Abstract:When investing through forex, you often come across terms such as long position and short position. You may wonder what these two mean and how they impact your trading experience. So, the key lies in understanding the very crux of this forex trading aspect, as one wrong step can put you behind in your trading journey. Keeping these things in mind, we have prepared a guide to long position vs short position forex trading. Keep reading!

When investing through forex, you often come across terms such as long position and short position. You may wonder what these two mean and how they impact your trading experience. So, the key lies in understanding the very crux of this forex trading aspect, as one wrong step can put you behind in your trading journey. Keeping these things in mind, we have prepared a guide to long position vs short position forex trading. Keep reading!

What is a Forex Position?

Firstly, a forex position is the total currency amount an individual owes to trade the price movement. Three things are basically involved in a forex position: the currency pair, size, and long or short positions.

Explaining Long and Short Positions in Forex Trading

As traders expect currency pair price appreciation, they open a long position and hold onto it for the time they want to leverage from constant price spikes. Traders seeking to enter long positions eye buying signals identified when a currency price falls to the support level. This is where the price does not fall further; rather, it goes upward.

On the other hand, if traders reckon that the currency pair prices will depreciate, they open a short position. So, if you are seeking a short position, see where the sell signals lie. Selling opportunities arise when prices reach the resistance level. At this level, the currency prices jump, change direction, and start falling.

The Time Involved in Holding Long and Short Positions

Traders can hold the forex position for a few minutes to a few years, depending on their investment goals. Several other factors, including economic indicators and forex trading strategy, can also influence the decision to hold positions. Some forex traders hold positions for weeks and months to earn profits over the medium term. Conclusively, holding onto a forex position is based on your forex entry and exit strategies, as well as investment objectives.

Long Position vs Short Position in Forex Trading Strategy

Position trading emerges as a long-term strategy, where you hold a forex position for a few months to years. With this strategy, you do not focus on short-term fluctuations. Instead, your focus shifts to broader and fundamental long-term trends. To fully leverage a position trading strategy, traders can take positions in a market expected to witness major long-term trends. They look to capture trends spanning weeks, months and even years.

Day trading, on the other hand, works for traders seeking to open a short position. While initiating day trading, traders are affected by events that lead to short-term market movements. A minimal currency pair change can significantly affect trades. Adopting trading strategies, such as scalping and range trading, can help traders make many small profits from the price changes during the day.

Conclusion

Understanding the differences between long and short positions is essential for making informed decisions in forex trading. Whether you choose to buy (go long) or sell (go short), your success largely depends on how well you read market trends, identify support and resistance levels, and apply the right trading strategy.

Long-term traders may benefit from position trading and broader market trends, while short-term traders often rely on quick market movements through strategies like day trading or scalping. By aligning your position type with your trading style, risk appetite, and market outlook, you can navigate the forex market more confidently and improve your chances of consistent profitability.

