简体中文

繁體中文

English

Pусский

日本語

ภาษาไทย

Tiếng Việt

Bahasa Indonesia

Español

हिन्दी

Filippiiniläinen

Français

Deutsch

Português

Türkçe

한국어

العربية

Jetafx Legitimacy Check: Is This a Fake Broker or Legitimate Trading Partner?

Abstract:When traders ask, Is Jetafx Legit as a trading partner, or is it a potential scam? They are asking the most important question in online finance. The safety of your money depends on the answer. After carefully reviewing regulatory information, user reports, and how the broker operates, our conclusion is clear: Jetafx operates with major warning signs that make it a high-risk company. The evidence strongly suggests traders should be extremely careful.

When traders ask, Is Jetafx Legit as a trading partner, or is it a potential scam? They are asking the most important question in online finance. The safety of your money depends on the answer. After carefully reviewing regulatory information, user reports, and how the broker operates, our conclusion is clear: Jetafx operates with major warning signs that make it a high-risk company. The evidence strongly suggests traders should be extremely careful.

The purpose of this 2026 Jetafx review is not to create panic, but to provide a detailed, factual analysis. We will break down the evidence behind our conclusion, looking at its regulation to tell you Is Jetafx Legit (or lack of it), its service claims, and the real experiences of its users. In a market where things can look misleading, independent checking is your most important tool. We help you make an informed decision based on facts you can verify, not marketing promises.

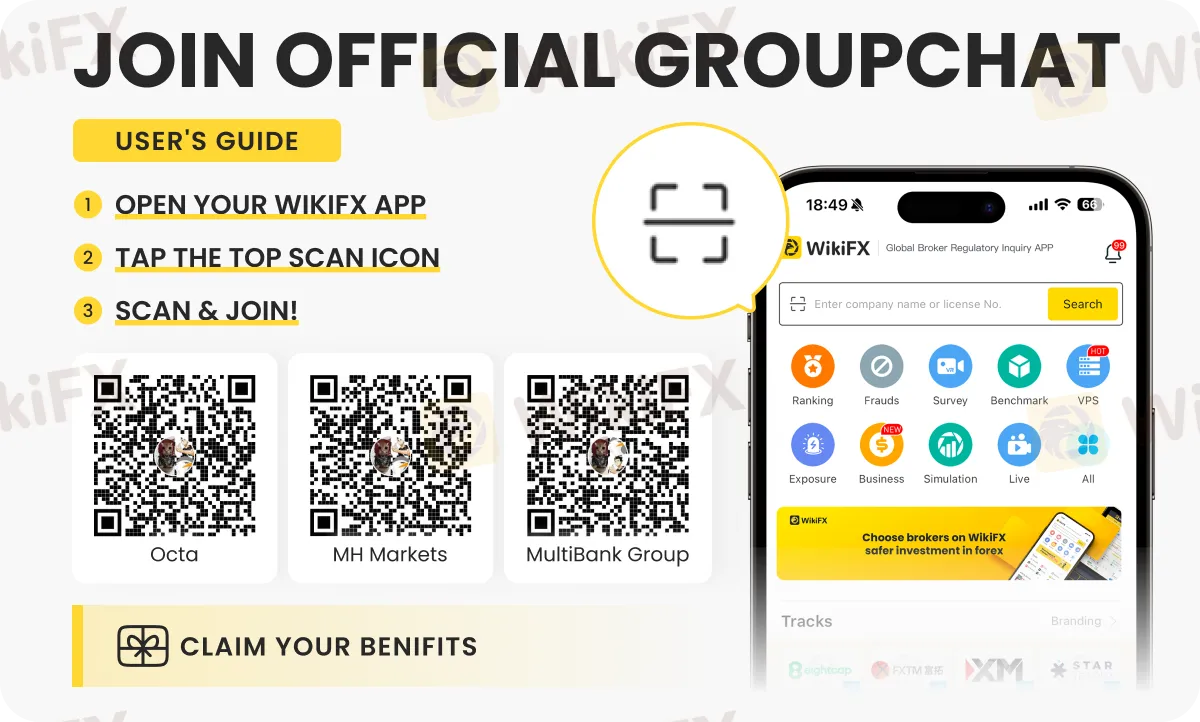

For a real-time look at Is Jetafx Legit or not and user reviews, we strongly recommend checking its detailed profile on WikiFX: https://www.wikifx.com/en/dealer/2259845172.html

