Riepilogo dell'azienda

Informazioni generali e regolamento

con sede ad Auckland, Forex Limited è una società di consulenza per la gestione del rischio di cambio e di tasso d'interesse e da oltre 30 anni aiuta molte aziende a gestire il proprio rischio di cambio, con una base di clienti che copre un'ampia gamma di attività in Nuova Zelanda e all'estero. Forex Limited detiene una nuova licenza fsp zelanda (numero di licenza: 4041).

Principali imprese

Forex LimitedLe attività principali di includono cambio valuta, cambio a termine, copertura, ordini limite, rapporti di mercato, consulenza di esperti e trasferimenti internazionali veloci.

Deposito minimo

l'importo del deposito minimo non può essere trovato sul Forex Limited sito web. i trader possono contattare questo broker per ottenere informazioni dettagliate.

Leva

non sono visualizzate informazioni relative alla leva finanziaria Forex Limited sito web ufficiale.

Spread e commissioni

tuttavia, le informazioni su spread e commissioni non sono completamente divulgate Forex Limited Sito ufficiale.

Servizio Clienti

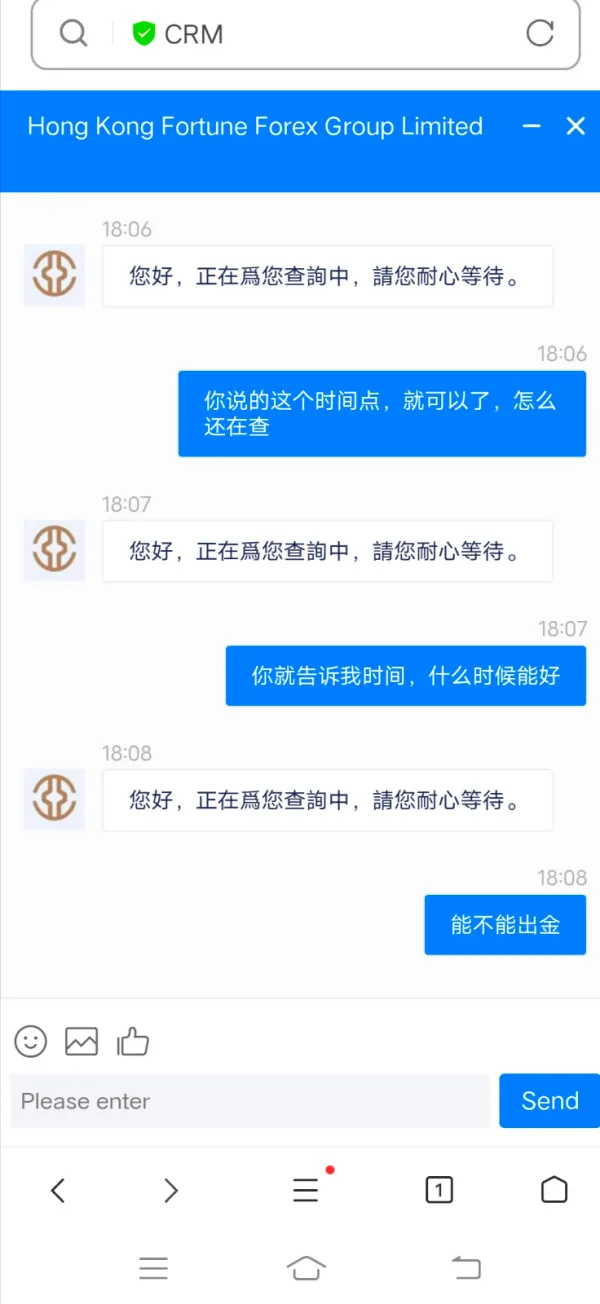

IL Forex Limited il team di assistenza clienti può essere raggiunto tramite e-mail, telefono. la chat dal vivo non è disponibile, il che porta i trader a non farlo

