简体中文

繁體中文

English

Pусский

日本語

ภาษาไทย

Tiếng Việt

Bahasa Indonesia

Español

हिन्दी

Filippiiniläinen

Français

Deutsch

Português

Türkçe

한국어

العربية

iq option Review: A Deep Dive into Safety and Regulation

Abstract:**iq option** holds a valid regulatory license in Cyprus but faces official warnings from financial authorities in Malaysia and Singapore. Recent WikiFX data indicates a high volume of unresolved complaints focused on blocked withdrawals and account verification delays.

Key Takeaways

- Mixed Regulation:iq option is regulated by CySEC (Cyprus) but listed on “Investor Alert” lists in Malaysia and Singapore.

- High Complaint Volume: In the last 3 months alone, WikiFX recorded 98 complaints from users.

- Withdrawal Risks: Many traders report difficulties withdrawing funds after making profits, often citing verification issues.

- Offshore Operations: The broker is headquartered in Antigua and Barbuda, which may offer less protection for global clients compared to European standards.

Quick Summary

iq option is a well-known broker established in 2014. It is famous for its proprietary trading platform and massive advertising presence. It holds a WikiFX score of 5.46 out of 10. While this score is not extremely low, it reflects a conflict between its valid European license and a high number of user complaints. The influence rank is AA, meaning it is very popular globally, especially in Latin America and Asia. However, popularity does not always guarantee safety.

Is the License Real?

The regulatory status of iq option is complex. It operates with a valid license in Europe but faces restrictions elsewhere.

Regulatory Table

| Regulator | Country | License Status | Safety Level |

|---|---|---|---|

| CySEC | Cyprus | Regulated | High (for EU clients) |

| SCM | Malaysia | Unauthorized | Low (Warning Issued) |

| MAS | Singapore | Investor Alert | Low (Warning Issued) |

What this means for you

1. The Good: The license from CySEC (Cyprus) is authentic. This generally protects traders within the European Union.

2. The Bad: Financial authorities in Malaysia and Singapore have issued warnings. The SCM (Malaysia) listed the broker as “Unauthorized” for carrying out capital market activities without a license.

3. The Risk: The broker's headquarters are in Antigua and Barbuda. If you are a trader outside of Europe, your account may be registered under this offshore structure. Offshore regulations are often less strict, which might explain why many international users face issues that European clients do not.

What Traders Say

WikiFX has received a surge of negative reports. The “Case Center” shows 98 complaints in just three months. Here are the main patterns found in the [2025] data:

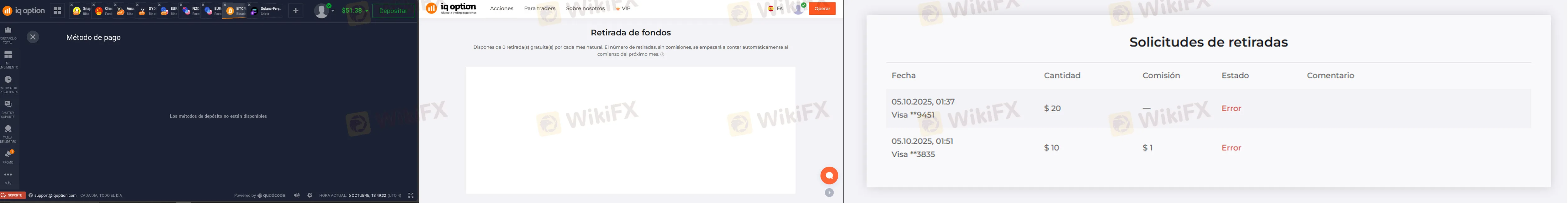

1. Withdrawal Failures

The most common issue is the inability to get money out.

- Case Evidence: A user from Mexico reported in [2025] that their last withdrawal of 30 USD never arrived.

