Abstract:Picking a trading broker is one of the most important financial decisions an investor can make. Your capital, your profits, and your peace of mind all depend on whether the platform is honest. You are smart to be careful, especially when you see a new name like Hija Markets. This platform says it is a modern, full-featured online brokerage, but what is really going on behind the scenes? This article gives you a complete, fact-based look into whether Hija Markets is legitimate. Our goal is to look past the marketing and study real facts to answer one main question: Is this a safe trading partner? While Hija Markets look attractive on the surface, our research shows several serious warning signs, especially that it has no financial regulation at all, which creates a big and unacceptable risk to traders' capital.

Picking a trading broker is one of the most important financial decisions an investor can make. Your capital, your profits, and your peace of mind all depend on whether the platform is honest. You are smart to be careful, especially when you see a new name like Hija Markets. This platform says it is a modern, full-featured online brokerage, but what is really going on behind the scenes? This article gives you a complete, fact-based look into whether Hija Markets is legitimate. Our goal is to look past the marketing and study real facts to answer one main question: Is this a safe trading partner? While Hija Markets look attractive on the surface, our research shows several serious warning signs, especially that it has no financial regulation at all, which creates a big and unacceptable risk to traders' capital.

Key Facts and Verdict

For traders who need a quick review, the most important information is listed below. This table gives you a quick look at what we found, showing the areas of biggest concern.

Based on these facts, the initial verdict is clear. Having no financial regulation is the most serious warning sign and a deal-breaker for any smart investor. Because of this, Hija Markets cannot be considered a safe or legitimate trading partner right now. The combination of having no regulation and being extremely new creates a high-risk situation for any investment you make

The lack of regulation is the most serious warning sign. Before thinking about any broker, especially a new one like Hija Markets, you need to check its regulatory status. You can get an instant, unbiased report on Hija Markets' regulatory claims and overall safety score by checking its profile on WikiFX. This simple step can save you from potential scams.

What Hija Markets Promises

To understand why a broker like Hija Markets might appeal to people, it's important to look at the features it advertises to attract clients. These offerings often look competitive and are designed to appeal to many different types of traders, from beginners to experienced professionals.

Different Trading Products

Hija Markets claims to give access to many different financial instruments across several major asset types. This is a common way to present a “one-stop shop” for traders. The offered products include:

· Forex (Foreign Exchange)

· Stocks

· Spot Metals

· Cryptocurrencies

· Commodities

This variety is designed to appeal to traders looking to diversify their portfolios or trade on different markets from a single account.

A Tiered Account System

The platform structures its offerings through a tiered account system, serving different levels of investment and trading styles. Each tier comes with different advertised benefits regarding deposits, spreads, and leverage.

· Standard Account: Marketed to beginners with a low entry point of a $50 minimum deposit and spreads starting from 1.5 pips.

· Prime Account: Aimed at higher-volume traders, requiring a $1,000 minimum deposit in exchange for tighter spreads from 0.6 pips.

· Raw Spread Account: For traders who prefer raw interbank spreads, this account requires a $500 minimum deposit and charges a $3 commission per lot traded. Even spread charges begin from 10 pips.

· LeveragePlus Account: A high-risk option with a minimal $10 deposit requirement, offering extreme leverage up to 1:2000.

This structure is typical, but the features, especially the high leverage, should be viewed with caution, as we will explore later.

Easy Funding and Withdrawals

Easy funding is a key selling point. Hija Markets promotes many different deposit and withdrawal methods, including traditional and modern options:

· Bank Transfer

· Credit Cards (Visa, MasterCard)

· E-wallets (Skrill, NETELLER)

· Cryptocurrencies (Tether, Bitcoin)

The broker highlights a low minimum deposit of just $10 and a “no-fee” policy on transactions. While this sounds attractive, it's a feature often used by high-risk brokers to make it as easy as possible for clients to put in capital. The real test of a broker's honesty, however, always lies in the withdrawal process.

