Lured by a deepfake video, retiree lost over $4,000 in an investment scheme

Investment scams recorded the highest amount of losses, at about $145.4 million, in the first half of 2025.

简体中文

繁體中文

English

Pусский

日本語

ภาษาไทย

Tiếng Việt

Bahasa Indonesia

Español

हिन्दी

Filippiiniläinen

Français

Deutsch

Português

Türkçe

한국어

العربية

Abstract:A Malaysian man who posed as a ‘licensed’ futures trader has been handed a 20-year prison sentence and a RM9 million fine after admitting to running a fraudulent derivatives investment scam.

A Malaysian man who posed as a ‘licensed’ futures trader has been handed a 20-year prison sentence and a RM9 million fine after admitting to running a fraudulent derivatives investment scam.

The Kuala Lumpur Sessions Court found Mohd Azhidi bin Laili guilty of deceiving nine investors between May 2013 and March 2014. Operating under the guise of an investment linked to crude palm oil (FCPO) futures through AmFutures Sdn Bhd, Azhidi misled victims into believing they were participating in a legitimate trading programme. The scheme, however, never existed in the first place.

Judge Puan Hamidah binti Mohamed Deril imposed nine separate sentences under section 206(b) of the Capital Markets and Services Act 2007 (CMSA) with two years imprisonment and a RM1 million fine for each charge. The jail terms will run concurrently. Should the fines remain unpaid, Azhidi faces an additional 27 months in prison upon completion of his primary sentence.

Azhidi also admitted to a further offence under section 59(1) of the CMSA for falsely presenting himself as an authorised representative of AmFutures without holding the necessary licence. For this, the court ordered an additional two years imprisonment, to be served concurrently.

The case first reached the courts in February 2022, shortly after Azhidis arrest. Initially pleading not guilty, he was released on RM250,000 bail with two sureties and was required to surrender his passport and report monthly to the Securities Commission Malaysia (SC). His trial began in February 2023 and continued into early 2025, with testimony from 28 prosecution witnesses, including seven victims.

However, his bail was revoked in May 2024 when he failed to appear in court for two scheduled mentions and neglected to comply with his monthly reporting obligations. The court ruled that his sentence would begin from the date his bail was withdrawn.

Prosecution was led by SC Deputy Public Prosecutor Mohd Izuddin Mohamad, supported by officers Quek Yiing Huey, Raihana Nadhira Rafidi, Eunice Ong Jo Xing, and Mark Rohan Mahadevan. Azhidi was represented by counsel Al-Sabri Haji Ahmad Kabri.

The SC stressed that the outcome underscores the severe consequences of unlicensed trading activities and the harm such scams can inflict on the capital market. The regulator has urged the public to remain cautious and verify any investment opportunities through its Investment Checker tool available on its official website.

