简体中文

繁體中文

English

Pусский

日本語

ภาษาไทย

Tiếng Việt

Bahasa Indonesia

Español

हिन्दी

Filippiiniläinen

Français

Deutsch

Português

Türkçe

한국어

العربية

BDSwiss Review: The Withdrawal Trap Draining Client Accounts

Abstract:Our investigation confirms a critical liquidity crisis at BDSwiss, with traders reporting withdrawal delays persisting since late 2024 and account access restrictions. The broker faces a frantic wave of global complaints regarding blocked funds and phantom 'inactivity fees', compounded by a severe regulatory warning from Germany's BaFin.

Is BDSwiss Broker Safe?

Urgent Warning: The evidence accumulating against BDSwiss paints a picture of a broker in severe distress. While their website promises seamless digital trading, the reality for recent traders is a nightmare of frozen funds and silence. Our investigation reveals a systemic collapse in their ability—or willingness—to process withdrawals, leaving users stranded.

The “Inactivity” Trap

The most disturbing pattern emerging from recent user reports involves a predatory fee structure. Imagine risking your capital in the Forex market, making a profit, asking for your money back, and then watching that money disappear while you wait.

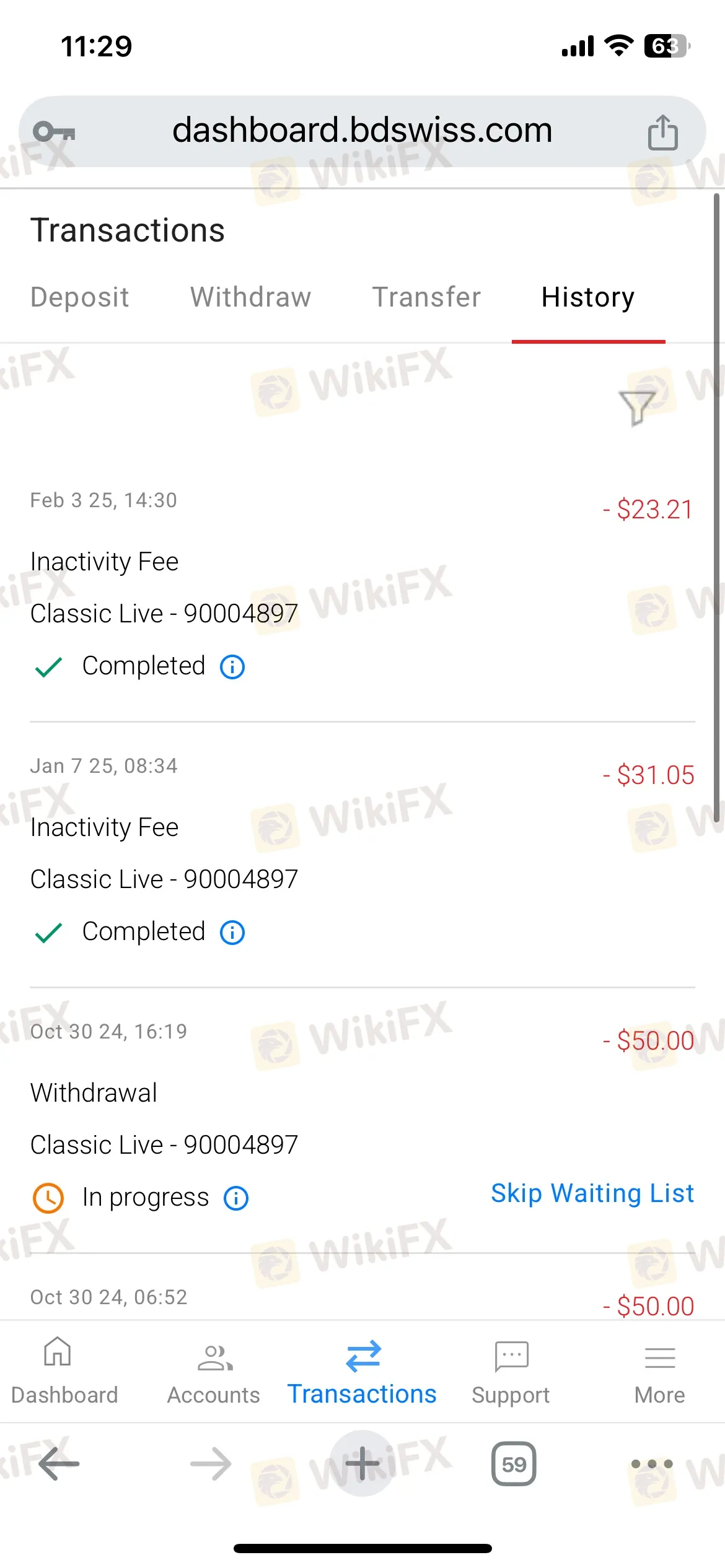

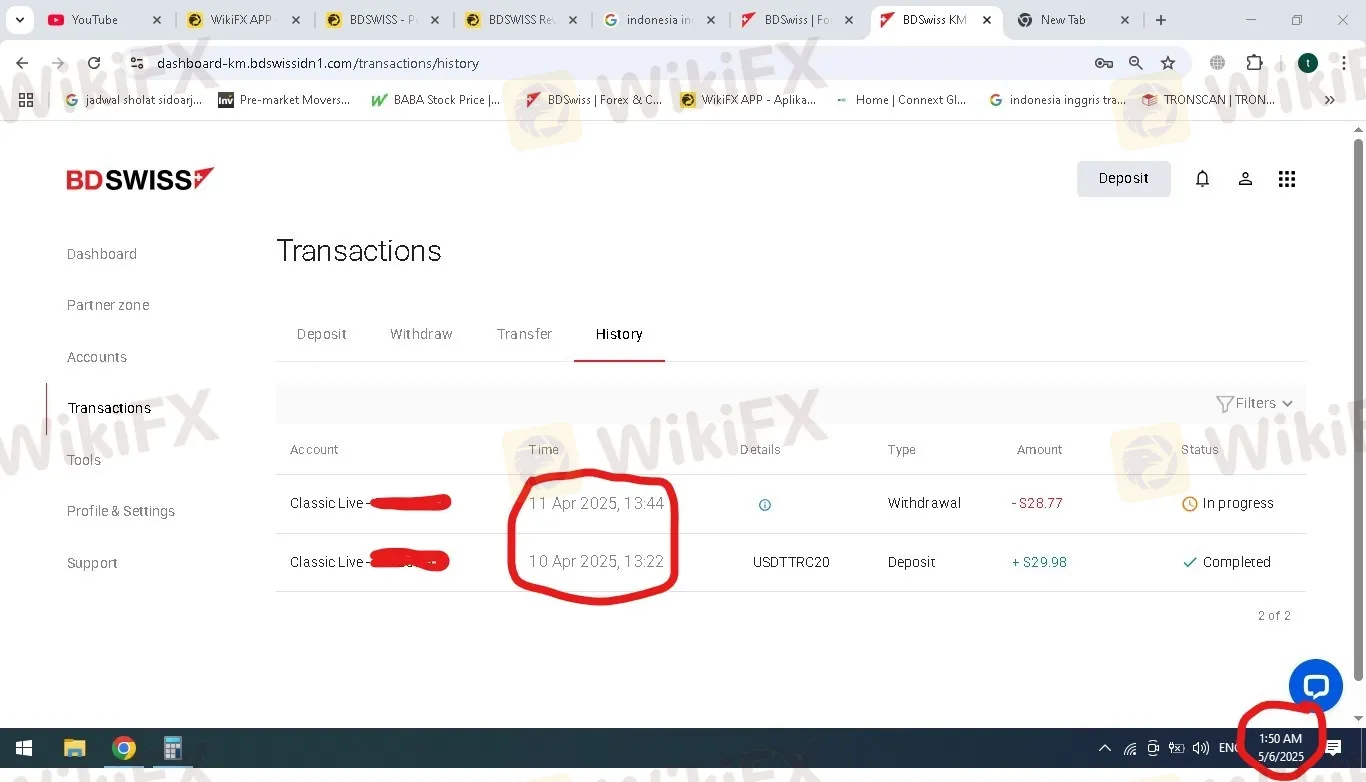

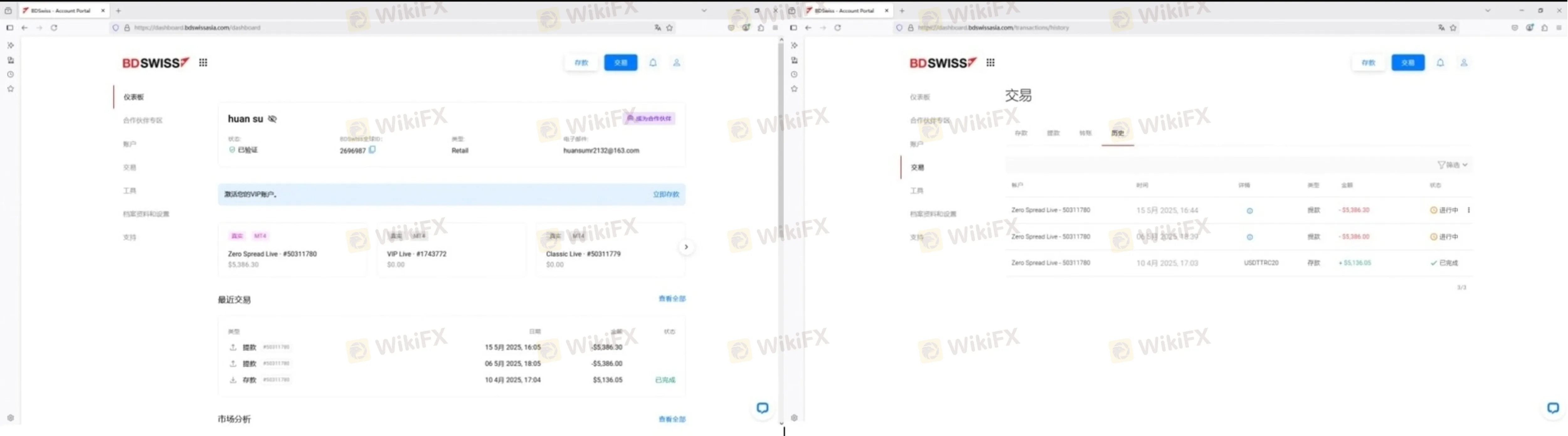

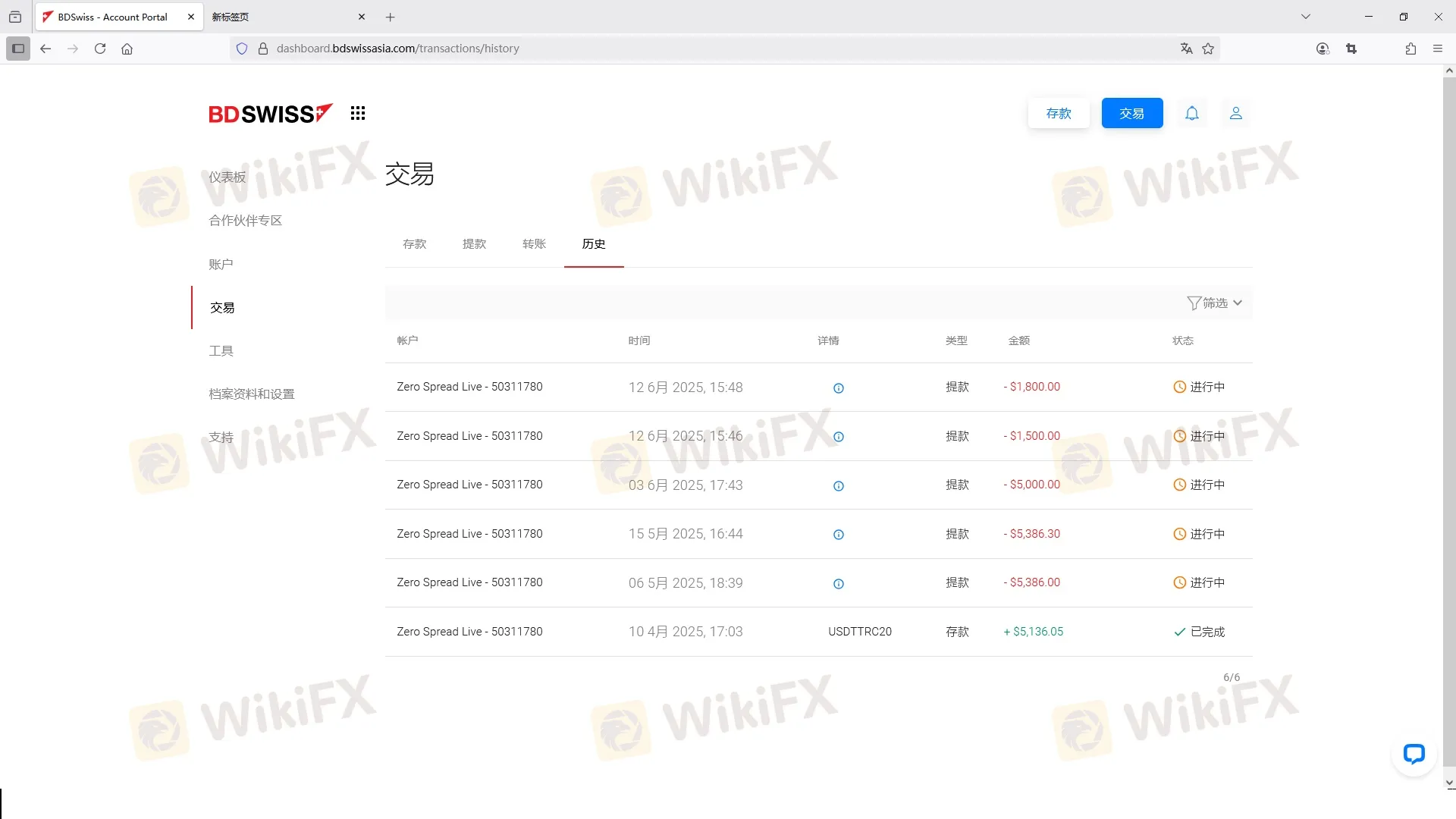

