Company Summary

| CommBank Review Summary | |

| Founded | 1911 |

| Registered Country/Region | Australia |

| Regulation | Regulated |

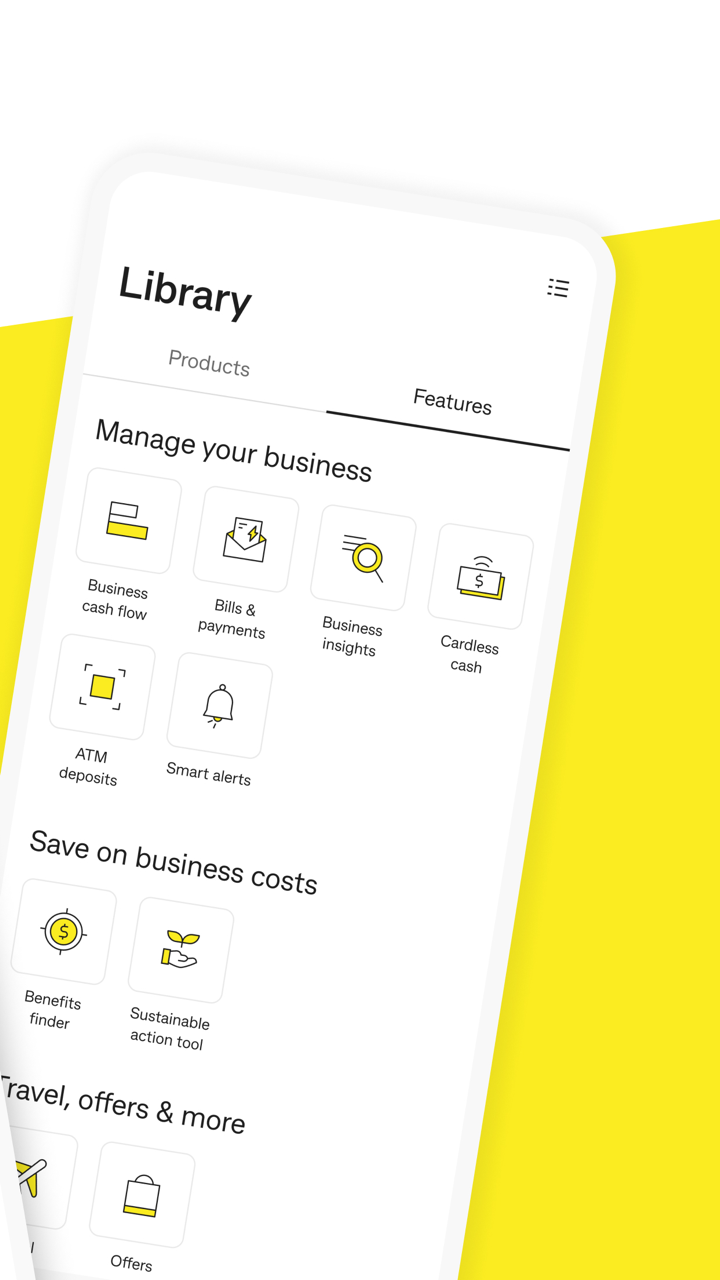

| Products and Services | Retail banking, commercial banking, investment, insurance, superannuation, etc. |

