简体中文

繁體中文

English

Pусский

日本語

ภาษาไทย

Tiếng Việt

Bahasa Indonesia

Español

हिन्दी

Filippiiniläinen

Français

Deutsch

Português

Türkçe

한국어

العربية

The Deriv Autopsy: A Multi-Regulated Facade for Systemic Pillage

Abstract:Deriv masks its predatory behavior behind a multi-layered regulatory facade, while clinical evidence reveals a systemic pattern of freezing profitable accounts, manipulating price feeds, and disappearing with client funds. With over 50 formal complaints and a history of being blacklisted by Indonesian authorities, this broker is a graveyard for retail capital.

Deriv likes to brandish its legal papers like a shield, but the data screams of a platform that operates more like a sophisticated trap than a brokerage. While they boast of being the “Most Transparent Broker,” the actual lived experience of their traders involves missing funds, mysterious “verification fees,” and price jumps that suspiciously always favor the house. This isn't just a few disgruntled losers; this is a pattern of institutionalized extraction.

The Indonesian Blacklist and the “Verification” Scam

If you want to see the true face of Deriv, look at Indonesia. In early 2022, the Indonesian Commodity Futures Trading Regulatory Agency (BAPPEBTI) didn't just warn about Deriv; they blocked them entirely. They labeled the entity as an illegal commodity futures trading operation, essentially categorizing their binary options as gambling masquerading as investment.

The reality on the ground is even uglier. One Indonesian trader reported a balance of 150 million rupiah being frozen under the guise of “unusual trading” after they were consistently profitable. The kicker? Deriv demanded a 10% “fund verification fee” to release the money. In the world of legitimate finance, that is not a compliance check; it is a ransom. Investigations revealed the funds weren't even in a local branch as claimed, but had been spirited away to an offshore account in Mauritius.

Regulatory Audit: The Safety Net with Giant Holes

On paper, Deriv is a regulated juggernaut. They hold licenses from Malta to Vanuatu. However, the data proves that these regulators are often used as retrospective tools rather than proactive guardians. One trader (CR5427736) had $26,455 unilaterally seized and shifted into an SVG wallet—the ultimate regulatory black hole—and only saw a refund 13 months later after bombarding six different regulatory bodies with complaints.

| Regulator | License Type | Status |

|---|---|---|

| Malta MFSA | Investment Services (C 70156) | Regulated |

| British Virgin Islands FSC | Investment Business (SIBA/L/18/1114) | Offshore Regulatory |

