简体中文

繁體中文

English

Pусский

日本語

ภาษาไทย

Tiếng Việt

Bahasa Indonesia

Español

हिन्दी

Filippiiniläinen

Français

Deutsch

Português

Türkçe

한국어

العربية

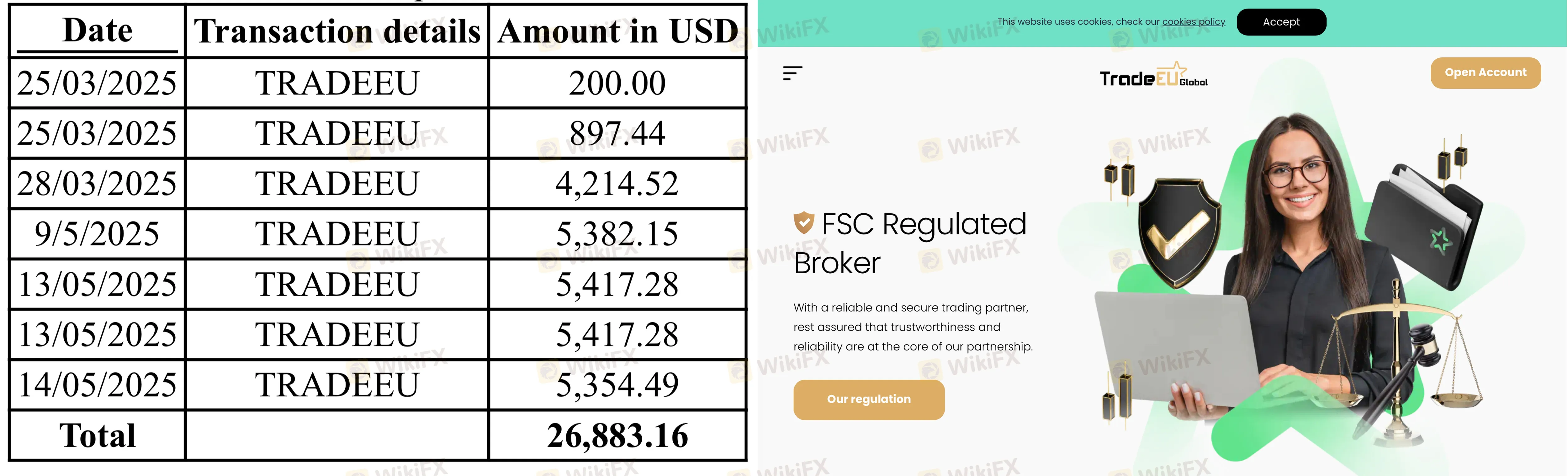

TradeEU Global Review: The "Rescue Bonus" Trap Exposed

Abstract:TradeEU Global presents a critical risk to traders, operating without valid regulation and accumulating over 40 severe complaints in just three months. Our investigation uncovers a systematic trap involving frozen withdrawals, manipulated platform access, and psychological extortion targeting retail investors.

