简体中文

繁體中文

English

Pусский

日本語

ภาษาไทย

Tiếng Việt

Bahasa Indonesia

Español

हिन्दी

Filippiiniläinen

Français

Deutsch

Português

Türkçe

한국어

العربية

Is Jetafx Safe or Scam? Looking at Real User Reviews to Check if it's Trustworthy

Abstract:Your main worry is whether Jetafx is a safe broker or a scam. After carefully studying its rules and what users say, the facts show this is an extremely risky choice. This article will break down the information to give you a clear, fact-based answer.

Your main worry is whether Jetafx is a safe broker or a scam. After carefully studying its rules and what users say, the facts show this is an extremely risky choice. This article will break down the information to give you a clear, fact-based answer.

Key Question Addressed: Is Jetafx Safe or a Scam?

Jetafx has many serious warning signs. The biggest problem is that it has no proper regulation at all, which raises the core question many traders ask: Is Jetafx Safe or Scam? This is confirmed by checking platforms like WikiFX, which give it a trust score of 1.89 out of 10. This creates a big problem: further fueling concerns over Is Jetafx Safe or Scam.

The goal of this study is to look past basic claims and check the real facts. We will look into Jetafx's rule status, break down user complaints, and study how it does business. This will give you the information you need to understand the real risks and make a smart money decision.

Important Factor: Rule Status

The most important thing when checking if a broker is safe is whether it follows proper rules. This isn't just paperwork; it's the basic system that protects your money. For Jetafx, this is where it fails badly.

Breaking Down “No Rules”

An independent check from a platform like WikiFX gives a clear and simple picture of where Jetafx stands. What they found are serious warnings that any trader should take seriously:

• Overall Score: 1.89/ 10. This is the lowest possible rating, showing there are no trust and safety signals at all.

• Rule Status: The profile clearly states “No Regulation” and “No forex trading license found.”

• Official Warning: A direct warning is given: “Warning: Low score, please stay away!”

• Risk Check: The broker is labeled as “High potential risk.”

These facts are not opinions; they are real summaries based on the lack of real, active rule watching. Trading with a broker that has no rules means there is no governing body to make sure practices are fair, ensure client money is kept separate, or provide a legal way to get help if the broker fails or does wrong things. Your money is not protected.

The “Exceeded” FCA License

The Jetafx profile mentions a license from the UK's Financial Conduct Authority (FCA), but its status is listed as “Exceeded.” This means the license is no longer valid, active, or following rules. For traders asking Is Jetafx Safe or Scam, an expired license offers no more protection than having no licens

Even more worrying, a closer look shows the license was given to a completely different company: “DLS MARKETS (AUST) PTY LTD.” It was not given to Jetafx or its parent company, Jeta FX LTD. This raises serious concerns and strongly impacts the debate around Is Jetafx Safe or Scam, as Connecting with an expired license belonging to another company is a major warning sign. The risks of working with an unregulated or formerly regulated broker are serious and include:

• No Client Money Protection: Regulated brokers must segregate client funds. Unregulated brokers are not required to do so, which puts your money at direct risk and deepens concerns over Is Jetafx Safe or Scam.

• No Financial Helper: If you have a problem, there is no independent group like the Financial Ombudsman Service to help or force a solution.

• No Legal Help: Getting money back from an offshore, unregulated company in case of a scam or bankruptcy is almost impossible.

Your First Check Step

The lack of real, active regulation under the broker's own name is the most important warning sign you can find. Before even thinking about a broker's advertised costs or platforms, you must check its rule status independently. This is the basic step of careful research.

We strongly advise all traders to use a reliable verification tool to confirm this information firsthand. Regulatory records are public, and a lack of transparency is a decisive deal-breaker when assessing Is Jetafx Safe or Scam.

