Abstract:Trading Pro Review for 2026 with updated data on licenses, leverage, and user complaints from Malaysia, Indonesia, and beyond. Read our verdict now.

Trading Pro Review exposes the troubling reality behind this broker‘s operations. Trading Pro, which is regulated by South Africa’s FSCA, has attracted traders across Malaysia, Indonesia, and other regions with promises of high leverage, multiple platforms, and low spreads. Yet beneath the polished image lies a pattern of complaints, questionable regulatory standing, and serious withdrawal issues. This Trading Pro Review highlights the risks, inconsistencies, and scam alerts tied to the broker. With leverage reaching 1:2000, offshore registrations, and mounting user grievances, Trading Pro poses significant dangers to unsuspecting investors. The urgency of this review lies in protecting traders from misleading claims and financial harm. By analyzing licenses, operational practices, and real user experiences, this article provides a clear verdict: Trading Pro is not the safe choice it markets itself to be.

Regulatory Claims vs. Reality

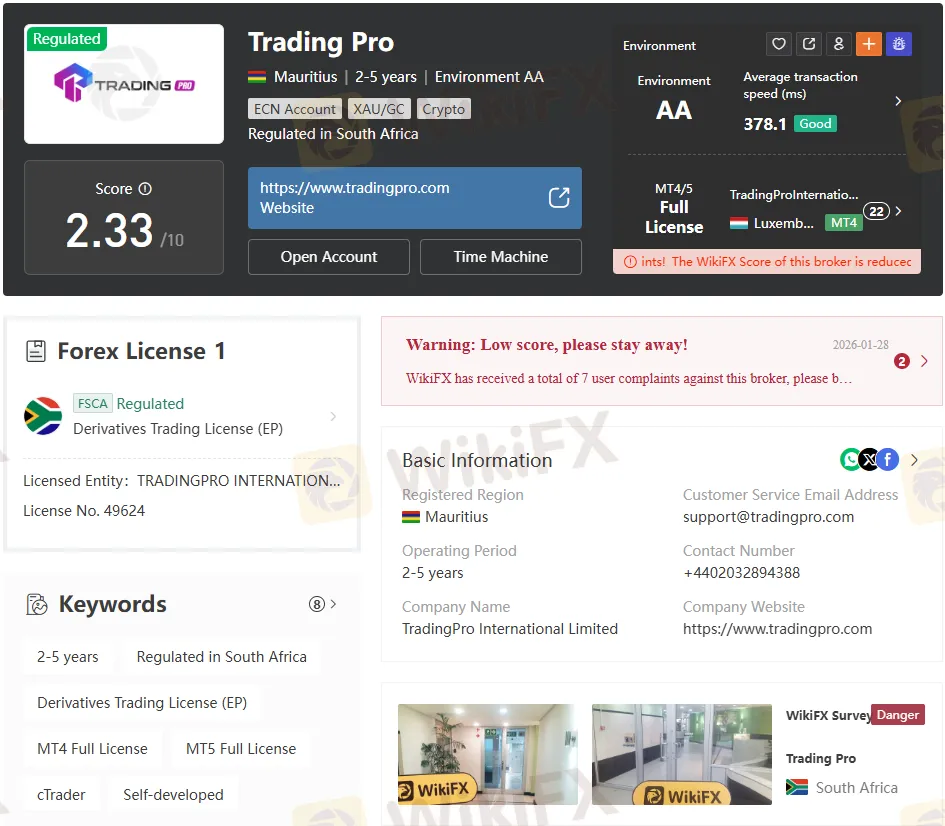

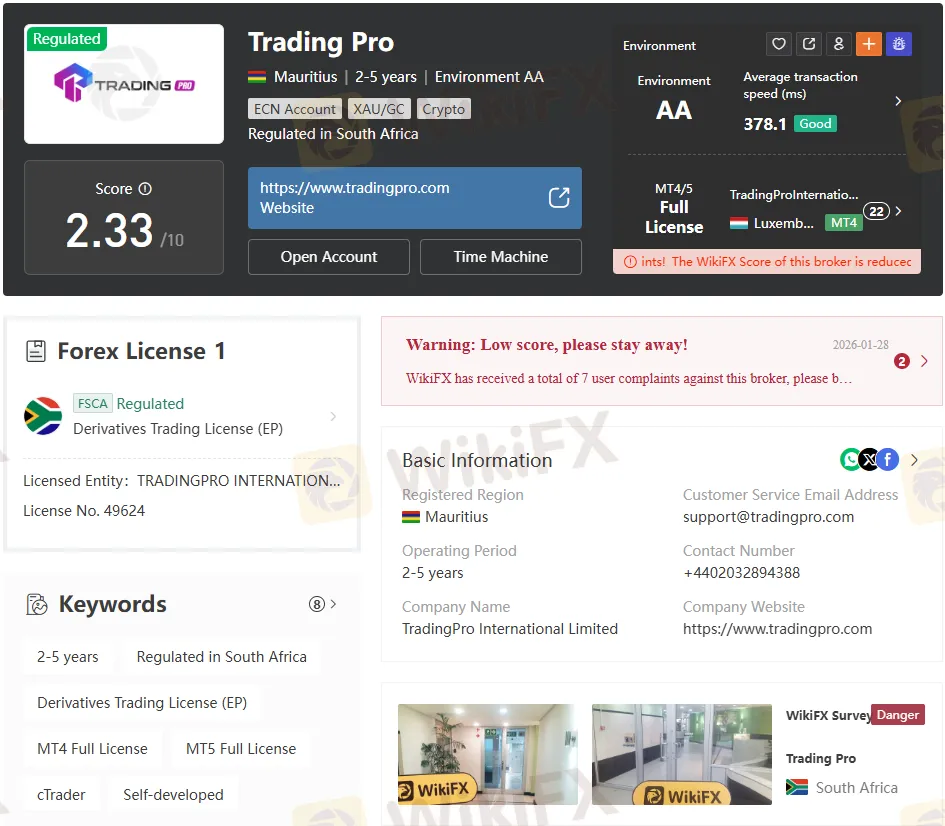

Trading Pro presents itself as regulated under the Financial Sector Conduct Authority (FSCA) in South Africa, with license number 49624. On paper, this suggests legitimacy. However, field investigations reveal inconsistencies. A reported office in Durban, South Africa, could not be verified, casting doubt on the broker's physical presence.

Further scrutiny shows that Trading Pro International Limited is registered in Mauritius and regulated by the Financial Services Commission (FSC). Offshore regulation is notoriously weaker than tier-one jurisdictions, offering limited investor protection. The dual claims of FSCA regulation and offshore registration create confusion, leaving traders unsure which authority actually oversees the broker.

This regulatory ambiguity is a red flag. While Trading Pro advertises compliance, its operational reality suggests reliance on offshore loopholes rather than robust oversight.

