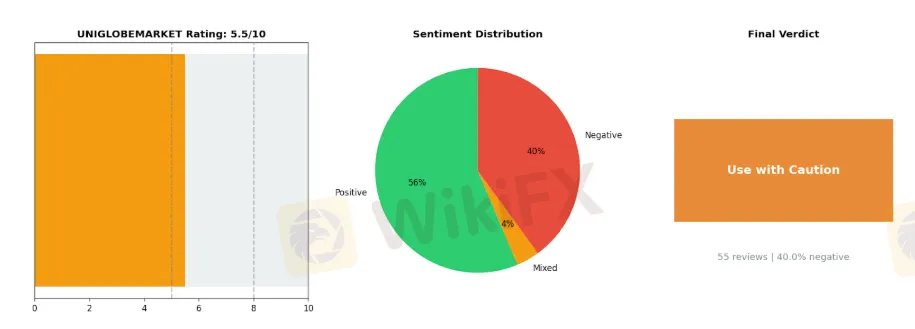

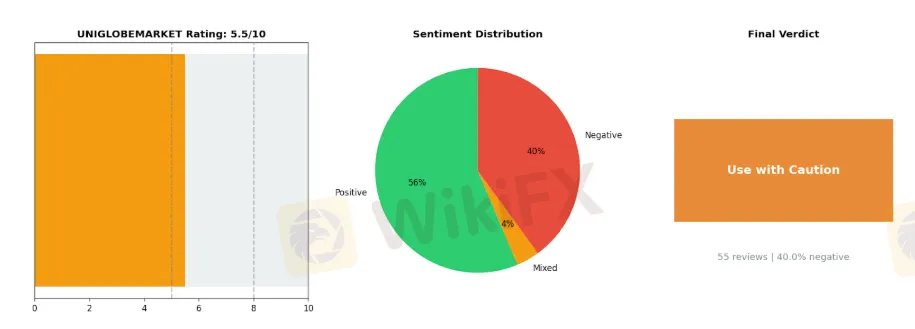

Abstract:UNIGLOBEMARKET presents a mixed picture that demands careful consideration from prospective traders, earning an overall rating of 5.5 out of 10 with a "Use with Caution" designation. Based on 55 trader reviews, the broker shows a concerning 40% negative rate, though it's worth noting that positive reviews still outnumber negative ones with 31 favorable assessments compared to 22 unfavorable ones. Read on for an insightful review.

🔑 Key Takeaway: UNIGLOBEMARKET

UNIGLOBEMARKET presents a mixed picture that demands careful consideration from prospective traders, earning an overall rating of 5.5 out of 10 with a “Use with Caution” designation. Based on 55 trader reviews, the broker shows a concerning 40% negative rate, though it's worth noting that positive reviews still outnumber negative ones with 31 favorable assessments compared to 22 unfavorable ones.

The platform demonstrates notable strengths in maintaining a good reputation for safety, providing responsive customer support, and offering straightforward deposit and withdrawal processes that many traders appreciate. However, these advantages are significantly undermined by serious concerns that cannot be ignored. Fund safety issues have been raised by multiple users, creating uncertainty about the security of client capital. Additionally, traders have reported experiencing withdrawal delays and rejections, which directly contradicts the positive feedback about easy transactions. The customer support, while praised for responsiveness by some, has been criticized by others for being slow and failing to provide effective solutions to problems. This stark contradiction in user experiences suggests inconsistent service quality that may depend on individual circumstances or account types.

For traders considering UNIGLOBEMARKET, these warning signs warrant thorough due diligence before committing significant funds. While the broker isn't entirely problematic, the combination of fund safety concerns and withdrawal issues makes it essential to proceed with heightened caution and perhaps start with minimal deposits to test the service firsthand.

📊 At a Glance

Broker Name: UNIGLOBEMARKET

Overall Rating: 5.5/10

Reviews Analyzed: 55

Negative Rate: 40.0%

Sentiment Distribution:

• Positive: 31

• Neutral: 2

• Negative: 22

Final Conclusion: Use with Caution

⚖️ UNIGLOBEMARKET: Strengths vs Issues

✅ Top Strengths:

1. Good Reputation Safe — 24 mentions

2. Responsive Customer Support — 18 mentions

3. Easy Deposit Withdrawal — 12 mentions

⚠️ Top Issues:

