Investment Wisdom Gathered Here

ECInvestingInsights Topic Launch: Explore the Forex Market with WikiFX Elite Club Members

简体中文

繁體中文

English

Pусский

日本語

ภาษาไทย

Tiếng Việt

Bahasa Indonesia

Español

हिन्दी

Filippiiniläinen

Français

Deutsch

Português

Türkçe

한국어

العربية

Abstract:Malaysia’s Securities Commission warns that complaints about unlicensed investment activities have doubled in five years—3,602 cases in 2024 and 2,039 in H1 2025—highlighting increasingly sophisticated scams targeting even professionals and seniors. Schemes often mimic legitimacy, then block withdrawals via “compliance” or “maintenance” excuses. The core defense is pre-investment verification and ongoing risk control.

The Securities Commission Malaysia (SC) has issued a fresh warning: complaints and enquiries involving unlicensed activities have doubled over the past five years. In 2024 alone, the SC received 3,602 cases—100% higher than in 2020—while the first half of 2025 recorded 2,039 cases, up about 51% year-on-year. SC Chairman Dato Mohammad Faiz Azmi stressed that scams have become more “professionalized” with the aid of technology. Beyond relying on stronger supervision and enforcement, the public must actively embrace “pre-investment verification” to avoid blind trust and impulsive deposits.

This is not a theoretical risk. In just one week, Malaysia saw at least three investment scam incidents. Victims were not “information-poor”—they included highly educated professionals such as engineers and teachers. The next most affected group were seniors, whom criminal syndicates target by exploiting unfamiliarity with digital tools, financial jargon, and online processes. Many victims later admitted they had skipped the most crucial step—checking the platforms credentials and licenses—before transferring funds.

Teachers and Lecturers Trapped by Investment Scams Promising Quick Profits

Scam Alert!! Family Loses RM750,000 in “Pyramid” Investment Scheme

Real-world scams often wear a mask of “professionalism and transparency.” They lure targets with “authoritative endorsements,” celebrity interviews, live-streamed signals, and “capital-protected high returns”; they add urgency with “limited-time offers,” private groups, and “one-on-one mentoring”; and they lower suspicion with polished dashboards, P&L screenshots, and withdrawal demos. Once money starts moving, the playbook shifts from small early withdrawals to “top-up margin,” “complete bonus terms,” “compliance reviews,” and “system maintenance” that suspend withdrawals—pushing you into a point of no return. By the time you react, the operator may have rebranded, gone offline, or moved offshore—making recovery far harder.

The key takeaway is clear: unregulated FX platforms and offshore investment schemes pose outsized risks. Many victims never verified the companys licensing status, legal entity, or regulatory scope—nor did they check for Malaysia-specific authorization. Some assumed that a “foreign license” was a universal passport, overlooking the stark differences in regulatory rigor, applicability, and investor protections across jurisdictions. If a platform lacks authorization in Malaysia, it remains illegal or unauthorised—regardless of offshore claims.

If youre unsure where to start, WikiFX can serve as your first verification gate. Available free on Android and iOS, it aggregates global regulator registries, platform fundamentals, user reviews, and risk flags—helping you quickly see whether a broker is licensed, where the license applies, any alerts or disputes, and overall transparency/safety indicators. Often, a simple name search reveals whether the platform is offshore-only or not authorized locally, empowering you to make a rational decision before sending money.

Past cases show that some platforms claiming “overseas regulation” actually steer Malaysian users into offshore entities to evade stricter local rules. When trouble hits, users may find their funds unprotected under Malaysian law, cross-border claims difficult, and the operating entity evasive. Had victims used WikiFX for basic checks, many would have recognized that certain “offshore licenses” offered no real protection and that the operator was unlicensed in Malaysia—and thus avoided funding it at all.

Beyond pre-trade checks, in-trade and post-trade risk controls matter just as much. Any pitch promising “stable high returns” or “guaranteed principal” should trigger alarms. Any request to transfer to personal accounts, or prolonged withdrawal delays justified by “compliance reviews” or “system maintenance,” warrants immediate evidence preservation and reporting to the authorities. WikiFX also issues real-time risk alerts, aggregates user feedback, and tracks suspicious platform movements, helping investors spot irregularities hidden in “business as usual.”

