Abstract:Before choosing a forex broker, it's crucial to spot red flags that could cost you. MTrading has raised concerns among traders, including delayed withdrawals, poor customer support, and questionable transparency. Users also report issues like slippage and platform glitches, which can harm your trading performance. In this article, we highlight the top 5 warning signs that explain why you should avoid MTrading broker and choose a more reliable alternative.

Before choosing a forex broker, it's crucial to spot red flags that could cost you. MTrading has raised concerns among traders, including delayed withdrawals, poor customer support, and questionable transparency. Users also report issues like slippage and platform glitches, which can harm your trading performance. In this article, we highlight the top 5 warning signs that explain why you should avoid MTrading broker and choose a more reliable alternative.

1. Lack of Proper Regulation

One of the biggest red flags when evaluating a forex broker is the absence of regulation by recognized financial authorities. Legitimate brokers are licensed by trusted regulators like the FCA (UK), ASIC (Australia), or the SEC (USA). However, suspicious brokers like MTrading often operate without any valid licenses, despite falsely claiming otherwise. This lack of regulation means there‘s no oversight—putting your funds and personal data at serious risk. Always verify a broker’s credentials before depositing money.

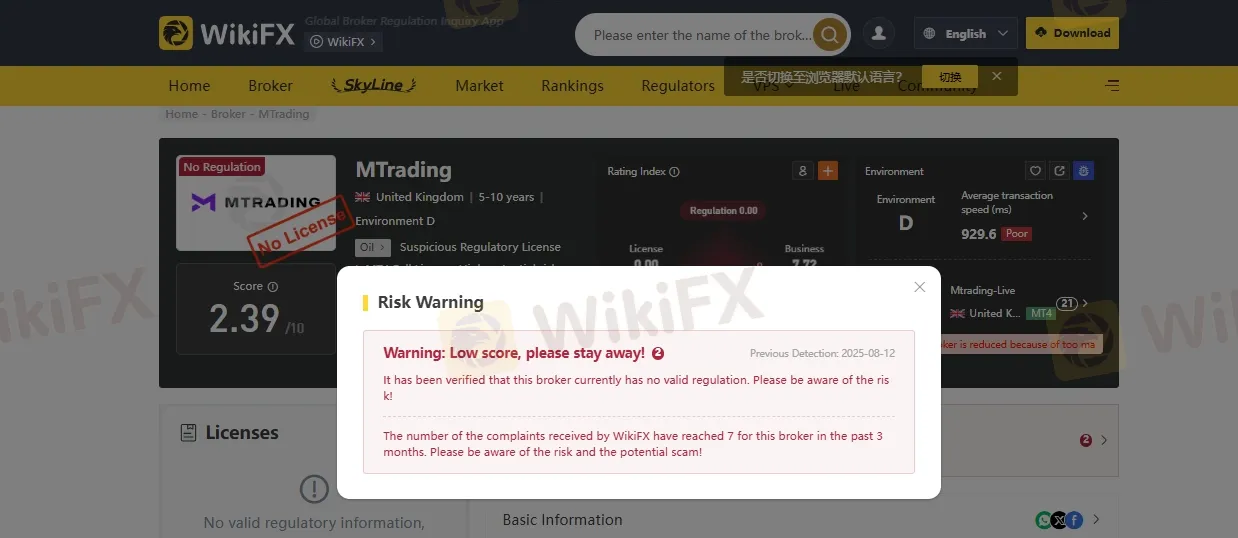

2. Low Rating on WikiFX

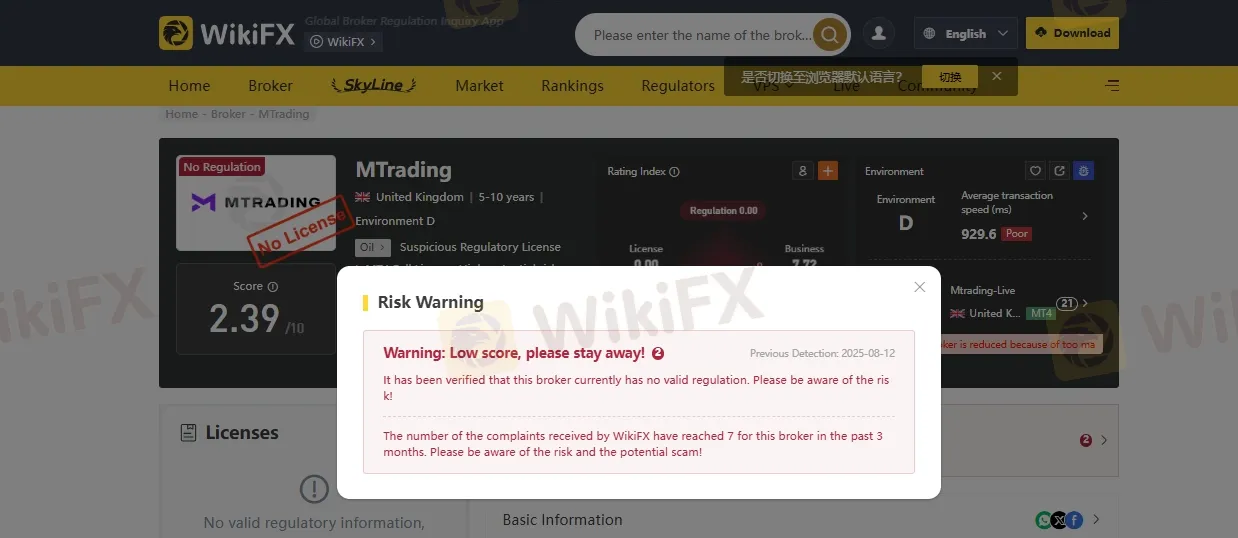

MTrading, another questionable broker, has received a very low rating of 2.39 out of 10 on WikiFX—a platform known for evaluating the credibility of forex and crypto brokers. Such a poor score indicates major concerns about the brokers transparency, user protection, and regulatory status. A low WikiFX rating typically means the broker lacks strong licenses and may not comply with essential trading safety standards.