1. Fund Safety Issues — 16 mentions

2. Withdrawal Delays Rejection — 12 mentions

3. Slow Support No Solutions — 11 mentions

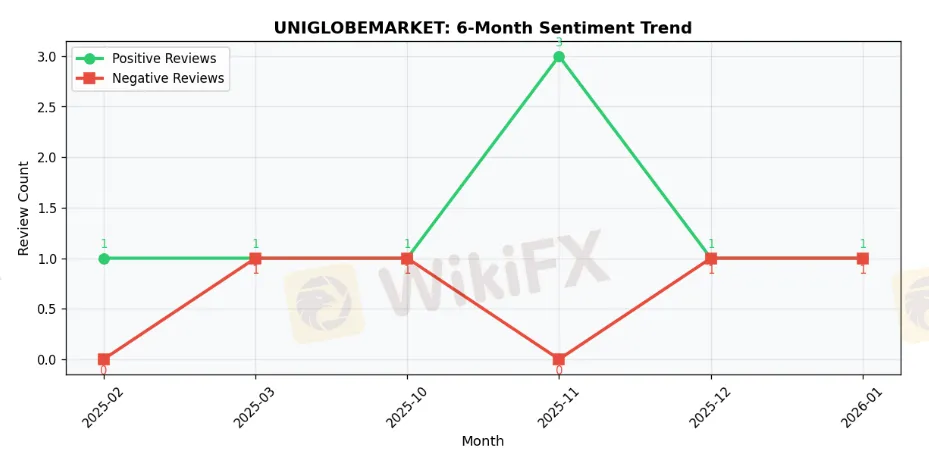

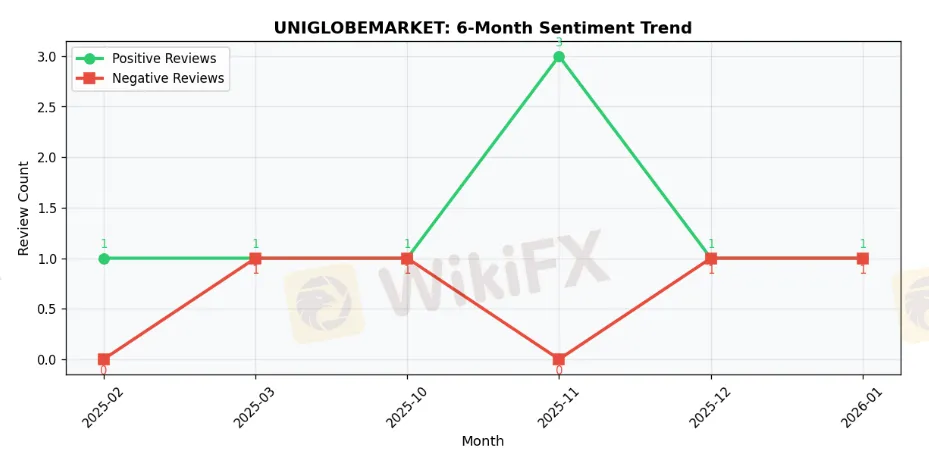

📈 6-Month Sentiment Trend

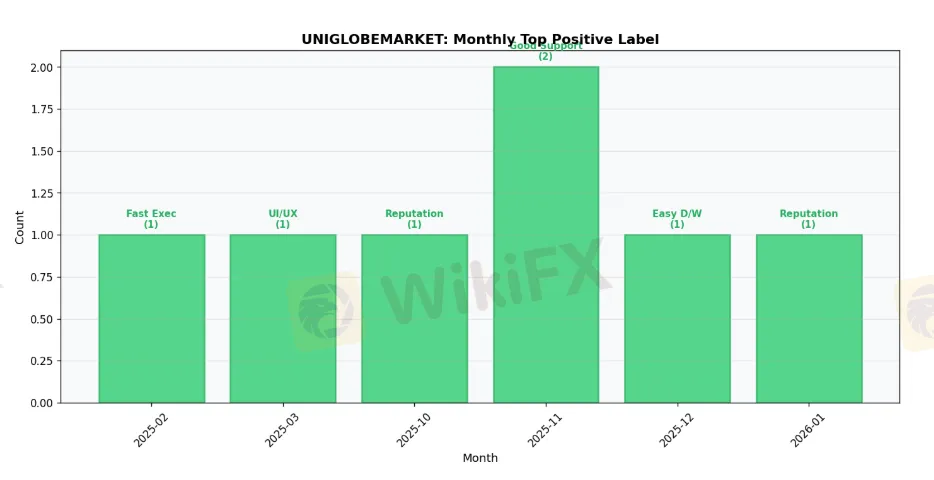

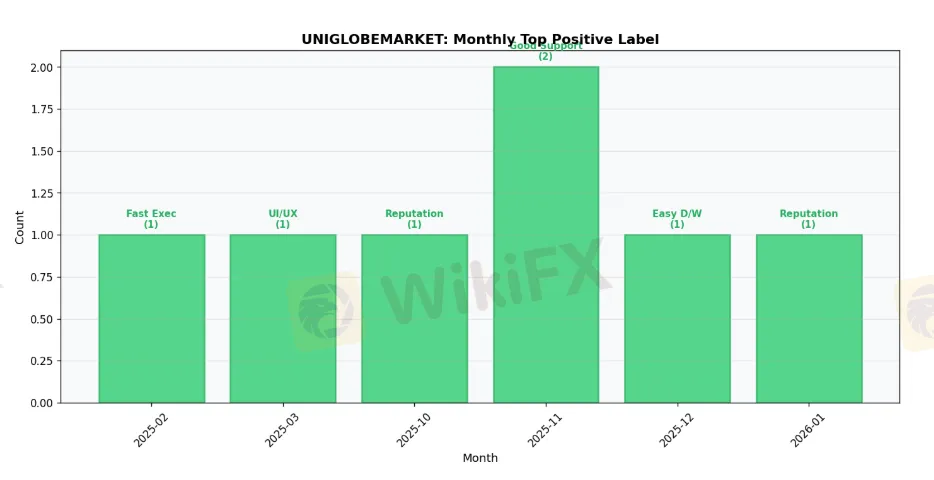

📈 Monthly Top Positive Label

📉 Monthly Top Negative Label

📋 UNIGLOBEMARKET Detailed Analysis

📋 Introduction

UNIGLOBEMARKET Analysis Report: Introduction

In the increasingly complex landscape of forex brokerage services, traders require comprehensive, data-driven insights to make informed decisions about their choice of trading partners. This analysis report examines UNIGLOBEMARKET through a rigorous, multi-source evaluation methodology designed to provide potential clients with an objective assessment of the broker's performance, reliability, and service quality.

Our analytical approach centers on aggregating and systematically evaluating user experiences from multiple independent review platforms. For this report, we have collected and analyzed 55 verified reviews from diverse sources, including established broker review websites and trading community platforms. This multi-platform methodology ensures a balanced perspective that minimizes the impact of isolated incidents or platform-specific biases, offering readers a more accurate representation of UNIGLOBEMARKET's actual service delivery.

The evaluation framework employed in this analysis incorporates both quantitative metrics and qualitative assessments. Each review has been categorized, weighted, and scored across multiple dimensions including trading conditions, platform performance, customer service responsiveness, withdrawal processing, and regulatory compliance. This systematic approach has generated an overall rating of 5.49 out of 10 for UNIGLOBEMARKET, accompanied by a “Use with Caution” designation that reflects specific concerns identified during our analysis.