FX4381686212

Hong Kong

前言:网络上各类期货交易平台未取得金融监管部门批准,均未在我国设立相关机构提供业务服务,未依法向电信部门备案,均属非法展业行为。而且,参与期货交易平台的各类主体,包括国内代理、宣传机构以及投资者都需要承担相应的法律责任。就是说即便是合法的国外受监管机构,只要在国内开展业务至少是违规的。多乾国际进行的期货交易模式是做市商交易,它不同于期货、股票的搓合交易,一方卖出会对应一方买入。多乾国际涉嫌向社会公众所提供非法期货交易平台,甚至可能就是直接交易的一方,既当运动员又当裁判员,已涉嫌严重违法。 提醒大家,现在的期货虚拟货币交易平台尤其是一些不知名的一些外汇平台,常常伪装成高大上的官方网站,买相关牌照,租服务器就成型了。交易软件也只是租用了盗版的MT4软件,一个月租金或许只需要几千元。对于没有接触过外汇,又想要涉及外汇从中赚到钱的交易者来说,根本只能被玩弄于股掌之间。今年4月份的时候,我接到多乾国际一个业务员的电话,他们当时打电话给我推荐股票,我起初并不想理他们,但是他们一直不停的打,还加我微信。说只是让我关注一下,不需要我跟着他们操作。我当时想,那也可以多一个参考。看他们机构准不准。谁能想到,已经一步步的踩进他们早已布好的重重陷阱。刚开始,他们每天都给我股票资讯,也每天都在朋友圈更新盘中票。刚开始我关注了一下,确实都涨的可以,有时候还有连续几天都是涨停板的。我当时还傻傻的以为,他们机构是真的有很厉害的操盘手。当时还是有点警惕性的,所以就小资金5W块跟他们玩玩,然后他们的老师就带我操作,赚了一点小钱。那半个月,他们每天都带我操作。大概赚了2W块的样子。然后突然有一天,他们突然不带了,我就问他们怎么回事。他们说收到消息,有一支内幕消息票,现在整个公司都不带客户,专门带客户进这支内幕消息票。说最少20-25个点的收益,做短线,3-5天出货,但是最低20W起带。当时我咬咬牙,就跟他们进了。那时候正逢股市震荡大跌的时候,我也是蠢,听信了他们的鬼话,连续七个跌停板!亏了我十来万。出也出不来。问他们老师怎么回事,他们老师就各种搪塞,说什么贸易战,美市股票大跌,影响了中国股市。过了两天,那个老师主动找我说,现在股票不好做了,带我们做CHINA50和沪深300以及Forex Limited,帮我们免费把亏损补回来。然后我就在他们指导下开了户,拉我们进了一个群—天龙战队交流群,还有一个直播间。当时我并不知道这些,也不知道群里一大半都是托,直播间里面大部分都是他们的水军。我当时也是蒙了眼,不到一个星期,我又亏了10多W。他们就让我加大资金,翻倍赚。我前前后后一共进了50多W。总是想着赚回本就不做了。结果越亏越多,最后出不起本钱我才意识到不对。

