Company Summary

| Tokai TokyoReview Summary | |

| Founded | 2009 |

| Registered Country/Region | Japan |

| Regulation | FSA |

| Market Instruments | Domestic stocks, Domestic Investment trusts, Government Bond Fund, MMF, Domestic Bond, Foreign Currency MMF, Foreign Bond |

| Demo Account | / |

| Leverage | / |

| Spread | / |

| Trading Platform | / |

| Min Deposit | / |

| Customer Support | Tel: +81 0120-848-104 |

| Social Media: Twitter, YouTube | |

With its headquarters located in Chūō, Tokyo, Tokai Tokyo Financial Holdings, Inc. is a Japanese financial services holding corporation. Its primary business is offering brokerage services via Tokai Tokio Securities, a subsidiary. When Tokyo Securities and Tokai Maruman Securities merged in 2009, Tokai Tokyo Securities was created. MMF, Foreign Currency MMF, Foreign Bond, Government Bond Fund, Domestic Stocks, and Domestic Investment Trusts are among its services.

Pros and Cons

| Pros | Cons |

| Regulated by FSA | Lack of transparency |

| A wide range of products & services | Limited contact channels |

| Multiple payment options |

Is Tokai Tokyo Legit?

Tokai Tokio is currently authorized and regulated by the Financial Service Agency of Japan (FSA), with regulatory license number: 東海財務局長(金商)第140号.

| Regulated Country | Regulated Authority | Current Status | Regulated Entity | License Type | License Number |

| Financial Services Agency (FSA) | Regulated | 東海東京証券株式会社 | Retail Forex License | 東海財務局長(金商)第140号 |

