简体中文

繁體中文

English

Pусский

日本語

ภาษาไทย

Tiếng Việt

Bahasa Indonesia

Español

हिन्दी

Filippiiniläinen

Français

Deutsch

Português

Türkçe

한국어

العربية

ALPEX TRADING Review: The Withdrawal Ransom and Copy Trade Trap

Abstract:Multiple trader reports confirm that ALPEX TRADING is withholding client funds, demanding fictitious "processing fees," and freezing accounts under the guise of technical restrictions. With no valid regulation and an alarmingly low safety score, this broker presents a critical risk to global investors.

By WikiFX Special Investigator

The promise was simple: easy deposits and automated profits. The reality, according to a surge of recent complaints, is a digital trap. Our investigation into ALPEX TRADING uncovers a disturbing pattern where withdrawal requests are met not with funds, but with demands for ransom fees and sudden account freezes.

If you are currently trading on this platform or considering it, the following investigation exposes why your capital is in immediate danger.

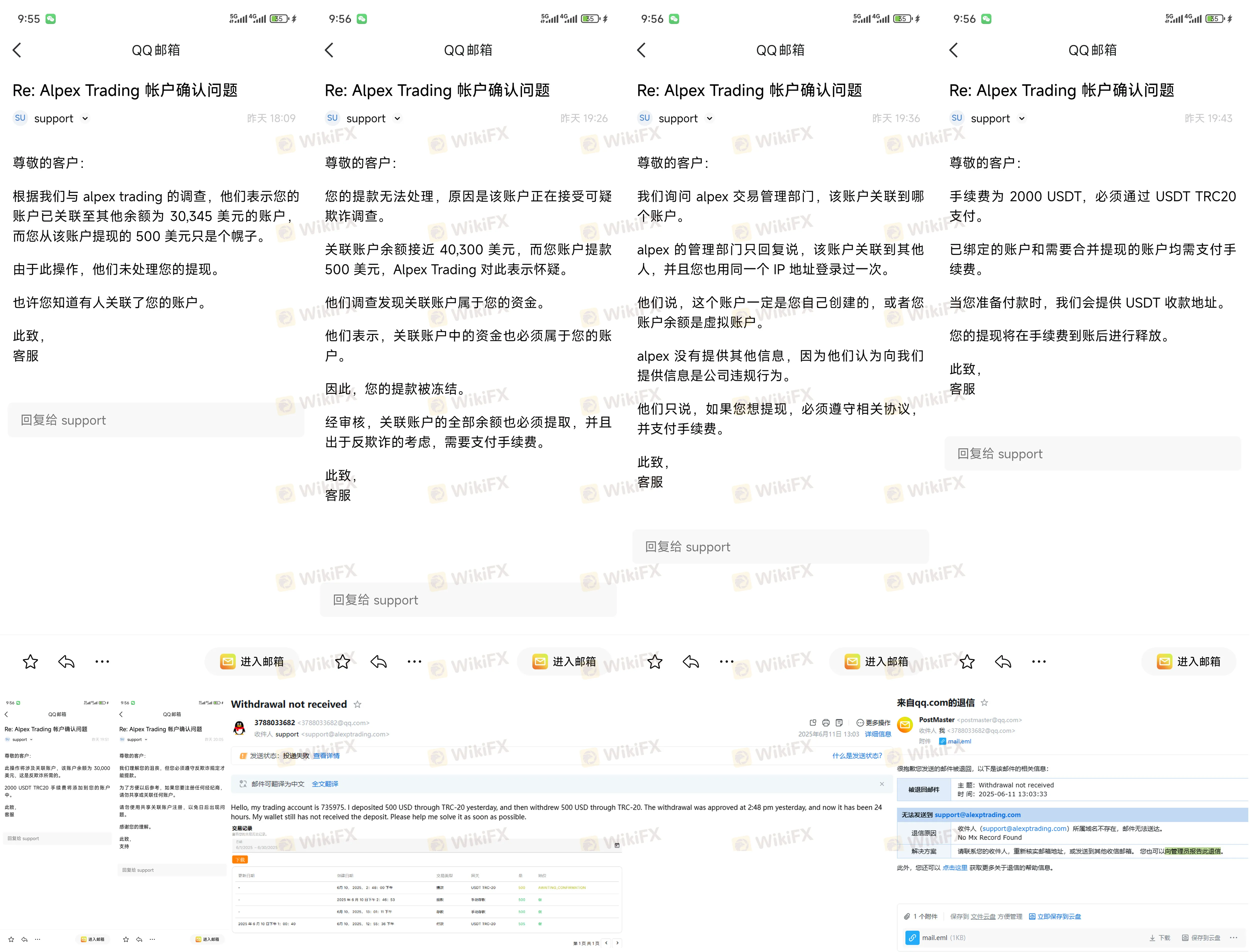

The $2,000 “Fee” Shock

The most alarming evidence comes from a verified user in June 2025. After attempting to withdraw their own money, the user received a shocking response. ALPEX TRADING support claimed the user's account was suspiciously “linked” to others—a vague accusation often used by high-risk platforms to stall payments.