Esposizione

FX4111098624

Sri Lanka

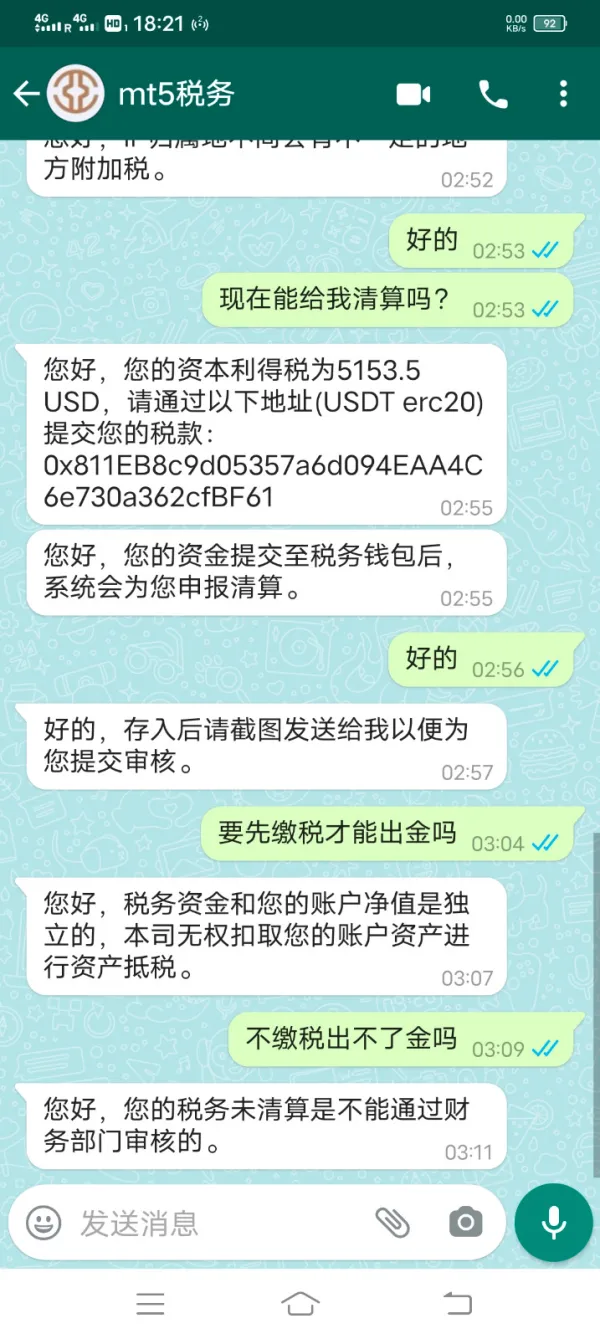

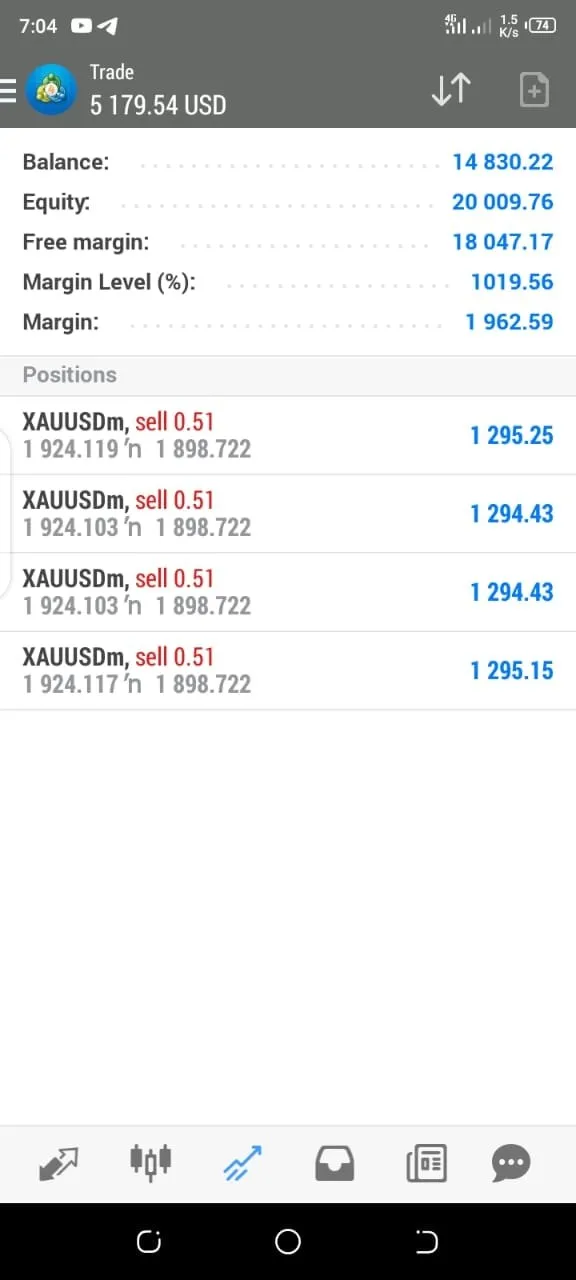

Mi ha chiesto di pagare le tasse prima di prelevare denaro. Non ho fatto come mi ha detto. Ho fatto soldi sul conto esattamente come il deposito. E lei continuava a dire che era ancora in fase di indagini e non era in grado di ritirarsi. La donna nella foto, di Chongqing, in Cina, viveva a Chicago, ha detto che suo fratello che lavorava nel settore finanziario aveva una squadra. Ogni volta che hai fatto come ti ha detto, puoi fare soldi, ma ti ha chiesto di prelevare quando il profitto è superiore al deposito e devi pagare le tasse prima. Non credere in lei! I loro dati sulla piattaforma MT5 sono falsi, la loro azienda lo èForex Limited .

