Abstract:Is HIJA MARKETS safe or a scam? This is the key question for any trader thinking about using this platform, and our research aims to give a clear, fact-based answer. Based on proven information, Hija Markets shows several major warning signs that require serious caution. The platform started very recently in late 2024, has no financial oversight, and barely exists online - these are huge red flags. This article will examine these issues to show the possible risks to your capital. We will look at the company's background, rules it follows, and how open it is about its business. Before investing with any broker, checking it independently is essential for safety. We strongly suggest using a complete platform, such as WikiFX, to check a broker's legal status and user reviews as your first step.

Answering Your Main Question

Is HIJA MARKETS safe or a scam? This is the key question for any trader thinking about using this platform, and our research aims to give a clear, fact-based answer. Based on proven information, Hija Markets shows several major warning signs that require serious caution. The platform started very recently in late 2024, has no financial oversight, and barely exists online - these are huge red flags. This article will examine these issues to show the possible risks to your capital. We will look at the company's background, rules it follows, and how open it is about its business. Before investing with any broker, checking it independently is essential for safety. We strongly suggest using a complete platform, such as WikiFX, to check a broker's legal status and user reviews as your first step.

Main Worries at a Quick Look

The question “Is HIJA MARKETS Safe or a Scam?” is important. Our early review shows that the platform has major risks. This analysis will break down the company's setup, legal standing, and online presence to give a complete answer. A key first step for any trader is to do independent research.

Breaking Down Hija Markets

To understand the risks, we must look at the broker's real profile. This section breaks down the company's business and structural information, pointing out the important gaps and problems that signal danger for traders. We go beyond opinions to show proven facts and explain what they mean for your safety.

Company Start and Age

Hija Global Markets Ltd. is registered as an International Business Company (IFC) in Saint Lucia under registration number 2024-00762. However, the most important fact is how old it is. The company's website domain, hijamarkets.com, was only registered on December 4, 2024. As of early 2026, this makes the broker pretty new.

A business history of just a year above is a big concern. It is impossible to judge its long-term reliability, financial stability, or honest behavior in handling client capital and executing trades. New companies have not yet survived market ups and downs or built a history of successful client withdrawals, making them naturally riskier than established, time-tested firms.

The Problem with Rules

A common confusion is the difference between company registration and financial rules. While Hija Markets is registered as a business in Saint Lucia, this is not the same as being controlled by a financial authority. Our check confirms that Hija Markets has no regulatory license from the Saint Lucia Financial Services Regulatory Authority (FSRA) or any other respected financial watchdog worldwide.

This lack of rules is the single most important risk factor. It means there is no governing body making sure that Hija Markets separates client funds from company funds, keeps enough capital, or follows fair trading practices. If there is a dispute or the company fails, traders have no help.

Online Presence and Openness

A modern broker's trustworthiness is often shown in its online presence and openness. In this area, Hija Markets raises more red flags. According to Semrush data, the broker's website gets fewer than 200 visits per month. This extremely low traffic shows almost no market presence and a lack of natural interest from the trading community.

Also, the broker has a complete social media blackout. There is no official presence on any major platforms such as Facebook, Twitter, LinkedIn, or Instagram. For a financial services company in 2026, this is very unusual. Legitimate brokers use social media for communication, brand building, and openness. The absence of these channels prevents public examination and makes it difficult for potential clients to judge the company's working status or engage with a wider community of users. This lack of a digital footprint suggests an operation that is not prepared for, or is actively avoiding, public engagement.

HIJA MARKETS Complaints

When evaluating a broker, traders often search for complaints to judge its reliability. With Hija Markets, we face a puzzle: the complete absence of user feedback. This section analyzes why, for a new and unregulated company, “no news” is not “good news” but is instead a major risk indicator by itself.

The Sound of Silence

Our complete search across trading forums, review sites, and consumer protection portals found no public user reviews or formal complaints filed against Hija Markets. This is not a sign of perfect service. Rather, it is a direct result of the broker being too new to have established a public track record.

Without a history of user feedback, it is impossible to independently verify important aspects of its service:

· The actual speed and reliability of the withdrawal process.

· The fairness of trade execution and the frequency of slippage or requotes.

· The true cost of trading, including hidden fees.

· The quality and responsiveness of customer support during real-world trading issues.

This data gap means that any trader depositing funds would be doing so blindly, with no historical user experience to guide their decision.

Our Customer Support Test

To gain first-hand insight into the broker's responsiveness, we conducted a direct test of its stated customer support channels. We sent a standard inquiry regarding account setup and regulatory status to its official support email, support@hijamarkets.com.

As of the time of this analysis, we have received no response.

This failure to respond to a simple prospective client query is a major operational failure. It shows poor or non-existent customer service infrastructure. For a trader, this is a deeply concerning sign. If the broker is unresponsive to a simple question, it is highly unlikely it will offer timely or effective help when you face urgent issues with your account, trades, or—most importantly—your funds.

