简体中文

繁體中文

English

Pусский

日本語

ภาษาไทย

Tiếng Việt

Bahasa Indonesia

Español

हिन्दी

Filippiiniläinen

Français

Deutsch

Português

Türkçe

한국어

العربية

Grand Capital Investigation: The "Seychelles" Broker That Seychelles Denies Knowing

Abstract:The smoking gun for Grand Capital isn't hidden in fine print; it is pasted on the official notice board of the Seychelles Financial Services Authority (FSA). While this broker’s marketing materials proudly claim an address at "Aarti Chambers" in Victoria, Mahe, the very regulator governing that jurisdiction has publicly disavowed them.

Score: 2.34 / 10

Status: Unauthorized / Blacklisted

Primary Complaint: Withdrawal Blocks & Fake Volume Requirements

The smoking gun for Grand Capital isn't hidden in fine print; it is pasted on the official notice board of the Seychelles Financial Services Authority (FSA). While this brokers marketing materials proudly claim an address at “Aarti Chambers” in Victoria, Mahe, the very regulator governing that jurisdiction has publicly disavowed them.

On July 1, 2024, the FSA issued a definitive “Scam Alert” against Grand Capital Ltd. The regulator‘s statement was blunt: this entity has “never been licensed” to conduct business there. When a broker’s claimed home base declares them a fraud, every other promise—from asset safety to withdrawal guarantees—collapses immediately. This isn't a regulatory gray area; it is a direct confrontation with reality.

The Regulatory Rap Sheet

Many brokers lose a license or face a fine. Grand Capital, however, has achieved a rare feat: they are actively warned against by three different national regulators across two continents.

The following table represents the complete regulatory history found in the WikiFX database. Note the repeated recurrence of “Unauthorized” status.

| Regulator | Country | License Type | Status | Date of Action |

|---|---|---|---|---|

| FSA (Seychelles Financial Services Authority) | Seychelles | Unauthorized | Scam Alert | 2024-07-01 |

| AMF (Autorité des Marchés Financiers) | France | Unauthorized | Blacklisted | 2021-01-18 |

| AMF (Autorité des Marchés Financiers) | France | Unauthorized | Blacklisted | 2019-07-23 |

| CMVM (Comissão do Mercado de Valores Mobiliários) | Portugal | Unauthorized | Warning | 2020-12-18 |

The timeline reveals a persistent pattern. The French AMF blacklisted them in 2019. They didn't fix the issue; they were blacklisted again in 2021. The Portuguese CMVM flagged them in 2020 for unauthorized financial intermediation. The 2024 Seychelles warning is merely the latest chapter in a long history of operating outside legal boundaries.

