简体中文

繁體中文

English

Pусский

日本語

ภาษาไทย

Tiếng Việt

Bahasa Indonesia

Español

हिन्दी

Filippiiniläinen

Français

Deutsch

Português

Türkçe

한국어

العربية

KIRA Regulatory Status: A Simple Guide to Their SCA License and Company Registration

Abstract:When you look at any trading company, the most important question is whether they follow the law. This creates the foundation of trust and safety for any trader. For people researching KIRA, the main claim is that they follow regulations in the United Arab Emirates. Let's break down what this means using information anyone can find online.

Understanding Basic Legal Claims

When you look at any trading company, the most important question is whether they follow the law. This creates the foundation of trust and safety for any trader. For people researching KIRA, the main claim is that they follow regulations in the United Arab Emirates. Let's break down what this means using information anyone can find online.

KIRA is a trading company that follows rules set by the UAE's Securities and Commodities Authority (SCA). This means they must follow the main financial rules in the country. To understand what this protection covers, we can organize the key facts into a clear summary. The information shown on their license gives us a solid starting point for checking if they're legitimate.

| Legal Detail | Information |

| Rule-Making Body | UAE Securities & Commodities Authority (SCA) |

| License Type | Category 1 |

| License Number | 20200000244 |

| Country | United Arab Emirates (UAE) |

| Main Office | Dubai, UAE |

This table shows the basic facts. Now, we will look deeper into what these details, especially the “Category 1” license, mean for a trader's safety and trading experience.

What a “Category 1” License Means

Saying that a broker “follows regulations” is just the beginning. The real value comes from understanding how strict and thorough those regulations are. The type of license a broker has determines what activities they can legally do and how closely they are watched. For traders considering a company regulated by the SCA, understanding the license types is important.

The SCA Financial Watchdog

The Securities and Commodities Authority (SCA) is the main financial rule-making agency of the United Arab Emirates. Started in 2000 under Federal Law No. 4, its job is to watch over and monitor the markets. The SCA's official mission focuses on protecting investors, keeping markets stable, and making sure there's a fair, efficient, and honest trading environment.

Unlike some offshore locations that may have easier requirements, the SCA works as a strong, onshore regulator. It sets strict rules for having enough money, business behavior, and protecting client funds. For a broker to work legally within the UAE (outside of special areas like the DIFC which has its own regulator), it must get an SCA license, agreeing to follow this complete oversight. This system is designed to create a safe environment for both local and international investors participating in the UAE's financial markets.

Understanding the “Category 1” License

Not all SCA licenses are the same. The SCA has different levels of licenses, and the “Category 1” license represents the highest level for brokers dealing in securities and derivatives. It's a designation that is not easy to get. A company holding a Category 1 license, such as KIRA, can engage in many different activities, including dealing in securities as a main player and an agent, and offering complex products like Contracts for Difference (CFDs).

To get and keep this top-level license, a company must meet several demanding requirements. These include:

• Large Amount of Money: The SCA requires Category 1 companies to keep a substantial amount of paid-up capital. This money acts as a financial safety net, showing the company's financial strength and its ability to handle market problems without putting client money at risk.

• Strong Internal Controls: Applicants must prove they have solid internal management, risk control, and rule-following systems in place. This involves detailed documentation of how they operate, anti-money laundering (AML) policies, and know-your-customer (KYC) procedures.

• Fit-and-Proper Tests: Key people, including directors and senior management, must pass “fit-and-proper” tests. The SCA checks their experience, qualifications, and honesty to make sure the company is managed by skilled and ethical people.

• Technology and Operations Checks: The company's trading platforms and operational systems must meet specific standards for reliability, security, and fairness.

Getting a Category 1 license clearly shows that a brokerage has been thoroughly examined and has committed significant resources to meet the highest regulatory standards in the UAE.

Key Protections from SCA

The main benefit of trading with a broker regulated under a strong system like the SCA's is the range of protections given to clients. These are not just promises made by the broker; they are legal and regulatory requirements. For a trader, these protections translate into real security for their money.