Low WikiFX Score and Warning Signs

Trading Pros' credibility takes another hit with its WikiFX score of just 2.33/10. Such a low rating signals systemic issues. WikiFX, which evaluates brokers based on licensing, transparency, and user complaints, explicitly warns traders to avoid Trading Pro.

The score reflects multiple factors:

- Offshore registration in Saint Vincent and the Grenadines.

- High leverage of up to 1:2000, magnifying risks.

- Numerous unresolved complaints about withdrawals.

- Difficulty verifying office addresses.

A broker with such a low score cannot be considered safe, regardless of its marketing claims.

Trading Platforms and Accounts

Trading Pro offers MT4, MT5, and cTrader platforms, appealing to both novice and experienced traders. It advertises four account types—Micro, Rookie, Pro, and Scalpx—with minimum deposits ranging from $1 to $50.

Key account features include:

- Spreads starting from 0.0 pips on Rookie and Scalpx accounts.

- Maximum leverage of 1:2000 across all accounts.

- Swap-free trading options.

While these features appear attractive, they mask underlying risks. High leverage is dangerous, especially for inexperienced traders, as it amplifies losses. The low minimum deposit attracts beginners, but the reported withdrawal issues make these accounts hazardous.

Deposit and Withdrawal Concerns

Trading Pro claims instant deposits and withdrawals processed within one working day. Supported methods include Visa/Mastercard, FasaPay, Paytrust, crypto, and regional systems like Dragonpay in the Philippines.

Yet user experiences contradict these promises:

- Delays of several days in fund transfers.

- Withdrawals rejected without a clear explanation.

- Accounts frozen after profit generation.

- Excuses ranging from “system hacks” to “cyber attacks.”

These repeated issues highlight a pattern of obstruction. Traders report that profits are being removed or that accounts are being flagged for alleged violations, undermining trust in the broker's financial integrity.