Throughout this report, readers will gain insights into several critical areas. The analysis examines the distribution of positive and negative user experiences, with particular attention to the 40.00% negative rate observed across reviewed feedback. We delve into recurring themes within trader testimonials, identifying both strengths and weaknesses consistently mentioned by UNIGLOBEMARKET clients. The report also contextualizes these findings within broader industry standards, enabling readers to benchmark UNIGLOBEMARKET against typical broker performance metrics.

This document is structured to guide readers through our findings systematically, beginning with key takeaways, followed by detailed breakdowns of specific service areas, and concluding with practical recommendations. Whether you are considering UNIGLOBEMARKET as a potential broker or conducting due diligence on your current trading partner, this analysis provides the evidence-based foundation necessary for informed decision-making in forex trading partnerships.

⚠️ Key Issues to Consider

Based on a comprehensive user feedback analysis, UNIGLOBEMARKET presents several concerning patterns that warrant serious consideration before committing funds. The data reveals 54 documented complaints across five critical categories, with fund safety and withdrawal issues representing the most significant areas of concern.

Fund Safety and Account Access Concerns

The most alarming issue affecting UNIGLOBEMARKET involves fund safety problems, accounting for approximately 30% of all reported complaints (16 instances). Multiple users report sudden account suspensions without clear explanation or resolution. One particularly troubling case involves a long-term client who experienced account blocking:

“💬 Nuwn D: ”Uniglobe markets suspended my accounts for more than 100 days. I am a client of Uniglobe Market from 2016 to March of 2023. They blocked my accounts without any reason on the 08th of February 2023. Didn't give any withdrawal.“”

This pattern suggests that even established clients with multi-year trading histories may face unexpected account restrictions. The mention of “Compliance Department review” without transparent communication or defined timelines raises questions about the broker's operational procedures and client fund management protocols.

