简体中文

繁體中文

English

Pусский

日本語

ภาษาไทย

Tiếng Việt

Bahasa Indonesia

Español

हिन्दी

Filippiiniläinen

Français

Deutsch

Português

Türkçe

한국어

العربية

REALHX Review: Safety, Regulation & Forex Trading Details

Abstract:REALHX currently operates without valid regulation and holds a concerningly low WikiFX safety score of 1.25 due to multiple verified reports of blocked withdrawals and login failures. Recent user data indicates the broker employs identity switching and social engineering tactics, posing a severe risk to investor funds.

Key Takeaways

- Unregulated Status:REALHX operates without any valid financial license, despite claims of being a UK-based entity.

- Withdrawal Blocks: Multiple users report being unable to withdraw funds, often being asked to pay excessive “taxes” or fees first.

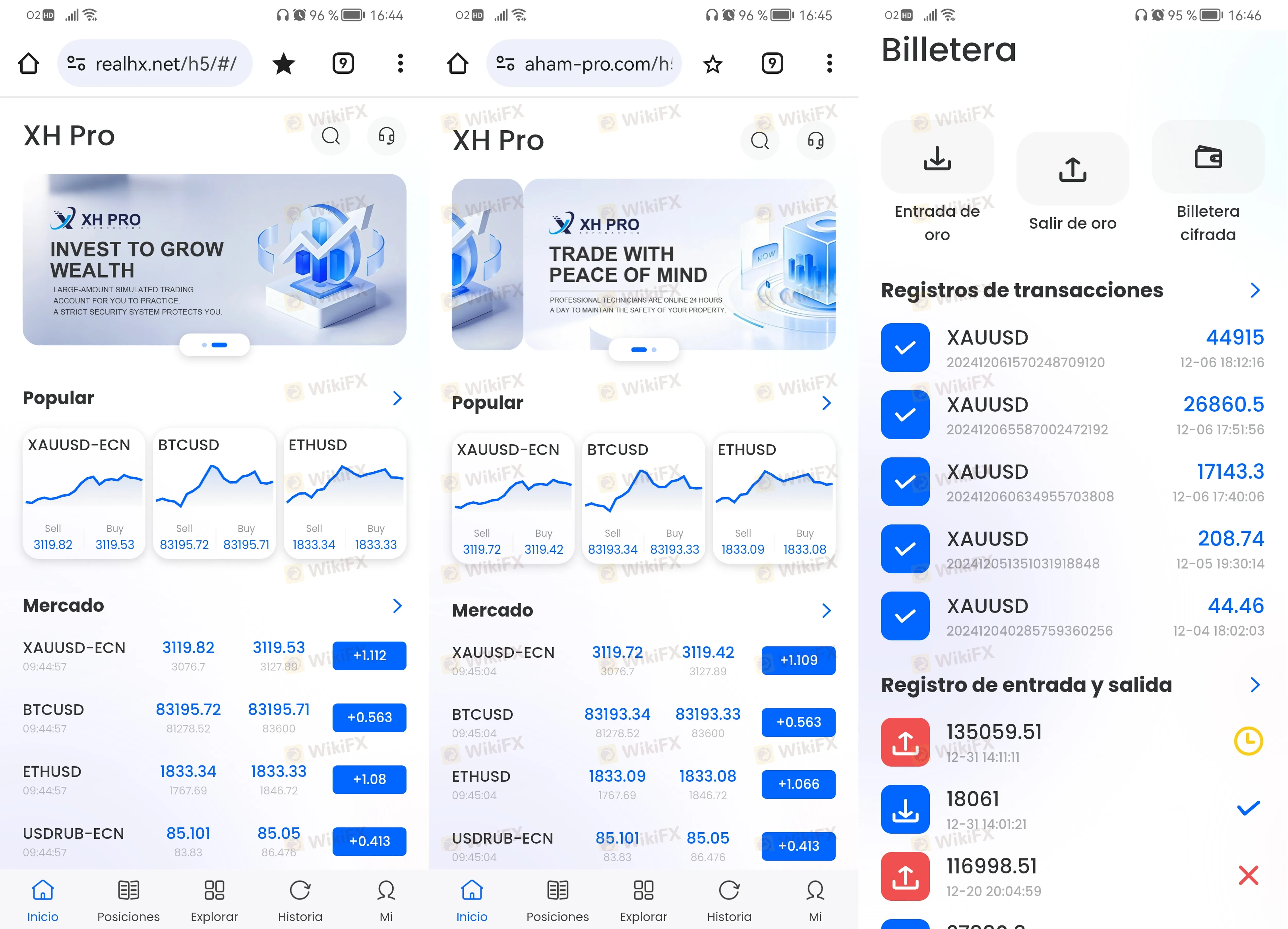

- Platform Instability: Evidence suggests the broker frequently changes names (e.g., AHAM PRO, XH PRO) and URLs to evade detection.

- Access Issues: Recent complaints highlight REALHX login failures, with some traders losing access to their accounts entirely.

REALHX Broker Summary

REALHX presents itself as a Forex broker established in 2024 generally targeting retail investors with high leverage offers up to 1:500. However, WikiFX analysis reveals a critical lack of safety protocols. The broker holds a WikiFX Score of 1.25 out of 10, a rating reserved for platforms with no verified regulatory supervision and a high volume of client complaints.

While the broker advertises ECN and Standard accounts with “simple digital opening” procedures, the underlying risk is substantial. The absence of a valid regulatory framework means that client funds are not protected by insurance schemes or segregation mandates typical of legitimate financial providers.

REALHX Regulation: Is the License Real?

One of the most critical aspects of any REALHX review is verifying regulatory status. A legitimate license ensures that a broker adheres to strict capital requirements and ethical standards.

According to WikiFX records, REALHX claims to be located in the United Kingdom but does not hold a license from the Financial Conduct Authority (FCA).

| Regulator | License Type | Status |

|---|---|---|

| None | No License | Unregulated |

Why this matters:

Brokers operating without regulation are not legally bound to process withdrawals or honor trade profits. In the event of a dispute or insolvency, investors have no government recourse. The claim of being a “UK broker” without an FCA license is a significant red flag in the Forex market.

