Abstract:Seeing MarketsVox as a forex broker, which can help you earn monumental profit on your investments? You have set your sights on the wrong option, unfortunately. The forex broker has been disallowing withdrawals, charging a much higher spread, and duping many traders under the pretext of high returns. Read on!

Seeing MarketsVox as a forex broker, which can help you earn monumental profit on your investments? You have set your sights on the wrong option, unfortunately. The forex broker has been disallowing withdrawals, charging a much higher spread, and duping many traders under the pretext of high returns. This made us introspect on the forex broker, and we found out some stunning complaints against it. Read on to know the complaints.

Stunning Complaints Against MarketsVox You Must Read

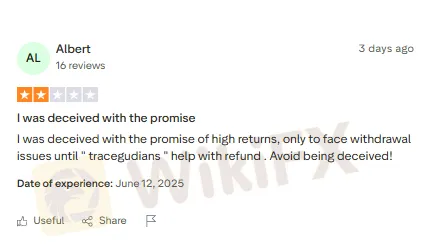

MarketsVox Fails to Deliver on High-return Promises

MarketsVox keeps acquiring customers by emphasizing high-return claims. Forex investments do yield substantial returns for investors. However, the yield comes when invested and not when used for other means. Here is one trader who made this specific complaint against MarketsVox.

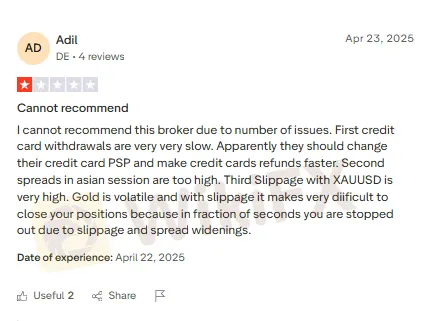

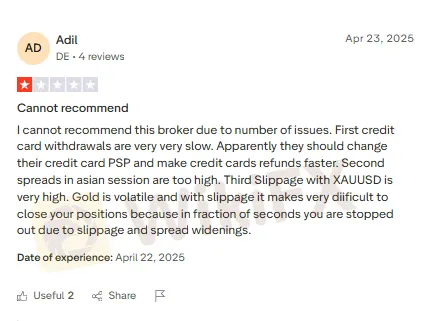

Slow Credit Card Withdrawals and High Slippage and Spreads Annoy Traders

Traders are annoyed with MarketsVox over multiple trading issues. These include slow-paced withdrawals via credit cards, high slippage with XAU USD, and excessive spreads in Asian trades. Due to high slippage and spreads, traders cannot close their positions with ease. One such trader has expressed annoyance through this comment.

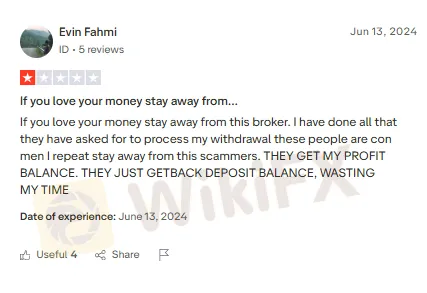

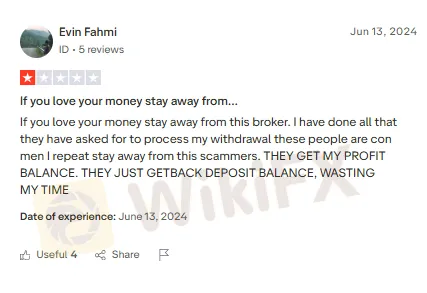

You May Access Your Deposit, But Not Profit

While withdrawal has always been an issue for traders at MarketsVox, in certain cases, it may allow you to access the deposits you make. As returns compound on your investments, you would like to withdraw them too. But unfortunately, you may not be able to do so. Such has been the case with this trader, who cautions others from trading with this forex broker.

WikiFX Opines on MarketsVox

Nothing much to talk about. MarketsVox, which despite being regulated in Seychelles, has been defrauding investors with a wide range of trade manipulations and tricks. Given the massive trader complaints, WikiFX, a leading forex broker regulation inquiry app, gives it a score of just 1.97 out of 10.

Here is an important update for you!

WikiFX Masterminds is launched, where you can discuss forex 24/7.

Here is how you can join it to discuss.

1. Scan the QR code placed right at the bottom.

2. Download the WikiFX Pro app.

3. Afterward, tap the ‘Scan’ icon placed at the top right corner

4. Scan the code again.

5. Thats it, you have become a community member.