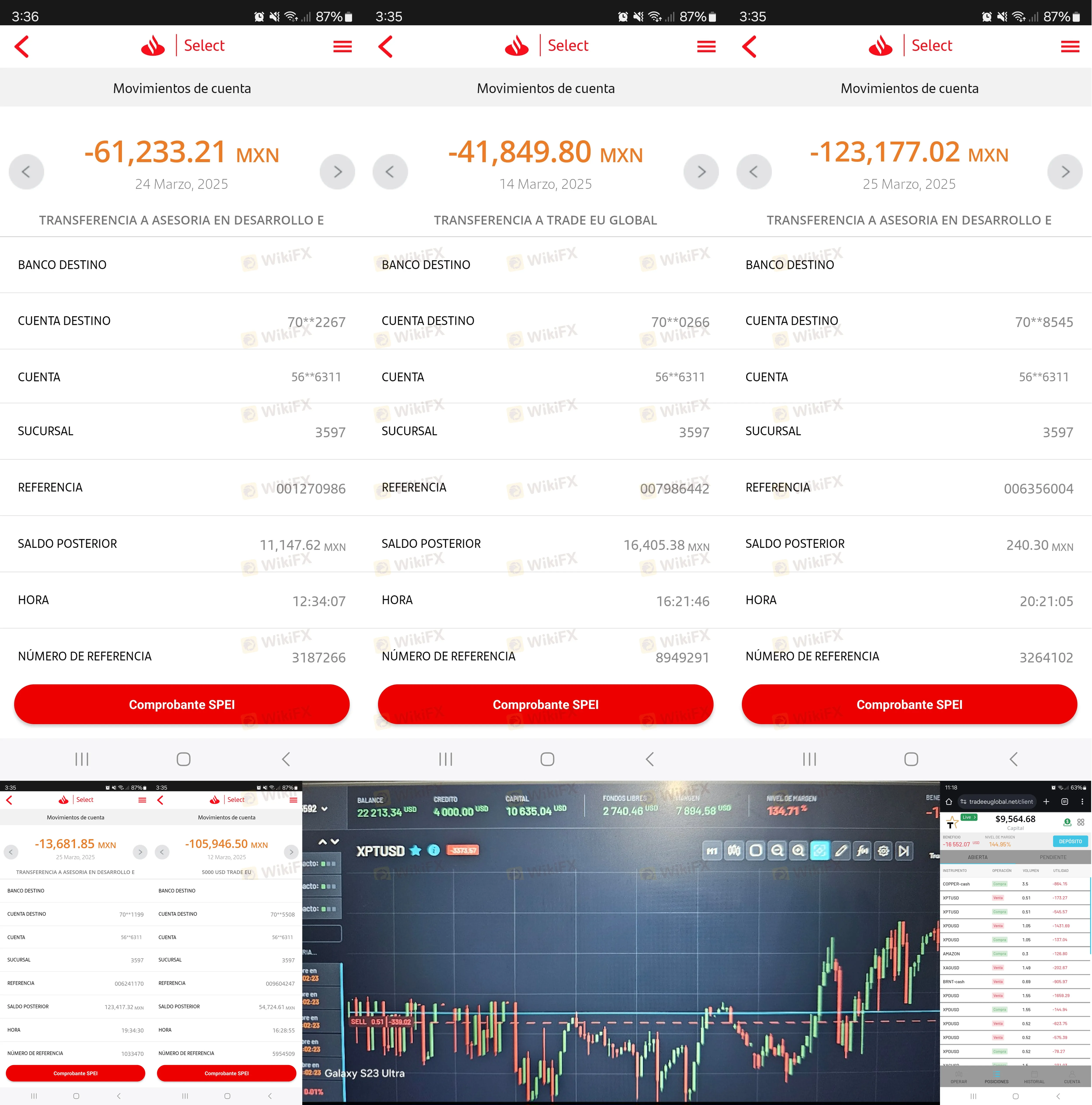

“I went to pawn my truck to pay them.”

This visceral confession from a TradeEU Global broker user in Mexico is not an isolated tragedy; it is the standard operating procedure for an entity that has triggered over 40 emergency complaints in just 90 days. From vegetable sellers in Malaysia to retirees in Ecuador, the pattern is identical: initial friendship, inflated profits, and a ruthless refusal to release funds.

Our investigation reveals that TradeEU Global is not merely an inefficient service provider—it is a financial black hole operating without oversight.

Is TradeEU Global Regulation Real?

The immediate answer to whether this platform is safe lies in its legal standing. Despite claims of global operations and “fully digital” accounts, our regulatory audit confirms that TradeEU Global holds a WikiFX Score of just 1.33 and possesses zero valid licenses.

While the broker claims a headquarters in Mauritius, there is no corresponding financial authority overseeing its conduct. This leaves clients with no legal recourse when funds vanish.

| Regulator | License Type | REAL STATUS |

|---|---|---|

| None | No License | Unregulated |

| Mauritius FSC | N/A | Unauthorized |

Without TradeEU Global regulation, the company faces no consequences for withholding client capital.