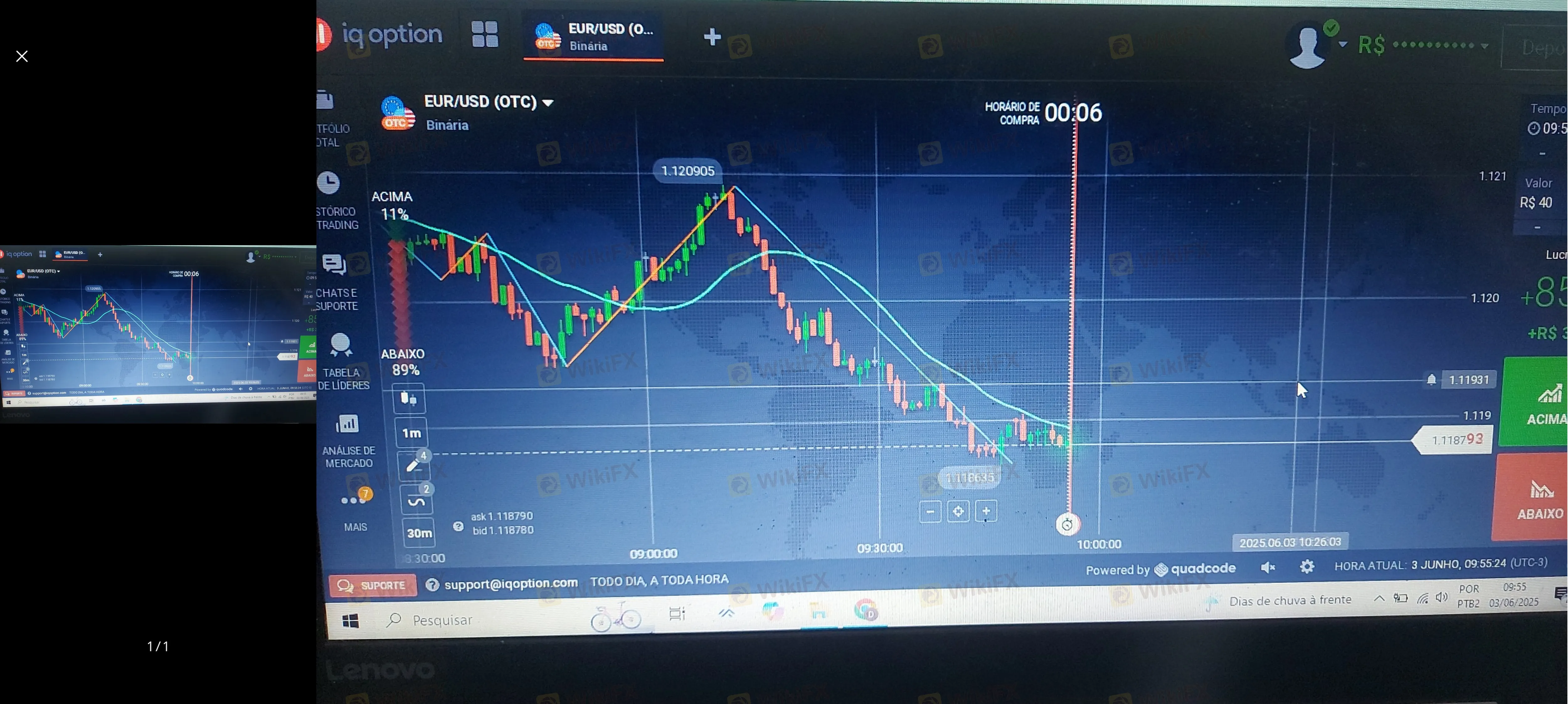

- Case Evidence: In Brazil, multiple users stated that withdrawals are processed but then returned to the trading account, or simply disappear. One user noted, “The platform does not pay, withdrawals get stuck.”

