Company Summary

| TradeStation Review Summary | |

| Founded | 1997 |

| Registered Country/Region | United States |

| Regulation | No license |

| Market Instruments | Stocks, options, futures, futures options, ETFs, mutual funds |

| Demo Account | ✅ |

| Trading Platforms | Desktop, web, mobile apps, FuturesPlus, TS Crypto |

| Min Deposit | / |

| Customer Support | Monday – Friday, 8:00 a.m. – 5:00 p.m. ET |

| Live chat, request a callback, phone, email | |

TradeStation Information

Founded in 1997, TradeStation is an online brokerage that has been supporting self-directed traders and active investors for many years. It offers a range of proprietary trading analysis tools and advanced order placement technology to help customers design, test, and automate custom trading strategies.

Originally a software product, TradeStation allowed customers to develop and back-test their own trading strategies using historical market data. It then evolved into an online securities brokerage in 2001, integrating its software platform with real-time market data and order placement for securities and futures markets.

Pros & Cons

| Pros | Cons |

|

|

|

|

|

|

| |

| |

|

Is TradeStation Safe or Scam?

TradeStation claims to offer several protection measures to safeguard customer accounts and personal information. These measures include account and trade monitoring, customer alerts, strict privacy policies, encrypted communications, advanced firewalls, unique usernames and strong encrypted passwords, strong customer login verification online, session timeouts, login attempt limitations, and extended secure website verification.

While these security measures are certainly important and can help protect against unauthorized access and cyber threats, it is also important to consider other factors when determining the safety and legitimacy of a trading platform or brokerage.

However, TradeStation's lack of valid regulation is a concerning point. Regulation provides oversight and accountability, ensuring that a company follows established standards and practices. It also provides a channel for customers to seek recourse if any issues or disputes arise.

It would be prudent to thoroughly research and assess the reputation and reliability of TradeStation before considering using their services. Reading user reviews, consulting trusted financial authorities, and seeking independent advice can help you make an informed decision regarding the safety and legitimacy of TradeStation.

Market Instruments

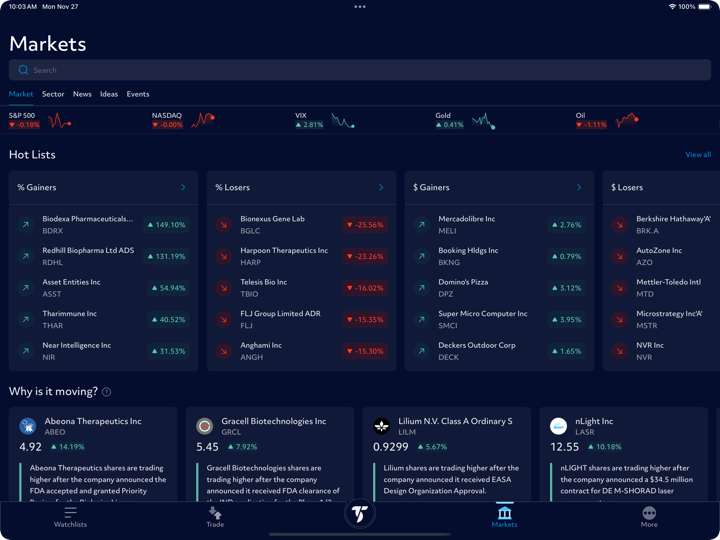

TradeStation offers trading in stocks, options, futures, futures options, ETFs, and mutual funds.

| Trading Assets | Available |

| Stocks | ✔ |

| Options | ✔ |

| Futures | ✔ |

| Futures Options | ✔ |

| ETFs | ✔ |

| Mutual funds | ✔ |

| Forex | ❌ |

| Commodities | ❌ |

| Indices | ❌ |

| Cryptocurrencies | ❌ |

| Bonds | ❌ |

Account Types

TradeStation offers several types of accounts to accommodate different trading needs and goals.

Individual and Joint Accounts:

These accounts are suitable for traders who want access to trading tools and research. They are flexible, and traders can upgrade to options or futures trading if they wish.

Retirement Accounts:

TradeStation offers a range of flexible retirement accounts, including Traditional IRAs, Roth IRAs, and SEP IRAs.

Entity Accounts:

These accounts are designed for corporations, limited liability companies, partnerships, trusts, and sole proprietorships. They offer a range of tools and services to help businesses invest and grow.

Commissions

TradeStation offers commission charges for stocks, options, futures, and cryptocurrencies. The commission fees differ based on whether the clients are U.S residents or non-U.S residents.

For instance, U.S residents are not charged any commissions for Stocks & ETFs and Stock Options, while non-U.S residents incur a $5 Commission per trade.

Traders are advised to visit the TradeStation website to obtain detailed information on the specific commission rates applied by the company.

