Company Summary

Company Summary

Company Profile

Feature | Information |

Registered Country/Region | Australia, Vanuatu, Seychelles |

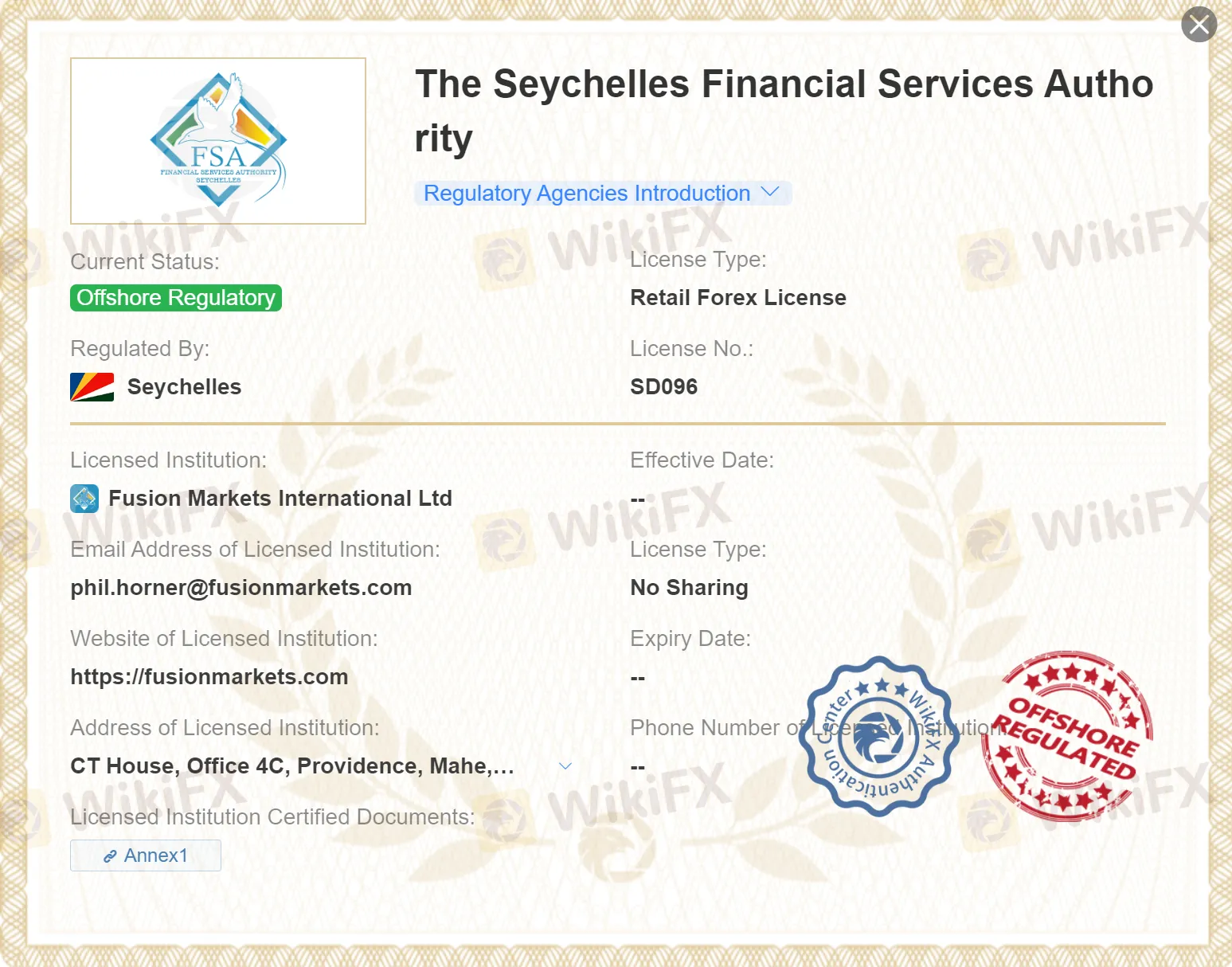

Regulation | ASIC, VFSC, FSA |

Market Instrument | Forex, energy, precious metals, equity indices, commodities, cryptocurrency CFDs and share CFDs |

