简体中文

繁體中文

English

Pусский

日本語

ภาษาไทย

Tiếng Việt

Bahasa Indonesia

Español

हिन्दी

Filippiiniläinen

Français

Deutsch

Português

Türkçe

한국어

العربية

Grand Capital Review: The Anatomy of a Regulatory Fugitive

Abstract:Grand Capital is a regulatory phantom operating under a cloud of global fraud alerts and a staggering volume of withdrawal complaints. With a measly WikiFX score of 2.34, this broker is essentially a financial trapdoor for unsuspecting retail traders.

Grand Capital is not merely a underperforming firm; it is a ghost ship sailing through international waters with every major lighthouse flashing red. Established in 2018 and supposedly headquartered in the Seychelles, the data suggests this broker exists primarily to swallow deposits while dodging the very authorities meant to oversee it. With a WikiFX score of 2.34 and a wave of 13 formal complaints within the last quarter, the facade of a “professional trading environment” is crumbling.

Grand Capital Regulation: A Global Web of Warnings

The most damning evidence against this entity comes from the regulators themselves. While many brokers struggle with minor compliance issues, Grand Capital has achieved the rare feat of being blacklisted by multiple major financial watchdogs. They are not merely “unregulated”—they are actively flagged as unauthorized and fraudulent.

| Regulator | License Type | Status |

|---|---|---|

| Seychelles Financial Services Authority (FSA) | Securities Dealing | Unauthorised / Fraud Company Alert |

| France Financial Markets Authority (AMF) | Forex/Investment Services | Blacklisted / Unauthorized |

| Portugal Securities Market Commission (CMVM) | Financial Intermediation | Unauthorized / Warning Issued |

On July 1, 2024, the Seychelles FSA issued a blistering “Scam Alert,” explicitly stating that Grand Capital Ltd has never been authorized to conduct securities business. This is the broker's own home turf calling them a fraud. When the regulator in your own backyard tells investors to run, you should probably listen.