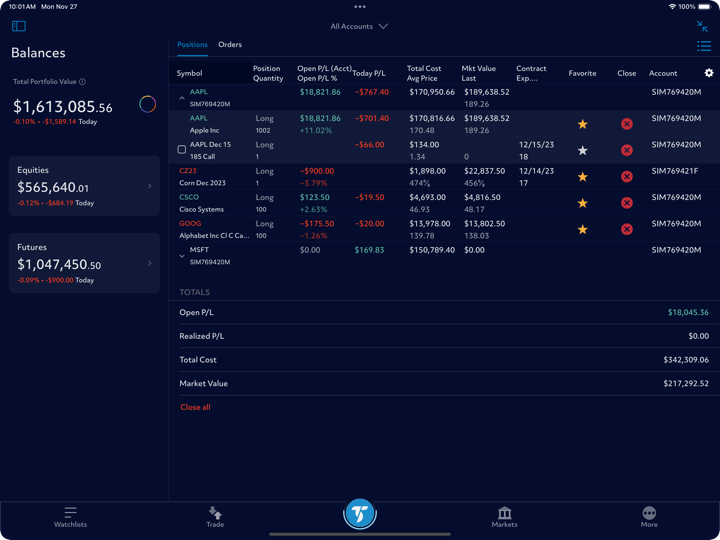

Trading Platforms

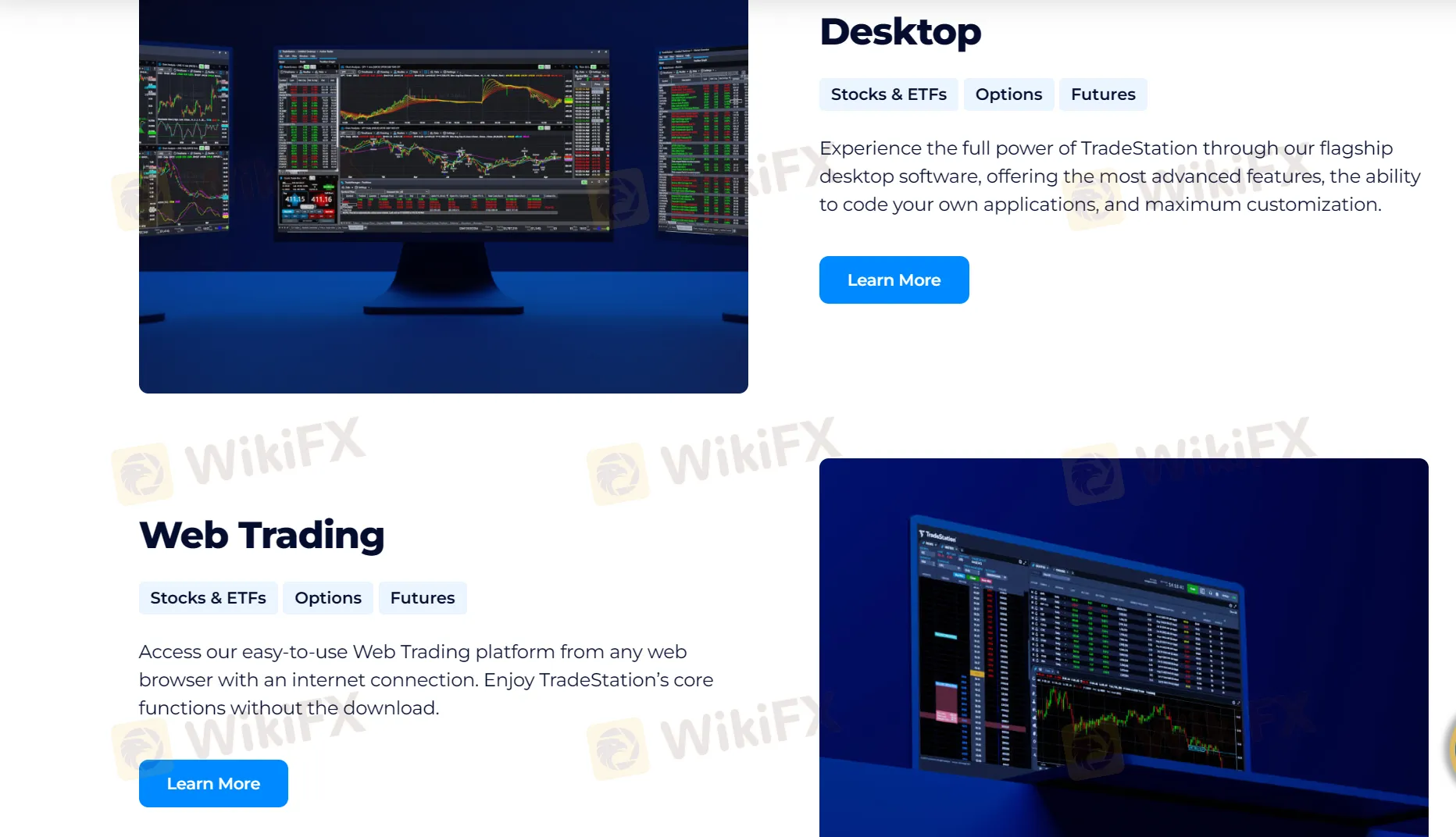

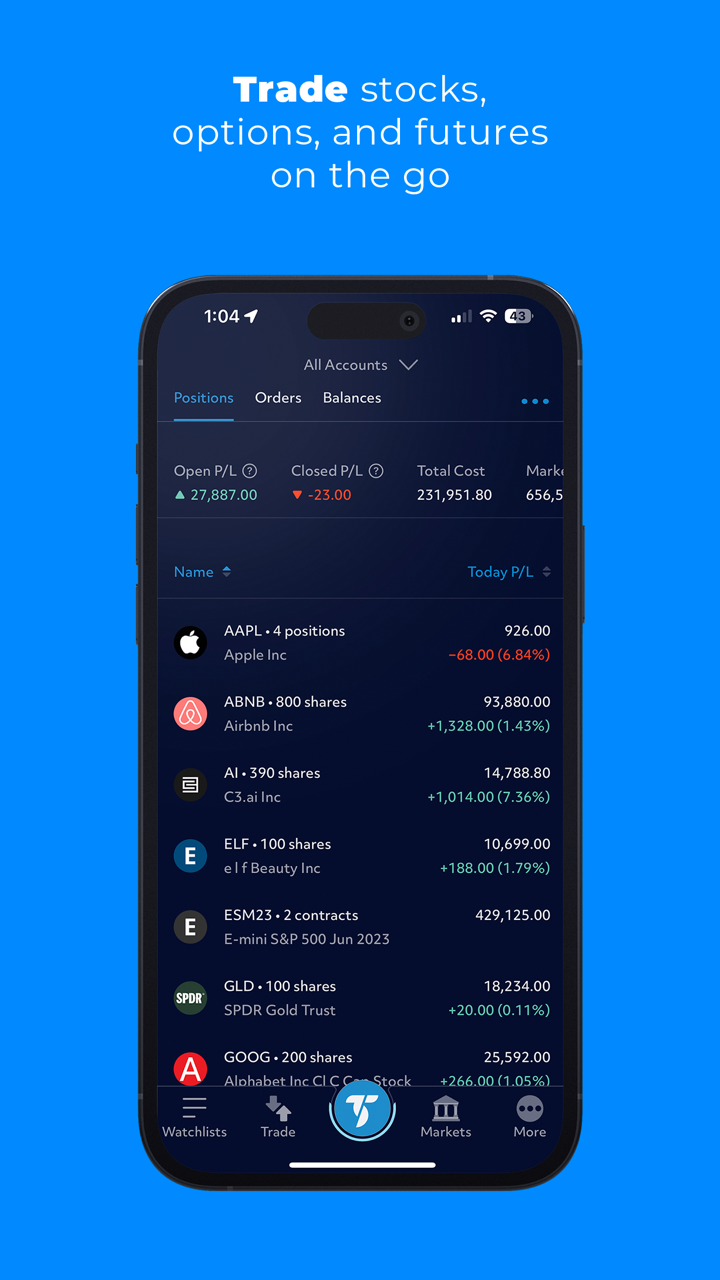

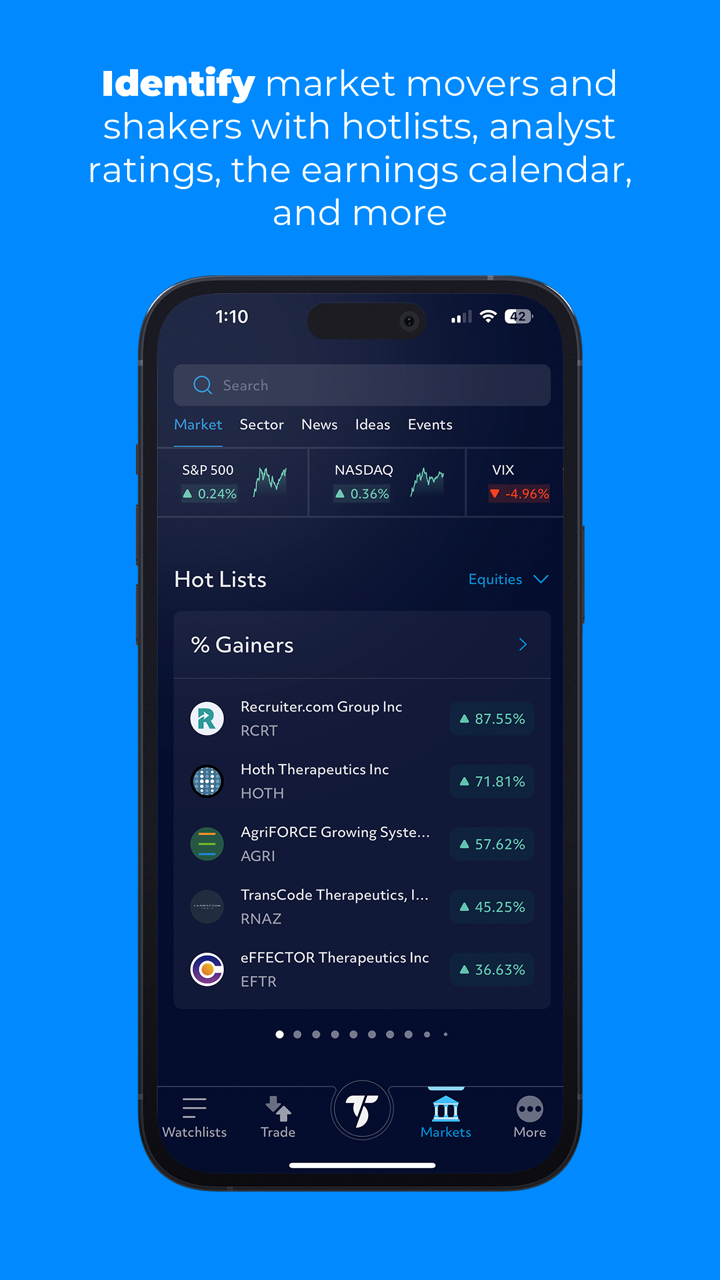

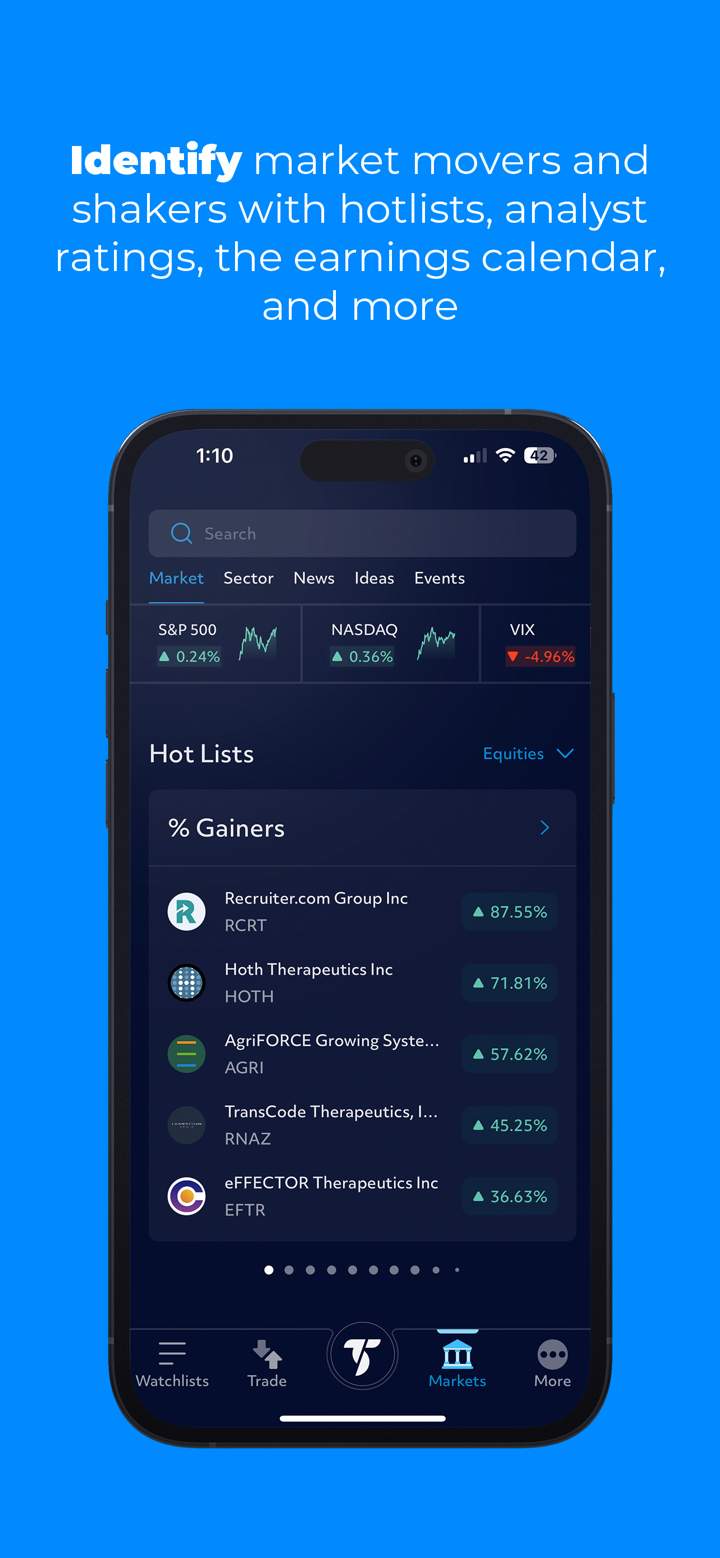

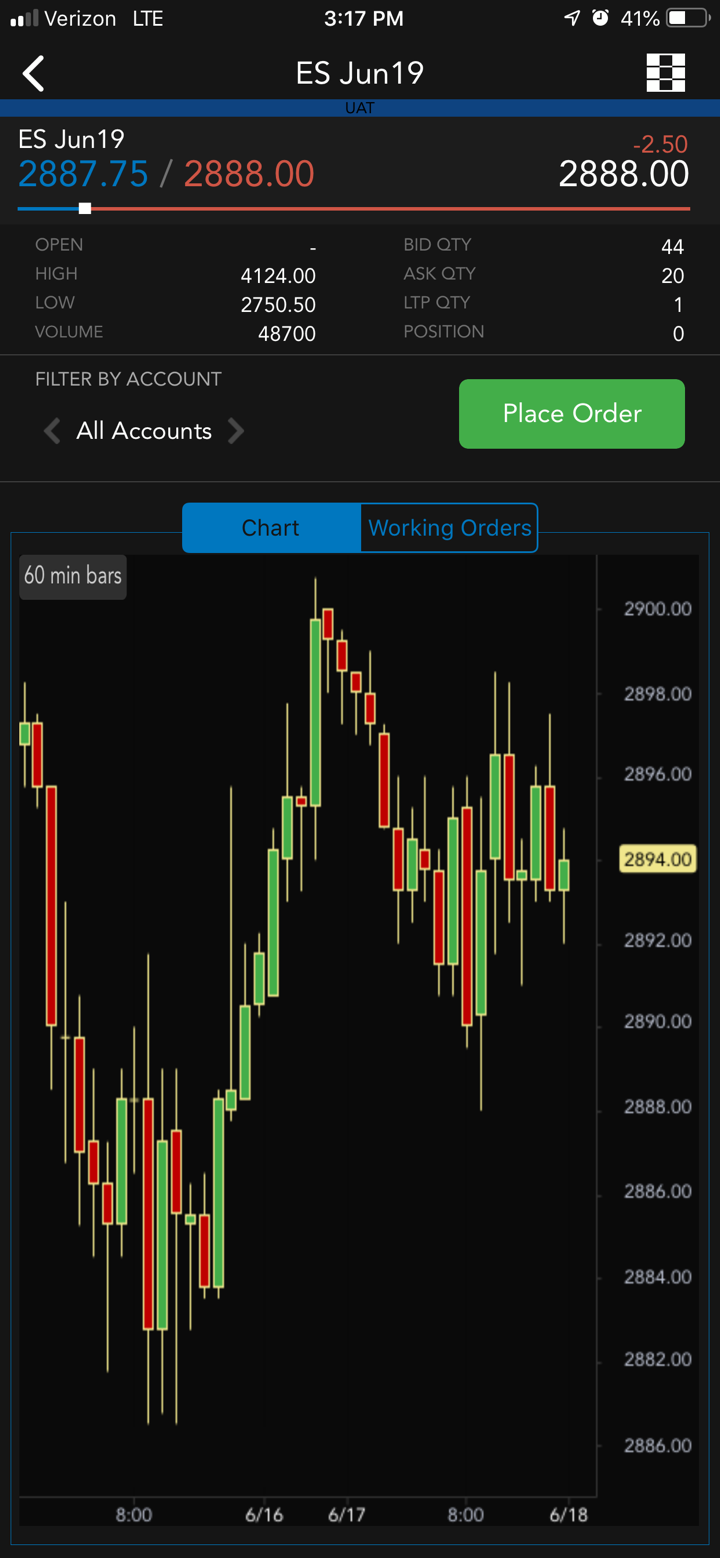

TradeStation is a leading online brokerage that offers several state-of-the-art trading platforms to its clients.

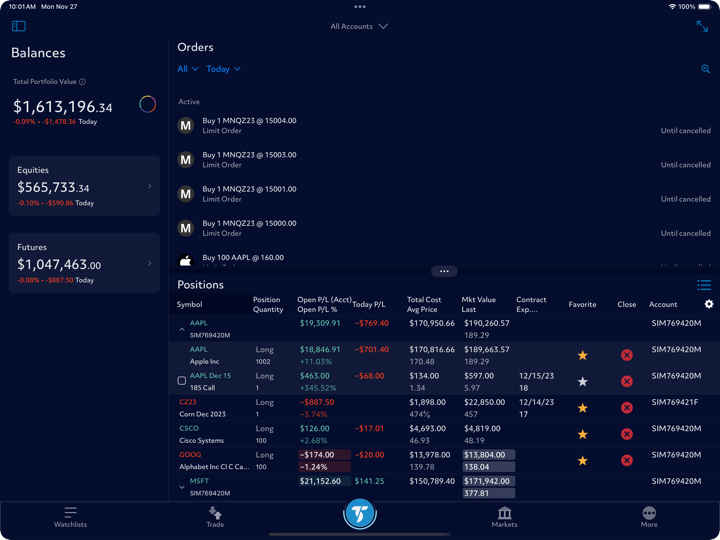

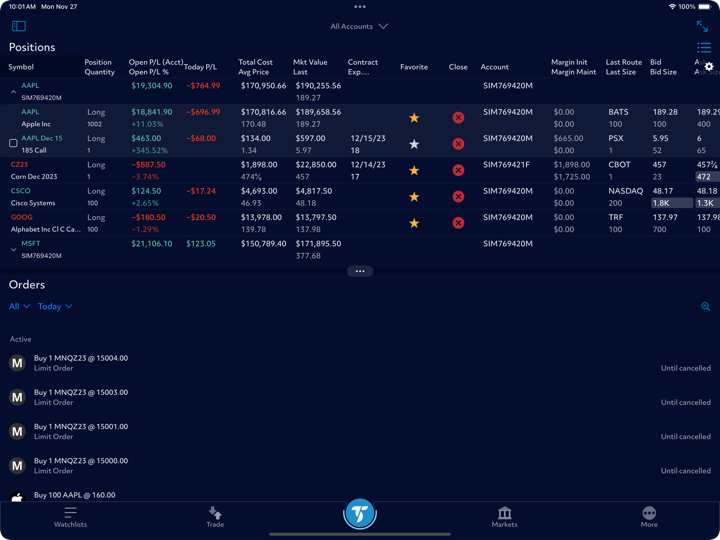

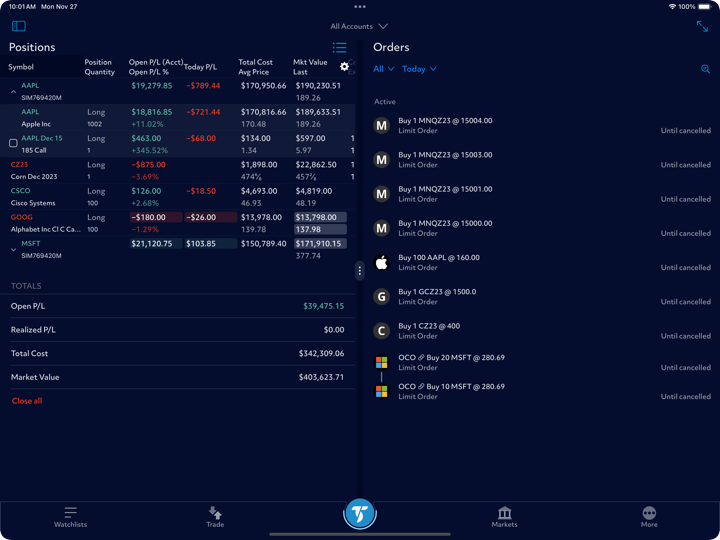

One of the most popular platforms is TradeStation Desktop, which provides traders with access to stocks, ETFs, options, and futures. This platform offers advanced features, the ability to code your own applications using EasyLanguage, and maximum customization.

