简体中文

繁體中文

English

Pусский

日本語

ภาษาไทย

Tiếng Việt

Bahasa Indonesia

Español

हिन्दी

Filippiiniläinen

Français

Deutsch

Português

Türkçe

한국어

العربية

Pepperstone Analysis Report

Abstract:This report is structured to provide actionable insights for both prospective and current Pepperstone clients. Readers will gain understanding of the broker's key strengths and weaknesses as identified through actual user experiences, rather than promotional claims. The analysis breaks down specific performance areas, highlighting where Pepperstone excels and where significant concerns have been raised by the trading community.

Key Takeaway: Pepperstone

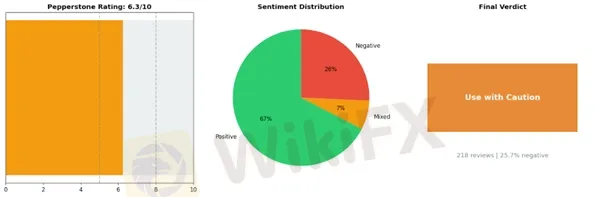

Pepperstone presents a mixed picture for forex traders, earning a moderate 6.3 out of 10 rating based on 218 reviews and a “Use with Caution” recommendation. The broker demonstrates notable strengths that have resonated with approximately 67% of its user base, particularly in areas where traders need reliability most. Responsive customer support stands out as a primary advantage, complemented by the broker's good reputation for safety and a user-friendly interface that appeals to both novice and experienced traders. These qualities have helped Pepperstone maintain a positive sentiment among the majority of its clients, with 147 positive reviews reflecting satisfaction with core services.

However, the 25.7% negative rate reveals concerning issues that cannot be overlooked. The most frequently reported problems center on support quality paradoxically being slow and failing to provide adequate solutions, despite the responsive reputation. More troubling are persistent complaints about withdrawal delays and rejections, which directly impact traders' access to their funds. Execution issues and slippage further compound these concerns, potentially affecting trading performance and profitability. These operational challenges suggest inconsistencies in service delivery that traders should carefully consider.

For those evaluating Pepperstone, the broker offers genuine advantages in usability and regulatory standing, but the withdrawal and execution concerns warrant thorough due diligence. Prospective clients should start with smaller deposits and closely monitor transaction processes before committing significant capital.

At a Glance

Broker Name: Pepperstone

Overall Rating: 6.3/10

Reviews Analyzed: 218

Negative Rate: 25.7%

Sentiment Distribution:

• Positive: 147

• Neutral: 15

• Negative: 56

Final Conclusion: Use with Caution

Pepperstone: Strengths vs Issues

✅ Top Strengths:

1. Responsive Customer Support — 118 mentions

2. Good Reputation Safe — 34 mentions

3. User Friendly Interface — 23 mentions

⚠️ Top Issues:

1. Slow Support No Solutions — 30 mentions

2. Withdrawal Delays Rejection — 29 mentions

3. Execution Issues Slippage — 16 mentions

In an increasingly complex forex trading landscape, selecting a reliable broker requires more than examining marketing materials and promotional offers. This comprehensive analysis of Pepperstone provides traders and investors with an objective, data-driven evaluation based on real user experiences across multiple review platforms.

Our research methodology centers on aggregating and analyzing authentic trader feedback from diverse sources. For this report, we examined 218 verified reviews collected from multiple independent review platforms, referred to as Platform A, Platform B, and Platform C to maintain analytical objectivity. This multi-platform approach ensures a balanced perspective that minimizes bias inherent in single-source data and provides a more accurate representation of the broker's performance across different user demographics and trading styles.

The analysis employs a quantitative scoring system that evaluates Pepperstone across critical dimensions including platform reliability, execution quality, customer service responsiveness, fee transparency, and withdrawal processes. Each review was systematically categorized, with sentiment analysis applied to identify patterns in trader experiences. Our findings reveal an overall rating of 6.25 out of 10, with a negative review rate of 25.69%, leading to our conclusion that traders should approach Pepperstone with caution.

This report is structured to provide actionable insights for both prospective and current Pepperstone clients. Readers will gain understanding of the broker's key strengths and weaknesses as identified through actual user experiences, rather than promotional claims. The analysis breaks down specific performance areas, highlighting where Pepperstone excels and where significant concerns have been raised by the trading community.

