简体中文

繁體中文

English

Pусский

日本語

ภาษาไทย

Tiếng Việt

Bahasa Indonesia

Español

हिन्दी

Filippiiniläinen

Français

Deutsch

Português

Türkçe

한국어

العربية

FXCC Review 2026: Comprehensive Safety Assessment

Abstract:FXCC holds a WikiFX Score of 4.60, balancing a valid CySEC license against significant offshore regulatory warnings. While the broker offers ECN trading conditions, recent user complaints regarding withdrawal delays and hidden account transfers raise serious safety concerns.

Executive Summary

In this in-depth review, we analyze the key metrics and operational history of FXCC to determine its viability for traders in the current market. The broker was established in 2010, positioning itself as a veteran player in the financial services industry. As a broker entity operating for over a decade, FXCC has built a presence in markets such as Australia, Brazil, and Europe, achieving an influence rank of C.

However, the broker's current standing is complex. It holds a moderate WikiFX Score of 4.60, a rating that reflects a conflict between its established European licensing and concerning data points regarding its offshore operations. While the firm offers digitized account opening and an ECN execution model, recent months have seen a surge in client dissatisfaction, with 16 complaints recorded in a single quarter. This FXCC review 2026 aims to dissect these mixed signals to provide a clear verdict on safety and performance.

1. Regulation & Safety Protocols

The most critical aspect of our audit is the regulation operates under, which serves as the primary safeguard for client funds. FXCC (FX Central Clearing Ltd) is authorized by the Cyprus Securities and Exchange Commission (CySEC) under license number 121/10. This tier-1 license theoretically guarantees adherence to strict regulation standards, including the segregation of client funds and participation in investor compensation funds.