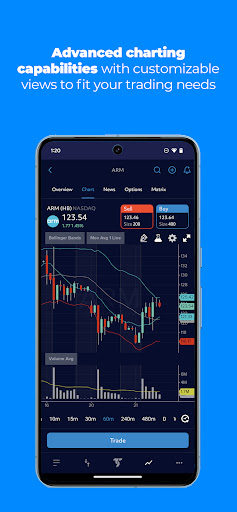

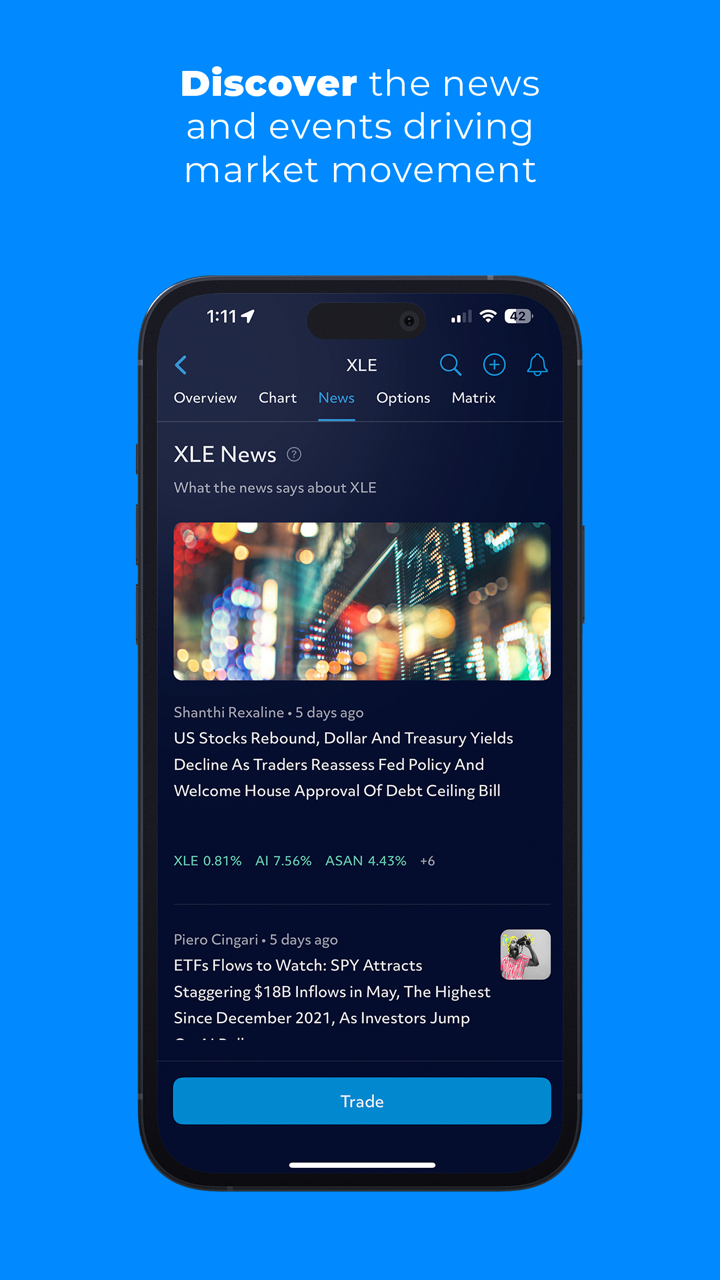

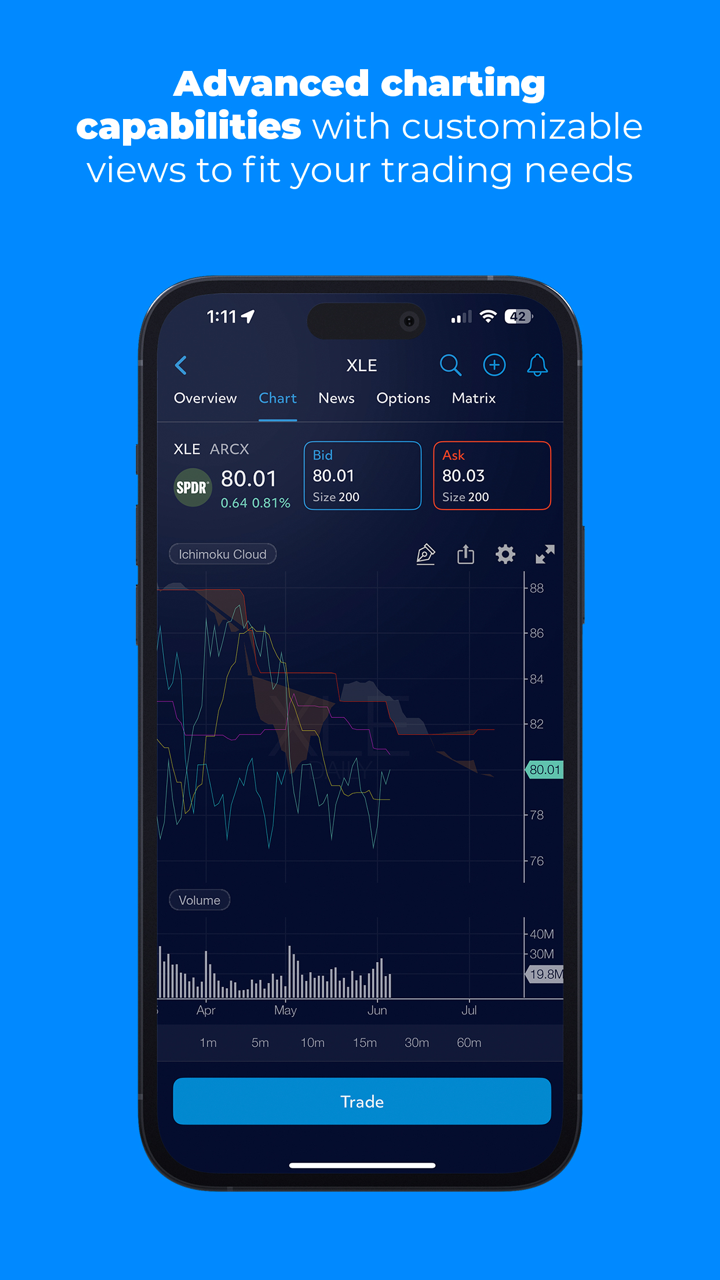

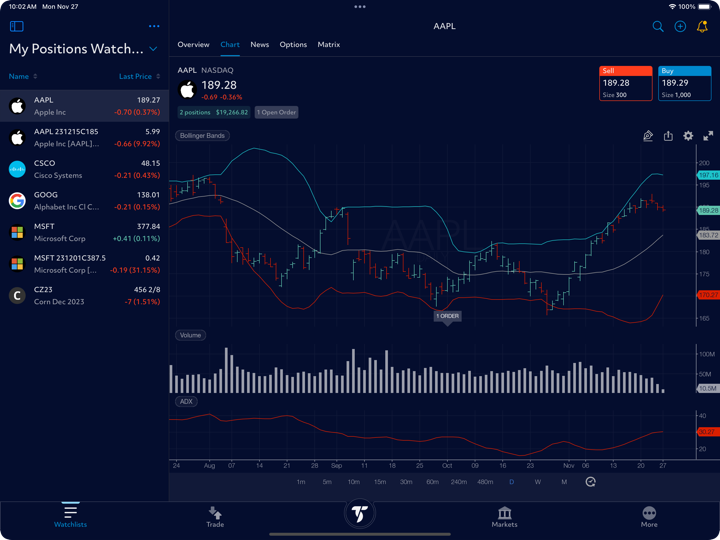

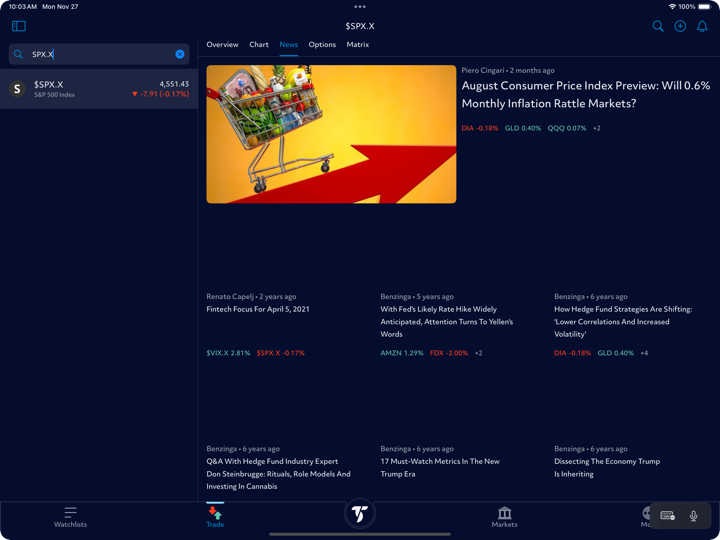

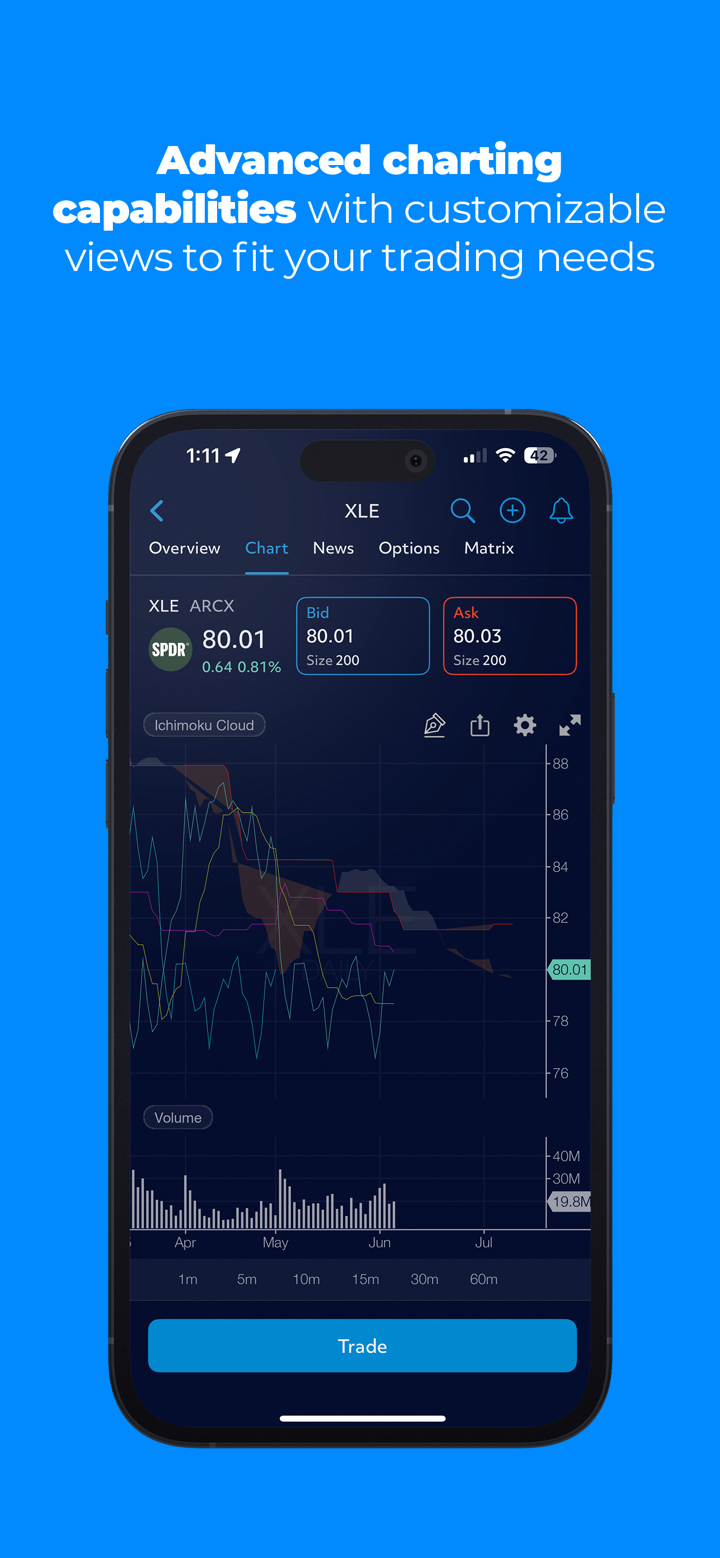

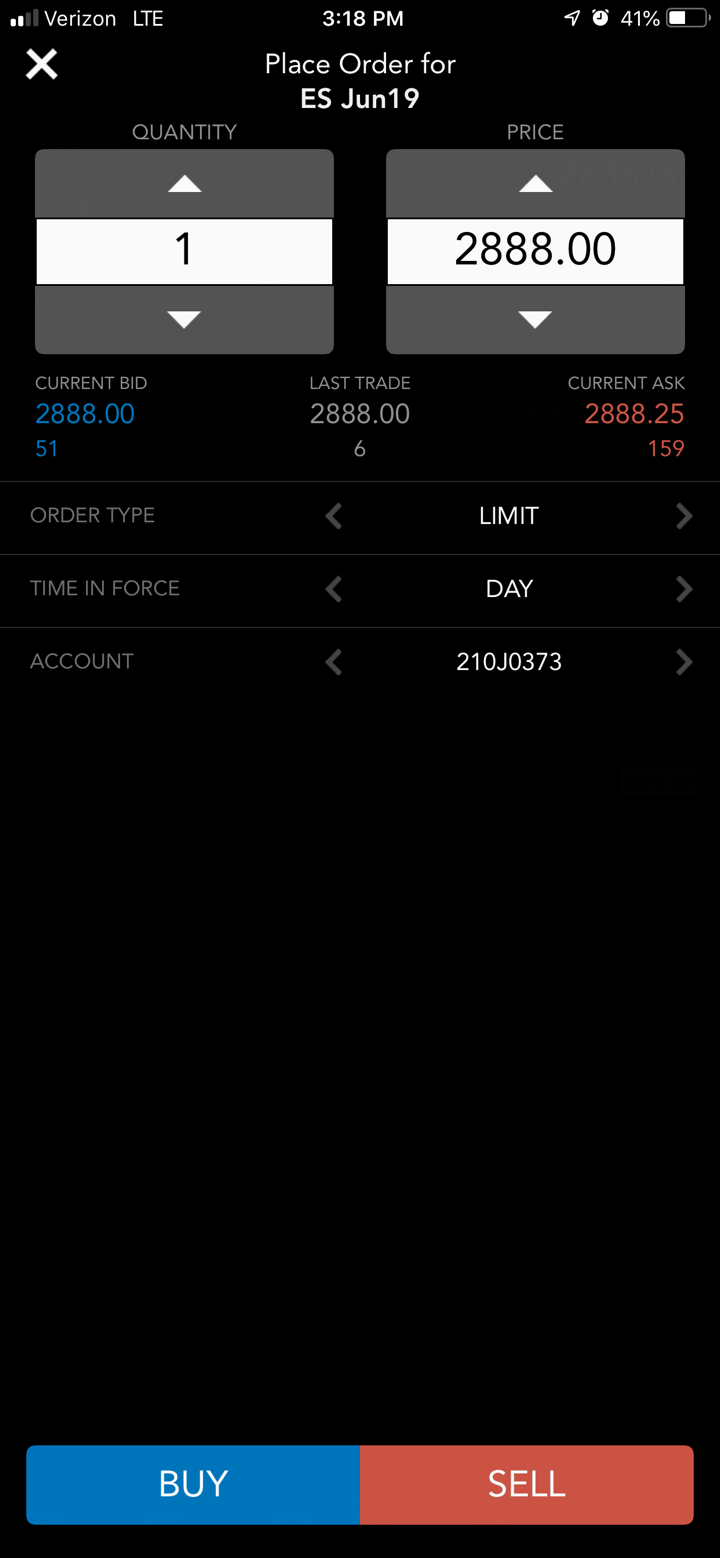

TradeStation also offers a web-based trading platform that can be accessed from any web browser with an internet connection. The Web Trading platform provides traders with all of the core functions of TradeStation Desktop, without requiring a download. This platform offers a user-friendly interface that makes it easy for traders to navigate and execute trades quickly. The platform also provides real-time market data, advanced charting tools, and a wide range of technical indicators.