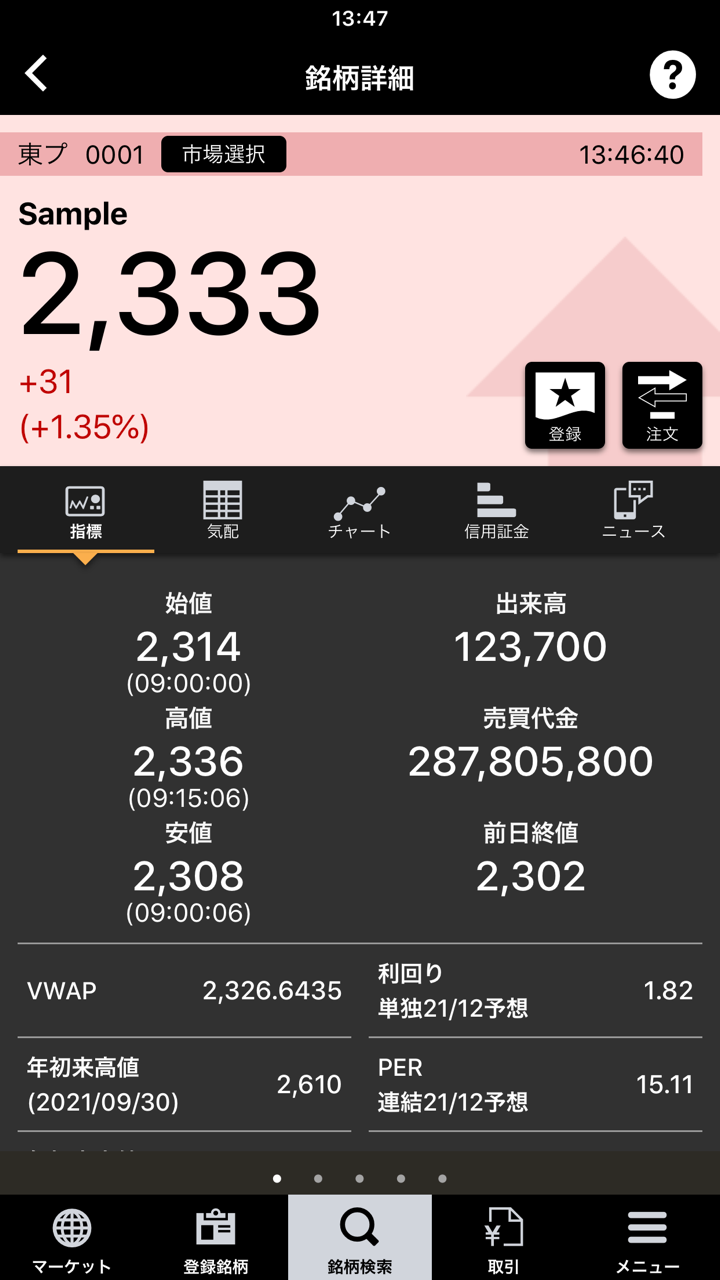

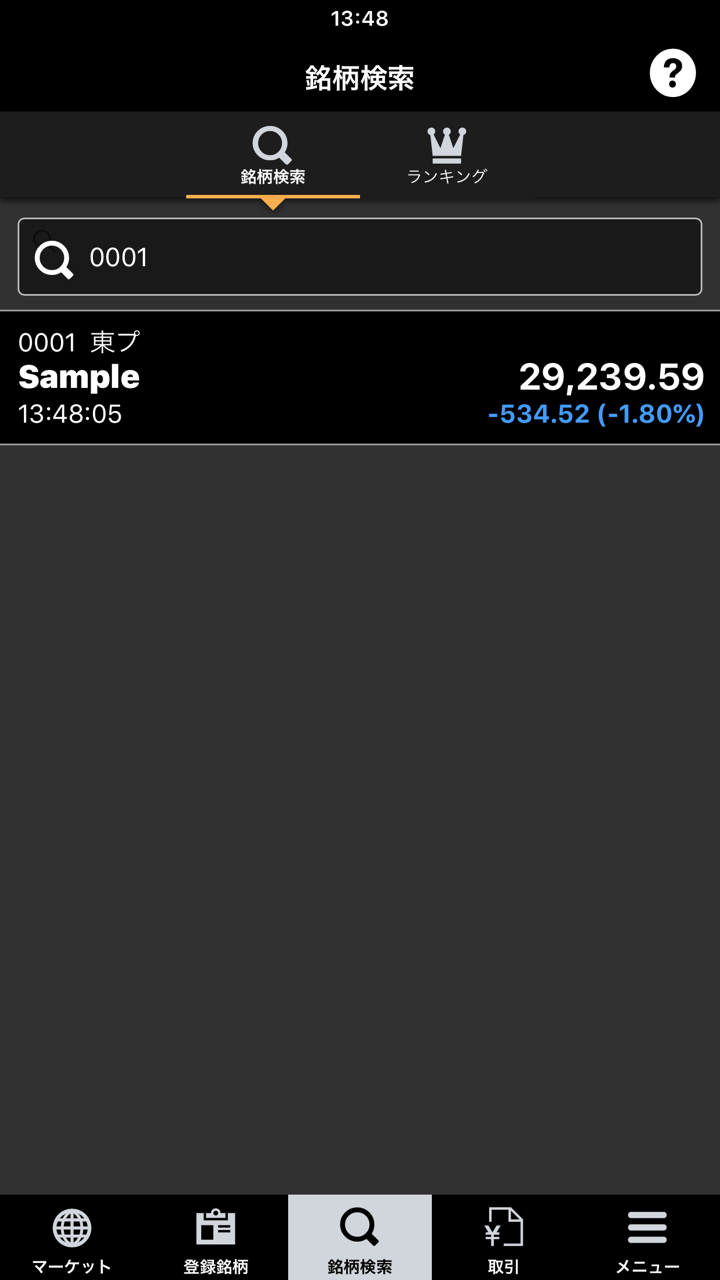

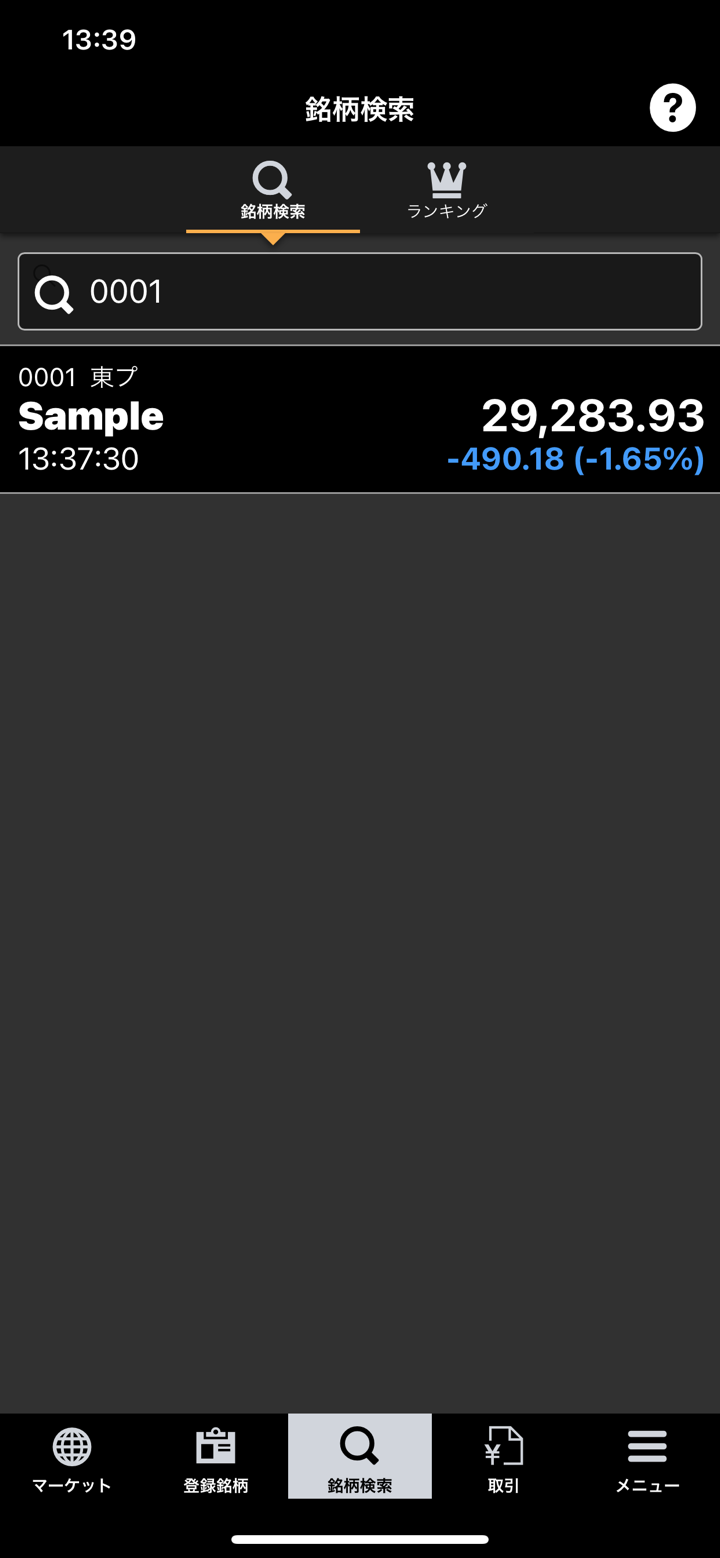

What Can I Trade on Tokai Tokyo?

| Trading Asset | Available |

| Domestic stocks | ✔ |

| Domestic Investment trusts | ✔ |

| Government Bond Fund | ✔ |

| MMF | ✔ |

| Domestic Bond | ✔ |

| Foreign Currency MMF | ✔ |

| Foreign Bond | ✔ |

| Commodities | ❌ |

| Indices | ❌ |

| Cryptocurrencies | ❌ |

Deposit and Withdrawal

Tokai Tokyo offers two deposit and withdrawal methods.

Using the Tokai Tokyo Card at:

- Japan Post Bank ATMs

- Bank of Tokyo-Mitsubishi UFJ ATMs

- Seven Bank ATMs (cash payments from management bank convenience store ATMs)

Bank counter, ATM, or online banking transfer to the designated account if not using the Tokai Tokyo Card.