Abstract:A Johor Baru kindergarten owner lost her life savings of RM1.3 million to a non-existent online investment scheme after responding to a social media ad promising returns of up to 41%. Between Nov 6–21, she made multiple transfers to several accounts and was later pressured to “add funds” to release profits that never materialised. She lodged a police report on Nov 28; the case is being probed under Section 420 (cheating).

A Johor Baru kindergarten owner has lost her life savings of RM1.3 million after falling for an online “investment” that never existed. The 42-year-old was lured by a social media advert in September touting unusually high returns, and later engaged with individuals claiming to be share-investment agents.

Johor police chief Comm Datuk Ab Rahaman Arsad said the victim was promised profits of up to 41% on her total capital. Between 6 and 21 November, she made a series of transfers totalling RM1.3 million into several bank accounts. When the supposed profits failed to materialise, the scammers pressured her to deposit even more funds, claiming extra money was needed to “release” her returns.

Realising something was wrong, the victim lodged a police report on Friday (28 Nov). The case is being investigated under Section 420 of the Penal Code for cheating. Police have cautioned the public not to be swayed by online schemes that dangle guaranteed or outsized returns—especially those encountered via social media.

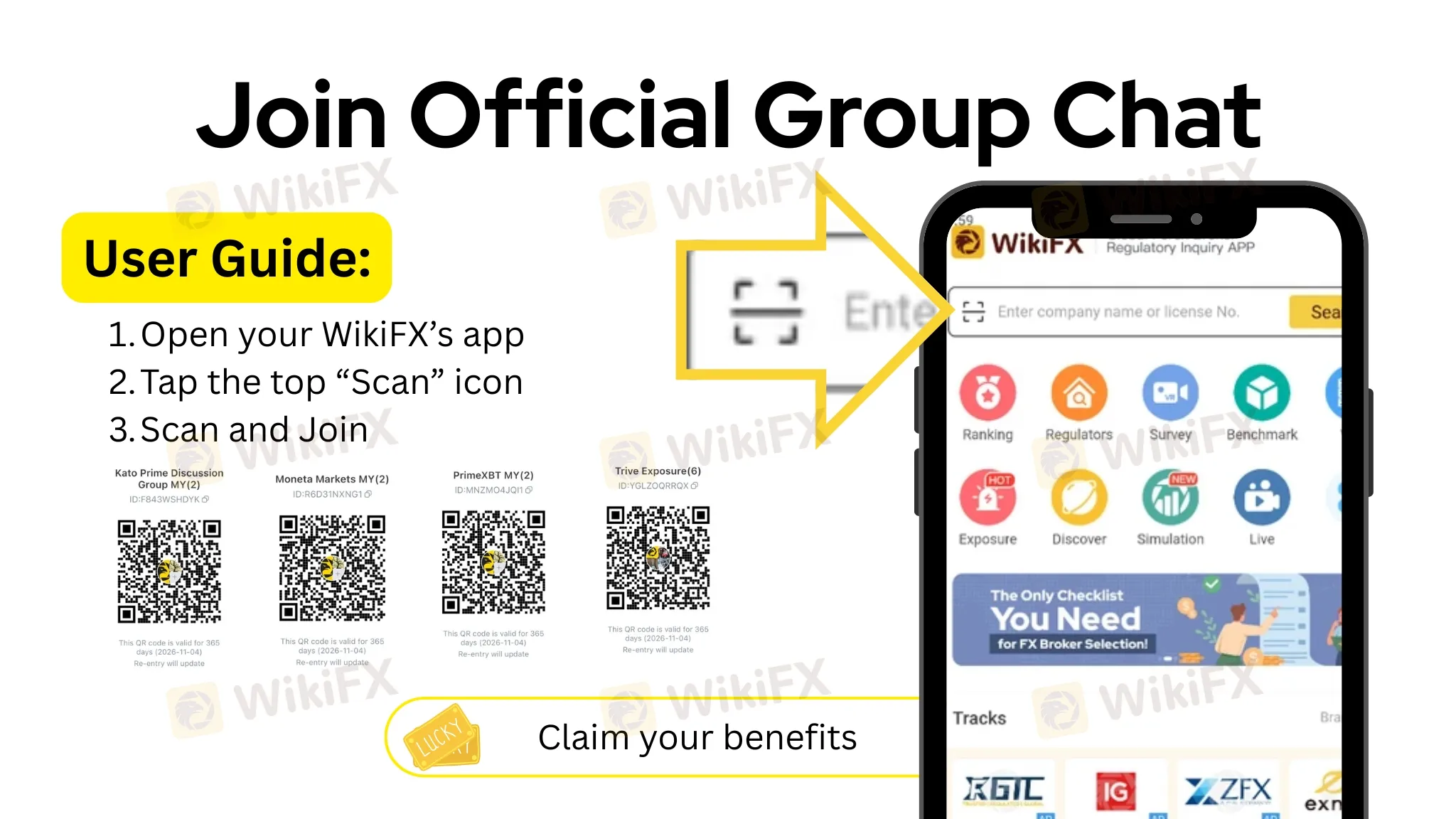

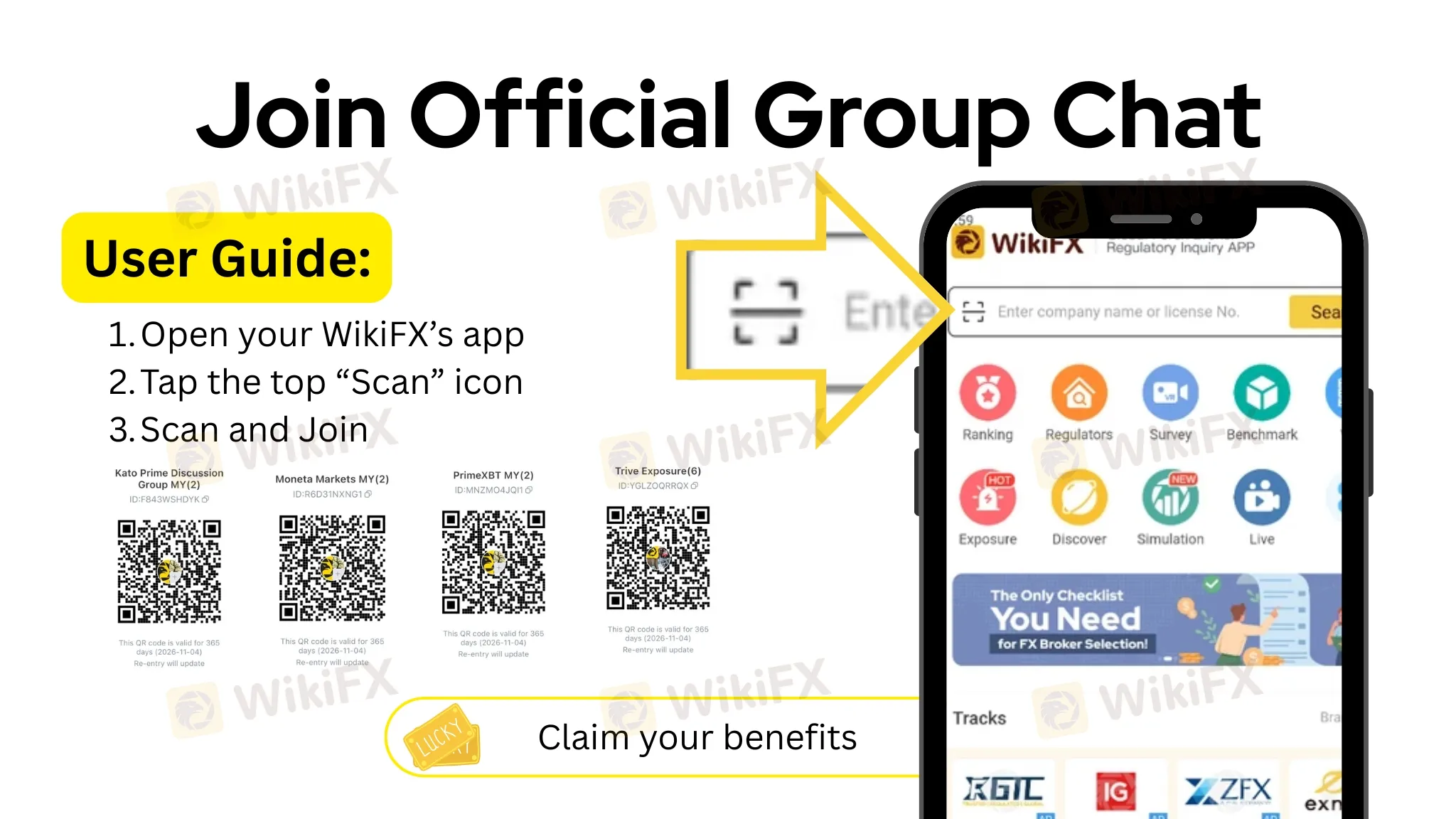

Members of the public are urged to verify any investment opportunity through official channels such as the Royal Malaysia Police (PDRM), Bank Negara Malaysia (BNM) and the Securities Commission Malaysia (SC). As an added step, users can also check a brokers regulatory status and community feedback via tools like the WikiFX app before committing funds.

For this victim, the warning signs came too late. What began as a search for better financial security ended in a devastating loss—reminding all of us that “too easy” and “too profitable” are red flags in the online investment world.

Disclaimer:

The views in this article only represent the author's personal views, and do not constitute investment advice on this platform. This platform does not guarantee the accuracy, completeness and timeliness of the information in the article, and will not be liable for any loss caused by the use of or reliance on the information in the article.