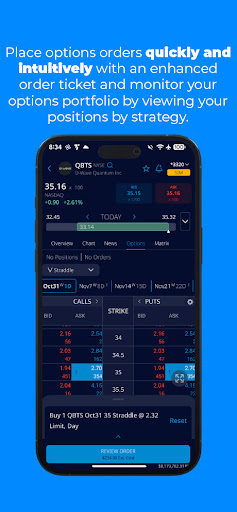

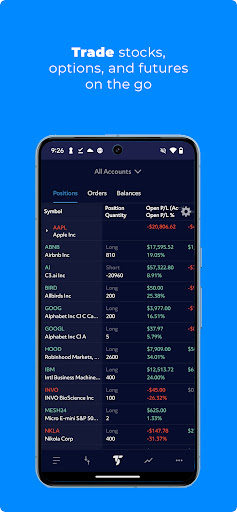

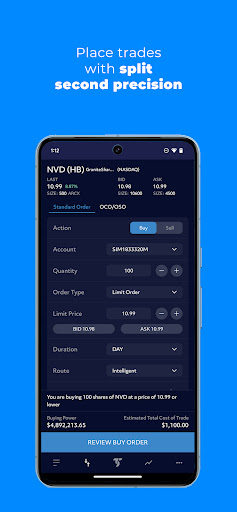

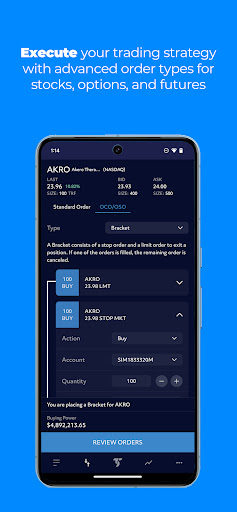

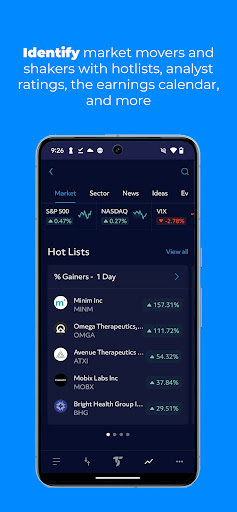

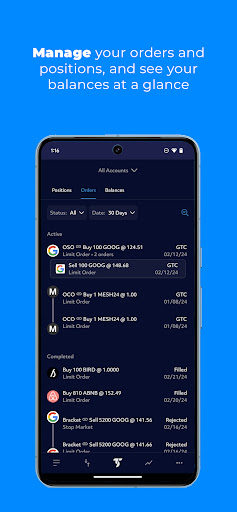

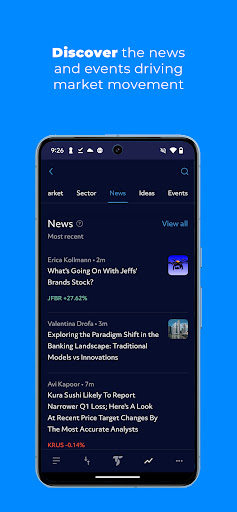

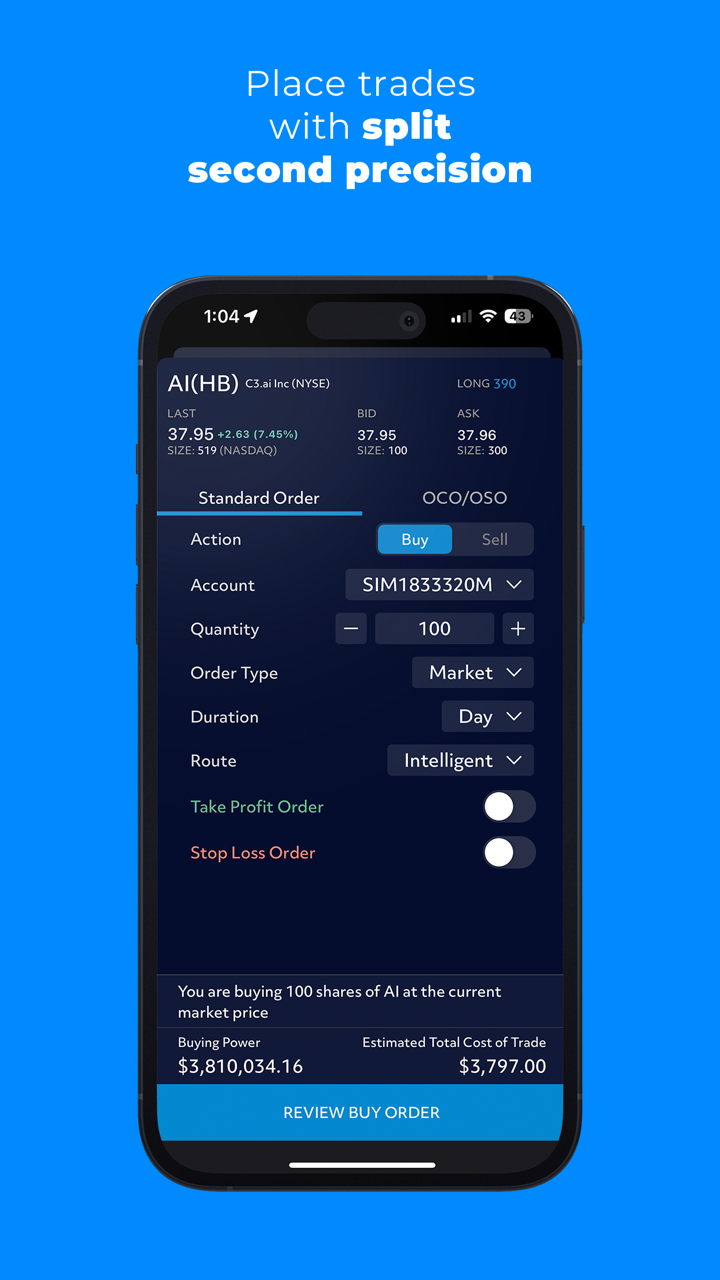

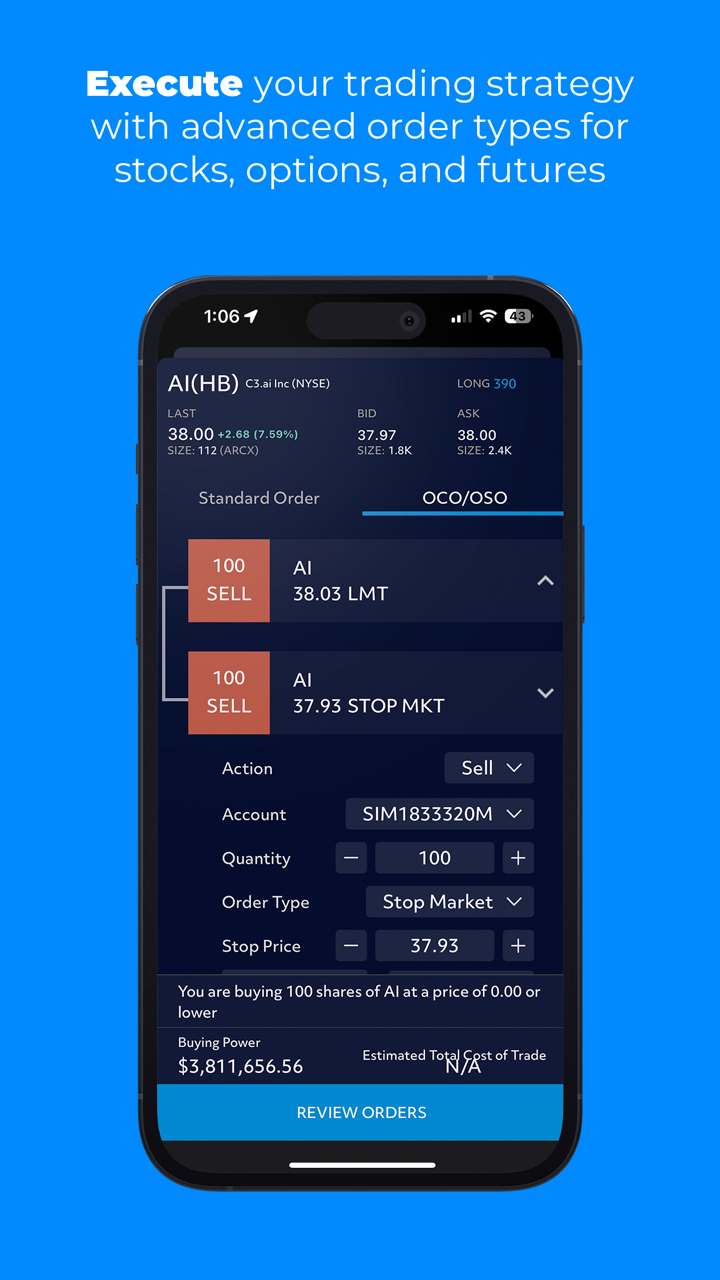

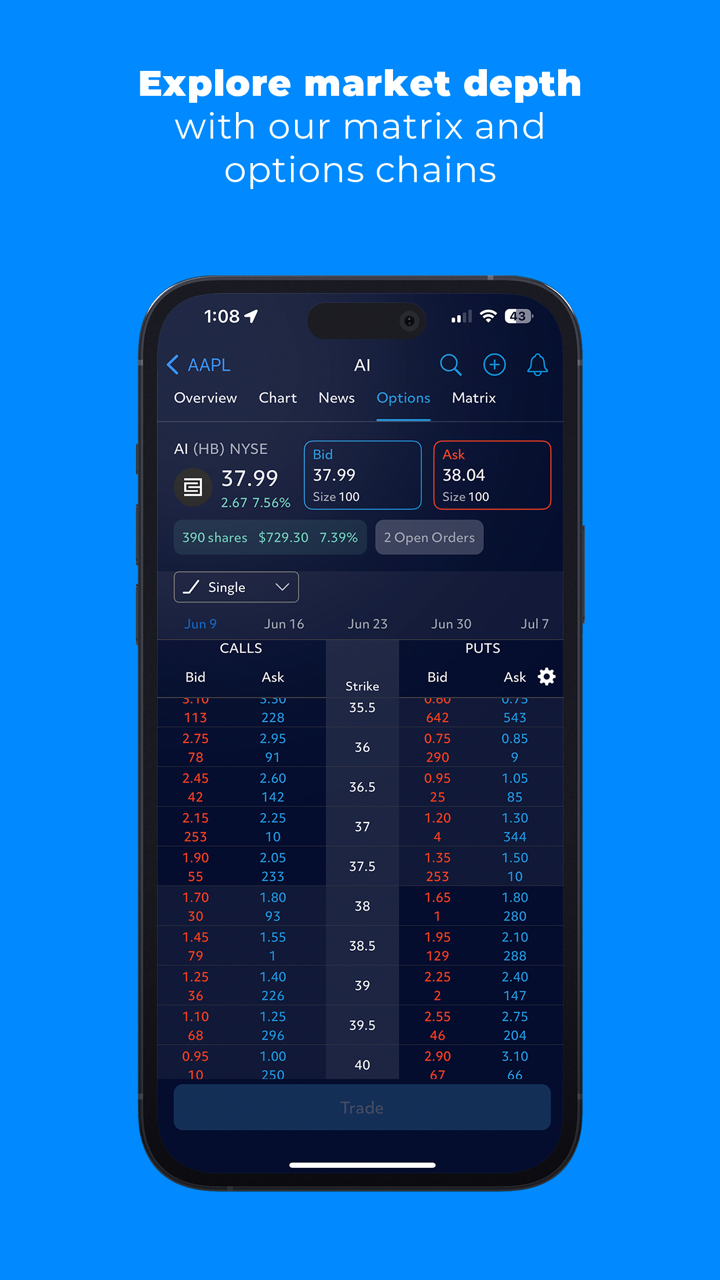

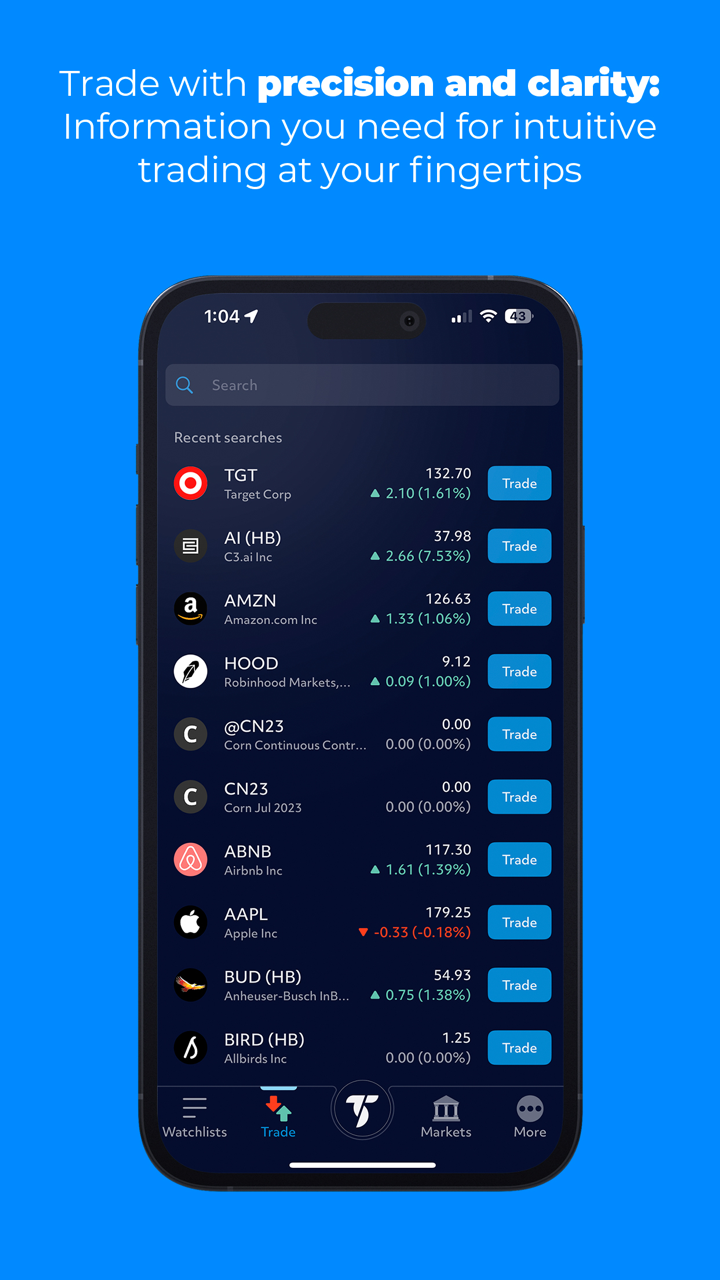

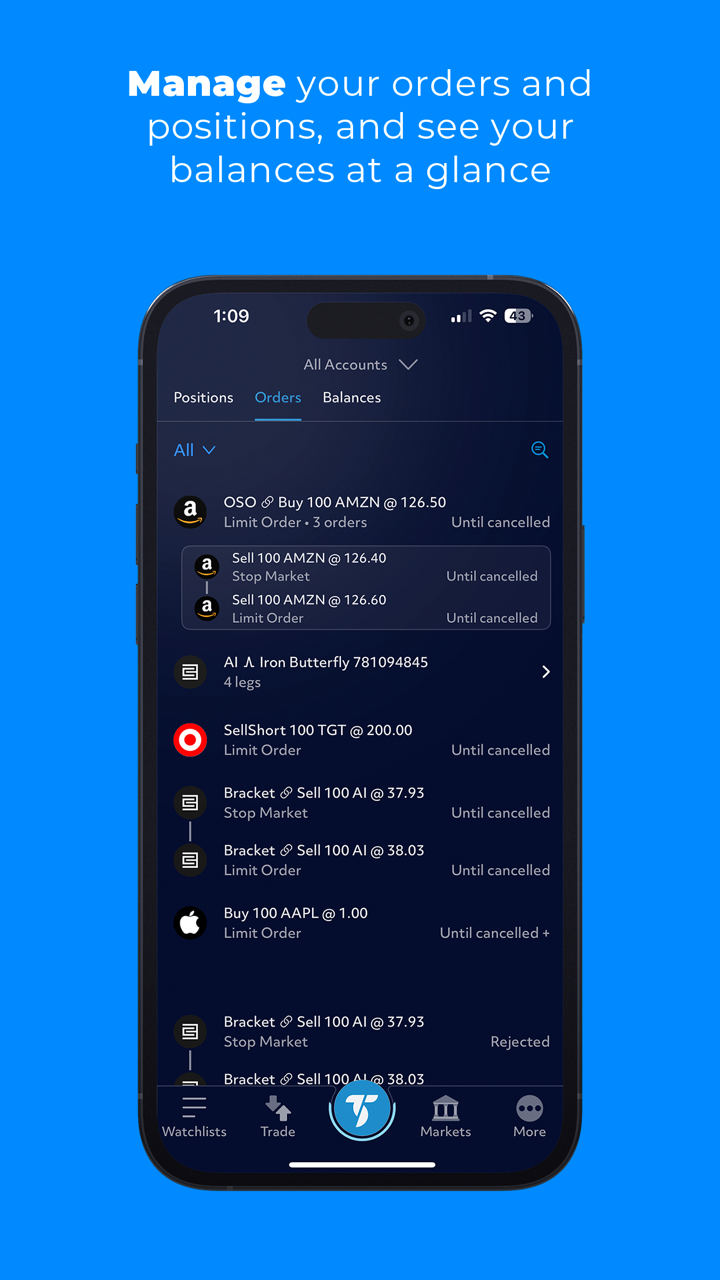

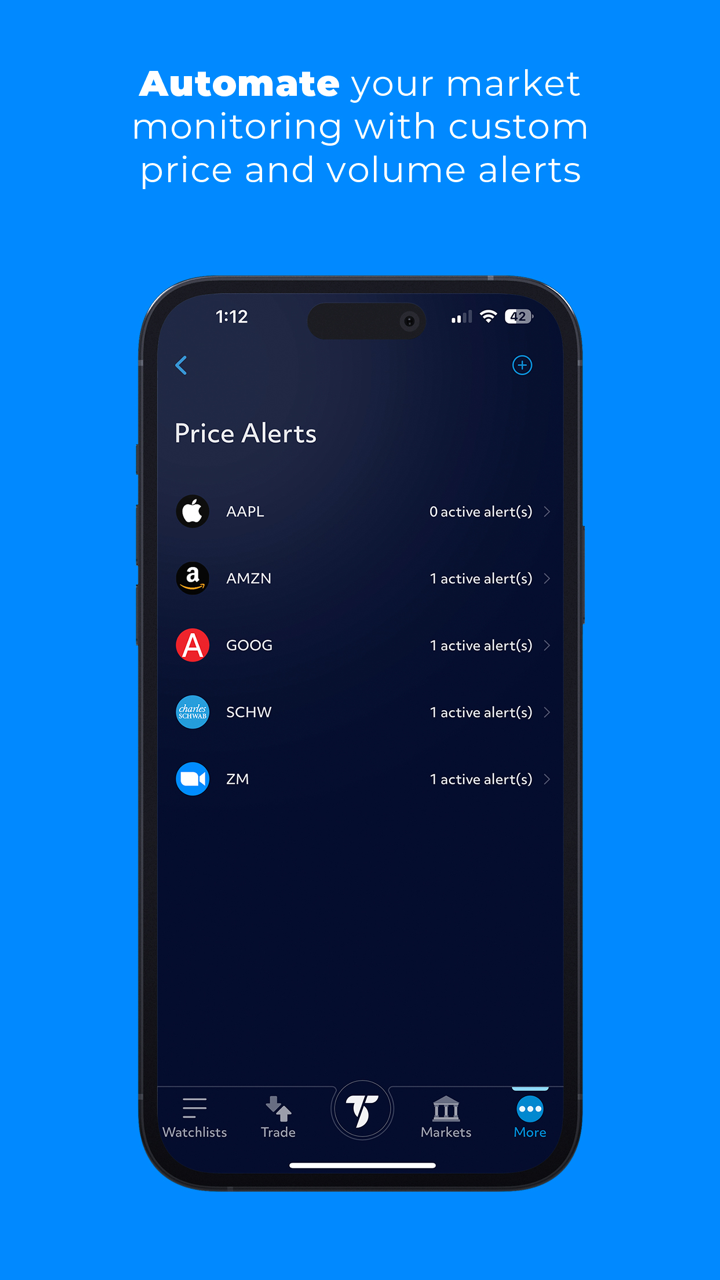

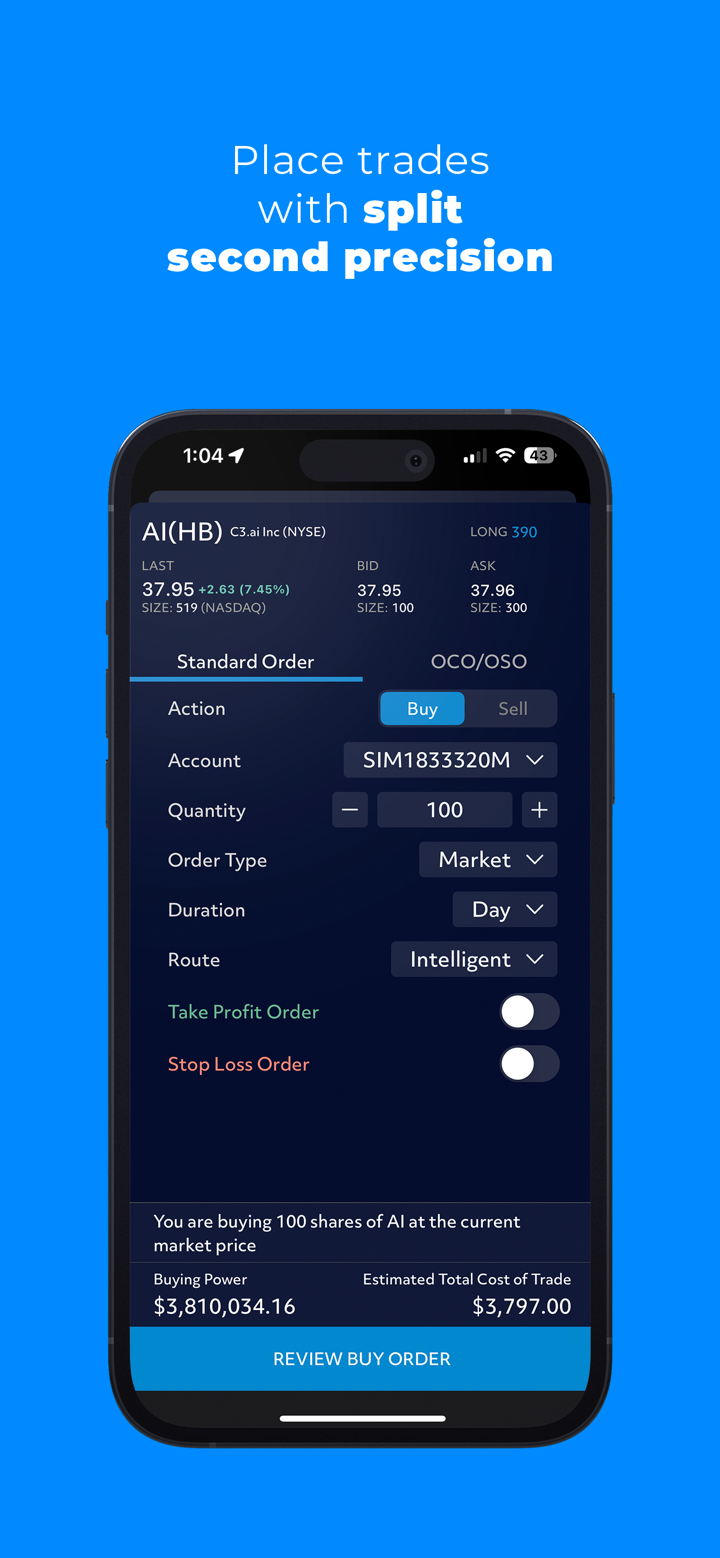

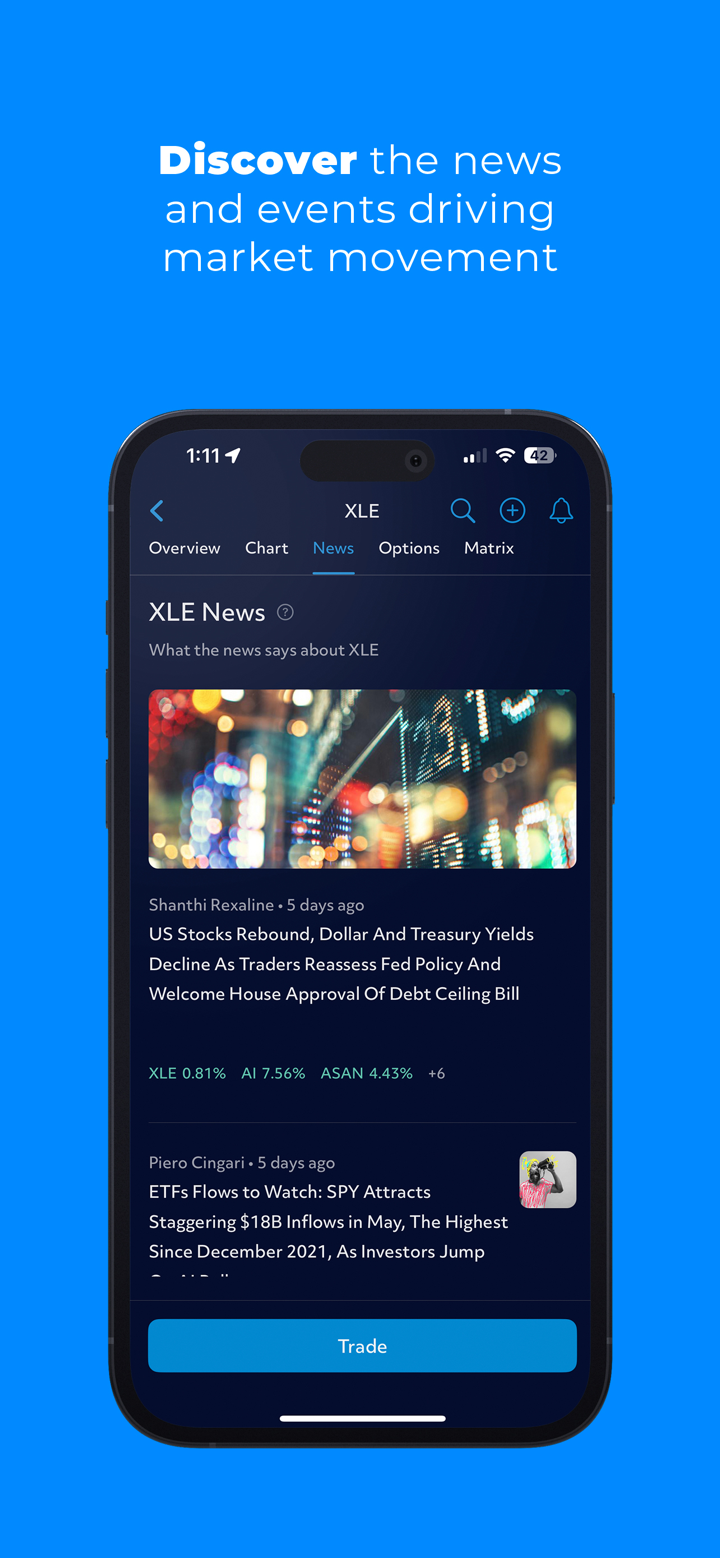