The Verdict at a Glance

The most important factor in checking any broker's legitimacy is its regulatory standing. This is not a matter of opinion but of public record. To the Question, Is Jetafx Legit ? the records show a concerning picture, immediately supporting the initial warnings and providing a clear answer to the main question of its safety.

A Clear Warning Score

The first piece of information from independent checking platforms is often the most telling. Jetafx holds a very low score, a clear sign of underlying problems.

> WikiFX Rating for Jetafx: 1.89 / 10.0

>

> Platform Warning: “Warning: Low score, please stay away!”

This score is not random. It is calculated from five key areas: license index, business index, risk management index, software index, and regulatory index. A score below 2.0 is a clear warning sign that shows basic problems in the broker's operational integrity and trustworthiness.

Understanding “No Regulation”

If we circle back at the beginning question Is Jetafx Legit or scam ? Jetafx is registered in Saint Lucia, an offshore location popular among brokers seeking minimal regulatory oversight. While not illegal, operating from such a location means the broker is not bound by the strict client protection rules enforced by top-tier regulators like the FCA (UK), ASIC (Australia), or CySEC (Cyprus). This lack of oversight directly translates to higher risk for traders, as there are no required separate accounts, compensation schemes, or fair-trading practice enforcement.

The most important detail about Is Jetafx Legit is its relationship with the UK's Financial Conduct Authority (FCA). Jetafx's profile is linked to an entity named DLS MARKETS (AUST) PTY LTD, which holds an “Exceeded” FCA license. An “Exceeded” status is a major red flag. It means the entity is no longer compliant with or covered by the FCA's regulatory framework. It may have had some form of legitimacy in the past, but that protection is gone. This suggests a broker that is either unable or unwilling to meet the standards of a reputable regulator, yet may still use past associations to imply a safety that no longer exists.

An “Exceeded” license is an important detail that can be easily missed. This is why cross-checking information on a dedicated verification platform is essential. You can examine this license detail directly on Jetafx's WikiFX page: https://www.wikifx.com/en/dealer/2259845172.html

A High-Risk Profile

Further analysis of Jetafx's profile on verification platforms reveals several keyword tags that work as clear warnings for any potential investor. These tags are assigned based on a deep analysis of the broker's structure and history.

• Suspicious Regulatory License: This tag directly addresses the “Exceeded” FCA status and the weak offshore registration. It confirms that the broker's claims of regulation are, at best, misleading and, at worst, deceptive.

• High Potential Risk: This is a direct result of the lack of meaningful regulation. Without a reputable authority overseeing its operations, there is no guarantee of fund safety, fair execution, or recourse in case of a dispute.

• Regional Brokers: This tag often indicates a broker with a limited operational scope and a less robust corporate structure compared to established global players. While not inherently negative, when combined with regulatory issues, it can suggest a less stable or reliable operation.

Analyzing Service Offerings

To provide a complete picture about Is Jetafx Legit partner or scam to avoid , we must also analyze the services Jetafx promotes, as these features are often what attract traders in the first place. However, it's important to weigh these attractive offerings against the foundational risks we have already identified.

