Company Summary

| RKFS Review Summary | |

| Founded | 2020-06-08 |

| Registered Country/Region | India |

| Regulation | Unregulated |

| Market Instruments | securities, mutual funds, stocks, insurance, consulting services, etc. |

| Demo Account | Not mentioned |

| Trading Platform | Sanjhi Poonji(Web, Android, and iOS) and backend |

| Min Deposit | No limit |

| Customer Support | Phone:+91-011-485644440+91-7834834444 |

| Email: Mcustomercare@rkfml.com | |

| Live chat | |

| Social Media(Facebook, Instagram, LinkedIn, YouTube, etc.) | |

RKFS Information

RKFS is a financial advisory company, providing various products and services, including securities, mutual funds, stocks, insurance, consulting services, etc. There are demat and RKFS-INDIA INX global accounts with free commission.

Pros and Cons

| Pros | Cons |

| Various products and services | Unregulated |

| 24/7 live support |

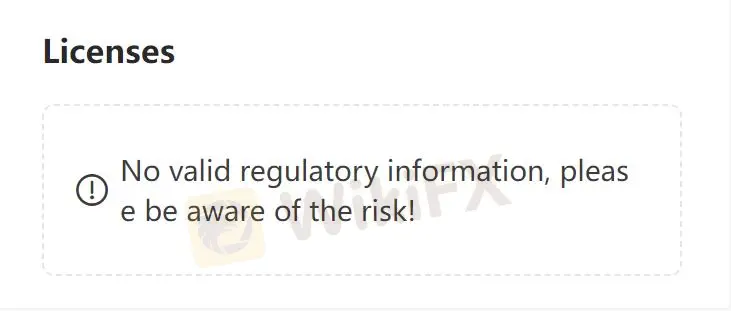

Is RKFS Legit?

RKFS is not regulated, which makes it less safe than regulated ones.