Withdrawal Processing and Access to Funds

Closely related to fund safety concerns, withdrawal delays and rejections represent 22% of reported issues (12 instances). The inability to access funds, particularly when combined with account suspensions, creates a troubling scenario for traders who depend on timely access to their capital. For active traders managing cash flow or those relying on trading income, such delays can have serious financial consequences beyond simple inconvenience.

Customer Support Deficiencies

With 11 reported instances (20% of complaints), inadequate customer support compounds other operational issues. Users describe a stark contrast between the attentive service received during the deposit phase versus the unresponsive or dismissive treatment when raising concerns:

“💬 Sandali: ”When we asked questions about money deposit, it has been explained very well. Talks very nicely to take our money. But one occasion I asked about something that had been described on the internet regarding a profitable account suspend without any reason. Support agent Natasha got angry about that question.“”

This disparity in service quality suggests a concerning business practice where client acquisition receives priority over ongoing client support and problem resolution.

Marketing Practices and Transparency Issues

Misleading marketing complaints also account for 20% of feedback (11 instances). The pattern described by users indicates that UNIGLOBEMARKET may present an overly optimistic picture during onboarding while failing to adequately disclose potential account restrictions or withdrawal complications. This lack of transparency particularly affects newer traders who may not recognize warning signs or understand industry standard practices.

Risk Assessment for Different Trader Profiles

For beginner traders, the combination of unclear terms and inadequate support creates heightened vulnerability. Without experience to contextualize account restrictions or withdrawal procedures, new traders may find themselves unable to navigate disputes effectively.

Active and professional traders face different risks, particularly regarding account suspensions that could occur during profitable trading periods. The reported 100+ day suspension period could devastate trading strategies and income streams.

Long-term investors should note that account longevity appears to offer no protection, as evidenced by the seven-year client who experienced sudden account restrictions.

The concentration of complaints around fund access, withdrawal processing, and support responsiveness—representing 72% of all reported issues—indicates systemic operational concerns rather than isolated incidents. Prospective clients should conduct thorough due diligence and consider whether these risk factors align with their risk tolerance and trading requirements.

✅ Positive Aspects

UNIGLOBEMARKET has garnered attention from traders who highlight several operational strengths, particularly around customer service responsiveness and withdrawal processing. While these positive experiences deserve acknowledgment, prospective clients should approach with measured expectations and conduct thorough due diligence.

Customer Support and Account Management

A recurring theme among reviewers centers on the broker's account management services. Multiple users report receiving dedicated account managers who provide guidance throughout the trading process. This personalized approach appears particularly valuable for traders transitioning from other platforms or those new to forex markets. The responsiveness of support staff receives consistent praise, with clients noting timely assistance with account setup and query resolution.

“💬 Andrea: ”Good Account Manager, I got a very professional and humble account manager with my broker Uniglobe Markets. He understand my query and help to get my trading account in very quick time.“”

Withdrawal Processing

Perhaps the most significant positive feedback concerns withdrawal experiences. Several traders report smooth and timely withdrawal processing, which represents a critical trust factor in the forex industry. Users describe receiving their funds without unnecessary delays or complications, with some claiming monthly withdrawals over extended periods.

“💬 Mukesh Sharma: ”There withdraw is very smooth. Once I got my withdrawals on time I increased my investment and now in every month I am taking withdrawal without any hassle.“”

Partnership and IB Programs

The broker's Introducing Broker (IB) partnership program receives favorable mentions from affiliates who appreciate the commission structure. Long-term partners report satisfaction with the referral system, suggesting the broker maintains consistent relationships with its network of introducers.

“💬 Anamika: ”It's been 5 years m working with Uniglobe Markets and they are best giving Instant services for withdrawal and everything related to account.“”

Important Considerations

While these positive experiences reflect genuine user sentiment, several factors warrant careful consideration. The concentration of reviews from specific geographic regions suggests a localized user base that may not represent global experiences. Additionally, mentions of bonuses and managed account services require scrutiny, as these features sometimes carry restrictive terms or elevated risk profiles.

