简体中文

繁體中文

English

Pусский

日本語

ภาษาไทย

Tiếng Việt

Bahasa Indonesia

Español

हिन्दी

Filippiiniläinen

Français

Deutsch

Português

Türkçe

한국어

العربية

Titan Capital Markets Review: The Anatomy of a Decaying Ponzi Scheme

Abstract:Titan Capital Markets is a confirmed Ponzi scheme masquerading as a high-tech Forex broker, currently under a dire 'Danger' warning from the Philippines SEC for illegal solicitation. With a pathetic WikiFX score of 1.45, it has effectively frozen global investor funds, leaving a trail of shuttered accounts and unpaid 'guaranteed' returns.

Titan Capital Markets doesn't just fail as a broker; it excels as a predatory financial trap. Scoring a bottom-of-the-barrel 1.45 on WikiFX, this entity has moved from “suspicious” to “actively terminal.” While it markets itself through polished websites and promises of AI-driven 99.9% accuracy, the reality is a grim pattern of blocked accounts, forced crypto conversions, and a total cessation of withdrawals. This is not a platform for trading; it is a black hole for capital.

The Regulation Mirage

The most damning evidence against the Titan Capital Markets regulation status comes directly from the Philippine Securities and Exchange Commission (SEC). In early 2024, the regulator didn't just issue a warning—they deconstructed Titan's entire business model, labeling it a “Ponzi Scheme.”

| Regulator | License Type | Status |

|---|---|---|

| Philippines SEC | Investment Solicitation | Blacklisted / Unregistered |

| Australia (ASIC) | Claimed Office Location | No Record of Regulation |

The SECs audit revealed that Titan Capital Markets was soliciting investments ranging from $100 to $3,000 with monthly returns of up to 24%. This is the hallmark of a fraud. Under the Securities Regulation Code (SRC), they have zero authority to touch public money.

The Forex Broker Trapping Mechanism

For those still attempting to use the Titan Capital Markets review to justify an investment, the victim reports from India, the UAE, and Maldives paint a horrific picture. The “broker” has transitioned into a classic exit scam phase.

