Abstract:There are several underrated features that set Exness apart from the competition especially for those who want more control, flexibility, and convenience in their trading experience.

When it comes to forex and CFD trading, Exness has earned a reputation for reliability, tight spreads, and fast execution. But while many traders are familiar with its basic offerings, there are several underrated features that set Exness apart from the competition especially for those who want more control, flexibility, and convenience in their trading experience.

1. Instant Withdrawals Even on Weekends

Exness offers automated withdrawals that are processed instantly for most payment systems, including e-wallets like Skrill, Neteller, and even crypto. Traders often get stuck waiting hours or even days for funds. Exness removes that friction, giving you quicker access to your profits or capital when you need it most.

2. Unlimited Leverage

Exness offers unlimited leverage for qualified accounts something rarely seen among major brokers. Once your account meets specific criteria (like trading volume and no open orders), you can apply ultra-high leverage beyond the standard limits. For experienced traders using strict risk management, high leverage can maximize short-term gains on low-volatility assets.

3. Free VPS Hosting for Active Traders

Did you know Exness offers free VPS hosting? If your trading account maintains a certain equity level (usually $500 or more), you can request a virtual private server to host your trading platform—perfect for automated trading with expert advisors (EAs).

This ensures faster execution, minimal slippage, and uninterrupted strategy running even when your computer is off.

4. Local Payment Options for Global Traders

Exness makes funding and withdrawals easier by offering localized payment methods tailored to your country. This includes local bank transfers, UPI, mobile wallets, and even regional cryptocurrencies in some areas. No more currency conversion headaches or international bank fees. The platform integrates seamlessly with local systems.

5. Real-Time Account Monitoring Tools

While many brokers offer analytics, Exness provides real-time monitoring of margin level, exposure, and portfolio performance via both the web platform and mobile app. These tools are incredibly useful for managing risk proactively. You get instant updates on your account health, helping you make smarter decisions under volatile market conditions.

6. Multilingual 24/7 Customer Support

Support in English is standard, but Exness goes the extra mile by offering multilingual customer service, available 24/7. This includes live chat, email, and callback options in over 15+ languages, catering to a truly global audience.

Read this Article too- www.wikifx.com/en/newsdetail/202508213724780226.html

Conclusion

Exness might seem like just another broker at first glance, but these lesser-known features reveal a platform built with trader convenience and performance in mind. Whether you‘re a beginner, a scalper, or a high-frequency algo trader, Exness offers tools and flexibility that many competitors simply don’t match.