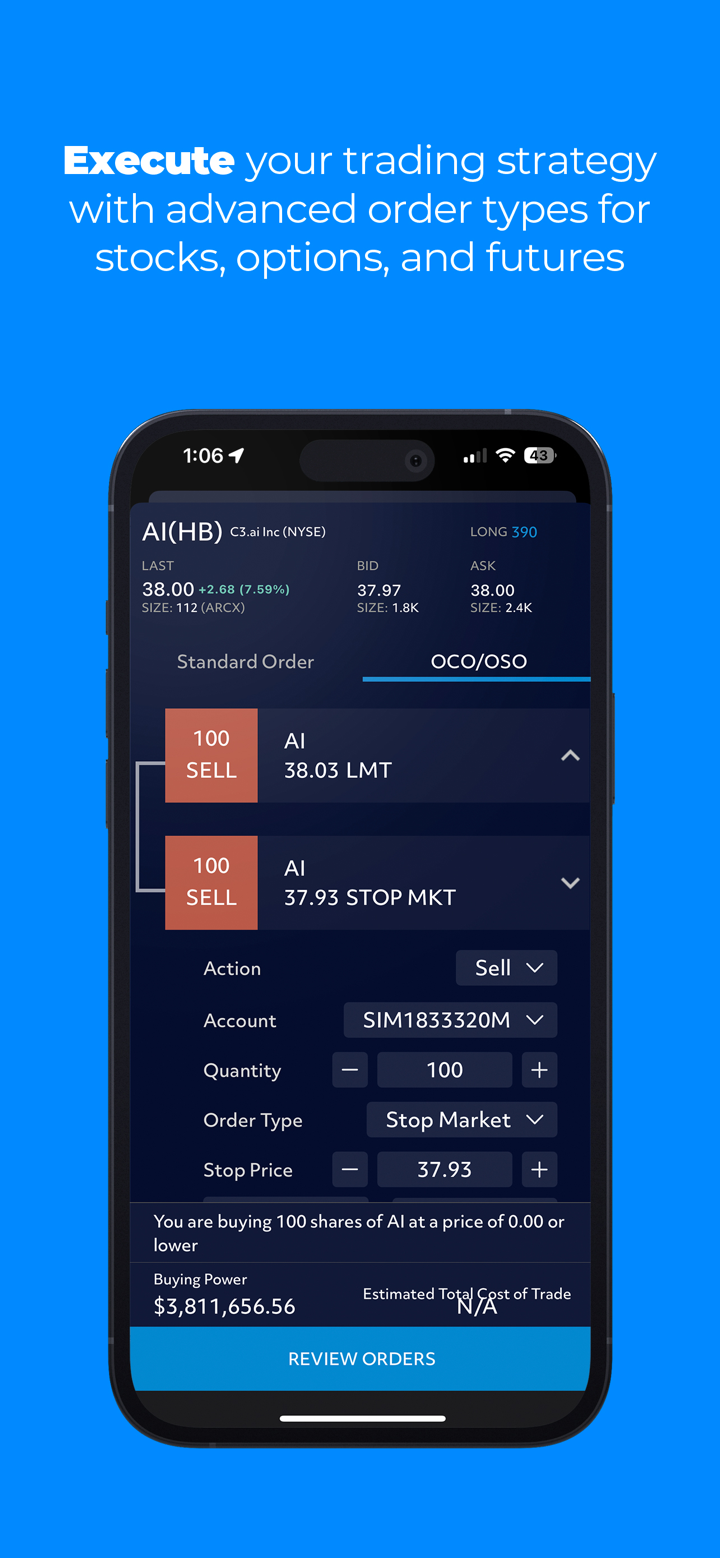

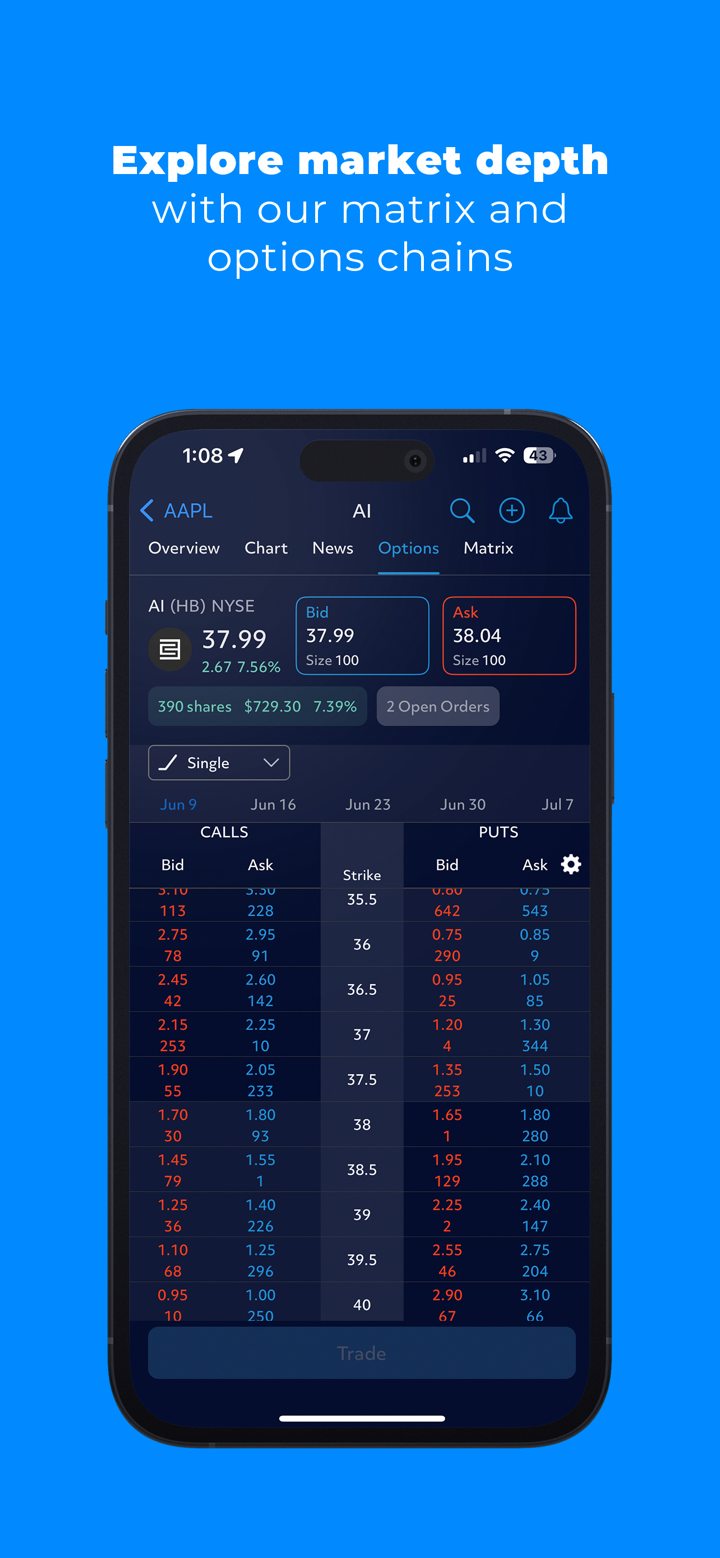

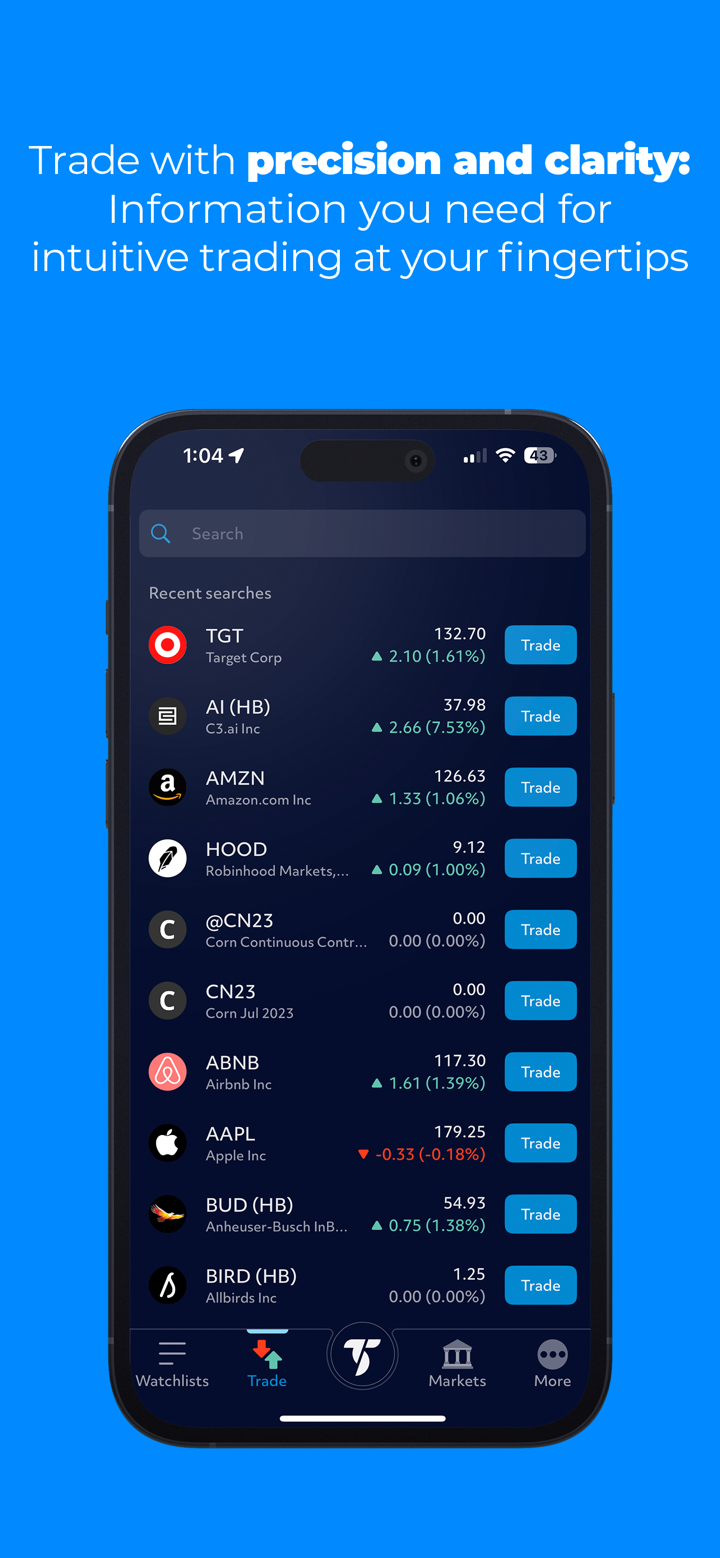

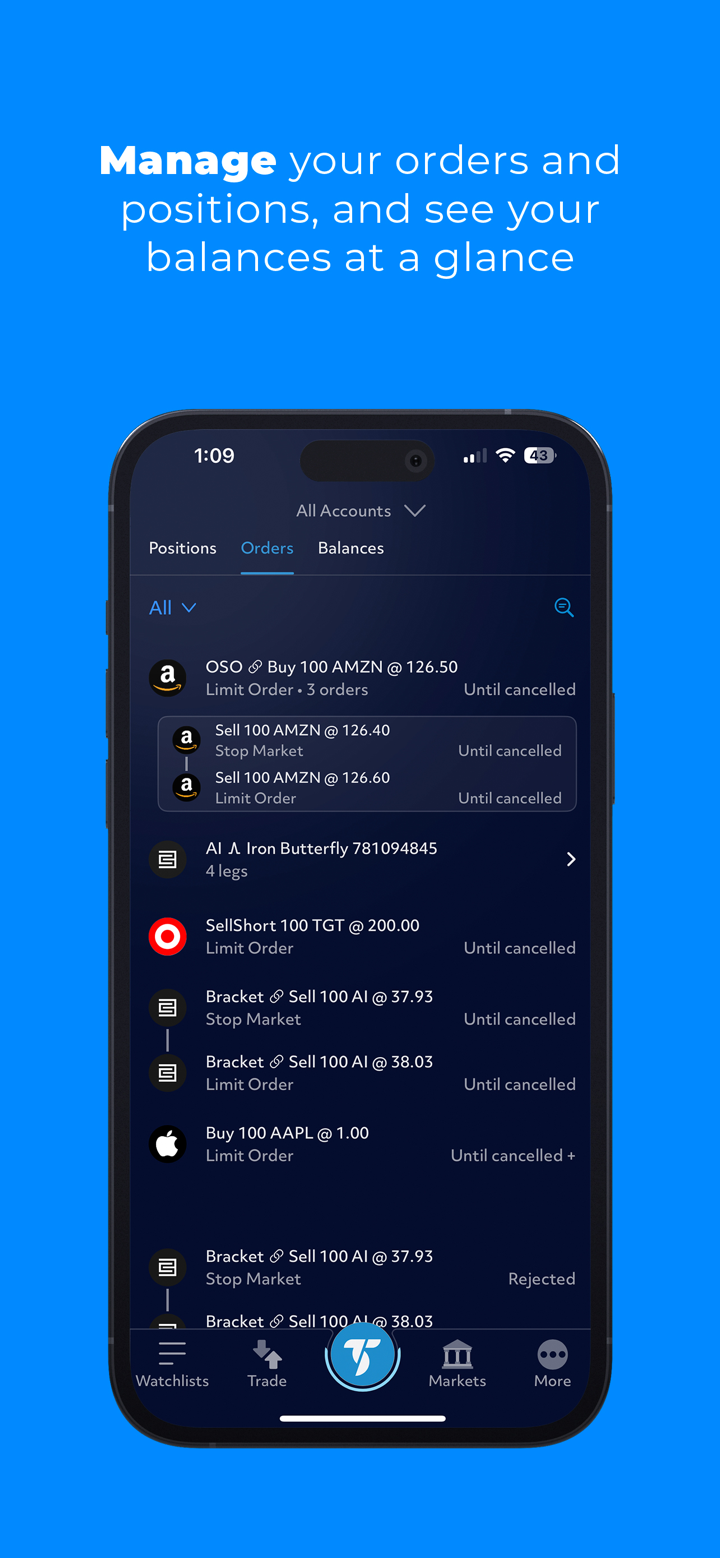

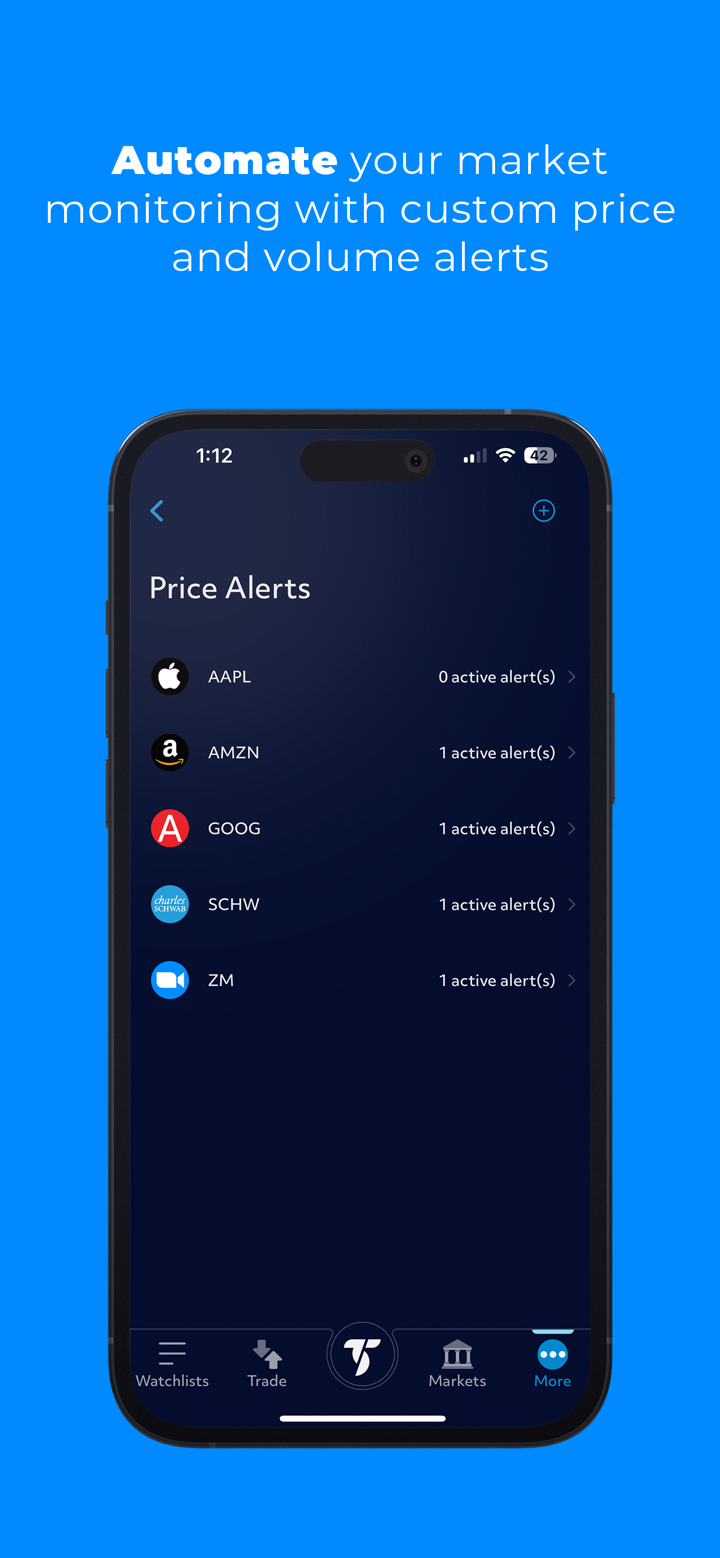

For traders who prefer to use mobile devices, TradeStation offers mobile apps for both iOS and Android devices. These apps allow traders to access their accounts, execute trades, and view real-time market data from the palm of their hand. The mobile apps are designed to provide traders with a unified experience, which means that all trades and account activity are synced across all devices.