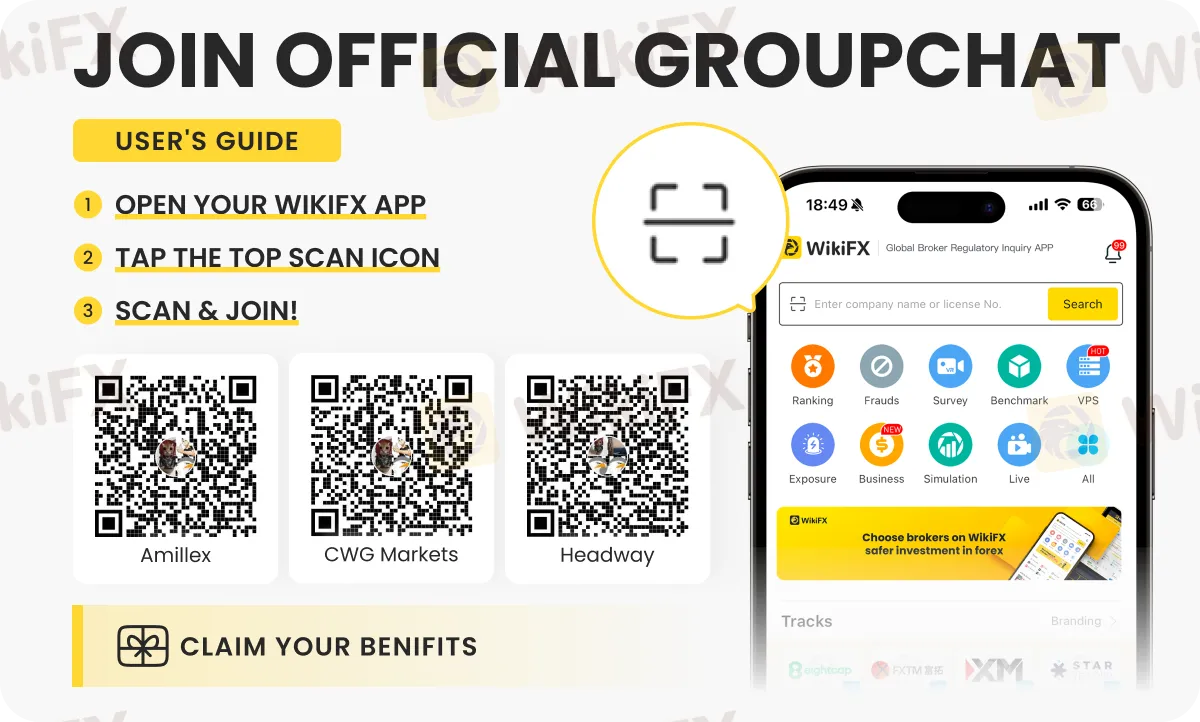

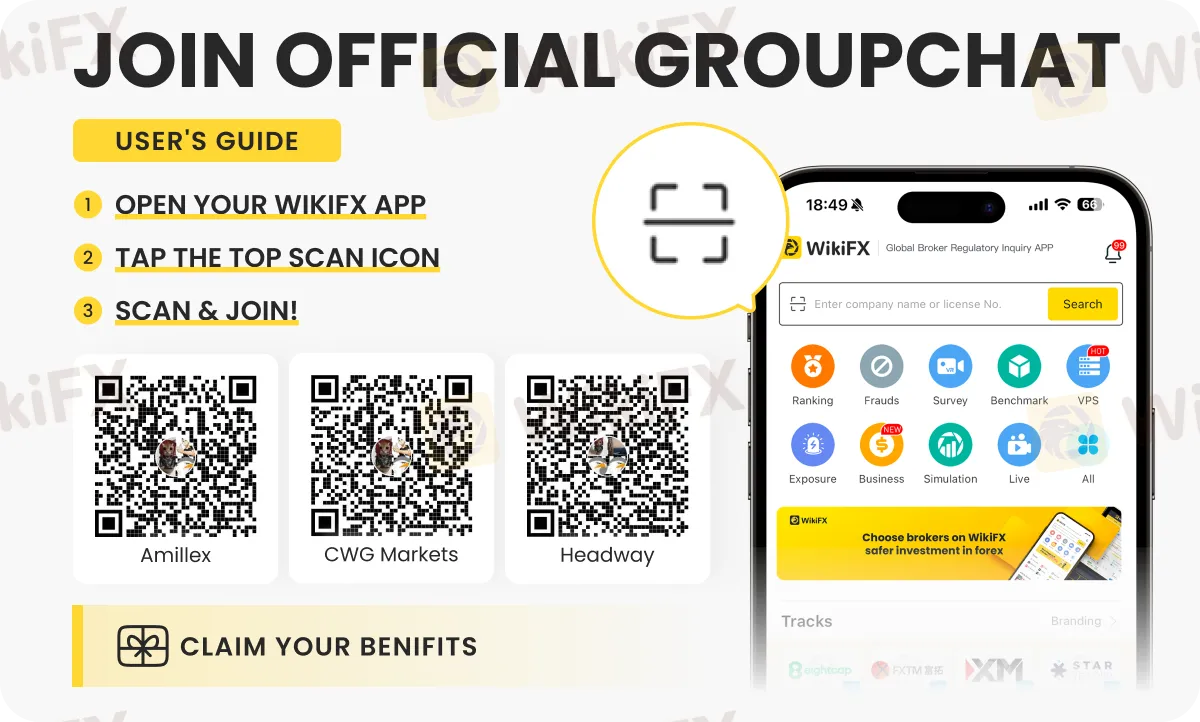

For more innovative forex trading strategies, join these special chat groups (OIFSYYXKC3, 403M82PDMX or W2LRJZXB7G) today.