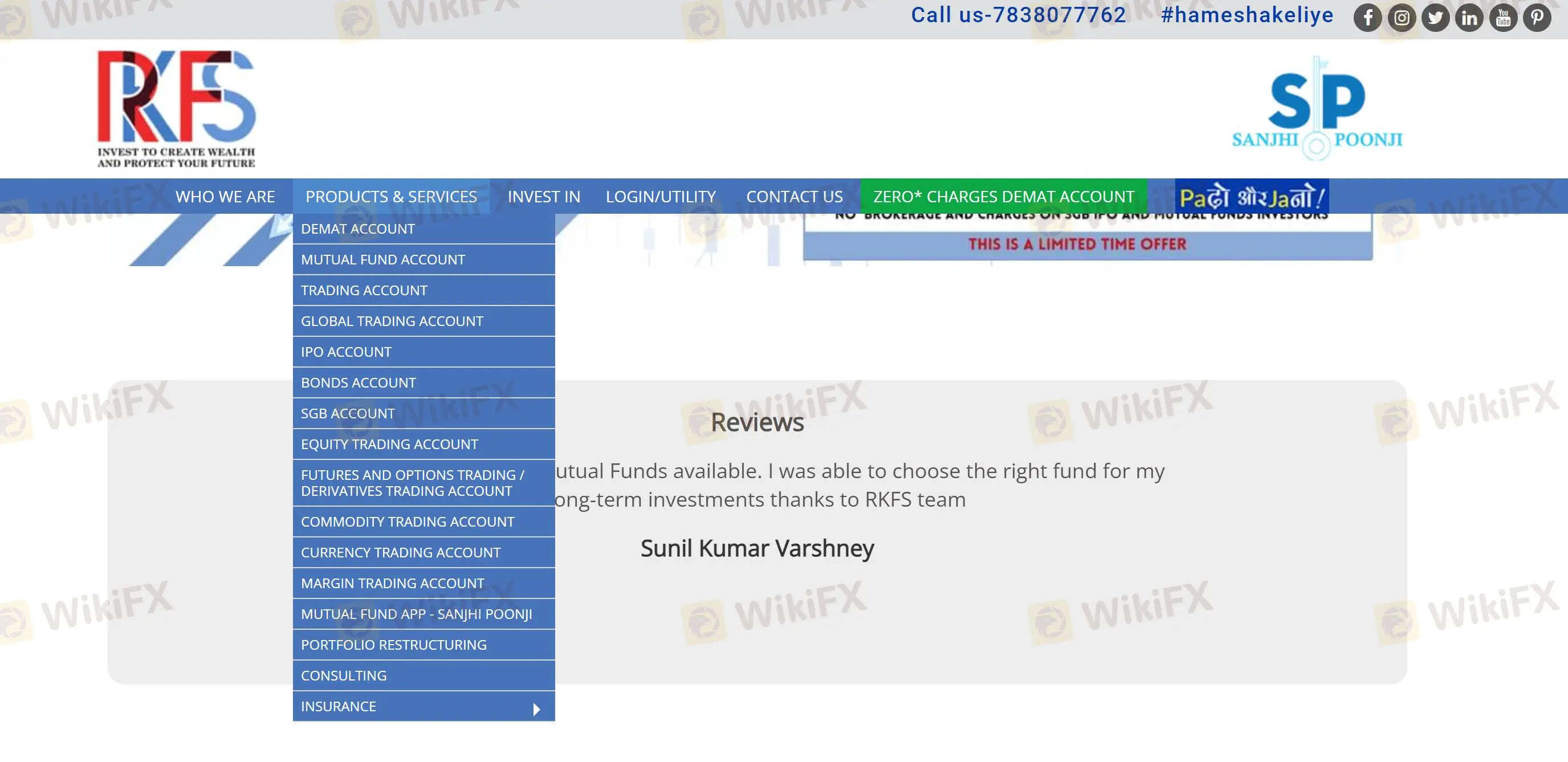

What products and services does RKFS have?

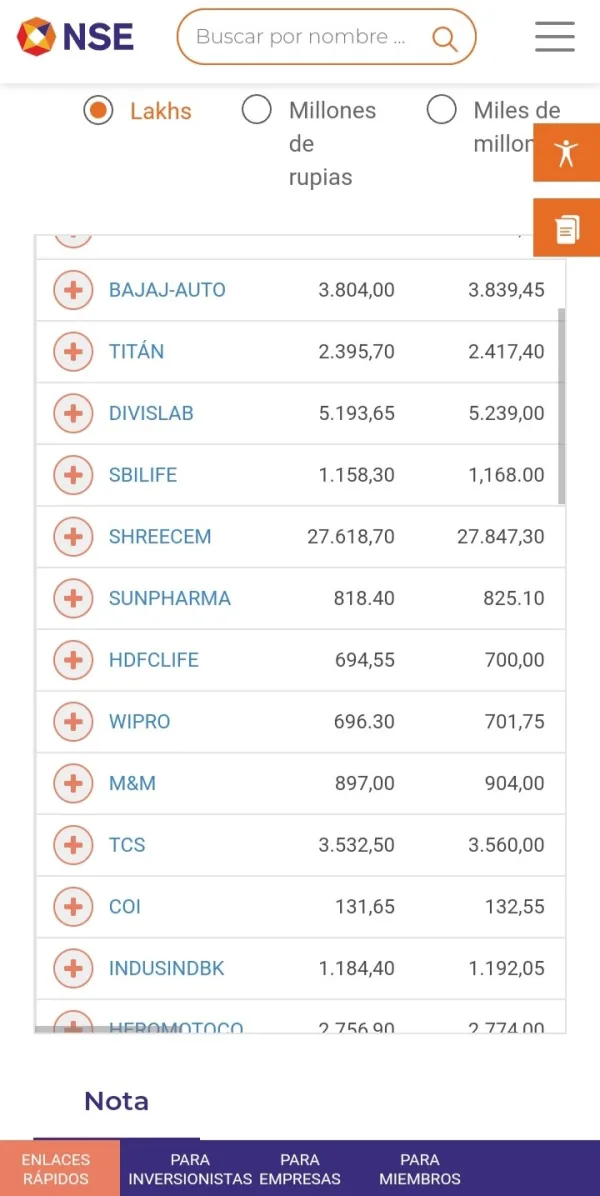

Traders can open an account to invest in multiple trading assets, including securities, mutual funds, IPO, stocks, options, futures, and margin trading, along with ETFs, currencies, bonds, and so on, as well as insurance and consulting services.

