简体中文

繁體中文

English

Pусский

日本語

ภาษาไทย

Tiếng Việt

Bahasa Indonesia

Español

हिन्दी

Filippiiniläinen

Français

Deutsch

Português

Türkçe

한국어

العربية

ZarVista Legitimacy Check : Is this fake broker or legitimate trading partner?

Abstract:If you're asking "Is ZarVista legit?" or are worried about a potential "ZarVista scam," you are smart to be careful. In the world of online trading, checking things out carefully isn't just a good idea – it's essential for protecting your money. This article gives you a clear answer to your question. We have done a complete legitimacy check using real regulatory information, documented user experiences, and a detailed look at what the broker claims to offer.

Your “Is ZarVista Legit?” Search

If you're asking “Is ZarVista legit?” or are worried about a potential “ZarVista scam,” you are smart to be careful. In the world of online trading, checking things out carefully isn't just a good idea – it's essential for protecting your money. This article gives you a clear answer to your question. We have done a complete legitimacy check using real regulatory information, documented user experiences, and a detailed look at what the broker claims to offer.

It's important to know that ZarVista used to be called Zara FX. This name change is a key piece of information, especially for traders who might have come across this company under its old name. Our investigation will examine ZarVista's regulatory status, reveal a troubling pattern of user complaints, and analyze what it offers to give you a clear, fact-based conclusion. Our goal is to give you the information you need to make a smart and safe decision. Due diligence always begins by asking Is ZarVista Legit, especially after a rebranding.

The Immediate Verdict

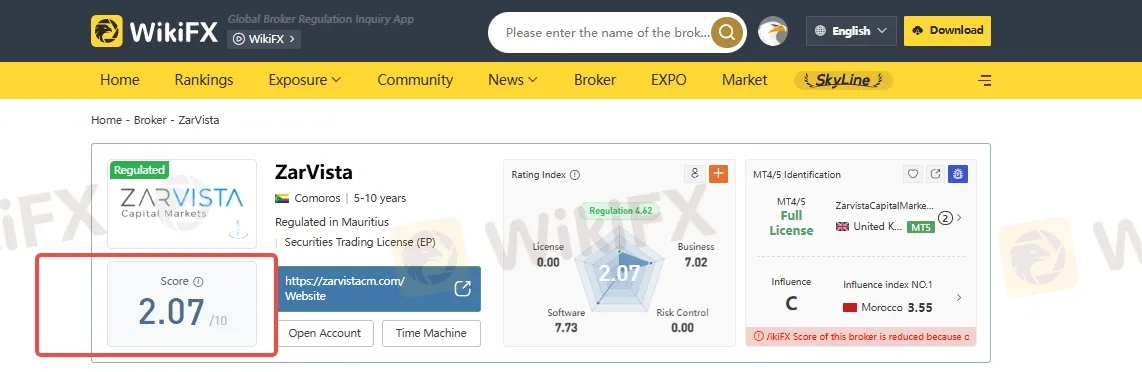

To address your main concern right away, we'll share our main finding first. Based on thorough analysis from global broker regulatory inquiry platforms, ZarVista is classified as an extremely high-risk broker. This finding directly answers the common question: Is ZarVista Legit.

> WikiFX Score: 2.07 / 10

This score is a critical warning sign. In simple terms, a score this low means serious problems with regulatory compliance, business practices, and overall trustworthiness. It shows a high number of serious user complaints and significant operational risks. The platform's own assessment is a direct and clear warning to all potential users:

> “Warning: Low score, please stay away!”

This score isn't random – it's based on careful analysis of the broker's licenses, business conduct, risk management, and software reliability. The biggest factor bringing this score down is the huge number of complaints filed by traders. You can review the full, current report and the factors contributing to this low score directly on ZarVista's WikiFX page [Link to ZarVista's page on WikiFX]. Understanding the evidence behind this score is the next important step. For anyone still wondering Is ZarVista Legit, this score provides a strong signal.

Investigating The Red Flags

The low trust score shows deeper, widespread problems. To understand the full extent of the risk, we need to examine the evidence piece by piece. This detailed look will explore the weak regulatory framework, the alarming user complaints, and the questionable physical presence of the company.

These red flags help answer Is ZarVista Legit with real-world evidence.

Weak Regulatory Oversight

ZarVista's regulatory status is the first major red flag. The broker is licensed in offshore locations, specifically by the Mwali International Services Authority (MISA) in Comoros and the Financial Services Commission (FSC) in Mauritius under license number GB23202450. For a trader, “offshore regulation” is a term that should immediately make you cautious. Unlike top-tier regulators in places like the United Kingdom (FCA), Australia (ASIC), or the United States (CFTC/NFA), offshore bodies typically offer:

Less Strict Oversight: The rules and reporting requirements are often minimal, allowing brokers to operate with less transparency. Weaker Investor Protection: There are often no compensation programs to protect client funds if the broker goes bankrupt or commits fraud.