Account Types and Conditions

Jetafx presents a range of four account types, seemingly designed to cater to different trading styles and capital levels. The low or zero minimum deposits are a common tactic used by offshore brokers to lower the barrier to entry.

| Account Type | Min. Deposit | Max. Leverage | Spread From |

| Pro | $100 | 1:2000 | 0.5 pips |

| Premium | $0 | 1:2000 | 1.2 pips |

| Zero | $0 | 1:2000 | 0 pips |

| Scalp | $0 | 1:500 | 0.1 pips |

When asking Is Jetafx Legit, this leverage alone raises serious concerns. The most concerning feature in is the maximum leverage of 1:2000. While this may appear to be a powerful tool for maximizing potential profits, it is an extremely dangerous instrument. Reputable regulators in major jurisdictions (like Europe, the UK, and Australia) have banned such high leverage for retail clients, typically capping it around 1:30. A leverage of 1:2000 magnifies losses just as quickly as it magnifies gains and can wipe out an account with a tiny market movement. Offering such extreme leverage is a hallmark of unregulated, offshore brokers who are not concerned with client protection or responsible trading practices. It is a marketing trick that preys on the inexperience of new traders. It is a marketing trick that preys on the inexperience of new traders and is central to the debate around Is Jetafx Legit.

Platforms and Instruments

Jetafx claims to offer the MetaTrader 5 (MT5) platform. MT5 is a legitimate, powerful, and widely respected trading platform used by countless brokers worldwide. It offers advanced charting tools, algorithmic trading capabilities, and a user-friendly interface.

However, an important distinction must be made when evaluating Is Jetafx Legit: a good trading platform does not equal a good broker. The platform is simply the software—the tool you use to place trades. The broker is the counterparty that holds your funds, executes your orders, and processes your withdrawals. A fraudulent or unreliable broker can manipulate the feed on a legitimate platform or simply refuse to process withdrawals, regardless of how sophisticated the software is. The integrity of the broker is what protects your capital, not the brand name of the trading terminal.

Jetafx also claims to offer a wide range of tradable instruments, including Forex, CFDs, Stocks, Commodities, and more. This broad offering is standard, but again, it is only as reliable as the broker providing it—another key consideration when asking Is Jetafx Legit.

The User Experience

Regulatory data provides the foundation for our analysis, but real-world user experiences provide important context in answering Is Jetafx Legit. This is where we move from abstract risk to concrete consequences, investigating the reports and allegations that give rise to the “Jetafx Scam” search query.

The Pattern of Positive Reviews

A review of user feedback on platforms like WikiFX shows a number of recent positive comments, primarily from late 2024. These reviews often cite “good customer support” and “fast withdrawals.” While we do not dismiss any user's personal experience, an expert analysis reveals a concerning pattern that is critical when assessing Is Jetafx Legit.

First, the positive reviews are often generic, lacking specific details about trade execution, spreads under volatile conditions, or complex withdrawal scenarios. Phrases like “good service” and “got my withdrawal on time” are common.

Second, there is a notable geographic concentration. A significant number of these positive reviews originate from a single region (India) and were posted within a narrow timeframe. While this could be a coincidence, it can also be a red flag for coordinated, inauthentic review campaigns designed to bolster a broker's reputation.

The important question for a discerning trader is: does a handful of positive, generic reviews about initial experiences outweigh the fundamental risk of dealing with an unregulated entity? This question sits at the heart of Is Jetafx Legit. History has shown that many fraudulent operations provide excellent service and fast withdrawals on small amounts initially to build trust before blocking larger withdrawals later.

The “Exposure” Files

In stark contrast to the generic positive feedback are the detailed, serious allegations documented in “Exposure” reports on WikiFX. These are not simple complaints; they are formal reports from users who claim to have suffered significant financial harm. These reports align perfectly with the risks expected from an unregulated broker and are critical evidence in determining Is Jetafx Legit.

The allegations against Jetafx follow a familiar and disturbing pattern:

• Fund Scams and Withdrawal Blocks: The most common and serious complaint is the inability to withdraw funds. Users report that after successfully depositing and trading, their withdrawal requests are either ignored, endlessly delayed, or outright rejected for spurious reasons.