The “Lot Requirement” Infinite Loop

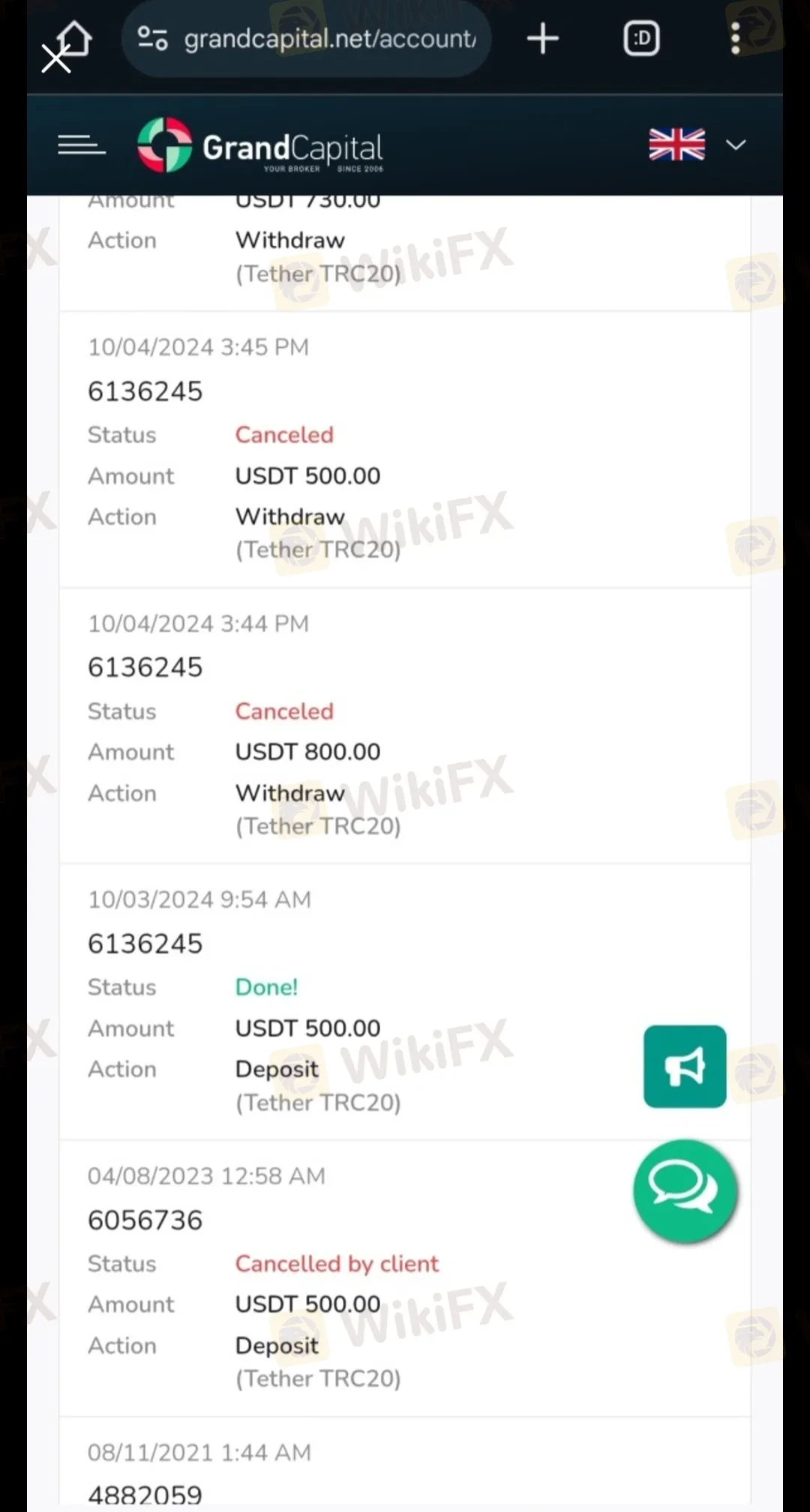

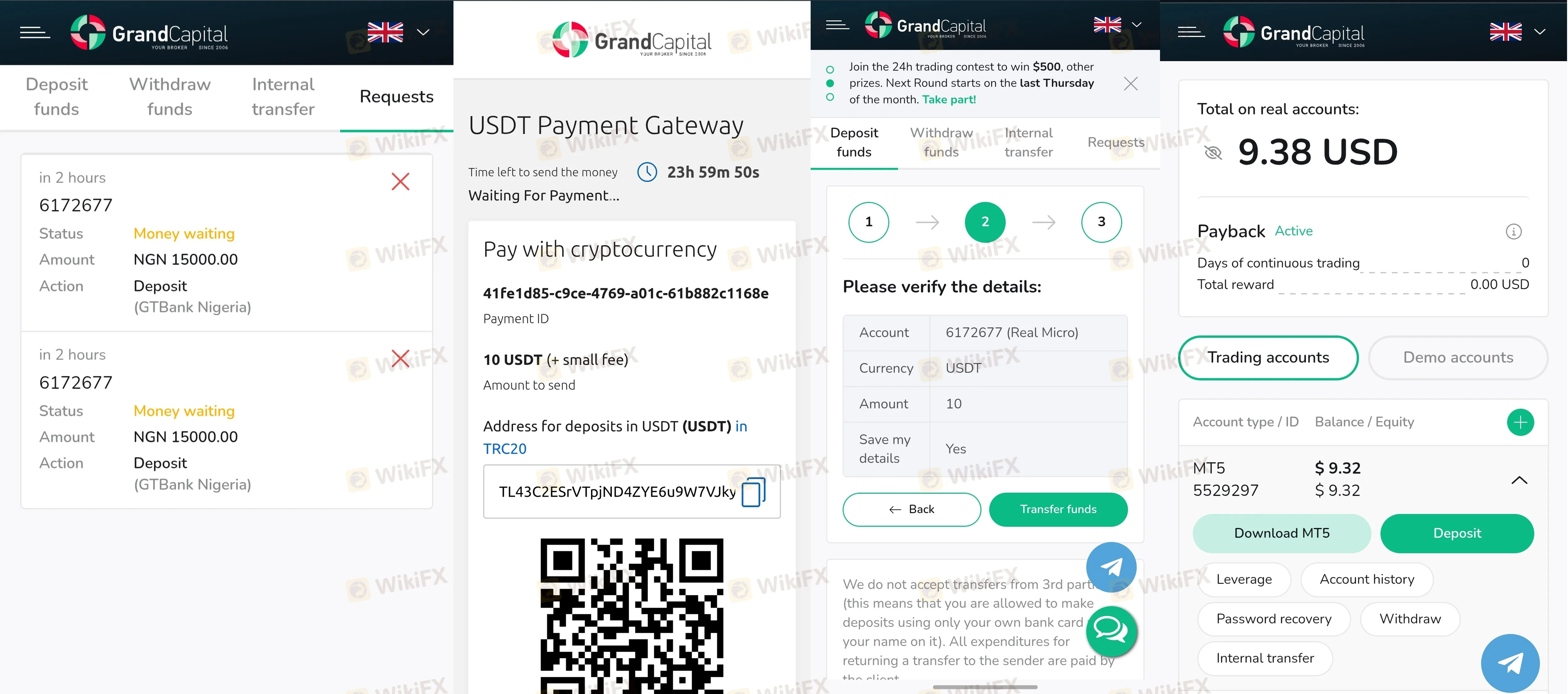

Beyond regulatory failures, the specific mechanics of client losses at Grand Capital point to a sophisticated retention trap. A complaint from a Turkish trader (Case #7) exposes a tactic known as “churning.”

The trader deposited $500 and generated $800 in profits. When they attempted to withdraw, the broker allegedly froze the request, citing a “5% lot requirement.” The trader complied, trading 25 lots. The goalposts then moved: Grand Capital demanded 9 more lots. After the trader completed those, the demand increased by another 15 lots.

This is not a risk management policy; it is an attrition strategy. By forcing a client to over-trade to unlock their own funds, the broker statistically ensures the market will eventually wipe out the balance. The “processing time” excuses that followed were simply the final door closing.