Limited Legal Options: If you have a dispute or lose your funds, taking legal action against a company registered in a remote offshore location is practically impossible for the average trader In simple terms, while ZarVista can claim to be “regulated,” the quality and effectiveness of that regulation are extremely low. This leaves your money with minimal to no meaningful protection, a risk that cannot be overstated. A trustworthy broker builds its reputation on strong, reputable regulation; ZarVista does not.

A Pattern of Complaints

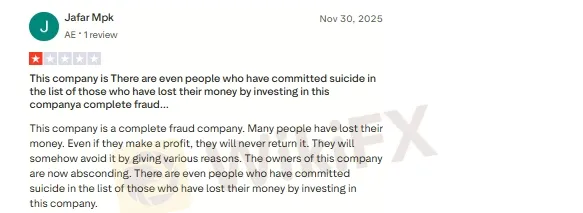

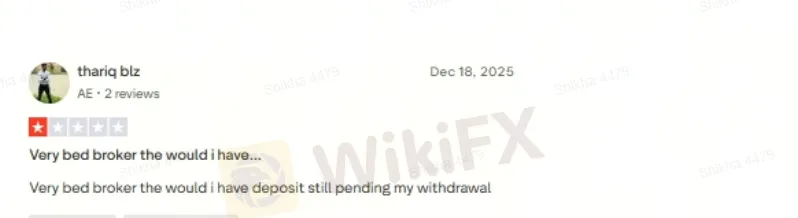

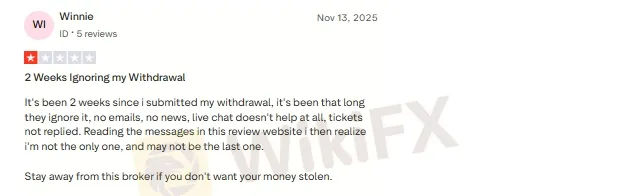

The most damaging evidence against ZarVista comes directly from the traders who have used its platform. An analysis of user reports on platforms like WikiFX reveals a consistent and troubling pattern of serious allegations. These are not minor complaints but claims that attack the very core of a broker's function: facilitating trades and securing client funds. Read the complaints below to know Is ZarVista Legit. We have summarized the main categories of complaints to provide a clear picture of the trader experience:

1. Withdrawal Rejections & Obstacles: This is the most common and severe complaint. Users consistently report that their withdrawal requests are declined for vague or unsubstantiated reasons. One user notes, “when withdrawing you may come across couple of decline withdrawals,” with the broker blaming the user's bank. Another trader states their profit, made through manual trading, was rejected for withdrawal without any “scientific evidence.”

2. Allegations of Stolen Funds: Several complaints go beyond withdrawal issues and make direct accusations of theft. One user details a terrible experience where they claim the broker stole their entire investment of “$50k usd” from a PAMM account. Another user reports a balance of “more then 75k usd” disappearing after the broker allegedly made a self-withdrawal and then deleted the user's MT4 and platform account details. The feeling is captured in a desperate plea: *“Steal my money by Zara fx owners ”*.

3. Platform Manipulation: There are accusations that the broker actively manipulates its platform against its own users. One trader claims the broker is “manipulating things in a way that goes against the terms and conditions of the MT5 trading terminal platform” to invalidate their profits. This suggests the trading environment itself may not be fair or transparent.

4. Loss of Access to Funds: In a particularly alarming escalation, a user from Nigeria reported that after filing a complaint about a withdrawal issue, they were completely locked out. “I'm now unable to access the website due to an error message. The website fails to load, and I'm concerned about my funds.” This tactic effectively cuts off communication and prevents the user from accessing their own money.

These first-hand accounts paint a picture of a broker that appears to systematically prevent traders from accessing their profits and, in the most severe cases, their entire capital.

Physical Presence Questioned

A legitimate global financial company maintains a verifiable physical presence. It's a basic requirement of corporate transparency and accountability. However, in the case of ZarVista (under its previous name, Zara FX), this is another area of serious concern.

Independent field surveys conducted by WikiFX investigators to know Is ZarVista Legit in Canada and Cyprus yielded the same result: “No Office Found.” Despite addresses or regional claims being associated with these locations, investigators were unable to locate any physical, operational office belonging to the broker.

The absence of a verifiable office is a massive red flag. It raises fundamental questions: Who are the people behind the website? Where are they actually operating from? A phantom office suggests a lack of substance and a deliberate attempt to hide the company's true location and identity, making it impossible to hold anyone accountable.

A Look Beyond The Risks

To maintain an objective analysis, it's important to acknowledge what ZarVista claims to offer. On the surface, the broker presents itself as a competitive, modern platform with features designed to attract both new and experienced traders. It uses the popular MetaTrader 5 (MT5) platform and offers high leverage, which can be appealing.