The most important protections guaranteed under the SCA system for a Category 1 broker include:

• Separation of Client Money: This is arguably the most important protection. SCA regulations require that all client money must be held in separated bank accounts, completely separate from the company's own operational funds. This means the broker cannot use client money for its business expenses, such as salaries or marketing. If the broker goes bankrupt, these separated funds are protected from the broker's creditors and should be returned to the clients.

• Strict Rule-Following and Reporting: Category 1 brokers are not just licensed once; they are continuously watched. They must submit regular, detailed financial reports and statements to the SCA. They are also subject to periodic and surprise checks by the regulator to ensure ongoing compliance with all rules, from having enough money to fair trade execution policies.

• Clear Business Practices: The SCA system enforces rules around transparency. This includes requirements for fair pricing, clear explanation of all risks associated with trading complex instruments like CFDs, and transparent order execution policies. Brokers must act in the best interest of their clients and avoid conflicts of interest.

• Dispute Resolution Systems: If a dispute arises between a client and the broker, the SCA provides a formal way for complaints and resolution. This gives traders options beyond the broker's internal customer service department, adding a layer of accountability. A regulated broker cannot simply ignore client complaints without facing potential regulatory consequences.

How to Check Regulation Yourself

A broker's claims of regulation and licensing are a starting point, not a final answer. In an industry where trust is very important, the responsibility falls on the individual trader to do their own research. Checking a broker's license independently is a must-do step before putting any money in. This process is straightforward and provides definitive proof of a broker's regulatory status.

The Golden Rule: Trust, but Check

The rule for any trader should be “Trust, but Check.” A good broker will be open about its regulatory details and should welcome examination. Showing a license number on a website is easy; proving that the license is current, valid, and applies to the correct company is what matters. Checking ensures you are not dealing with a fake company or a broker making false claims. This simple check can protect you from potential scams and provides peace of mind that you are operating within a regulated environment.

Checking the SCA Register

We can walk through the process of checking a broker's license directly with the regulator. This is the most reliable method and should be the primary source of truth. Let's use KIRA Regulation details as a practical example.

1. Go to the Official SCA Website: Your first step is to go to the official online portal of the UAE Securities and Commodities Authority. Make sure you are on the real government website, typically ending in a `.gov.ae` domain.

2. Find the Public Register: On the website, look for a section labeled “Licensed Companies,” “Regulated Entities,” “Public Register,” or a similar term. This section is designed for public access and transparency.

3. Search for the Broker: Use the search function within the register. You can typically search by the company's name (“KIRA”) or, for a more precise result, by its license number. In this case, you would enter `20200000244`.

4. Compare the Details: Once you find the entry, carefully examine the information provided on the SCA's register. You need to confirm several key points:

• The company name on the register must exactly match the name of the broker you are researching.

• The license number must match the one claimed by the broker.

• The license status should be listed as “Active” or “Licensed.”

• Check the “Approved Activities” to ensure they align with the services being offered (e.g., trading in securities, CFDs).

If all these details align perfectly with the information on the broker's website, you have successfully verified its regulatory status directly with the source.

Using Third-Party Tools

In addition to direct checking with the regulator, traders can use specialized third-party platforms for a more complete view. These platforms gather data from numerous regulators worldwide and often include other valuable insights that can inform your decision.