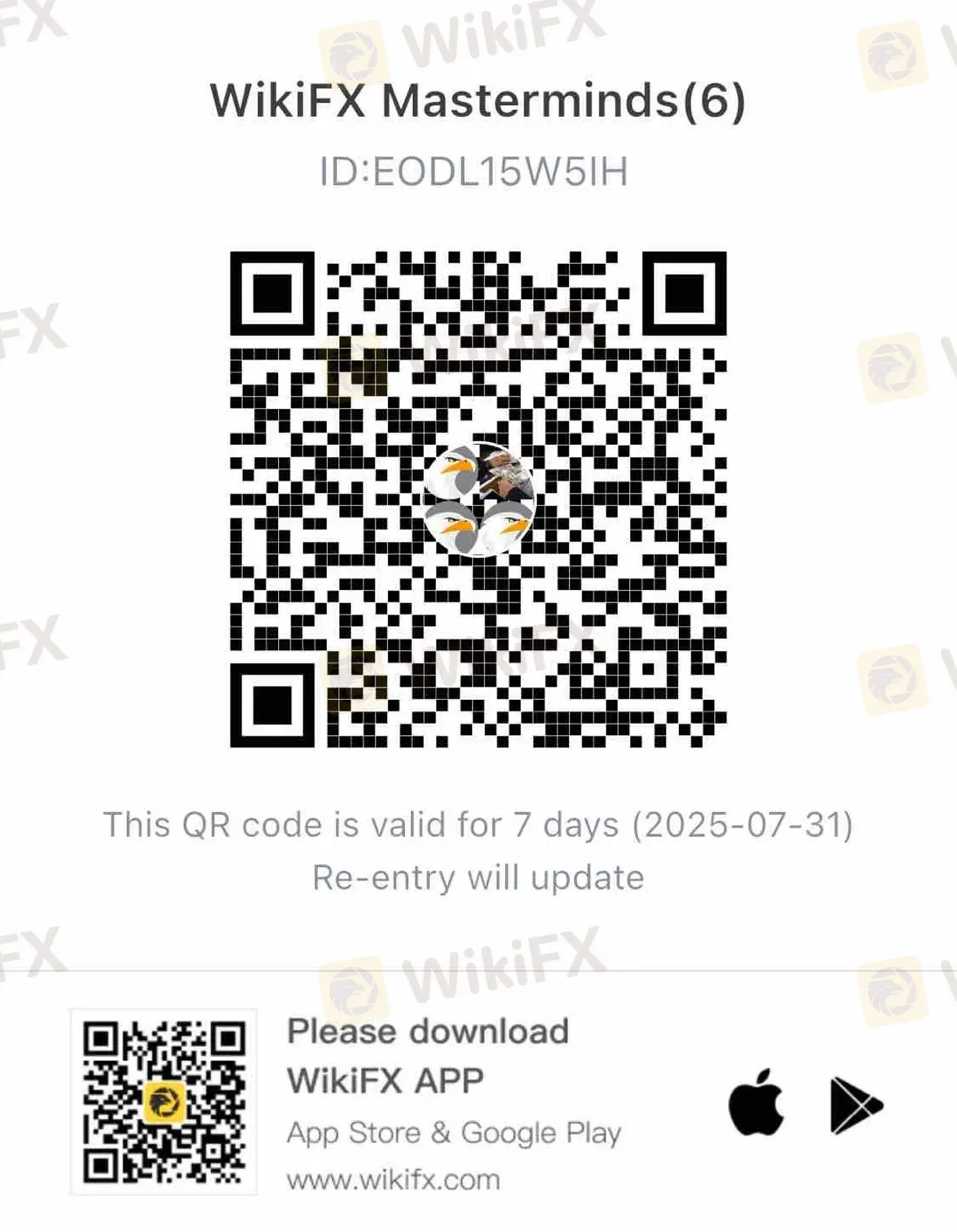

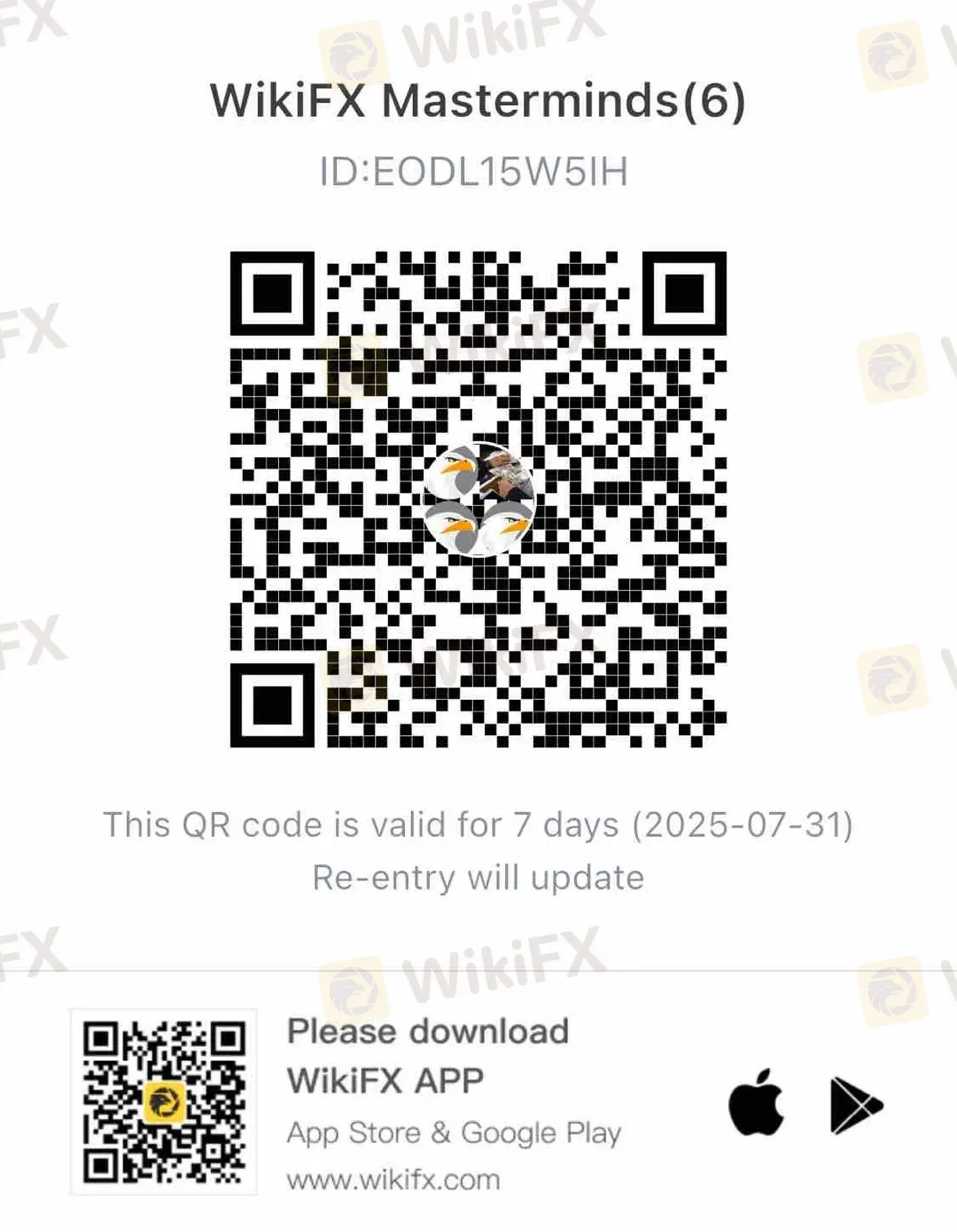

Join WikiFX Community

Be attentive and stay updated with WikiFX. You can get all the information you need to know about the Forex market, fraud alerts, and the latest news related to Forex trading — all in one place. Join the WikiFX Community by scanning the QR code at the bottom.

Steps to Join

1. Scan the QR code below

2. Download the WikiFX Pro app

3. After installing, tap the Scan icon at the top right corner

4. Scan the code again to complete the process

5. You have joined!