简体中文

繁體中文

English

Pусский

日本語

ภาษาไทย

Tiếng Việt

Bahasa Indonesia

Español

हिन्दी

Filippiiniläinen

Français

Deutsch

Português

Türkçe

한국어

العربية

SOOLIKE Review: Withdrawal Blackmail and Login Blocks Exposed

Abstract:Urgent warning: SOOLIKE broker is aggressively freezing client funds and deleting profitable accounts under the guise of 'violation' checks. Our investigation confirms a coercive pattern where users are forced to sign non-complaint agreements just to recover their own principal, signaling a critical risk to all capital.

By WikiFX Special Investigator

The pattern is distinct, aggressive, and spreading. A massive influx of complaints against SOOLIKE broker has triggered a red-level alert in our database. Traders who believed they were entering the Forex SOOLIKE market with a regulated entity are now reporting a nightmare scenario: profits erased, withdrawals blocked, and accounts vanishing overnight.

Our investigation reveals a platform that appears to be weaponizing its terms of service to trap client funds. If you are currently trading here, this review SOOLIKE report is your immediate wake-up call.

The Trap: “Sign This or Lose Everything”

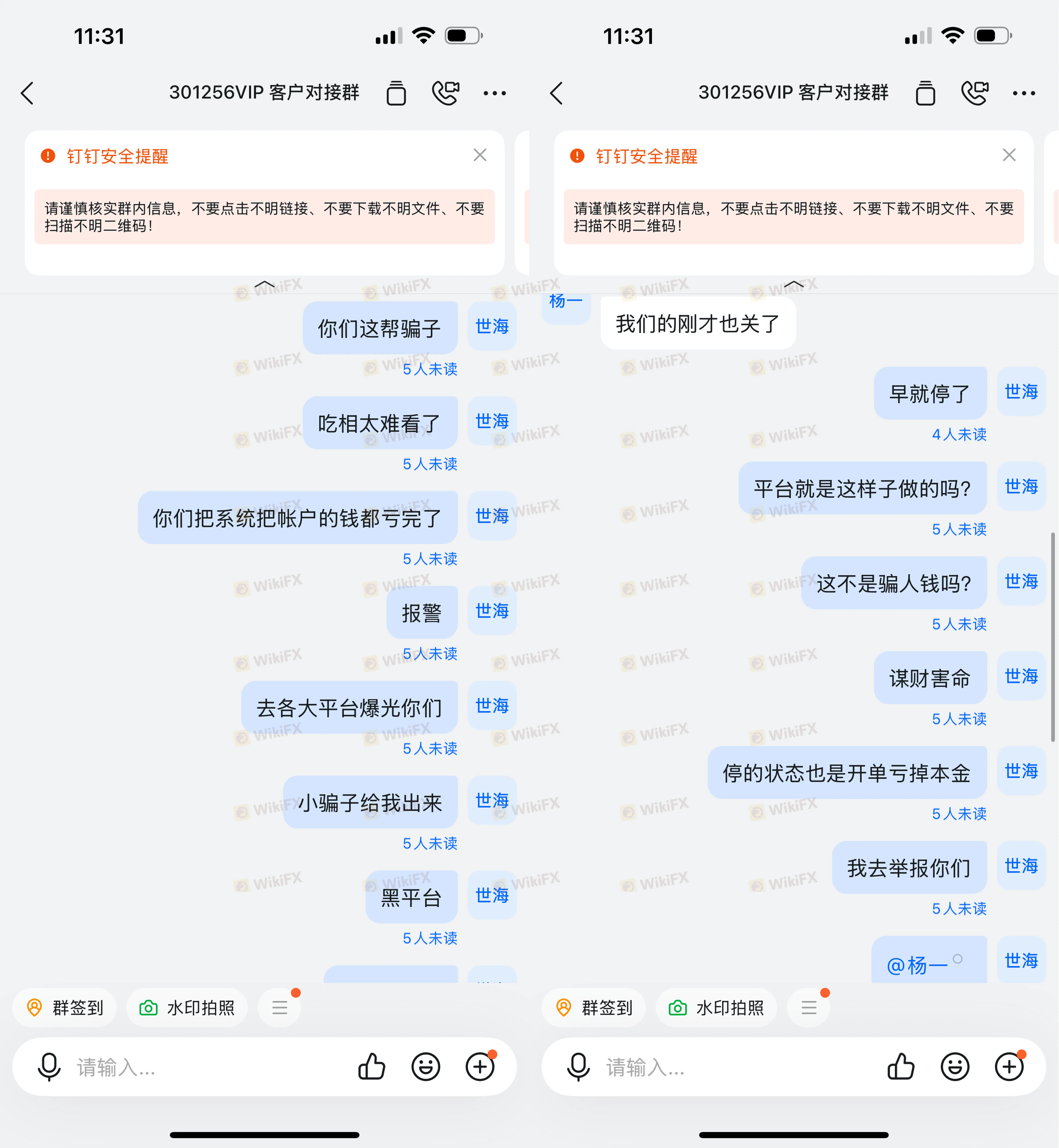

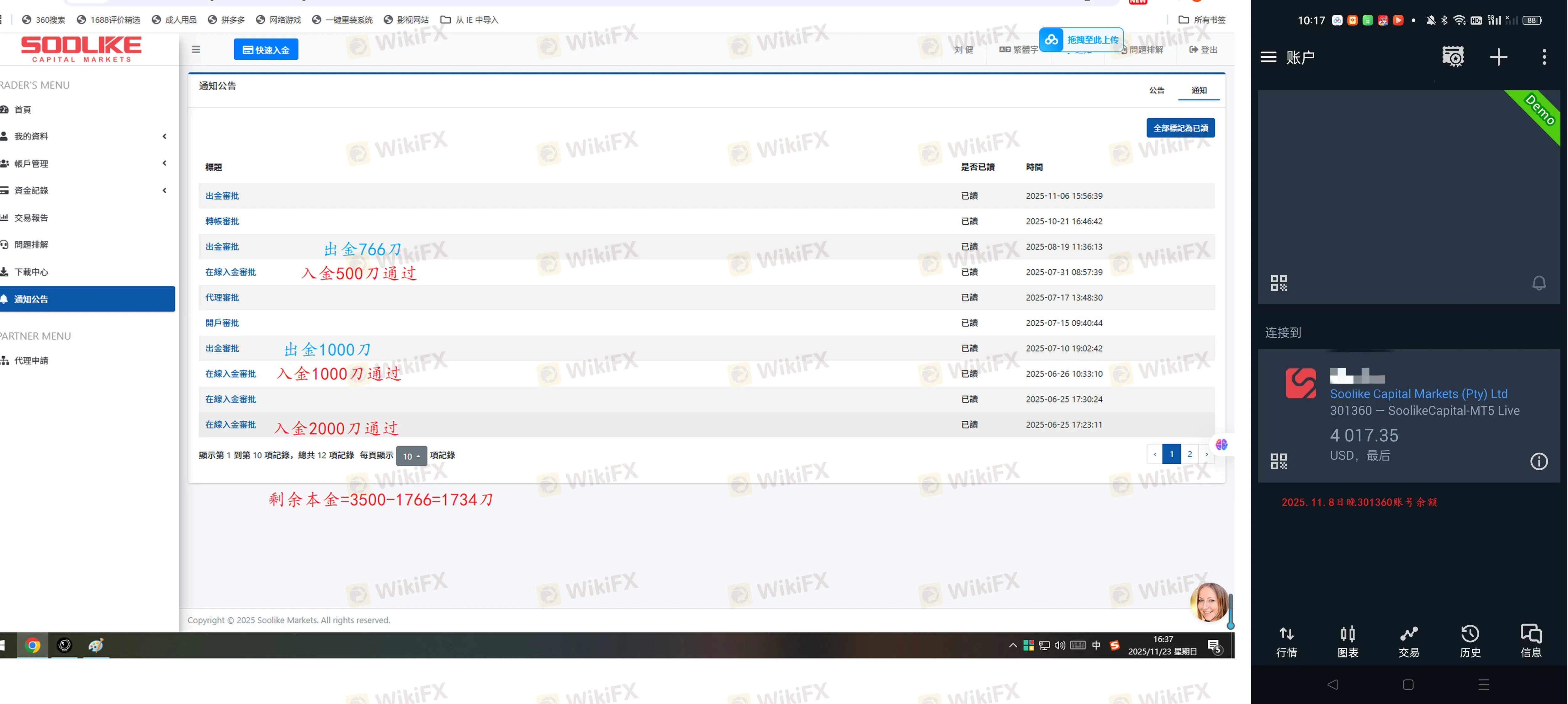

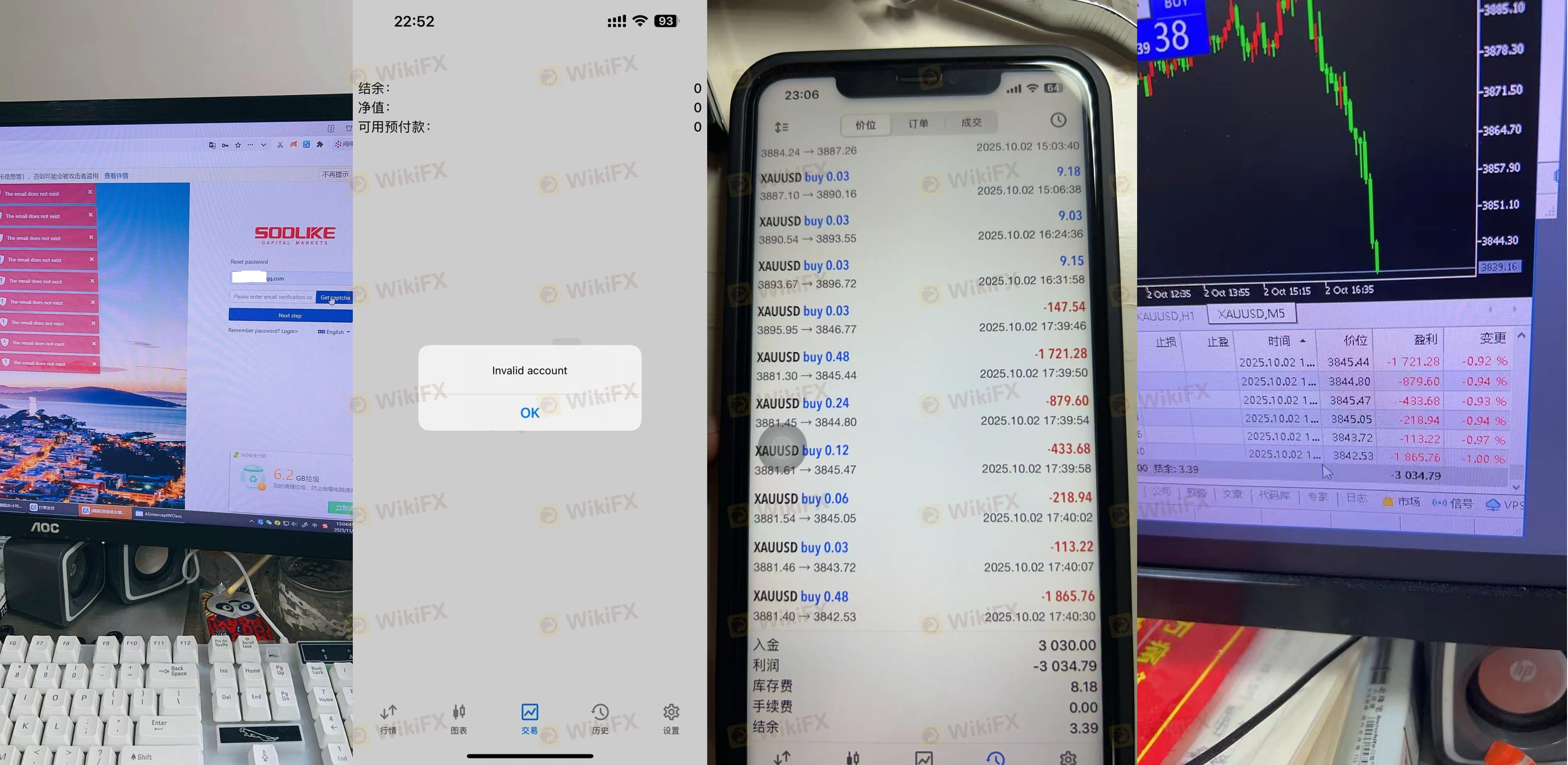

