简体中文

繁體中文

English

Pусский

日本語

ภาษาไทย

Tiếng Việt

Bahasa Indonesia

Español

हिन्दी

Filippiiniläinen

Français

Deutsch

Português

Türkçe

한국어

العربية

OtetMarkets Review 2025: Is This Forex Broker Safe?

Abstract:OtetMarkets is a Forex broker established in 2023 and registered in St. Lucia. With a low WikiFX Score of 2.20 and no effective regulation, it presents significant risks. While it offers high leverage up to 1:1000 on MT5 and cTrader platforms, the broker is plagued by serious user complaints regarding withdrawal rejections, trade manipulation, and severe server issues.

OtetMarkets is a Forex broker established in 2023 that has quickly gained attention, primarily within markets such as the UAE, Germany, and France. Operating with a registration in St. Lucia, the entity provides digital trading services across various account types. However, its safety profile is concerning; the broker currently holds a WikiFX Score of 2.20, indicating a high-risk environment. Furthermore, current data shows that OtetMarkets is effectively unregulated, operating without valid oversight from major financial authorities.

Pros and Cons of OtetMarkets

- ✅ Supports industry-standard platforms like MT5 and cTrader.

- ✅ Offers high leverage options up to 1:1000.

- ✅ Provides a low entry barrier with a minimum deposit of $25 on ECN accounts.

- ✅ Customer support includes online chat and telephone assistance in English.

- ❌ Unregulated status increases the risk of fund insecurity.

- ❌ Extremely low WikiFX Score (2.20) due to risk factors.

- ❌ Severe user complaints regarding withdrawal rejections and trade errors.

OtetMarkets Regulation and License Safety

When evaluating a broker's credibility, regulation is the most critical factor. Currently, OtetMarkets does not hold a valid license from a tier-1 regulatory body (such as the FCA or ASIC).

Risk Warning

The broker is registered in St. Lucia, which is often considered an offshore jurisdiction with lenient financial oversight compared to major hubs. WikiFX data confirms that there is no valid regulation found for this entity. Trading with an unregulated broker means that in the event of insolvency or disputes, clients may not have access to compensation schemes or legal recourse. The lack of regulatory disclosure serves as a significant red flag for potential investors.

Real User Feedback and Complaints

The WikiFX system has logged multiple verified complaints against OtetMarkets, particularly within the last few months. These reports highlight critical issues regarding trade execution and fund withdrawals.

- Withdrawal Rejections & Server Issues: One user from Australia reported that starting in October, withdrawal requests were rejected under the guise of “bonus activities.” Later attempts failed due to alleged “server problems,” preventing the user from accessing their profits.

- Trade Manipulation (Big Scammer): A trader from Afghanistan reported a serious discrepancy where a requested 0.01 lot position was opened as a 1.0 lot trade, resulting in a 30% loss of capital. The support team dismissed this as a user typo despite the user having screenshot evidence.

- Hidden Pricing Gaps: A German user on the MT5 platform reported a “5-min hidden gap” on XAUUSD, where trading was disabled while prices moved, leading to substantial losses. The user claimed this gap was not mentioned in the client agreement.