| Tradable Instruments | Supported |

| Securities | ✔ |

| Mutual Funds | ✔ |

| IPO | ✔ |

| Stocks | ✔ |

| Options and Futures | ✔ |

| Margin Trading | ✔ |

| ETFs | ✔ |

| Currencies | ✔ |

| Mutual Funds | ✔ |

| Insurance | ✔ |

| Consulting | ✔ |

Account Type

RKFS provides demat and RKFS-INDIA INX global accounts. GA allows investors to invest globally in stocks, ETFs, options, futures, currencies, bonds, mutual funds from a single integrated account and in addition to providing the above asset services, demat can also invest in IPOs, commodities, and so on.

| Account Type | Supported |

| Demat Account | ✔ |

| RKFS-INDIA INX GLOBAL ACCOUNT(GA) | ✔ |

RKFS Fees

The commission is zero.

Trading Platform

RKFS can invest in public funds through Sanjhi Poonjis Android, iOS, or web version. Other asset investments can be learned and downloaded through the back office.

| Trading Platform/Software | Supported | Available Devices |

| Sanjhi Poonji | ✔ | Web, Android, and iOS |

Deposit and Withdrawal

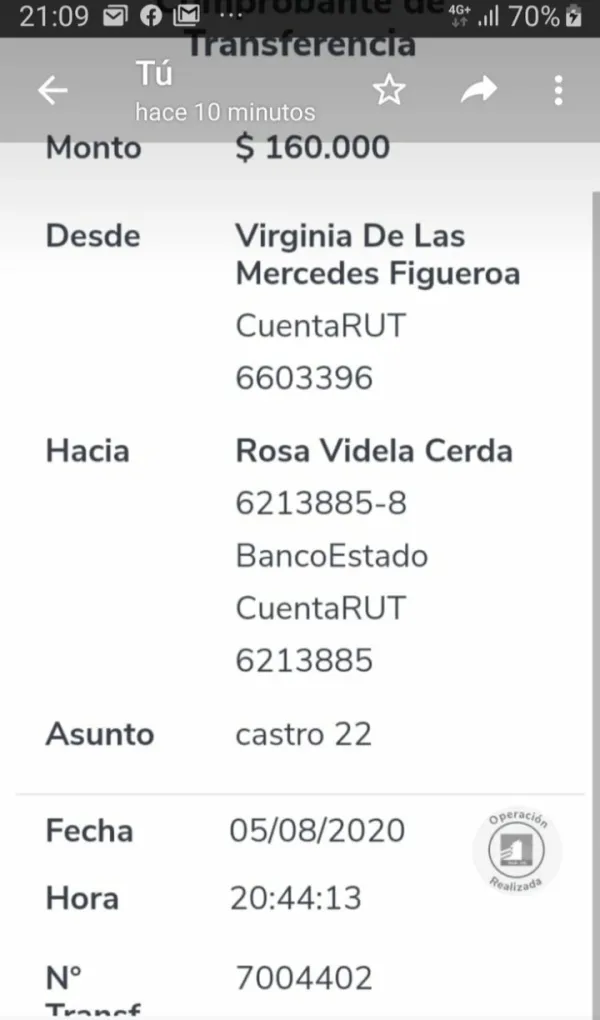

The minimum deposit is no limit. RKFS supports online fund transfers, and partner banks have HDFC and ICICI banks.

Customer Support Options

Traders enjoy value-added services, such as 24/7 live support. RKFS supports contact via phone and email, as well as social media, including Facebook, Instagram, LinkedIn, YouTube, etc.

| Contact Options | Details |

| Phone | +91-011-485644440+91-7834834444 |

| Mcustomercare@rkfml.com | |

| Live chat | ✔ |

| Social Media | Facebook, Instagram, LinkedIn, YouTube, etc. |

| Supported Language | English |

| Website Language | English |

| Physical Address | R. K. Financial Services (RKFS)A-7, Block B1, Mohan Co-operative Ind.Estate, Mathura Road, New Delhi-110044 |