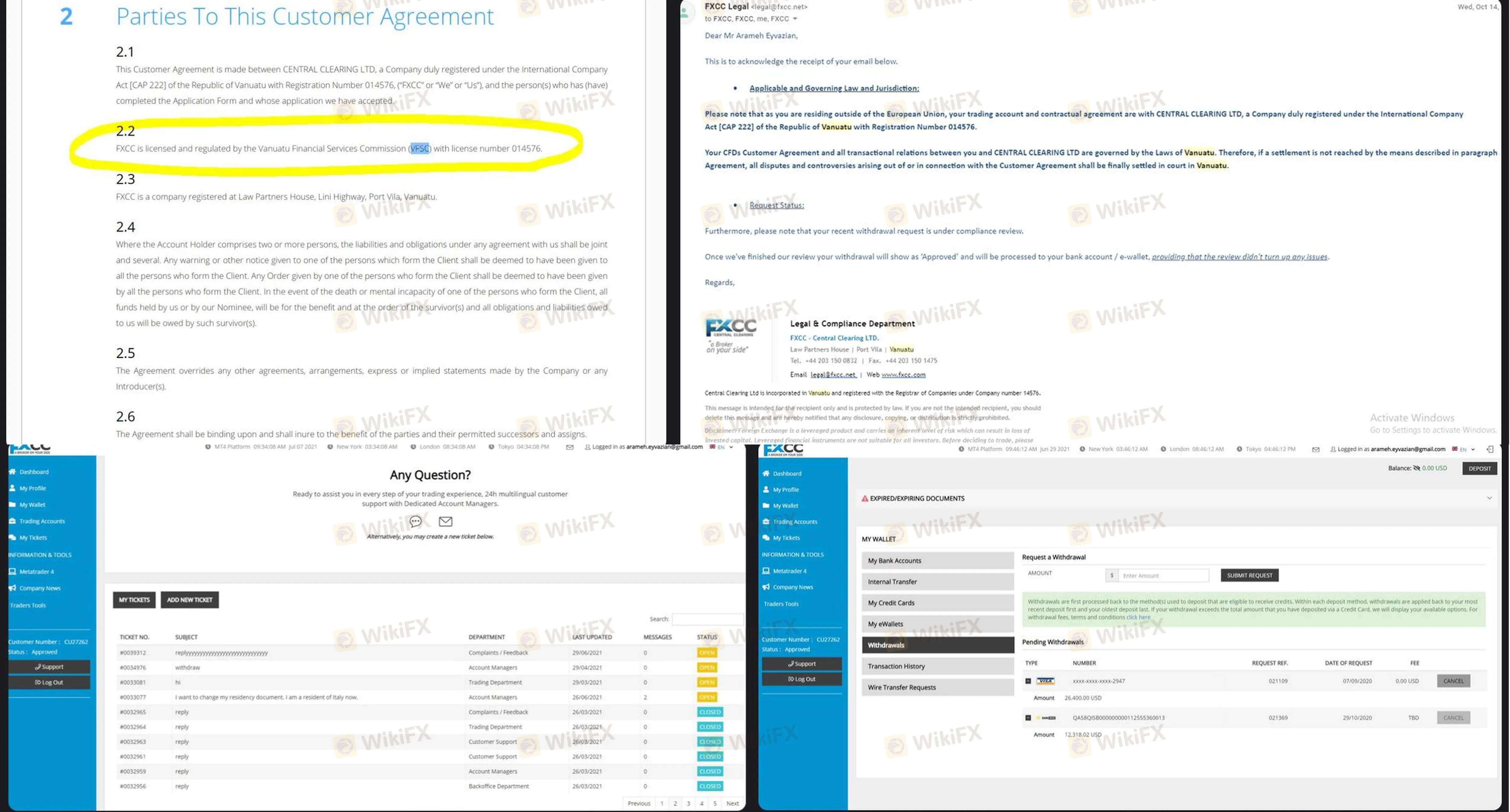

However, a deeper dive into the regulatory disclosures reveals a significant red flag. Data indicates that the broker has received a public warning from the Vanuatu Financial Services Commission (VFSC). The disclosure explicitly states that the entity is “Unauthorized” or not licensed to carry out financial services in that jurisdiction, despite potential claims otherwise. This discrepancy is alarming because many brokers use offshore entities to offer higher leverage. If the offshore branch is operating without valid oversight, clients migrated to that jurisdiction may lose all regulatory protection.

2. Forex Trading Conditions

For traders focusing on Forex instruments, FXCC markets itself as an ECN provider, aiming to offer direct market access with competitive pricing.

- Account Structures: The broker offers three primary account types: ECN Advanced, ECN XL, and ECN Standard. The entry barriers vary significantly, with the XL account accessible from $100, while the Standard account requires a substantial deposit of $10,000.

- Leverage & Costs: While CySEC regulations cap leverage at 1:30, the broker's data highlights a maximum leverage of 1:200. This suggests that retail clients may be funneled to non-European branches to bypass restrictions.

- Pricing: The core question for traders is: Does Forex pricing compete with top-tier providers? FXCC claims zero commission trading on certain ECN accounts, which is a strong selling point. However, this benefit must be weighed against the risk of the execution venue.

3. User Feedback & Complaints

An analysis of the `casesText` data reveals a disturbing pattern of operational issues. Recent feedback from 2025 indicates severe friction in fund processing.

One significant case involves a user from India who reported a stalled withdrawal of $38,718 USD. According to the complaint, the request had been pending for over 11 months without resolution. The user alleged that their account was transferred to a Vanuatu-based branch without their explicit consent. When they attempted to pursue legal action, the broker purportedly claimed that the account was no longer under EU jurisdiction.

The complainant also provided evidence that the broker's claim of holding a Vanuatu license (No. 014576) was contradicted by the regulator's official warning. These reports of “hidden transfers” regarding client jurisdiction are critical for any potential trader to consider, as they directly impact the ability to retrieve funds.

4. Software & Access

- Platform Capability: FXCC relies on the MetaTrader 4 (MT4) platform. MT4 is renowned for its customization options and EA (Expert Advisor) support, making it a staple for automated trading.

- Security Assessment: Despite the platform's popularity, the software audit highlights a security gap: the system reportedly lacks two-step authentication features. To access the platform, traders must complete the login security steps using standard password protocols.

- Recommendation: Given the lack of biometric or 2FA integration, users must be extremely diligent in securing their login credentials. Using unique, high-strength passwords is the only defense against unauthorized access in this environment.

Final Verdict

FXCC presents a divided profile: a legitimate CySEC-regulated European branch versus an offshore operation plagued by warnings and withdrawal complaints. While the regulation in Cyprus is authentic, the evidence of unauthorized offshore activity and client fund disputes cannot be ignored. Traders should exercise extreme caution, particularly regarding jurisdiction clauses in their client agreements. For real-time updates on regulation status or to verify the official login page, consult the WikiFX App.

Disclaimer:

The views in this article only represent the author's personal views, and do not constitute investment advice on this platform. This platform does not guarantee the accuracy, completeness and timeliness of the information in the article, and will not be liable for any loss caused by the use of or reliance on the information in the article.

WikiFX Broker

Latest News

CBN Bolsters Forex Liquidity: Resumes BDC Sales as Reserves Hit $47 Billion

PXBT Review: A Seychelles-Based Trap for Your Capital

KK Park 2.0? New Scam Hub Shockingly Emerges in Myanmar

FX Markets: Aussie Dollar Breaks 0.7100, Yen Rallies on Political Shifts

Anzo Capital Detailed Analysis

Pemaxx User Reputation: Looking at Real User Reviews to Check If It's Trustworthy

CFI Detailed Analysis

Beware ThinkMarkets: Forex Fraud Cases Exposed

China’s "Deposit Migration" Myth Debunked: A Gradual Shift, Not a Flood

Theos Markets Review 2026: Is this Forex Broker Legit or a Scam?

Currency Calculator