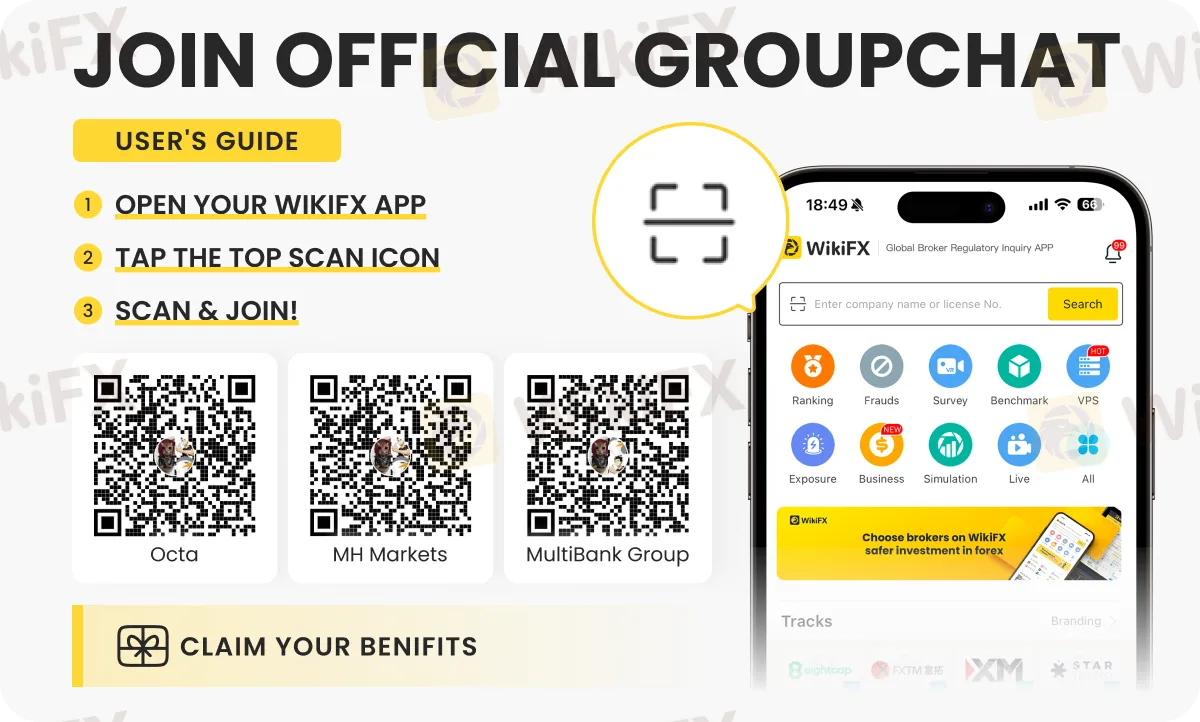

Importantly, before committing to any broker, we strongly recommend that traders use independent checking platforms. A valuable resource for this is WikiFX, which gathers regulatory data, KIRA License details, and user reviews for thousands of brokers worldwide.

Using a platform like WikiFX offers several advantages. It can present complex regulatory information in a simplified, easy-to-understand format. Furthermore, it often provides a more complete picture by including details such as the broker's operational history, the physical address of its headquarters, and, importantly, user-submitted reviews and complaints. This combination of official data and user experience can help you identify potential warning signs that might not be obvious from the regulatory register alone. It serves as an excellent secondary check to complete your research.

Looking at Company and Money Safety

Understanding a broker's regulatory license is the foundation. The next step is to look at how the broker's specific business model and product offerings align with that regulatory framework. KIRA makes several claims about its services, from its target audience to its fund security measures. We can now examine these claims through the lens of its SCA Category 1 license.

UAE-Based and GCC-Focused

KIRA presents itself as a broker built for traders in the Gulf Cooperation Council (GCC) region, with a main office in Dubai. This regional focus, combined with its SCA license, has several practical benefits. A local physical presence suggests a commitment to the regional market beyond just a translated website.

For traders in the GCC, this can mean real benefits such as:

• Local Customer Support: The availability of support staff who understand the local language (Arabic) and business culture can be a significant advantage for resolving issues efficiently.

• Regional Market Understanding: A broker with a team on the ground is more likely to understand the specific needs and preferences of regional traders.

• Islamic Accounts: As claimed, the provision of swap-free Islamic accounts is an important feature for a large segment of the GCC population, showing an alignment with regional cultural and religious principles.

This focus suggests a business strategy tailored to a specific group, rather than a one-size-fits-all global approach.

A Closer Look at Money Security

KIRA's claim that funds are “held in fully separated accounts” and “kept away from company operations” is a direct reflection of the SCA's required rules for a Category 1 licensed company. This is not merely a company policy; it is a regulatory requirement.

