简体中文

繁體中文

English

Pусский

日本語

ภาษาไทย

Tiếng Việt

Bahasa Indonesia

Español

हिन्दी

Filippiiniläinen

Français

Deutsch

Português

Türkçe

한국어

العربية

Evest Review: Is This Forex Broker Demanding You Sell Your Assets?

Abstract:Traders report aggressive demands to liquidate personal assets and losses surpassing $245,000 USD. Despite holding a South African license, our investigation exposes severe complaints regarding account manager manipulation and offshore regulatory gaps.

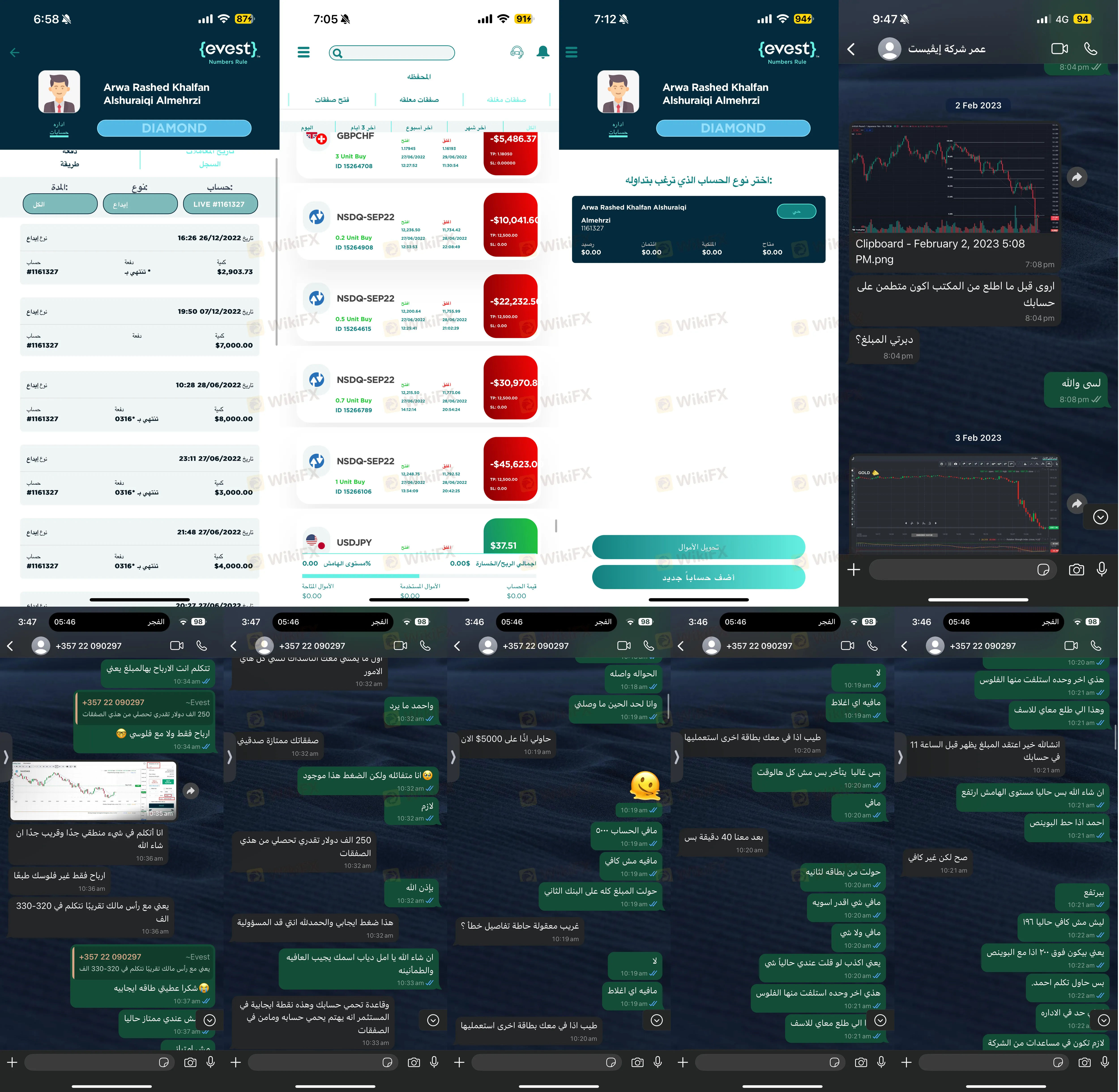

“Sell Your Car, Sell Your Gold”