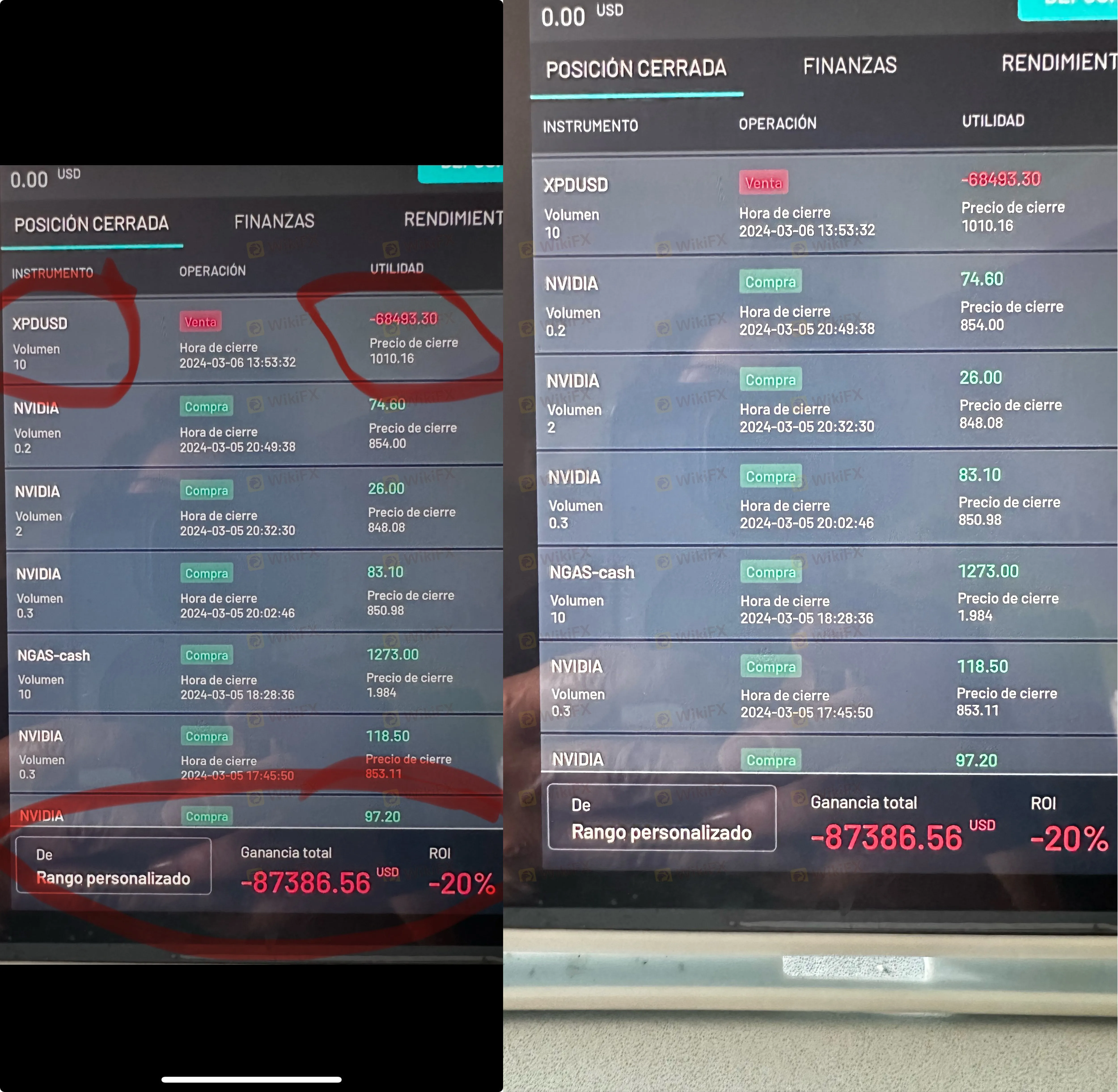

The Withdrawal Blockade: How the Trap Works

1. The “Rescue Bonus” Handcuffs

Traders frequently report being offered large bonuses—sometimes up to $15,000—under the guise of “market protection” or a “rescue bonus” (Case 8). This is not a gift.

Our analysis of the complaint data shows that once a bonus is applied, TradeEU Global broker agents utilize it to block withdrawals. They claim the funds now belong to the company or that the user must reach an impossible trading volume to unlock their own cash. When users like the victim in Case 20 attempted to leave, they were told they could not withdraw because they were trading with “company money,” despite having deposited thousands of their own.