The Investigation: 4 Critical Red Flags

Our deep dive into Hija Markets goes beyond its marketing claims to uncover the facts. This investigation revealed four major red flags that any potential investor must consider. These are not minor issues; they are basic flaws that question whether the broker is legitimate and safe.

Red Flag #1: No Financial Regulation

Financial regulation is the foundation of a broker's trustworthiness. It ensures that a firm follows strict standards for protecting client capital, fair trading practices, and transparent operations. It also gives clients a legal way to resolve disputes.

Hija Markets' registration status is a critical point of failure. The company, Hija Global Markets Ltd, is registered as an International Business Company (IBC) in Saint Lucia with the number 2024-00762. However, this is just a business registration, much like registering any other type of company. It is not a financial license. Our checks confirm that Hija Markets is not licensed or regulated by the Saint Lucia Financial Services Regulatory Authority (FSRA) or any other reputable financial watchdog worldwide. This means there is no oversight, no requirement for separate client accounts, and no protection for your funds if the company becomes insolvent or acts dishonestly.

Checking a broker's license is the single most important step in your research. A fancy website can be misleading, but a regulatory database doesn't lie. We strongly advise cross-referencing any broker's claims on a trusted third-party platform, such as WikiFX, which gathers data directly from regulators worldwide. A quick search for Hija Markets here will confirm its unregulated status.

Red Flag #2: A Digital Ghost

A legitimate financial company builds a track record and maintains a transparent public presence over time. Hija Markets is noticeably absent in this regard, operating like a ghost in the digital world.

· Extremely New: The website domain, `hijamarkets.com`, was registered on December 4, 2024. As of 2025, this makes the company brand new. It has no operating history, no established reputation, and no proven track record of successfully processing client withdrawals over a long period.

· No Social Media Presence: In today's market, it is very unusual for a customer-facing financial services company to have zero presence on major social media platforms such as LinkedIn, Facebook, or X (formerly Twitter). This lack of engagement suggests an unwillingness to be transparent or accountable in a public forum.

· Very Small Web Traffic: Data from Semrush shows the website receives fewer than 200 visits per month. This shows a tiny market footprint and suggests the broker has not gained any significant traction or trust within the trading community.

Red Flag #3: Unreachable Customer Support

Effective and responsive customer support is crucial, especially concerning your capital. To test Hija Markets' reliability, we conducted a simple but revealing test.

We sent a test inquiry to its official support email (`support@hijamarkets.com`) asking a basic question about its services. As of this writing, we have not received any reply. This failure to respond is a major concern. If a potential new client cannot get a response, it raises serious doubts about the level of support an existing client would receive when facing a critical issue, such as a withdrawal problem or a trading dispute.

Red Flag #4: Unclear Tech and Location

Further problems appear when examining the broker's technology and physical presence.

Hija Markets claims to offer the industry-standard MetaTrader 5 (MT5) platform. However, the official website provides no download link for the software. While our research found a server related to “Hija Global Markets Ltd” within the MT5 application, the lack of a direct, official download from the broker's site is unusual and raises questions about whether they hold a legitimate, full-service license for the platform.

Furthermore, the company lists a physical office address in Dubai: Office 2013, The Binary by Omniyat, Business Bay. However, there is no independent, verifiable evidence or third-party confirmation that Hija Markets maintains an operational office at this location. An unverified address for an unregulated broker is another significant warning sign.

Anatomy of a High-Risk Broker

It's not enough to just identify red flags; it's crucial to understand why it is dangerous. Unregulated brokers often use a specific playbook of “too good to be true” features to attract unsuspecting traders. The very offerings promoted by Hija Markets, basically, are classic examples of this strategy.

The Lure of High Leverage

Hija Markets offers leverage up to an amazing 1:2000 on its LeveragePlus account. While high leverage can theoretically increase profits, it is a double-edged sword that equally increases losses. It is the fastest way for inexperienced traders to lose their entire account balance.

For this exact reason, reputable financial regulators in major areas, such as the UK (FCA), Europe (ESMA), and Australia (ASIC), have put in place strict leverage limits for retail clients, typically around 1:30. Unregulated offshore brokers offer extreme leverage not as a professional tool, but as bait to lure in traders with the promise of large profits from small deposits.