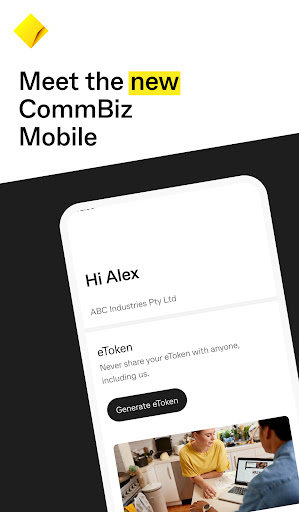

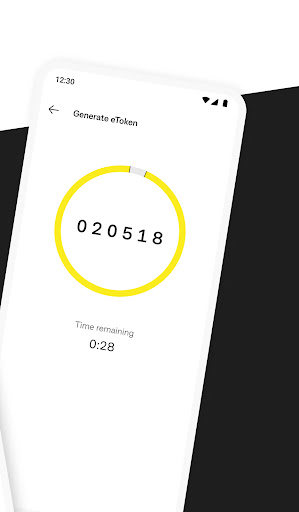

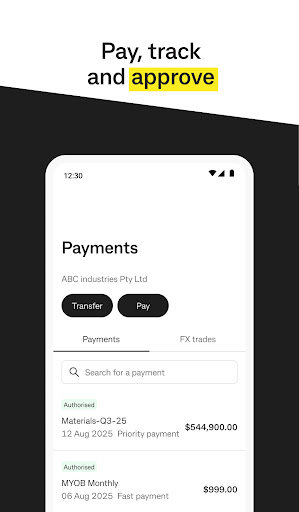

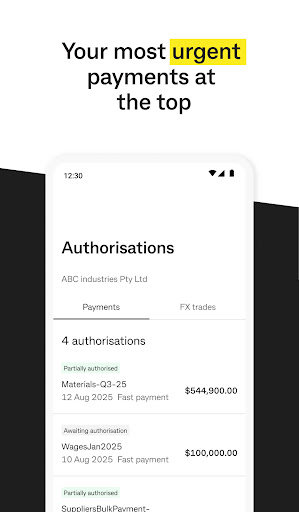

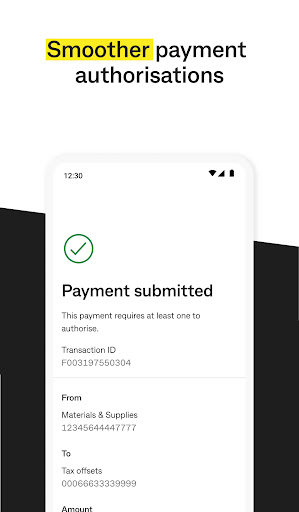

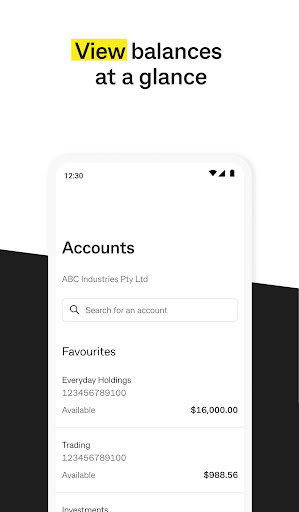

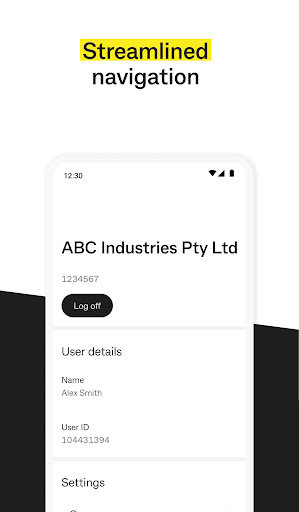

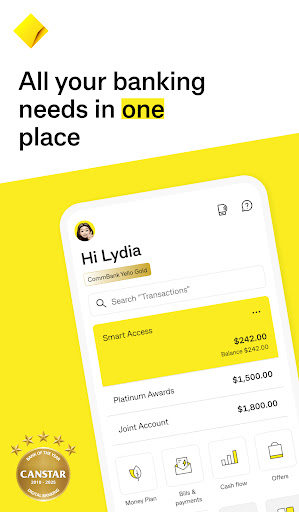

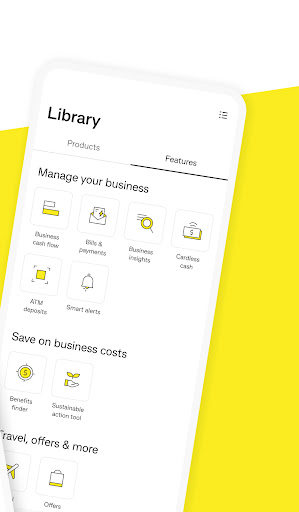

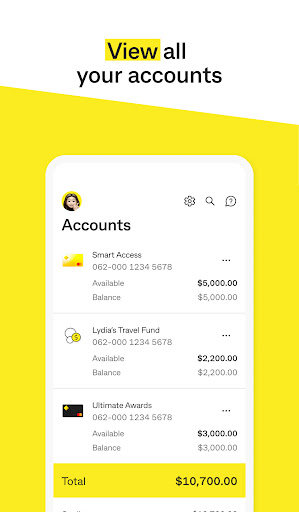

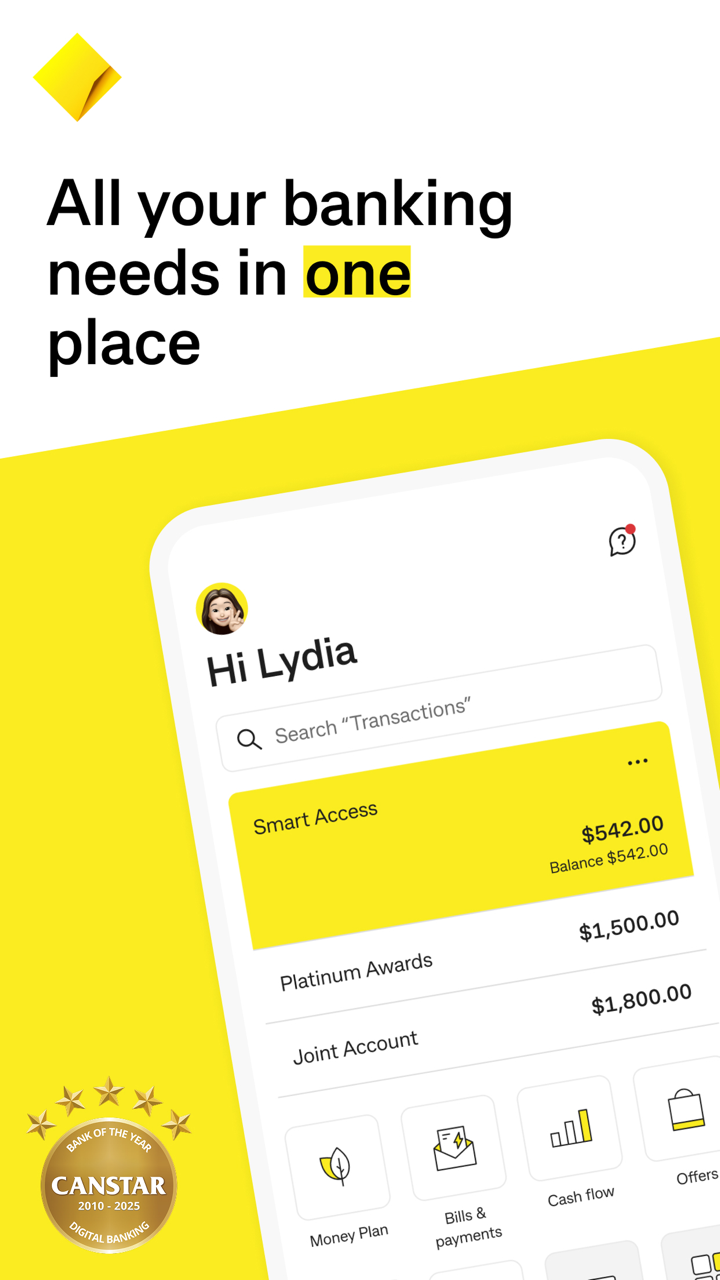

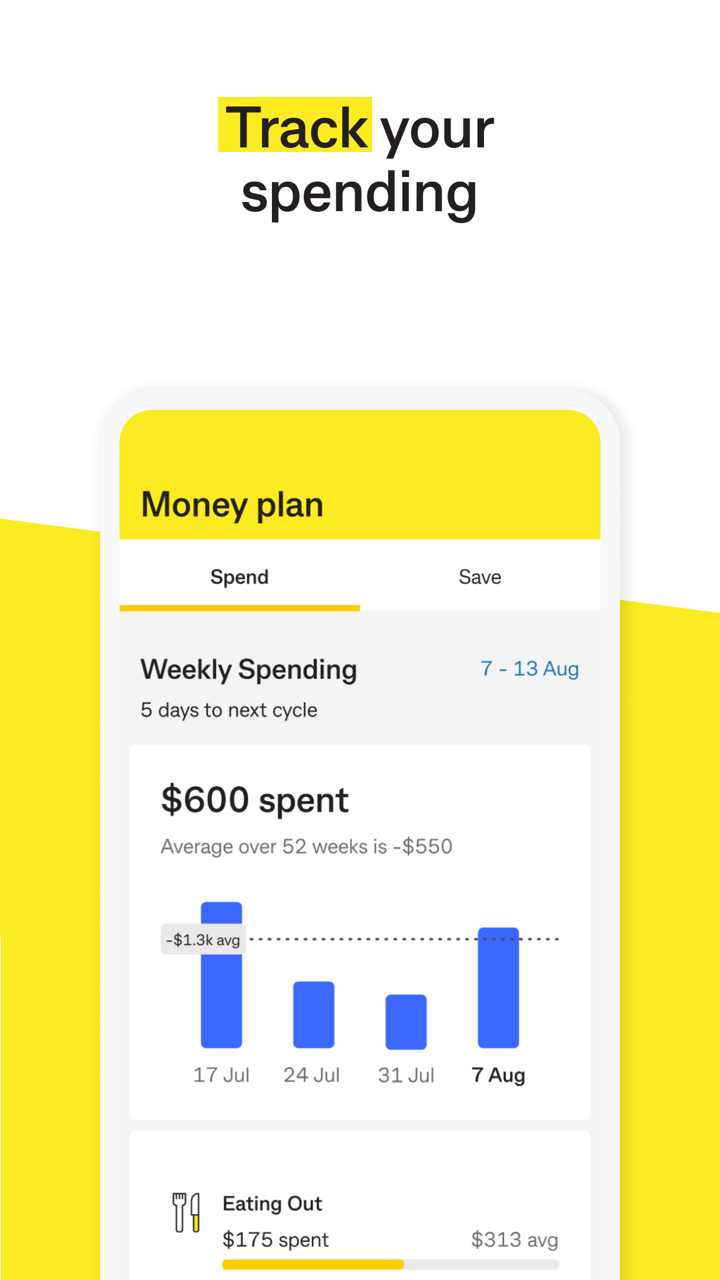

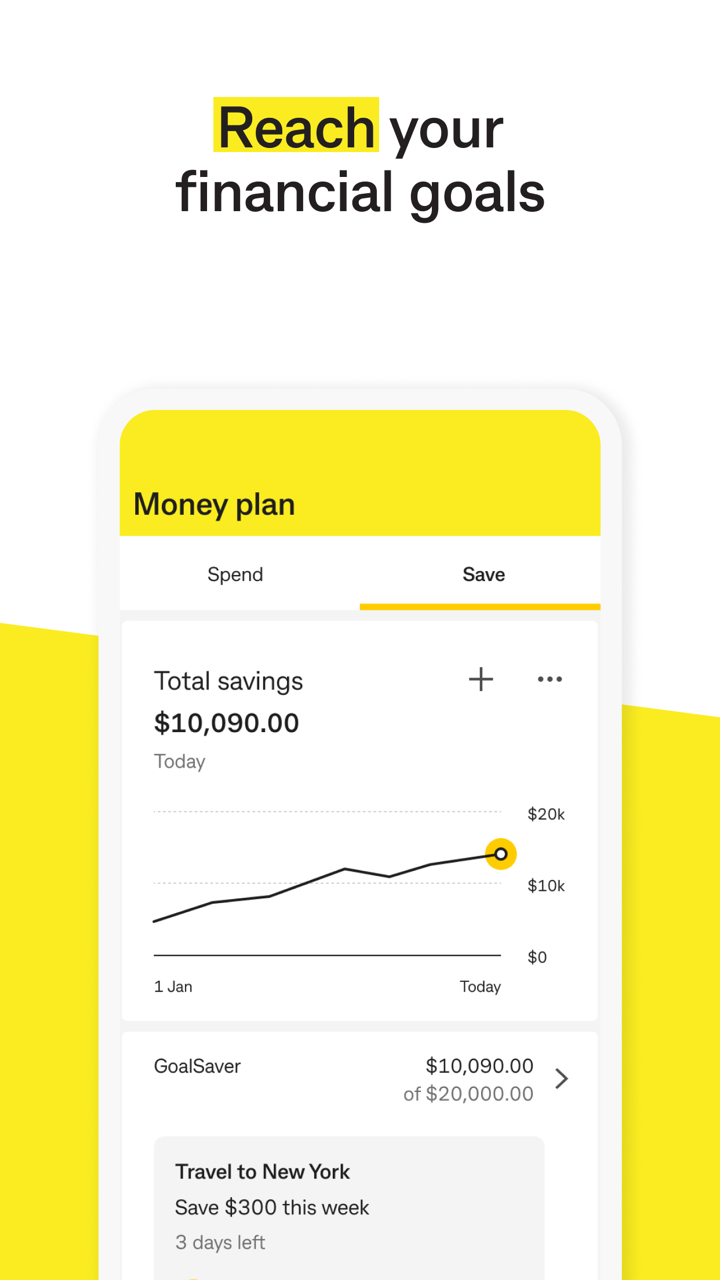

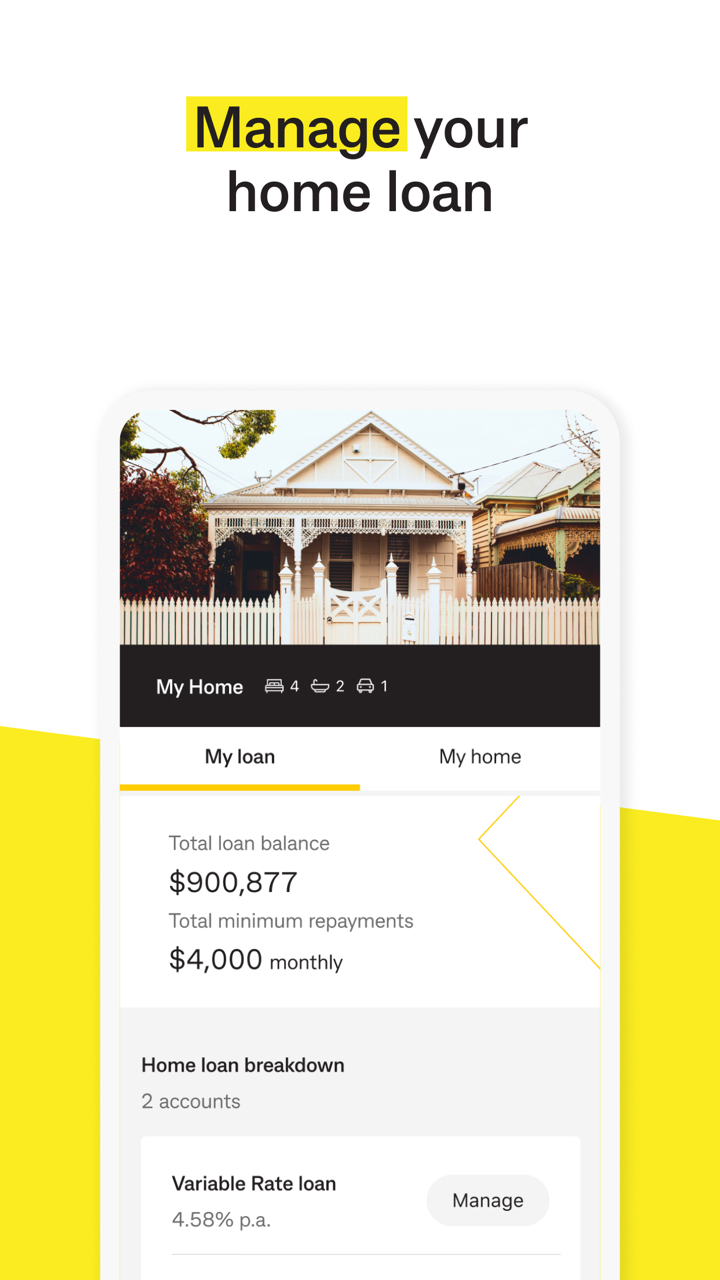

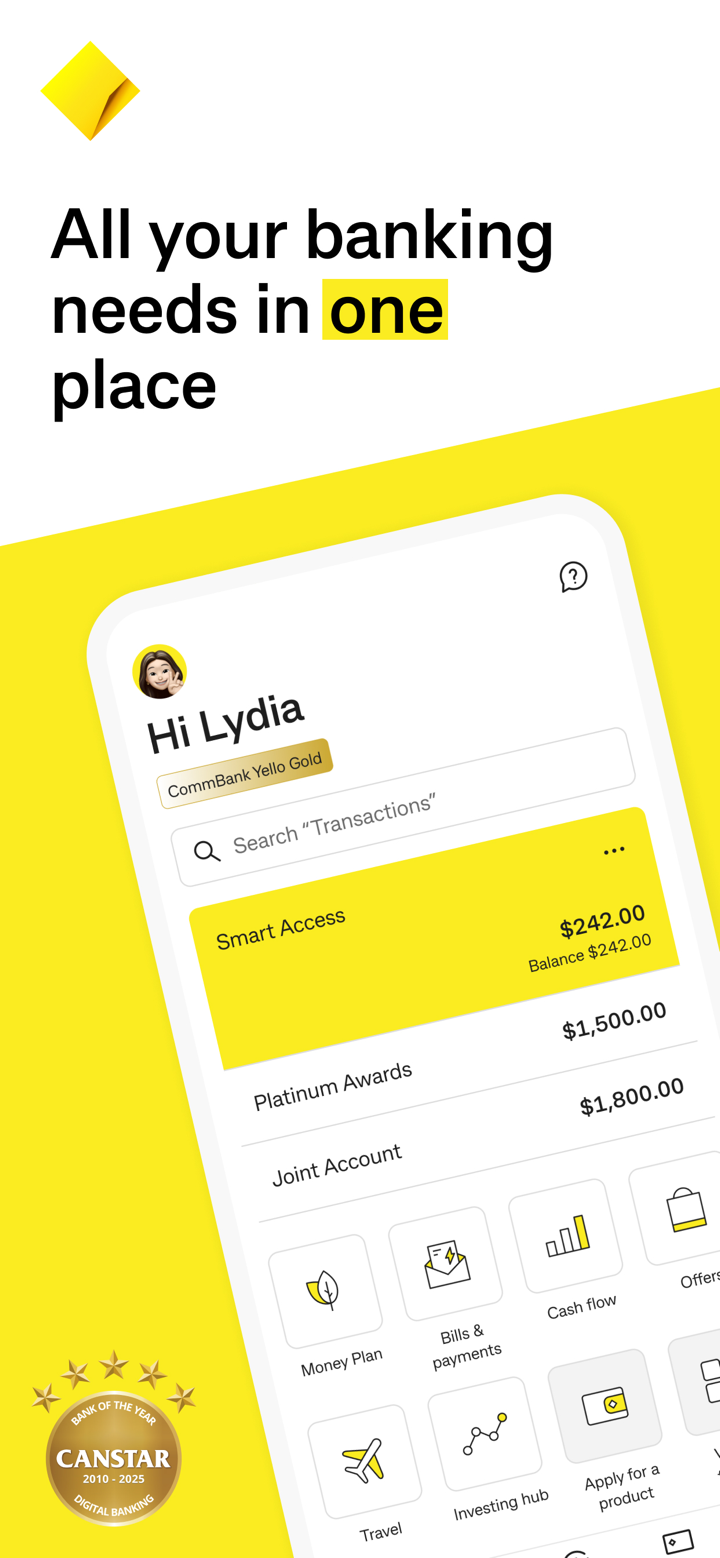

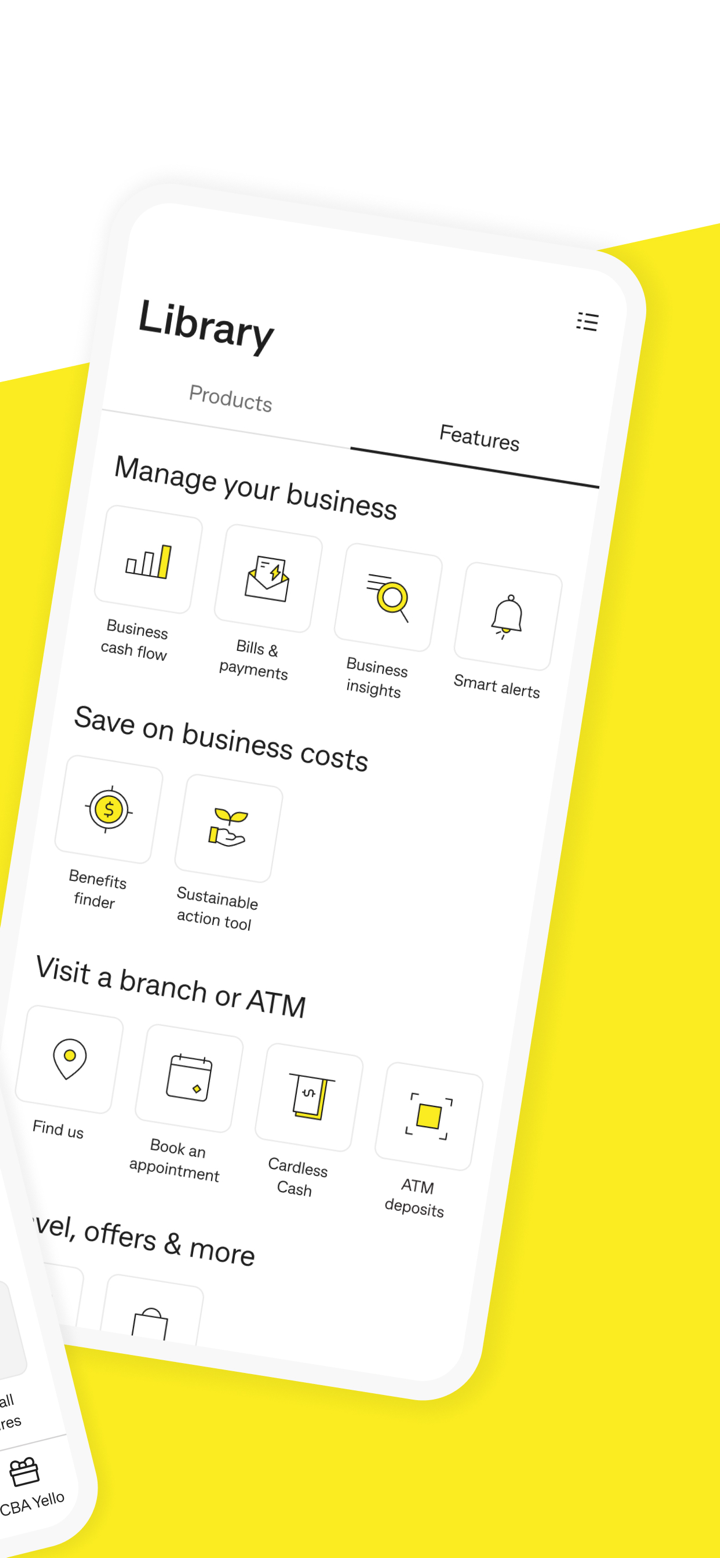

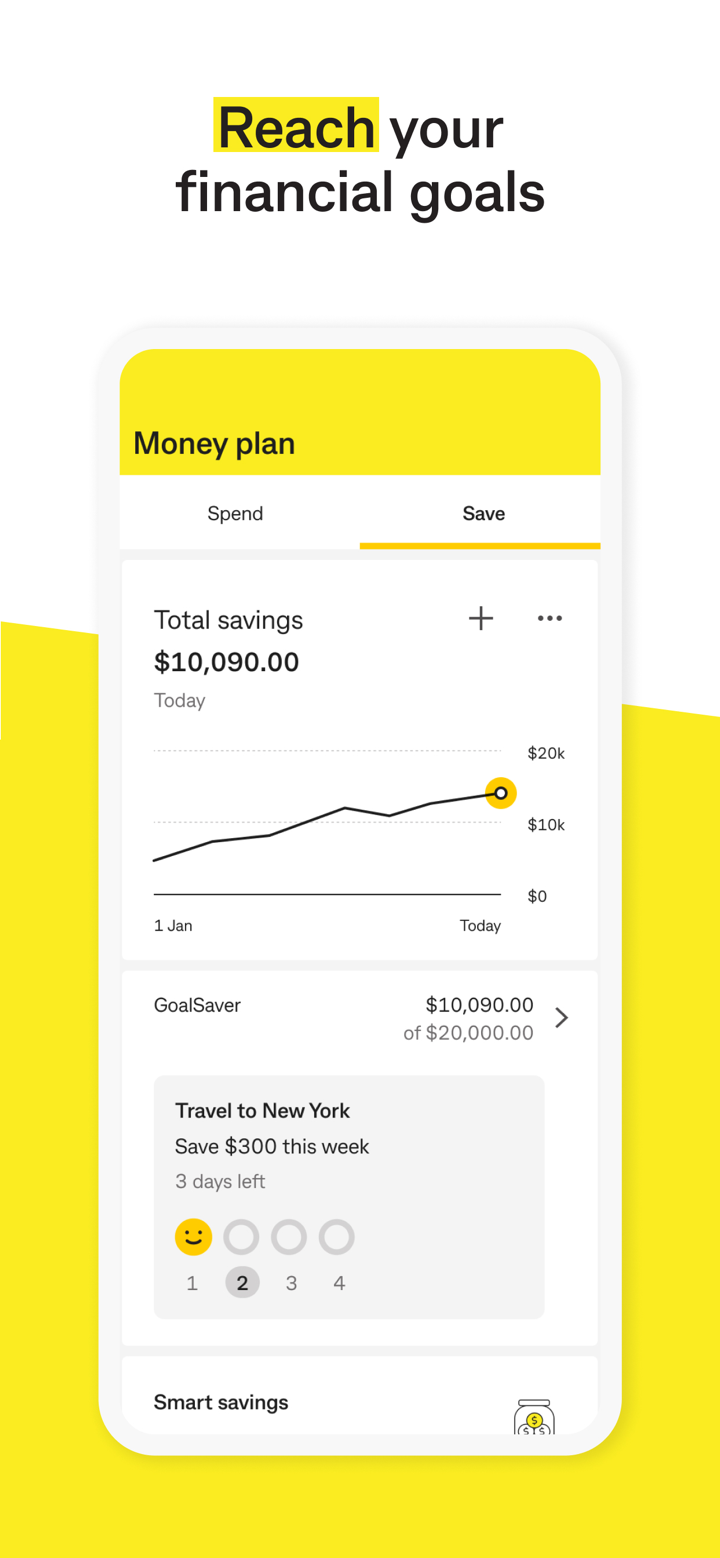

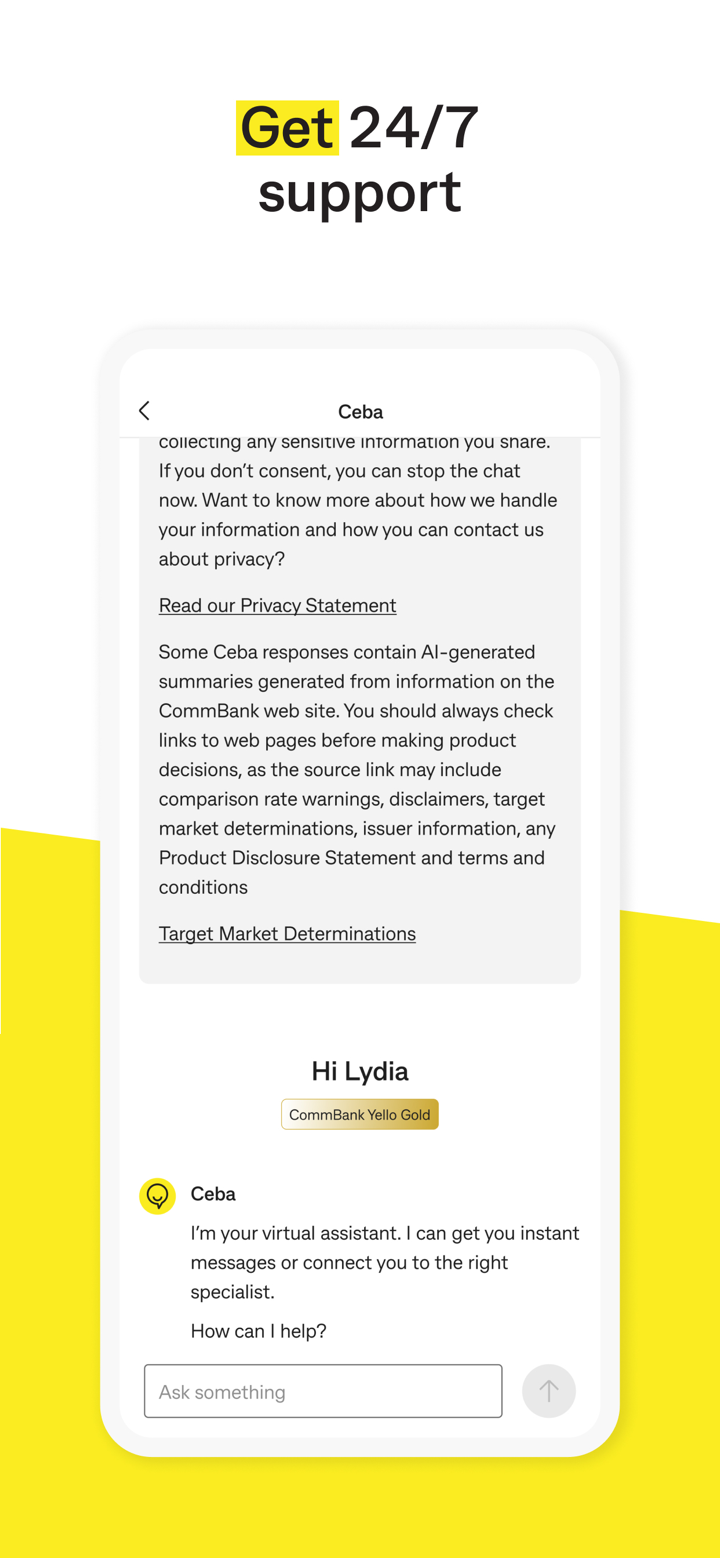

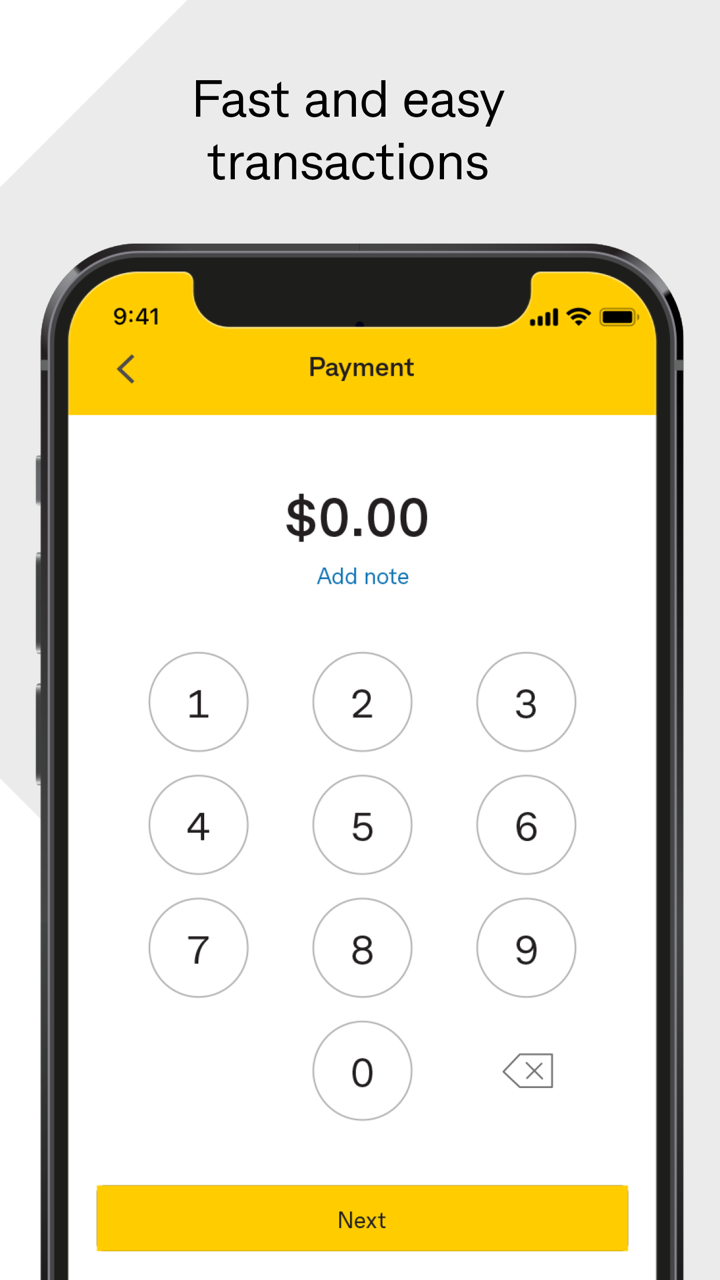