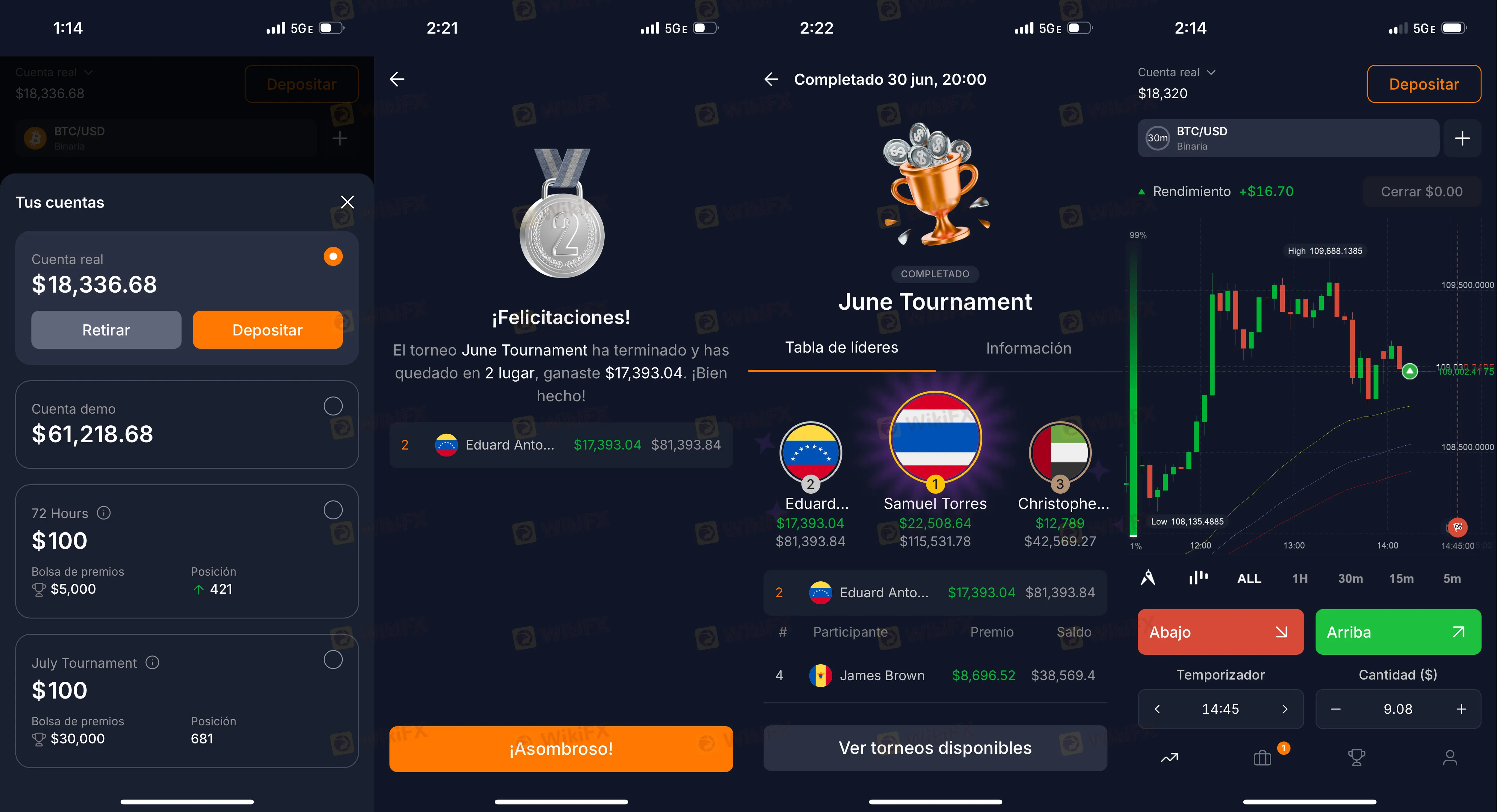

2. Account Blocking After Profits

Several traders claim their accounts were disabled immediately after they made a profit.

- Case Evidence: A trader from Bolivia invested 20 USD, grew it to over 50 USD, and was blocked when attempting to withdraw. They reported that support stopped responding.

- Case Evidence: A user from Venezuela described the platform as blocking communication after requesting documents for verification, resulting in a loss of funds.

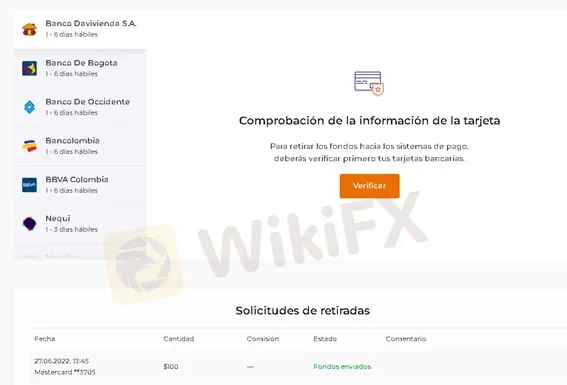

3. Verification Loops

Traders report being asked for documents repeatedly, even after their accounts were already verified.

- Case Evidence: A user from Colombia mentioned that iq option requested verification for bank cards used over 4 years ago, which were impossible to provide. This creates a barrier that prevents users from accessing their money.

> Note: While there are some positive reviews regarding the platform's features from Thailand and Bangladesh, they are heavily outnumbered by reports of payment issues in Latin America.

Conclusion

iq option presents a significant risk for international investors. While it holds a valid license in Cyprus, the high number of complaints regarding withdrawal blocks and account restrictions cannot be ignored.

Recommendation:

- For EU Residents: You are likely protected by CySEC rules, but caution is still advised.

- For Global Traders (Asia/Africa/LATAM): The risk is high. You are likely trading under the offshore entity. The evidence suggests a pattern where small deposits work, but withdrawing profits becomes difficult.

Final Verdict: We advise traders to choose brokers with fewer recent complaints and stronger regulatory protection in their specific region. Please be aware of the risks.

Disclaimer:

The views in this article only represent the author's personal views, and do not constitute investment advice on this platform. This platform does not guarantee the accuracy, completeness and timeliness of the information in the article, and will not be liable for any loss caused by the use of or reliance on the information in the article.

WikiFX Broker

Latest News

Asia Market Volatility: KOSPI Stages Historic 12% Rebound as Capital Flows Pivot

AssetsFX Review 2026: Is this Broker Safe?

Fed Beige Book: Stagflation Risks Rise as Growth Stalls While Prices Stick

China Economic Watch: PMI Divergence and "Two Sessions" Signal Structural Shift

Emerging Markets: South African Fiscal Strains in Focus Amid Calls for SOE Reform

TradeEU Global Review 2026: Is this Forex Broker Legit or a Scam?

Oil Spikes 9% and Shipping Rates Soar as Middle East Logistics Fracture

Evest Broker Review: Regulated, but Complaints Persist

Is Eightcap Safe or Scam? Eightcap User Reputation : Looking at Real User Reviews

Understanding Dbinvesting Deposit and Withdrawal: What Traders Should Know

Currency Calculator