Throughout this evaluation, we maintain strict analytical objectivity, allowing the data to speak for itself. Our goal is not to advocate for or against Pepperstone, but to equip traders with comprehensive information necessary for informed decision-making. Whether you are considering opening an account with Pepperstone or evaluating your current broker relationship, this report provides the empirical foundation needed to assess whether this broker aligns with your trading requirements and risk tolerance. The following sections present detailed findings, statistical breakdowns, and specific user feedback themes that inform our overall assessment.

Key Caution Areas for Pepperstone Traders

While Pepperstone maintains a presence as an established forex broker, recent user feedback reveals several concerning patterns that warrant careful consideration before committing funds. The most prevalent issue centers on customer support responsiveness and problem resolution, with 30 documented cases highlighting significant delays and unsatisfactory outcomes during critical situations.

The support infrastructure appears particularly strained when traders face urgent technical or financial issues. One long-term client experienced a troubling scenario during a margin call situation, where a USDT deposit arrived on the blockchain but registered as “Failed” in their Pepperstone account. The subsequent support experience proved frustrating:

“💬 EnriqueG: ”I was a client of Pepperstone for many years. However, the service has deteriorated to a low level that I could never imagined... I made quickly a deposit of 200 usdt to put the numbers in order. The money arrived instantly according to the blockchain, but in Pepperstone my deposit showed up as 'Failed'.“”

Withdrawal complications represent another substantial concern, with 29 reported cases involving delays or rejections. These issues appear particularly problematic when accounts transition from losses to profits, raising questions about processing consistency. Additionally, traders report difficulties with copy trading services, where withdrawal requests following profitable periods triggered unexpected account reviews and delays.

Execution quality concerns affect 16 documented cases, with specific warnings about trading certain instruments like Palladium. Traders report experiencing unusual slippage, pricing discrepancies compared to market data, and in extreme cases, allegations of unauthorized trade modifications:

“💬 David: ”This broker edits and modifies trades of new clients, because they think everyone loses money... I noticed that overnight one of my trades magically had a TP set of 15 pips. This is impossible, because I never usually set TP's.“”

Fund safety issues, while representing 13 cases, carry disproportionate weight given their severity. Any concerns regarding deposit processing, withdrawal access, or account manipulation directly threaten trader capital. The combination of failed deposits showing blockchain confirmation alongside withdrawal obstacles creates legitimate anxiety about fund accessibility.

Fee transparency problems round out the major concerns, with 11 cases highlighting unexpected charges. One trader specifically mentioned swap fees described as “ridiculous,” alongside pricing discrepancies that deviated substantially from publicly available market data:

“💬 Leo leoo: ”Their price is very different from what I checked on the Internet. It is suspected that they are cutting leeks through point differences. Second, their swap fee is ridiculous.“”

Different trader profiles face varying risk levels. High-frequency traders and scalpers are particularly vulnerable to execution issues and slippage, where milliseconds matter. Copy traders should exercise heightened caution given reported difficulties with strategy provider accounts and withdrawal processing. Traders holding positions overnight face exposure to swap fee concerns, while those trading exotic instruments like Palladium encounter additional execution risks.

The deterioration narrative from long-term clients proves especially concerning—suggestions that service quality has declined over time indicate systemic rather than isolated problems. When combined with support inadequacies during critical financial moments, these patterns suggest prospective clients should thoroughly test services with minimal capital before committing substantial funds. The concentration of issues around profitable accounts and withdrawal requests deserves particular scrutiny, as these represent fundamental broker reliability indicators that transcend normal market risk.

Positive Aspects of Pepperstone That Require Careful Consideration

Pepperstone demonstrates several strengths that attract traders, particularly in customer service responsiveness and platform reliability. However, these positive attributes should be evaluated within the broader context of individual trading needs and risk management practices.