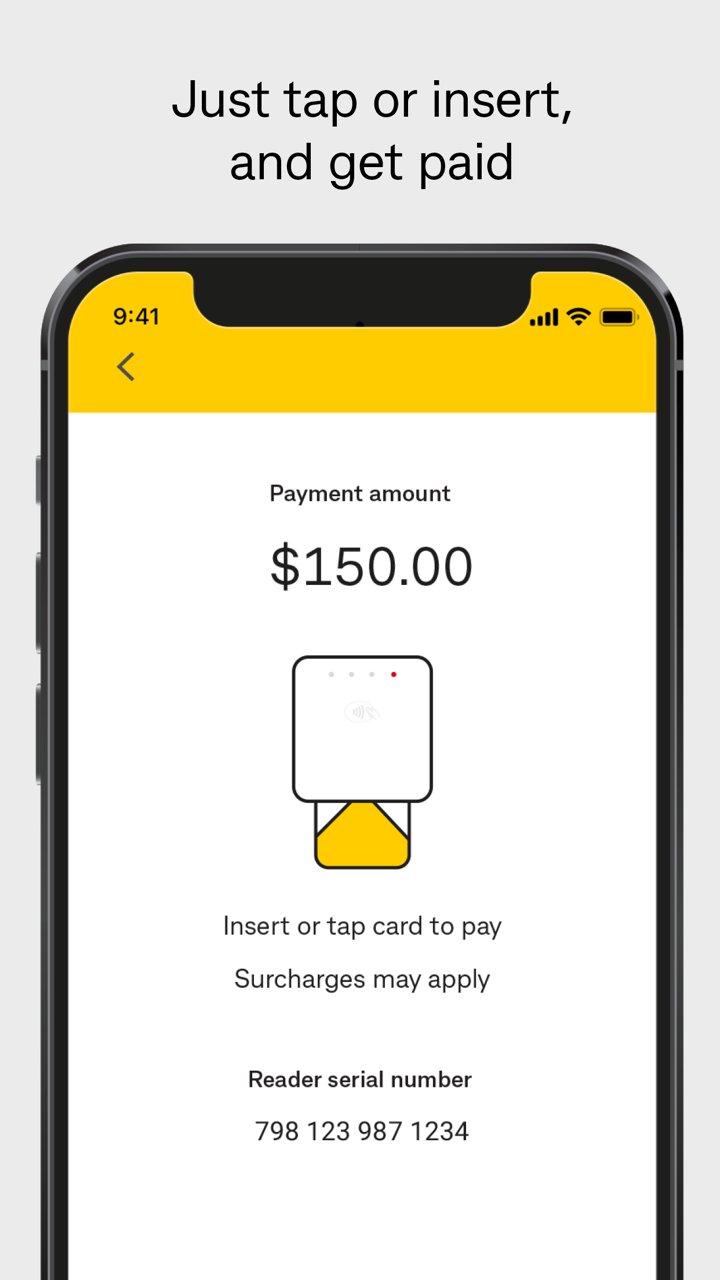

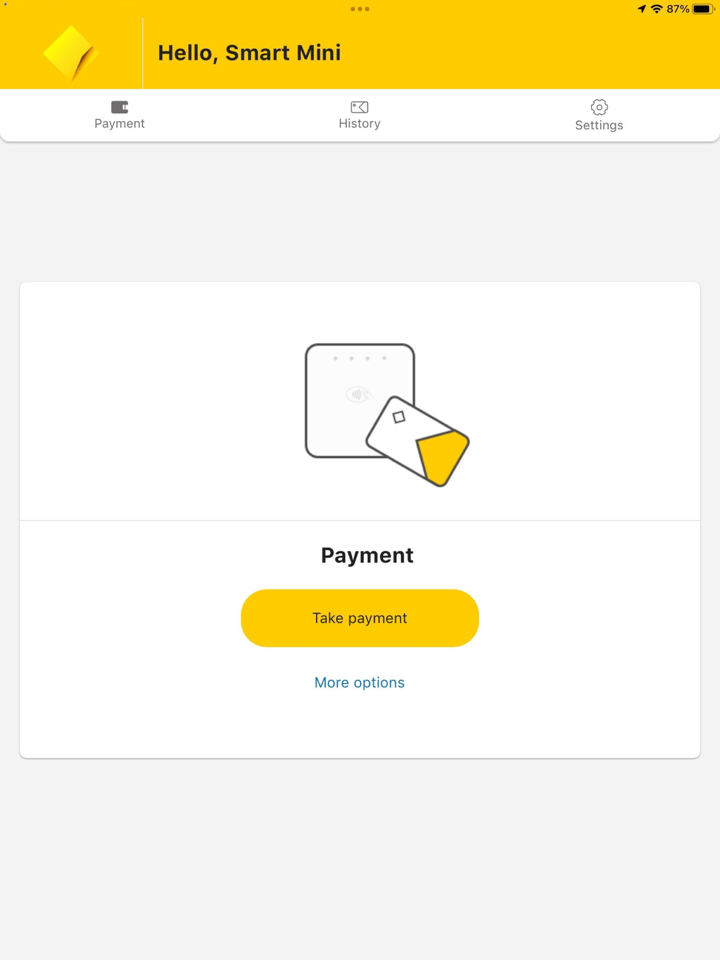

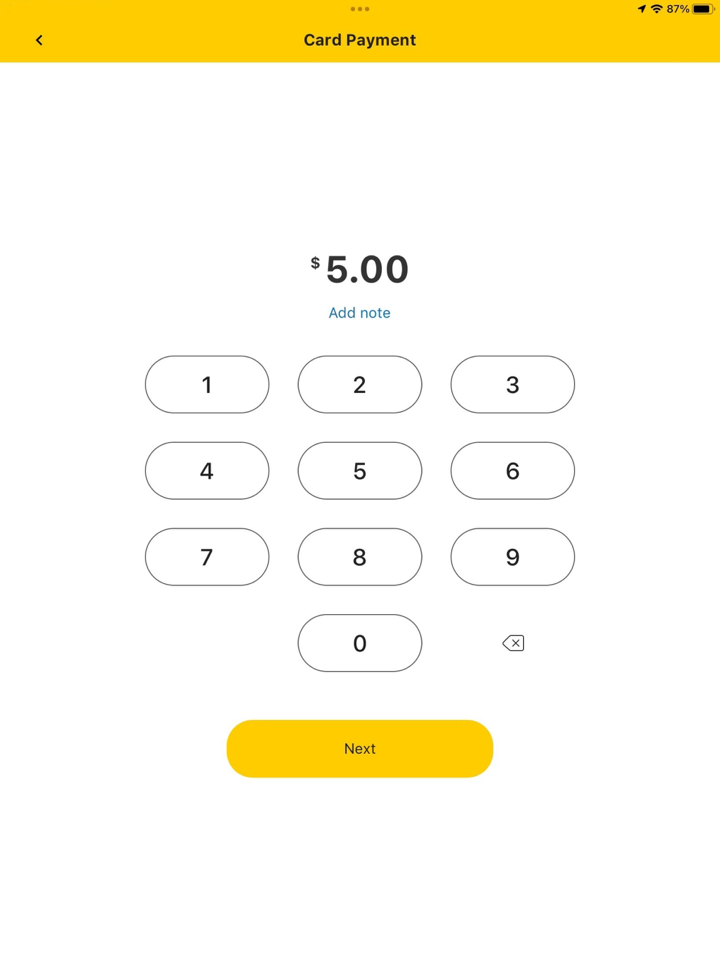

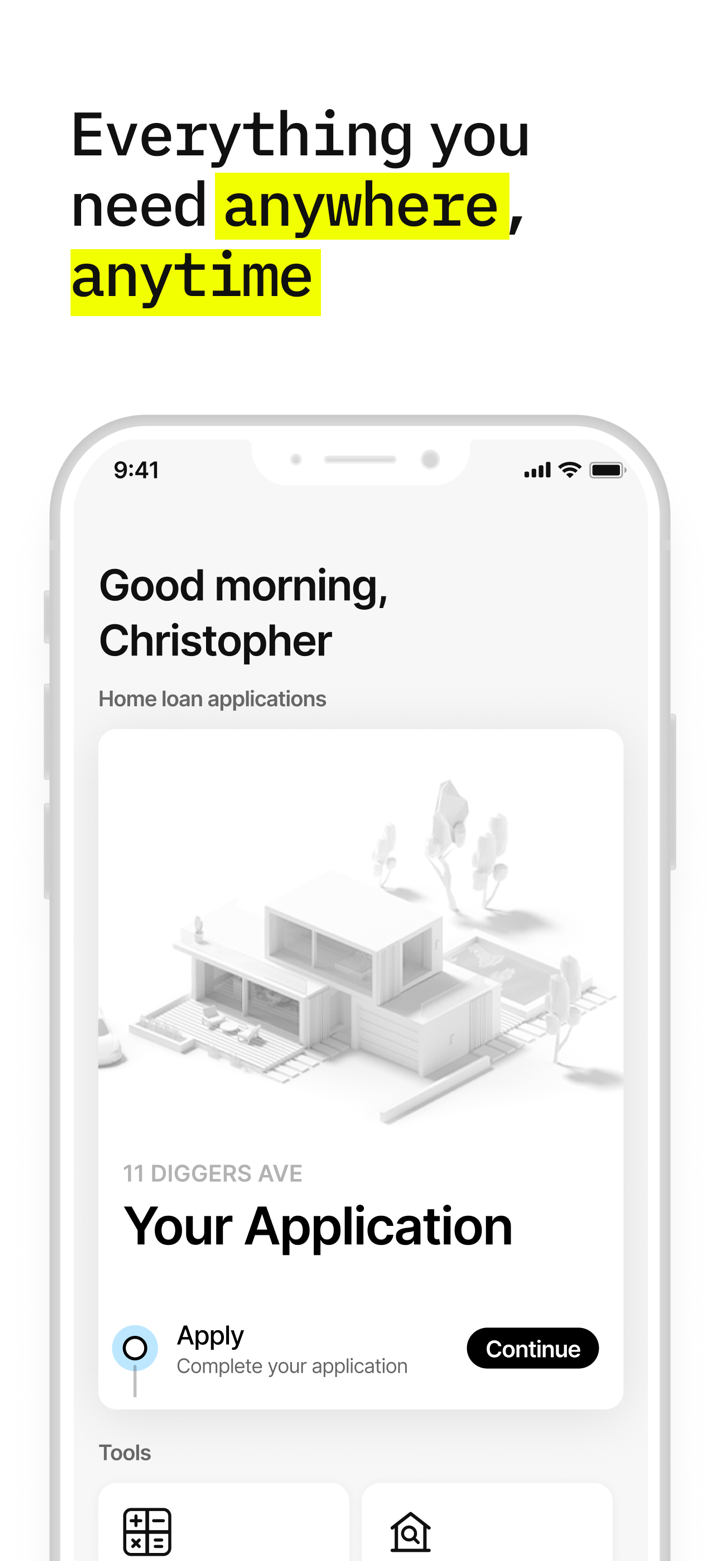

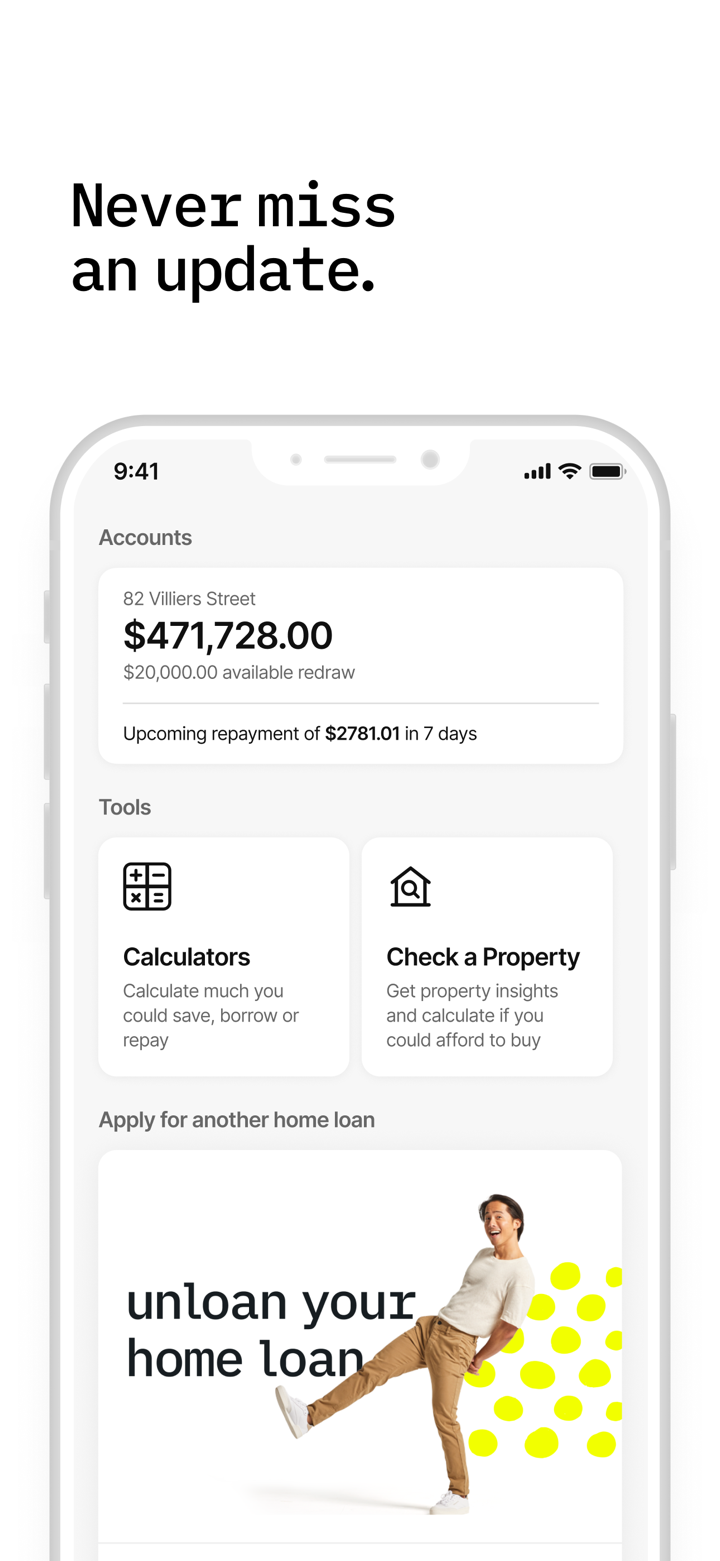

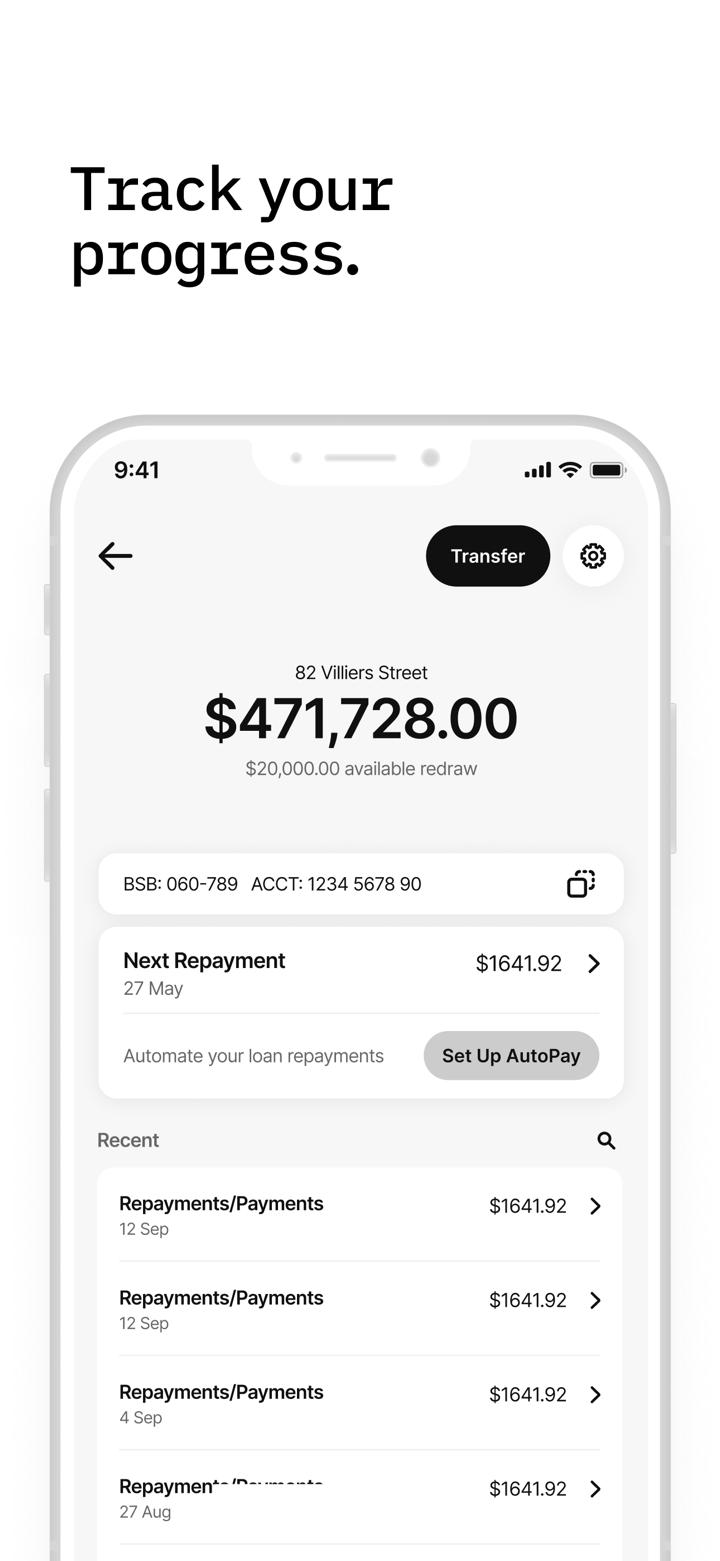

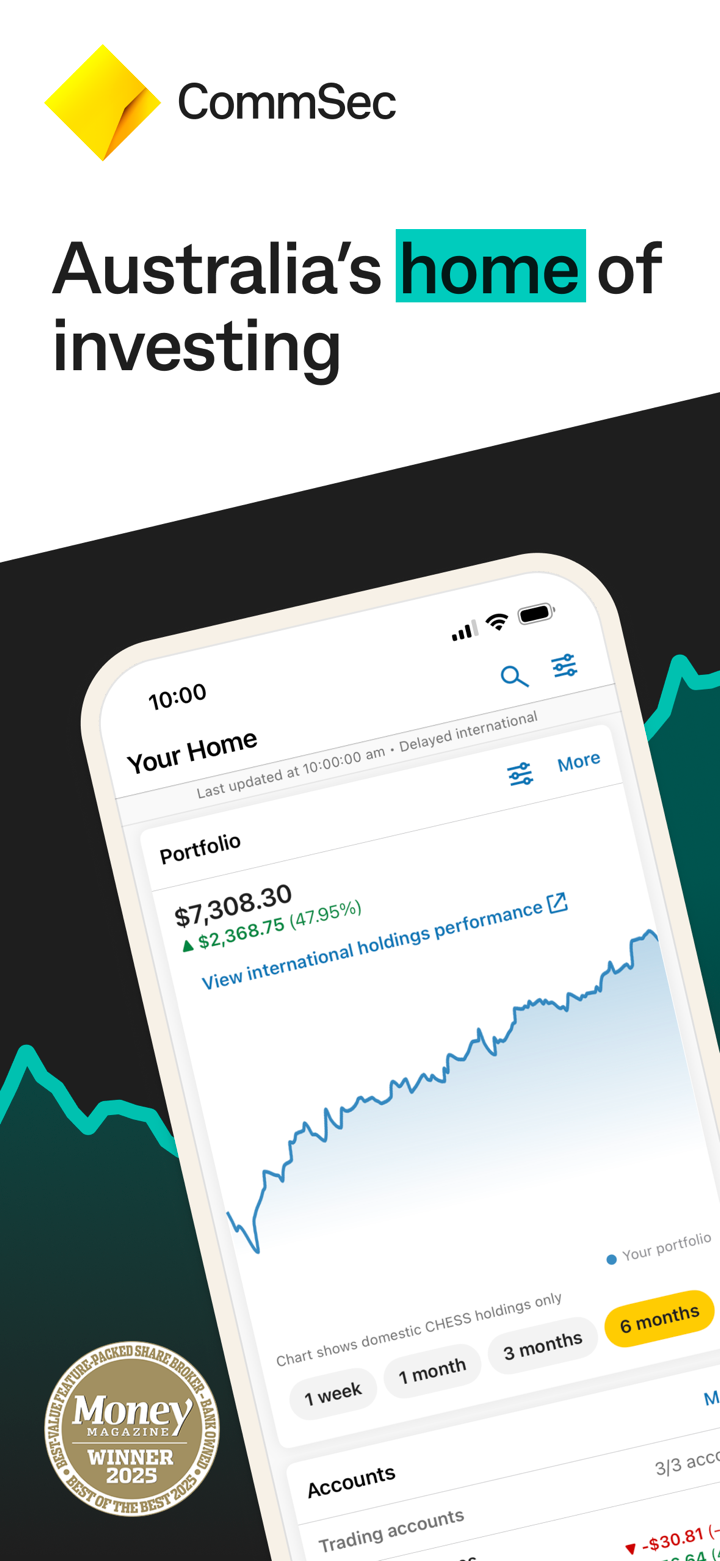

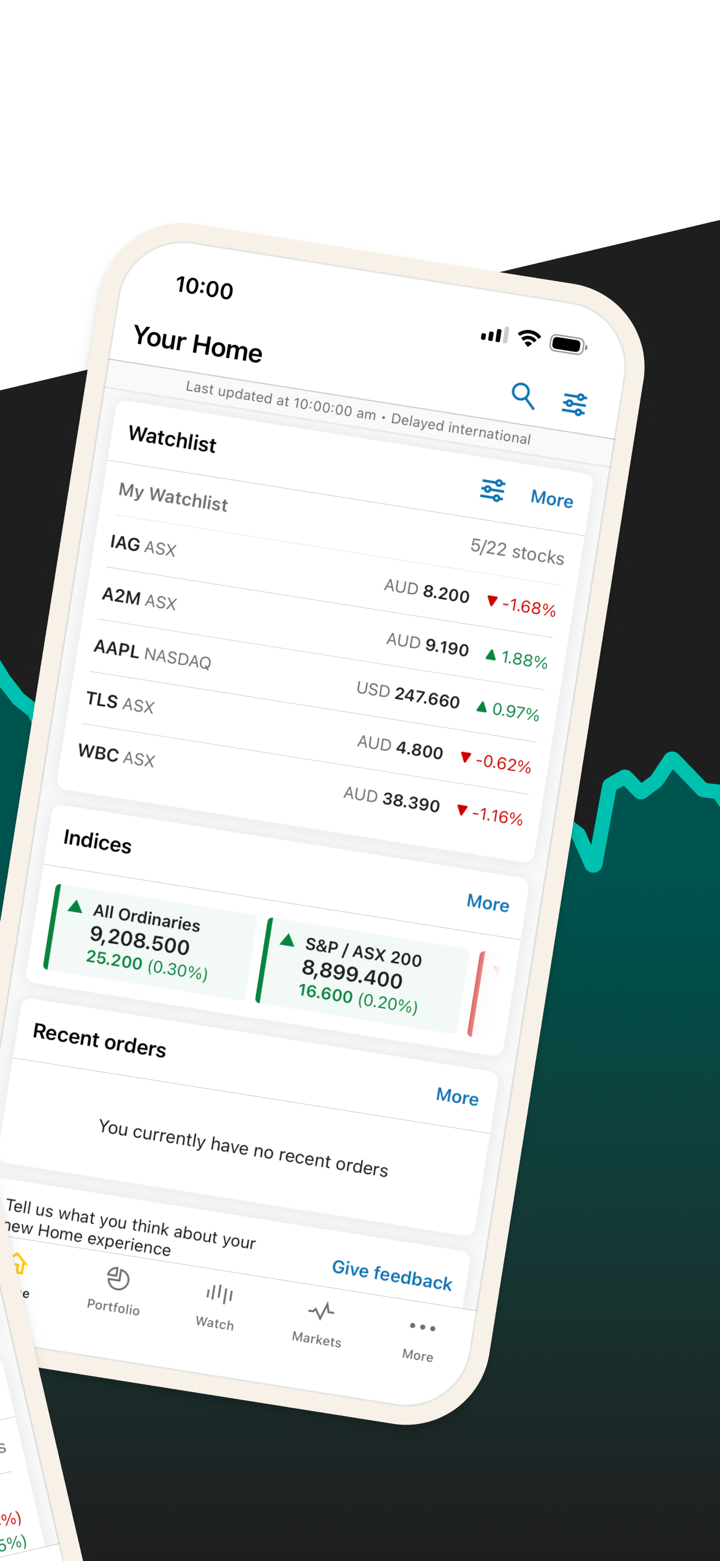

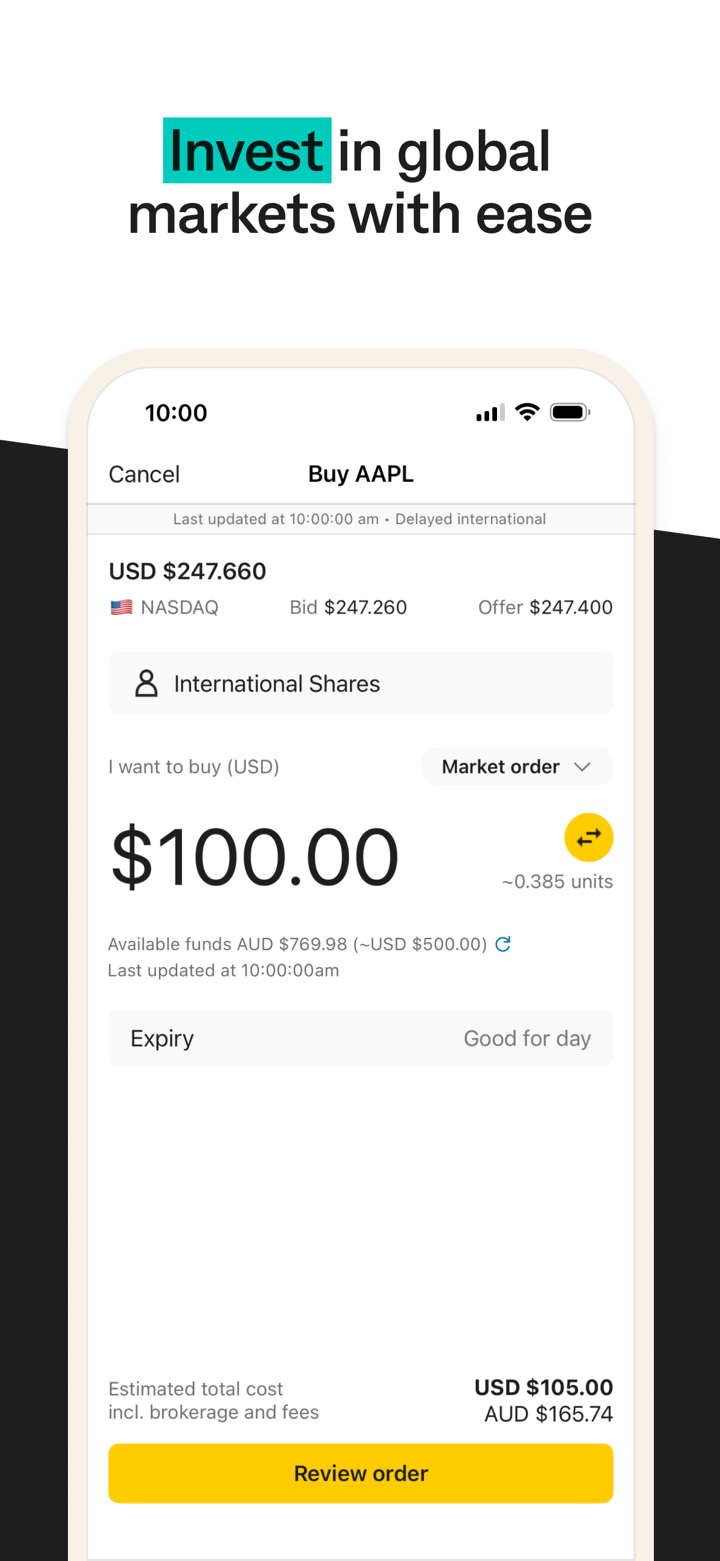

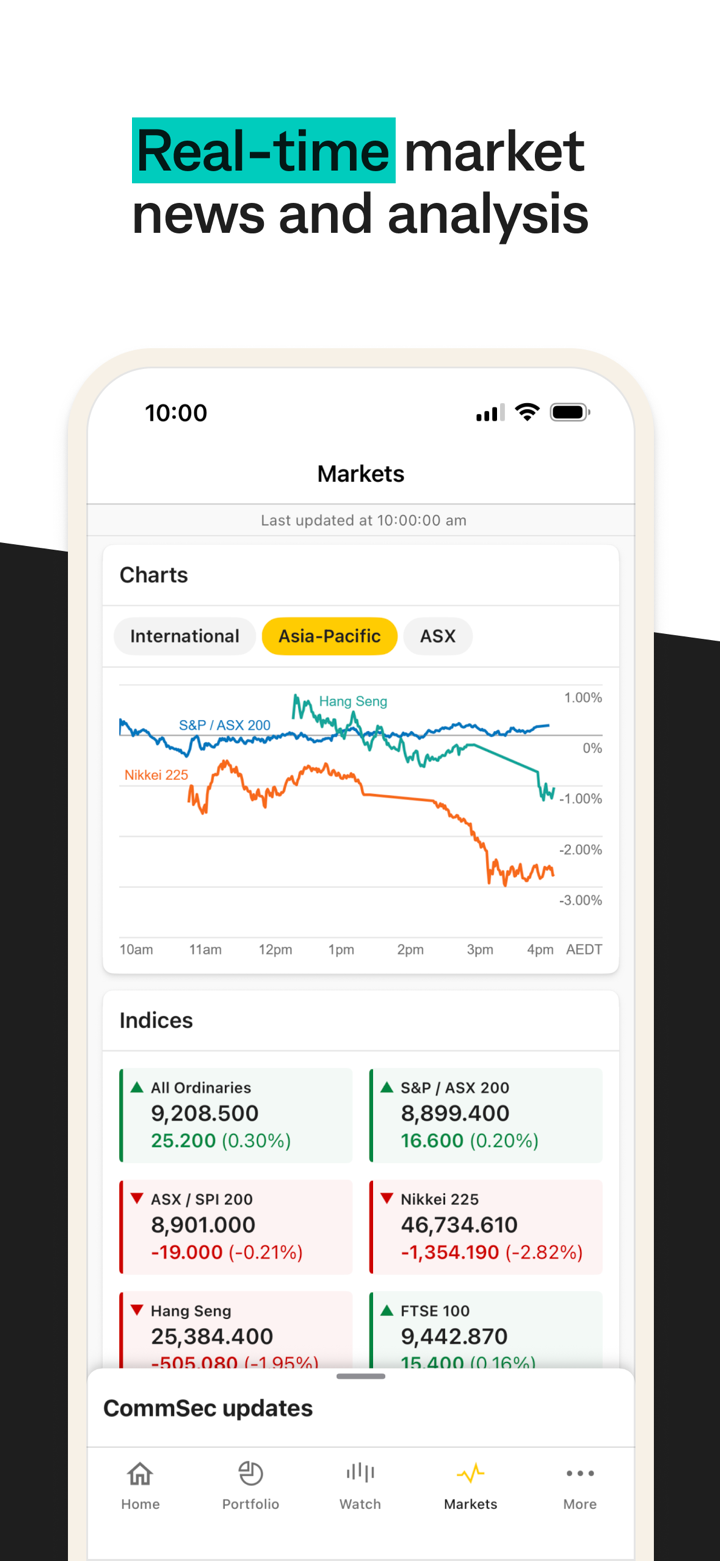

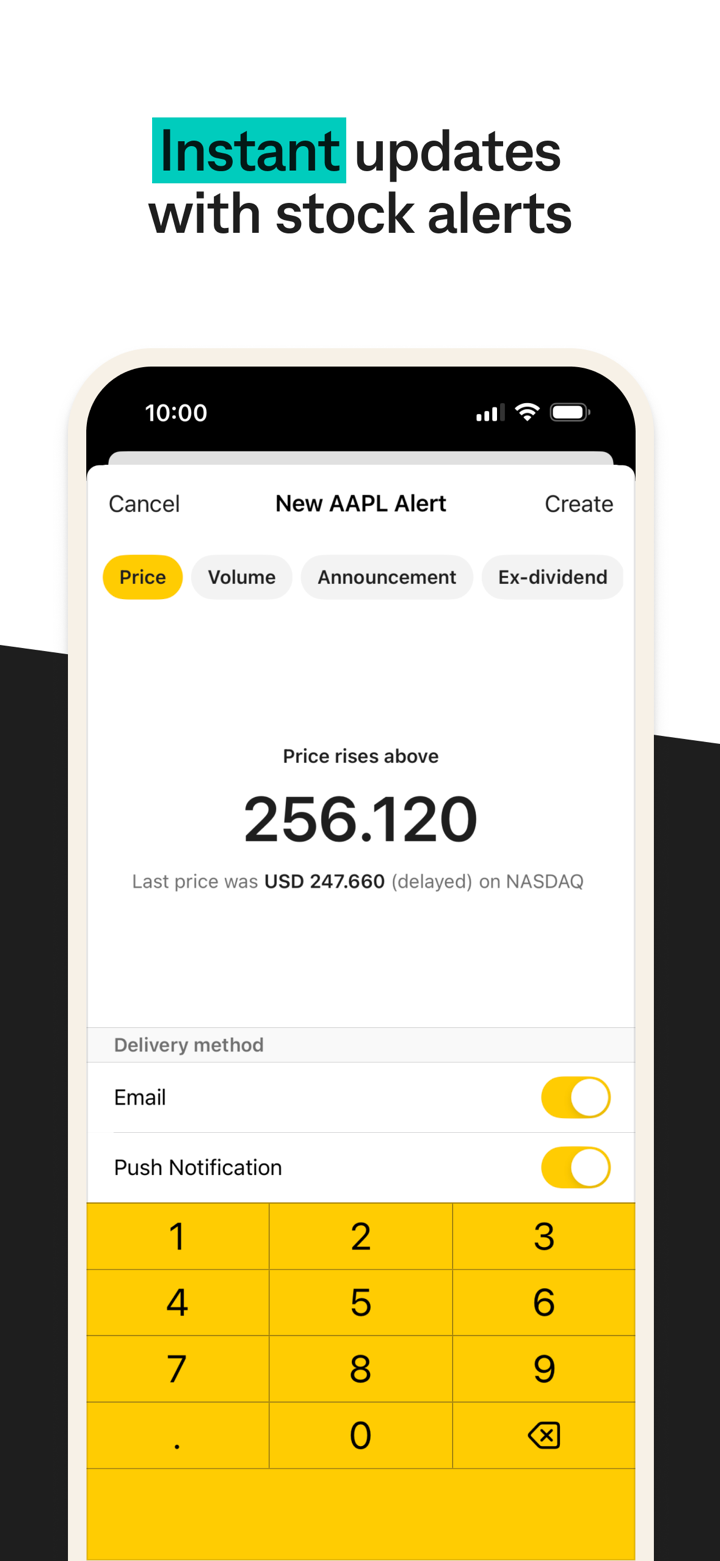

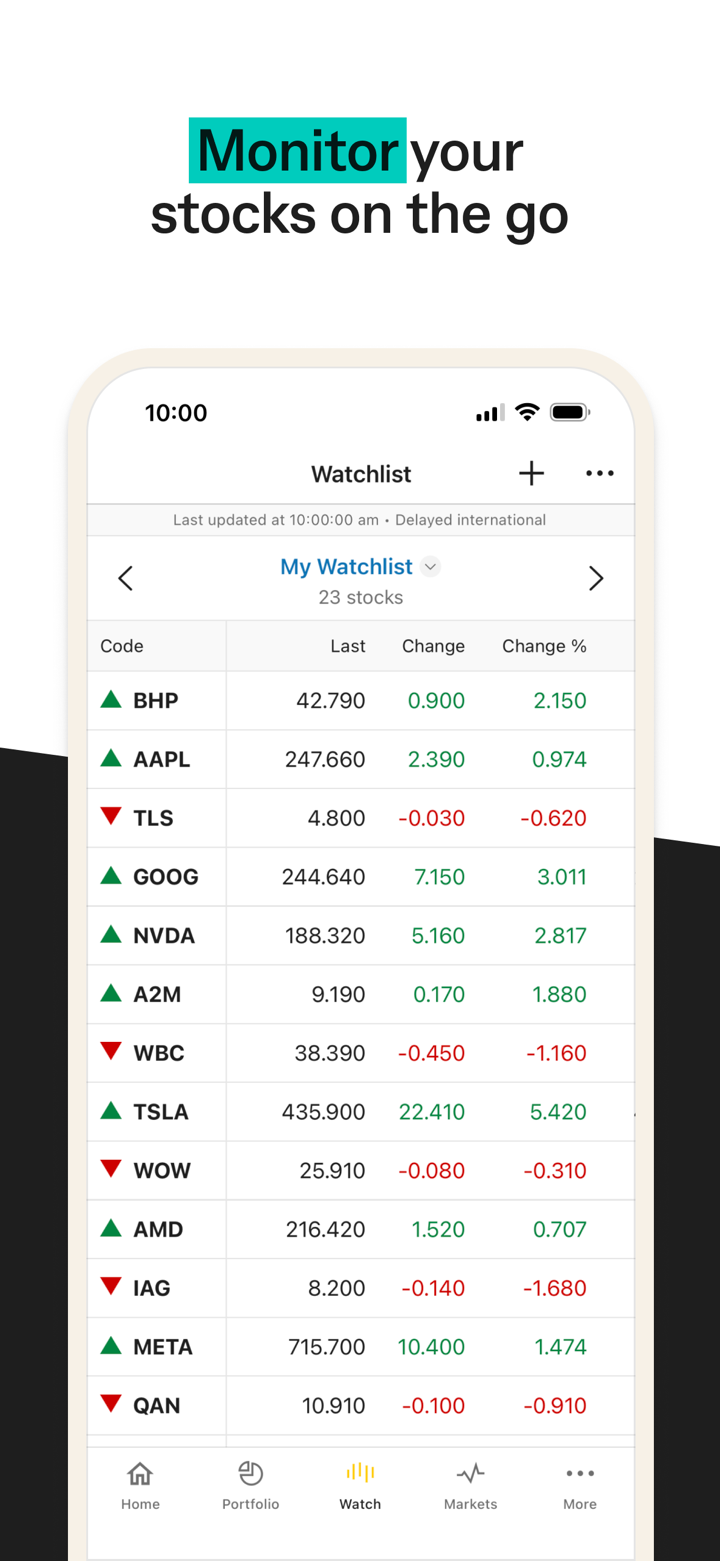

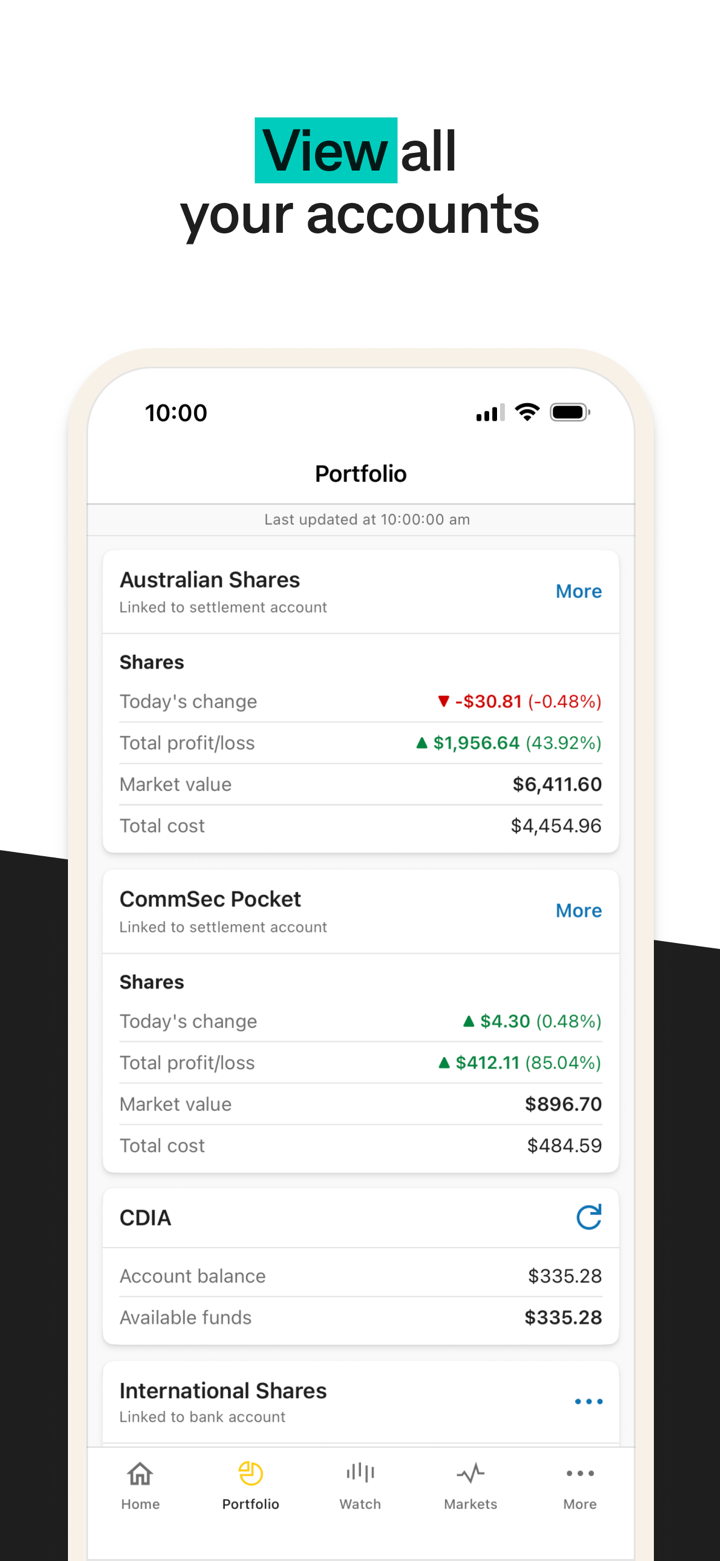

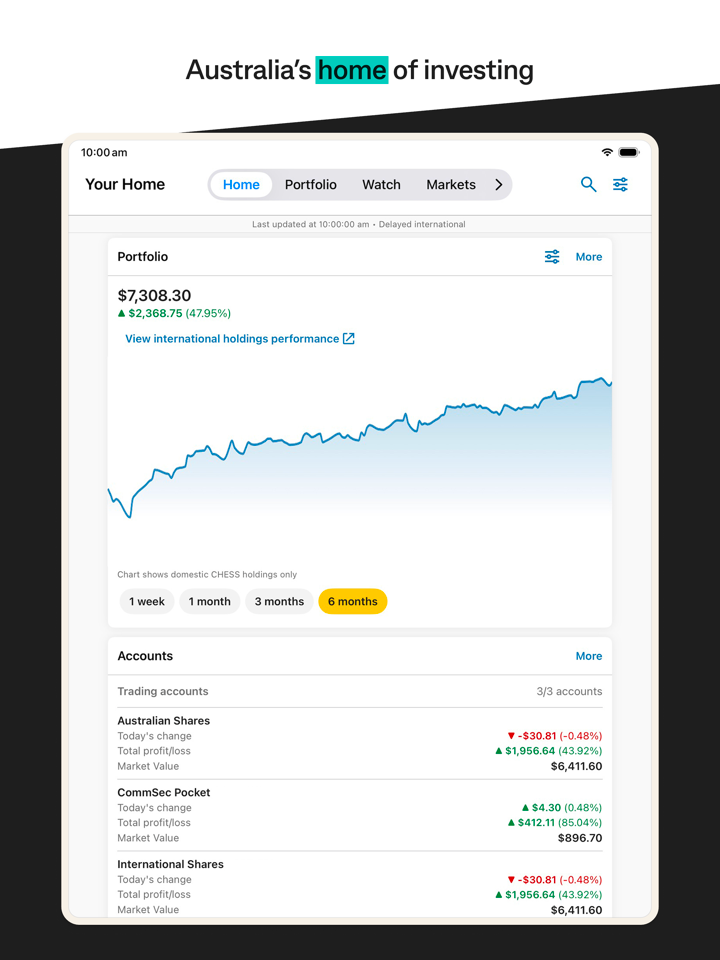

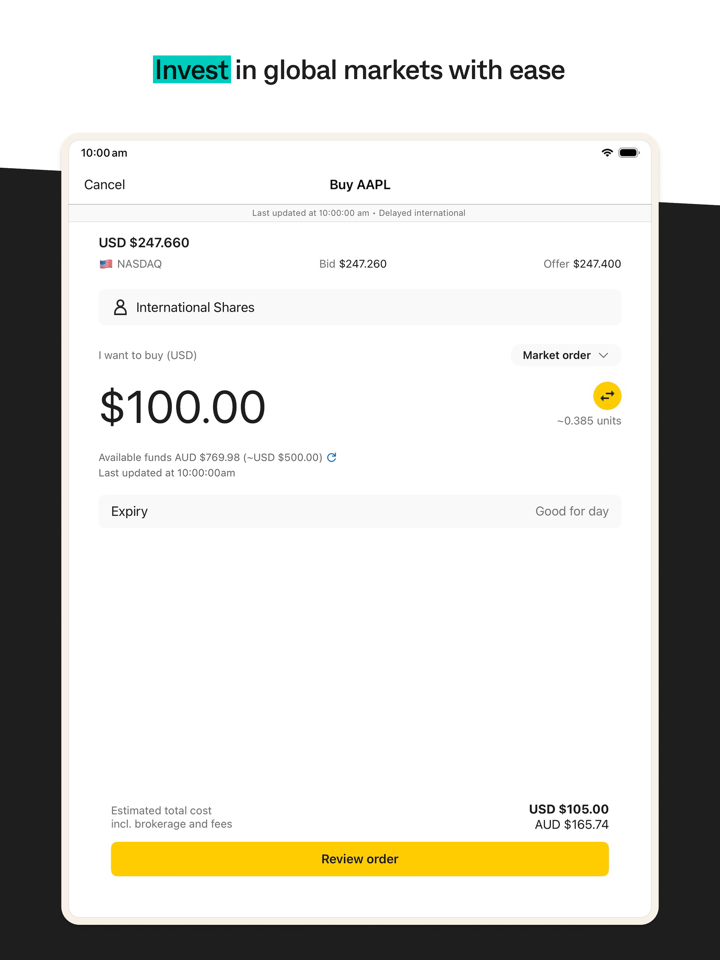

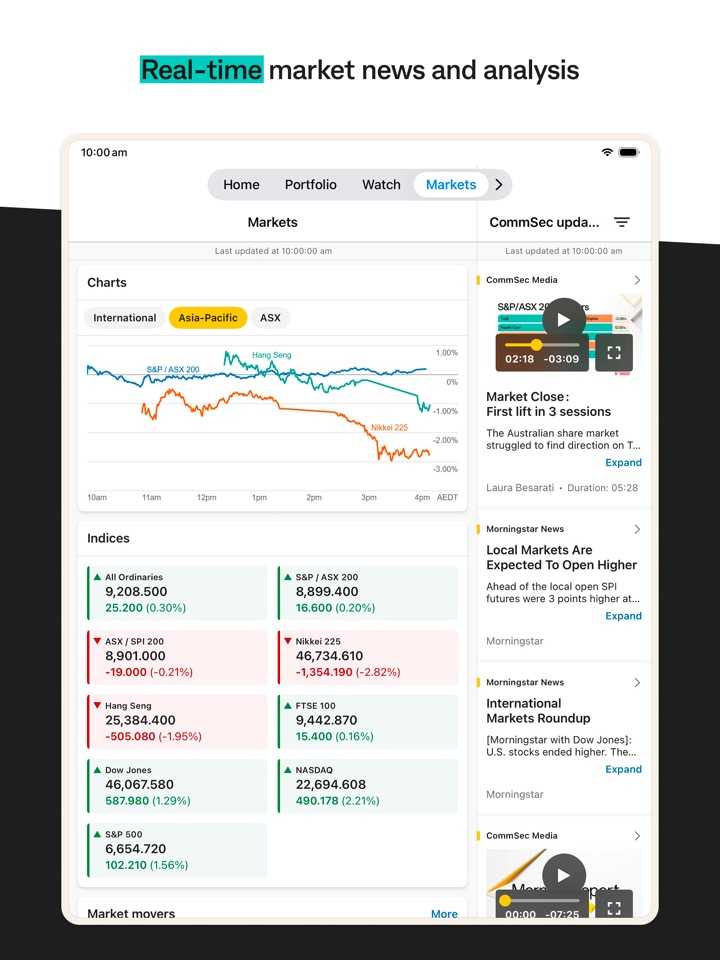

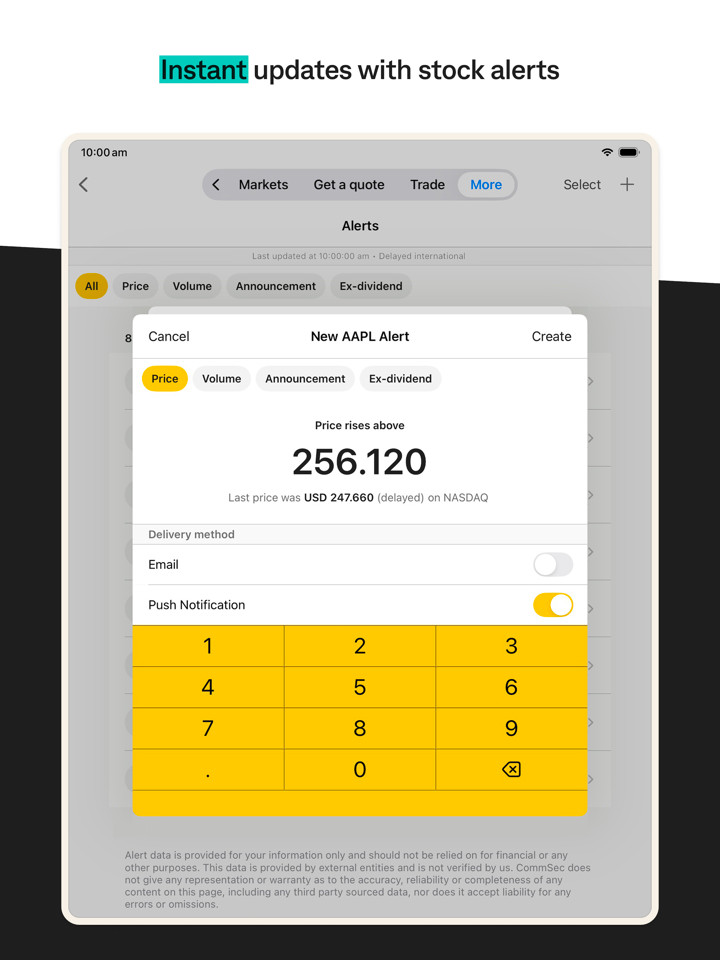

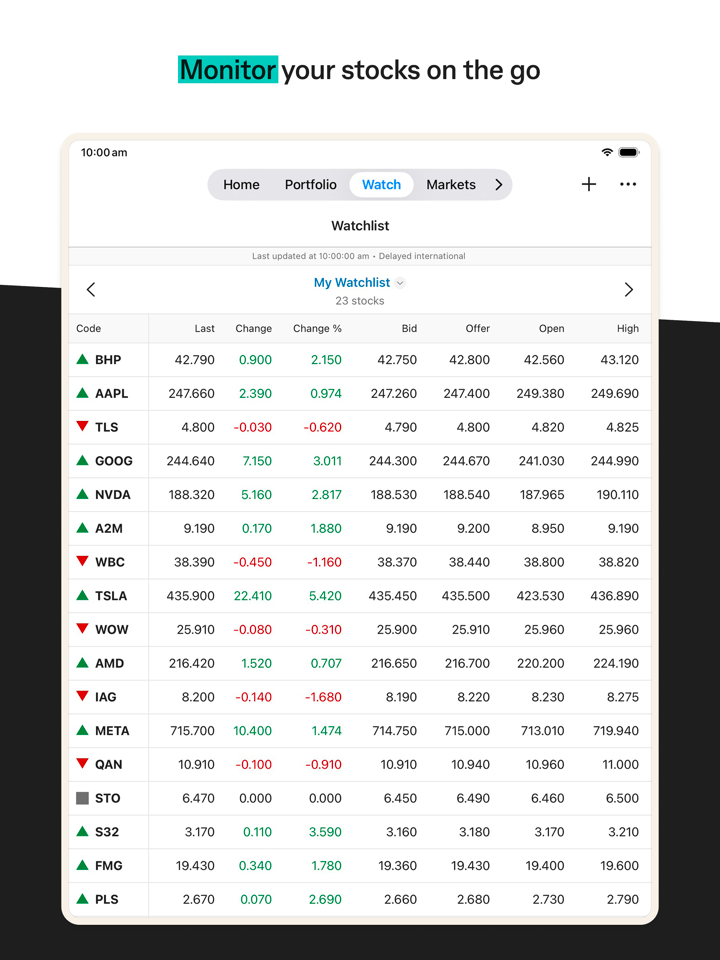

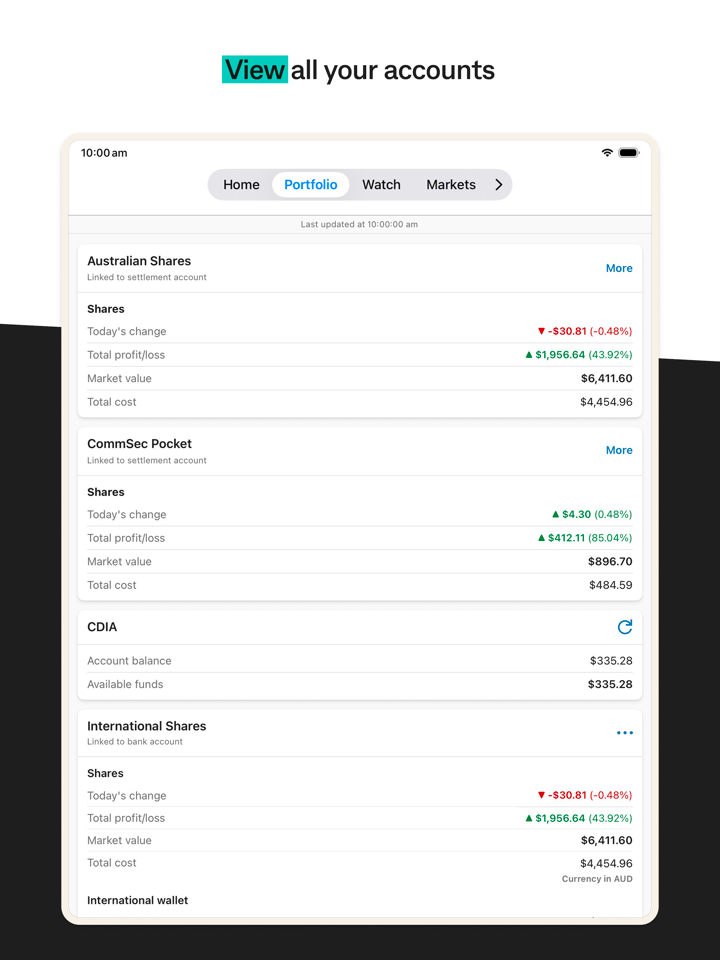