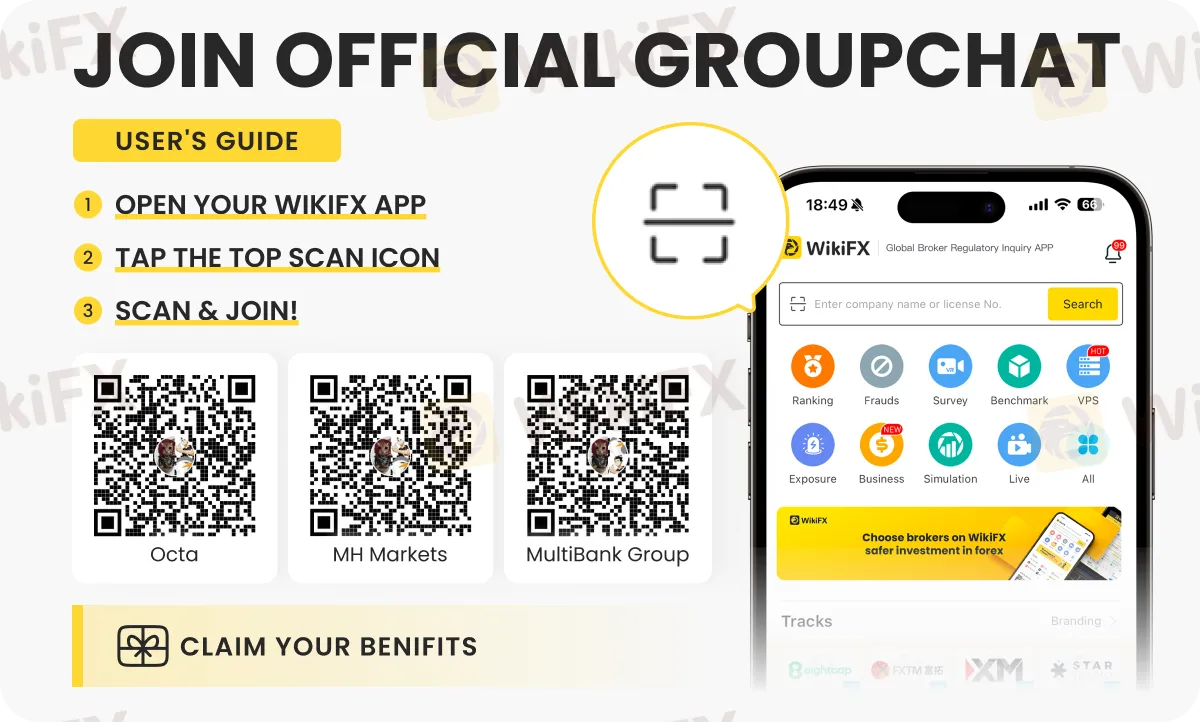

You can check the complete and updated rule details for Jetafx on its WikiFX profile to see this information for yourself: www.wikifx.com/en/dealer/2259845172.html

Looking at the Conflicting Story

At first look, Jetafx's user feedback shows a confusing picture. A small number of positive reviews seem to go against the serious rule warnings and recorded complaints. To find the truth, we must carefully check the source, nature, and believability of each type of feedback.

A Closer Look at Positive Feedback

The WikiFX profile notes a few positive reviews. The common themes in this feedback include:

• Fast withdrawal processing, with one user claiming 4-5 hour turnarounds.

• Good or helpful customer support experiences.

• Beginner-friendly features like demo and cent accounts.

However, this praise needs important context. All these reviews are marked as “Unverified” on the platform, meaning their realness has not been confirmed. Also, they come from a very small geographic area, mainly India and Singapore. When evaluating Is Jetafx Safe or Scam, the reliability of a small number of unverified and regionally concentrated reviews is weak—especially when weighed against official high-risk warnings.

The Weight of Negative Claims

In contrast, the negative reports recorded in the “Exposure” and “News” sections of WikiFX present serious, detailed allegations that directly address Is Jetafx Safe or Scam.

Key claims from user complaints and investigative reports include:

• Claims of Money Scams: Users report experiences they describe as outright scams.

• Systematic Withdrawal Blocking: A common pattern is described where the broker allows one or two small, initial withdrawals to build trust. Once the trader deposits a larger sum or builds up significant profits, later withdrawal requests are blocked.

• Use of Unfair Excuses: One of the most serious complaints involves the use of an “Unfair VPS Trading Rule” as a reason to deny withdrawals and possibly take funds. This suggests the broker may make up random rules to avoid paying out clients.

• Failed Customer Support: Contrary to the positive reviews, complainers report that the support team becomes unresponsive or fails to address critical issues, particularly those related to fund withdrawals.

Weighing the Evidence

When one set of feedback consists of unverified general praise and the other consists of recorded, specific claims of financial wrongdoing, the latter carries much more weight. The nature of the complaints is far more serious and directly impacts a trader's financial safety.

| Positive Feedback (Unverified) | Negative Claims (Recorded) |

| Claims of “fast” withdrawals | Reports of systematic withdrawal blocking |

| Praise for “good” customer support | Claims of support failing on critical issues |

| General, unspecific praise | Specific scam tactics cited (e.g., unfair rules) |

| Unverified posts from a narrow region | Recorded complaints in “Exposure” sections |

The conclusion is clear: the specific, serious, and recorded claims of financial wrongdoing are far more believable and telling than a few unverified positive comments. The complaints describe a pattern of behavior consistent with fraudulent operations, making them the most important factor in checking Jetafx's real-world reputation.

A Critical Look at Offerings

Unregulated brokers often use attractive trading conditions to lure in unsuspecting clients. Features like extremely high leverage, low minimum deposits, and popular platforms can create a surface of legitimacy. This is often the first point where traders begin asking, Is Jetafx Safe or Scam, and that question deserves careful, risk-aware analysis.