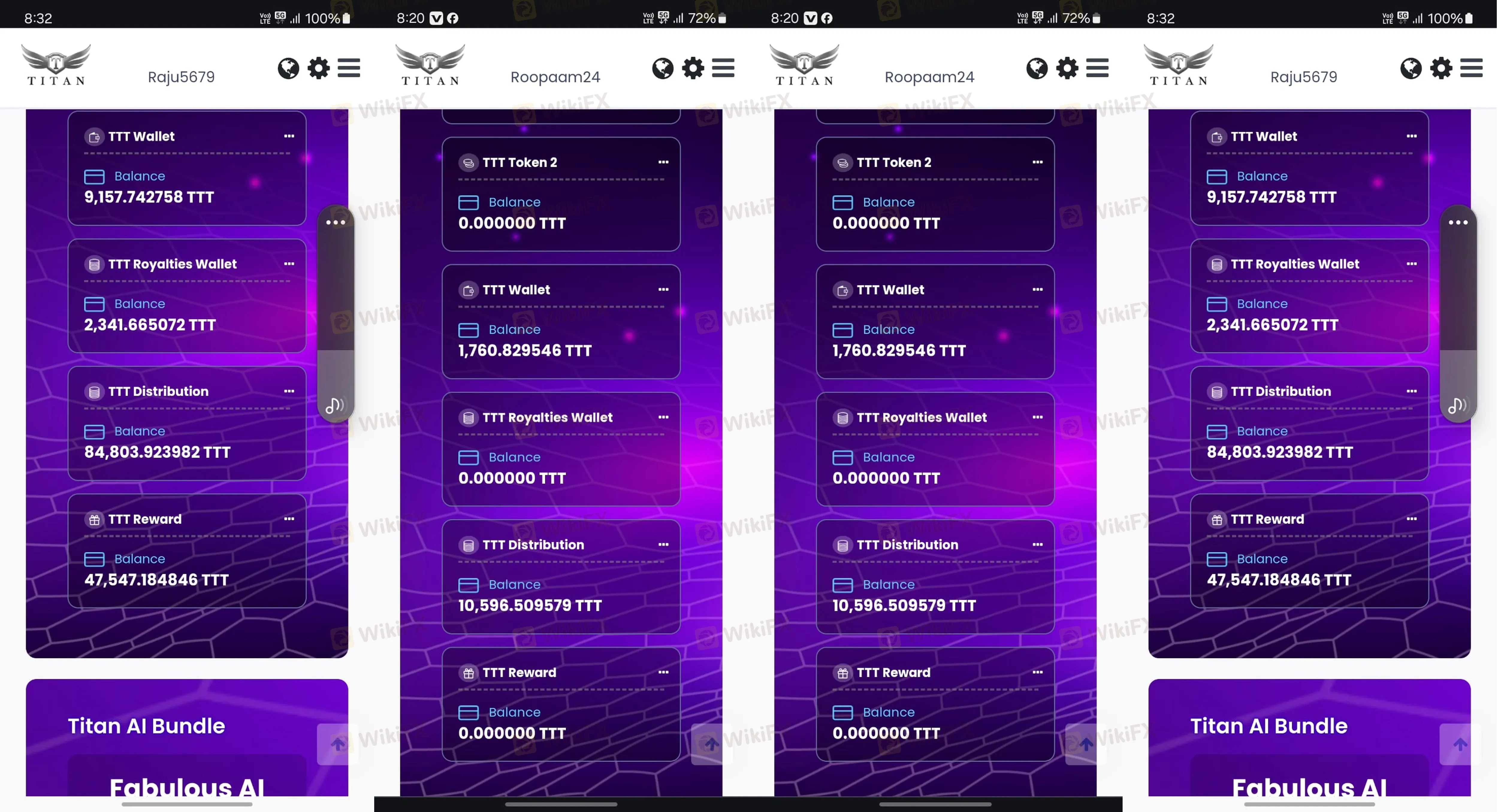

Multiple investors report that their Forex funds were forcibly converted into a worthless proprietary token named “TTT.” Once the conversion happened, the withdrawal options were systematically removed. This is a common tactic among failed Forex broker operations: when the real cash runs out, they issue “digital dust” to keep the masses quiet while the founders head for the exit.