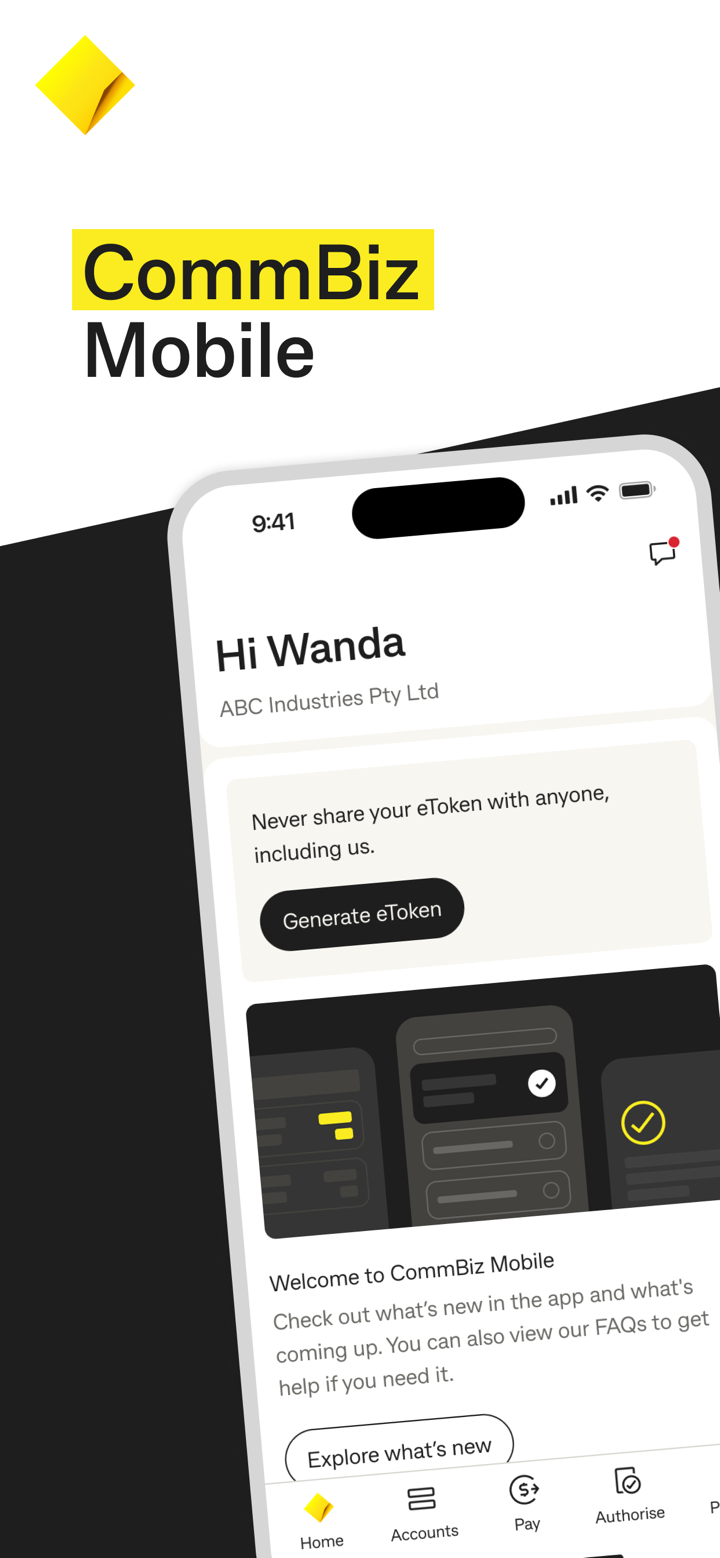

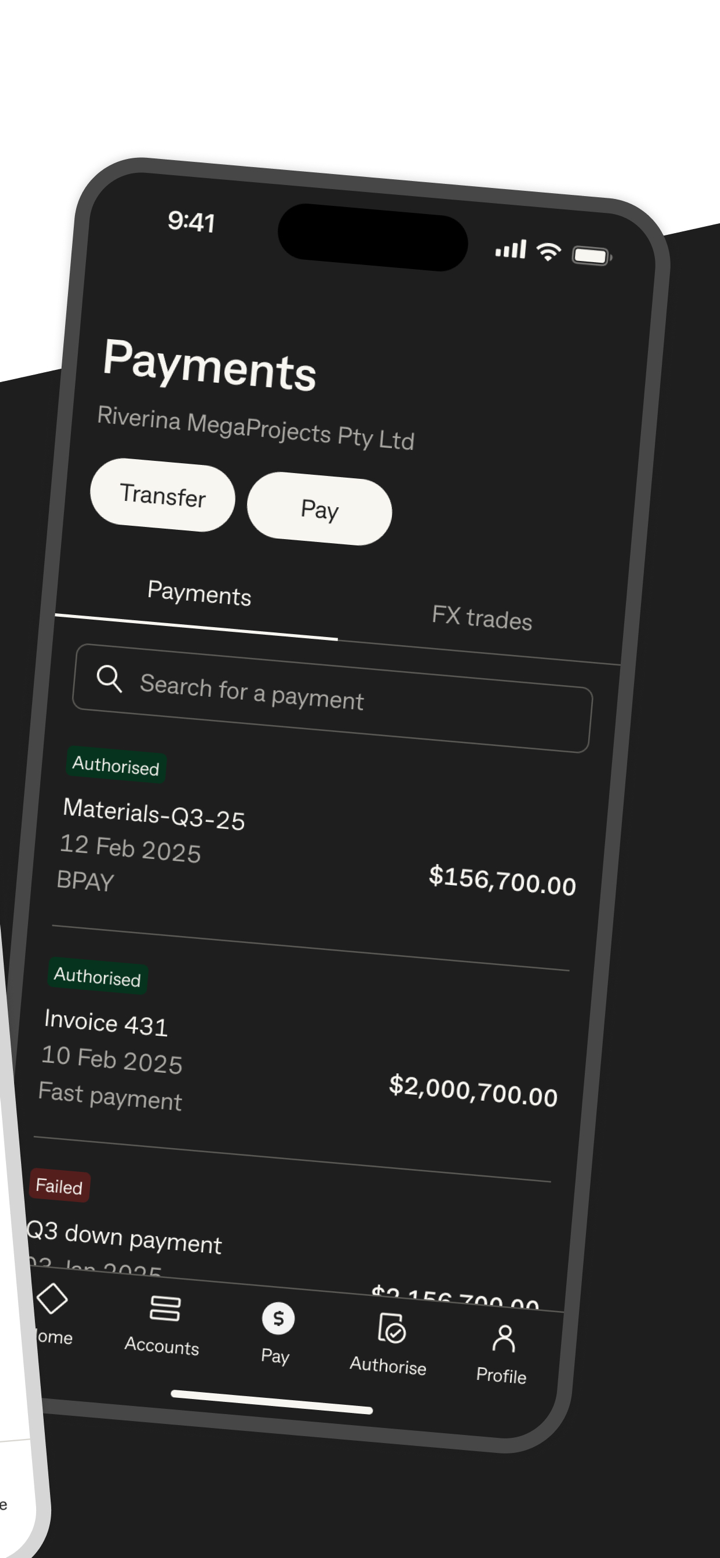

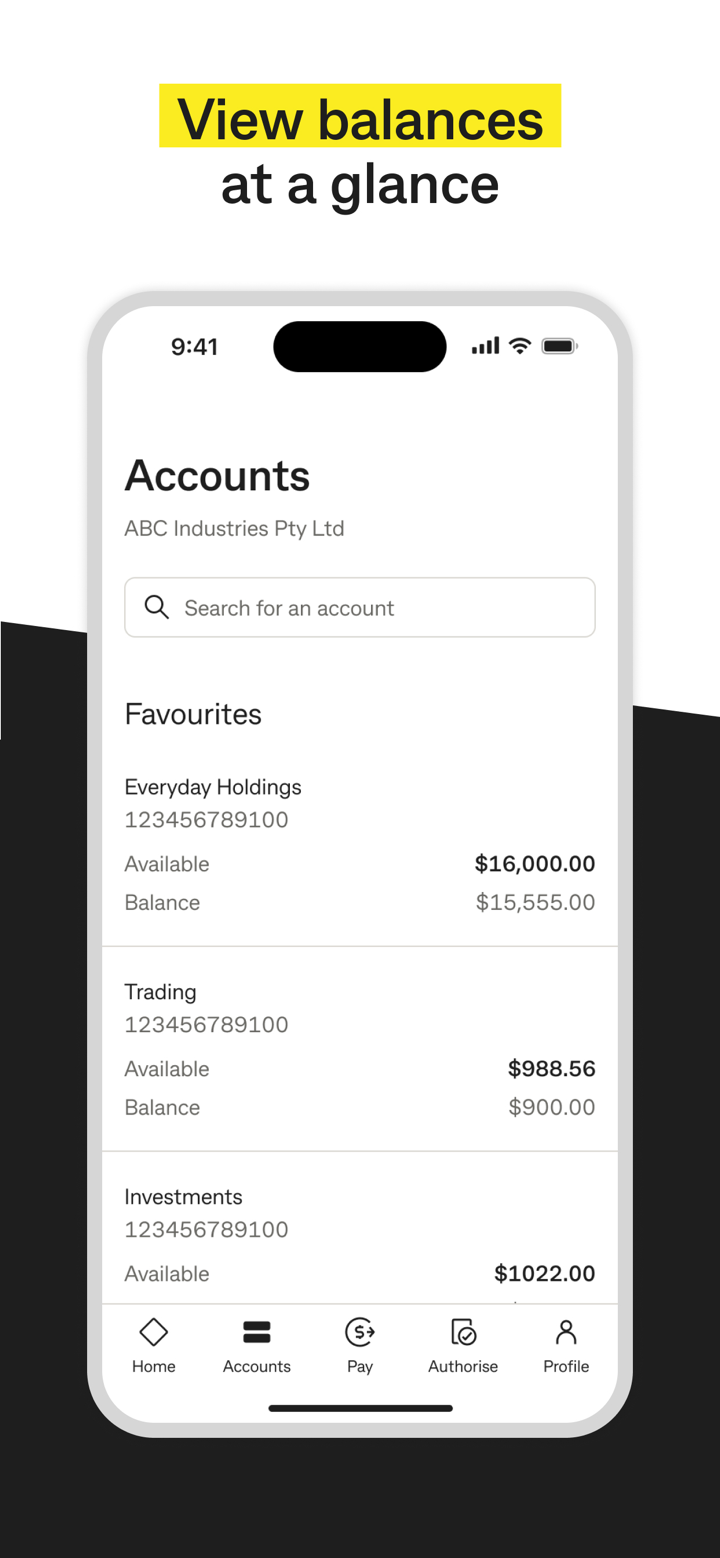

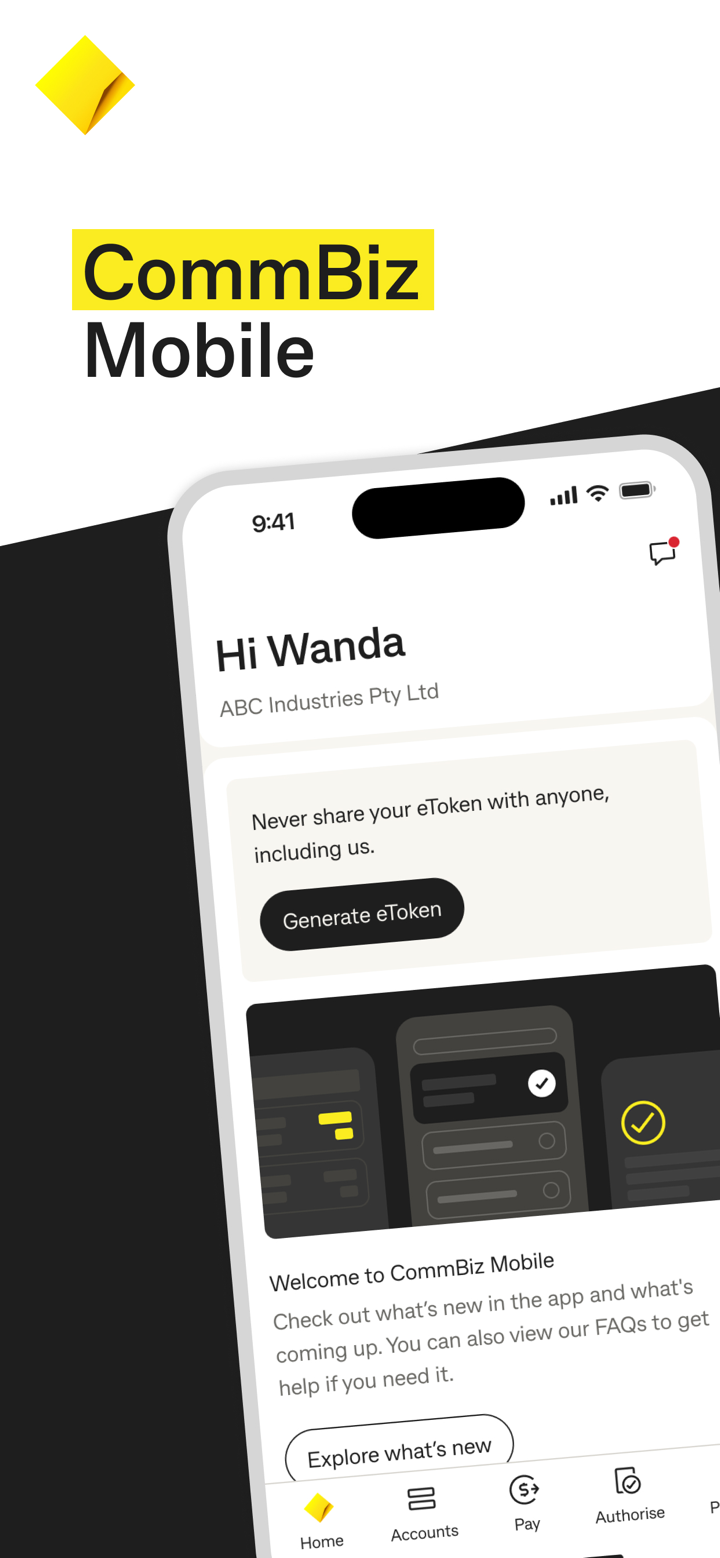

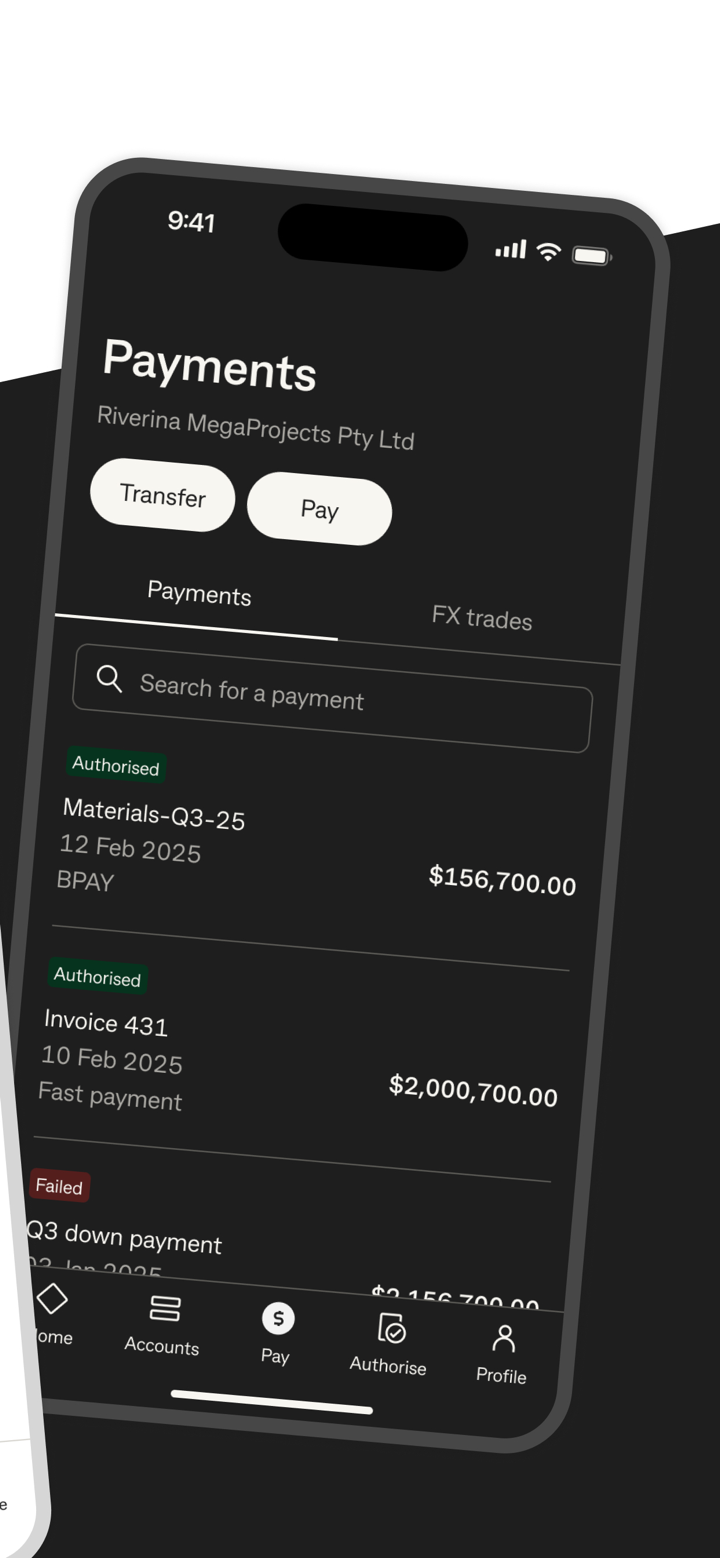

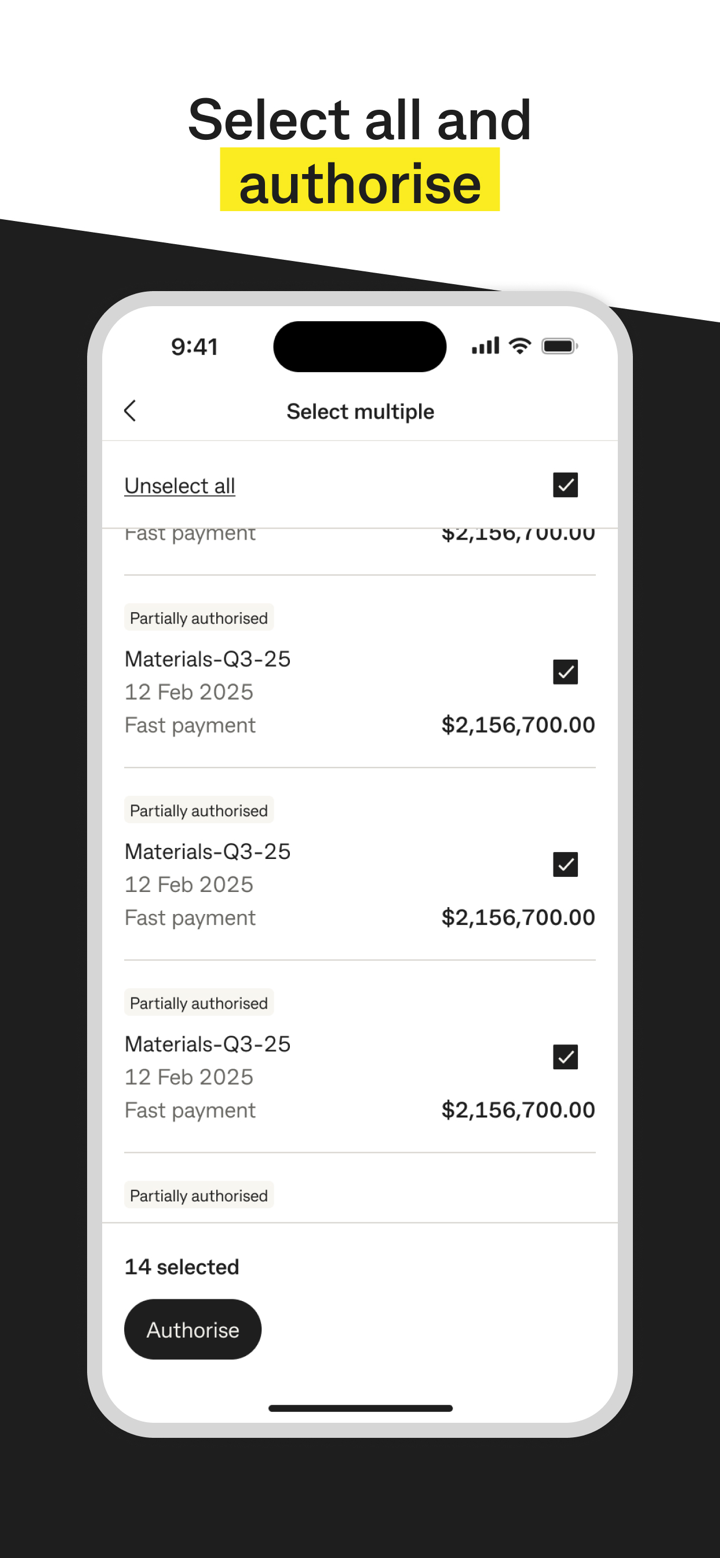

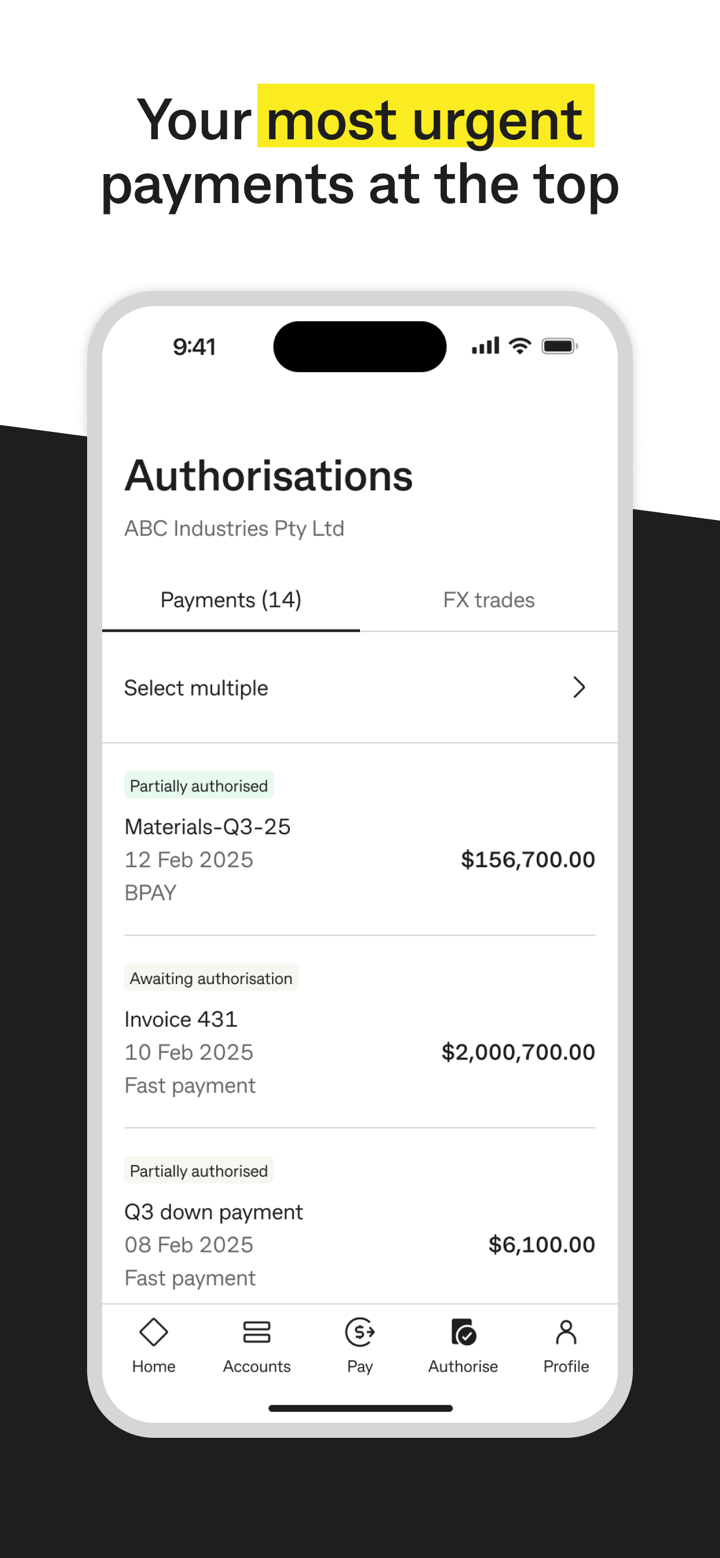

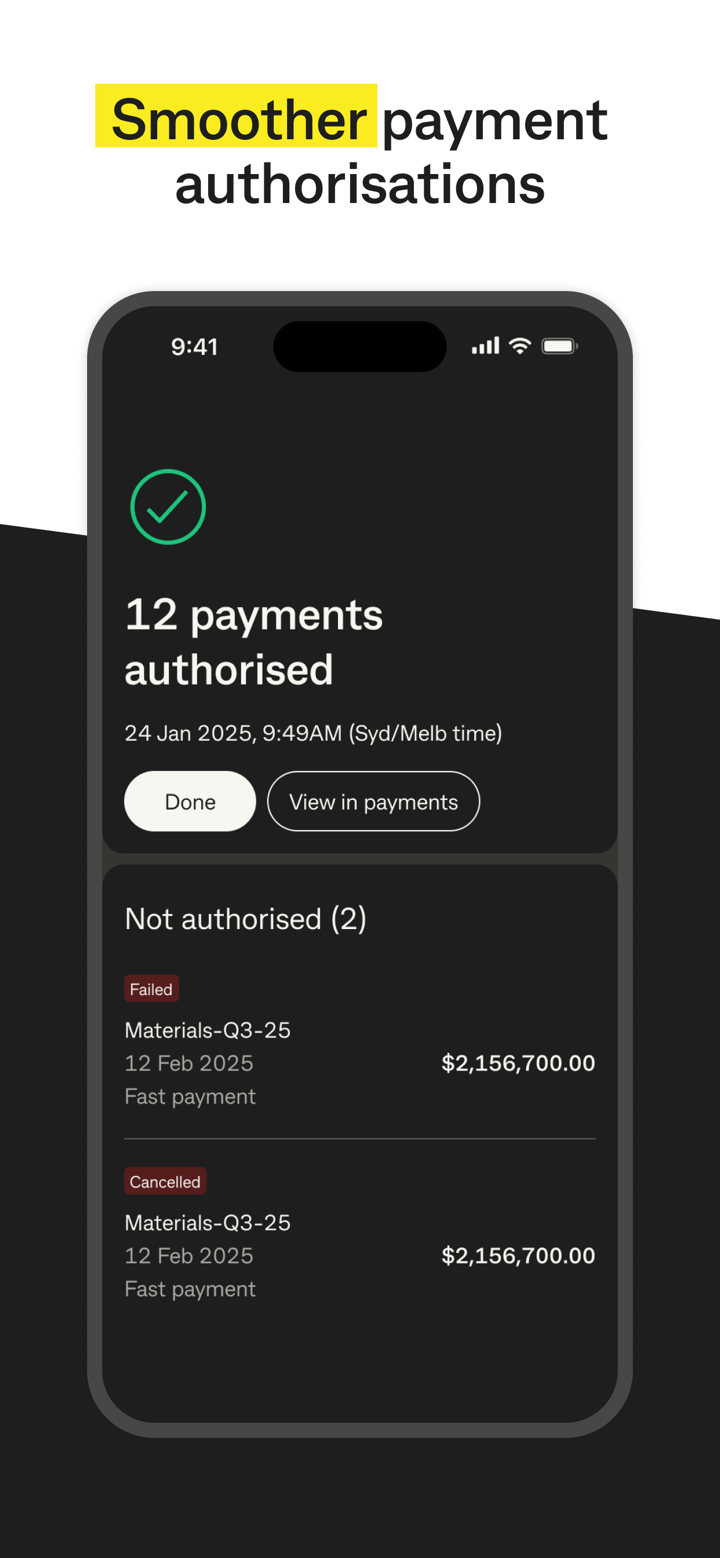

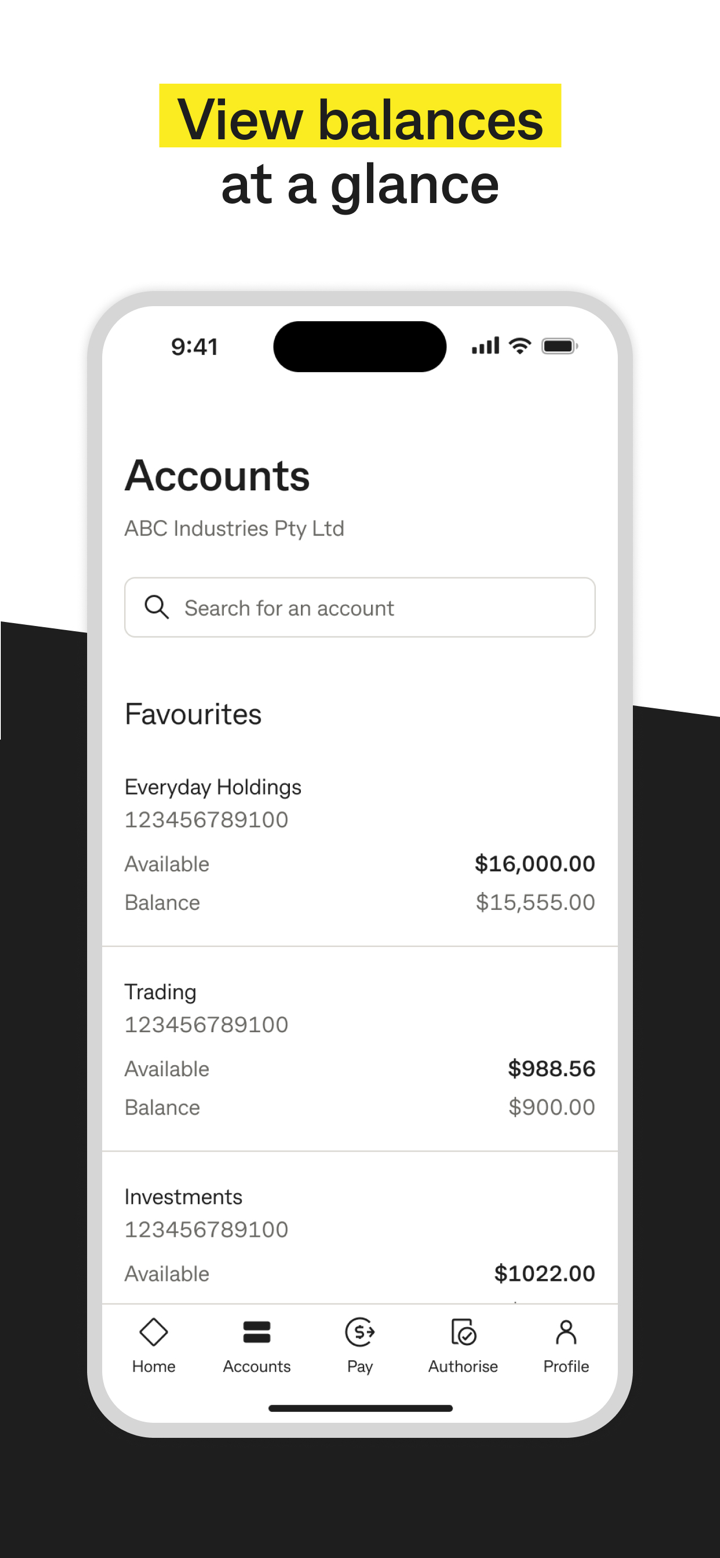

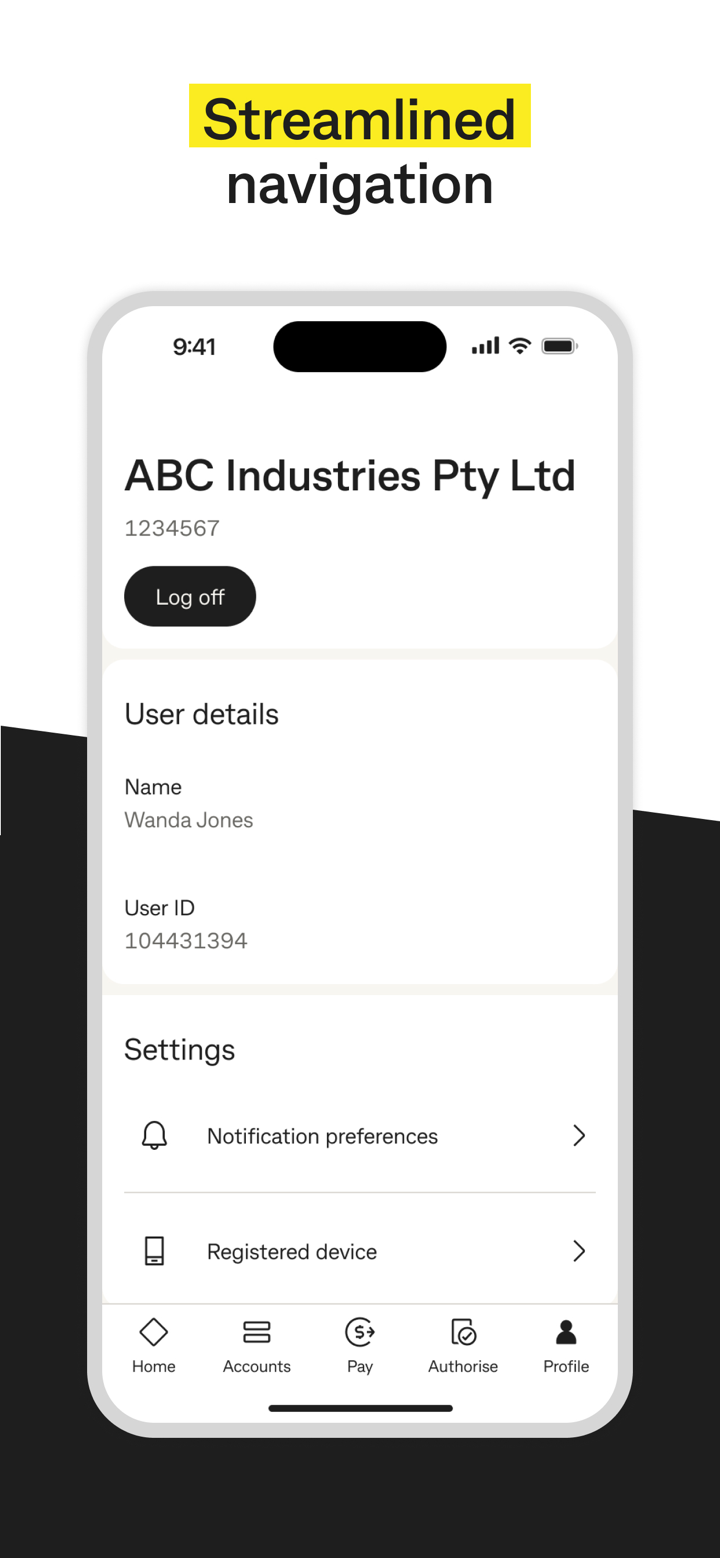

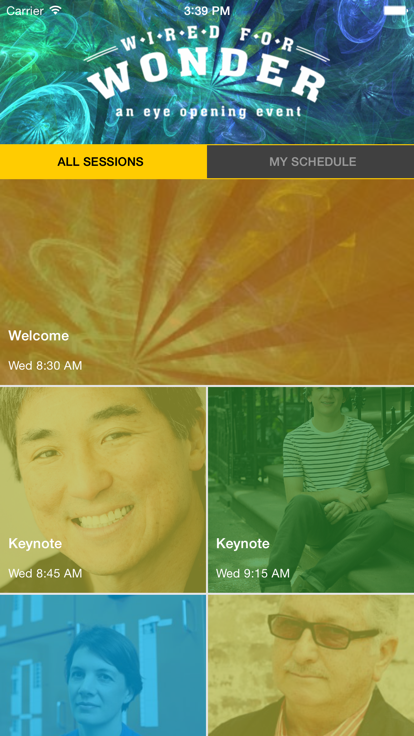

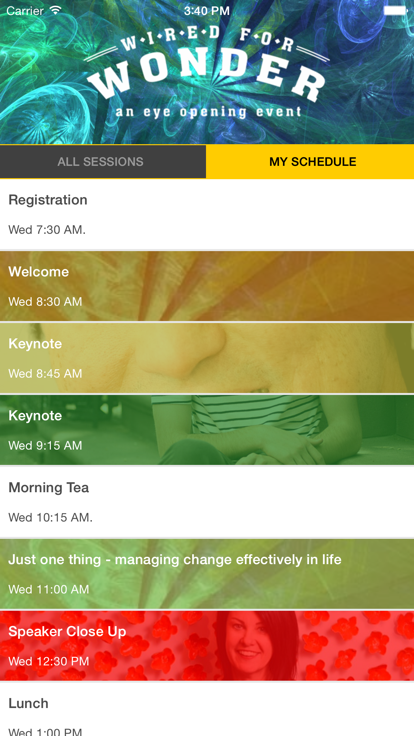

| Trading Platform | CommBank app, NetBank (Web), and CommSec |

| Customer Support | +61 2 9999 3283 |

| 13 2221 | |

CommBank Information

CommBank was founded in 1911 with its headquarters in Sydney, Australia. As one of the “Big Four Banks” in Australia, its business