This is the reality for a trader in Morocco (Case 10). After requesting a withdrawal in October 2024, the funds were held in “processing” limbo for months. Shockingly, while BDSwiss held the money hostage, they began deducting “inactivity fees” from the very balance the user was trying to remove. By February 2025, significant portions of the user's capital had been eroded by these internal charges. This is not just poor service; it is a calculated mechanism to deplete client funds.

BDSwiss Regulation: A Safety Illusion?

Many traders are lured by the brand's long-standing presence, but a closer look at the BDSwiss regulation status exposes critical gaps in protection. While they flaunt multiple licenses, the entity serving many global clients operates under offshore jurisdictions with loose oversight.

Even more alarming is the regulatory backlash in Europe. The German Federal Financial Supervisory Authority (BaFin) issued a specific warning against the operator, stating they lack authorization to offer financial services in the region. This red flag suggests that BDSwiss has been operating outside legal boundaries in strict jurisdictions.

Regulatory Reality Audit

| Regulator | License Type | REAL STATUS |

|---|---|---|

| Cyprus (CySEC) | European Authorized | Unverified / Suspicious |

| Seychelles (FSA) | Offshore License | Offshore Regulation |

| Germany (BaFin) | N/A | Warning: Unauthorized Business |

BDSwiss Login Issues and Withdrawal Blockades

The complaints flooding in from 2024 and 2025 indicate a total breakdown in platform reliability. A crucial aspect of any broker review is accessibility, yet users are finding themselves locked out at critical moments.