User Reviews: REALHX Login and Withdrawal Complaints

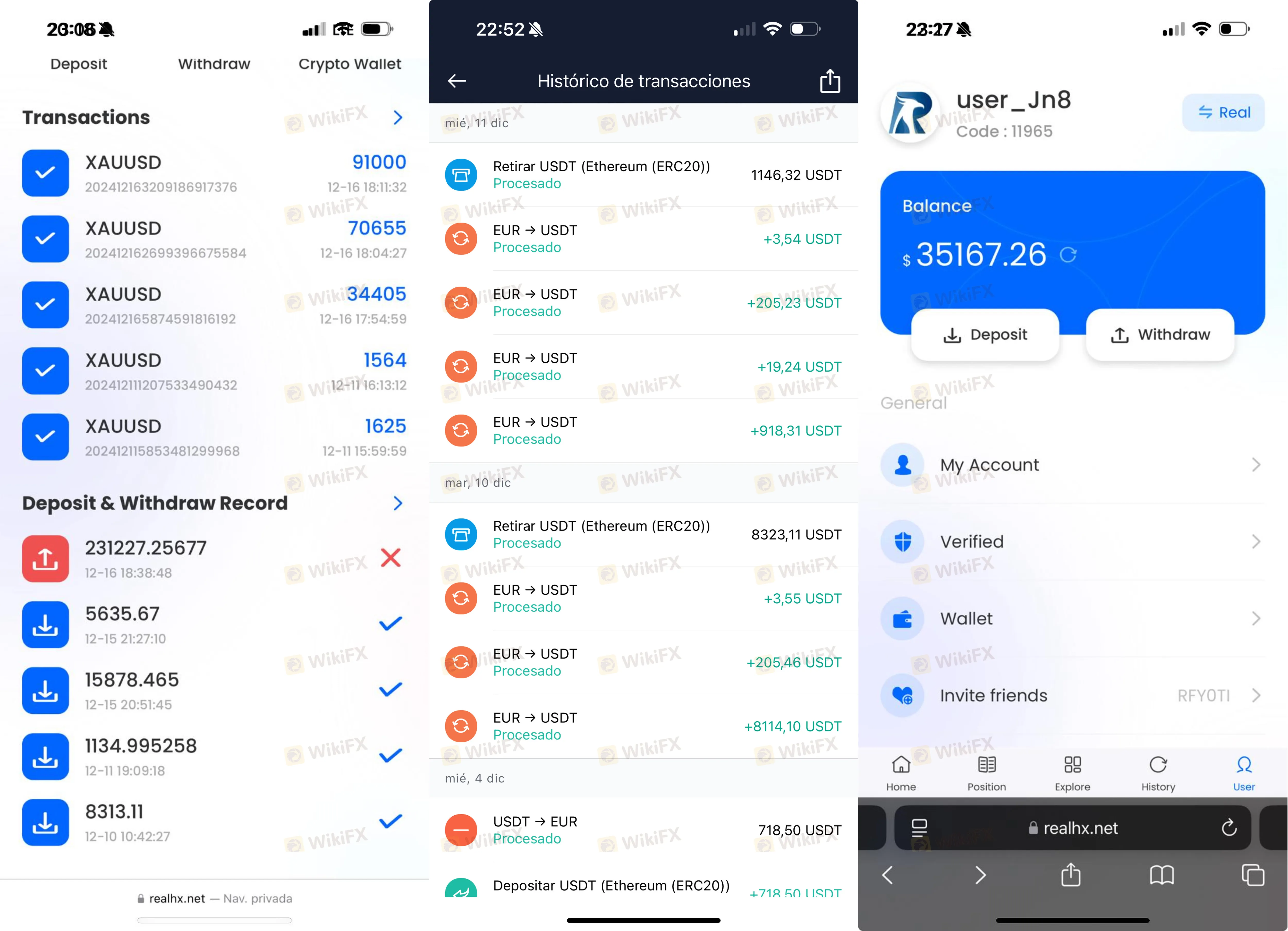

Current market data from WikiFX shows a surge in complaints regarding REALHX. In the last three months alone, at least 8 severe exposure cases have been logged. The complaints follow a specific pattern involving social engineering, name changes, and access denials.

1. Withdrawal Delays and “Tax” Demands

A recurring theme in user reviews is the refusal of withdrawals. Traders attempting to access their funds are frequently told they must pay a “tax” or a “customs fee” to release their money.