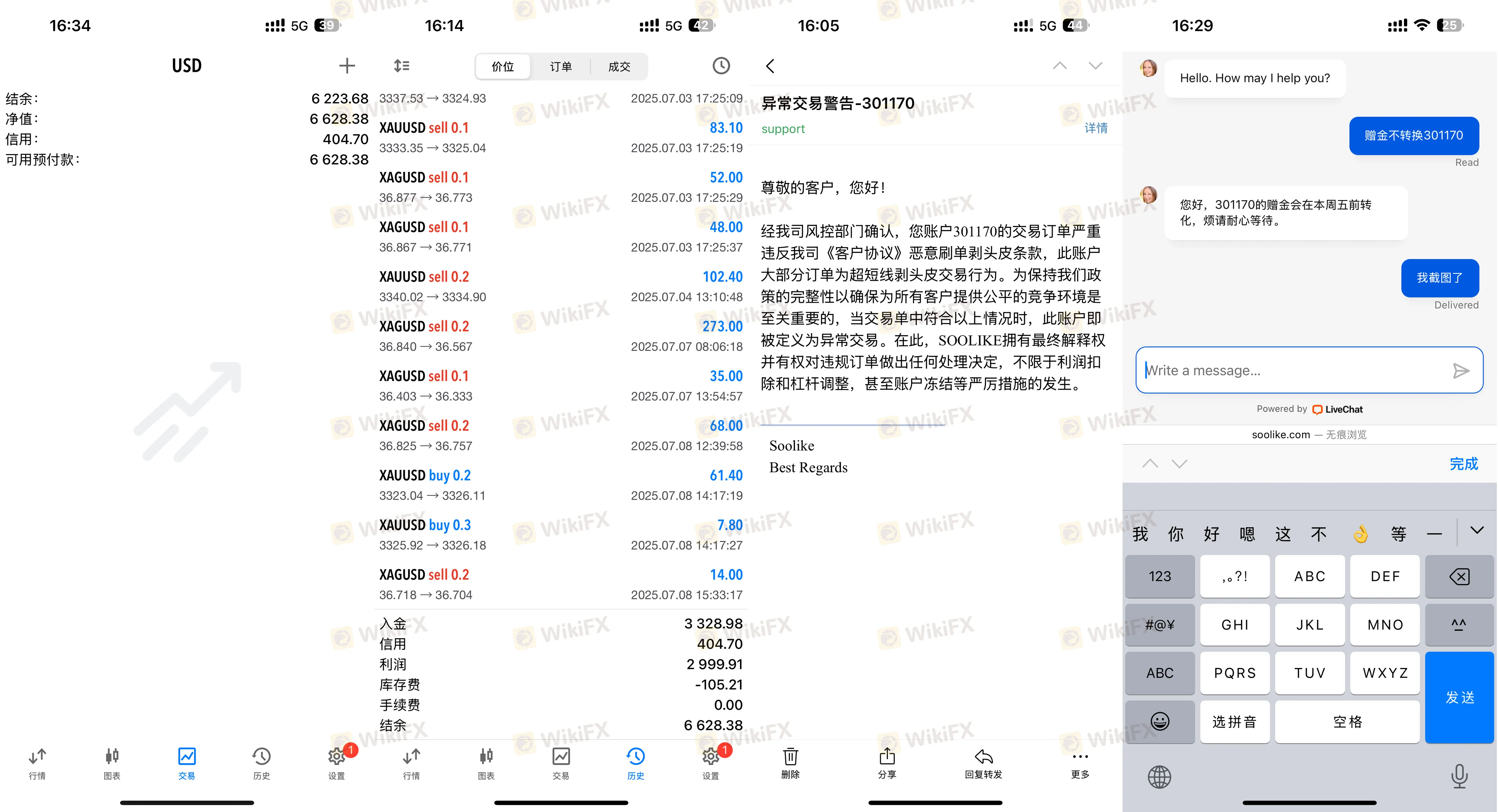

The most disturbing trend in the SOOLIKE review data is the alleged coercion of clients. Multiple users report that after requesting a withdrawal, they are accused of “scalping” or “illegal trading” without evidence. The broker then reportedly deletes the user's profits and issues an ultimatum: sign a “non-complaint guarantee” or a “settlement agreement” to get your principal back.

