 0.35% - 0.40%. SPX gains 0.25% to 0.75%: Probability 40.0%

- Core MoM prints between 0.30% - 0.35%. SPX gains 1% - 1.5%: Probability 20.0%

- Core MoM prints below 0.30%. SPX gains 1.25% - 1.75%: Probability 2.5%

Finally, for now, we seem to be avoiding a 1970s redux in Fed policy error helping to re-ignite an inflationary rebound...

Source: Bloomberg

...but time will tell.

Disclaimer:

The views in this article only represent the author's personal views, and do not constitute investment advice on this platform. This platform does not guarantee the accuracy, completeness and timeliness of the information in the article, and will not be liable for any loss caused by the use of or reliance on the information in the article.

WikiFX Broker

Latest News

HFM Review 2026: Is this Forex Broker Legit or a Scam?

ESMA Tightens Derivative Rules: Crypto 'Perpetuals' Face Strict CFD Leverage Caps

INFINOX Analysis Report

Dukascopy Triples MetaTrader 5 Asset Suite to Surpass 400 Instruments

Scope Prime Strengthens Institutional Liquidity Infrastructure with Ultency Integration

NAGA Earnings Signal Industry Stress Amid Low FX Volatility

Equity Volatility Signals Risk-Off Shift as Prime Broker IPO Stalls

European Retail FX Brokers Pivot to Futures Amid Regulatory Crackdown

UK Retail Sentiment: Inflation Reality Check Damps Appetite for Cash

OANDA Japan Slashes Gold Trading Limits as Volatility Drains Liquidity

Currency Calculator