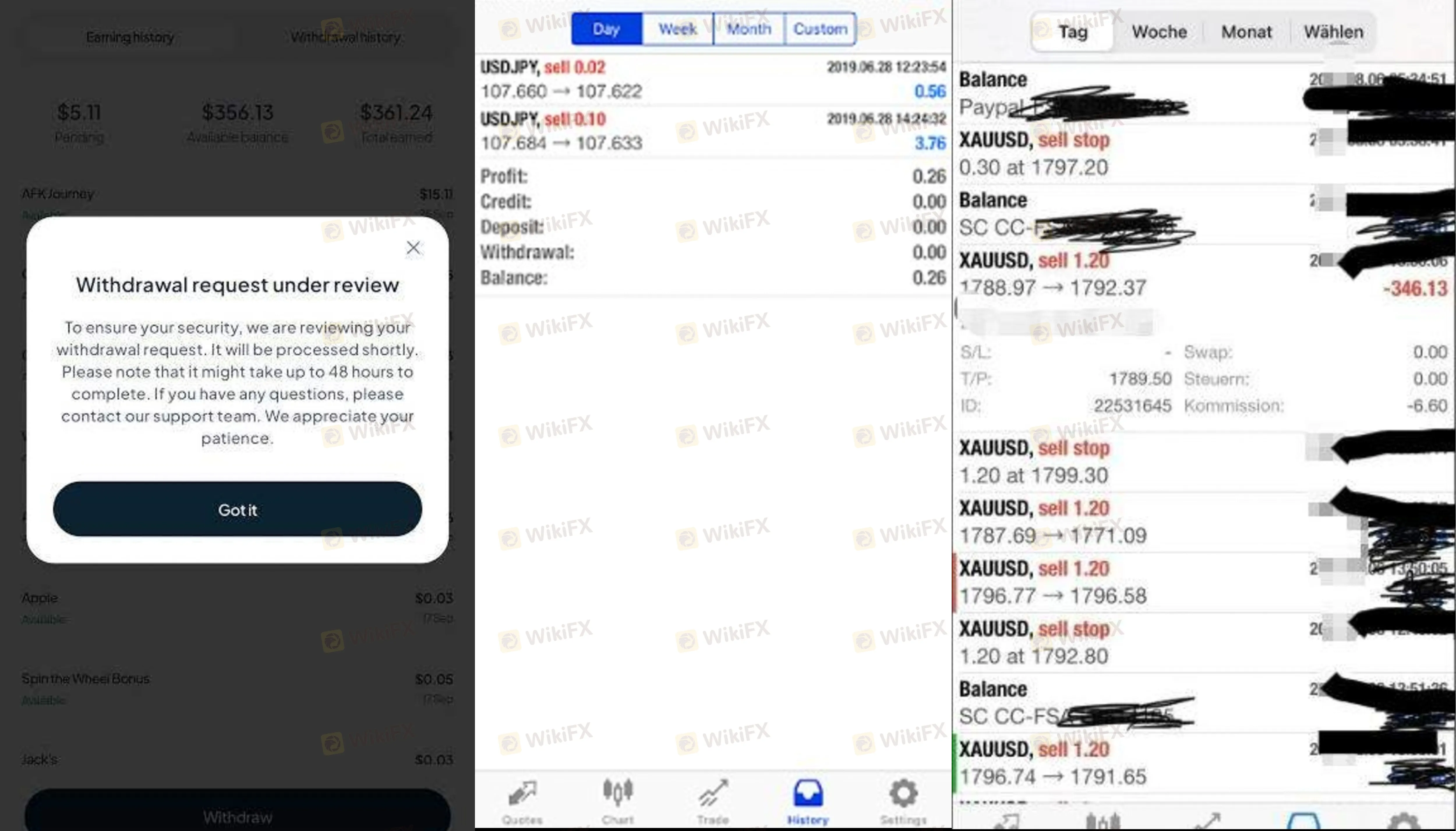

“Withdrawal in Review”: The Global Black Hole

The bulk of recent complaints—specifically from September 2025 back to mid-2024—originate from India and Thailand, painting a picture of systemic liquidity denial. The WikiFX database logs 13 complaints in just three months, a high volume for a broker with a “C” influence rank.

Traders report that the interface itself seems designed to fail. One user (Case #4) described the application interface as constantly “getting stuck” during withdrawal attempts. Others receive the generic “in review” status indefinitely.

A specific case from Thailand (Case #9) highlights the disconnect between sales agents and reality. An Introducing Broker (IB) and a “GrandCapitalBKK” admin allegedly promised the client that deposits over $1,000 would be exempt from lot requirements. Once the money was in, the exemption vanished, and the withdrawal was rejected for—you guessed it—rule violations.

Even micro-deposits are not safe. An Indian trader (Case #6) reported that a mere $10 deposit was deducted from their source but never credited to the trading account. If a broker's payment gateway cannot reliably handle $10, trusting them with significant capital is logically unsound.

Verdict

Grand Capital presents itself as an established entity (founded 2018) with MT4/MT5 capabilities. However, the data suggests these tools are being used by an entity that the Seychelles FSA explicitly labels a “Fraud/Scam.”

With regulators in France, Portugal, and Seychelles all issuing warnings, and a documented pattern of moving goalposts regarding withdrawal conditions, the risk here is not just market volatility—it is counterparty malice.

WikiFX Risk Warning

Start your due diligence with the facts, not the marketing. Trading forex and CFDs involves significant risk and is not suitable for all investors. The information provided here is based on the latest available data from regulatory bodies and user reports. Anonymity of the traders involved in the complaints has been preserved where applicable.

Disclaimer:

The views in this article only represent the author's personal views, and do not constitute investment advice on this platform. This platform does not guarantee the accuracy, completeness and timeliness of the information in the article, and will not be liable for any loss caused by the use of or reliance on the information in the article.

WikiFX Broker

Latest News

Dukascopy Triples MetaTrader 5 Asset Suite to Surpass 400 Instruments

Scope Prime Strengthens Institutional Liquidity Infrastructure with Ultency Integration

NAGA Earnings Signal Industry Stress Amid Low FX Volatility

HFM Review 2026: Is this Forex Broker Legit or a Scam?

ESMA Tightens Derivative Rules: Crypto 'Perpetuals' Face Strict CFD Leverage Caps

INFINOX Analysis Report

UK Retail Sentiment: Inflation Reality Check Damps Appetite for Cash

Equity Volatility Signals Risk-Off Shift as Prime Broker IPO Stalls

OANDA Japan Slashes Gold Trading Limits as Volatility Drains Liquidity

European Retail FX Brokers Pivot to Futures Amid Regulatory Crackdown

Currency Calculator