Imagine a broker telling you to liquidate your personal life to feed a trading account. That is the reality reported by users in this evest review.

In a shocking complaint from the UAE dated January 19, 2025, a trader alleges that account managers—specifically naming individuals like “Ali Hassan” and “Rola”—pressured them aggressively. The claim states the managers urged the victim to “sell your car, sell your gold” to recover lost funds. This isn't just bad service; it is predatory behavior.

Our investigation reveals a disturbing pattern where broker evest staff allegedly guide users into massive losses, only to demand more money to “fix” the problem.

## Regulation Evest: The Safety Gap Exposed

While the website claims a UK background, the regulatory reality is mixed. We conducted a deep audit of the regulation evest operates under.

| Regulator | License Type | REAL STATUS |

|---|---|---|

| Vanuatu (VFSC) | Offshore (Lic. 17910) | Offshore Regulation |

| South Africa (FSCA) | Registry (Lic. 36060) | Regulating |

The Red Flag: While the FSCA license is valid, many traders fall under the darker umbrella of offshore protections. A UK-based headquarters without an FCA (UK) license is a significant anomaly for a broker targeting global clients.

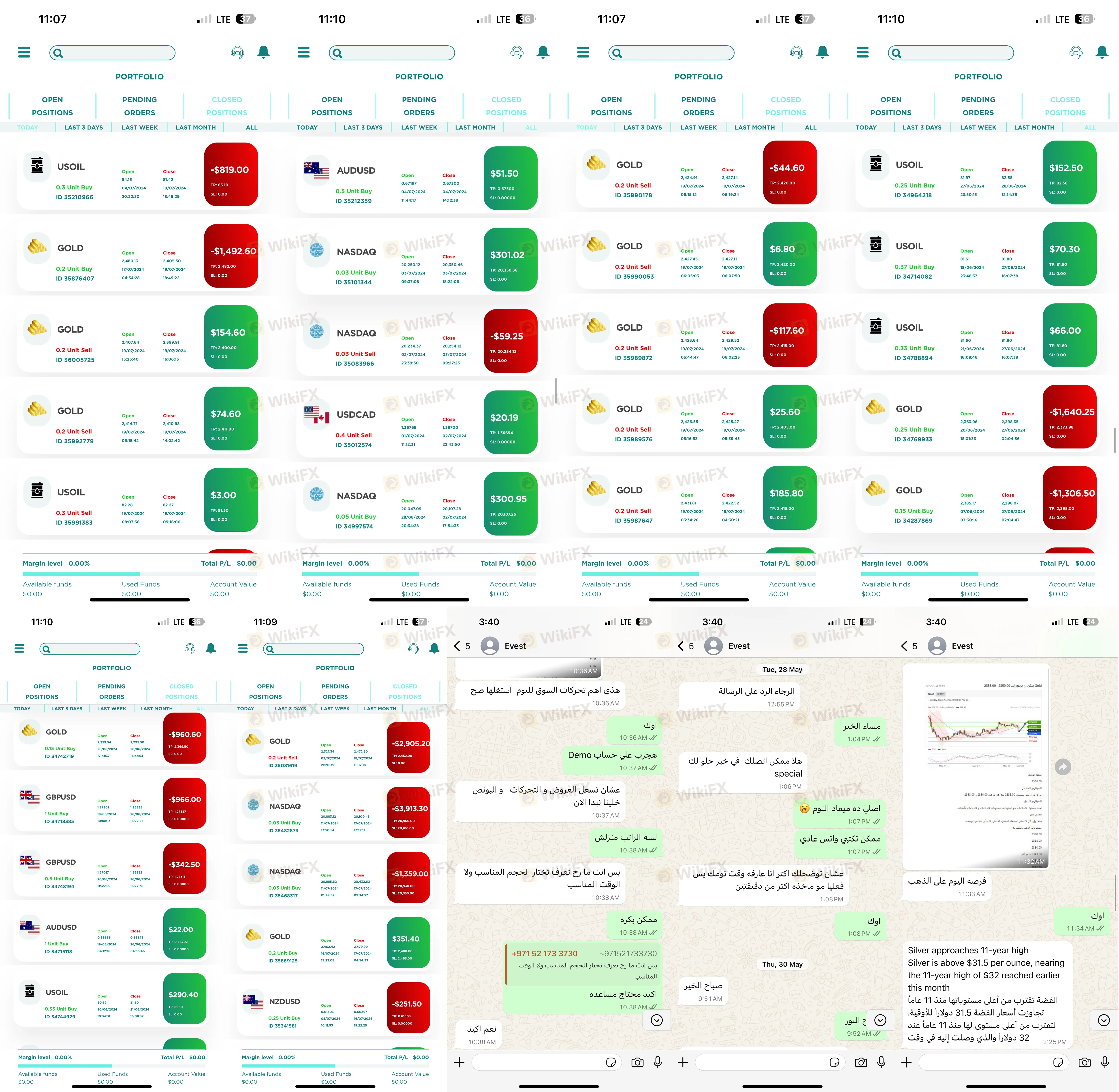

The “Recovery” Trap: How They Drain Accounts

Our analysis of the Forex evest trading environment uncovers a specific trap detailed in Case 5 (Kuwait, January 2025):

1. The Setup: An account manager encourages small profits to build trust.

2. The Freeze: When you try to withdraw, they refuse, citing “market movement opportunities.”

3. The Wipeout: The manager forces the account into bad trades until funds hit zero.

4. The Double-Dip: A new manager calls, claiming they can recover the loss—but only if you deposit more money.