The “Zero Commission” Illusion

Many traders are attracted by promises of “zero commission” trading and low spreads. Hija Markets advertises spreads from 0.6 pips on its Prime account. However, in an unregulated environment, there is no one to ensure these conditions are honored. Unregulated brokers can change spreads, especially during volatile market news, or execute trades at significantly worse prices (slippage) than what is displayed. The “low cost” advertised can quickly disappear through hidden costs and poor execution, with no recourse for the trader.

The Danger of Easy Deposits

Hija Markets makes investing easy, even accepting cryptocurrencies. While convenient, this is another hallmark of high-risk operations. Crypto transactions are largely irreversible and can be difficult to trace. Scam operations prefer these methods because once the fund is sent, it is nearly impossible for the victim to get it back. The ease of deposit often stands in stark contrast to the extreme difficulty, or impossibility, of making a withdrawal.

The combination of extreme leverage, low entry barriers, and easy crypto funding is not a sign of a customer-friendly broker. It is a classic formula used by high-risk, unregulated entities to attract capital with little intention of returning it.

Final Verdict and Recommendation

After a thorough analysis of the available evidence, our conclusion is clear: Hija Markets shows all the primary characteristics of a high-risk, unregulated entity. The potential for financial loss when dealing with this broker is very high.

We can summarize the most damning evidence in a few key points:

· No financial regulation whatsoever. This is the most critical failure and exposes clients to total risk.

· Extremely new with no track record. The broker has been in existence for only a few months.

· A complete lack of transparency, with no social media presence or verifiable office.

· Failed our basic customer service test, showing a lack of professional support.

Our final recommendation is direct and firm: We strongly advise against putting any capital with Hija Markets. The risk of having withdrawal problems, unfair trading conditions, or losing your entire investment is not a risk worth taking. Legitimate, well-regulated brokers exist that offer far greater security and peace of mind.

Your financial safety is most important. Never trade with a broker without first running a complete background check. Before you even consider another broker, make it a habit to use a comprehensive verification tool. Visit WikiFX to check any broker's license, read user reviews, and see its risk rating in seconds. It is the most important step you can take to protect yourself in the world of online trading.