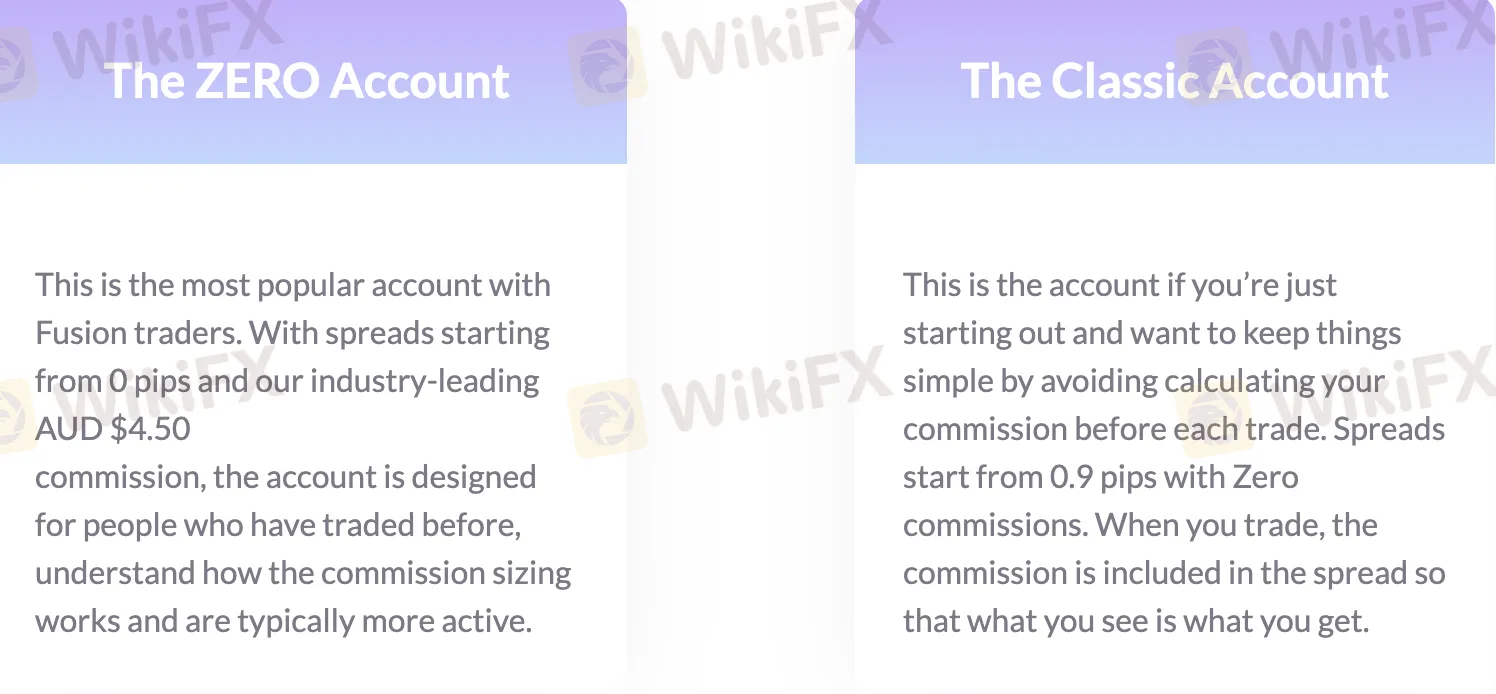

Account Type | Zero, Classic |

Demo Account | Yes |

Maximum Leverage | 1:500 |

Spread | 0 pips (Zero account) 0.9 pips (Classic Account) |

Commission | $4.50 USD (round turn) |

Trading Platform | MT4, MT5, cTrader, Fusion +, MAM/PAMM |

Minimum Deposit | $0 |

Deposit & Withdrawal Method | Visa, MasterCard (credit & debit), PayPal, Skrill, Neteller, Fasapay, Jeton Wallet, Perfect Money, Online Naira, Doku, Cryptos, Bank Wire, and more. |

Fusion Markets is an Australian-based online forex broker providing a competitive trading environment across various asset classes. Regulated by the Australian Securities Investments Commission (ASIC), the Seychelles Financial Services Authority (FSA), and the Vanuatu Financial Services Commission (VFSC), Fusion Markets emphasizes regulatory compliance to ensure a secure and transparent trading environment for its clients.

They have made significant progress in the industry with their industry-leading $4.50 USD round turn commission and high-quality service, rated among the world's best for both of these metrics.

Trading Opportunities

Fusion Markets offers a diverse range of tradable assets, allowing clients to trade in forex, commodities, indices, share CFDs, and cryptocurrency CFDs. This broad selection caters to the individual preferences of traders seeking a comprehensive suite of options to navigate the dynamic financial markets.

Leverage Options

Recognizing the significance of leverage in trading, Fusion Markets provides competitive leverage options, with ratios reaching up to an impressive 1:500. Traders can potentially amplify their positions, although responsible use of leverage is encouraged, as outlined by industry best practices.