Customer Support Excellence

The broker's customer support stands out as a significant positive, with 118 users highlighting responsive service. Traders report that Pepperstone's support team handles complex issues professionally, including technical disconnections and account-related queries. One notable case involved a trader who experienced a server disconnect during market entry:

“💬 Samuel Abiola Robinson: ”I had lost on a trade because of a disconnect immediately after a market entry which didn't allow me time to add an sl and when the server reconnected I was already in deep loss so I contacted Pepperstone in a polite and respectful manner with all the Screenshots and Logs and they refunded me the lost amount within 2 weeks.“”

While this demonstrates goodwill, traders should note that such resolutions aren't guaranteed and typically require thorough documentation. The two-week timeframe also suggests that issue resolution, though fair, may not be immediate. Relying on broker intervention for technical failures isn't a substitute for robust risk management practices like always setting stop-losses.

Regulatory Standing and Trust

Users appreciate Pepperstone's regulatory compliance across multiple jurisdictions, which provides a foundation of security for deposited funds. The broker's established reputation offers peace of mind, particularly for traders in regions with strong financial oversight. However, regulatory protection varies significantly by jurisdiction, and traders should verify which entity holds their account and what protections apply specifically to them.

Platform Accessibility and Processing

Pepperstone receives positive feedback for straightforward deposit and withdrawal processes, with some users reporting same-day transactions:

“💬 Myrna: ”My last withdrawal only hour and I received already. Thank you.“”

The platform's integration with MT5 and cTrader appeals to traders seeking industry-standard tools. However, some reviews mention that certain systems appear “archaic” compared to newer fintech solutions, suggesting the user experience may vary depending on which platform and account type you choose.

“💬 Matt: ”They use a rather archaic system compared to some of the more modern brokers, which was a bit surprising.“”

Who Might Benefit

Pepperstone appears best suited for traders who value regulatory oversight, competitive spreads, and reliable customer support over cutting-edge interface design. Those requiring frequent support interaction or managing technical issues may find the responsive service team valuable. However, traders should conduct their own due diligence, test services with smaller amounts initially, and maintain disciplined risk management regardless of broker quality. No broker's positive attributes eliminate the inherent risks of forex trading.

Pepperstone: 6-Month Review Trend Data

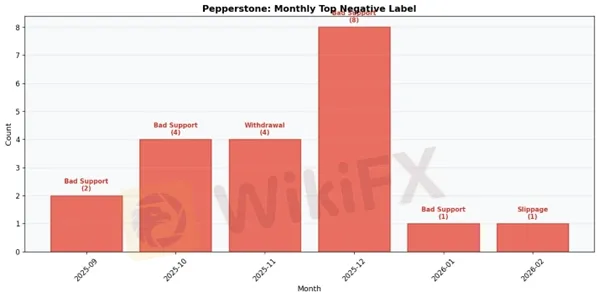

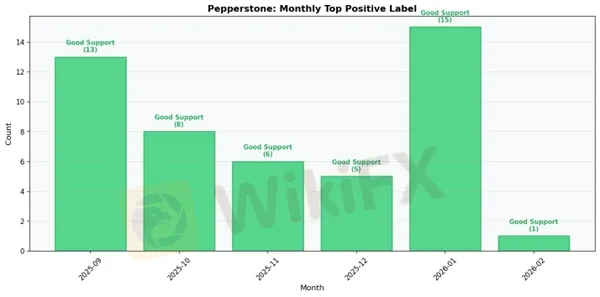

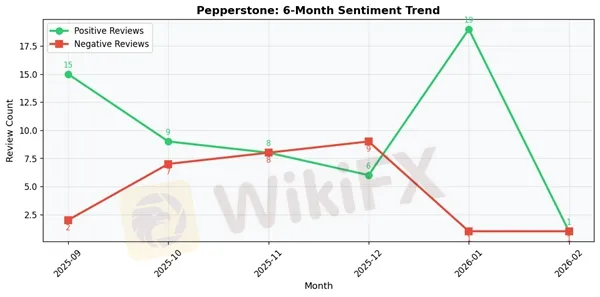

2025-09:

• Total Reviews: 19

• Positive: 15 | Negative: 2

• Top Positive Label: Responsive Customer Support

• Top Negative Label: Slow Support No Solutions

2025-10:

• Total Reviews: 18

• Positive: 9 | Negative: 7

• Top Positive Label: Responsive Customer Support

• Top Negative Label: Slow Support No Solutions

2025-11:

• Total Reviews: 19

• Positive: 8 | Negative: 8

• Top Positive Label: Responsive Customer Support

• Top Negative Label: Withdrawal Delays Rejection

2025-12:

• Total Reviews: 17

• Positive: 6 | Negative: 9

• Top Positive Label: Responsive Customer Support

• Top Negative Label: Slow Support No Solutions

2026-01:

• Total Reviews: 20

• Positive: 19 | Negative: 1

• Top Positive Label: Responsive Customer Support

• Top Negative Label: Slow Support No Solutions

2026-02:

• Total Reviews: 2

• Positive: 1 | Negative: 1

• Top Positive Label: Responsive Customer Support

• Top Negative Label: Execution Issues Slippage

Pepperstone Final Conclusion

Pepperstone emerges as a moderately reliable broker that demonstrates both commendable strengths and concerning weaknesses, earning a 6.25/10 rating that warrants a “Use with Caution” approach from prospective traders.

The broker's performance analysis reveals a mixed picture. On the positive side, Pepperstone maintains responsive customer support, has built a solid reputation in the industry, and offers a user-friendly interface that simplifies the trading experience. These strengths position Pepperstone as an accessible platform for many traders. However, the 25.69% negative feedback rate from 218 reviews cannot be overlooked, particularly given the recurring complaints about slow support resolution, withdrawal delays and rejections, and execution issues including slippage. These problems directly impact traders' profitability and trust, representing significant operational concerns that Pepperstone must address.

For beginners entering the forex market, Pepperstone's user-friendly interface provides a gentle learning curve, and the responsive initial customer support can help navigate early challenges. However, new traders should maintain conservative position sizes and thoroughly test withdrawal processes with smaller amounts before committing substantial capital. The execution issues reported suggest beginners should avoid trading during high-volatility periods until they understand the platform's behavior under various market conditions.

Experienced traders may find Pepperstone adequate for diversifying their broker relationships but should not rely on it as their primary trading venue. The withdrawal concerns and execution inconsistencies make it prudent to keep only working capital with Pepperstone while maintaining core funds with more reliable alternatives. These traders possess the expertise to recognize and document any execution anomalies, which could prove valuable if disputes arise.

High-volume traders and scalpers should exercise particular caution with Pepperstone. Slippage and execution issues become magnified when trading frequently or in large sizes, potentially eroding the thin profit margins these strategies depend upon. The withdrawal delays reported by users pose liquidity management challenges for active traders who need reliable access to their funds. High-frequency strategies require near-perfect execution, and Pepperstone's track record suggests it may not consistently deliver this level of performance.

Swing traders and position traders face fewer immediate concerns, as execution precision matters less for longer-term holds. However, even these traders must remain vigilant about withdrawal processes and maintain detailed records of all transactions.

Before opening an account with Pepperstone, traders should thoroughly verify current regulatory status, test the platform with a small deposit, document all interactions, and maintain alternative broker relationships. Reading recent user reviews and monitoring any changes in company policies remains essential.

Pepperstone presents as a broker with genuine potential undermined by operational inconsistencies—suitable for cautious traders willing to maintain vigilant oversight, but not yet deserving of unconditional trust with substantial trading capital.

Disclaimer:

The views in this article only represent the author's personal views, and do not constitute investment advice on this platform. This platform does not guarantee the accuracy, completeness and timeliness of the information in the article, and will not be liable for any loss caused by the use of or reliance on the information in the article.

WikiFX Broker

Latest News

Capital.com Review: Is Your Money Locked Inside this Broker?

The Deriv Review: A Masterclass in Regulatory Smoke and Mirrors

Swissquote Scam Alert: 53/64 Negative Cases Exposed

FxPro Broker Analysis Report

ACY SECURITIES Regulatory Status: A Complete Guide to Licenses, Warnings and Trader Issues

FBS Forex Scam Alert: High Complaint Ratio

ThinkMarkets Scam Alert: 83/93 Negative Cases Exposed

Exchange Rate Fluctuations: Key Facts Every Forex Trader Should Know

ACY Securities Deposit and Withdrawal: The Complete 2025 Guide (Fees, Methods & User Warnings)

US Industrial Production Surged In January

Currency Calculator