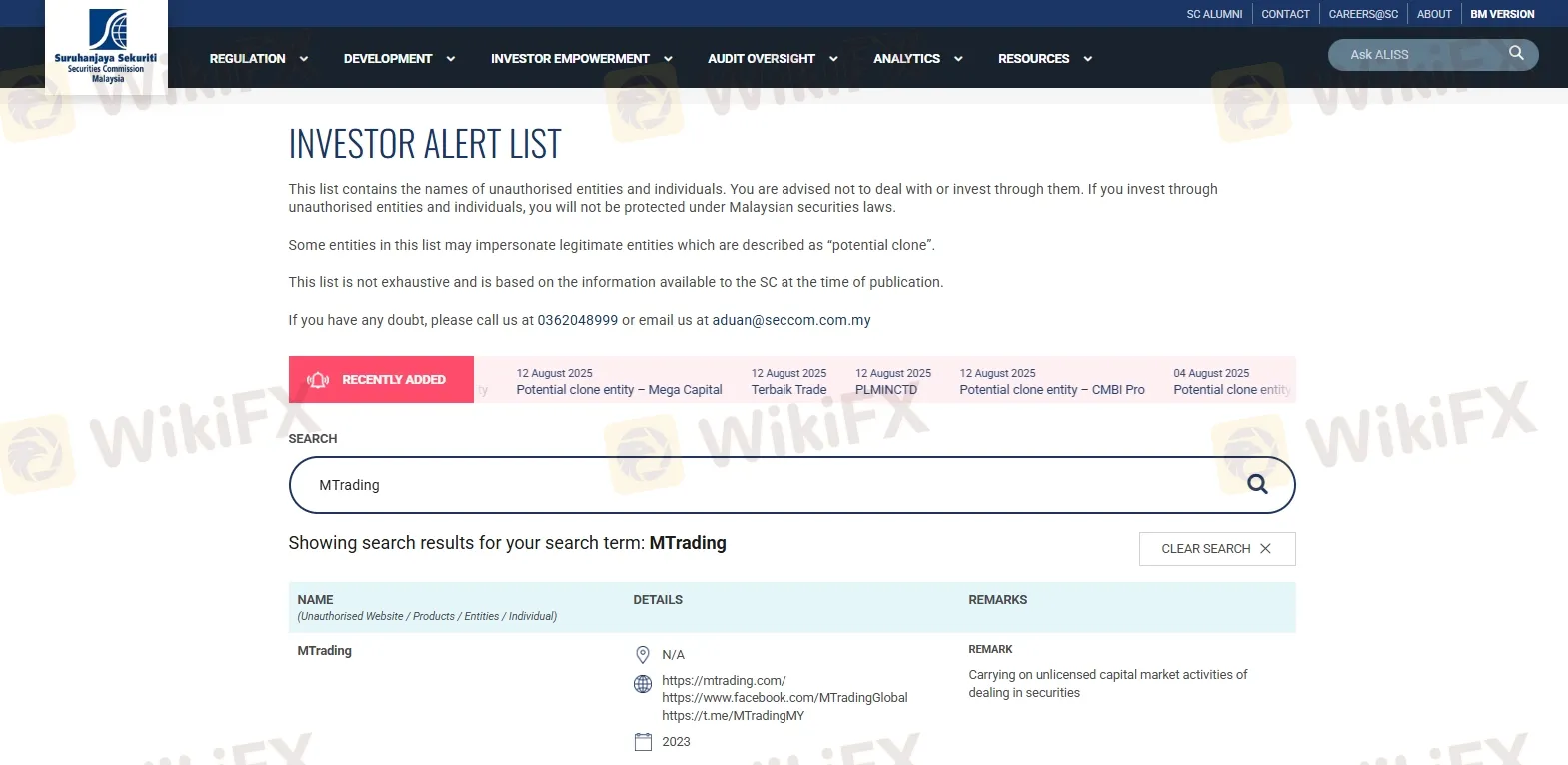

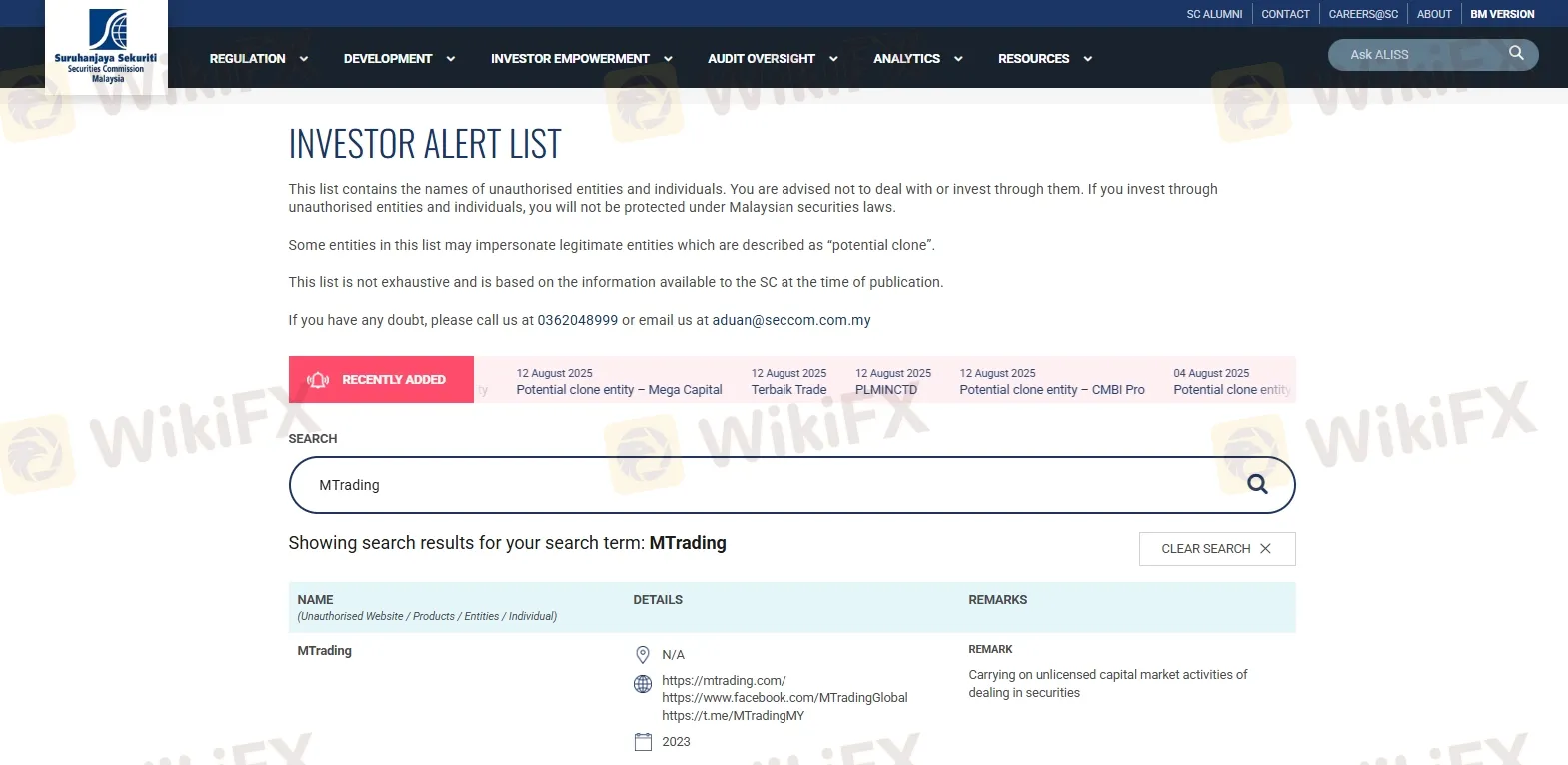

3. Official Warning from Securities Commission Malaysia (SCM)

In 2023 , Securities Commission Malaysia (SCM) issued warning against MTrading . Authority accused MTrading of Operating Without a License and Engaging in Unauthorized Capital Market Activities.

4. WikiFX Warning Against MTrading

MTrading has been flagged by WikiFX as a potential scam broker. The platform issued a clear warning: “Low score, please stay away! No valid regulation. Be aware of the risk.” This strongly suggests that MTrading lacks proper regulation and may pose a significant risk to traders. If you're considering MTrading, think twice—trading with an unregulated broker can lead to serious financial loss.

5. Negative User Reviews

