简体中文

繁體中文

English

Pусский

日本語

ภาษาไทย

Tiếng Việt

Bahasa Indonesia

Español

हिन्दी

Filippiiniläinen

Français

Deutsch

Português

Türkçe

한국어

العربية

From RM200 to RM94,000: Fake Trading Platform Destroyed a Retiree’s Pension

Abstract:A 59-year-old retiree has lost RM94,463 of his pension compensation after falling victim to a fraudulent online investment scam, according to police in Kuala Terengganu.

A 59-year-old retiree has lost RM94,463 of his pension compensation after falling victim to a fraudulent online investment scheme, according to police in Kuala Terengganu.

The victim made a police report on 17 August. Investigations showed that the scam began just three days earlier, on 14 August, when he was introduced to an “investment opportunity” through a mobile app while at home.

He registered on a website linked to the scheme and started with an investment of RM200. The platform showed fake profits almost instantly, making it look real. Believing the returns were genuine, he followed more instructions given by the operators.

The platform then persuaded him to make further payments under the pretext of unlocking and processing his supposed returns. Convinced by the convincing appearance of the profits displayed online, he transferred additional sums across several transactions.

Between 14 and 17 August, the victim made 12 separate payments into six different bank accounts. Each transfer was presented as a necessary step to access the profits he believed he had earned. By the time he realised he had been deceived, nearly RM95,000 of his pension funds had been lost.

Police confirmed that the case is being investigated under Section 420 of the Penal Code, which deals with cheating. Kuala Terengganu District Police Chief, Assistant Commissioner Azli Mohd Noor, stated that the funds lost were part of the victims pension compensation, underscoring the personal and financial impact of the fraud.

This case reflects a wider trend in Malaysia and across Southeast Asia, where online investment scams have surged alongside the rapid growth of digital finance. According to data released by the Royal Malaysia Police earlier this year, investment fraud ranks among the top three categories of cybercrime in the country, with thousands of victims reporting losses amounting to hundreds of millions of ringgit annually.

The scams typically rely on professional-looking websites or mobile applications that simulate real-time trading results to create the illusion of profit. Victims are often encouraged to invest small sums initially, only to be pressured into committing larger amounts as they are shown fabricated returns. Once substantial funds are transferred, the platforms usually collapse or become inaccessible.

The trend is not confined to Malaysia. Across the Asia-Pacific region, regulators in Singapore, Thailand and the Philippines have issued repeated warnings about the rise in fraudulent trading platforms and cryptocurrency-based schemes. The International Monetary Fund (IMF) has also highlighted the risks posed by unregulated digital financial products, particularly in emerging markets where consumer protection measures are weaker.

Retirees and middle-income earners are frequently targeted because they are seen as holding accessible savings, such as pension funds or compensation payouts. Fraudsters exploit both their financial vulnerability and their desire for secure, higher-yield investments in an uncertain economic climate.

Authorities worldwide continue to strengthen oversight and enforcement, but the speed and sophistication of these scams often leave victims with little chance of recovery. In Malaysia, the police and the Securities Commission have repeatedly urged investors to verify the legitimacy of investment platforms through official channels before committing funds.