Advanced Trading Platforms

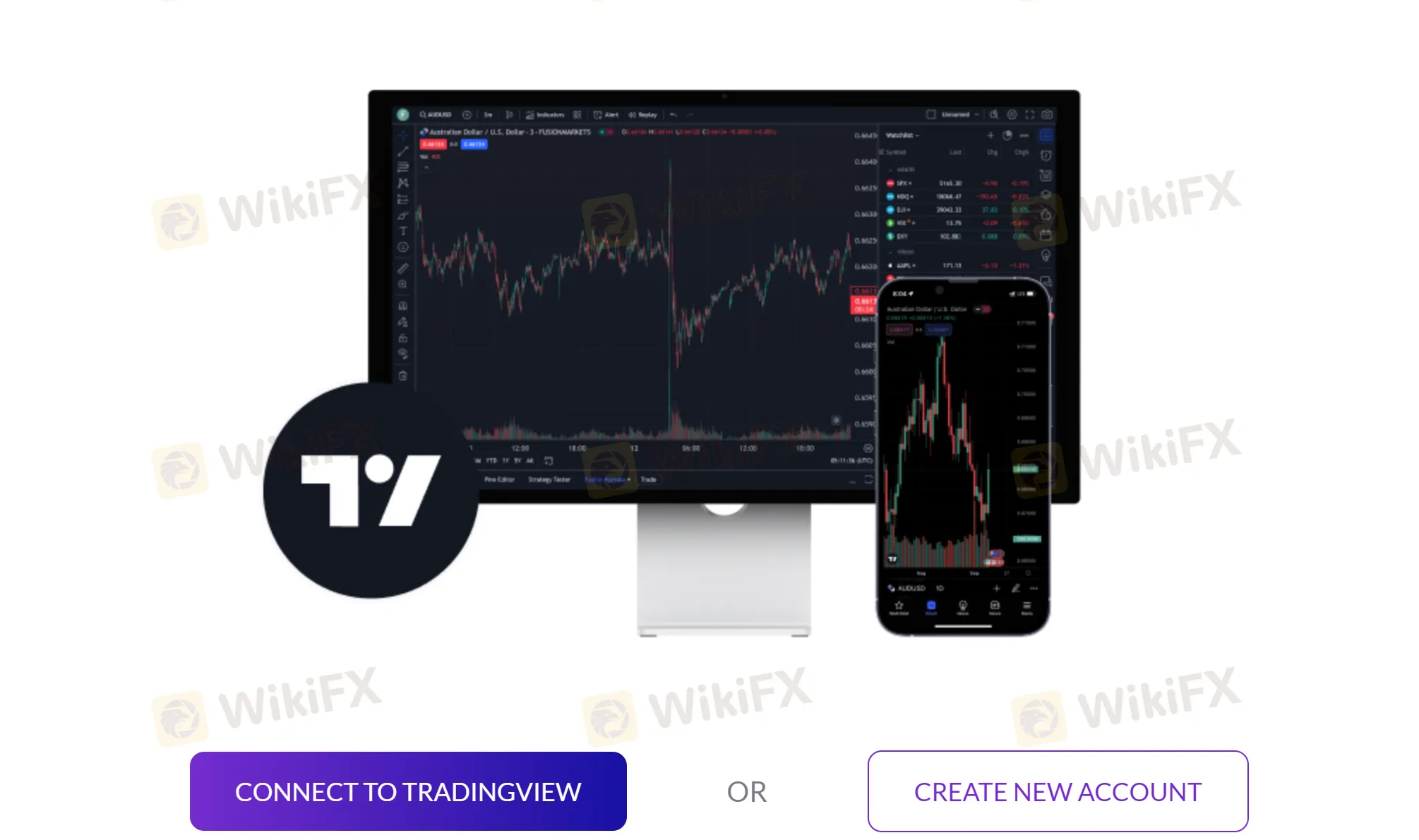

Fusion Markets supports multiple advanced trading platforms, including Metatrader 4, Metatrader 5, cTrader, Fusion Plus, and MAM/PAMM. Known for their intuitive interfaces, advanced charting tools, and comprehensive features, these platforms cater to various trading styles, reflecting Fusion Markets' commitment to a seamless trading experience.

Customer Support

A hallmark of Fusion Markets is its commitment to customer support, providing assistance through live chat, email, and phone channels 24/7. This dedication aligns with industry standards, ensuring traders have access to support whenever needed.