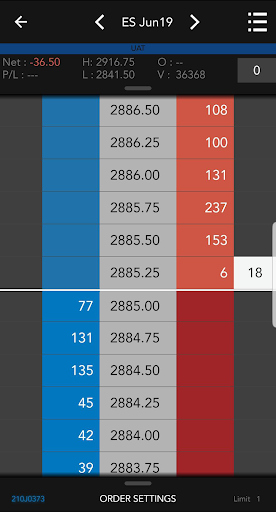

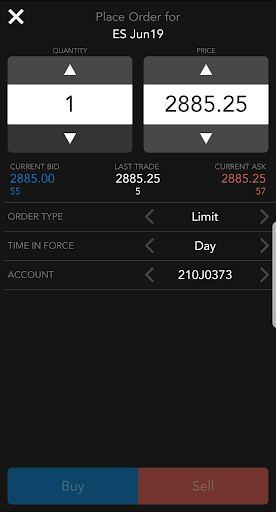

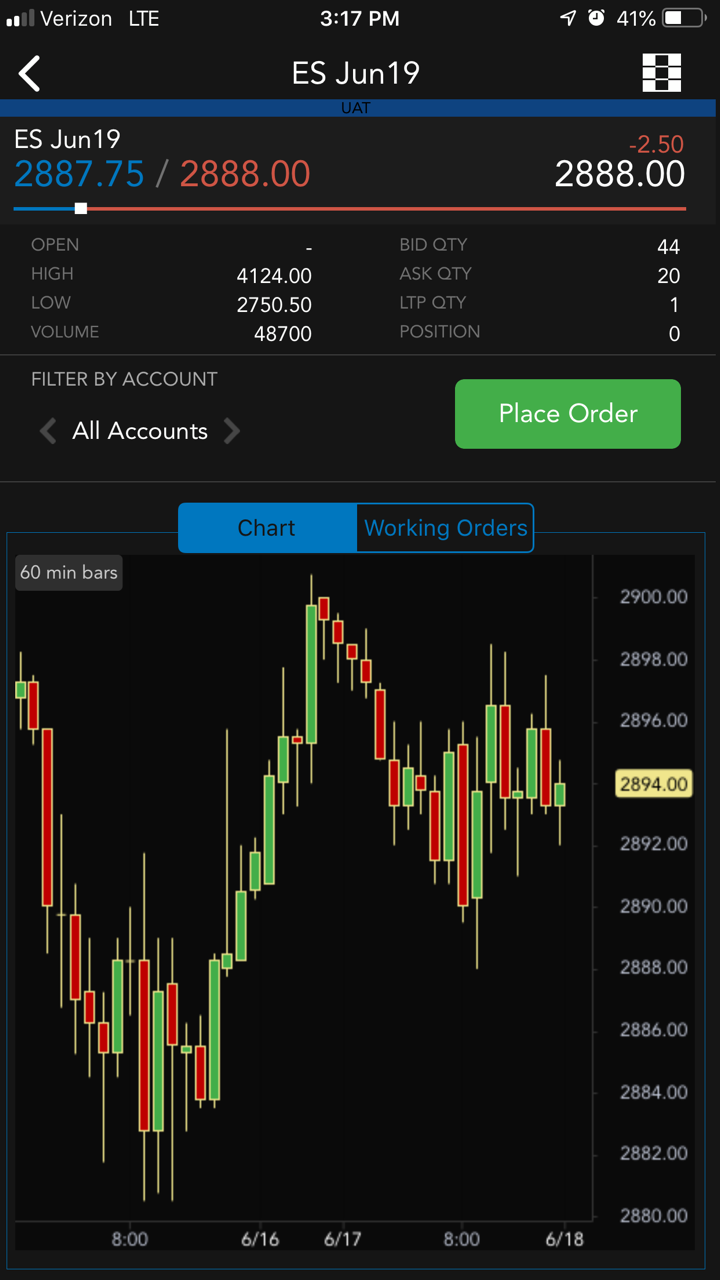

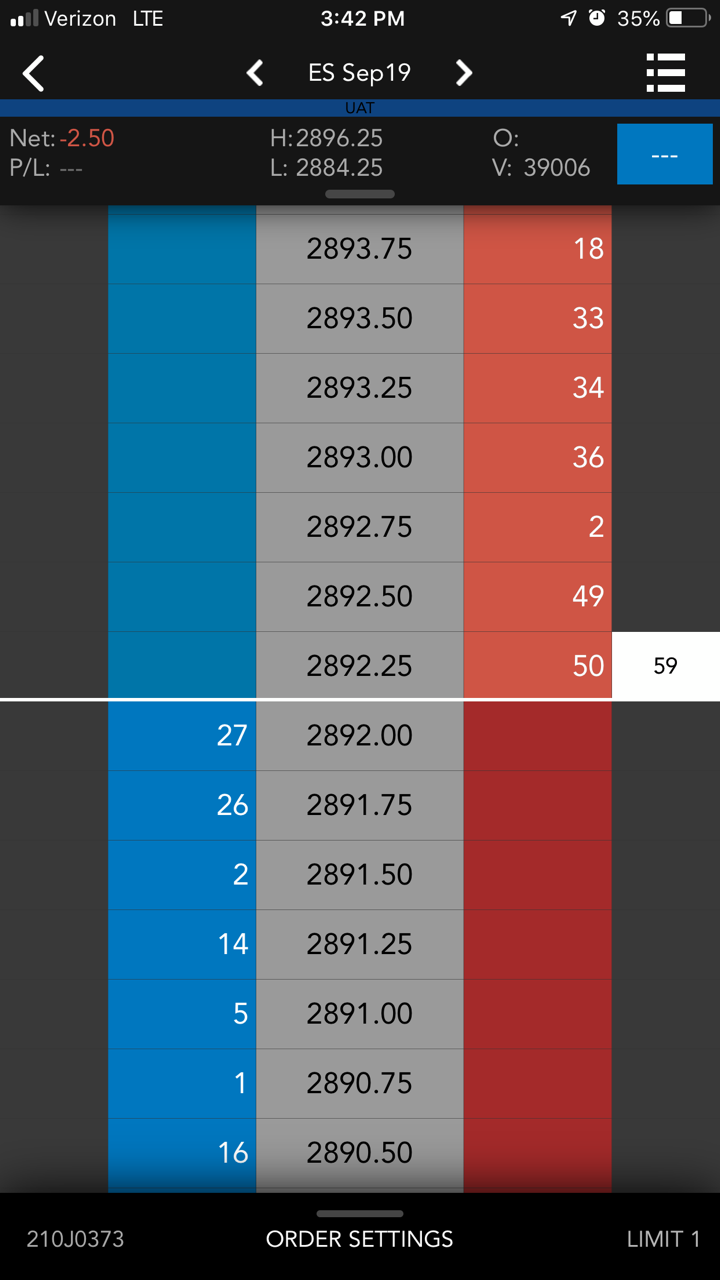

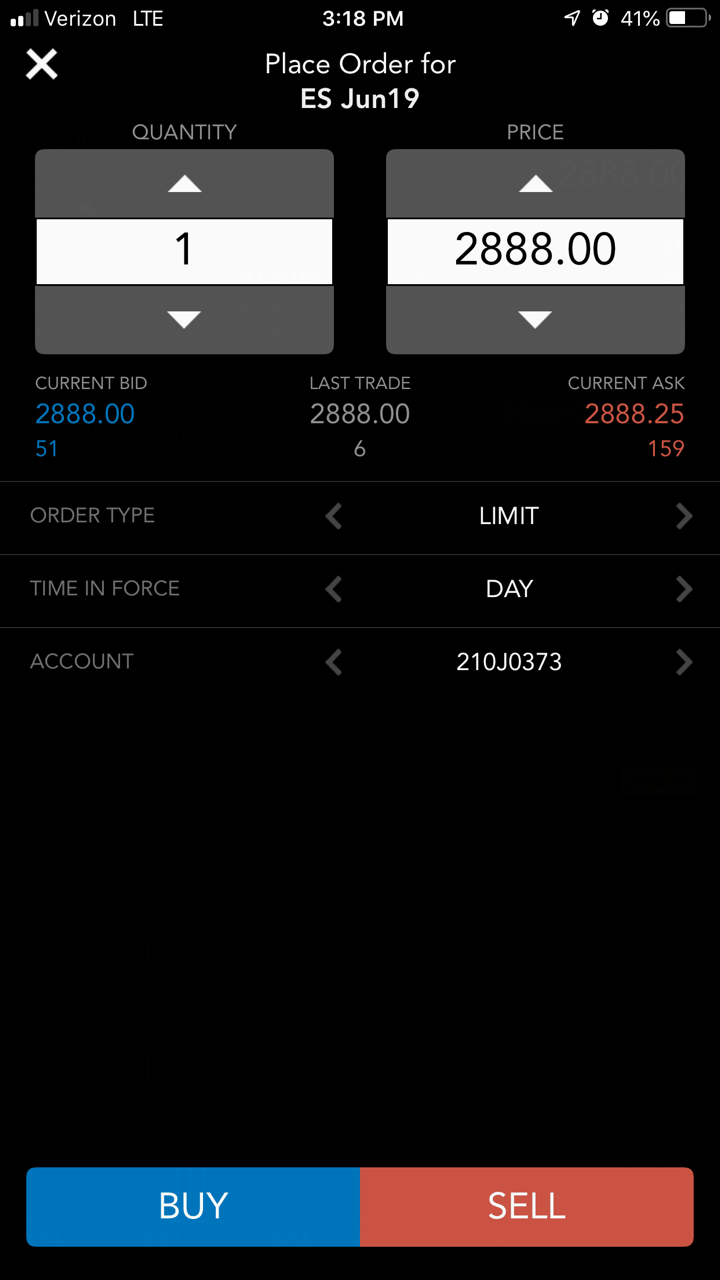

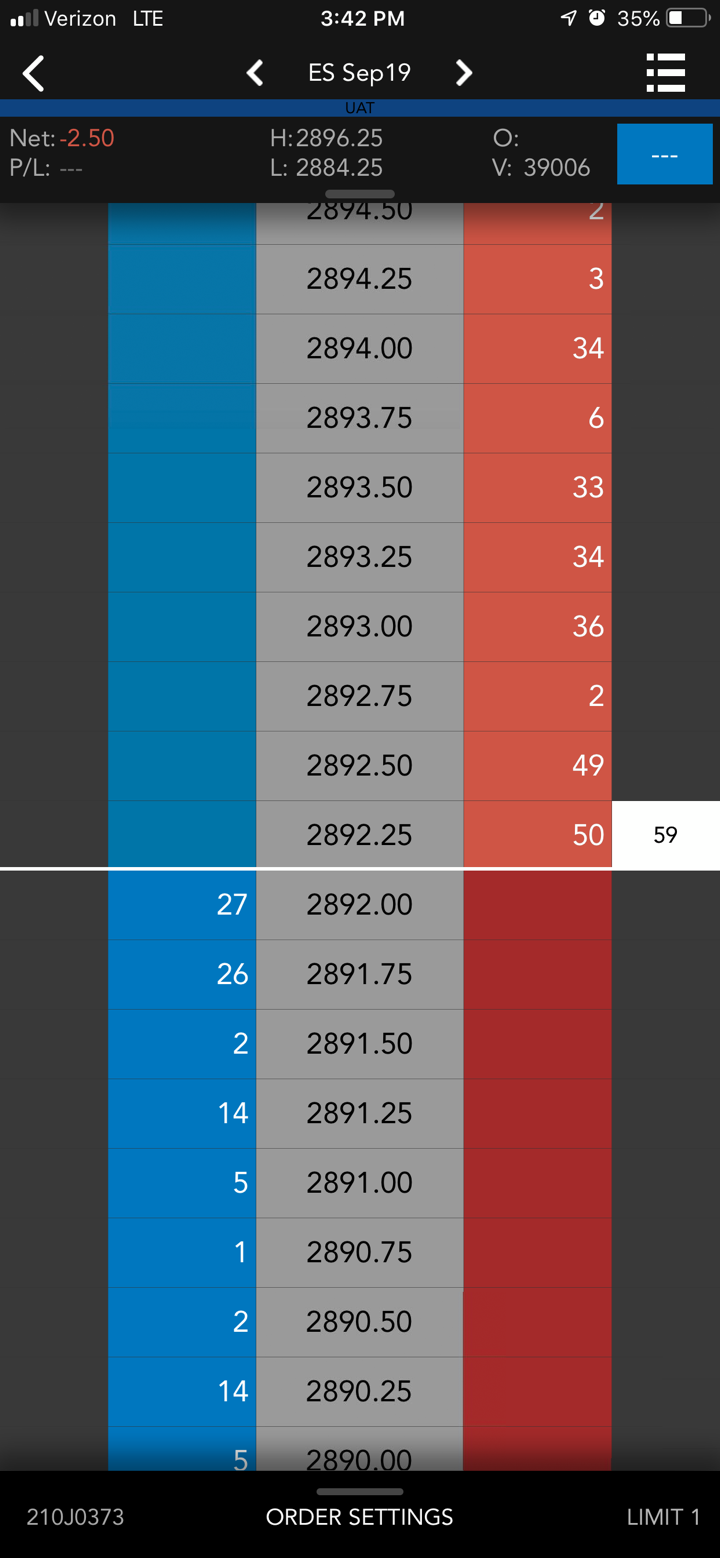

In addition to its traditional trading platforms, TradeStation also offers FuturesPlus, a platform designed specifically for options on futures trading. FuturesPlus provides traders with the ability to visualize their futures options strategies and send RFQs directly from the analysis tools. The platform also allows traders to manage their risk from a web browser or mobile device.

TradeStation also offers TS Crypto for traders who are interested in trading cryptocurrencies. This platform allows traders to research, analyze, execute trades, and manage their accounts from their desktop or mobile device. TS Crypto provides traders with access to multiple asset classes with a single login, making it easy to trade across a wide range of digital assets.