The Danger of Extreme Leverage

Jetafx advertises leverage of up to 1:2000. While this may seem like a powerful tool to amplify profits, it is a double-edged sword that equally amplifies losses at an amazing rate. It is an extremely high-risk feature, particularly for beginner and intermediate traders.Such extreme leverage is especially dangerous for beginner and intermediate traders and is often a red flag when assessing Is Jetafx Safe or Scam.

Importantly, reputable financial regulators in places like the UK, the European Union, and Australia have legally prohibited brokers from offering such high leverage to retail clients. These caps were put in place to protect consumers from catastrophic losses. Leverage of 1:500 or 1:2000 is almost exclusively a feature of offshore, unregulated brokers using it as a marketing tool to attract risk-seeking clients.

A Low Barrier to High Risk

The broker offers several account types, including some with a $0 minimum deposit. A low or non-existent barrier to entry can seem appealing, as it allows traders to start with very little capital.

However, when combined with an unregulated environment, this becomes a trap. It entices inexperienced traders into a high-risk ecosystem where their capital has no protection. The ease of depositing a small amount can mask the immense difficulty—and in some alleged cases, impossibility—of withdrawing funds later.

Platform and Instruments

Jetafx provides access to the MetaTrader 5 (MT5) platform. MT5 is a legitimate, powerful, and industry-standard trading terminal. The broker also offers a wide range of tradable instruments.

However, it is vital to understand that the quality of the trading platform is entirely separate from the trustworthiness of the broker. A fraudulent operation can easily license and use a legitimate platform like MT5 to carry out its business. Judging a broker based on its platform is like judging a driver's skill by the brand of car they drive; the two are not directly related. Your safety depends on the integrity of the operator, not the quality of their tools. Ultimately, the real answer to Is Jetafx Safe or Scam depends not on the tools offered, but on regulation, transparency, and the integrity of the operator behind them.

Before committing funds based on platform features or account types, it is vital to re-verify the broker's fundamental safety. We recommend cross-referencing all features against the broker's full risk profile on WikiFX: https://www.wikifx.com/en/dealer/2259845172.html

Final Verdict and Recommendation

After a thorough analysis of Jetafx's regulatory status, user feedback, and business practices, we can now provide a clear answer to the core question: Is Jetafx Safe or Scam?

Evidence Points to High Risk

The evidence overwhelmingly points to Jetafx being an extremely high-risk entity that traders should approach with maximum caution, if at all. The key findings are:

1. No Valid Regulation: This is the most critical failure. The broker operates without oversight from any reputable financial authority, leaving client funds unprotected. The mention of an “Exceeded” license belonging to another company is another major red flag.

2. Serious Scam Claims: Recorded and specific user Jetafx Complaints detail a pattern of withdrawal blocking and the use of unfair rules to justify withholding funds. These claims go beyond poor service and point toward potential fraudulent activity.

3. Misleading Features: The use of extreme leverage (1:2000) and low deposit minimums are common tactics employed by high-risk, offshore brokers to attract clients into an unsafe trading environment.

4. Unreliable Positive Feedback: The handful of positive reviews are unverified and are massively outweighed by the volume and severity of the recorded negative claims.

Our Final Recommendation

In response to the question, Is Jetafx Safe or Scam, the evidence strongly indicates that Jetafx is an extremely high-risk broker that should be avoided. The complete lack of regulation means there is absolutely no protection for your funds. The believable and specific complaints suggest a significant risk of falling victim to what users have described as a scam.

Do not be swayed by attractive marketing, a slick website, or a few unverified reviews. When it comes to choosing a broker, the safety of your capital must be the absolute priority. The presence of so many severe red flags makes engaging with Jetafx an unacceptable risk.

Before depositing funds with ANY broker, it is crucial to conduct your own due diligence. We strongly recommend using a comprehensive broker verification tool like WikiFX. You can view Jetafx's full, up-to-date profile and see all the data for yourself here: www.wikifx.com/en/dealer/2259845172.html

Disclaimer:

The views in this article only represent the author's personal views, and do not constitute investment advice on this platform. This platform does not guarantee the accuracy, completeness and timeliness of the information in the article, and will not be liable for any loss caused by the use of or reliance on the information in the article.

WikiFX Broker

Latest News

If you haven't noticed yet, the crypto market is in free fall, but why?

Emerging Markets: Nigeria's Debt Market Valuation Hits N99.3 Trillion

SkyLine Guide 2026 Thailand — Official Launch of the Judge Panel Formation!

JRJR Review: The Anatomy of a Hong Kong Liquidity Trap

South Africa Macro: Mining Policy Risks Cloud GNU Economic Optimism

JPY In Focus: Takaichi Wins Snap Election to Become Japan's First Female Leader

Vebson Scam Exposure: Forex Withdrawal Failures & Fake Regulation Warning

Amaraa Capital Scam Alert: Forex Fraud Exposure

Galileo FX Exposure: Allegations of Fund Losses Due to Trading Bot-related Issues

EGM Securities Review: Investigating Multiple Withdrawal-related Complaints

Currency Calculator