Retiree loses over RM300k in FB investment scam, hoping for RM9m profits

Police say 81-year-old duped by bogus high-return scheme after 15 online transfers to multiple bank accounts

简体中文

繁體中文

English

Pусский

日本語

ภาษาไทย

Tiếng Việt

Bahasa Indonesia

Español

हिन्दी

Filippiiniläinen

Français

Deutsch

Português

Türkçe

한국어

العربية

Abstract:Red flags are the warning signs you need to notice. Brokers hide their red flags, always show you the bright side and never reveal the risks associated with it. But as a trader, you need to focus on red flags more carefully before investing. In this article, we will reveal the red flags of TenTrade.

Red flags are the warning signs you need to notice. Brokers hide their red flags, always show you the bright side and never reveal the risks associated with it. But as a trader, you need to focus on red flags more carefully before investing. In this article, we will reveal the red flags of TenTrade. 1. Non-Functional Website

A non-functional website is a major red flag for any online trading platform. If users are unable to access or navigate the site smoothly, it raises concerns about the brokers reliability and professionalism. A website that frequently crashes, has broken links, or lacks updated content can significantly affect user trust and overall trading experience.

2. WikiFX Serious Warning

Receiving a serious warning from WikiFX is a strong indicator that a broker may not be trustworthy. If a broker is flagged with a serious warning, it often means there are unresolved complaints, lack of regulation, or potentially fraudulent activities. Traders should take such warnings seriously and thoroughly research the broker.

3. 24/5 Customer Support

While 24/5 customer support ensures assistance during standard trading hours, it may fall short for traders operating in different time zones or those who trade cryptocurrencies over the weekend. Consider platforms that provide 24/7 support for a more flexible and reliable trading experience.

4. Limited to MetaTrader 5 Only

Limiting traders to only MetaTrader 5 can restrict flexibility and personal trading preferences. While MT5 is a powerful and popular platform, some traders prefer alternatives like MetaTrader 4, cTrader, or proprietary trading apps that offer unique features. A lack of platform diversity can hinder customization and the ability to execute specific strategies. Brokers that support multiple trading platforms typically offer a more inclusive and trader-friendly environment.

Read this Article too- www.wikifx.com/en/newsdetail/202508218324781731.html

5. No Negative Balance Protection

The absence of negative balance protection poses a significant risk to traders, especially during highly volatile market conditions. Without this safeguard, traders can lose more money than they initially deposited, resulting in unexpected debts. Reputable brokers usually offer negative balance protection to ensure clients losses are limited to their account balance. Always verify if this feature is included before choosing a trading platform to protect your investments and minimize risk.

Tips to Stay Away from Scam Brokers

1. Check Regulatory Status

Always verify if the broker is licensed by a recognized authority (e.g., SEBI, FINMA, FCA). Regulated brokers must follow strict rules to protect investors.

2. Avoid Unrealistic Promises

Be cautious of brokers offering guaranteed profits or high returns with little to no risk. These are classic red flags.

3. Verify Contact Information

A legitimate broker will have a physical office, working phone numbers, and professional email addresses. Scam brokers often hide behind vague or fake contact info.

4. Read Online Reviews

Search for user feedback, reviews, and scam alerts. Multiple negative reviews or unresolved complaints are warning signs.

5. Test Customer Support

Contact their support team with questions. Poor or evasive responses could indicate a scam.

6. Beware of Pressure Tactics

If a broker pushes you to deposit quickly or invest large amounts, take a step back. Scammers often use urgency to trap victims.

7. Check Withdrawal Policies

Scam brokers usually make it hard to withdraw your money. Read the fine print and look for hidden fees or restrictions.

8. Look for Secure Payment Methods

Use brokers that offer secure, traceable payment options. Avoid those who insist on crypto or wire transfers to unknown accounts.

9. Confirm Website Legitimacy

Scam brokers may copy the design of real firms. Double-check the URL, company registration, and official listings.

10. Register Your Complaints

If you suspect you've been scammed or mistreated by a broker, report it immediately. Most regulatory authorities have complaint portals where you can formally submit your issue.