The Forex Broker Traps: Lot Requirements and Ghost Support

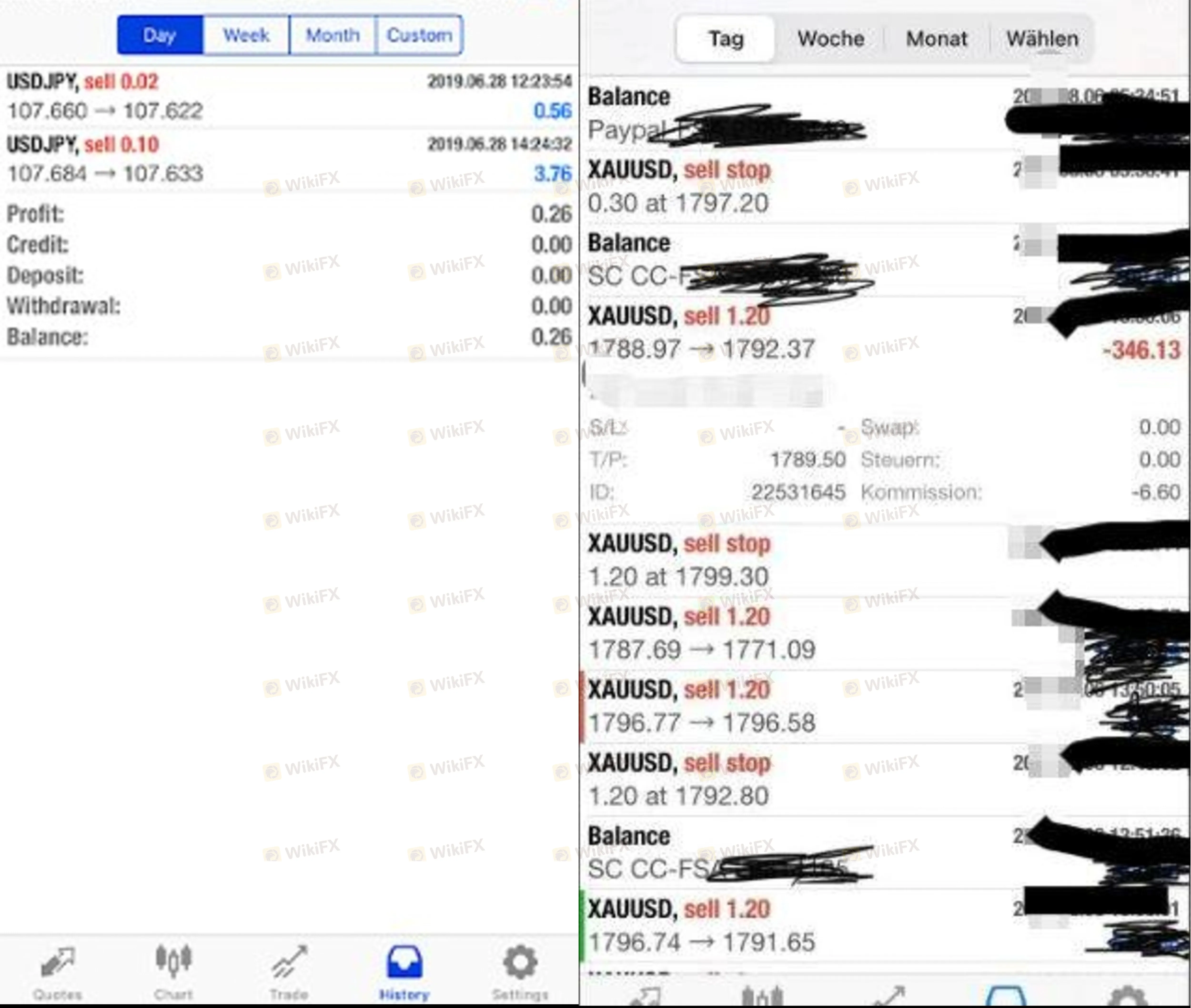

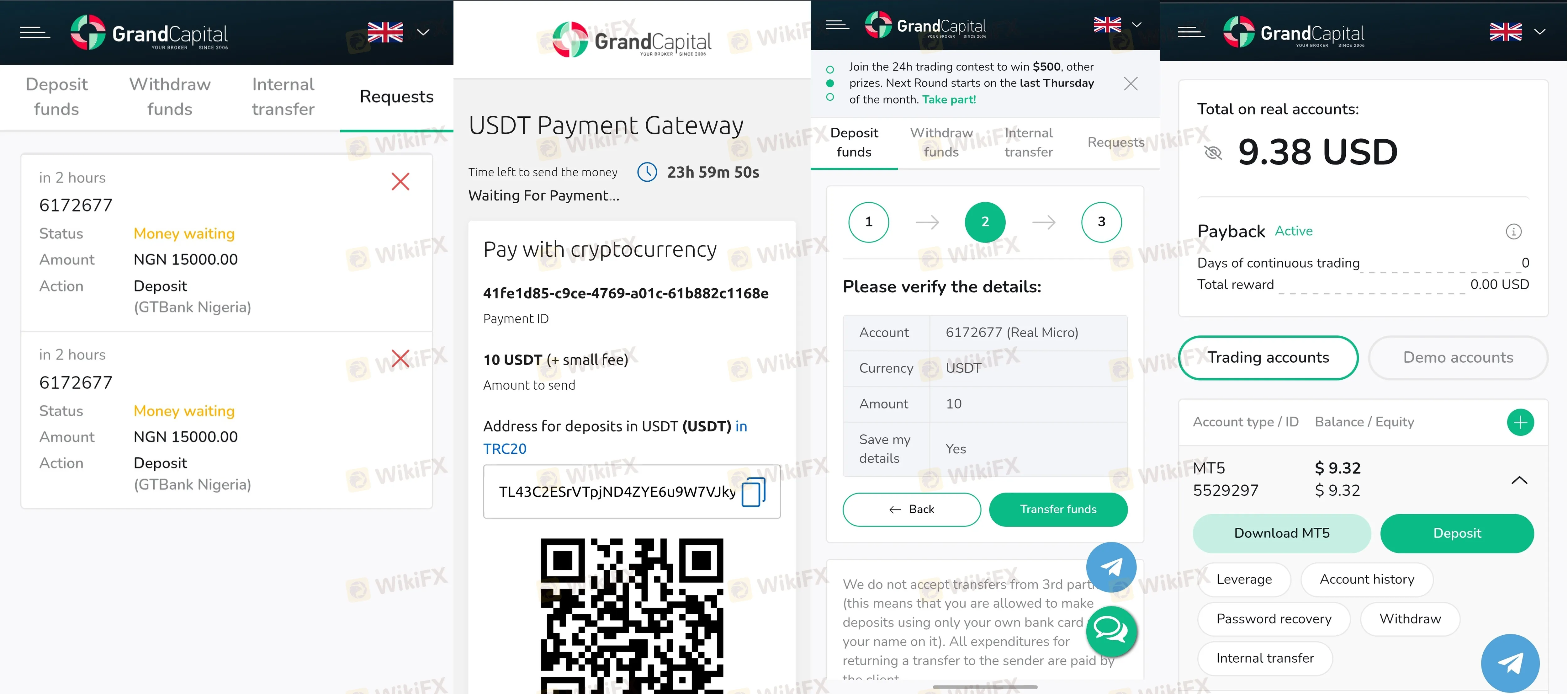

Victims of Grand Capital often report a similar, painful narrative. It begins with the alluring promise of high-leverage Forex trading and ends in a bureaucratic nightmare where withdrawals are held hostage. One trader in Turkey reported depositing $500 and winning $800, only to be met with shifting “lot conditions.” First, the broker demanded 5% lots, then 25, then 9 more—a classic “moving the goalposts” scam designed to ensure the trader eventually wipes out their account before a withdrawal is ever processed.

In India, another user reported that after depositing $700 based on “live profit” proof from a recruiter, their funds simply vanished from the dashboard. This isn't just a technical glitch; it's a systematic extraction of retail capital.

The Login Nightmare: Stuck in a Digital Cul-de-sac

The technical infrastructure of Grand Capital appears as unreliable as its licensing. Users have reported that the login experience is the gateway to a digital trap. While the broker markets its use of MT4 and MT5, the actual application interface according to user reports “takes too long to load and always gets stuck.”

Traders have noted that they are forced to exit and re-enter multiple times, only to find their withdrawal requests still “in review” or “pending” indefinitely. If you find yourself staring at a spinning wheel on the login screen while your capital is locked away, understand that this is by design. The lack of two-step authentication and biometric security mentioned in tech audits only adds another layer of risk to your personal data.

Broker Review: Why a 2.34 Score is Actually Generous

When conducting this Grand Capital review, we looked at the influence index, which currently sits at a mediocre “C.” Their influence is spread across Argentina, Brazil, and Germany, meaning they are casting a wide net for victims. Despite claiming to have “fluent” web-based software, the reality on the ground is a trail of disgruntled traders and ignored support tickets.