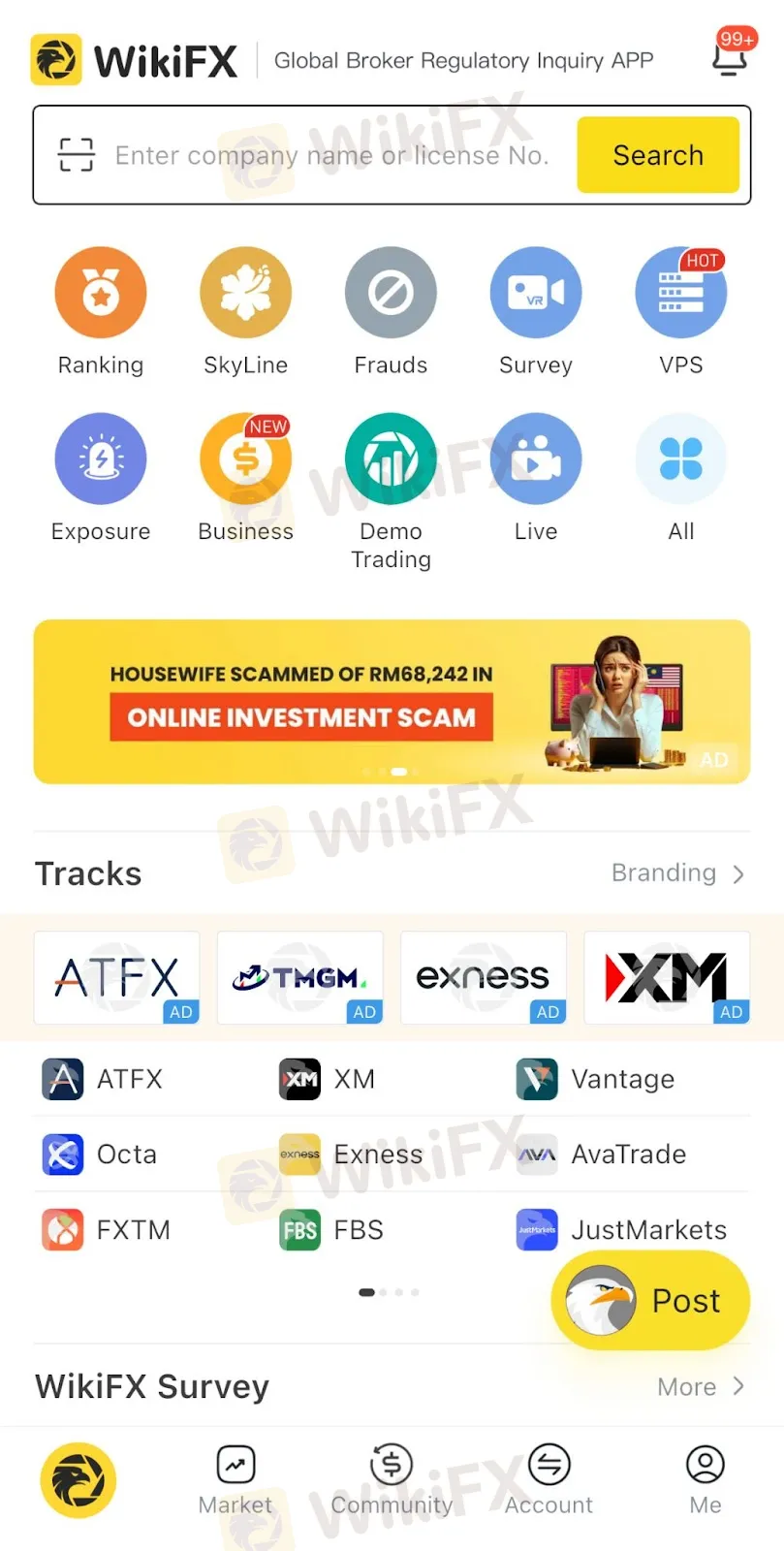

As incidents like this become increasingly common, tools such as WikiFX can also play a vital role in helping individuals verify the legitimacy of brokers and financial platforms. WikiFX offers an extensive database of global broker profiles, regulatory status updates, and user reviews, enabling users to make informed decisions before committing to any financial investment. Its risk ratings and alerts for unlicensed or suspicious entities help investors easily spot red flags and avoid potential scams. By using tools like WikiFX to research a broker's background, individuals can safeguard their hard-earned savings and reduce the risk of falling victim to fraudulent scams.

Disclaimer:

The views in this article only represent the author's personal views, and do not constitute investment advice on this platform. This platform does not guarantee the accuracy, completeness and timeliness of the information in the article, and will not be liable for any loss caused by the use of or reliance on the information in the article.

WikiFX Broker

Latest News

CySEC Withdraws CIF License of OBR Investments Ltd (OBRInvest)

Arena Capitals User Reputation: Looking at Real User Reviews and Common Problems

What Will US-Iran War Affect Stock Market: A Comprehensive Investor's Guide to 2026

Is FINOWIZ Safe or Scam? 2026 Deep Dive into Its Reputation and User Complaints

FX Deep Dive: Dollar King Returns as Energy Shock Splits G10 Currencies

The 25-Day Tipping Point: Energy Markets Stare Down a Hormuz Blockade

Eightcap Review: Understanding Fees, Features, and Important User Warnings

Exnova Review 2026: Is this Forex Broker Legit or a Scam?

Stop Letting Your Trading Rewards Gather Dust: A Limited-Time 30% Opportunity

Middle East Escalation Rocks Markets: Oil Surges while Brokers Tighten Leverage

Currency Calculator