Evaluating Trading Offerings

To provide a complete picture, we must also analyze what Hija Markets claims to offer. This section gives an objective overview of its advertised services, including account types, software, and payment methods. This allows you to see the broker's features in the context of the basic safety risks discussed earlier.

Account Types Offered

Hija Markets presents four different account types, seemingly serving a wide range of traders from beginners to professionals.

While this variety may seem appealing, the features themselves contain risks. The offering of up to 1:2000 leverage on the LeveragePlus account is extremely dangerous. Respected regulators in major countries cap leverage for retail traders at much lower levels (e.g., 1:30 in Europe and the UK) to protect them from catastrophic losses. An unregulated broker offering such high leverage is a sign that it is not concerned with responsible trading practices or client protection.

The MT5 Platform Claim

The broker states that it provides the industry-standard MetaTrader 5 (MT5) trading platform, which is known for its advanced charting tools and support for automated trading. However, a critical piece is missing: the official website does not provide a download link for the MT5 software.

While our investigation found a server name related to “Hija Global Markets Ltd.” within the MT5 application, the lack of a direct, official download from the broker's site is another transparency issue. Users cannot easily verify the legitimacy of the server or the platform integration. This forces traders to search for the server manually, adding a layer of complexity and uncertainty that is not present with legitimate brokers.

Deposit and Withdrawal Methods

Hija Markets advertises a comprehensive suite of funding options, which on the surface appears convenient for global clients. These methods include:

· Bank Wire & Credit Cards (Visa, MasterCard)

· E-wallets (Skrill, NETELLER)

· Prepaid Cards (Perfect Money, AstroPay)

· Cryptocurrencies (Tether, Bitcoin)

The platform claims most deposits are processed instantly with no fees. However, the convenience of depositing funds is irrelevant if the withdrawal process is unreliable, difficult, or impossible. For an unregulated broker, the safety of your capital rests entirely on the company's honesty. There are no external safeguards to force them to return your capital. Platforms, such as WikiFX, often feature user-submitted reviews specifically detailing withdrawal experiences, which can be an invaluable, real-world data point when assessing a broker's trustworthiness.

Conclusion: The Final Verdict

After a thorough, evidence-based analysis, we can now combine our findings to provide a clear answer to the primary question and offer a decisive recommendation for traders.

Summary of Findings

To put it simply, the attractive features claimed by Hija Markets are completely overshadowed by the basic, verifiable risks associated with its operation.

Is Hija Markets Safe or a Scam?

Based on the overwhelming evidence, Hija Markets shows numerous characteristics that are hallmarks of high-risk, untrustworthy, and potentially fraudulent brokers.

The complete lack of financial regulation is the most critical and non-negotiable flaw. This single fact means there is no authority ensuring the safety of your funds, requiring fair trading practices, or providing a legal path for dispute resolution. Should the broker decide to withhold your funds, you have no help.

While we cannot legally label the entity a “scam” without a court ruling, its profile matches perfectly with operations designed to be high-risk for consumers. The combination of being unregulated, brand new, non-transparent, and unresponsive to communication makes it an exceptionally dangerous platform. The potential for a complete loss of deposited funds is significant.

Our Strong Recommendation

We strongly and completely advise against depositing any funds with Hija Markets. The risks associated with this broker far outweigh any of its claimed benefits. The probability of encountering issues with withdrawals or other unfair practices is unacceptably high.

Your primary criteria for selecting any broker must always be strong regulation from a top-tier authority (like the FCA, ASIC, or CySEC) and a long, proven track record of transparent operations and positive user feedback. Do not be tempted by high leverage or flashy marketing from an unvetted entity.

As a final precaution, make it a non-negotiable step in your process to conduct your own research before engaging with any broker, new or old. Use trusted third-party verification tools. A comprehensive check on a platform, such as WikiFX, can provide consolidated, up-to-date information on a broker's license, operational history, and user-reported issues. This simple step can empower you to make a truly informed and safe decision, protecting your hard-earned capital from unnecessary risks.