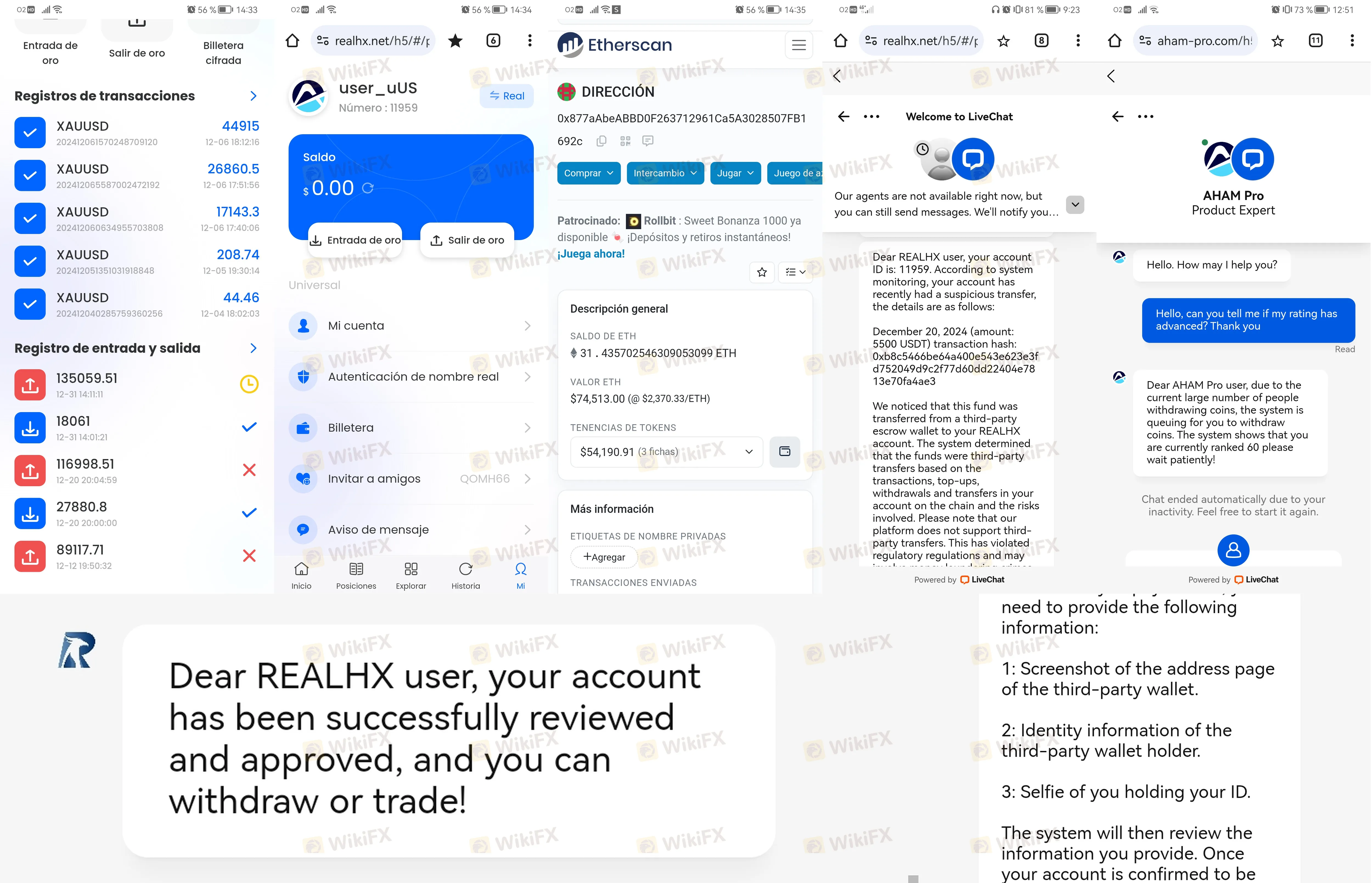

- Case Evidence (May 2025): A user from France reported good trading results initially but was asked to pay a large tax to withdraw. Even after paying, the funds remained “in waiting” for two months.

- Case Evidence (March 2025): A trader from Spain stated they had over 60,000 Euros trapped, having paid extra for “taxes” and “Platinum account deposits” without ever receiving their funds.

2. REALHX Login Issues and Platform Hopping

Investors have reported confusion regarding the broker's identity and issues with the REALHX login portals.