One trader (Case 3) reported: “Platform refused withdrawal... deleted my account... said I must withdraw the complaint and sign a non-complaint guarantee to return my principal. This is obvious coercion.”

Another user (Case 71) detailed losing over $10,000, stating the platform forced them to record a video admitting mistake just to retrieve their own money relative to the principal, while profits were confiscated. This is not standard broker SOOLIKE behavior; it is a predator's tactic.

Is SOOLIKE Regulation Valid?

Traders often ask about regulation SOOLIKE status to verify safety. While they hold a license, our investigation highlights a severe disconnect between their paper status and their operational reality. A license is worthless if the broker acts with impunity.

Regulatory Reality Audit

| Regulator | License Type | REAL STATUS |

|---|---|---|

| South Africa FSCA | Financial Service Provider | Regulated (But High Risk / Low Score: 2.08) |

Despite the SOOLIKE regulation covering their operations in South Africa, the WikiFX score is a dismal 2.08. This score suggests that the operational risks and volume of complaints far outweigh the safety net usually provided by this license.

The “Login SOOLIKE” Blackout

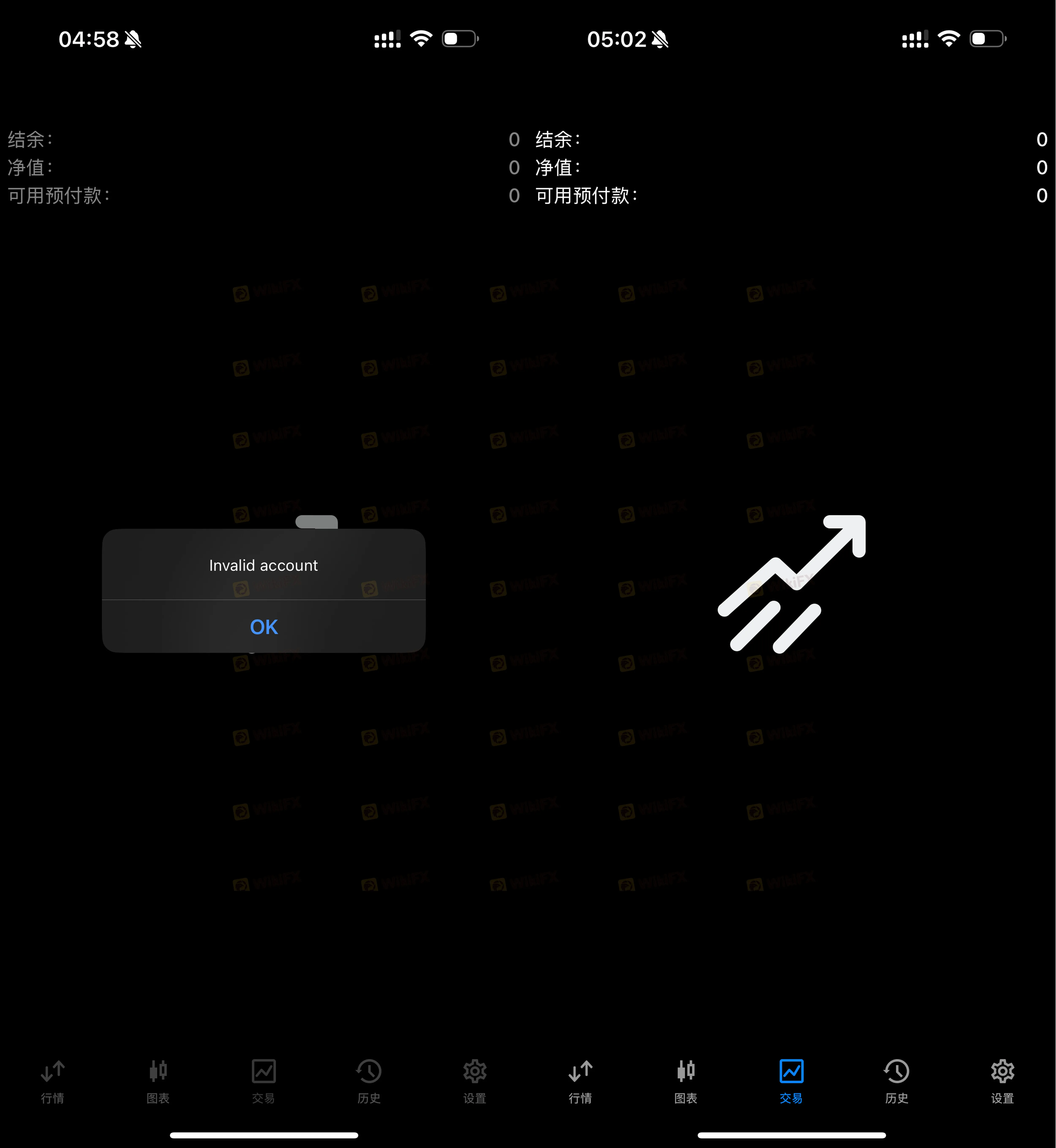

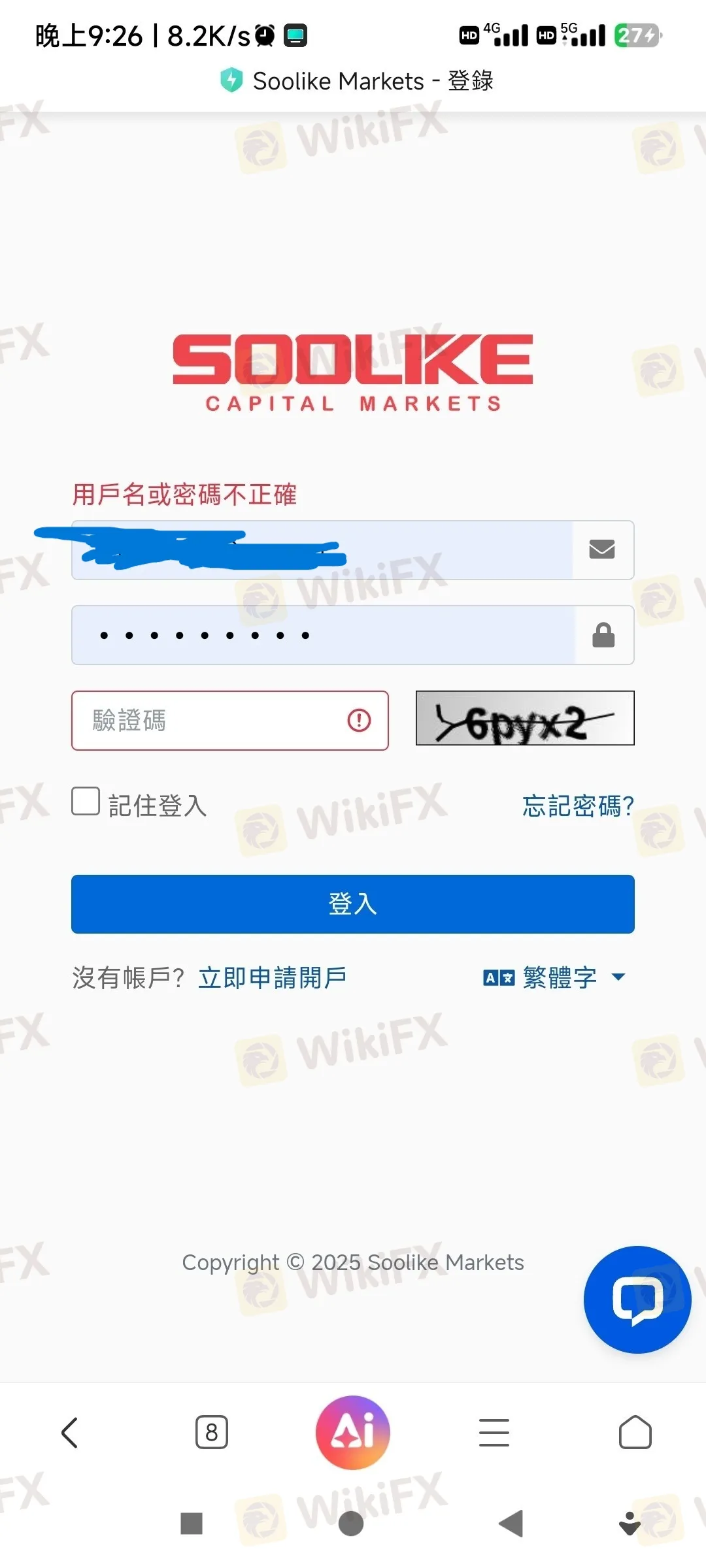

A critical red flag for any mobile trader is the sudden loss of access. Our data contains explicit reports of SOOLIKE login failures occurring exactly when a trader attempts to withdraw or questions a failed trade.