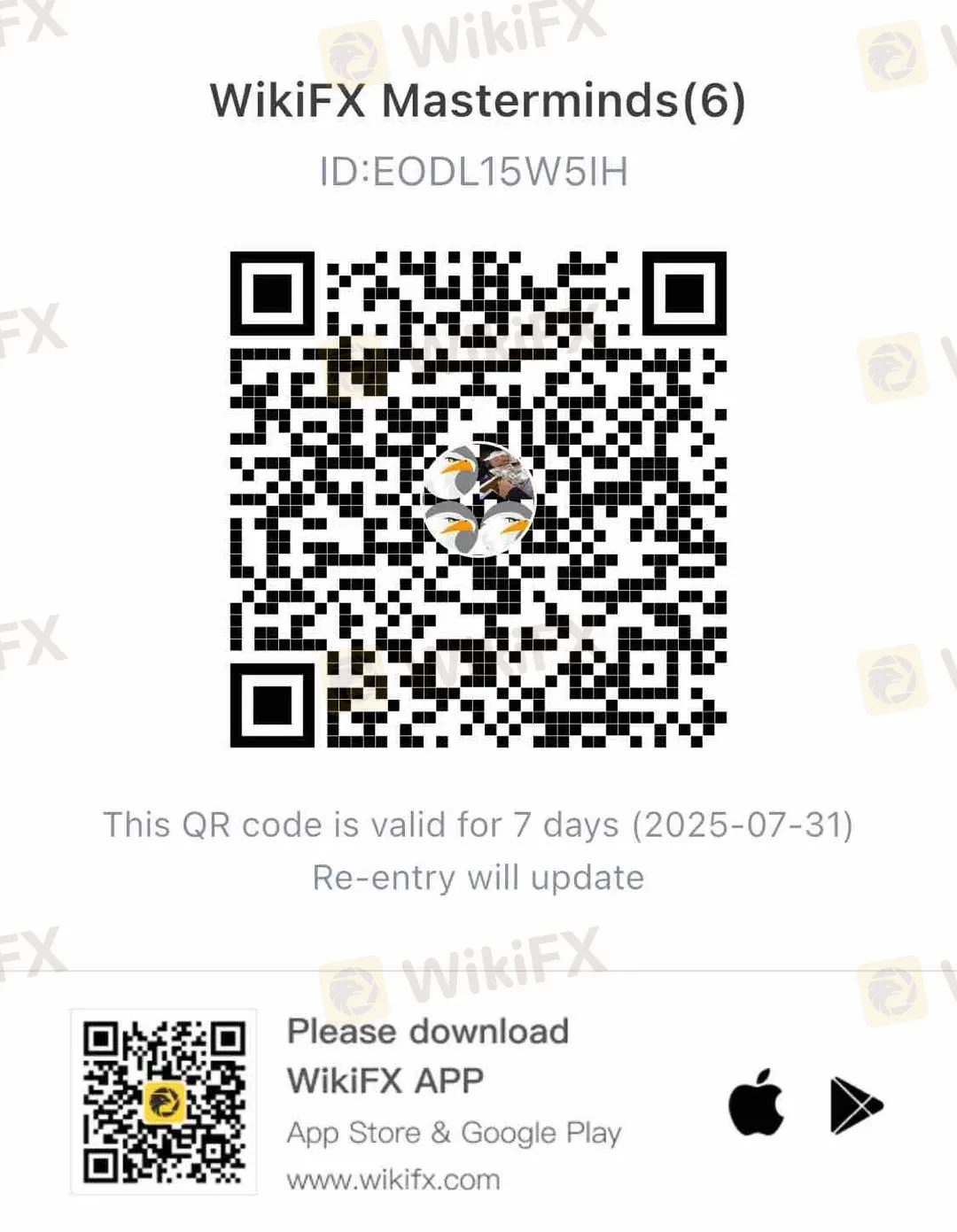

Join WikiFX Community

Be attentive and stay updated with WikiFX. You can get all the information you need to know about the Forex market, fraud alerts, and the latest news related to Forex trading — all in one place. Join the WikiFX Community by scanning the QR code at the bottom.

Steps to Join

1. Scan the QR code below

2. Download the WikiFX Pro app

3. After installing, tap the Scan icon at the top right corner

4. Scan the code again to complete the process

5. You have joined!

Disclaimer:

The views in this article only represent the author's personal views, and do not constitute investment advice on this platform. This platform does not guarantee the accuracy, completeness and timeliness of the information in the article, and will not be liable for any loss caused by the use of or reliance on the information in the article.

Police say 81-year-old duped by bogus high-return scheme after 15 online transfers to multiple bank accounts

In a forex market where fundamental and technical factors impact the currency pair prices, volatility is expected. If the price volatility acts against the speculation made by traders, it can result in significant losses for them. This is where a stop-loss order comes to their rescue. It is one of the vital investment risk management tools that traders can use to limit potential downside as markets get volatile. Read on as we share its definition and several strategies you should consider to remain calm even as markets go crazy.

Did you find trading with 1Prime options fraudulent? Were your funds scammed while trading on the broker’s platform? Did you witness unfair spreads and non-transparent fees on the platform? Was your forex trading account blocked by the broker despite successful verification? These are some issues that make the traders’ experience not-so memorable. In this 1Prime options review article, we have investigated the broker in light of several complaints. Keep reading!

This EXTREDE Review serves an important purpose: to examine the big differences between what the broker advertises and what we can actually prove. For any trader thinking about using this platform, the main question is about safety and whether it's legitimate. We will give you a clear answer right away. Our independent research, backed up by third-party information, shows that EXTREDE operates without proper regulation, creating a high-risk situation for all investors. The main focus of this investigation is the absolutely important need to check a broker's claims before investing. A broker's website is a marketing tool; it cannot replace doing your own research. The information that EXTREDE presents contains contradictions that every potential user must know about. A quick way to see these warnings gathered together is by checking the broker's live profile on verification platforms. For example, the EXTREDE page on WikiFX brings together regulatory status, user feedback and expert ri