The Access Blackout:

In August 2025, a trader from India reported devastating BDSwiss login failures (Case 1). After months of pending withdrawals, the user suddenly found they could no longer access their account dashboard. This tactic prevents traders from gathering evidence or contacting support, effectively silencing them.

The “System Update” Excuse:

Multiple users across Indonesia and Brazil report identical excuses from customer support. When deposits are made, they clear instantly. However, withdrawal requests are met with claims that the “system is being fixed”—an excuse that has allegedly persisted for months (Case 7). A legitimate Forex BDSwiss provider does not take months to “fix” a withdrawal gateway while keeping the deposit gateway wide open.

Visual Evidence: Global Outcry

Users from India to Hong Kong have documented their struggles. Below is a snapshot of the current crisis:

User Complaint Evidence (August 2025): Withdrawal Pending for Nearly a Year

User Complaint Evidence (July 2025): Hong Kong Trader Reports “Risk of Closure”

Key Red Flags

- Predatory Fee Deductions: Charging inactivity fees on funds that are pending withdrawal is a severe anomaly.

- BaFin Warning: The German financial authority has explicitly flagged their operations as unauthorized.

- One-Way Transactions: Deposits are instant, but withdrawals are stalled indefinitely using technical excuses.

- Login Denials: Users reporting BDSwiss login errors after requesting large withdrawals.

Verdict