- The Disconnect: Users report receiving “Authorization Failed” errors on MT5 immediately after profitable trades (Case 4, Case 12).

- The wipeout: In Case 27, a user reported being unable to login for 10 minutes. When access was restored, the account had been traded aggressively by the backend system, wiping out the principal.

- Blocked Access: Case 6 explicitly states, “Directly cancelled my account, now I cannot login.”

If you experience login SOOLIKE issues, do not assume it is a technical glitch. It may be the first stage of account seizure.

Visual Evidence

(Case 3: Evidence of coerced settlement and funds withheld)

(Case 4: The dreaded Login/Authorization Failed screen)

The EA and Bonus Bait

Many victims were lured into the Forex SOOLIKE ecosystem through promises of automated trading (EA) and deposit bonuses.

1. The EA Killer: Users report that the “stable” EA suddenly opens massive positions in the wrong direction, causing instant liquidation (Case 5, Case 16). When users complain, the broker blames “market distortion” but refuses to compensate.

2. The Bonus Trap: Traders are promised 15% to 100% deposit bonuses. However, when they try to withdraw, they are told they haven't met impossible trading volume requirements (e.g., 45 lots), effectively locking their capital indefinitely (Case 40, Case 51).

Key Red Flags

- Severe Withdrawal Restrictions: Users are blocked from accessing funds for months, with support citing endless “anti-money laundering” reviews.

- Forced account deletion: Profitable accounts are simply erased from the server.

- Coercion: Demanding users delete negative reviews to access their own money.