scope covers retail banking, commercial banking, investment, insurance, superannuation, etc. It is suitable for individual and corporate clients who value local services and pursue stability, especially in home loans, superannuation, and daily financial management.

Pros and Cons

| Pros | Cons |

| Regulated | Limited international investment products (Australian market). |

| Diversified financial services | Complex fee structures |

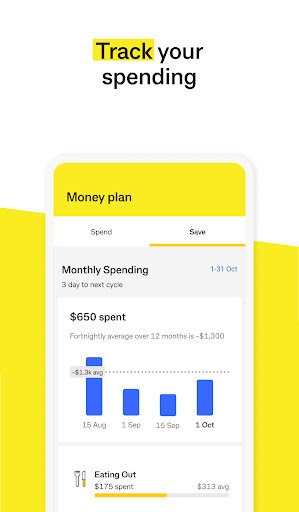

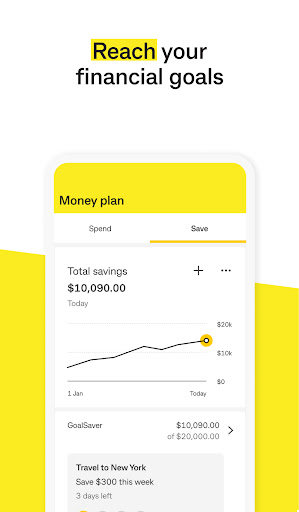

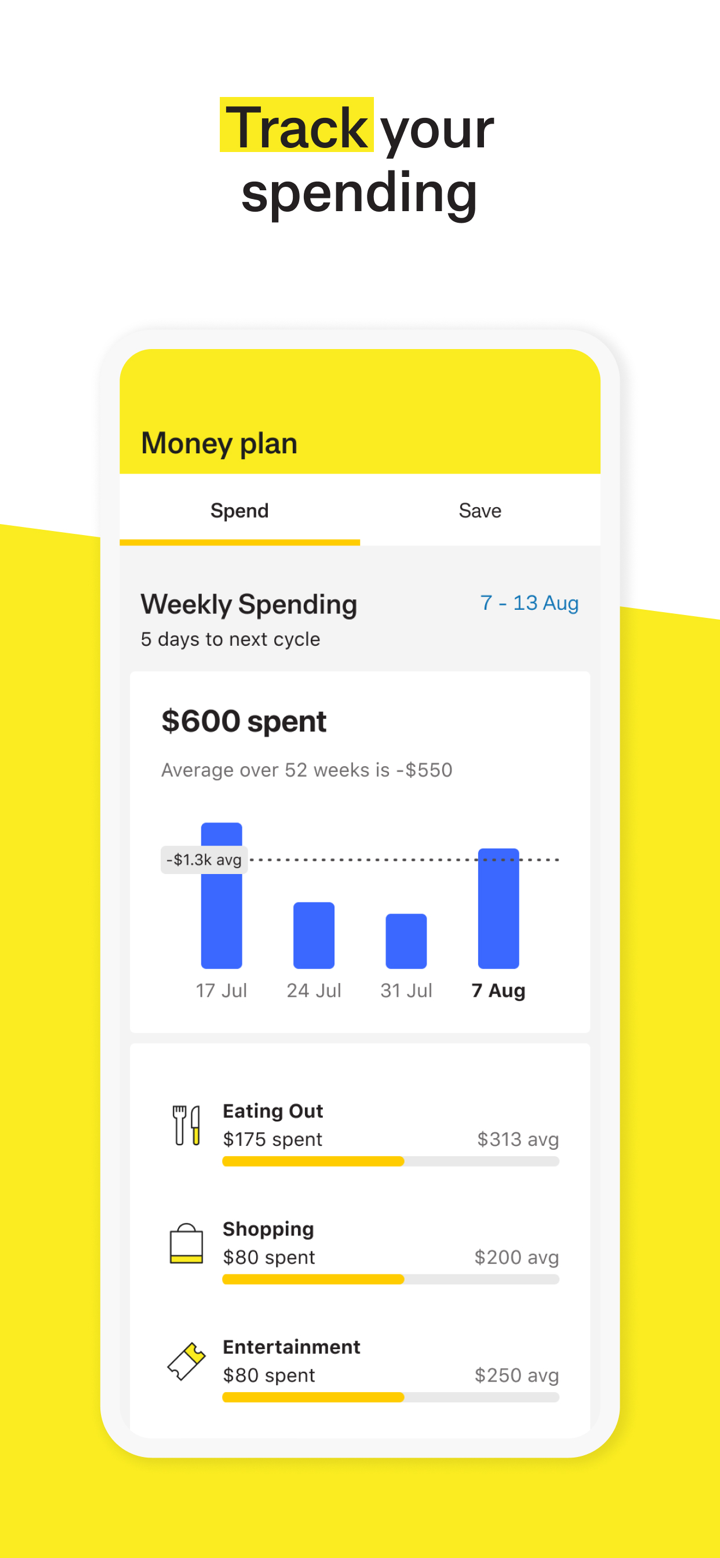

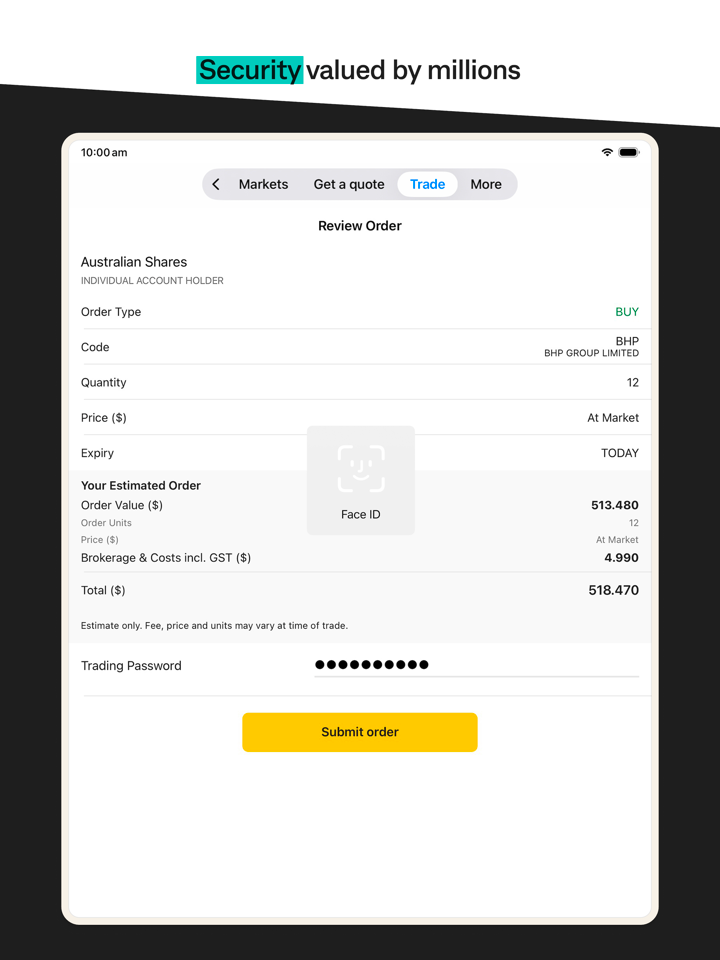

| Advanced digital tools (e.g., CommBank app) | Restrictions on overseas services |

| Customer loyalty rewards program |

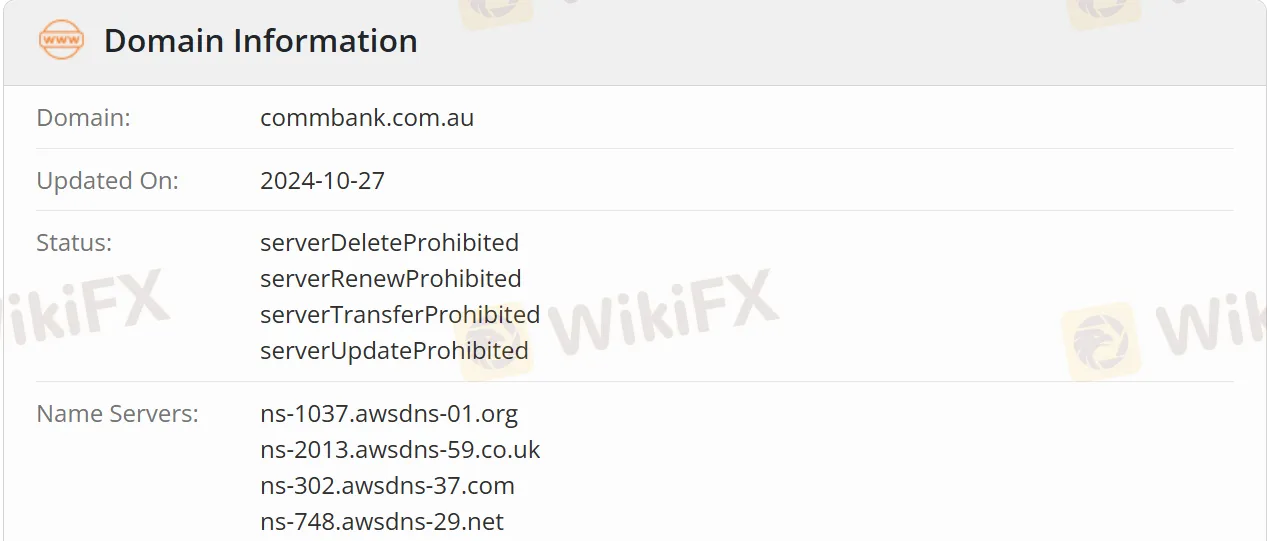

Is CommBank Legit?