Fees

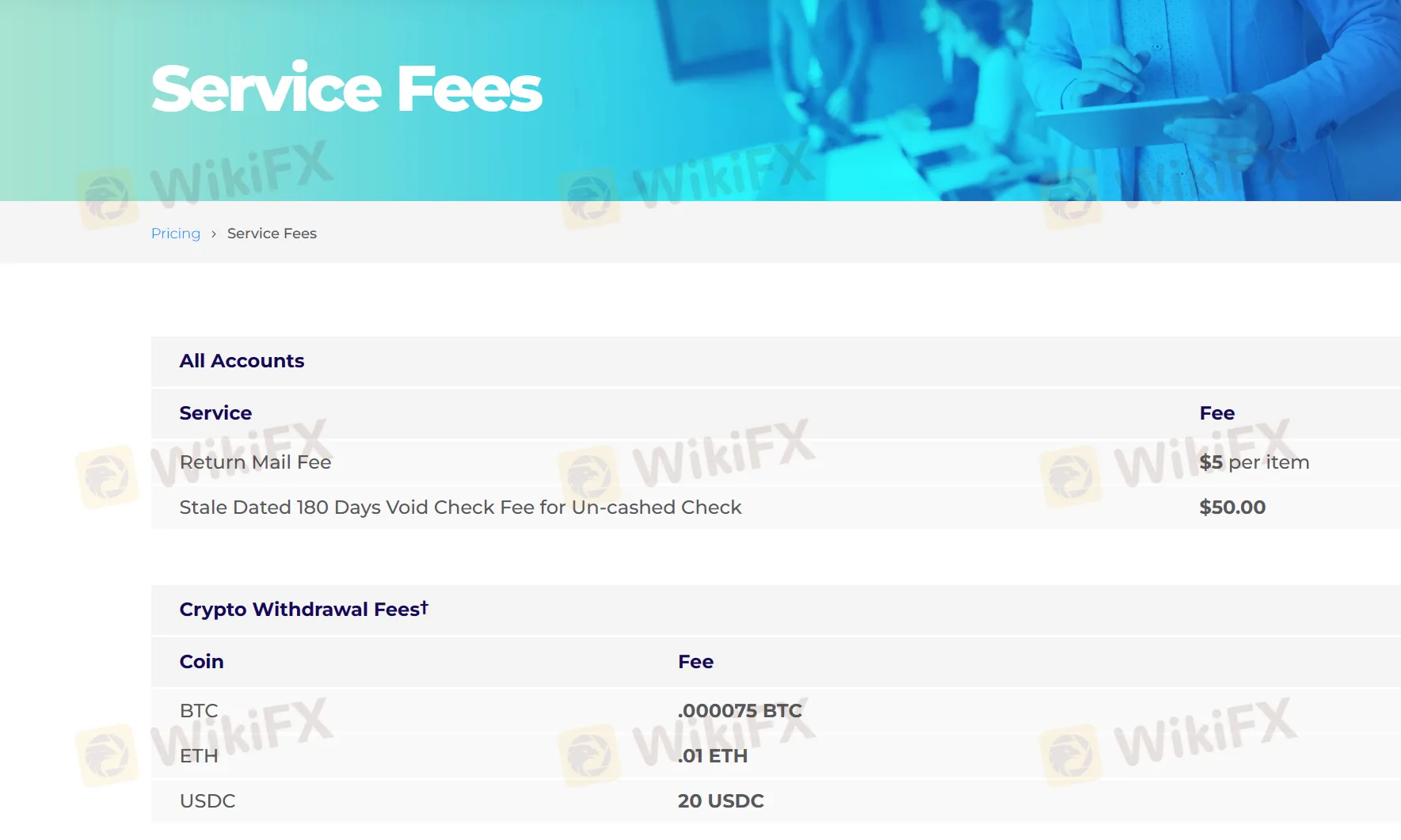

TradeStation levies a variety of fees for different services. These fees encompass different services like return mail fee, Stale Dated 180 Days Void Check Fee for Un-cashed Check, Crypto Withdrawal Fees, Clearing and Carrying, T-Bills, and several others.

It is important to note that the fees mentioned above do not include additional fees that are imposed by third-party custodians for TradeStation IRA accounts. Traders are encouraged to click on the provided link to obtain more information about additional fees.

IRA service fees are collected by TradeStation Securities and are debited from the trader's TradeStation Securities account. If a trader engages in crypto trading within the IRA account at any time in a billing cycle, they will incur the TradeStation Crypto IRA Administration Fee. A portion of the IRA service fees is then given to TradeStation Crypto through an affiliate accounting agreement. Detailed information on each fee item is available on the TradeStation website, and traders are advised to visit the site to make informed decisions on their accounts.

Deposits & Withdrawals

TradeStation offers several options for depositing and withdrawing funds from user accounts.

For wire transfer deposits, users can request wire instructions through the platform, which will provide them with the necessary details for making a wire transfer. Similarly, for wire withdrawals, users can enter the keywords “request wire” to initiate the process.

For ACH deposits and withdrawals, users can enter the keywords “request ach” to transfer funds to or from their TradeStation account through the Automated Clearing House network. Check deposits can also be made, with instructions available through the platform, while check withdrawals can be requested by entering the keywords “request a check”.

Equities account transfers to and from TradeStation can also be completed through the platform. By entering the keywords “account transfer”, users can initiate the process of transferring equities into their TradeStation account, while “acat withdrawal” can be used to move equities out of the account.

Moving funds between TradeStation accounts can be done using the “transfer funds between accounts” option, which provides a quick and easy way to move funds between different accounts held by the same user.

For IRA contributions, users can enter the keywords “make contribution” to add funds to their individual retirement account. Similarly, “IRA distribution” can be used to initiate withdrawals from the account, while “required minimum distribution” is available for managing IRA minimum distribution requirements.

TradeStation also offers international transfer services, with instructions available by entering the keywords “international deposits”.

| Transaction Type | Method |

| Deposit/ Withdrawal | Wire Transfer |

| ACH | |

| Check | |

| Equities Account Transfer | |

| IRA Distribution | |

| IRA Required Minimum Distribution | |

| Internal Transfer | Internal Account Transfer |

| International | International Deposit |

Moreover, it is worth noting that IRA accounts on TradeStation cannot accept cryptocurrency deposits, and traders cannot withdraw cryptocurrency from their IRA accounts.

Customer Service

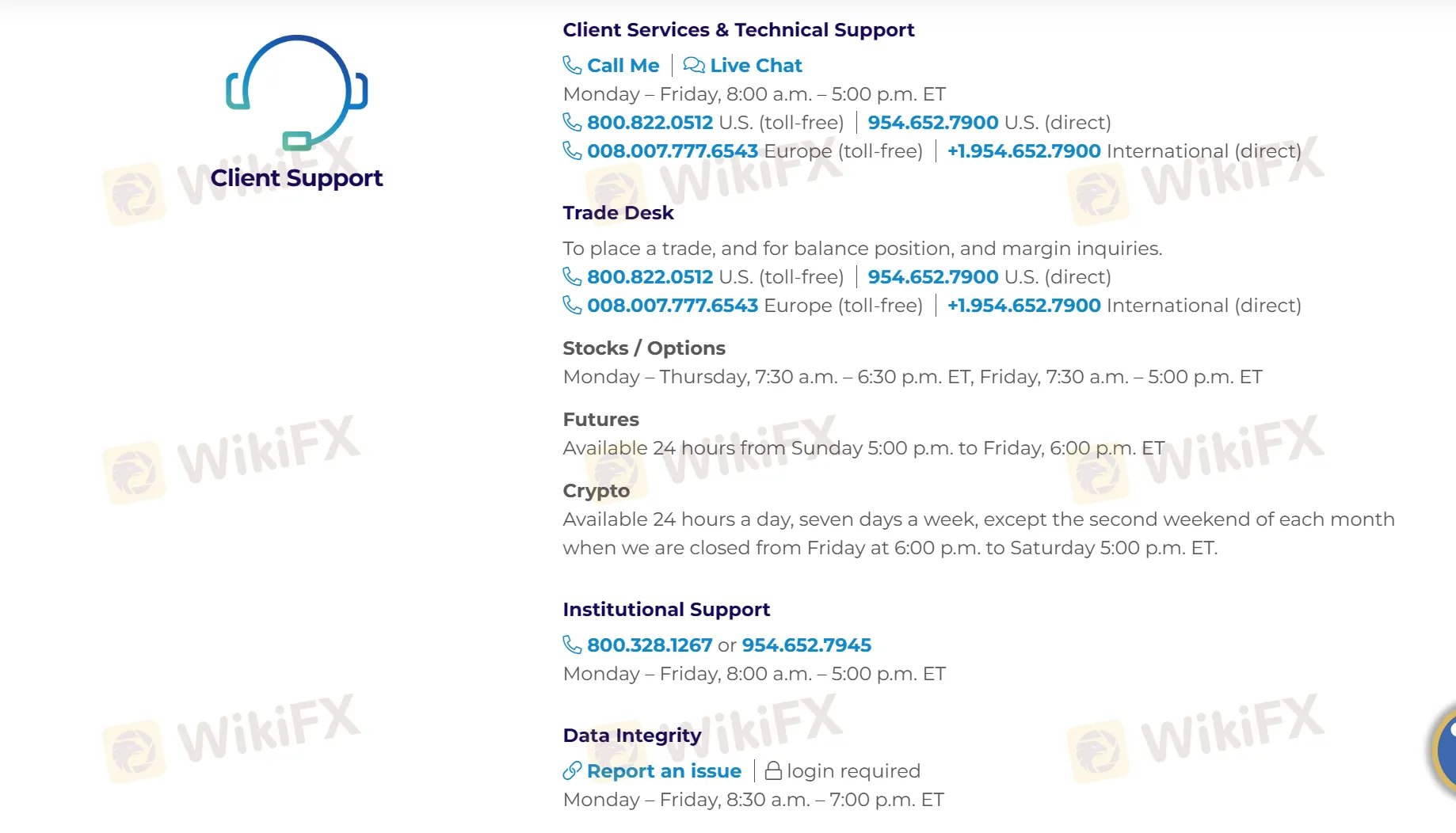

TradeStation offers live chat. With live chat, customers can get their questions answered quickly and receive help with any issues they may have.

Customers can visit their office or get in touch with customer service line Monday – Friday, 8:00 a.m. – 5:00 p.m. ET using the information provided below:

Telephone: 8008220512 U.S. (toll-free) / 9546527900 U.S. (direct)

0080077776543 Europe (toll-free) / +19546527900 International (direct)

Email: TradeStation@calibercorporateadvisers.com

Moreover, clients could get in touch with this broker through the social media, such as Twitter, Facebook, Instagram, and YouTube.

Whats more, TradeStation provides a Frequently Asked Questions (FAQ) section on their website to assist their clients with commonly asked questions and provide relevant information.

Conclusion

In conclusion, TradeStation is a US-based online brokerage firm that provides a wide range of trading and investment services. Its major products and services include advanced trading platforms, trading instruments. It is known for its state-of-the-art trading platforms and tools, making it a popular choice among traders looking for advanced trading capabilities.

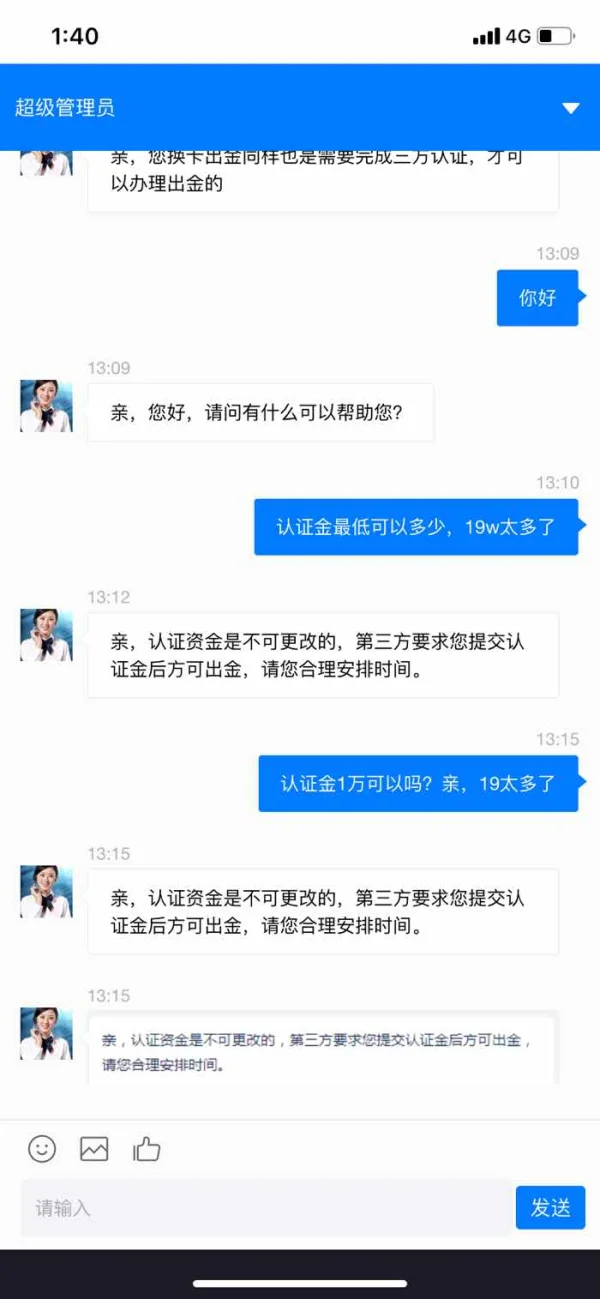

However, while TradeStation claims to have measures in place to protect customer accounts and personal information, it is important to note that some users have reported difficulties with withdrawals on their website. Additionally, the lack of valid regulation is a concerning point for some potential customers.

Frequently Asked Questions (FAQs)

Is TradeStation regulated?

No. It has been verified that this broker currently has no valid regulation.

Does TradeStation offer demo accounts?

Yes.

What platform does TradeStation offer?

It offers TradeStation Desktop, web-based trading platform, mobile apps, FuturesPlus, and TS Crypto.

Risk Warning

Online trading involves significant risk, and you may lose all of your invested capital. It is not suitable for all traders or investors. Please ensure that you understand the risks involved and note that the information provided in this review may be subject to change due to the constant updating of the company's services and policies.