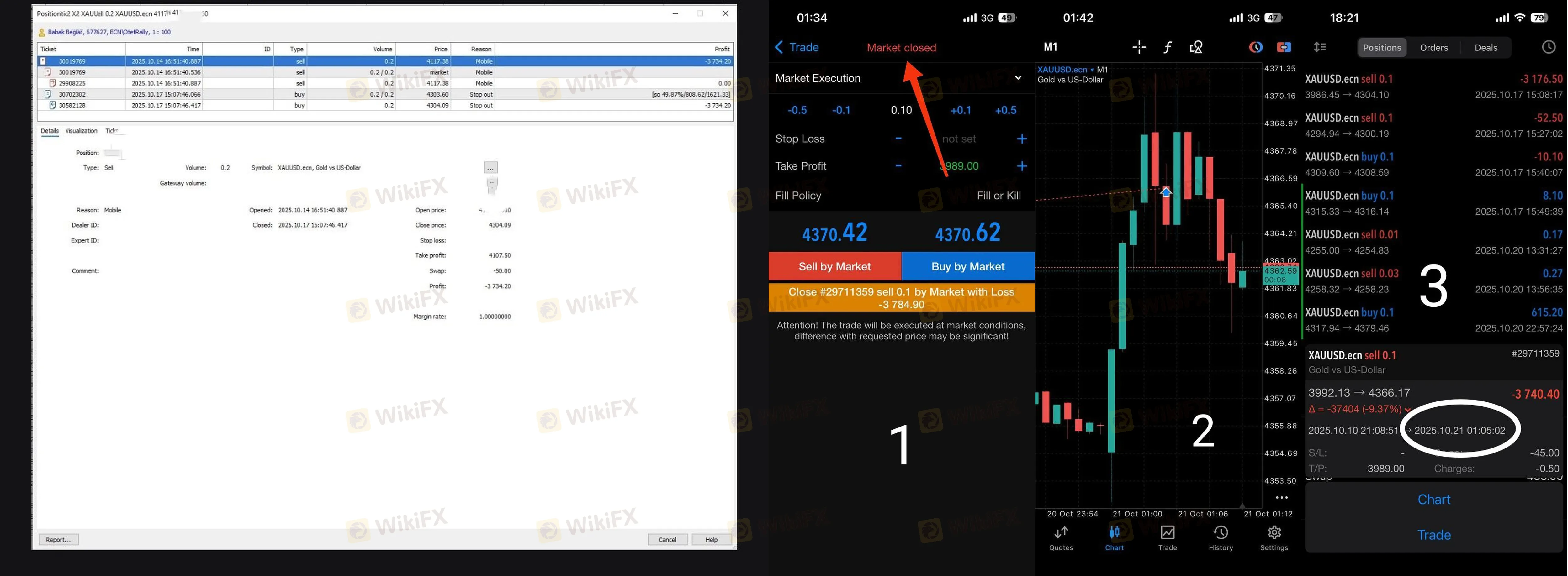

Evidence of User Issues:

OtetMarkets Forex Trading Conditions and Fees

OtetMarkets attempts to attract traders with competitive conditions, though these come with the aforementioned risks.

Accounts and Leverage

The broker offers five account tiers: Otet Plus(+), ECN+, ECN, NO SWAP, and STOCK.

- Leverage: Traders can utilize high leverage up to 1:1000 on most account types, which amplifies both potential profits and losses.

- Spreads: Spreads are competitive, starting from 0.2 pips on the ECN+ account and 0.4 pips on the standard ECN account.

- Minimum Deposit: Entry requirements vary, with the ECN account requiring only $25, while the ECN+ account requires $5000.

Platforms

Clients have access to a variety of software, including MetaTrader 5 (MT5), cTrader, and a proprietary self-developed platform. To manage their positions and execute orders, users must complete the OtetMarkets login process directly through these supported platforms or the mobile app, which offers access to global markets.

Final Verdict

OtetMarkets presents a high-risk profile for traders. While it offers attractive leverage and modern platforms like MT5 and cTrader, the fundamental lack of regulation and the low WikiFX Score of 2.20 outweigh these benefits. The volume of complaints regarding unauthorized trade modifications and blocked withdrawals suggests serious operational issues.

Traders are advised to exercise extreme caution. Always verify the official URL to avoid phishing sites when accessing your account.

To stay safe and view the latest regulatory certificates, check OtetMarkets on the WikiFX App.

Disclaimer:

The views in this article only represent the author's personal views, and do not constitute investment advice on this platform. This platform does not guarantee the accuracy, completeness and timeliness of the information in the article, and will not be liable for any loss caused by the use of or reliance on the information in the article.

WikiFX Broker

Latest News

If you haven't noticed yet, the crypto market is in free fall, but why?

Emerging Markets: Nigeria's Debt Market Valuation Hits N99.3 Trillion

SkyLine Guide 2026 Thailand — Official Launch of the Judge Panel Formation!

JRJR Review: The Anatomy of a Hong Kong Liquidity Trap

South Africa Macro: Mining Policy Risks Cloud GNU Economic Optimism

JPY In Focus: Takaichi Wins Snap Election to Become Japan's First Female Leader

Vebson Scam Exposure: Forex Withdrawal Failures & Fake Regulation Warning

Amaraa Capital Scam Alert: Forex Fraud Exposure

Galileo FX Exposure: Allegations of Fund Losses Due to Trading Bot-related Issues

EGM Securities Review: Investigating Multiple Withdrawal-related Complaints

Currency Calculator