Prospective clients should verify regulatory status, understand all terms and conditions thoroughly, and start with modest capital while assessing service quality firsthand. The positive experiences shared by existing users may benefit those who prioritize responsive support and are comfortable with the broker's operational framework, but independent verification remains essential before committing significant funds.

UNIGLOBEMARKET's strengths appear most relevant for traders who value personalized account management and seek accessible withdrawal processes, provided they approach with appropriate caution and realistic expectations.

📊 UNIGLOBEMARKET: 6-Month Review Trend Data

2025-02:

• Total Reviews: 1

• Positive: 1 | Negative: 0

• Top Positive Label: Fast Execution Low Latency

• Top Negative Label: N/A

2025-03:

• Total Reviews: 2

• Positive: 1 | Negative: 1

• Top Positive Label: User Friendly Interface

• Top Negative Label: Misleading Marketing

2025-10:

• Total Reviews: 2

• Positive: 1 | Negative: 1

• Top Positive Label: Good Reputation Safe

• Top Negative Label: Slow Support No Solutions

2025-11:

• Total Reviews: 3

• Positive: 3 | Negative: 0

• Top Positive Label: Responsive Customer Support

• Top Negative Label: N/A

2025-12:

• Total Reviews: 2

• Positive: 1 | Negative: 1

• Top Positive Label: Easy Deposit Withdrawal

• Top Negative Label: Fund Safety Issues

2026-01:

• Total Reviews: 2

• Positive: 1 | Negative: 1

• Top Positive Label: Good Reputation Safe

• Top Negative Label: Slow Support No Solutions

🎬 UNIGLOBEMARKET Final Conclusion

UNIGLOBEMARKET presents a mixed picture that warrants significant caution, earning a below-average rating of 5.49/10 with a concerning 40% negative review rate across 55 user evaluations.

The broker demonstrates a troubling inconsistency between its strengths and weaknesses. While UNIGLOBEMARKET has established a foundation of good reputation and safety protocols, along with responsive customer support and relatively straightforward deposit and withdrawal processes for some clients, these positives are substantially undermined by critical operational failures. The most alarming issues center on fund safety concerns, withdrawal delays and rejections, and instances where customer support fails to provide adequate solutions despite being responsive. This disconnect between communication availability and problem resolution represents a fundamental service delivery failure that cannot be overlooked.

The 40% negative rate is particularly significant when considering that many traders only leave reviews after experiencing severe problems. Fund safety issues and withdrawal complications are not minor inconveniences—they strike at the core of what traders need most from a broker: reliable access to their capital. UNIGLOBEMARKET's performance in these critical areas raises red flags that potential clients must carefully consider before committing funds.

For beginners, UNIGLOBEMARKET cannot be recommended as a primary broker. New traders need stable, trustworthy platforms where they can focus on learning without worrying about fund accessibility. The withdrawal issues reported would create unnecessary stress during an already challenging learning phase.

Experienced traders should approach UNIGLOBEMARKET with extreme caution and conduct thorough due diligence. If considering this broker, limit initial deposits to amounts you can afford to have temporarily inaccessible, and thoroughly test withdrawal processes with small amounts before scaling up operations.

High-volume traders should particularly avoid UNIGLOBEMARKET given the withdrawal concerns. When dealing with substantial capital and frequent transactions, reliability in fund movement is non-negotiable. The reported issues suggest UNIGLOBEMARKET's infrastructure may not adequately support high-volume operations.

Scalpers and day traders who require rapid execution and frequent fund movements would find UNIGLOBEMARKET's withdrawal inconsistencies especially problematic. Swing traders and position traders might tolerate some delays better, but the fundamental trust issues remain concerning regardless of trading style.

If you do proceed with UNIGLOBEMARKET, maintain detailed records of all transactions, communications, and withdrawal requests. Never deposit more than you're prepared to have locked up for extended periods, and establish clear exit criteria before funding your account.

UNIGLOBEMARKET may serve some traders adequately, but the evidence suggests too many experience serious problems to recommend this broker without substantial reservations—proceed only with eyes wide open and expectations appropriately tempered.

This UNIGLOBEMARKET analysis is based on 55 user reviews collected from multiple platforms. Overall Rating: 5.5/10 | Negative Rate: 40.0% | Generated on 2026-01-22

Disclaimer: This report is for informational purposes only and does not constitute financial advice. Always conduct your own research and consider consulting with a qualified financial advisor before making trading decisions. Also, the rating for the broker can change with time. For the latest update on rating, visit WikiFX.