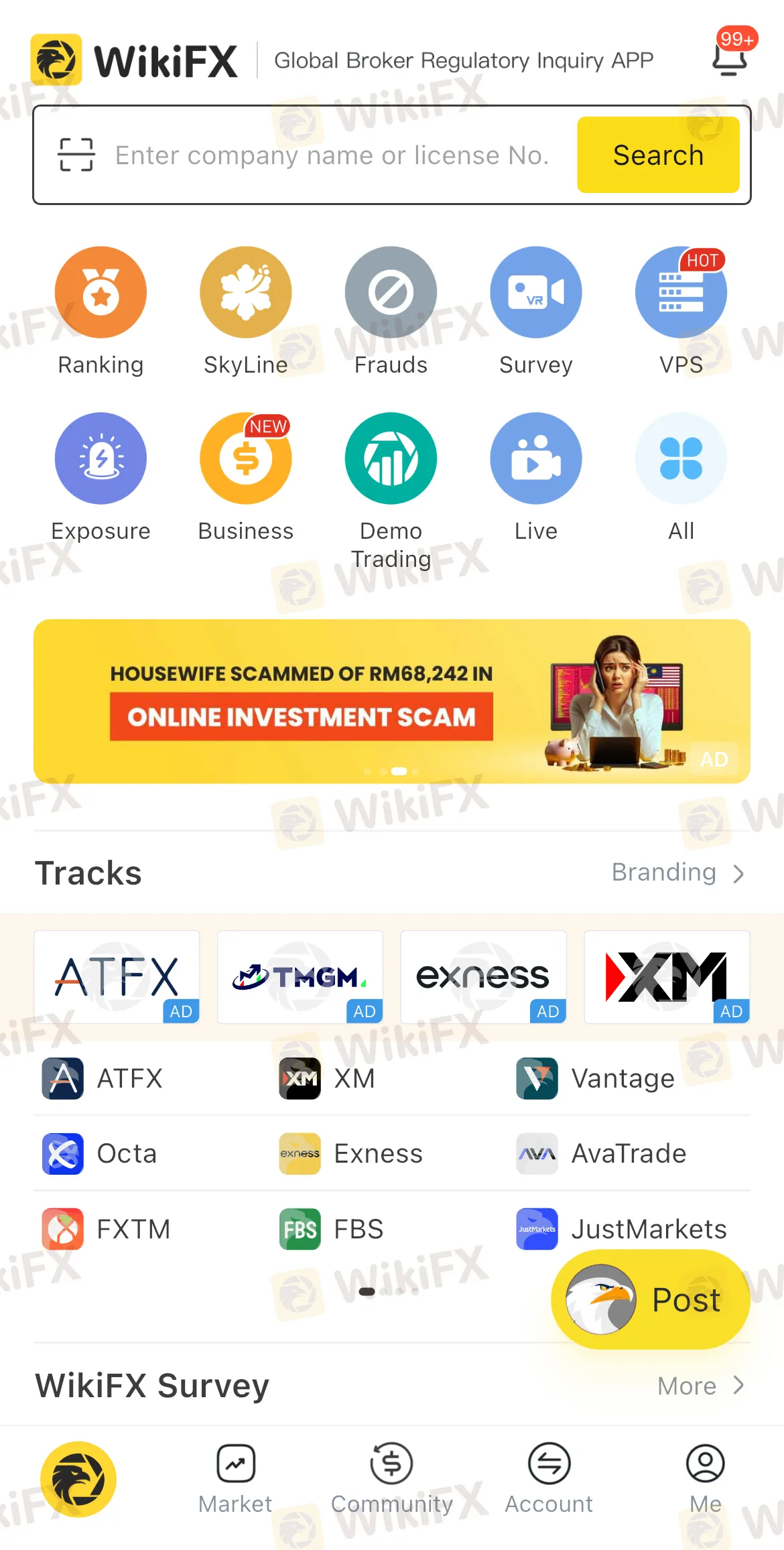

As incidents like this become increasingly common, tools such as WikiFX can play a vital role in helping individuals verify the legitimacy of brokers and financial platforms. WikiFX offers an extensive database of global broker profiles, regulatory status updates, and user reviews, enabling users to make informed decisions before committing to any financial investment. Its risk ratings and alerts for unlicensed or suspicious entities help investors easily spot red flags and avoid potential scams. By using tools like WikiFX to research a broker's background, individuals can safeguard their hard-earned savings and reduce the risk of falling victim to fraudulent schemes.

Disclaimer:

The views in this article only represent the author's personal views, and do not constitute investment advice on this platform. This platform does not guarantee the accuracy, completeness and timeliness of the information in the article, and will not be liable for any loss caused by the use of or reliance on the information in the article.

Investment scams recorded the highest amount of losses, at about $145.4 million, in the first half of 2025.

Does Pemaxx prevent you from withdrawing funds once you make profits? Has the Mauritius-based forex broker disabled your trading account upon your withdrawal request? Do you fail to withdraw funds despite meeting the trading lot requirements? These scam-like trading activities have allegedly become a part of the broker’s operation, as many traders have complained about them online. In this Pemaxx review article, we have highlighted their comments against the forex broker. Keep reading!

Did Fortune Prime Global deduct all your profits by accusing you of market manipulation? Are you struggling to access withdrawals for months? Has the forex broker disabled your forex trading account upon the withdrawal application? Does the broker stipulate tax payments as a condition for fund withdrawals? You are not alone! In this Fortune Prime Global review article, we have highlighted these complaints. Read on!

Melaka police raided a call centre run by four Chinese nationals targeting victims with fake investment schemes via a mobile app.