Educational Resources

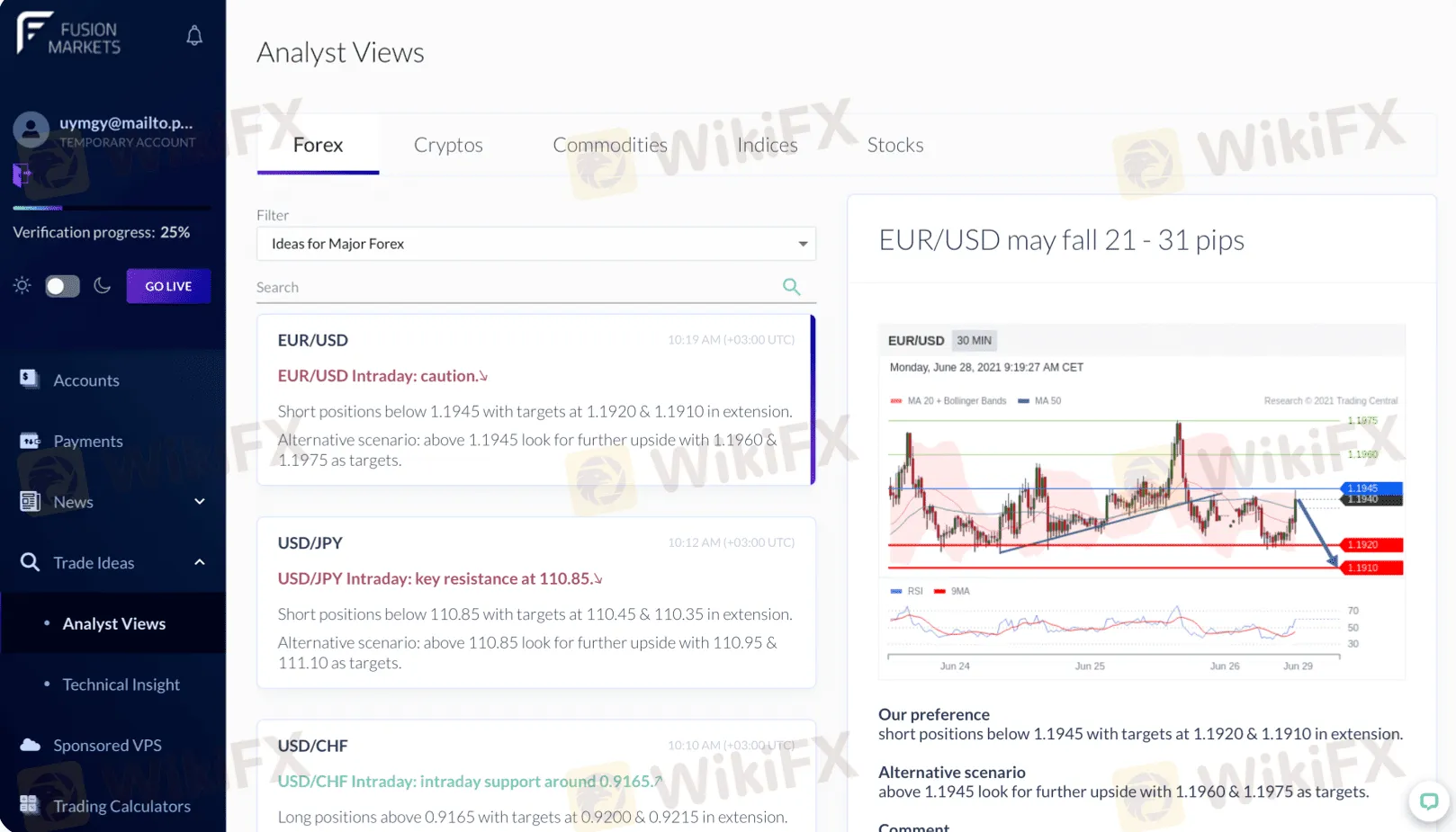

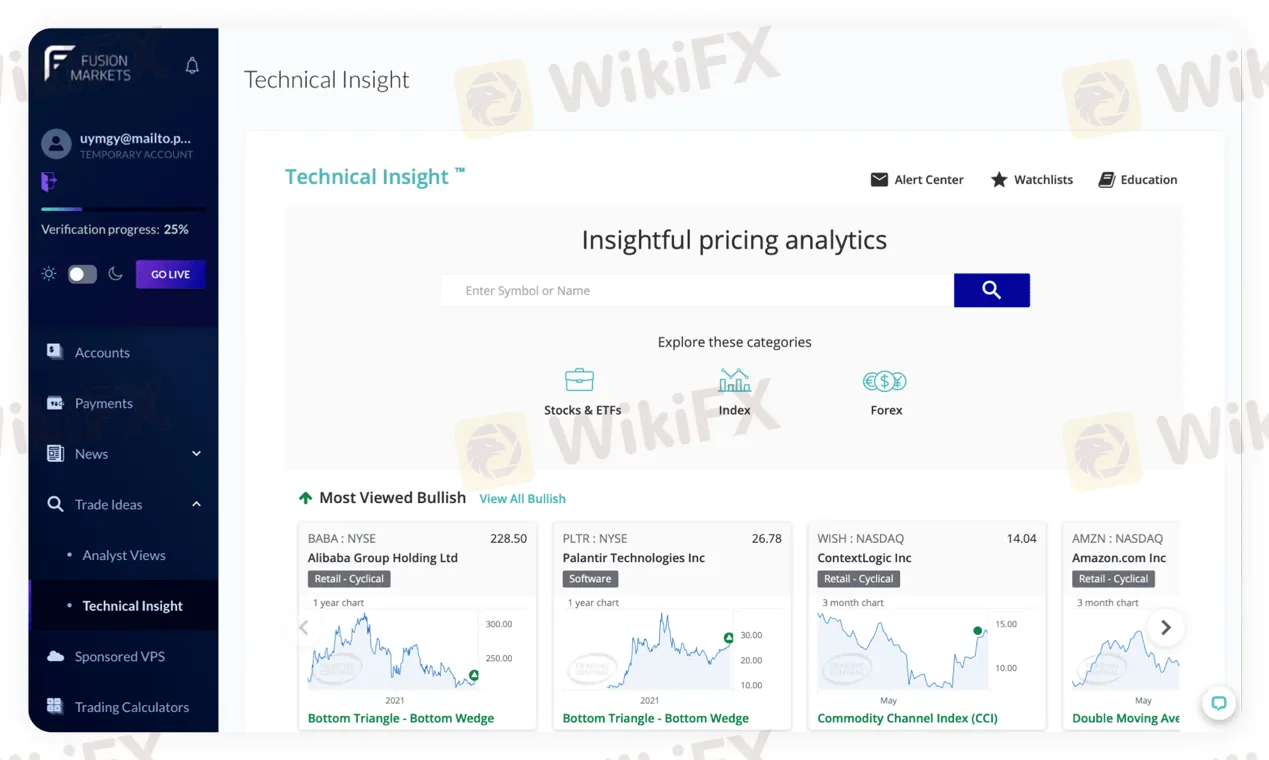

Understanding the importance of education in trading, Fusion Markets offers a range of educational resources. Traders can access 1/1 platform support, educational materials, a dedicated Telegram group, a signal centre, and a blog. These resources aim to empower traders with knowledge and tools for making informed trading decisions.

In conclusion, Fusion Markets stands as a regulated and customer-focused online forex broker, offering a robust trading experience with diverse opportunities, competitive leverage options, and a commitment to client support and education.

Is Fusion Markets legit or a scam?

Fusion Markets, a forex broker operating globally, takes regulatory compliance seriously. The broker operates under the regulation of three regulatory authorities, ensuring that it adheres to stringent regulatory standards and maintains the highest level of integrity.

In addition, Fusion Markets has institutional backing from Glen Eagle Securities, a large Australian Financial Services company holding over $400 million in client funds, and having raised over $1 billion in capital.

Pros and Cons

Fusion Markets offers a range of advantages to traders, including strong regulation by reputable authorities such as ASIC, FSA, and VFSC. Additionally, Fusion Markets provides user-friendly trading platforms and excellent 24/7 customer support services.

Pros | Cons |

Regulated by ASIC, FSA, and VFSC | Limited availability of localized customer support |

Competitive leverage ratios up to 1:500 | Tiered trading accounts not provided |

No minimum deposits | |

User-friendly trading platforms, MT4, MT5 & cTrader | |

Multiple customer support options | |

Large online video guide library | |

Demo accounts available | |

Swap Free Accounts available |

Conclusion

In conclusion, Fusion Markets is a forex broker registered in Australia and regulated by reputable authorities such as the ASIC, FSA, and VFSC. The broker's strengths lie in its diverse selection of tradable assets, including forex currency pairs, commodities, indices, and cryptocurrencies, providing ample opportunities for traders to explore different markets. The availability of competitive leverage ratios up to 1:500 allows traders to potentially maximize their trading positions, although it should be used responsibly due to associated risks.