Markets never lack opportunities. But what truly protects your money isn‘t “mentor rhetoric” or a glossy website—it’s verifiable regulation and your own skepticism. Before any transfer, make “Search WikiFX to verify the license” a standard step in your workflow. A three-minute check could be the strongest firewall between you and a scam.

Disclaimer:

The views in this article only represent the author's personal views, and do not constitute investment advice on this platform. This platform does not guarantee the accuracy, completeness and timeliness of the information in the article, and will not be liable for any loss caused by the use of or reliance on the information in the article.

ECInvestingInsights Topic Launch: Explore the Forex Market with WikiFX Elite Club Members

The victim, who works at a hospital in Pahang, received phone calls from several individuals on December 31.

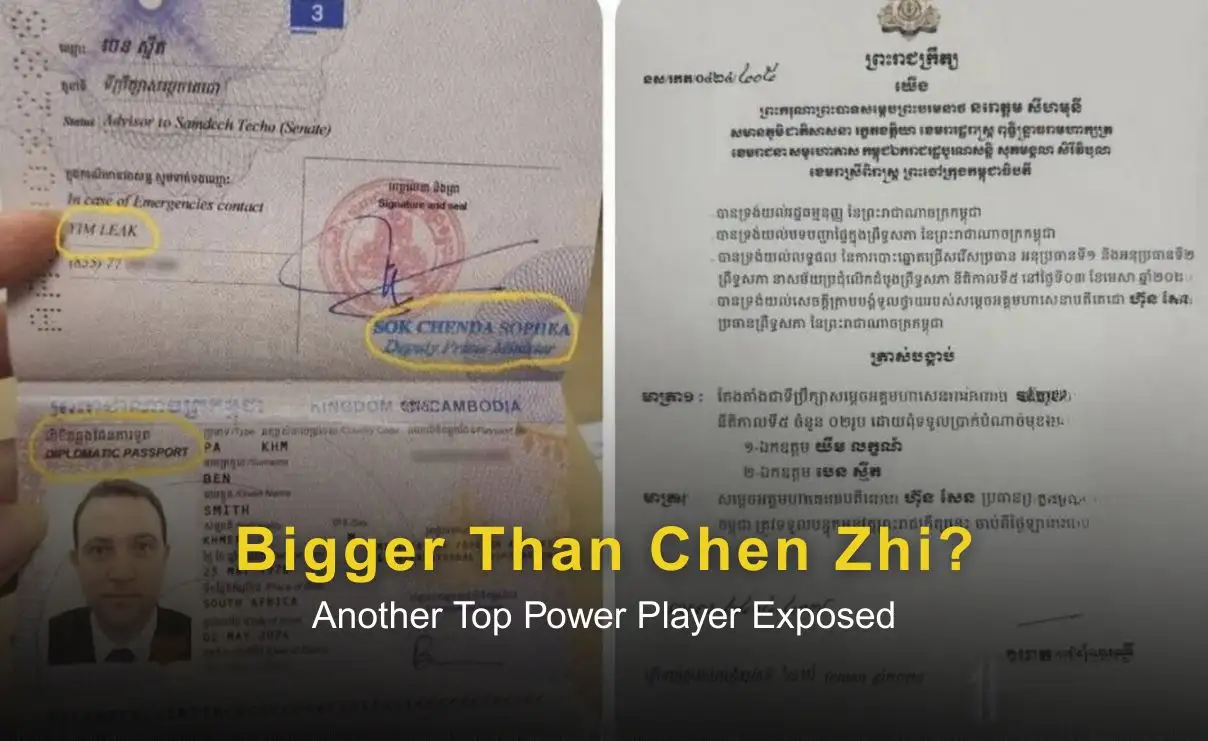

Amid ongoing scrutiny over Chen Zhi’s Cambodian citizenship, a separate case involving alleged money-laundering figure Benjamin Moberg has raised fresh concerns. Reports that Moberg held a Cambodian diplomatic passport and advisory role despite links to criminal investigations have prompted questions about possible high-level protection and systemic misuse of citizenship and diplomatic status. Analysts warn the case may reflect deeper governance and enforcement challenges rather than isolated incidents.

Belgian consumers lost over €23M to crypto and WhatsApp investment scams in late 2025, financial regulator warns amid rising fraud cases.