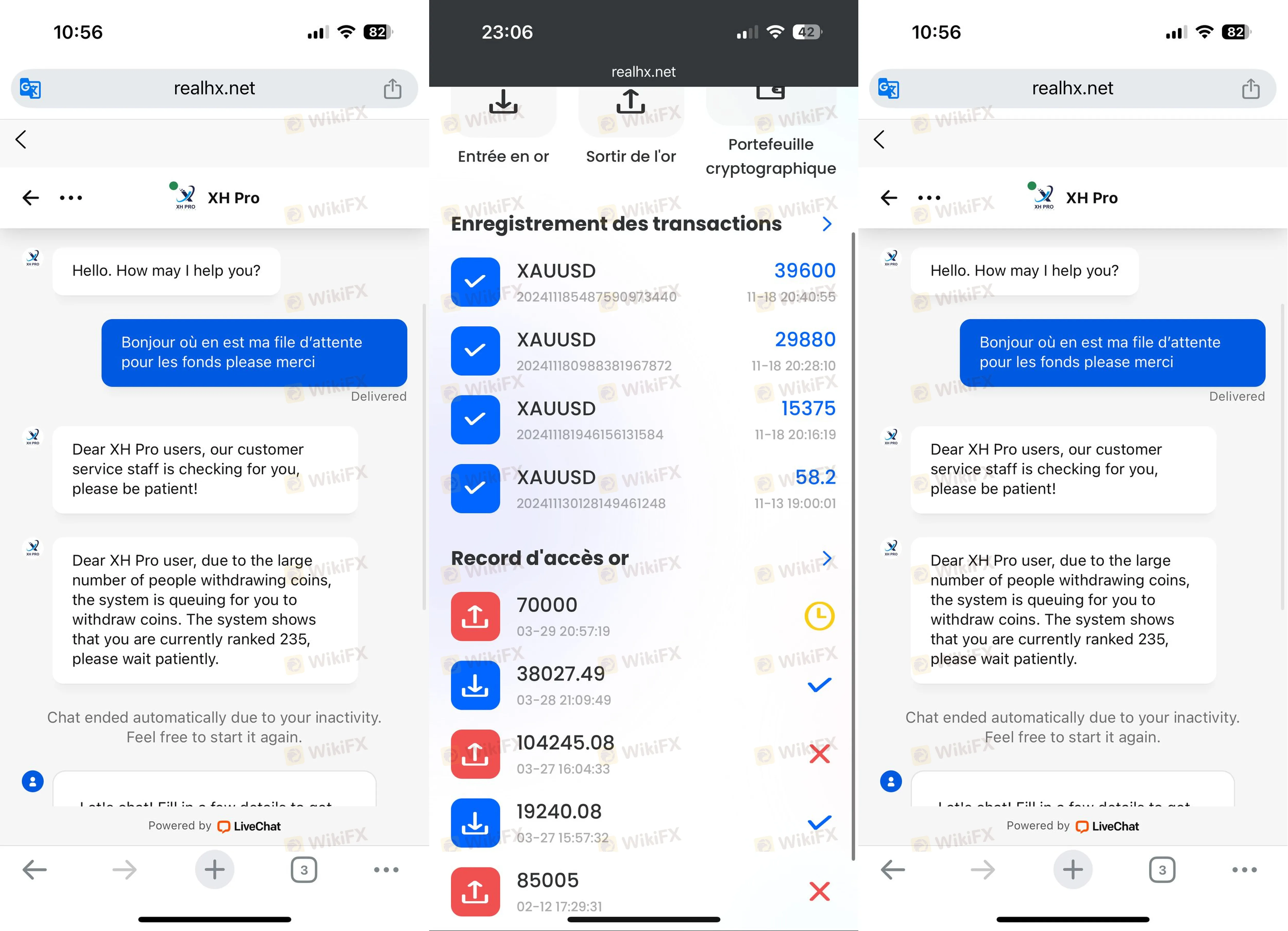

- Identity Switching: Users noted the platform changed names from REALHX to AHAM PRO and later XH PRO (Case 2, March 2025). This tactic is often used to distance the platform from negative reviews while keeping the same victim base.

- Access Blocked: While some users could log in via new URLs, others reported total lockouts. One victim explicitly stated, “It hasn't let me enter my Realhx account for days” (Case 6, Feb 2025), confirming active login denials.

3. Social Engineering Risks

Several reports indicate that users were introduced to REALHX via social platforms like Tinder or WhatsApp (Case 1, Case 6). This method involves building a personal relationship or friendship to gain trust before convincing the victim to invest larger sums, a tactic investors should be highly wary of.

Conclusion: Final REALHX Review Recommendation

Based on the lack of regulation, the WikiFX Score of 1.25, and clear evidence of withdrawal manipulation, REALHX is classified as a high-risk broker. The combination of REALHX login failures, name changing (to XH PRO or AHAM PRO), and demands for external payments constitutes a hostile trading environment.

Recommendation:

- Avoid depositing funds with REALHX or its associated alternate names.

- Do not pay additional fees (taxes/security deposits) if withdrawals are frozen; these are often tactics to extract more capital without releasing funds.

- Choose validly regulated brokers with a transparent track record.

Disclaimer:

The views in this article only represent the author's personal views, and do not constitute investment advice on this platform. This platform does not guarantee the accuracy, completeness and timeliness of the information in the article, and will not be liable for any loss caused by the use of or reliance on the information in the article.

WikiFX Broker

Latest News

9Cents Review 2026: Is this Broker Safe?

Titan Capital Markets Review 2026: Comprehensive Safety Assessment

Plus500 Scam Alert: Withdrawal Issues Exposed

PXBT Review: A Seychelles-Based Trap for Your Capital

JRJR Review: The Anatomy of a Hong Kong Liquidity Trap

Here are the five key takeaways from the January jobs report

Is Alpari safe or scam? What You Need to Know

Pemaxx Review: A Deep Look into Serious User Problems and Safety Concerns

SkyLine Guide 2026 Thailand — Official Launch of the Judge Panel Formation!

South Africa Macro: Mining Policy Risks Cloud GNU Economic Optimism

Currency Calculator