We cannot recommend broker BDSwiss under any circumstances. The combination of verified withdrawal blockades, aggressive fee deductions on trapped funds, and regulatory warnings creates an unacceptable risk profile.

If you are currently trading with them, we strongly advise halting all deposits. For those seeking a safe BDSwiss review conclusion: this platform currently exhibits the behavior of a collapsing entity rather than a functional financial service. Protect your capital and look elsewhere.

Disclaimer:

The views in this article only represent the author's personal views, and do not constitute investment advice on this platform. This platform does not guarantee the accuracy, completeness and timeliness of the information in the article, and will not be liable for any loss caused by the use of or reliance on the information in the article.

WikiFX Broker

Latest News

Solitaire PRIME Regulatory Status: Understanding Their Licenses and Company Information

Trade deal: India and EU to announce FTA amid Trump tariff tensions

Asia FX & Rates: JGB Yields Spike vs. China Capital Inflows

Winter Storm Fern To Lower Q1 GDP By 0.5% To 1.5%

Gold Elephant Review: Safety, Regulation & Forex Trading Details

Weltrade Review 2025: Is This Forex Broker Safe?

Copper Supply Alarm: AI and Green Tech Boom Threatens Global Shortage

Bitget Review: A Regulatory Ghost Running a Phishing Playground

ThinkMarkets Review 2026: Comprehensive Safety Assessment

Transatlantic Fracture: European Capital Flight Emerges as Key Risk to Wall Street

Currency Calculator