• Initial Trust-Building: Some users report being allowed to make one or two small, successful withdrawals. This tactic is designed to build confidence, encouraging the trader to deposit a much larger sum of money, which is then subsequently blocked.

• Invention of Unfair Rules: One of the most specific allegations involves Jetafx creating a “new VPS trading rule” out of thin air and using it as a pretext to block withdrawals and confiscate profits. This is a classic move by unscrupulous brokers—inventing arbitrary rules retroactively to justify withholding client funds.

• Unresponsive Customer Support: When these critical issues arise, the once “good” customer support allegedly becomes unresponsive or unhelpful. Users report that their emails are ignored and their queries about blocked funds are met with silence, leaving them with no recourse.

These documented “Exposure” reports provide the real-world evidence that gives weight to the regulatory red flags. They suggest a broker that may not be operating in good faith.

Final Verdict and Protection

After a comprehensive review of Jetafx's regulatory status, service claims, and user-reported experiences, our final verdict on Is Jetafx Legit is clear and unequivocal.

Recapping the Evidence

The case against Jetafx as a safe trading partner is built on several pillars of verifiable evidence. We advise extreme caution due to the following:

• Lack of Valid Regulation: The broker is registered offshore in Saint Lucia and its associated FCA license is “Exceeded,” meaning it offers no genuine regulatory protection to traders. This is the single most important red flag.

• Official High-Risk Rating: An independently verified score of 1.89/10, accompanied by an explicit warning to “stay away,” confirms its high-risk status.

• Serious User Allegations: Documented “Exposure” reports detail a pattern of withdrawal blocks, unresponsive support, and the use of unfair rules to withhold client funds, which are consistent with the behavior of a scam operation.

• Excessively High Leverage: Offering leverage of up to 1:2000 is an irresponsible practice banned by reputable regulators and serves as a lure for inexperienced traders into high-risk scenarios.

Your Most Important Action

The evidence overwhelmingly points towards Jetafx being an unsafe and non-legitimate choice for a trading partner. For anyone still asking Is Jetafx Legit, The appeal of low deposits, zero-pip spreads, or impossibly high leverage should never overshadow the non-negotiable need for regulatory protection. A broker's primary job is to safeguard your funds, and unregulated entities have no legal obligation to do so.

The financial markets are complex, but choosing a broker doesn't have to be a blind gamble. Before you deposit a single dollar with any broker, take two minutes to perform your due diligence. For a comprehensive and unbiased report on over 50,000 brokers, including Jetafx, use a trusted resource like WikiFX. This simple step is the most effective way to protect your capital from potential scams.

Verify Jetafx and any other broker on WikiFX now: https://www.wikifx.com/en/dealer/2259845172.html

Disclaimer:

The views in this article only represent the author's personal views, and do not constitute investment advice on this platform. This platform does not guarantee the accuracy, completeness and timeliness of the information in the article, and will not be liable for any loss caused by the use of or reliance on the information in the article.

WikiFX Broker

Latest News

If you haven't noticed yet, the crypto market is in free fall, but why?

Gold Rally Validated as Miners Forecast Doubled Earnings

Renewable Grid Integration: Economics and Technology

US Labor Market 'Noise' vs. Reality; Trump Trade Agenda Looms Over Outlook

Emerging Markets: Nigeria's Debt Market Valuation Hits N99.3 Trillion

JPY In Focus: Takaichi Wins Snap Election to Become Japan's First Female Leader

Vebson Scam Exposure: Forex Withdrawal Failures & Fake Regulation Warning

Amaraa Capital Scam Alert: Forex Fraud Exposure

Central Bank Divergence: BoE Dovish Tilt Pressures Sterling as Global Policy Paths Fork

Bitcoin Reclaims $71,000: Volatility as a Proxy for Global Risk Appetite

Currency Calculator