When we checked the user reviews on WikiFX, we found that many people shared negative feedback and experiences. Most of them are talking about withdrawal issues. We collected the reviews, and you may look at them for reference.

1. Issues with withdrawal

Issues with withdrawal.....minimum withdrawal requirements and excess charges on deposit. Low conversion rates for withdrawals and high fees for deposits

2. Withdrawing money is very difficult.

The broker refuses to allow withdrawals. The broker notifies that a minimum deposit is required before withdrawals can be made. However, even though the deposit has been credited, it cannot be withdrawn.

3. Market manipulation

not recommend to use this broker, scam highly suspect just market manipulate the market

4. Deceiving customers to deposit and become VIP customer. The platform let the so-called traders lose all the money of their customers, and now they are not allowed to withdraw cash

5. It seems about to crash and cannot withdraw now. It shows passed, but cannot receive the transfer.

How to Protect Yourself from Scam Brokers

1. Verify the License of Brokers

2. Avoid Unregulated Brokers

3. Cross-Check Contact Information

4. Do not Fall for “Too Good to Be True” Promises

5. Test with a Demo Account First

6. Read Online Reviews

7. Do Your Research

8. Do not Rush

9. Report Suspicious Activity

10. Keep Records

Join WikiFX Community

Be attentive and stay updated with WikiFX. You can get all the information you need to know about the Forex market, fraud alerts, and the latest news related to Forex trading — all in one place. Join the WikiFX Community by scanning the QR code at the bottom.

Steps to Join

1. Scan the QR code below

2. Download the WikiFX Pro app

3. After installing, tap the Scan icon at the top right corner

4. Scan the code again to complete the process

5. You have joined!