Rain lab | kaka

Hong Kong

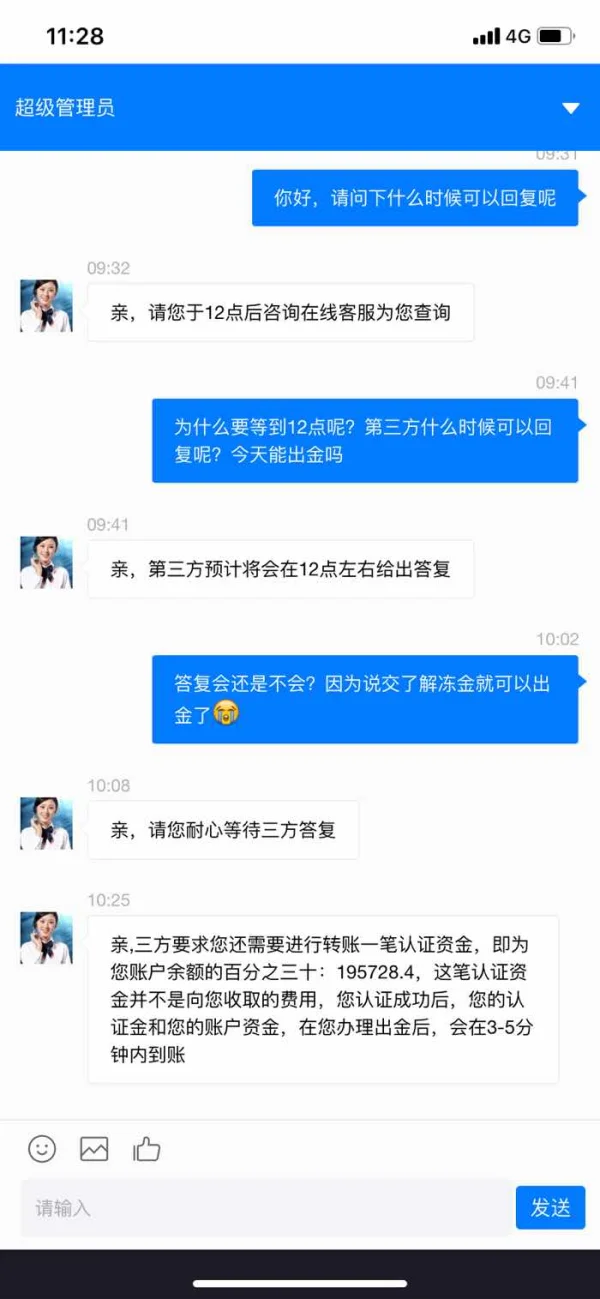

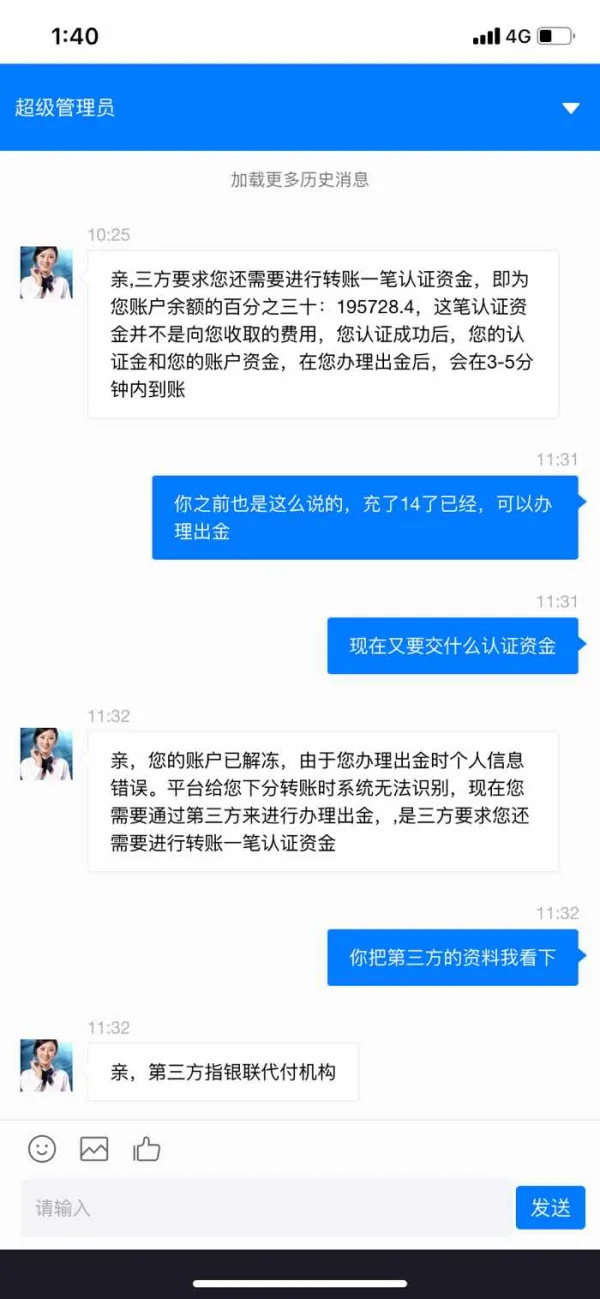

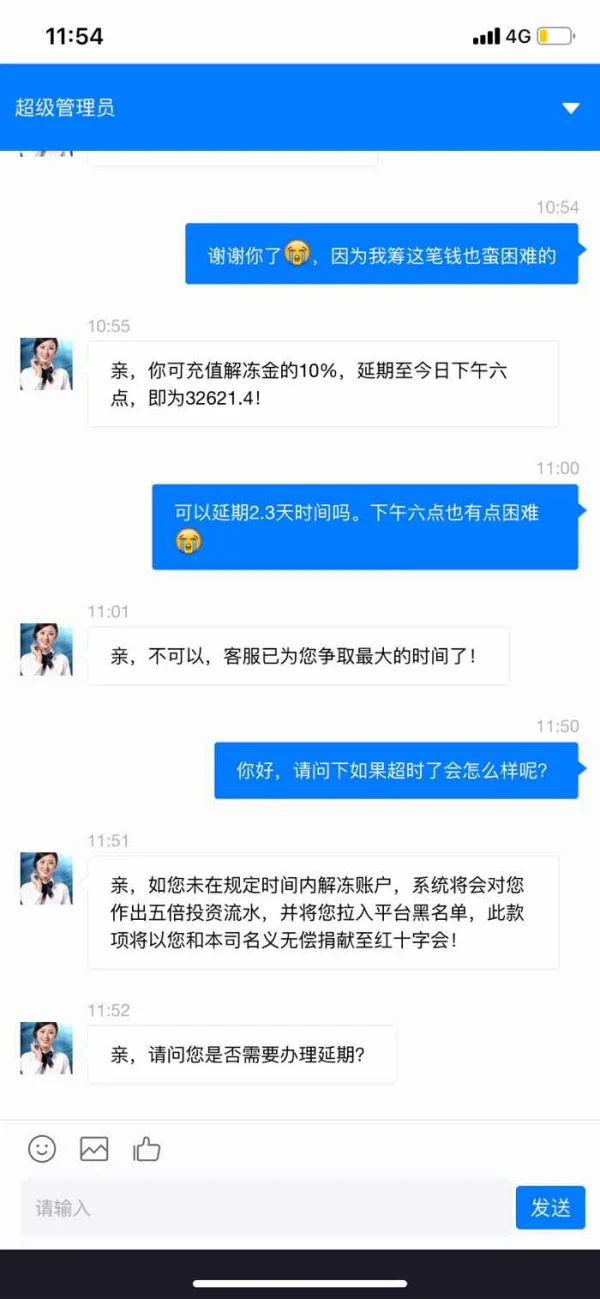

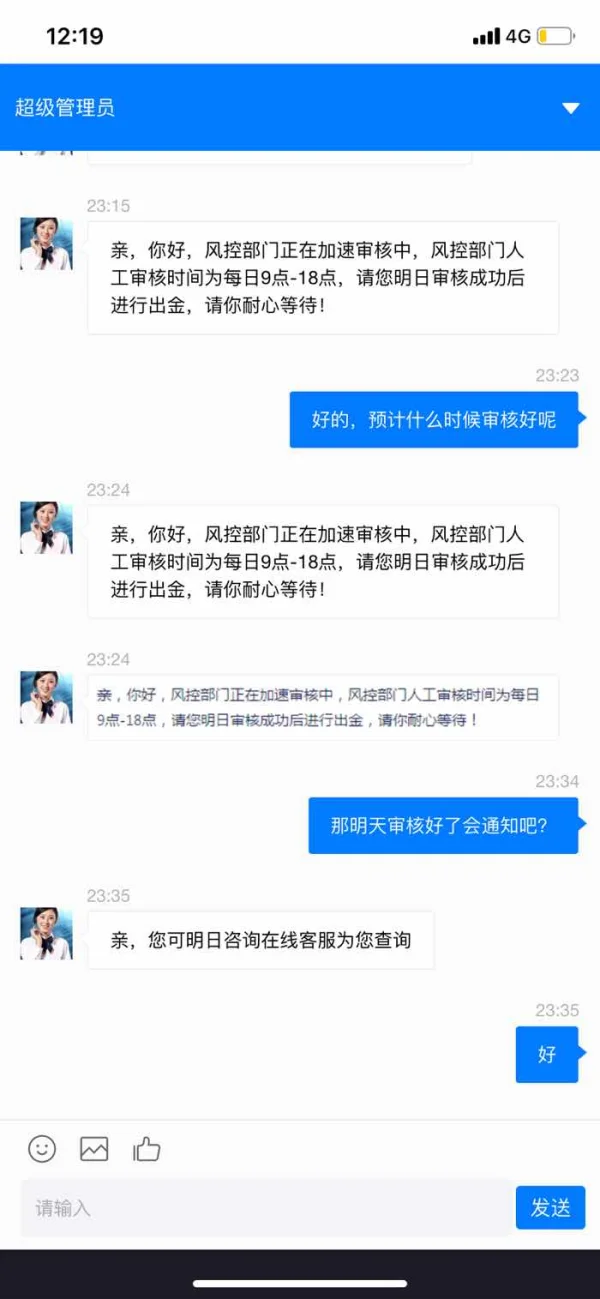

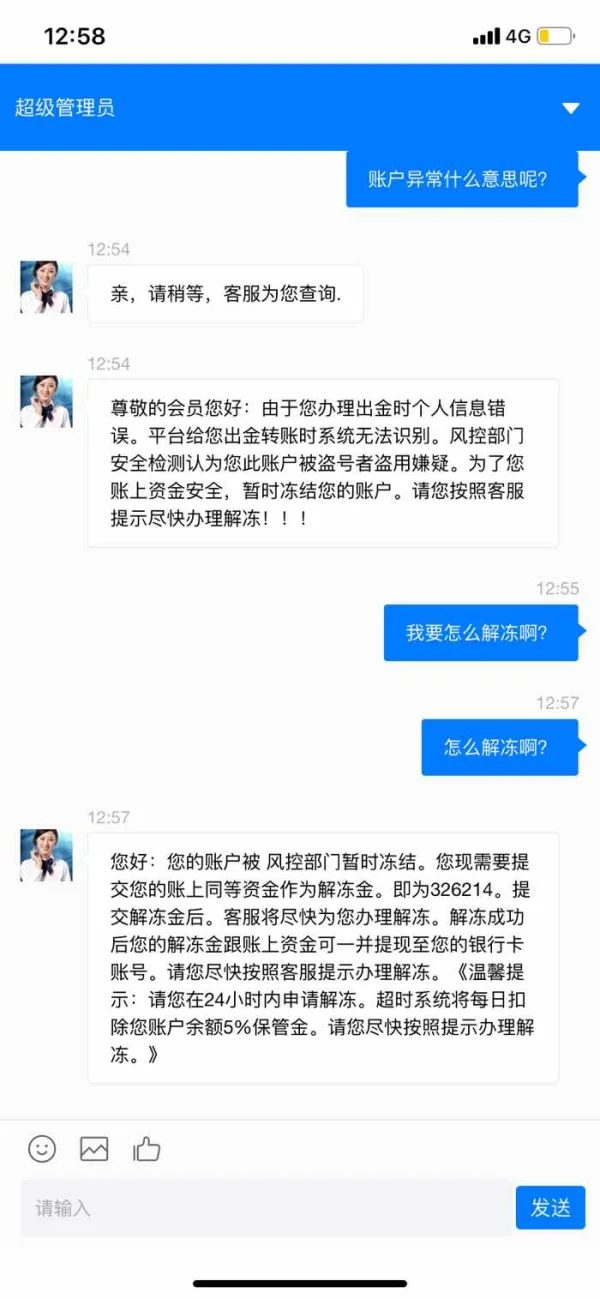

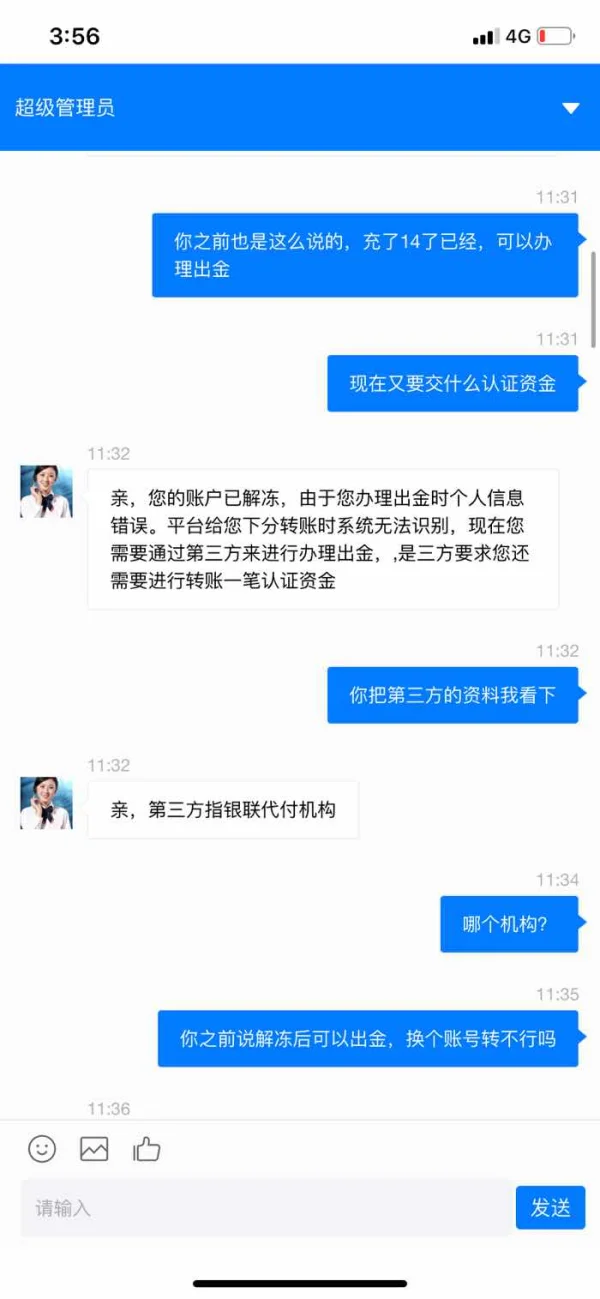

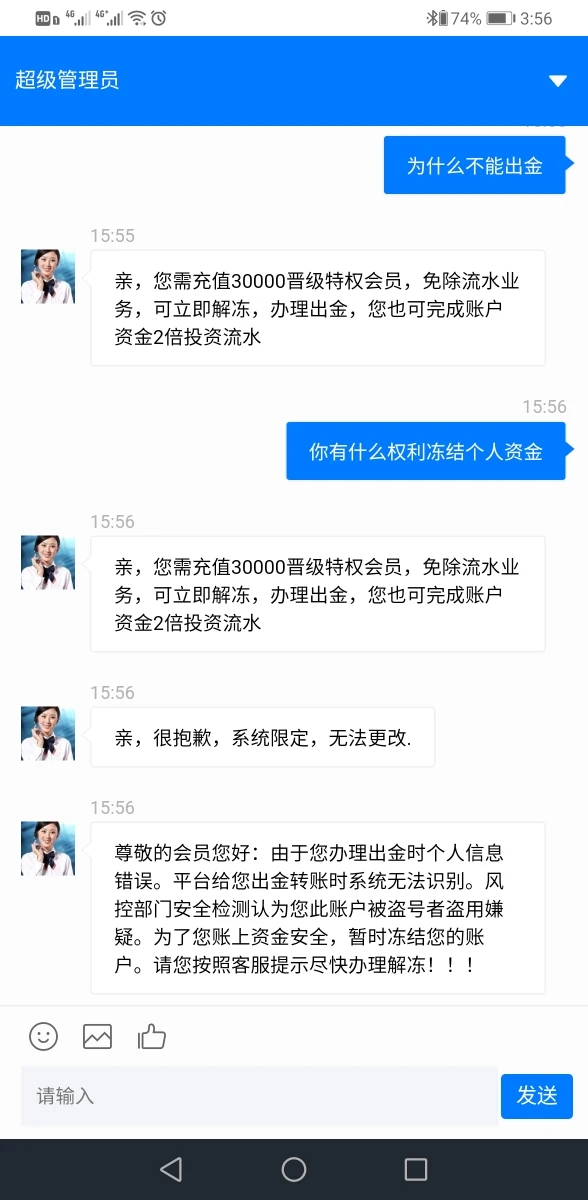

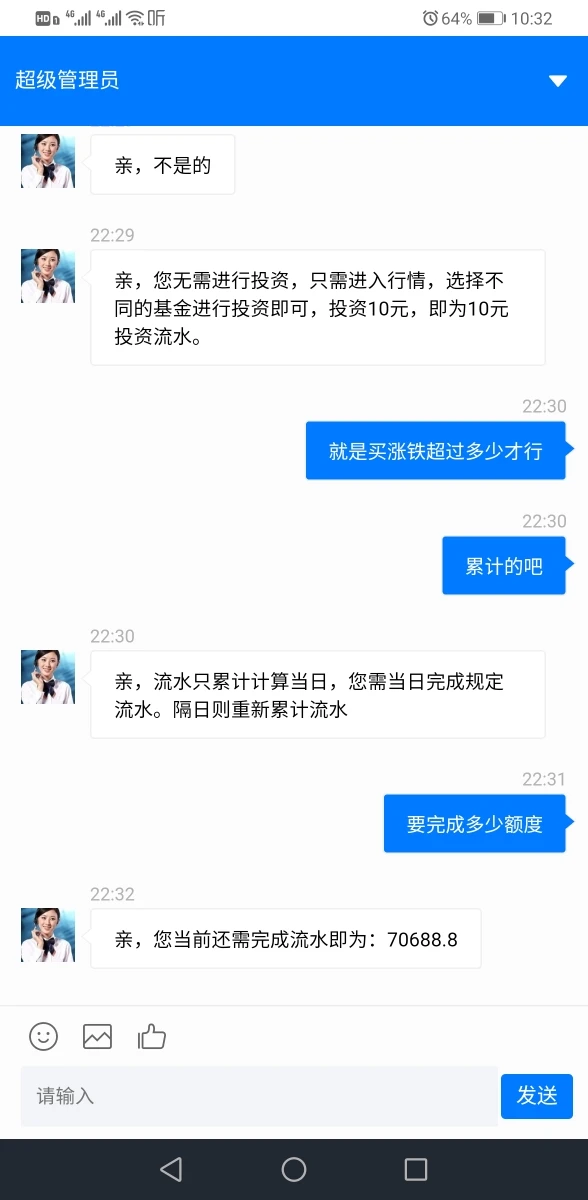

A friend on the Internet asked me to recharge 100,000, and I could rebate 15,000 yuan. Later, he said that a total of 300,000 recharges were needed to reserve a place. The customer service asked me to recharge 4 times and each amount was 50,000. At this time, the account totaled 326,214 yuan. The customer service said that the gold can be withdrawn after the review, and I waited until the next day at 8 o'clock in the morning to withdraw the gold. Then the next day I found that the account was delayed, and I found out that the customer service sent me a wrong account, but their platform even had a screenshot of the successful transfer. I was surprised. Why can the account be credited to the account if the account number is wrong? I asked the customer service, and he said that I filled in the wrong information and couldn't withdraw the money. He said that it could be refunded to the platform. Later I checked and the amount was refunded to the platform. But the customer service said that my account may be stolen due to risk control detection, and my account was frozen. I need to pay another 326,214 yuan to unfreeze! I panicked, there is not so much money at all! The customer service asked me to transfer the account within 24 hours before it can be unfrozen, otherwise the money will be treated as turnover. Then I called the police! The police said it was a fraud. But where does the money go? I don't have any money, it's all my savings for work and life. With the mentality of giving it a try, I still transferred it according to the friend of the customer service, and transferred 326,214 yuan together! But the customer service said I was overtime! The account is unfrozen, but the third-party UnionPay payment agency needs my ID number and the front and back of the bank card number, and asks me to pay 195728.4! I was completely surprised that this was a scam! ! ! ! Help! Really helpless! I don't have a penny on my body, and I hope this exposure will recover my justice and property for myself! ! !

Exposure

凯弦·归来

Hong Kong

Say that the bank card number is wrong, and it needs to invest 7W to unfreeze.

Exposure

Raj Kumara

Malaysia

Never had a glitch with TradeStation, charting tools do good to pro traders like me.

Positive

Ste7en♥卡卡

South Africa

Opening an account requires so many documents and really tortured me. While thankfully, their customer support team helped me out patiently. Overall fees, commissions, service fees, and margin rates are very competitive compared to other companies. This company is very friendly and you can invest any amount as you want. I would give it five stars and I hope they could simplify their trading procedure.

Neutral