User Complaints and Scam Alerts

The most damning evidence against Trading Pro comes from user complaints across Malaysia, Indonesia, and beyond.

Examples include:

- Malaysia (2024-12-05): A trader reported pending withdrawals with excuses of system hacks and cyber attacks.

- Indonesia (2024-12-01): Funds delayed for two days without confirmation.

- Indonesia (2024-11-17): Website inaccessible during supposed “technical maintenance.”

- Malaysia (2024-08-15): Withdrawal requests rejected, with funds deducted from accounts.

- United Arab Emirates (Forex Expo): Traders lured with 100% credit bonuses, only to have profits removed after withdrawal attempts.

These cases reveal a consistent pattern: Trading Pro obstructs withdrawals, manipulates accounts, and fails to honor trader profits.

Offshore Registration Risks

Trading Pros' registration in Saint Vincent and the Grenadines further undermines its credibility. Offshore jurisdictions often lack stringent oversight, allowing brokers to operate with minimal accountability.

Key risks of offshore registration include:

- Limited investor protection.

- Difficulty pursuing legal recourse.

- Higher likelihood of scams and fraud.

For Malaysian and Indonesian traders, this means deposits are at risk, with little chance of recovery if disputes arise.

High Leverage Danger

Trading Pros' leverage of 1:2000 is among the highest in the industry. While marketed as an opportunity for higher profits, such leverage is extremely risky.

Consider this:

- A $100 deposit can control $200,000 in trading volume.

- Small market fluctuations can wipe out accounts in an instant.

- Novice traders are particularly vulnerable to rapid losses.

High leverage is often used by questionable brokers to attract clients, but it exposes traders to catastrophic risks.

Platform Reliability Issues

Despite offering MT4 and MT5, users report frequent platform freezes and execution delays. Complaints include:

- MT5 hangs during trades.

- Orders rejected or delayed.

- Sudden price anomalies, such as USDCHF dropping to 0.00001 on cent accounts.

These technical issues suggest poor infrastructure or deliberate manipulation, both of which compromise trading integrity.

Marketing Tactics and Misleading Promises

Trading Pro aggressively markets bonuses, copy trading, and PAMM accounts. At expos, it offers 100% credit bonuses to lure traders. However, these promotions often come with hidden conditions.

Traders report that profits earned with bonuses are later removed, and their accounts are flagged for violations. Such tactics exploit inexperienced traders, creating false expectations of easy profits.

Regional Impact: Malaysia and Indonesia

Trading Pros' presence in Malaysia and Indonesia is particularly concerning. Multiple complaints from these regions highlight withdrawal failures and inaccessible platforms.

For example:

- Malaysian traders reported unauthorized deductions from their accounts.

- Indonesian traders faced delays and website outages.

These cases show that Trading Pros risks are not isolated but widespread across Southeast Asia.

Company Background and Domain Data

Trading Pro‘s domain, tradingpro.com, was registered in 1999 and updated in 2024. While longevity might suggest stability, the broker’s operational practices contradict this.

The company operates under multiple names: Trading Pro International (PTY) LTD in South Africa and Trading Pro International Limited in Mauritius. Such fragmented identities raise transparency concerns.

Pros and Cons

Pros:

- MT4/MT5 platforms available.

- Multiple tradable instruments.

- Swap-free accounts.

- 24/5 customer support.

Cons:

- Offshore regulation.

- High leverage of 1:2000.

- Numerous withdrawal complaints.

- Low WikiFX score.

- Negative user reviews.

The cons outweigh the pros, especially when financial safety is at stake.

Is Trading Pro Legit?

While Trading Pro claims FSCA regulation, its offshore registration and mounting complaints suggest otherwise. A legitimate broker should provide transparent operations, reliable withdrawals, and consistent platform performance. Trading Pro fails on all counts.

Bottom Line

Trading Pro Review reveals a broker riddled with red flags. Despite claims of regulation and advanced platforms, the reality is offshore registration, high-risk leverage, and widespread withdrawal issues. Complaints from Malaysia, Indonesia, and other regions confirm a pattern of obstruction and manipulation.

Actionable Advice:

- Verify broker licenses directly with regulatory authorities.

- Avoid brokers offering excessively high leverage.

- Be cautious of bonus schemes tied to withdrawal restrictions.

- Choose brokers with transparent operations and strong regulatory oversight.

Trading Pro is not a safe choice. Investors should protect themselves by avoiding this broker and opting for regulated alternatives with proven credibility.