Key Market Levels for Traders

MARKET ANALYSISUSDJPYUSD/JPY Intraday: towards 152.10.Pivot:154.00Our preference:Short positions below 154.00 with targets at 152.80 152.10 in extension.Alternative scenario:Above 154.00 look for fur

简体中文

繁體中文

English

Pусский

日本語

ภาษาไทย

Tiếng Việt

Bahasa Indonesia

Español

हिन्दी

Filippiiniläinen

Français

Deutsch

Português

Türkçe

한국어

العربية

MARKET ANALYSISUSDJPYUSD/JPY Intraday: towards 152.10.Pivot:154.00Our preference:Short positions below 154.00 with targets at 152.80 152.10 in extension.Alternative scenario:Above 154.00 look for fur

MARKET ANALYSISUSDJPYUSD/JPY Intraday: towards 152.10.Pivot:154.00Our preference:Short positions below 154.00 with targets at 152.80 152.10 in extension.Alternative scenario:Above 154.00 look for fur

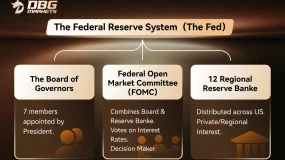

Market OverviewThe Federal Reserve released its latest policy decision yesterday, opting to keep interest rates unchanged and offering no indication that rate cuts will resume in the near term. In res

Google has agreed to pay $68 million to settle a class-action lawsuit alleging that its voice assistant recorded users private conversations without consent. According to Reuters, the claims focused o

While market attention on Intel often centers on AI competition and execution challenges, the company has been quietly expanding a fast-growing custom chip business. According to The Motley Fool, Inte

Fundamental Analysis in FX, Indices, and Commodities CFDs TradingFundamental Analysis (FA) is a core pillar of market analysis in the world of financial trading. It focuses on evaluating the underlyin

Fed Independence in Doubt? How the Probe Threatens the US Financial SystemIn January 2026, the US Department of Justice (DOJ) launched a rare criminal investigation into Federal Reserve Chair Jerome P

Market ReviewAccording to ETO Markets monitoring, on January 27 (Tuesday), gold prices surged sharply again. Spot gold jumped USD 173.43 in a single session, up 3.46%, closing at USD 5,181.78 per ounc

Against the backdrop of long-standing economic sanctions and elevated domestic inflation, Irans internal tensions spilled into the geopolitical arena. According to ETO Markets monitoring on January 13

Valetax has been named “The Best Broker in Australia” at the TU Awards 2025, an annual industry event organized by Traders Union that recognizes excellence across the global trading industry. The awar

Central Bank Ahead: Fed Integrity Governance Discount Dollar, Gold Silver OutlookFOMC Fed Preview: The Eye of the StormThe Federal Open Market Committee (FOMC) concludes its two-day meeting today, J

On Tuesday, due to Trump's remarks about the "yo-yo" of the US dollar and signs of coordinated action by traders to intervene in the foreign exchange market, the US dollar index plummeted to a nearly

BUY GOLD 5140 and below TP 5210SELLGOLD 5220 and above TP 5135BUY EURUSD 1.1960 target 1.2050SELL EURUSD 1.2040 target 1.1940BUY GBPUSD 1.3750 target 1.3850SELL GBPUSD 1.3855 target 1.3745BUY USDJPY 1

We previously flagged the risk of a downside break in the U.S. dollar. While market consensus has largely attributed recent weakness to coordinated efforts by the U.S. and Japan to curb excessive yen

Market OverviewU.S. equities showed mixed performance ahead of major tech earnings releases. The SP 500 notched its fifth consecutive gain and closed at a new all-time high, while the Nasdaq remained

MARKET ANALYSISUSDJPYUSD/JPY Intraday: under pressure.Pivot:153.50Our preference:Short positions below 153.50 with targets at 152.00 151.30 in extension.Alternative scenario:Above 153.50 look for fur

MARKET ANALYSISUSDJPYUSD/JPY Intraday: under pressure.Pivot:153.50Our preference:Short positions below 153.50 with targets at 152.00 151.30 in extension.Alternative scenario:Above 153.50 look for fur

MARKET ANALYSISUSDJPYUSD/JPY Intraday: under pressure.Pivot:153.50Our preference:Short positions below 153.50 with targets at 152.00 151.30 in extension.Alternative scenario:Above 153.50 look for fur

DBG Markets, a global leader in multi-asset trading, continues its partnership with RCD Espanyol as the team prepares for its third home fixture in La Liga. On January 30, Espanyol will host Deportivo

Wall Street‘s Defiance and Gold’s Wild Ride: Whats Next Ahead of FOMC?Golds “5,000 Era”: Flash Crash or Healthy Correction?Yesterday, Spot Gold successfully touched the $5,100 milestone before a wave