Let's show the flow of client funds under this required structure:

• Step 1: A client makes a deposit into their trading account.

• Step 2: These funds are legally required to be placed into a designated client bank account at a reputable UAE bank. This account is separate from KIRA's company accounts.

• Step 3: The broker's own money, used for operational costs like salaries, rent, and marketing, is held in a completely different company account. The two are not allowed to mix.

• Result: This legal separation, known as segregation, ensures that in the unlikely event the brokerage faces financial difficulties or bankruptcy, client funds are protected and not considered assets of the company. Therefore, they are protected from being used to pay off the company's debts.

This practice is a cornerstone of financial regulation worldwide and is one of the most significant protections a trader has. The fact that KIRA operates under this SCA requirement provides a strong layer of security for client money.

Islamic Accounts and Sharia Principles

The offering of swap-free Islamic accounts is another key feature highlighted. This type of account is designed to follow Sharia law, which prohibits the charging or earning of interest (Riba). In forex trading, this typically shows up as overnight swap fees, which are charged for holding positions open from one day to the next.

An Islamic account eliminates these swap fees. It is an essential product feature for any broker serious about serving the GCC and wider Muslim market. While the provision of an Islamic account is a product-level decision rather than a direct regulatory requirement from the SCA, it shows the broker's commitment to serving its stated target audience. It aligns the broker's business offerings with the cultural context of its primary operational area.

Conclusion: Putting Together the Profile

After a detailed analysis of KIRA's regulatory status, company structure, and product claims, we can put together our findings into a clear and simple summary. This profile provides a factual basis for any trader doing their research on the brokerage.

A Summary of Key Findings

Our deep dive into KIRA Regulation framework reveals several important points that are essential for any potential client to consider.

• KIRA is verifiably regulated by the UAE's Securities and Commodities Authority (SCA) under a top-tier Category 1 license (No. 20200000244). This is not an offshore or light-touch regulation but a strong, onshore framework.

• The SCA regulatory structure provides significant and legally required trader protections. The most important of these is the strict requirement for the separation of client funds, which shields trader money from the broker's company finances.

• The broker's stated company strategy and product offerings, such as a strong focus on the GCC region, local support, and the provision of Sharia-compliant Islamic accounts, are consistent with its base of operations in Dubai and its target market.

The Final Word on Responsibility

In conclusion, a strong regulatory license from a reputable authority like the SCA provides an important foundation of security and trust. It establishes a baseline of operational standards, financial stability, and client protection. However, the ultimate responsibility for protecting one's money always lies with the individual trader.

Regulation reduces risk; it does not eliminate it. Therefore, doing personal and thorough research is not just a recommendation; it is an essential practice for anyone serious about trading.

As a final check, always consider cross-referencing any broker's details on a comprehensive platform like WikiFX before opening an account or putting in funds. This careful step is a hallmark of a serious and successful trader.

Disclaimer:

The views in this article only represent the author's personal views, and do not constitute investment advice on this platform. This platform does not guarantee the accuracy, completeness and timeliness of the information in the article, and will not be liable for any loss caused by the use of or reliance on the information in the article.

WikiFX Broker

Latest News

Admiral Markets Review: Regulation, Licences and WikiScore Analysis

1,789 Victims, Nearly $300 Million Lost: Gold High-Return Scam Exposed

UPFOREX Regulatory Status: A 2026 Deep Dive into Its Licenses and Risks

HKEX Profit Surge Signals Massive Chinese Capital Inflow and Asian Market Resilience

The micro-documentary "Let Trust Be Seen" is officially launched today!

Understanding FX SmartBull Withdrawal & Deposit: Essential Information Before You Start Trading

ProMarkets Review: Total Forex Scam Alert

Clone Broker Alert: Darwinex, AIM & Spreadex Targeted

Understanding UPFOREX Money Transfers: Important Facts You Need to Know

TradingMoon Review: Offshore Regulated Fraud Risk Exposed

Currency Calculator