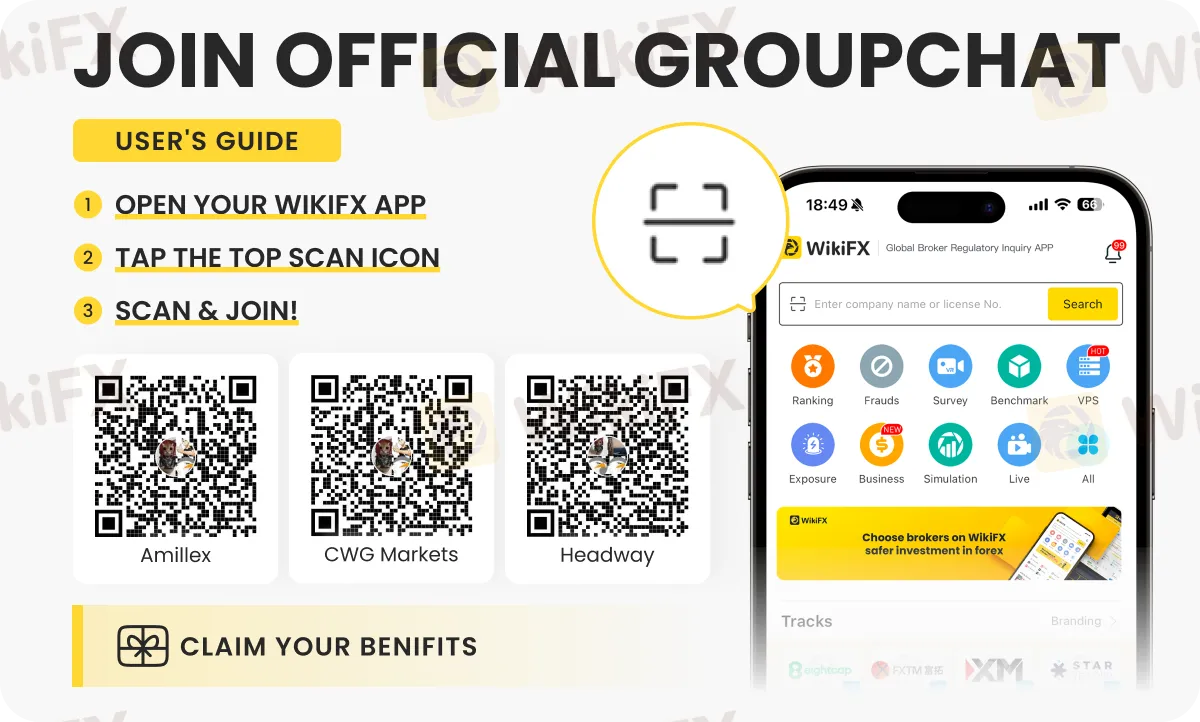

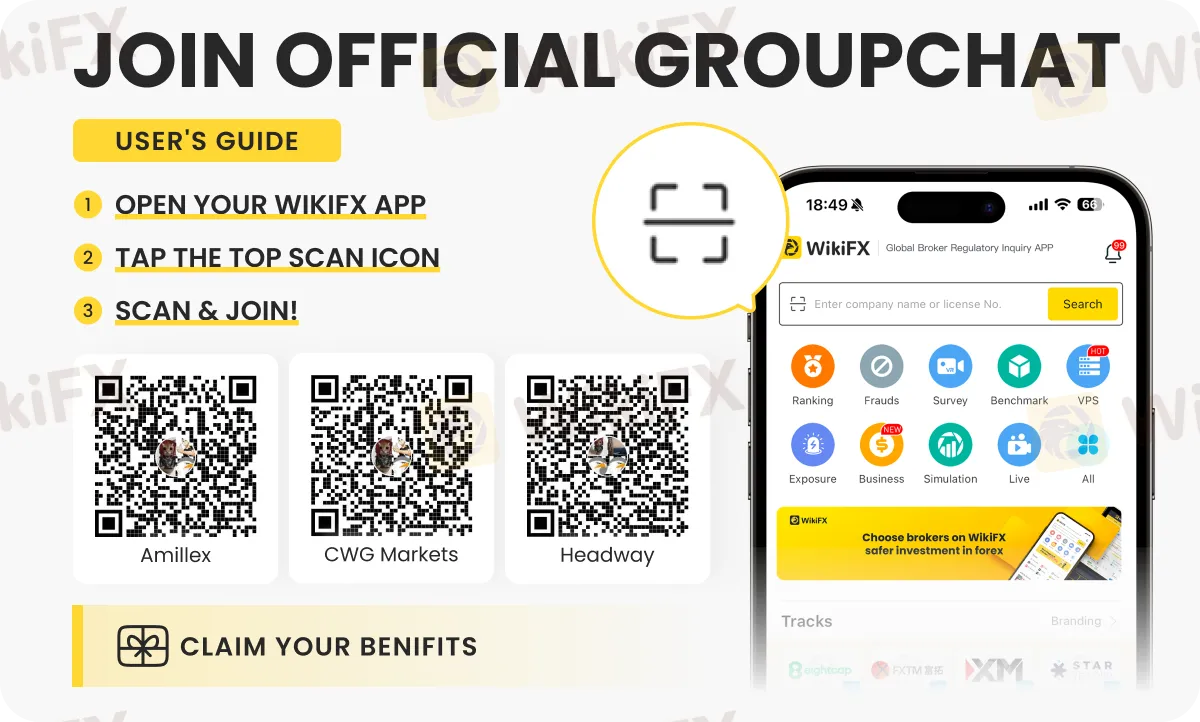

For more forex updates, join any of these special chat groups - OIFSYYXKC3, 403M82PDMX or W2LRJZXB7G - by following the instructions shown below.