2025 SkyLine Thailand

2025 SkyLine Thailand

FX1505787300

Turkey

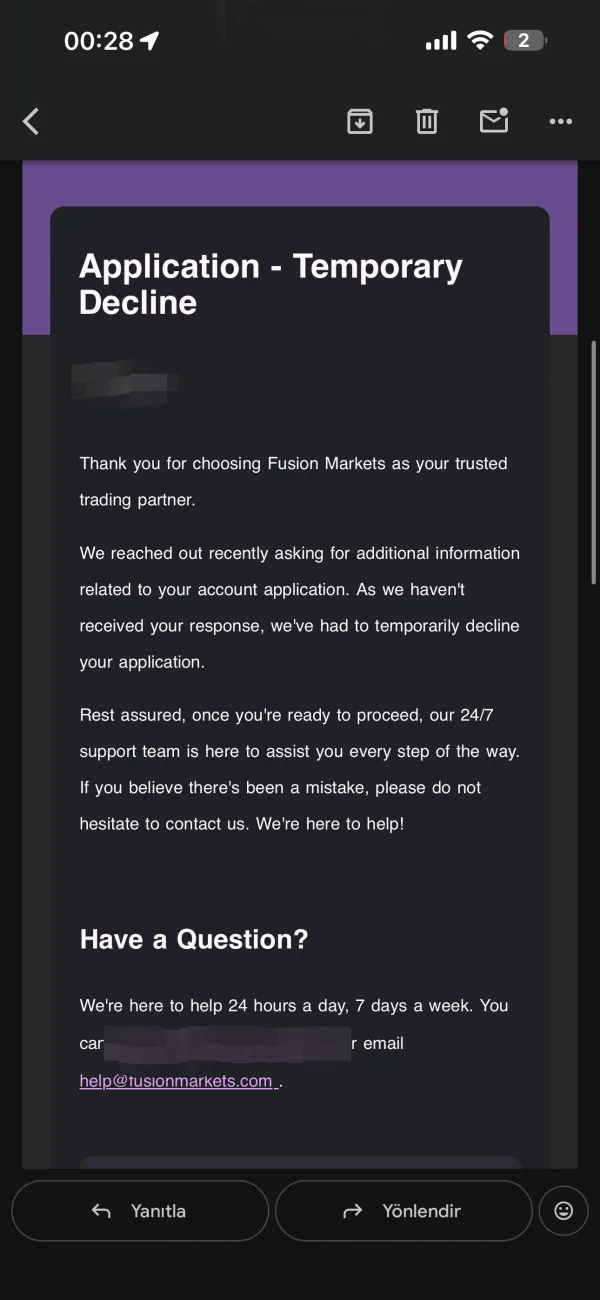

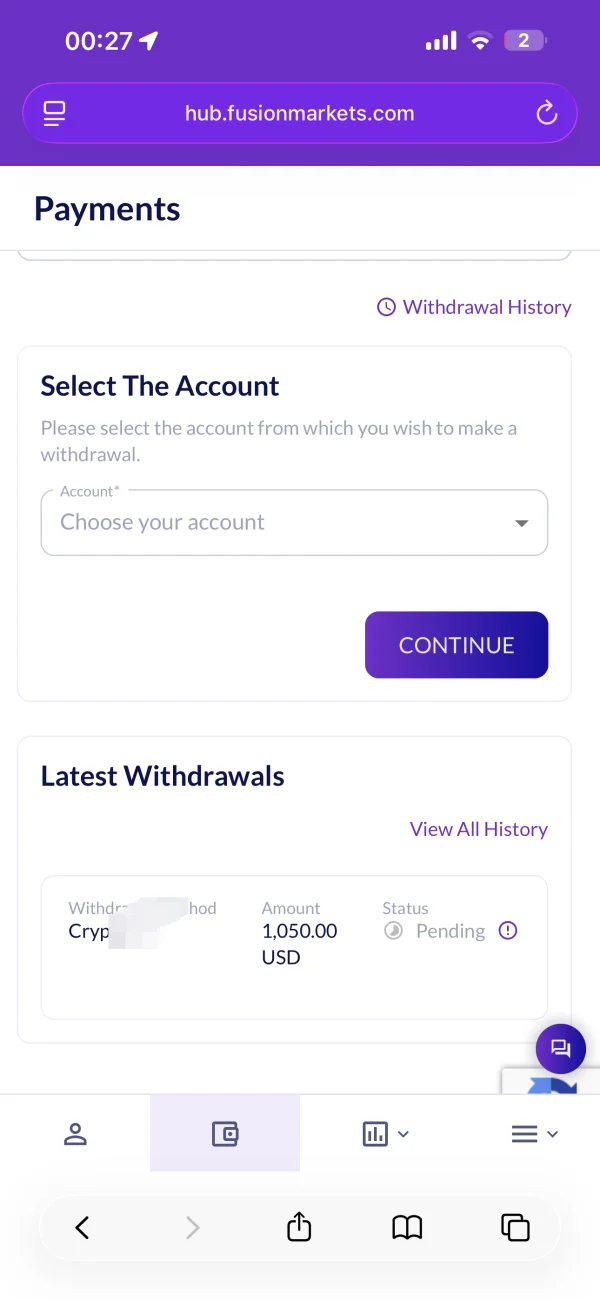

I created an account and uploaded all my documents. Then I made a fundraising request, and after that, they refused to verify my documents. They asked me to upload two more proof of identity besides my ID card and to take a live selfie. I did all of that, but they still didn't verify and asked for additional documents. They are not returning my funds and are not contacting me. I have $1050 in funds with them; I urgently need help.