But it didn't stop there. The broker demanded an additional $2,000 “processing fee” to release the funds. This is a classic hallmark of a capital trap: forcing victims to throw good money after bad. Instead of processing the withdrawal, the broker held the funds hostage, leaving the trader with nothing but a depleted bank account and unanswered emails.

Others report similar walls of silence. In another 2025 case, a trader deposited $500 only to find that the support email addresses provided on the ALPEX TRADING broker website were invalid, bouncing back inquiries while the interface refused all withdrawal attempts.

ALPEX TRADING Regulation: Zero Protection for Forex Traders

Why does this broker feel comfortable demanding extra fees? The answer lies in their regulatory status. Our audit confirms that ALPEX TRADING operates without a valid license from any Tier-1 financial authority.

Regulatory Reality Audit

| Regulator | License Type | REAL STATUS |

|---|---|---|

| St. Vincent & The Grenadines | Commercial Registration | UNREGULATED |

| Global Tier-1 Agencies | None | NO LICENSE |

| WikiFX Risk Score | 1.34 / 10 | DANGEROUS |

While the broker claims to differ from the competition, the regulatory data is clear. Registration in St. Vincent does not grant a brokerage license. It means there is no watchdog to intervene when ALPEX TRADING denies a withdrawal. In the unregulated Forex market, you are essentially relying on the broker's goodwill—which, in this case, appears non-existent.

The “Money Printer” Trap and Login Denials

Beyond simple withdrawal refusals, our investigation reveals a sophisticated trap targeting passive investors. Multiple reports from late 2024 describe a “Copy Trade” scheme, specifically a group named “Money Printer.”

Investors poured thousands into this system, hoping for automated returns. However, when they attempted to cash out, they were blocked. The method? The “master” trader keeps positions open (floating) indefinitely. Because the system requires all positions to be closed before withdrawal, users are stuck. They cannot close the trades themselves, and they cannot access their cash.

One victim reported: “I invested $3,000... funds are stuck because the trader holds floating positions forever. I cannot exit.”

Even more concerning are the ALPEX TRADING login restrictions. In several severe cases, including a report from Belarus and another from Malaysia, users found their access completely cut off. One long-term client reported their account was suddenly “frozen” or “disabled” after years of activity. When a broker disables a specific ALPEX TRADING login right as a user attempts to retrieve funds, it is a definitive signal of bad faith.

Visual Evidence: Current Year Complaints

The following evidence collected from the WikiFX exposure center highlights the ongoing crisis:

Key Red Flags

- Pay-to-Withdraw Demands: Users are asked to pay huge “fees” (e.g., $2,000) to access their own money.

- The “Floating” Lock: Copy trading systems are rigged to prevent withdrawals by keeping losing trades open indefinitely.

- Communication Blackouts: Support emails bounce, and “managers” disappear once deposits are made.

- Unauthorized Status: The firm holds no license to operate as a financial service provider in regulated markets.

Final Verdict

The data is undeniable. ALPEX TRADING is exhibiting severe warning signs synonymous with a capital trap. From demanding ransom fees to locking investors into unending copy trades, the mechanics are designed to accept deposits and reject withdrawals.

Recommendation: Do not deposit funds. If you are already involved, cease strict reliance on their “support” channels and document all communications immediately. This is not a safe environment for Forex trading.

WikiFX reminds traders to check the 'Regulation' column before transfer. Download the WikiFX App for real-time alerts on unregulated brokers.

Disclaimer:

The views in this article only represent the author's personal views, and do not constitute investment advice on this platform. This platform does not guarantee the accuracy, completeness and timeliness of the information in the article, and will not be liable for any loss caused by the use of or reliance on the information in the article.

WikiFX Broker

Latest News

Telegram Investment Scam Wiped Out RM91,000 in Days

SPEC TRADING Review 2026: Is this Forex Broker Legit or a Scam?

Gold Smashes $5,100 Barrier: Dalio Warns of 'Capital Wars'

Fiscal Policy Monitor: Authorities Tighten Tax Compliance Framework

AMBER MARKETS Review 2026 — Is AMBER MARKETS Broker Safe for Forex Trading?

Who are the “Police” Watching Your Forex Broker? (FCA, ASIC, NFA Explained)

Dollar Index Hits Four-Year Low as 'Fed Whisperer' Signals Rate Pause

PayPal Re-enters Inbound Nigerian Market via Paga Partnership

German Capital Flows Heavy into China, Defying Trade War Risks

FIBOGROUP Review: Safety, Regulation & Forex Trading Details

Currency Calculator