One user from Saudi Arabia reported a staggering loss of $245,000 USD in June 2024, citing “fake names” and “professional fraud.”

Key Red Flags Checked

- Predatory Sales Tactics: Reports of staff pressuring clients to sell personal assets (cars, jewelry).

- Withdrawal Blockades: Managers allegedly refusing withdrawals to “keep the account open.”

- High-Value Victimization: Documented losses exceeding $200k.

Verdict: Is Broker Evest Safe?

The evidence is alarming. While distinguishing itself with an FSCA license, the volume of severe complaints regarding aggressive account managers and withdrawal refusals cannot be ignored.

WikiFX Recommendation: If you are approached by an account manager asking you to sell personal property to fund a Forex account, stop immediately. We classify this as a high-risk environment. Proceed with extreme caution.

Disclaimer:

The views in this article only represent the author's personal views, and do not constitute investment advice on this platform. This platform does not guarantee the accuracy, completeness and timeliness of the information in the article, and will not be liable for any loss caused by the use of or reliance on the information in the article.

WikiFX Broker

Latest News

Is ICM Brokers Legit? Checking Its Legitimacy and Scam Risks

Trade Nation Rebrands TD365 in Global Integration Move

NaFa Markets Review: An Important Warning & Analysis of Fraud Claims

TenTrade Review: Safety, Regulation & Forex Trading Details

USD Crisis: Capital Flight Accelerates as Europe Pivots Away from 'Political Risk'

Gold Breaches $5,110: 'Fear Trade' Dominates as Dollar Wavers

Italian Regulator Moves to Block Multiple Unauthorised Investment Platforms

Yen Awakening: Intervention Risks and Real Rates Signal Structural Turn

HERO Review: Massive Withdrawal Crisis and Platform Blackouts Exposed

PRCBroker Review: Where Profitable Accounts Go to Die

Currency Calculator