| Vanuatu VFSC | Financial Dealer (14556) | Offshore Regulatory |

| Cayman Islands CIMA | Securities Investment (2108455) | Offshore Regulatory |

| UAE CMA | Capital Markets | Regulated |

| Indonesia BAPPEBTI | Futures/Options | BLACKLISTED/UNAUTHORIZED |

Price Manipulation and “Ghost” Slippage

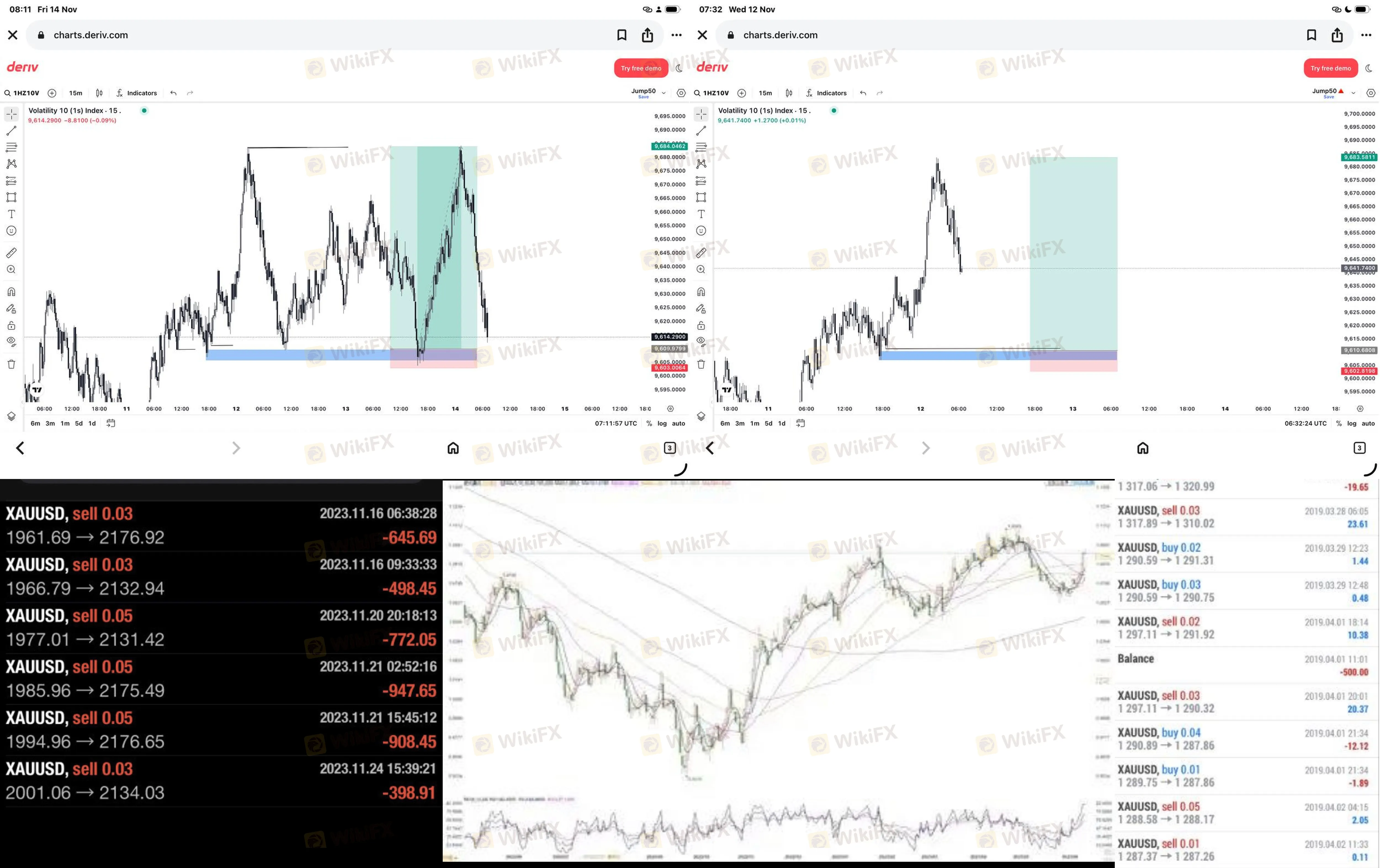

If you can actually get your money onto the platform, you then have to survive the execution. Multiple reports highlight a phenomenon where the platform suddenly “freezes” when a customer is in a profitable position, only to resume once the market has reversed.

One trader documented a monitored win rate of 48.7% on contracts where the theoretical win rate was 54.5%—a statistical impossibility over 2,000 samples unless the deck is stacked. In the final five seconds of trades, users report “price jumps” of 0.2 to 0.5 pips against them with 77% frequency. This is clinical execution of a “B-Book” strategy designed to ensure the house never loses.

The “Leverage Death Drop”

Deriv lures traders with the promise of 1:1000 leverage, then pulls the rug during active trades. We have documented accounts of leverage being slashed from 1:200 to 1:50 at 3:00 AM without warning. This isn't for “client protection.” Its to force a margin call and liquidate positions. One Indian agricultural trader lost 567,000 rupees in a single night because the system forced a liquidation while the underlying asset had barely moved, all thanks to a “scheduled” leverage adjustment that just happened to coincide with his trade.

Final Verdict: Profits are Optional, Losses are Guaranteed

Deriv is a master of the “Regulatory Bait and Switch.” They lure you in with a Malta license and then shift your funds to an offshore SVG wallet where they can ignore your emails and charge “hidden fees” that eat 30% of your withdrawal. With 50 complaints in the last 90 days ranging from blocked withdrawals to forged compliance qualifications, Deriv is a high-risk gamble where you are the mark.

Risk Warning: Trading with Deriv involves a high probability of “administrative” loss. Your funds are not safe when the platform has the power to unilaterally adjust leverage and freeze accounts at the exact moment of profitability. Anonymity is their best friend; transparency is your only weapon. Avoid.

Disclaimer:

The views in this article only represent the author's personal views, and do not constitute investment advice on this platform. This platform does not guarantee the accuracy, completeness and timeliness of the information in the article, and will not be liable for any loss caused by the use of or reliance on the information in the article.

WikiFX Broker

Latest News

TAG MARKETS Review 2026: Allegations of Withdrawal Denials & Trading Glitches

WikiFX Wishes You a Happy International Women's Day

Retiree’s Tabung Haji Savings Gone: Elderly Retiree Loses RM277,000 After One Whatsapp Message

Oil prices jump above $100 for first time in four years

Forex Brief: Dollar Dips Ahead of NFP; RBA Bets Lift AUD

Crude Oil Rallies to $85 on Escalating Middle East Geopolitical Risks

China Signals Tolerance for Slower Growth with Revised 2026 Outlook

Oil Surges as Qatar Warns of $150 Crude and 'Force Majeure' Across Gulf Exporters

JRJR Review: Safety, Regulation & Forex Trading Details

HeroFx Review: Withdrawal Problems, Scam Alert & Risks

Currency Calculator