CommBank is an old-established bank with a long history in Australia. It is strictly regulated by APRA and is a member of the Australian Financial Claims Scheme. The Australian Securities and Investments Commission (ASIC) regulates this bank, and its license number is 000234945. Therefore, deposit security is guaranteed.

What Services Does CommBank Offer?

The types of investment transactions include the following four categories:

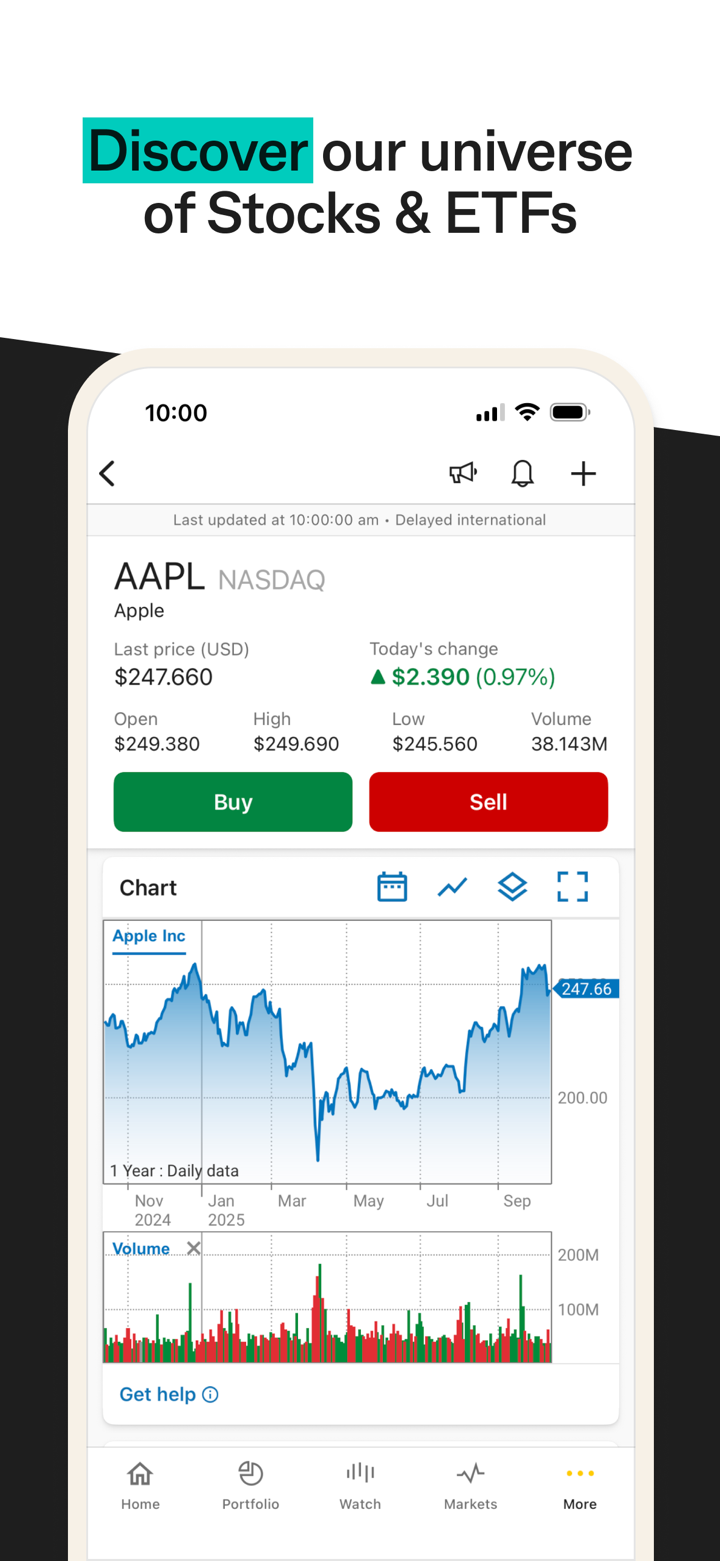

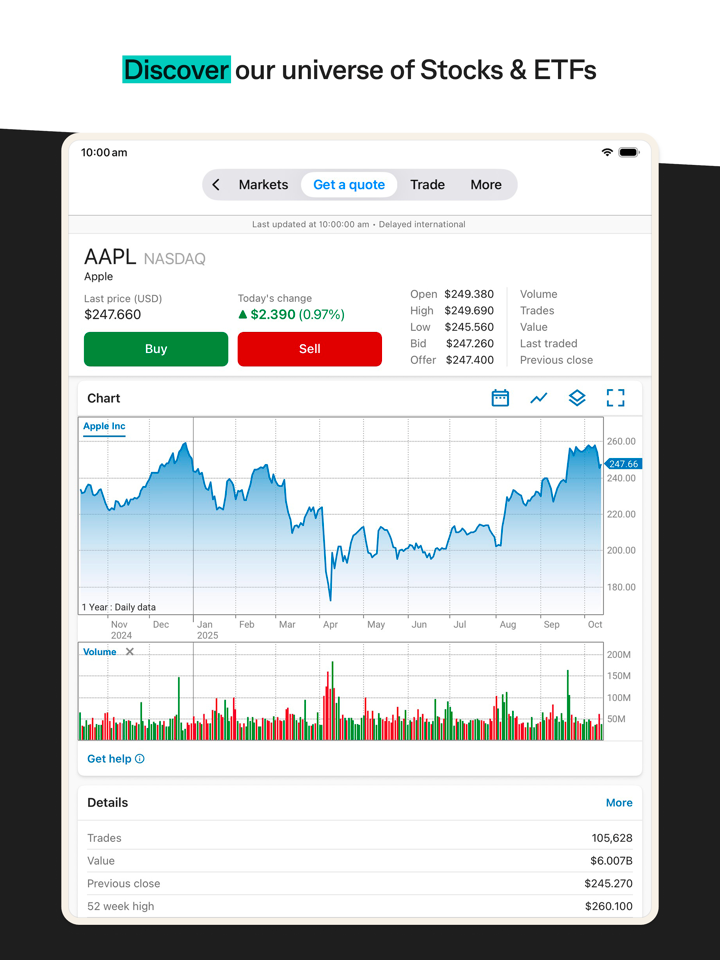

Australian Stocks (ASX): Trade over 2,000 Australian stocks through the CommSec platform. The minimum first trade is $500, and subsequent trades start at $100.