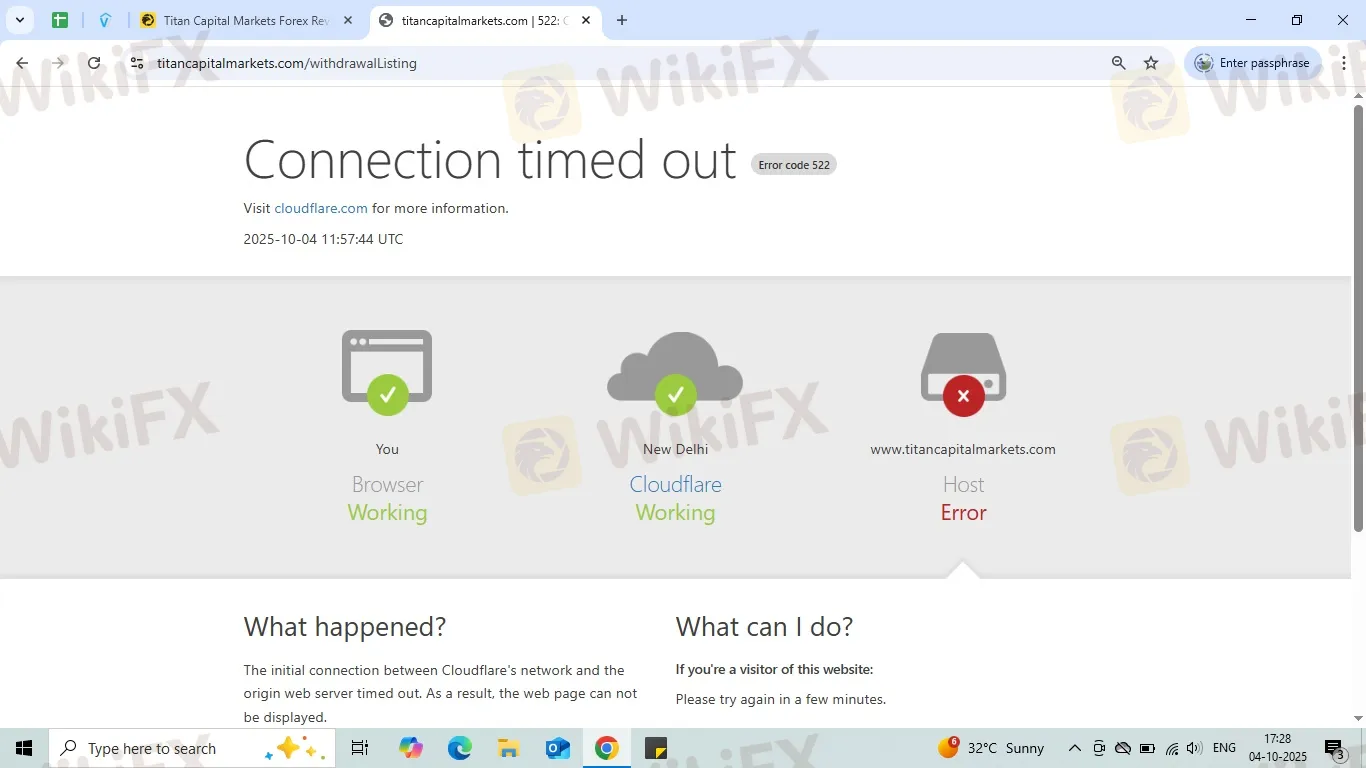

The Login Nightmare and Frozen Assets

The most frequent complaint involves the Titan Capital Markets login portal. Users are finding their IDs blocked—specifically cited as “JASBIR3090” and others—without any prior notice or explanation. When the login works, the withdrawal buttons have either vanished or are restricted to a measly 5% of the balance, a move described by victims as “pure harassment.”

One investor from Thailand reported being asked to pay a “tax” of $566 just to unlock their $2,800 balance—a classic “advance fee” fraud layered on top of the original scam. Once the tax was paid, the platform simply demanded another $500 for “inspection.” The login page is essentially a gateway to a ransom note.

Global Fallout: India, Thailand, and Beyond

The destruction is widespread. Case data shows $50,000 lost by a single investor in Haryana, India, where local leaders allegedly abandoned the company just before the site went dark. The Forex trading accuracy they claimed was nothing more than a simulated circus designed to lure in those looking for “automated wealth.”

- Exit Scams: Reports from late 2024 and early 2025 confirm the site has been shut down periodically or has moved operations to names like “Yun Shang Hui Xin Limited” to dodge legal heat.

- Crypto Shell Game: By moving investor funds into 'distribution wallets' and 'staking profit' schemes, they have effectively laundered the initial Forex deposits into illiquid crypto assets.

Final Investigative Verdict

Titan Capital Markets represents the worst of the offshore brokerage world. They lack any valid regulation from reputable bodies and are currently the subject of an active criminal warning for operating a Ponzi scheme.

If you have funds here, do not pay “taxes” or “inspection fees” to get them out—it is a secondary scam. The platform is functionally dead, and the review of their activities confirms a total loss of investor trust. Those still promoting this entity are, according to the SEC, liable for criminal prosecution.

Risk Warning: Financial markets are volatile enough without handing your wallet to a blacklisted predator. High scores on WikiFX are earned through transparency; a score of 1.45 is a siren blaring in the dark. Ignore it at your own peril.

Disclaimer:

The views in this article only represent the author's personal views, and do not constitute investment advice on this platform. This platform does not guarantee the accuracy, completeness and timeliness of the information in the article, and will not be liable for any loss caused by the use of or reliance on the information in the article.

Latest News

Macro Strategy: Hard Assets Favored Over Consumption in Inflationary Environments

Central Bank 'Super Week': ECB, BoE, and RBA to Test FX Volatility

Precious Metals Capitulation: Gold Plunges 12% to Break $5,000 Support

EZINVEST Review: The Financial Abattoir Behind the CySEC Mask

SARB Pauses Rate Cycle at 6.75% Amid Lingering Uncertainty

Eurozone Resilience: Economy Defies Gloom as Germany Rebounds

Lured by a deepfake video, retiree lost over $4,000 in an investment scheme

Geopolitical Risk: Iran Accuses West of Inciting Domestic Unrest

Oil Markets Tighten: OPEC+ leans towards extending output pause into March

Geopolitical Risk: US Carrier Deploys as Iran Eyes Hormuz

Currency Calculator