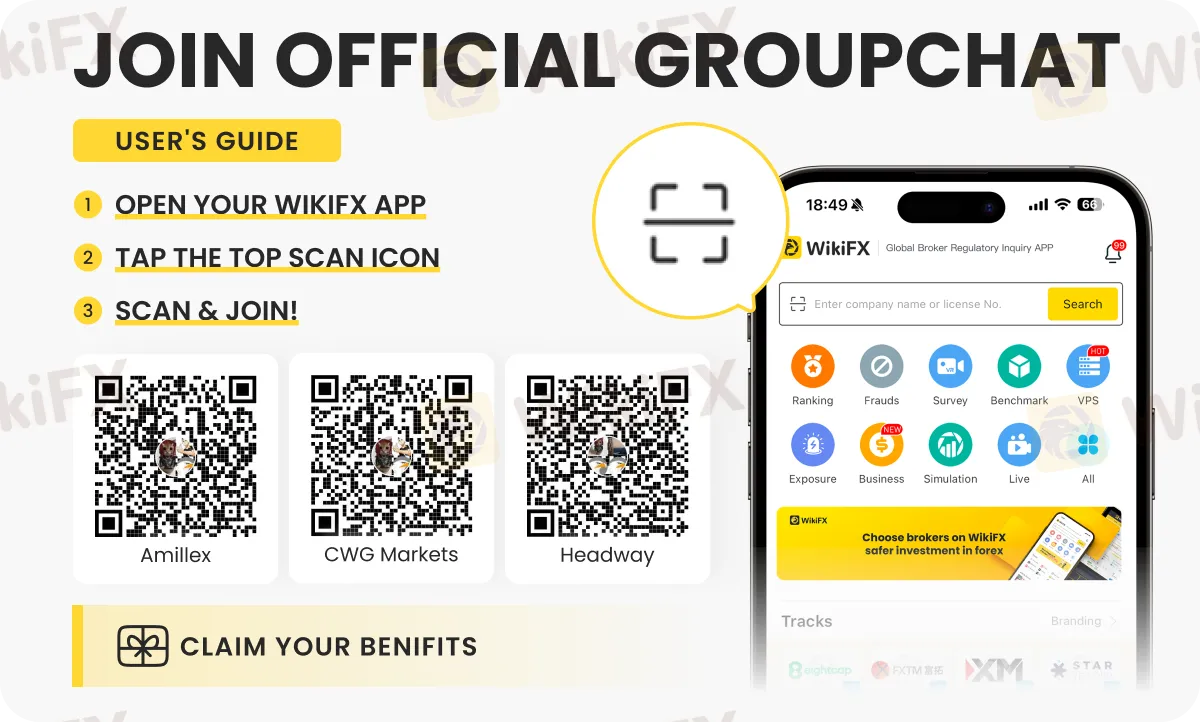

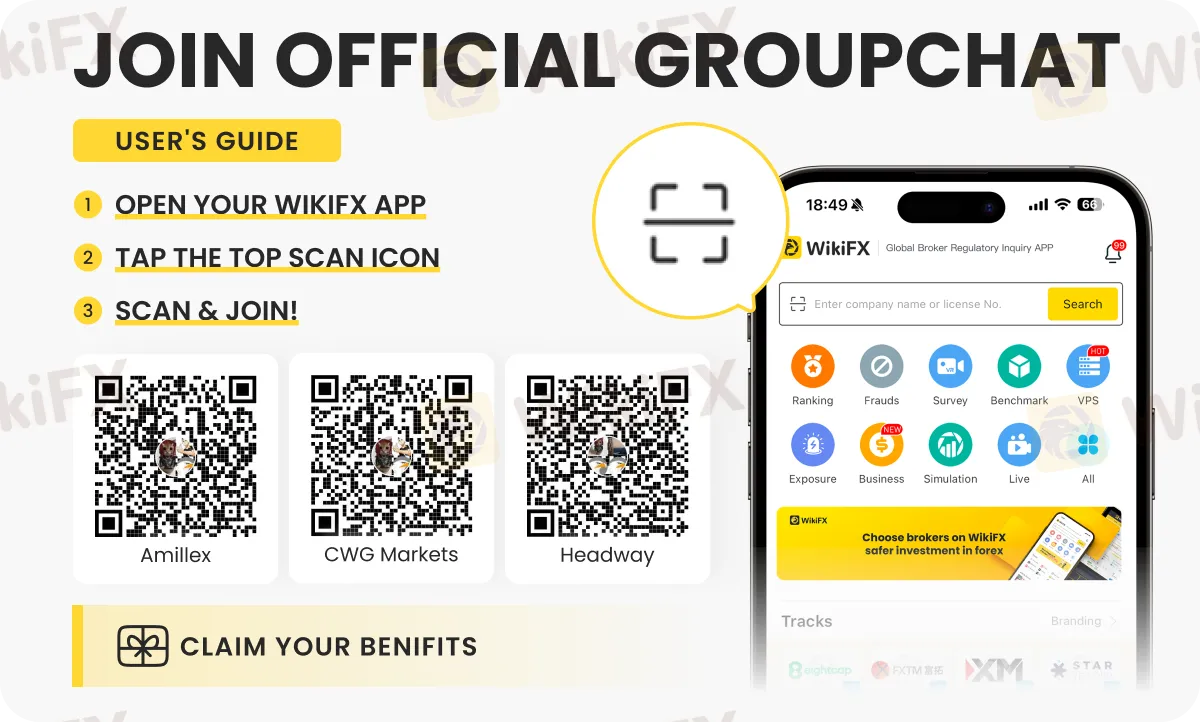

Want to stay updated about the latest forex trends to make the right investment call? Join these special chat groups - OIFSYYXKC3, 403M82PDMX or W2LRJZXB7G - by following the instructions shown below.