A review of their promotional materials and account structures shows a standard set of offerings. There are even a few positive user reviews that praise the platform's speed and the availability of useful tools. One user from New Zealand mentioned liking the customizable charts and receiving a trading bonus, while another from Nigeria praised the platform's speed and customer service response time.

| Feature | ZarVista's Claim |

| Trading Platform | MetaTrader 5 (MT5) - a well-regarded and powerful industry-standard platform. |

| Leverage | Up to 1:500 - high leverage that amplifies both potential profits and losses. |

| Account Types | Multiple tiers (Starter, Professional, VIP) with different spread/commission structures. |

| Spreads | Claims spreads from 0 pips on its highest-tier VIP account (with a $5 commission per lot). |

| Bonuses & Social Trading | Offers a 30% deposit bonus and social/copy trading features (PAMM/MAM). |

However, and this is the most critical point of this section, these features exist in isolation, completely separate from the broker's fundamental trustworthiness. A state-of-the-art platform, low spreads, and attractive bonuses are completely meaningless if the broker is operating under weak regulatory protection and users are unable to withdraw their funds. The positive reviews are vastly outnumbered by severe complaints about financial loss. The core promise of any broker is the safety of your funds, and this is precisely where ZarVista fails the test.

Your Legitimacy Checklist

To summarize our findings, we've created a simple checklist. These are the five critical red flags that our investigation into ZarVista has confirmed. You can use this as a practical tool to evaluate not just this broker, but any broker you consider in the future.

1. Weak Offshore Regulation: Is the broker licensed only in an offshore location with weak investor protection (like Comoros or Mauritius)?

2. Extremely Low Trust Score: Does it have a very low score (e.g., below 5.0/10) on independent, data-driven review platforms?

3. High Volume of Severe Complaints: Are there multiple, unresolved complaints about fundamental issues like withdrawals, lost funds, or platform manipulation?

4. No Verifiable Physical Office: Can you confirm the broker has a real, staffed office in a reputable financial center, or do investigations show no presence?

5. Bonus Offers Seem Too Good: Are they using large, attractive bonuses (like a 30% withdrawable bonus) to lure you in, potentially hiding underlying operational or financial issues?

ZarVista checks all these red flag boxes. Before you deposit funds with *any* broker, run them through this checklist. More importantly, verify their details on a comprehensive platform like WikiFX [Link to ZarVista's page on WikiFX] to see the full, unvarnished picture.

The Verdict And Your Next Step

After a comprehensive review of the available evidence, we can now provide a definitive answer. Despite offering modern trading features on the MT5 platform, ZarVista's foundation is critically flawed. The combination of weak offshore regulation, a documented pattern of severe user complaints regarding withdrawals and lost funds, and the lack of a verifiable physical presence makes it an extremely high-risk proposition for any trader.

So, is ZarVista legit? Based on the evidence, it operates with characteristics commonly associated with untrustworthy brokers and potential scam operations. While it holds a license, its location and the sheer volume of negative user experiences indicate that it does not provide a safe or reliable trading environment. The risk of losing your money is substantial. We cannot, under any circumstances, advise engaging with this broker.

Your financial security is most important. The most important step you can take before choosing any trading partner is to conduct your own careful research. The online brokerage world is filled with both legitimate partners and predatory operations. We strongly advise using an independent verification tool to protect yourself. Check the full regulatory details, user reports, and up-to-date risk warnings for any broker on WikiFX [Link to ZarVista's page on WikiFX] to shield yourself from potential financial harm. Your money is too important to risk on a broker with this many red flags.

Disclaimer:

The views in this article only represent the author's personal views, and do not constitute investment advice on this platform. This platform does not guarantee the accuracy, completeness and timeliness of the information in the article, and will not be liable for any loss caused by the use of or reliance on the information in the article.

WikiFX Broker

Latest News

China Holds Rates Steady After Hitting 5% Growth Target, Easing Expected in Q1

JPY Volatility Ahead: PM Takaichi Calls Snap Election Amid Rate Hike Speculation

Is Forex Still Worth It in 2026? Global Central Banks Are Splitting

The Fed on Trial: Markets Brace for Supreme Court Showdown Over Central Bank Independence

Trade War 2.0: Trump’s Greenland Ultimatum Rattles Transatlantic Alliance

Euro Stabilizes as France Forces 2026 Budget; Bond Spreads Narrow

JPY Volatility Spikes as PM Takaichi Calls Snap Election and Fiscal Gamble

JGB Yields Breach 4% as PM Takaichi's Fiscal Gambit Triggers 'Sell-Off'

Scrolled, Clicked, Lost RM166,000: Factory Worker Trapped by Online Investment Scam

China Macro: Liquidity Trap Signals Persist Despite Credit Bump

Currency Calculator