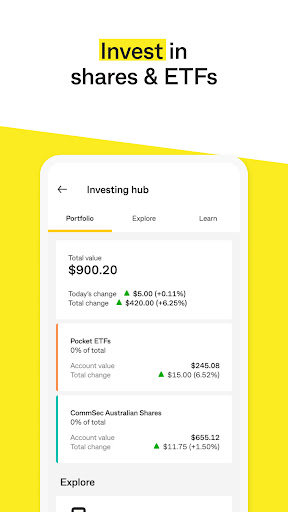

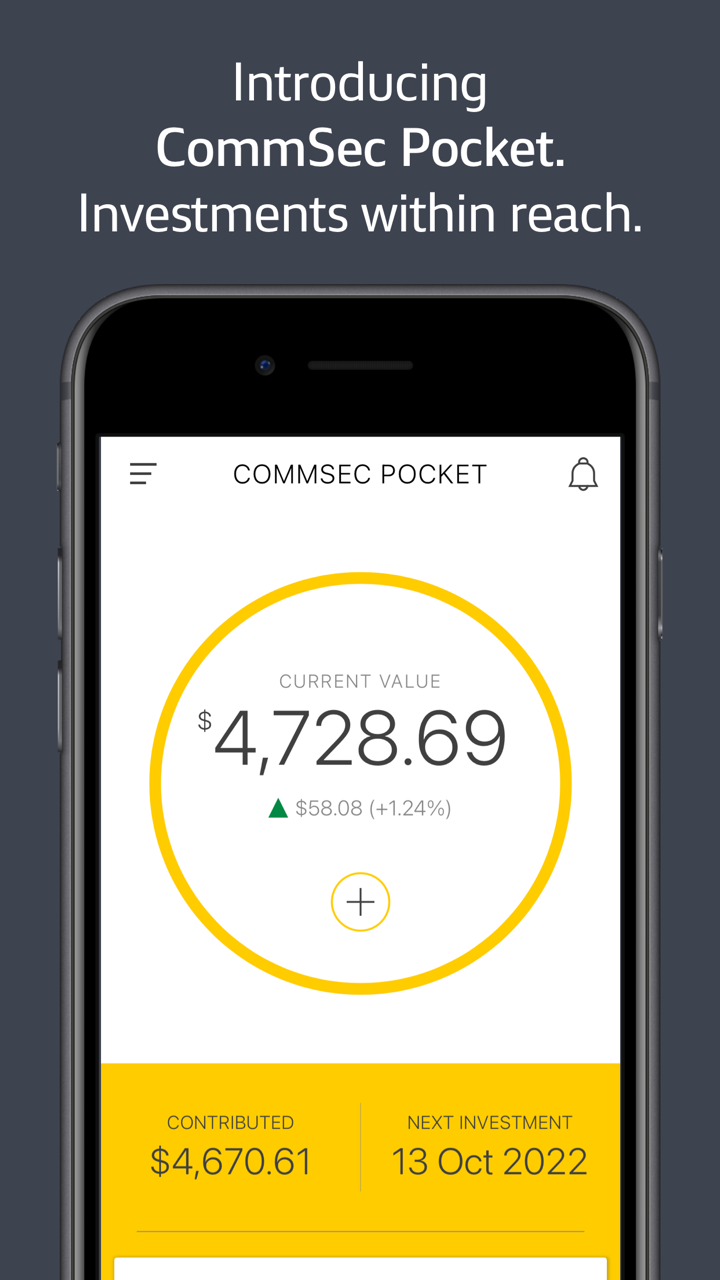

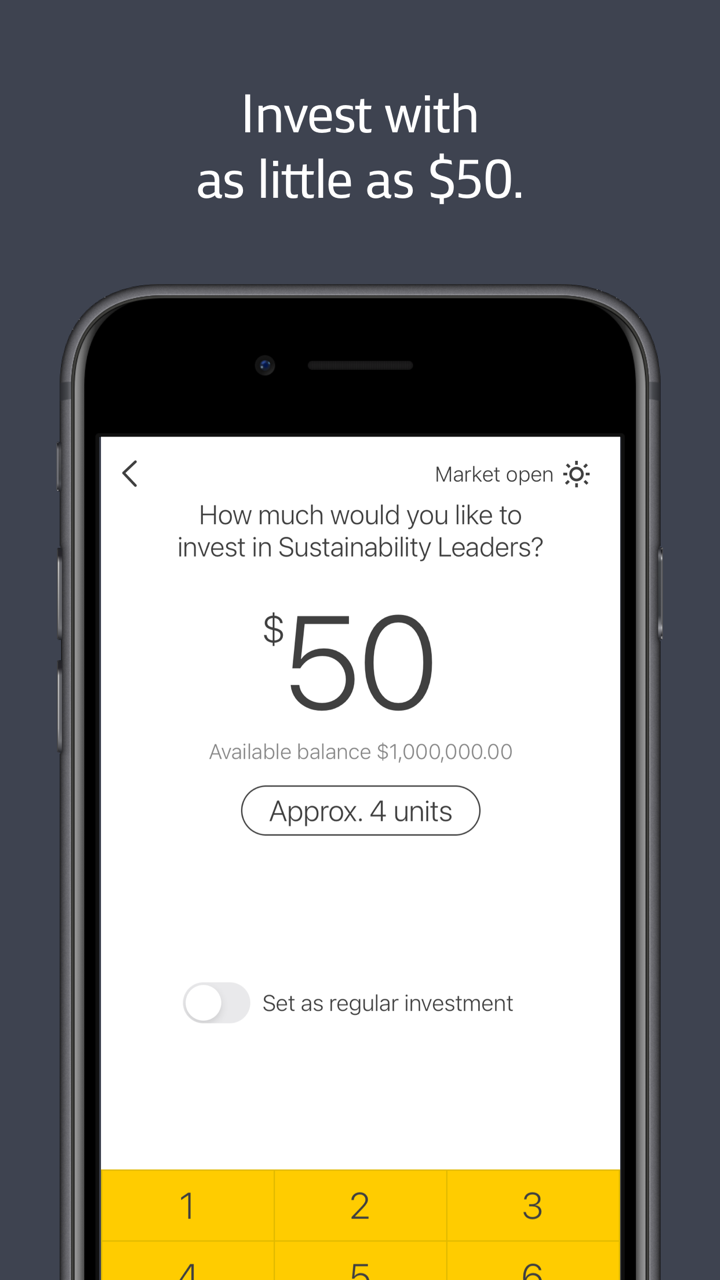

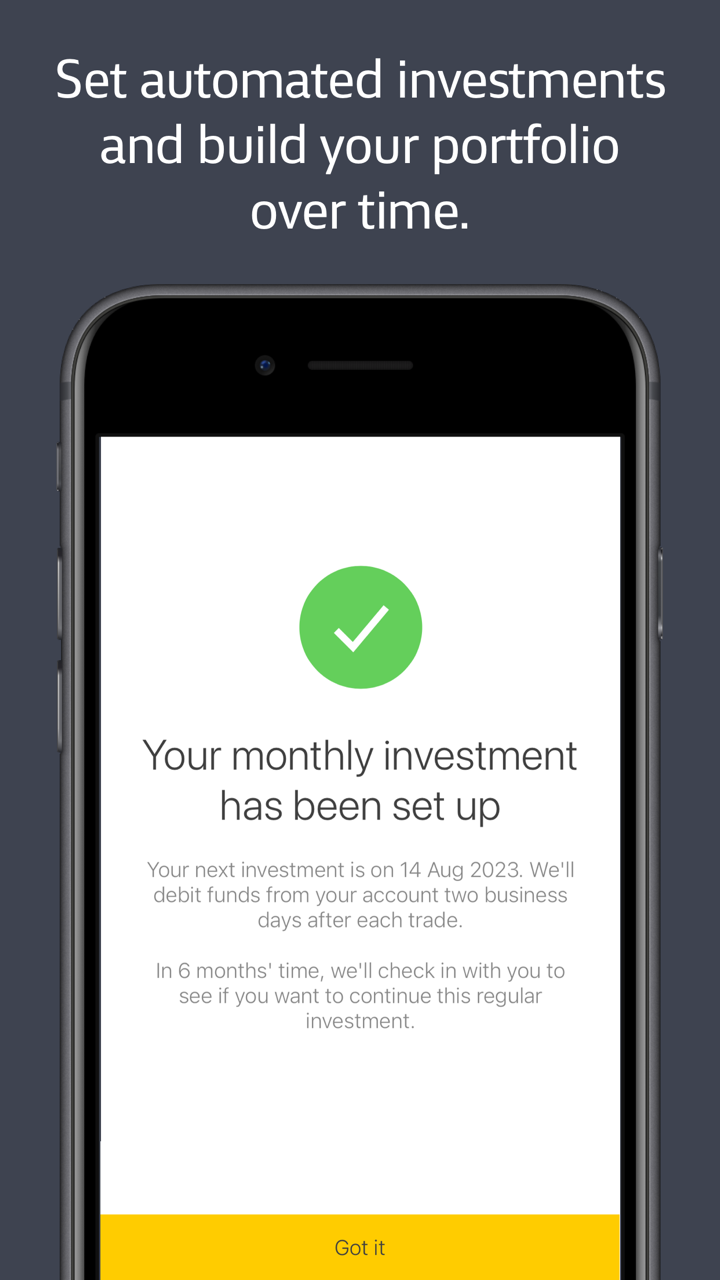

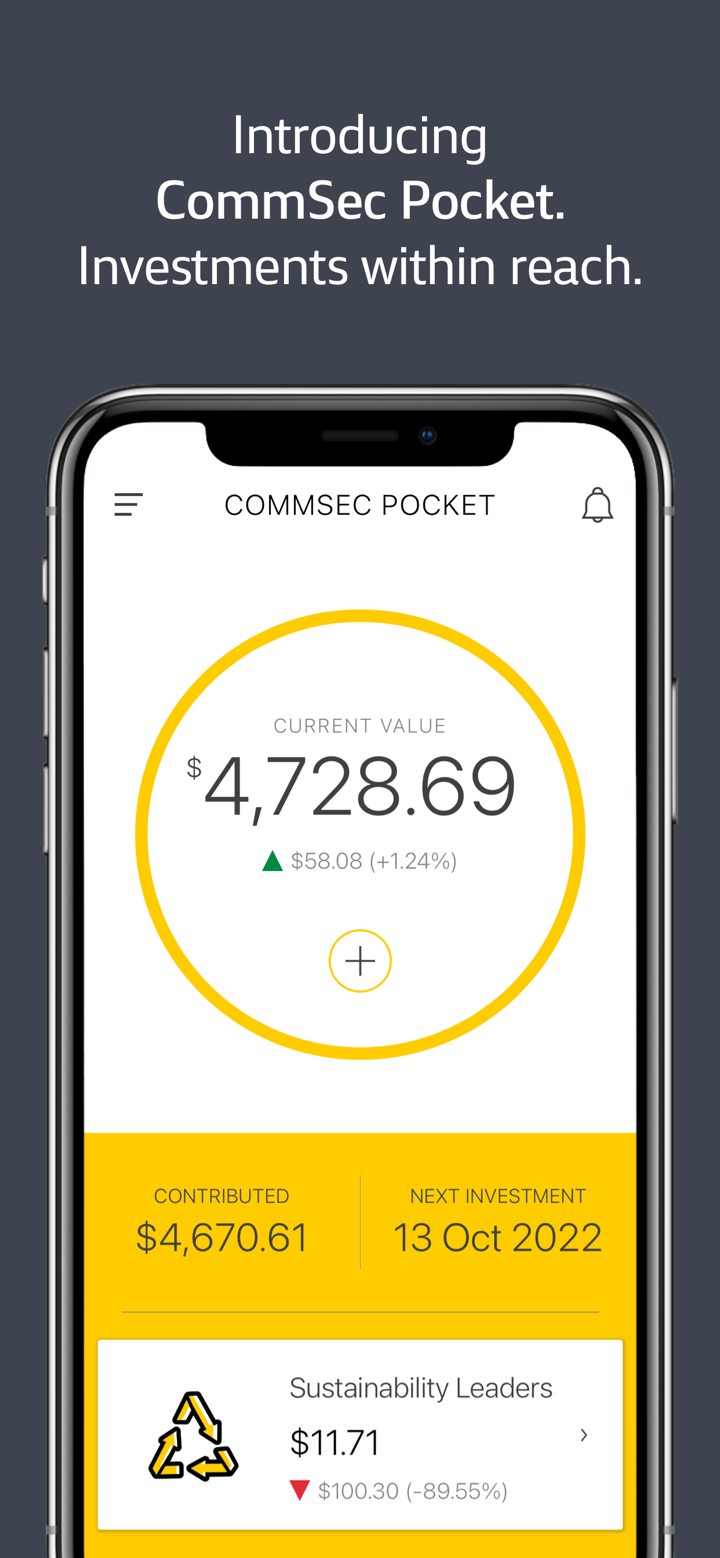

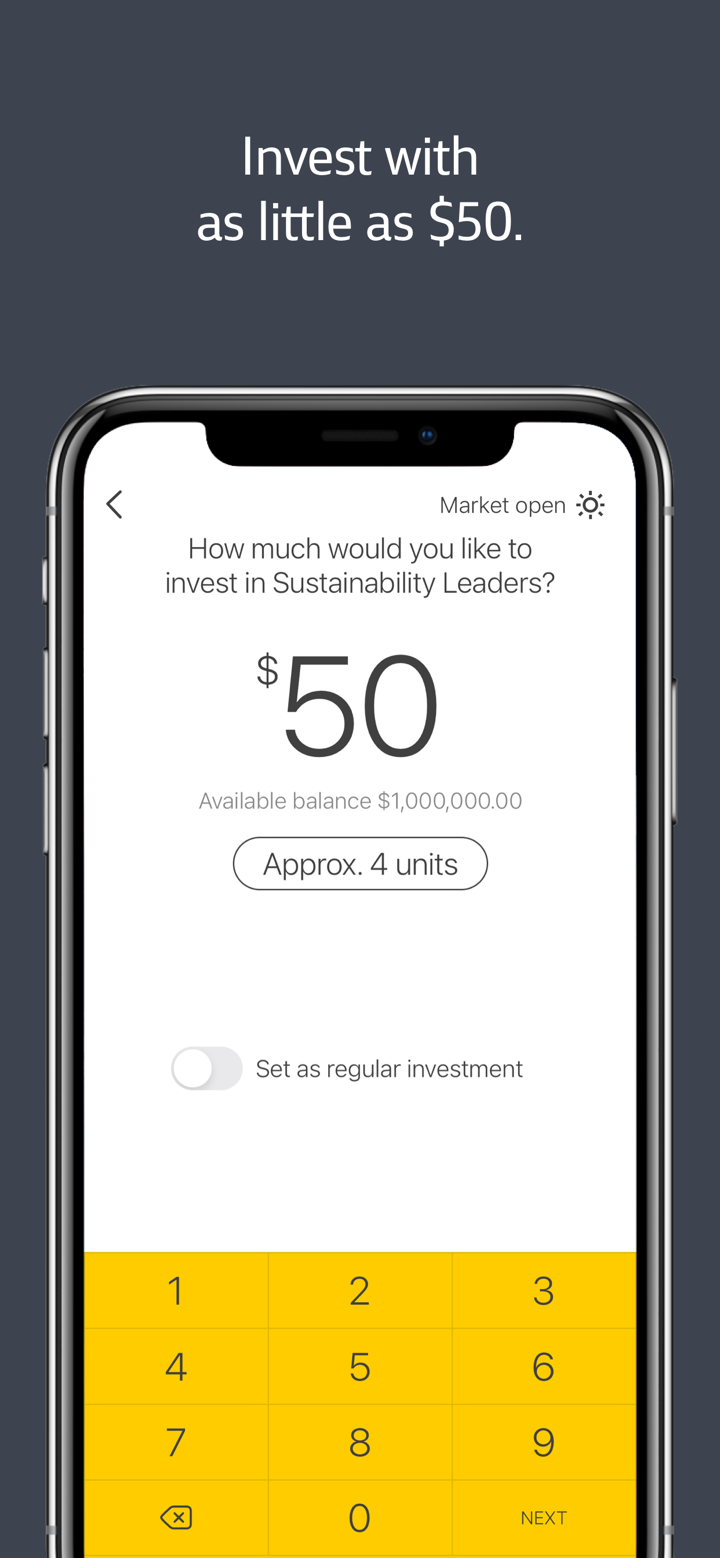

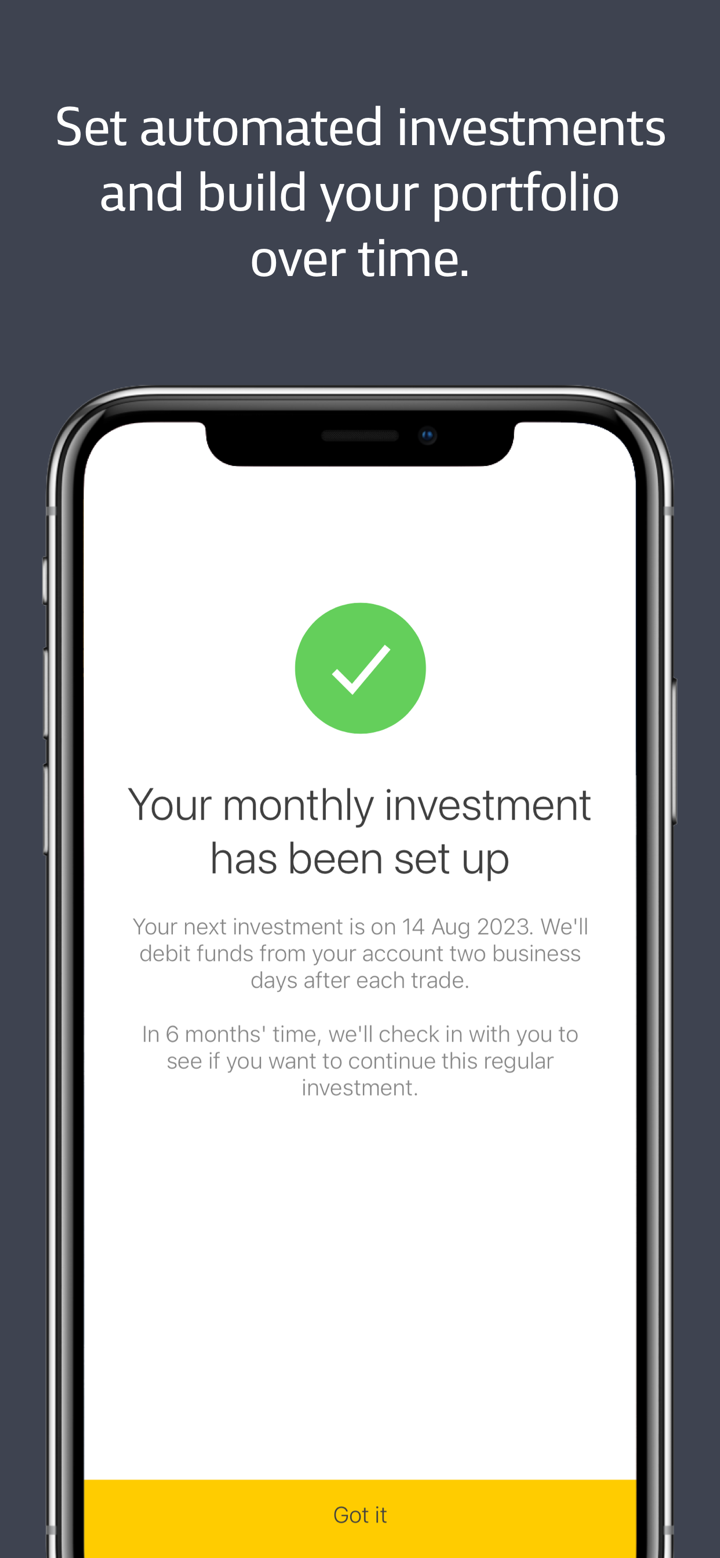

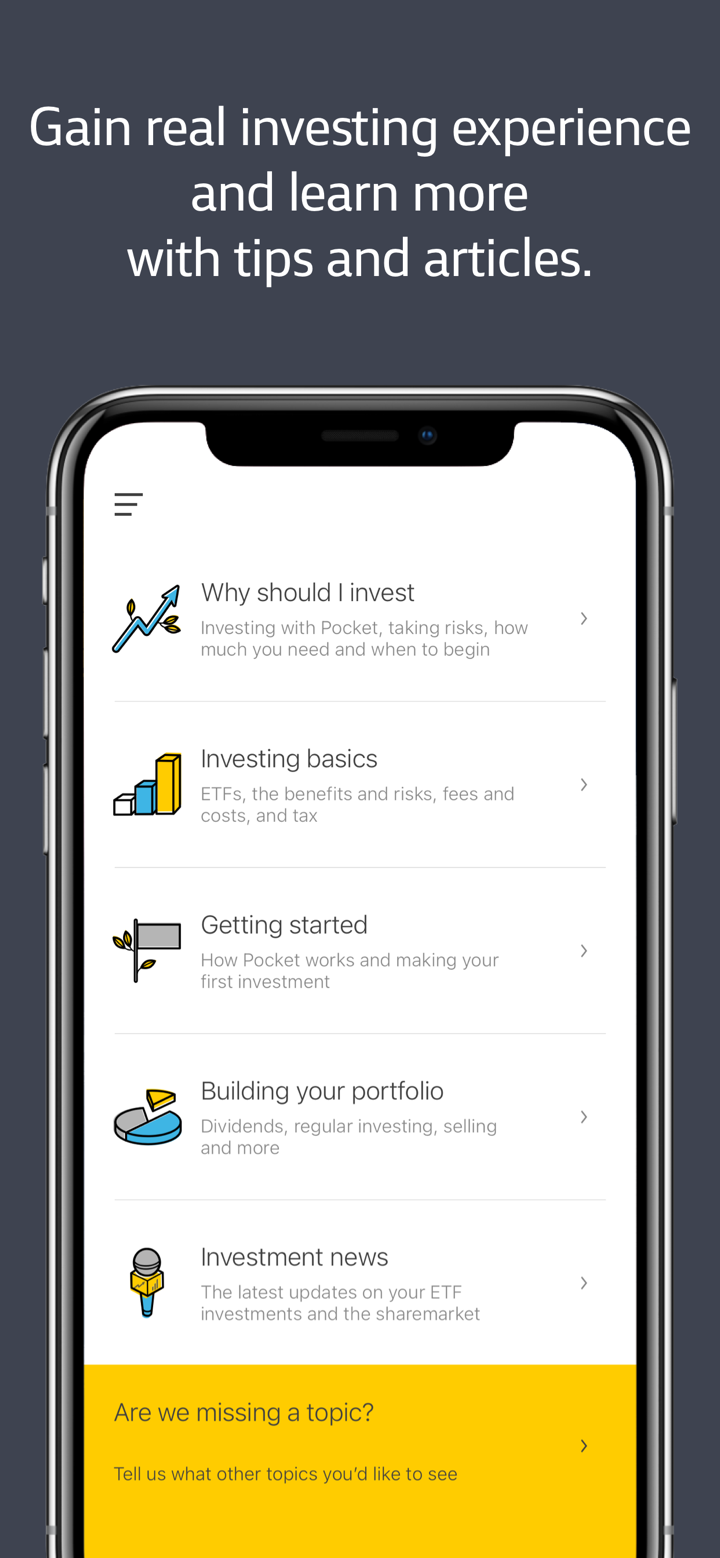

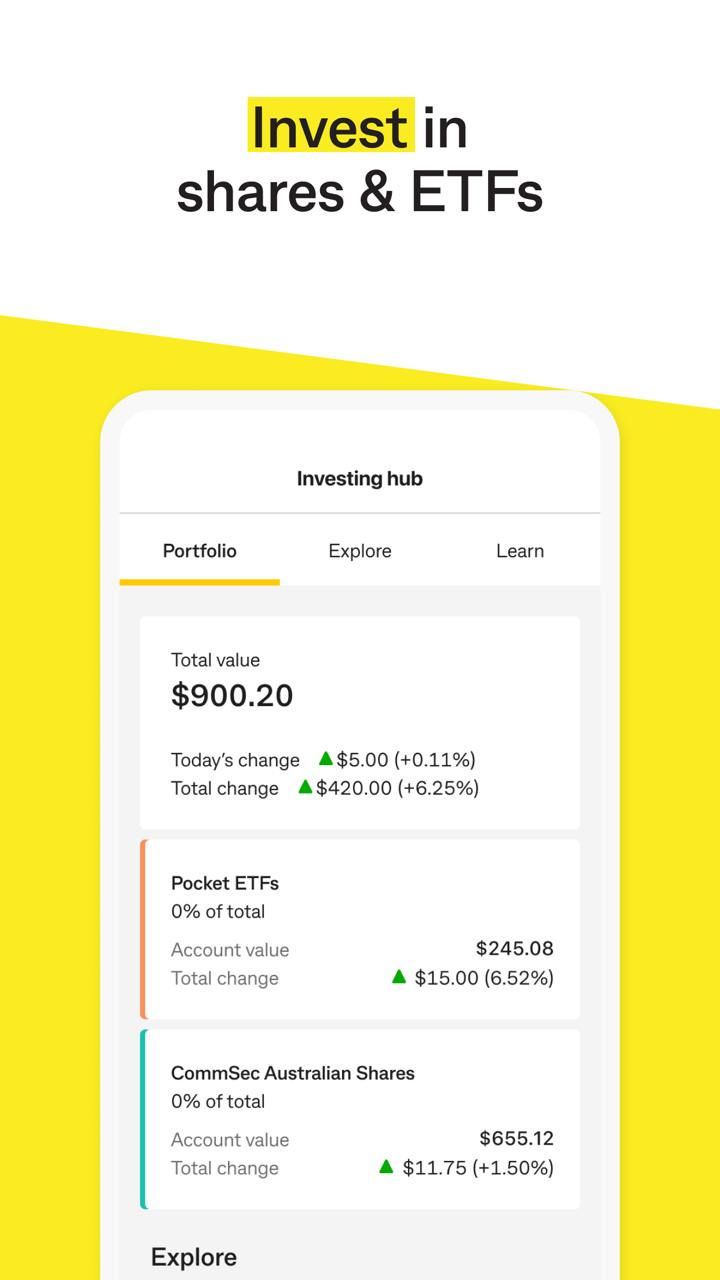

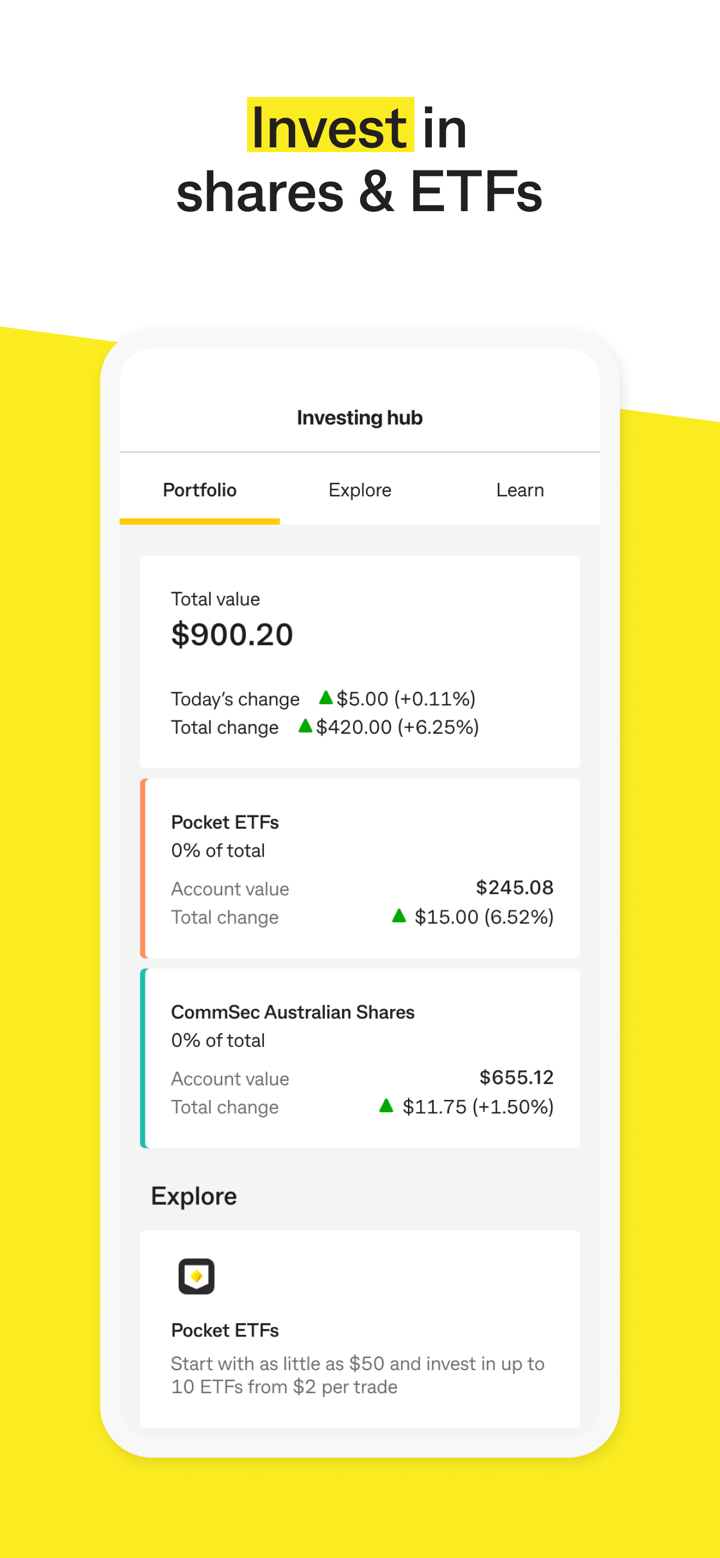

Exchange-Traded Funds (ETFs): Pocket ETFs offer 10+ themed ETFs (e.g., technology, healthcare) with a minimum investment of $50. Commission is $2 per trade (for trades ≤ $1,000) or 0.2% (for trades > $1,000).

Superannuation: Provided by Colonial First State, products like Essential Super have fees 15% lower than the industry average.

- Term Deposits and Savings Accounts: A limited-time interest rate of 4.05% is offered for 9-month business investment accounts, while ordinary savings account rates fluctuate with the market.

| Servies | Supported |

| Australian Stocks (ASX) | ✔ |

| Exchange-Traded Funds (ETFs) | ✔ |

| Superannuation | ✔ |

| Term Deposits and Savings Accounts | ✔ |

Account Type

Personal Accounts

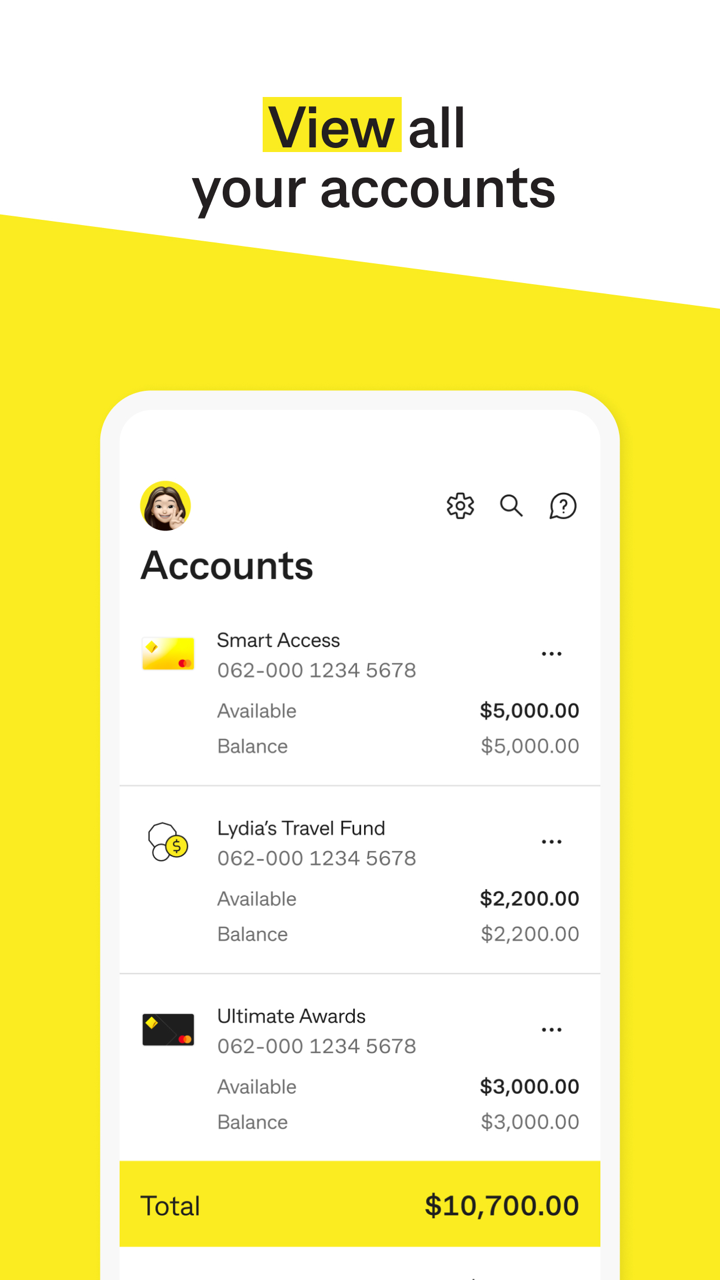

| Account Type | Account Name | Key Features |

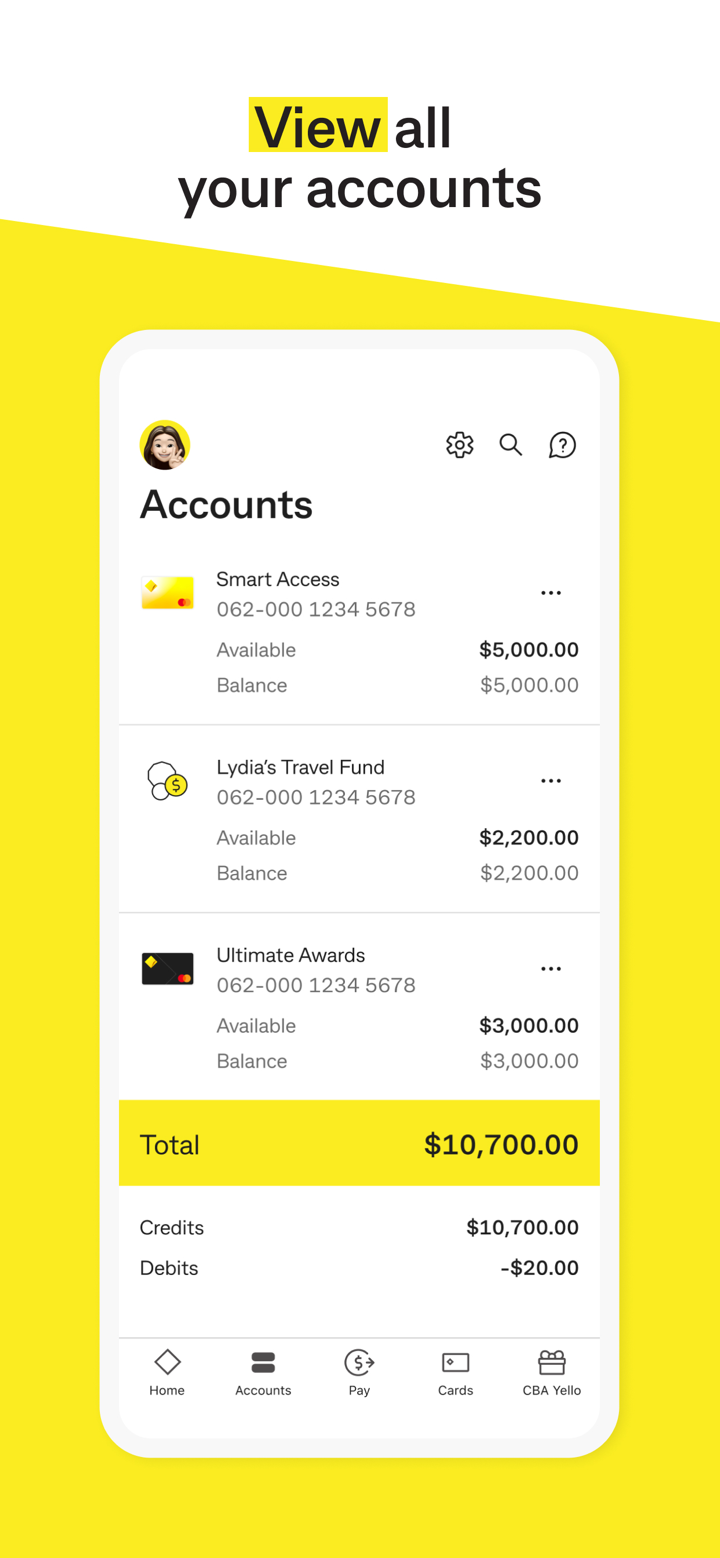

| Everyday Transaction Account | Smart Access | • No monthly fee• Supports fast transfers via PayID• Cardless cash withdrawal |

| Everyday Offset | • Linked to home loans, the account balance can offset interest | |

| Savings Account | NetBank Saver | • Flexible interest rate• Suitable for short-term savings |

| Term Deposit | • Fixed interest rate• Deposit terms ranging from 3 months to 5 years | |

| Investment Account | CommSec Share Trading Account | • For trading Australian stocks• Requires linkage to CDIA (Cash Management Account) |

| Pocket Account | • Focused on ETF trading• Minimum investment of $50 |

Business Accounts

CommBank offers a Business Transaction Account suitable for small businesses, with a $0 monthly fee and requiring ASIC verification. Additionally, users can choose business loan accounts such as the Better Business Loan (unsecured small loan) and vehicle and equipment financing.

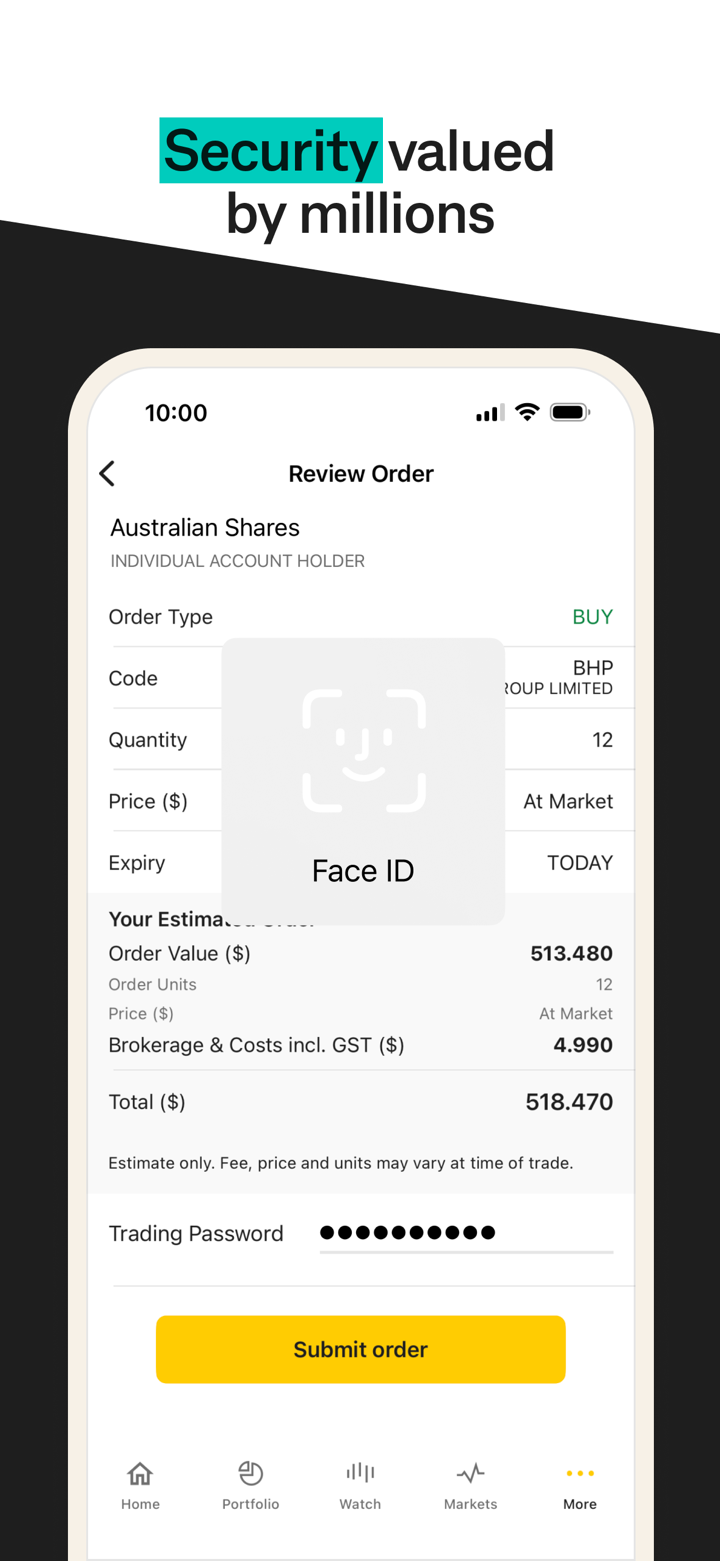

CommBank Fees

| Service Type | Item | Fee Standard |

| Transaction Accounts | Basic Account Monthly Fee | Most have no monthly fee |

| Cross-border Transfer | $15–$25 per transaction | |

| Foreign Exchange Conversion Fee | 1%–3% | |

| Investment Trading | Australian Stock Trading Commission | $10–$29.95 per transaction |

| ETF Trading Commission | ≤ $1,000: $2 per transaction; > $1,000: 0.2% | |

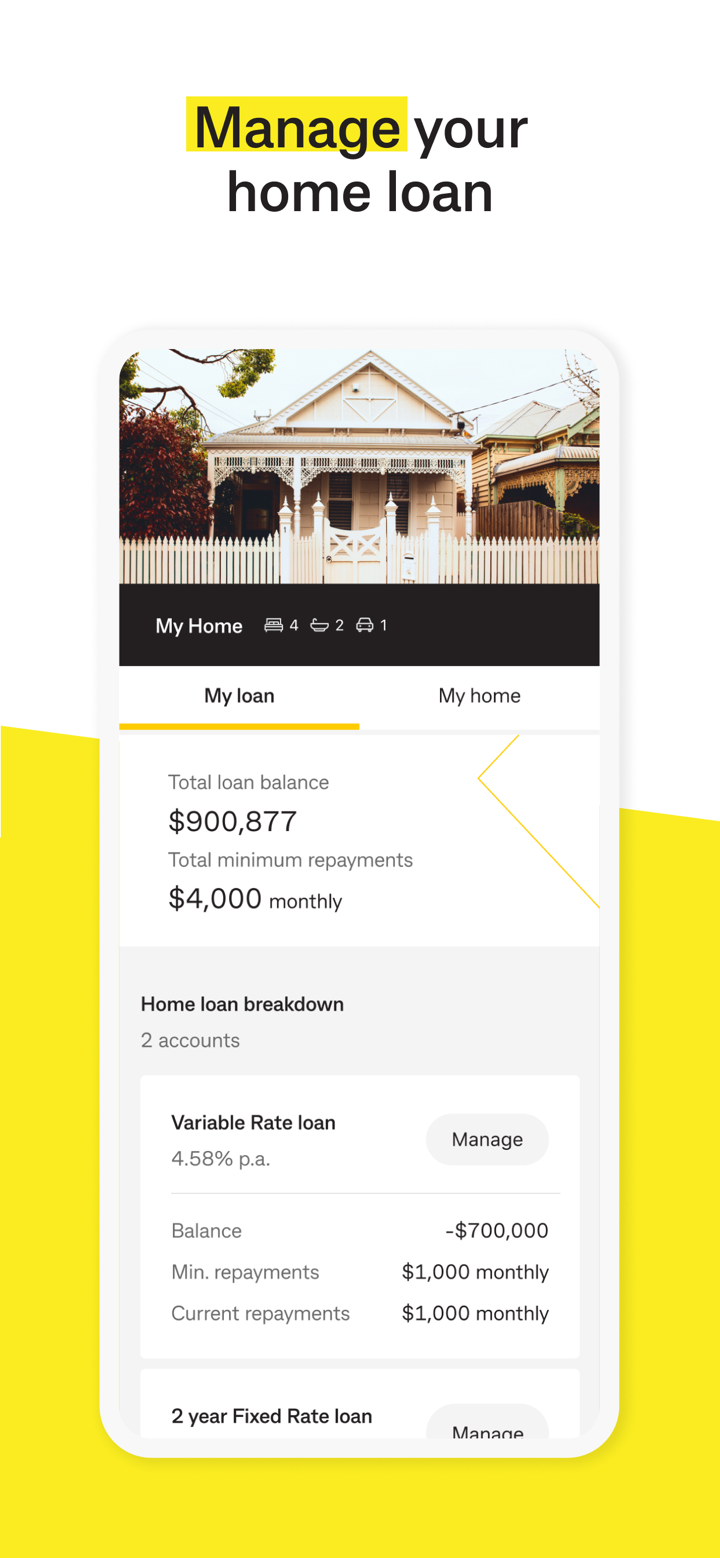

| Home Loans | Home Loan Application Fee | $495–$995 |

| Refinance Fee | Approximately $395 | |

| Wealth Package Annual Fee | $395 (includes home loan rate discount) | |

| Insurance | Pet Insurance (First-Year Offer) | First 2 months free |

| Pet Insurance (Subsequent Monthly Fee) | $20–$80 |

Leverage

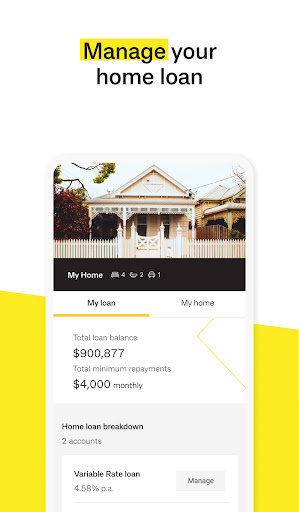

For CommBank home loan leverage, the maximum loan amount can be 80% of the property value (LVR ≤ 80%).