Exposure

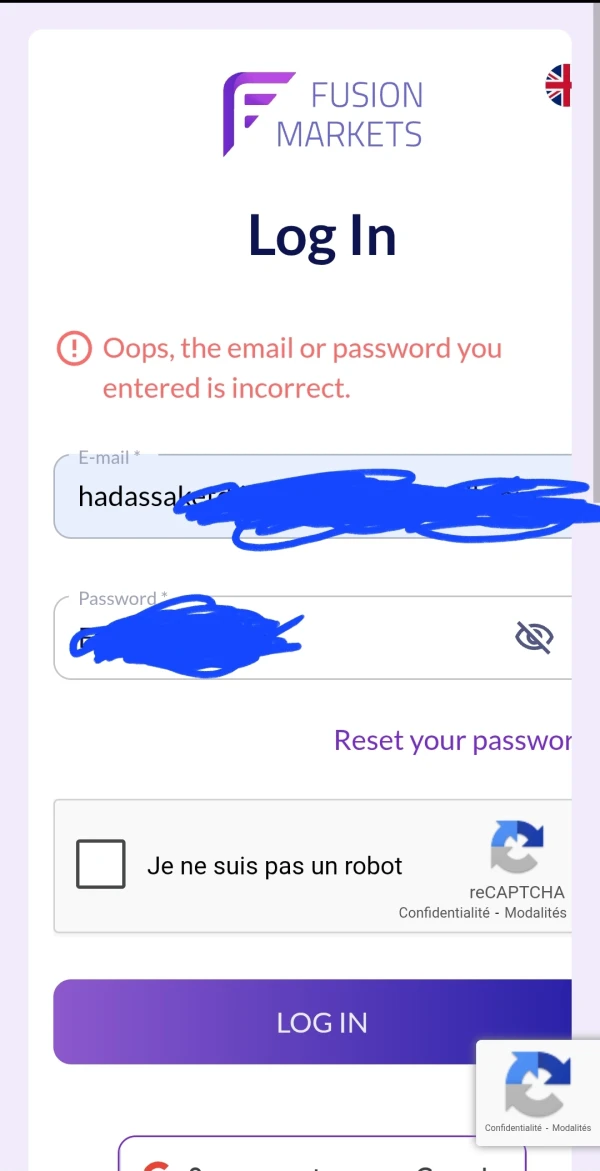

FX4241632869

Canada

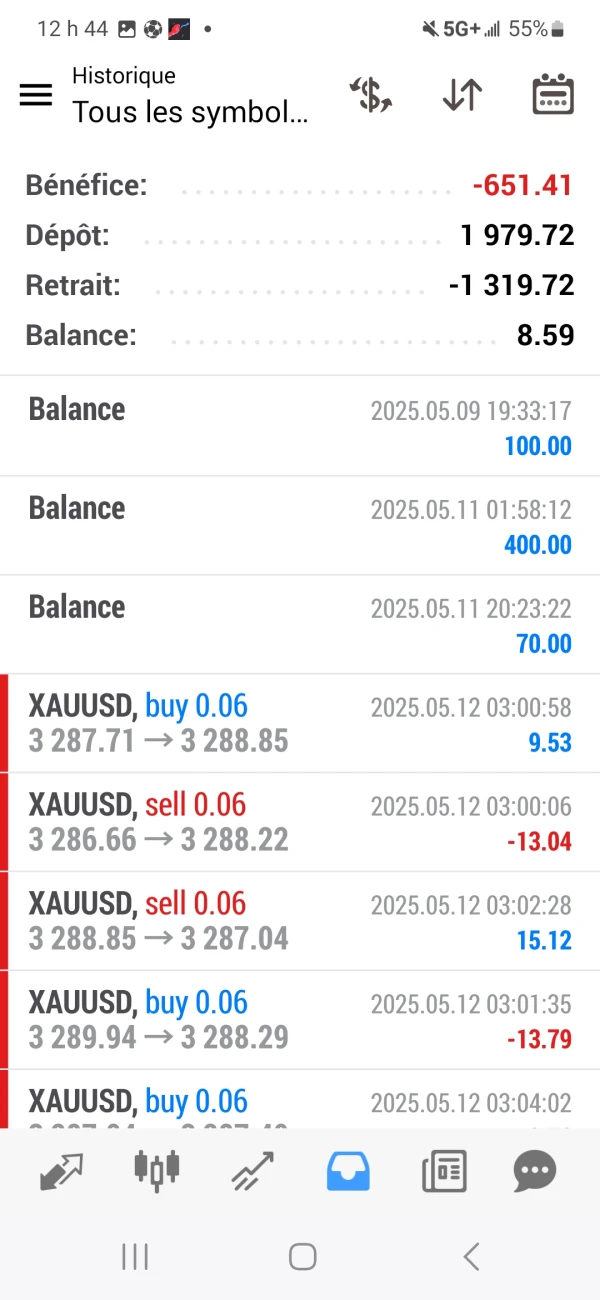

fusionmarkets is a scam broker, it stole 1319 dollars, I can no longer log into my mt4 trading account, even though I reset my password