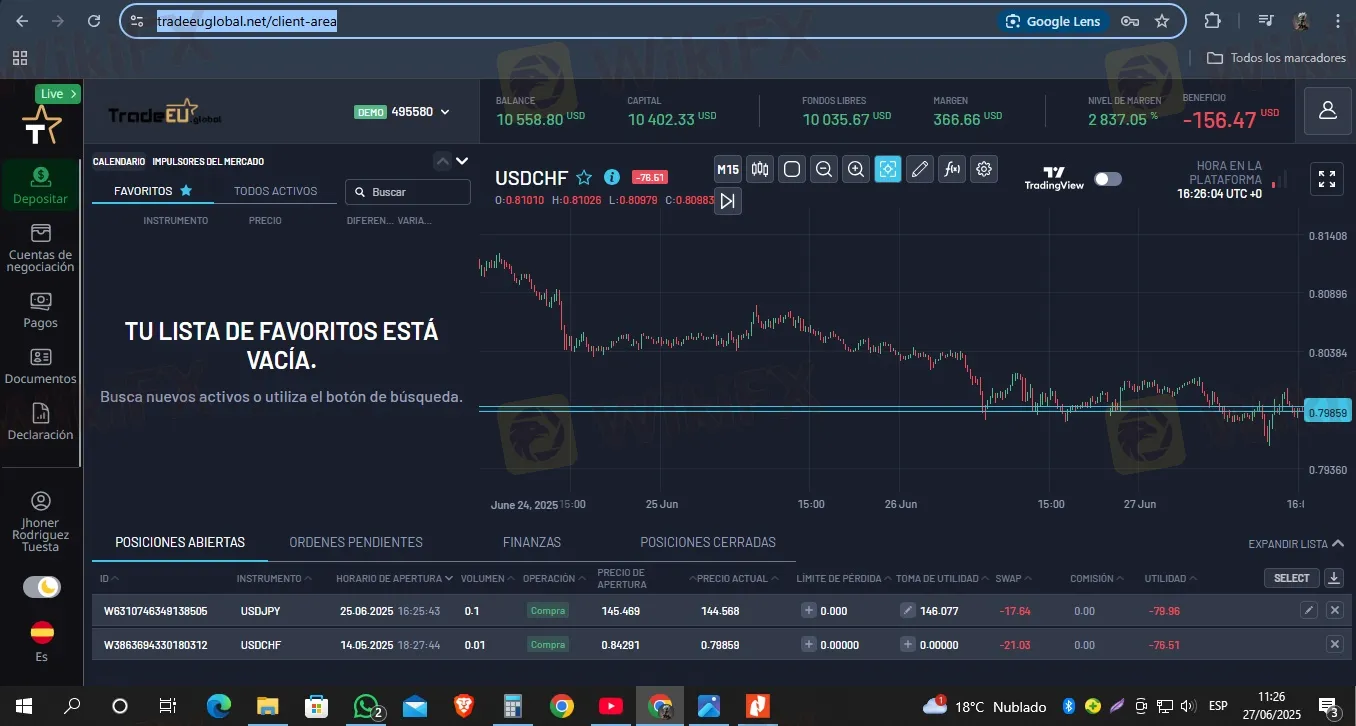

2. TradeEU Global Login Failures and Platform Manipulation

A distinct pattern of technical interference has emerged. Advanced traders and novices alike report that once they attempt to withdraw profits, their access is severed.

User reports (Case 17 and Case 41) describe a terrifying scenario: “No such platform connections... time out for all type of computer.” Blocking a TradeEU Global login is a coercive tactic used to demand “unlock fees.” In Case 17, the user was told to pay 15,000 soles just to regain access to the dashboard. If you cannot log in, you cannot close trades, and your account is quietly drained by swap fees or manipulated market moves.

3. The “Director” Extortion Call

When a standard account manager fails to extract more money, the file is often escalated to a “Senior Director” (names like “Christian Arévalo” or “Marcos” appear frequently in complaints). These figures do not offer support; they offer threats.

They use aggressive psychological pressure, telling clients their accounts are in the “red” and will be liquidated unless an immediate deposit of $5,000 or $10,000 is made. Victims who refuse are often shouted at or ignored entirely.

Key Red Flags Detected

- Zero Regulatory Oversight: The entity operates without a license, scoring a dangerous 1.33 on WikiFX.

- Withdrawal Paralysis: Over 40 recent cases confirm users cannot retrieve funds, regardless of the amount.

- Fees on Top of Fees: Agents demand taxes, unlock fees, and certification fees—none of which result in a successful withdrawal.

- Psychological Abuse: Documented cases of managers shouting at clients or coercing them into debt (Case 20, Case 38).

Verdict

The evidence is overwhelming. TradeEU Global exhibits the classic behaviors of a high-risk illicit platform: unauthorized operations, withheld funds, and aggressive harassment.

Traders are strongly advised to avoid Forex dealings with this entity. If you are currently trading here, do not send further funds to “unlock” your account—history shows it will not lead to a withdrawal.

Disclaimer:

The views in this article only represent the author's personal views, and do not constitute investment advice on this platform. This platform does not guarantee the accuracy, completeness and timeliness of the information in the article, and will not be liable for any loss caused by the use of or reliance on the information in the article.

WikiFX Broker

Latest News

Macro Strategy: Hard Assets Favored Over Consumption in Inflationary Environments

Central Bank 'Super Week': ECB, BoE, and RBA to Test FX Volatility

Precious Metals Capitulation: Gold Plunges 12% to Break $5,000 Support

EZINVEST Review: The Financial Abattoir Behind the CySEC Mask

SARB Pauses Rate Cycle at 6.75% Amid Lingering Uncertainty

Eurozone Resilience: Economy Defies Gloom as Germany Rebounds

Lured by a deepfake video, retiree lost over $4,000 in an investment scheme

Geopolitical Risk: Iran Accuses West of Inciting Domestic Unrest

Oil Markets Tighten: OPEC+ leans towards extending output pause into March

Geopolitical Risk: US Carrier Deploys as Iran Eyes Hormuz

Currency Calculator