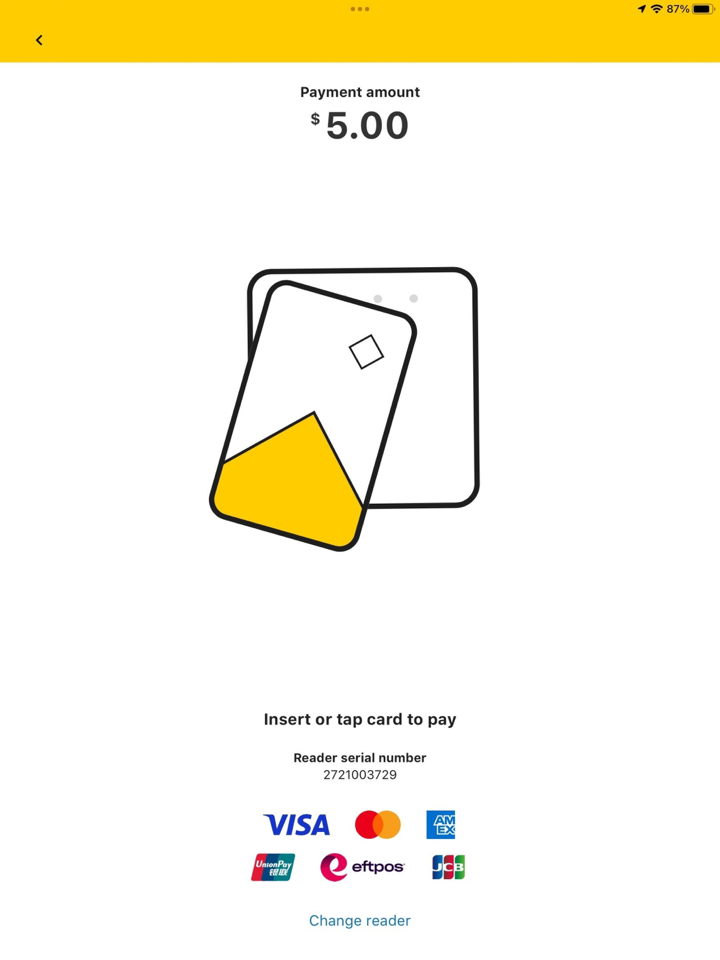

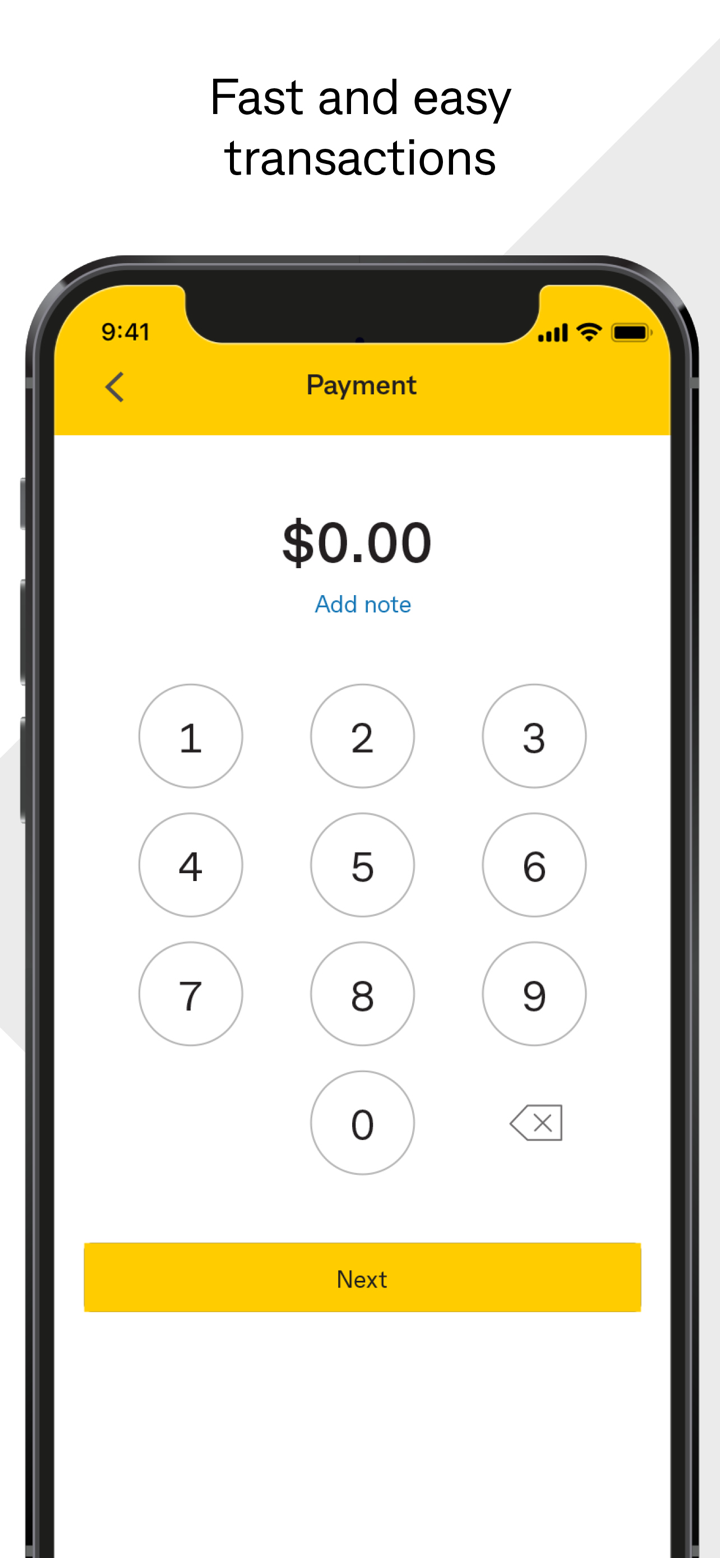

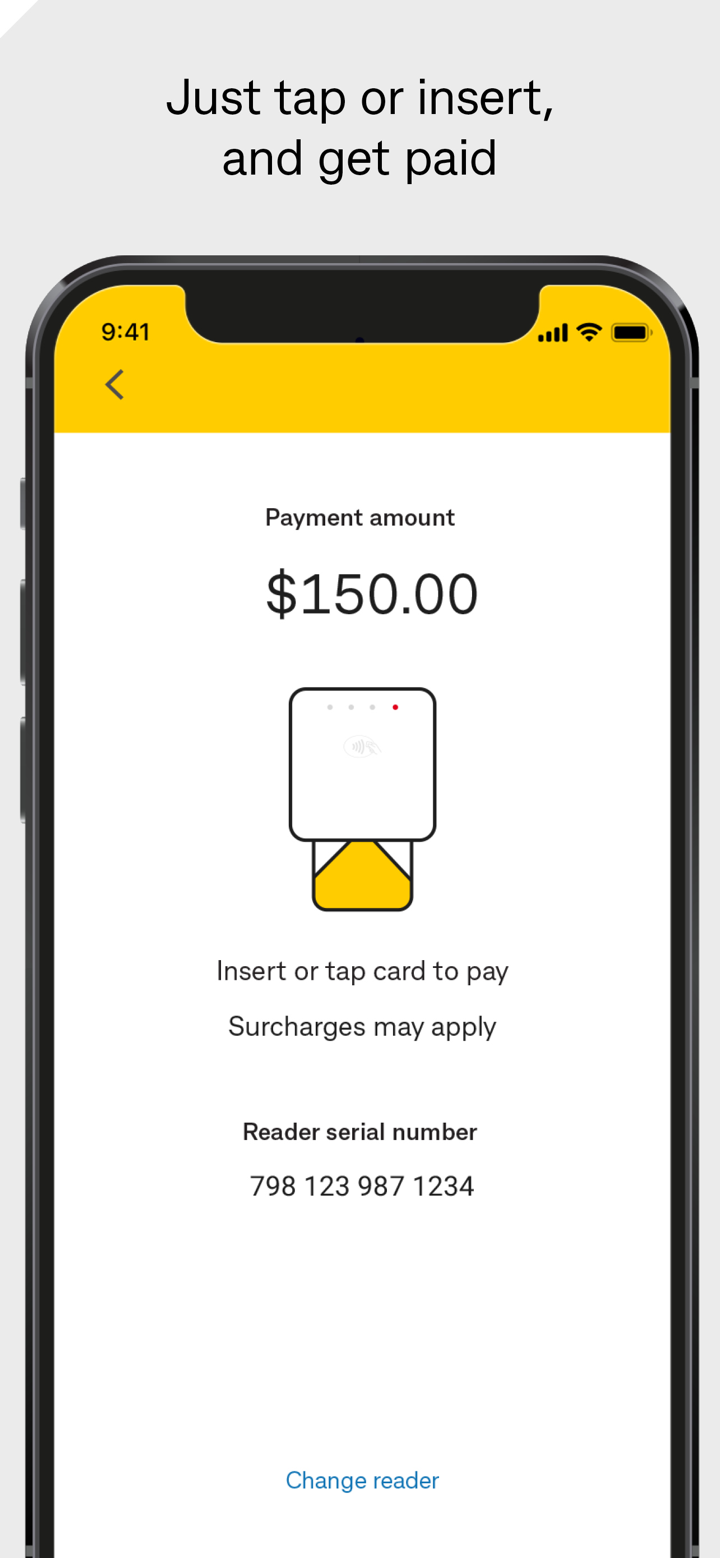

Trading Platform

| Trading Platform | Supported | Available Devices |

| CommBank app | ✔ | - |

| NetBank | ✔ | Web |

| CommSec | ✔ | - |

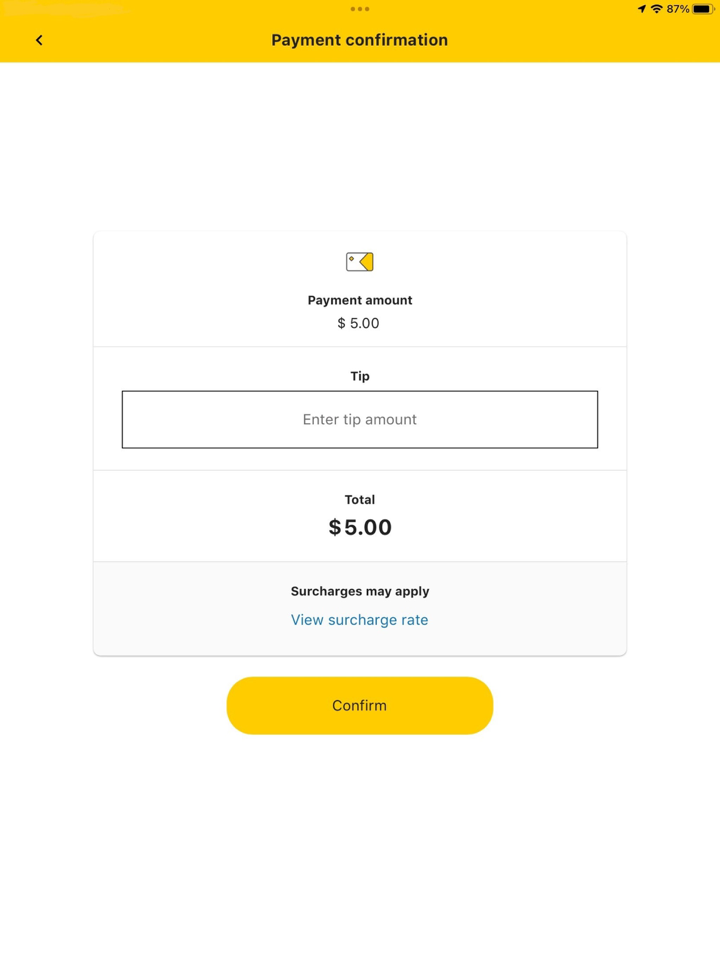

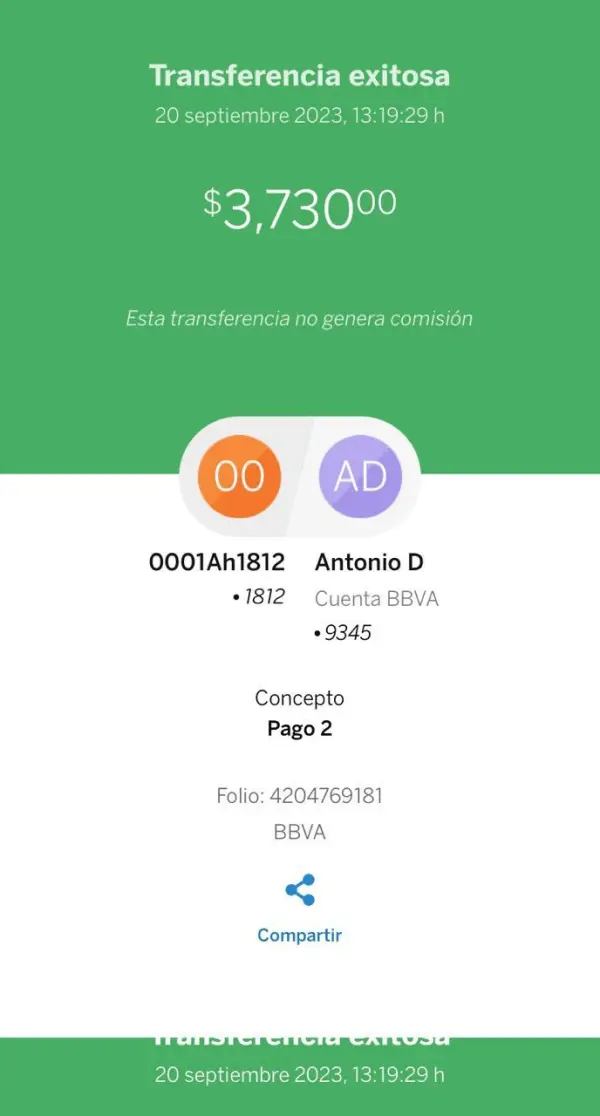

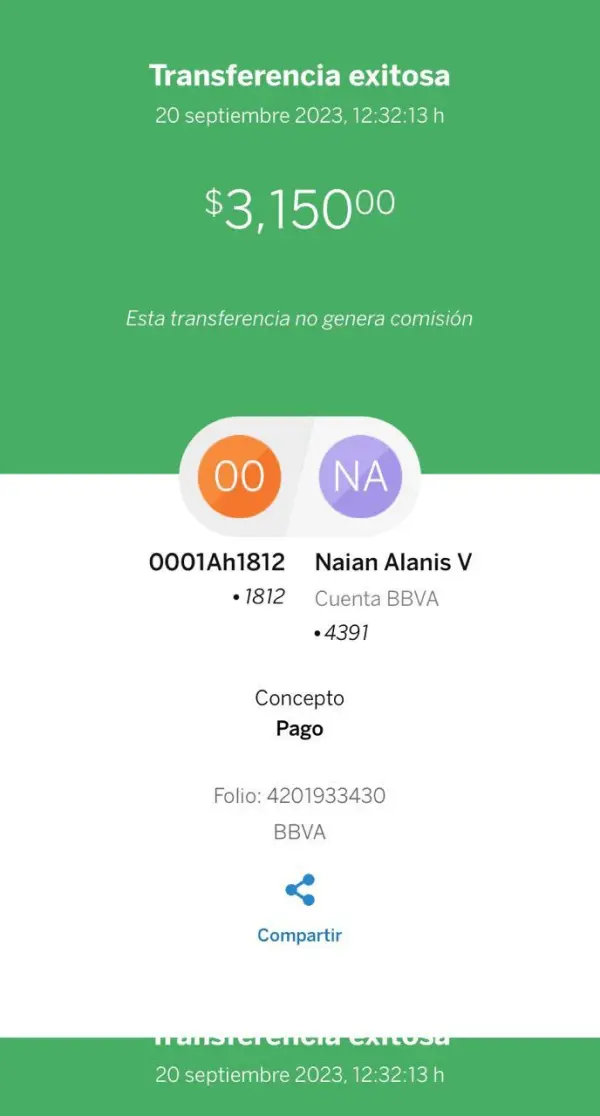

Deposit and Withdrawal

| Category | Method | Details |

| Deposits | Bank Transfer | Supports local/international transfers; SWIFT code required for international transfers: CBAUAT22. |

| ATM Deposit | Free cash/check deposits at CommBank ATMs within Australia | |

| Direct Salary Deposit | Allows employers to deposit salaries directly; Reward eligibility for certain accounts (e.g., Smart Awards credit card points) | |

| Withdrawals | ATM Withdrawal | Access Australian dollars or local currency at Mastercard ATMs worldwide; Overseas withdrawal fee: $5 per transaction + currency conversion fee |

| Transfer to Linked Accounts | Free real-time transfers to other CommBank accounts or third-party accounts (requires PayID/BSB number) |

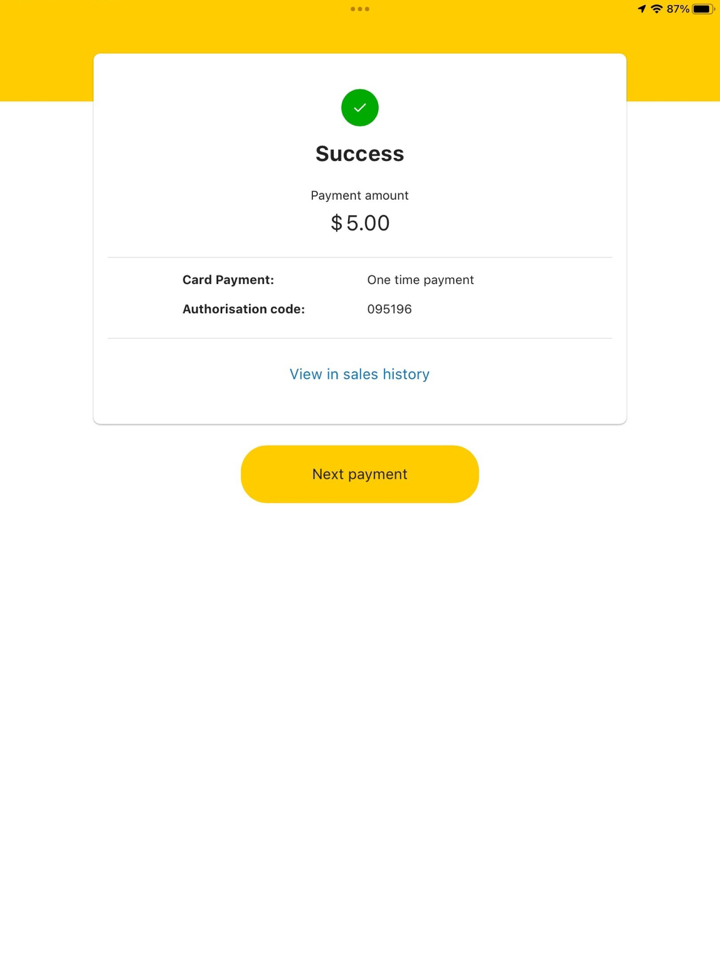

Bonus

CommBank's new customer rewards include: opening a designated transaction account and completing transactions to receive a $200 cash bonus (limited-time offer); new home loan customers can enjoy a $699 conveyancing discount (via the Home-in service).

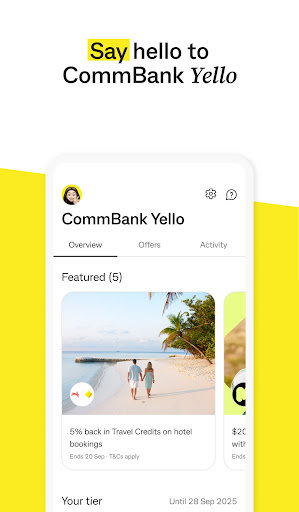

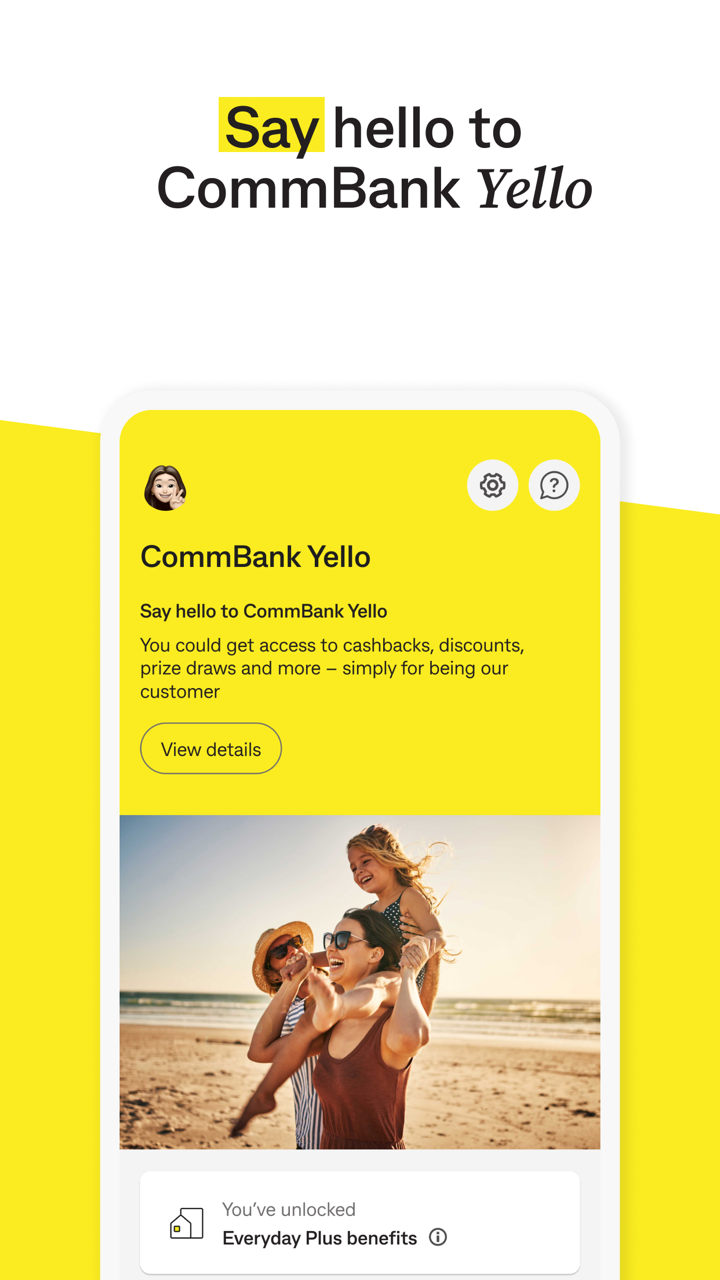

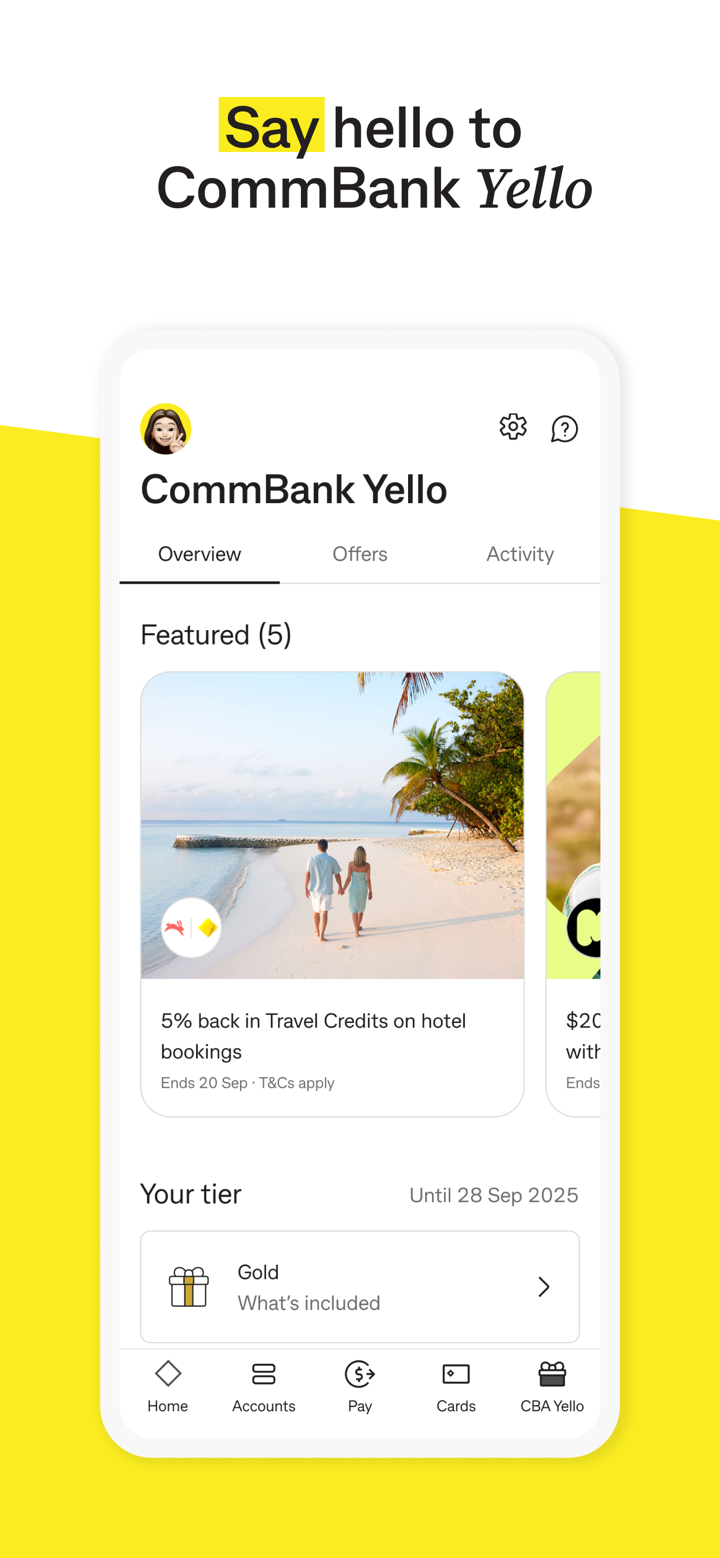

Additionally, investors can access loyalty rewards such as the CommBank Yello program, which offers points, cashback (e.g., up to $40 monthly cashback on home loans), and service discounts. Credit card spending accumulates CommBank Awards points, which can be redeemed for gift cards or Qantas frequent flyer miles.