The “support” at Grand Capital is a polyglot of disappointment, offered in 18 languages but effectively unresponsive when money is on the line. Traders from Thailand to Colombia have expressed the same frustration: the moment you stop depositing and start asking for your money, the “18 languages” falling silent.

Final Investigative Verdict

Grand Capital behaves like a classic offshore predatory broker. It leverages the reputation of MT4/MT5 platforms to gain an air of legitimacy, while its regulatory reality is a sequence of fraud alerts. The Grand Capital broker model relies on the “lot requirement” trap and a support system that vanishes during emergencies.

Risk Warning: Trading with an entity blacklisted by the AMF and flagged as a fraud by the Seychelles FSA is not “high-risk” investing—it is a guaranteed path to capital loss. Secure your funds and avoid the login page of this entity at all costs. Anonymity is their shield; your data and deposit are their targets. Underscoring this, WikiFX has tagged this broker with a high-risk warning. Stay vigilant.

Disclaimer:

The views in this article only represent the author's personal views, and do not constitute investment advice on this platform. This platform does not guarantee the accuracy, completeness and timeliness of the information in the article, and will not be liable for any loss caused by the use of or reliance on the information in the article.

WikiFX Broker

Latest News

Telegram Investment Scam Wiped Out RM91,000 in Days

SPEC TRADING Review 2026: Is this Forex Broker Legit or a Scam?

Gold Smashes $5,100 Barrier: Dalio Warns of 'Capital Wars'

Fiscal Policy Monitor: Authorities Tighten Tax Compliance Framework

AMBER MARKETS Review 2026 — Is AMBER MARKETS Broker Safe for Forex Trading?

Who are the “Police” Watching Your Forex Broker? (FCA, ASIC, NFA Explained)

Dollar Index Hits Four-Year Low as 'Fed Whisperer' Signals Rate Pause

PayPal Re-enters Inbound Nigerian Market via Paga Partnership

German Capital Flows Heavy into China, Defying Trade War Risks

FIBOGROUP Review: Safety, Regulation & Forex Trading Details

Currency Calculator