Esposizione

FX3739673730

Filippine

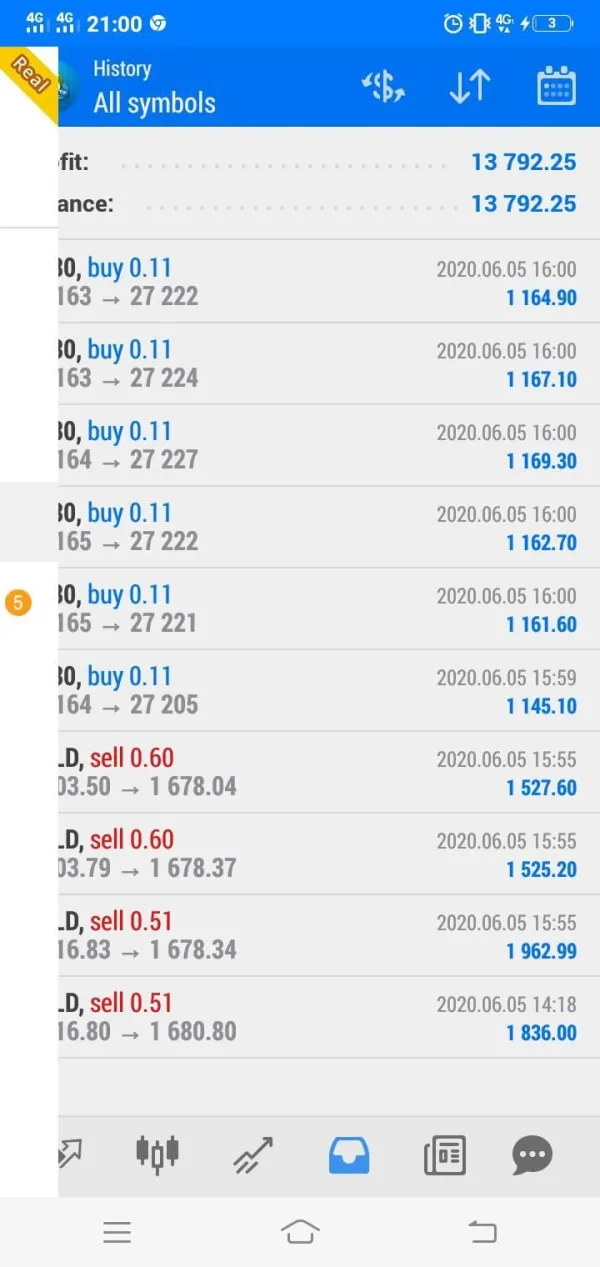

Ho anche appena ricevuto una truffa da questo broker steady168, ho incontrato un ragazzo online detto da Hong Kong, abbiamo parlato e mi ha presentato MT5 e steady 168. Ho depositato 5k e nel mio primo trade ho guadagnato 1100 $. Posso con 2 due volte, prima 500$ poi 4500$. Quindi questo ragazzo continua a incoraggiarmi a depositare sempre più soldi in cui ho detto che non posso, mi ha trasferito 2000 $ dal suo conto che ho ricevuto un messaggio dal servizio clienti che dice che devo depositare 3000 $ per il deposito di rischio. L'ho fatto e lunedì 13 settembre con le istruzioni di questo ragazzo di nuovo, ho guadagnato 11k di profitto e voglio prelevare denaro e il servizio clienti ha detto che ora devo pagare l'imposta sul reddito personale del 30% del profitto. Ciò fa scattare il mio sospetto perché non ho mai sentito una cosa del genere pagare l'imposta sul reddito delle persone fisiche prima di ritirarmi. Poi ho cercato su google e ho trovato questo post. Ora non posso prelevare soldi. Il mio account verrà bloccato e detratto il 10% se non pago le imposte sul reddito delle persone fisiche. Ora ho perso i miei 11k, mi sento così di merda per essere truffato

Esposizione

FX1046772946

Venezuela

Sono molto felice di condividere con te la mia opinione su Forex Limited. Anche se non ho ancora fatto trading su Forexlimited, e non ho intenzione di farlo, voglio ancora dire qualche parola. Prima di tutto, le informazioni fornite sul loro sito Web sono molto scarse e non ci sono informazioni di base come deposito minimo e leva finanziaria. Il secondo è che ho visto molte recensioni negative su wikifx, presumibilmente questo broker non vale la pena fare trading.

Neutro

不吃香菜的女孩

Malaysia

Pensavo che questo fosse il modo più redditizio per fare soldi online, ma poi ho scoperto di essere stato imbrogliato e di aver perso più di $ 12.000. L'azienda funziona su Telegram e Whats App senza indirizzo registrato. Forniscono segnali gratuiti e sembrano essere più redditizi di qualsiasi altra società commerciale al mondo. Queste persone ti trattavano come se fossi il loro dio prima che tu pagassi le loro spese, ma dopo ti hanno ignorato. Usano sempre "SIR" nelle loro conversazioni. Possono riscuotere da te le commissioni di partecipazione agli utili e quindi inserire in modo casuale le transazioni nel tuo account. Alcune transazioni non hanno stop loss. Fai attenzione che il loro sistema sembri reale, ma sono truffatori.

Esposizione

FX5944873722

Malaysia

Il mio ritiro ha richiesto più di 2 mesi.

Esposizione

FX5944873722

Malaysia

L'uomo mi ha presentato MT5 e mi ha portato a depositare 5000. All'inizio ho guadagnato $ 1100 e mi ha convinto a depositare di più. Il 13 settembre ho guadagnato $ 11.000 ma quando ho provato a prelevare, il servizio clienti mi ha detto di pagare il 30% di tasse personali. Altrimenti il mio account sarebbe bloccato. Attenzione.

Esposizione