Exposure

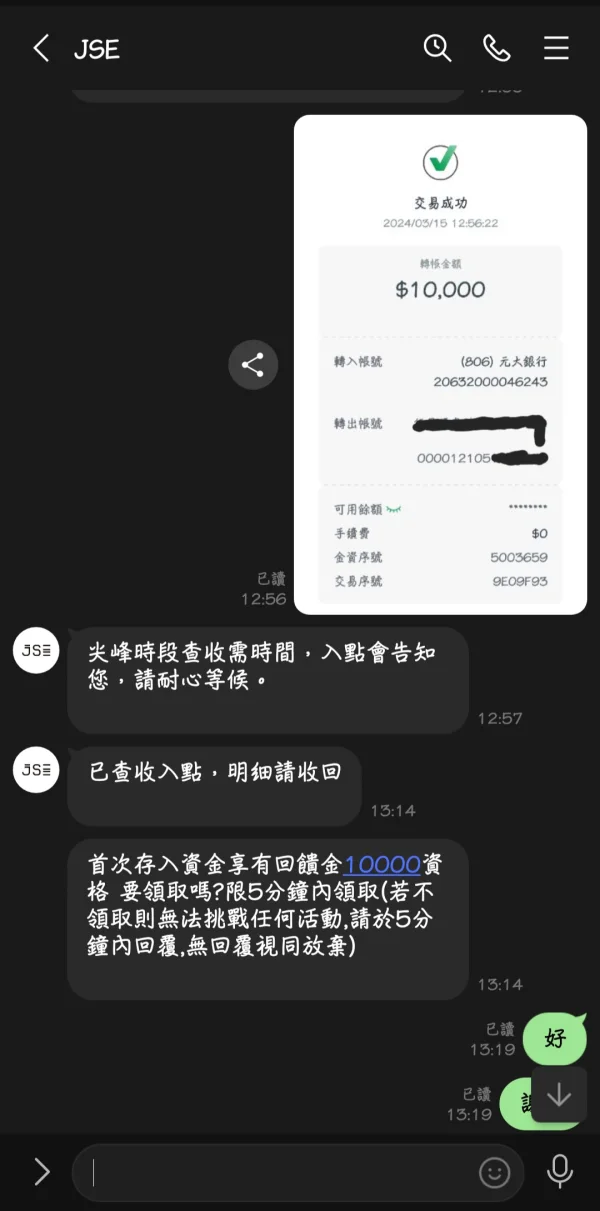

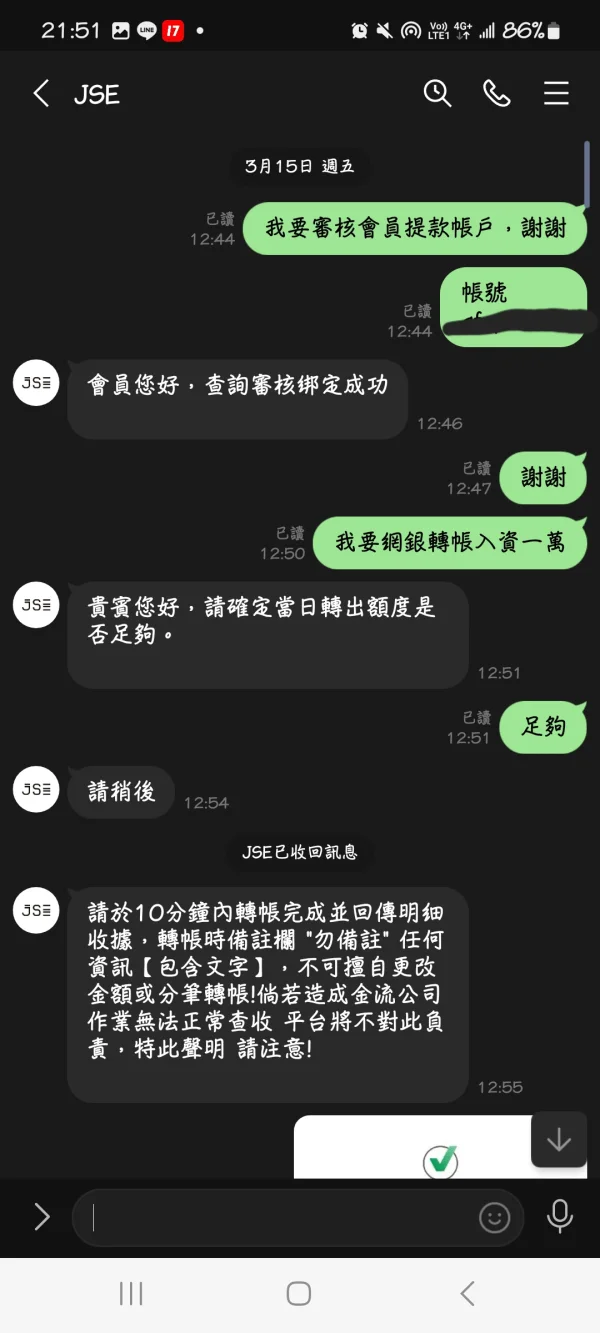

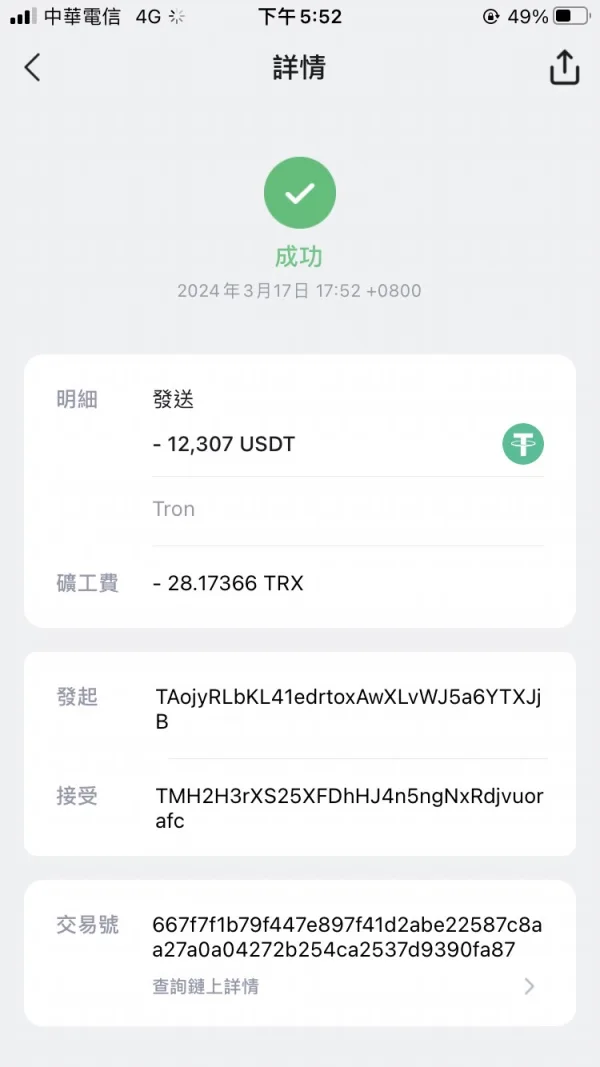

koi355

Taiwan

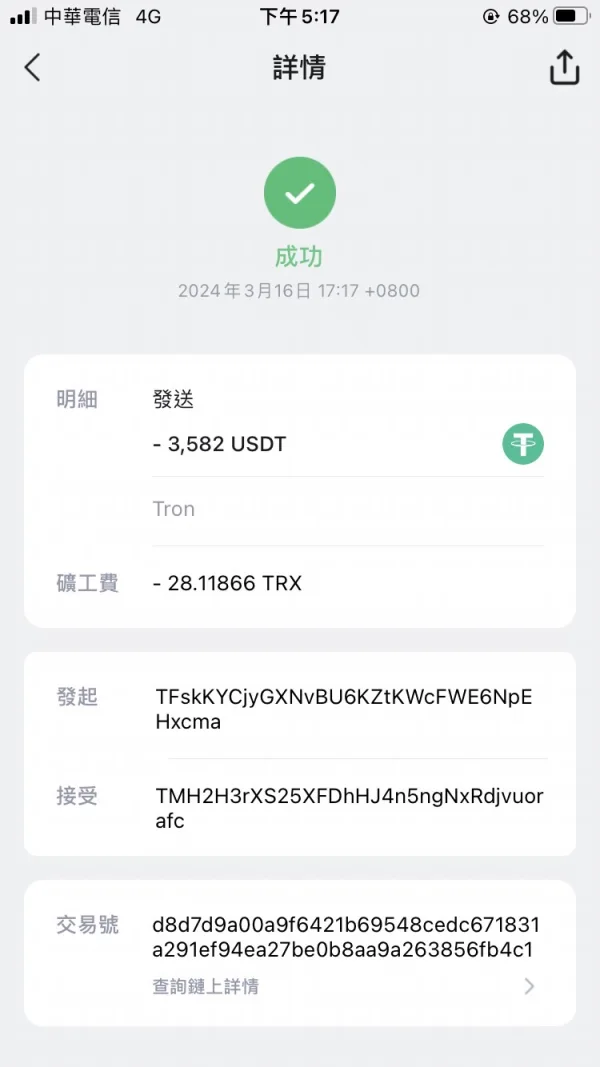

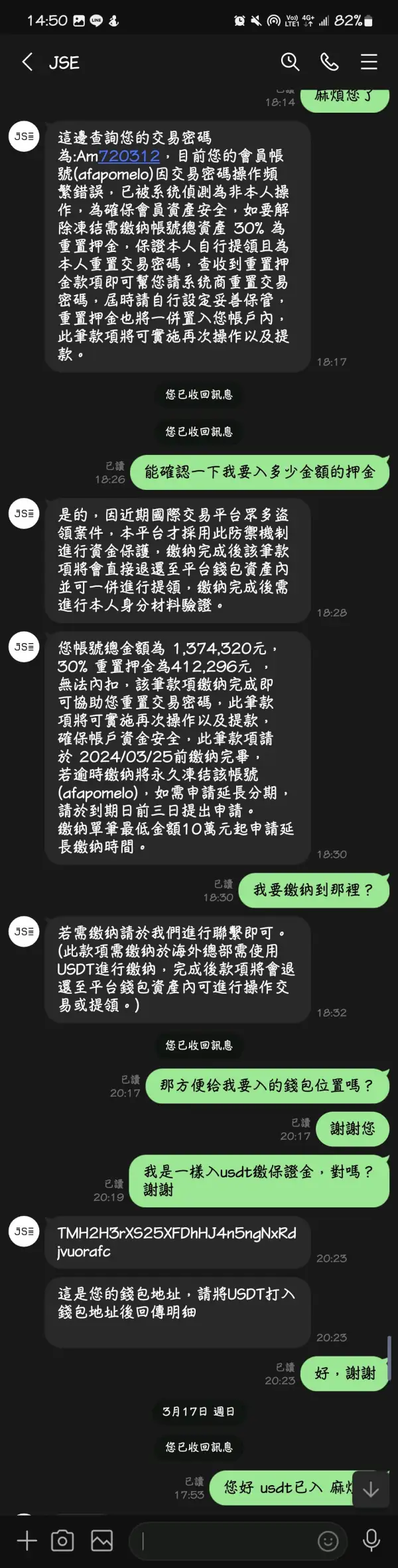

Claiming to be an investment company (look at the solicitation information, the company registrant is a celebrity), sign a capital guarantee contract, and guide the registration of the jseobf.com platform (the website address is changed all the time). After making profits, the money cannot be withdrawn. They said that I didn't meet the platform standard and needed to deposit. After that, they said my password was incorrect and a margin was required again. After the margin was paid, the platform informed that the activity time had expired and a new deposit was required. During the time, investment company personnel will continue to use contracts to threaten me, telling that if I don’t deposit, I will not be compensated with high amount.

Exposure

FX3850441903

Taiwan

1. Account Opening Process: Fast and Hassle-Free Verification Fusion Markets' account opening process is quite straightforward, requiring no complicated documentation. The author's same-day approval during testing proves the high efficiency and smoothness of the review process, which is a significant advantage for traders in urgent need of opening an account.

Positive

FX2843838381

Bolivia

So far everything is perfect. I hope they continue like this, very satisfied 🥰🥰🥰🥰

Positive

BLACKDEATH

Mexico

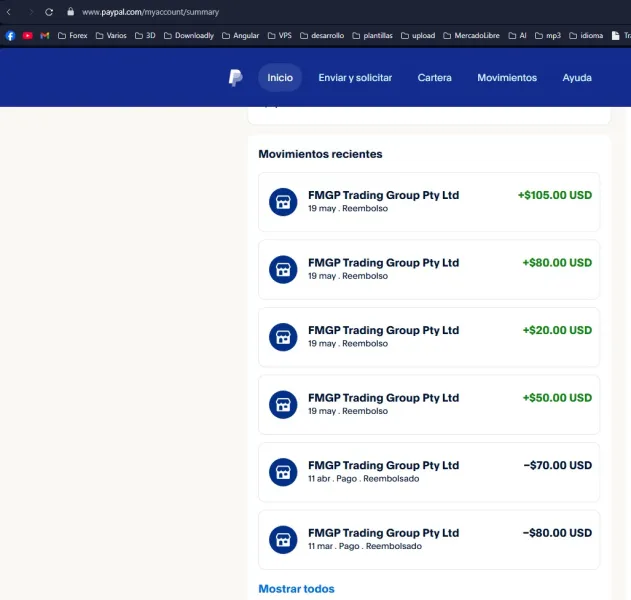

Today I made my first withdrawal and it was a complete success, the withdrawal was processed and in less than 5 minutes I already had the money in my PayPal account, I was surprised by the speed of the broker, EXCELLENT!

Positive

Montgomery

Australia