The Verdict

SOOLIKE broker exhibits the behavior of a high-risk capital trap. The combination of forced agreements, sudden login SOOLIKE blocks, and the erasure of trading history suggests this platform is not operating in good faith.

We strongly advise all traders to cease deposits immediately. If you are currently trading on Forex SOOLIKE markets through this entity, prioritize the retrieval of your principal funds above all else. This review SOOLIKE stands as a final warning: your capital is in immediate danger.

Disclaimer:

The views in this article only represent the author's personal views, and do not constitute investment advice on this platform. This platform does not guarantee the accuracy, completeness and timeliness of the information in the article, and will not be liable for any loss caused by the use of or reliance on the information in the article.

WikiFX Broker

Latest News

Precious Metals Capitulation: Gold Plunges 12% to Break $5,000 Support

SARB Pauses Rate Cycle at 6.75% Amid Lingering Uncertainty

EZINVEST Review: The Financial Abattoir Behind the CySEC Mask

Central Bank 'Super Week': ECB, BoE, and RBA to Test FX Volatility

Eurozone Resilience: Economy Defies Gloom as Germany Rebounds

Oil Markets Tighten: OPEC+ leans towards extending output pause into March

Lured by a deepfake video, retiree lost over $4,000 in an investment scheme

Geopolitical Risk: Iran Accuses West of Inciting Domestic Unrest

Wall Street Giants Pivot: The "Reflation Trade" Returns

Geopolitical Risk: US Carrier Deploys as Iran Eyes Hormuz

Currency Calculator