Okay, buckle up for my take on Fusion Markets. Platform-wise, it's user-friendly, no doubt. Their resources are a total life-saver for beginners. Now, their customer service is... interesting. At times they're Johnny-on-the-spot, at others, it's like finding a needle in a haystack. Matters get sticky when we talk about their limited instrument choices and occasional hike in fees - not really ideal. Bottom line? If you're a seasoned pro looking for a wide array, you may want to shop around a bit more.

Neutral

Penelope Arabella Winthrop

Malaysia

I've been dabbling with Fusion Markets for a spell now, and man, I'm mostly jazzed about it. Their platform is super easy to manoeuvre. Even for a newbie like me, it felt like playing on home field. Here's the best part - their customer service. Rockstars, every one of them, always ready to sort out my panics. Not everything's hunky-dory, though. I feel like they could do with a few more trading instruments. But, all said and done, they're a huge plus on my trading journey.

Neutral

币凡

Vietnam

I had some issues with deposits at Fusion Markets. It took a while for my funds to show up in my account and their customer support wasn't very responsive. Definitely unreliable to trade with.

Neutral

FX1239803071

Mexico

Do not invest here please. This broker claims that it is authorized and regulated by ASIC, one of the best regulators in the world, but actually the license is fake...

Neutral

王智

Taiwan

I've been trading for a year now and I haven't had any issues so far. I have been doing copy trading on the mt5 trading platform, which is really awesome for me, a newbie in forex. I have already made a lot of money haha, let’s continue to work hard together in the future!

Positive

FX3786556241

Singapore

I open Fusion recently in November. Deposit is easy. Withdrawal Same day via credit cards or PayPal. Recommended ✅

Positive

刘清

Argentina

Currently, in my judgment, I believe that fusionmarkets is a qualified broker. At first I felt good after using their MT4 demo account, so now I started to experience the MT4 real account. It offers a wide variety of trading instruments, and I can trade the ones I like and hold various positions.

Positive