Abstract:Kulai police chief Tan Seng Lee says the victim was drawn by the promised 30% to 40% profits on her 'investments'.

A 55-year-old accountant in Johor lost RM916,700 after falling for a so-called share investment “opportunity” that promised quick money. According to Kulai district police chief Supt Tan Seng Lee, the pitch dangled 30%–40% returns within just 24 hours — the kind of offer thats hard to ignore when it keeps popping up on your phone.

Over the next few weeks, from 2 Oct to 11 Nov, she made 35 transfers into four local bank accounts. On the investment app — “RGFO Maxx” — her dashboard even showed “profits” of RM5.43 million. Everything looked legitimate on screen, until she tried to cash out. The moment she requested a withdrawal, the app blocked her account. Thats when reality hit, and she lodged a police report.

Cases like this are heartbreaking because they often start with hope — paying off debts, helping family, or finally building some savings. Scammers know this and use slick apps, fake dashboards and “customer service” chats to keep victims depositing more. The red flags are always the same: guaranteed high returns, urgency to deposit, and excuses or “system issues” when you ask to withdraw.

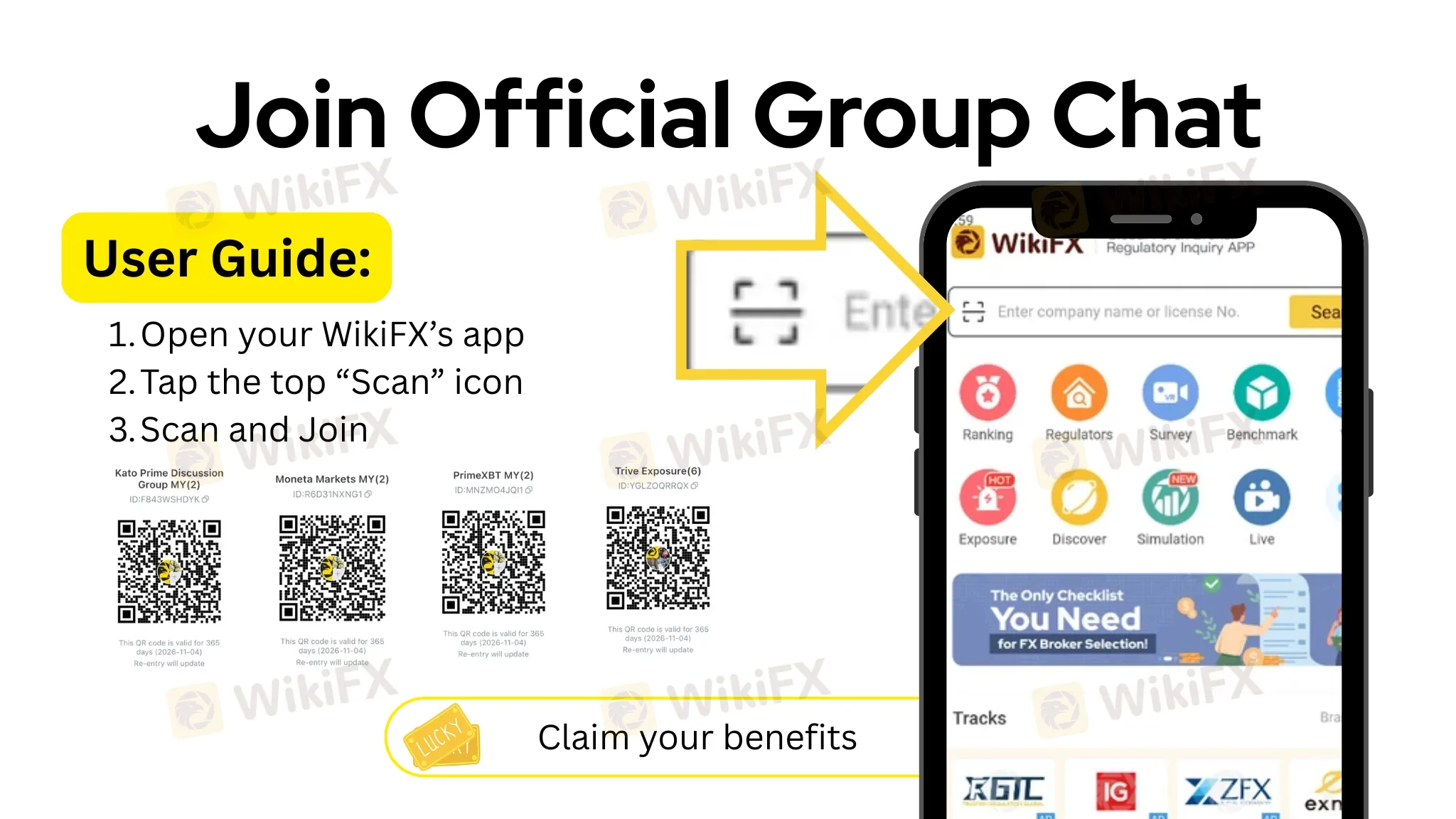

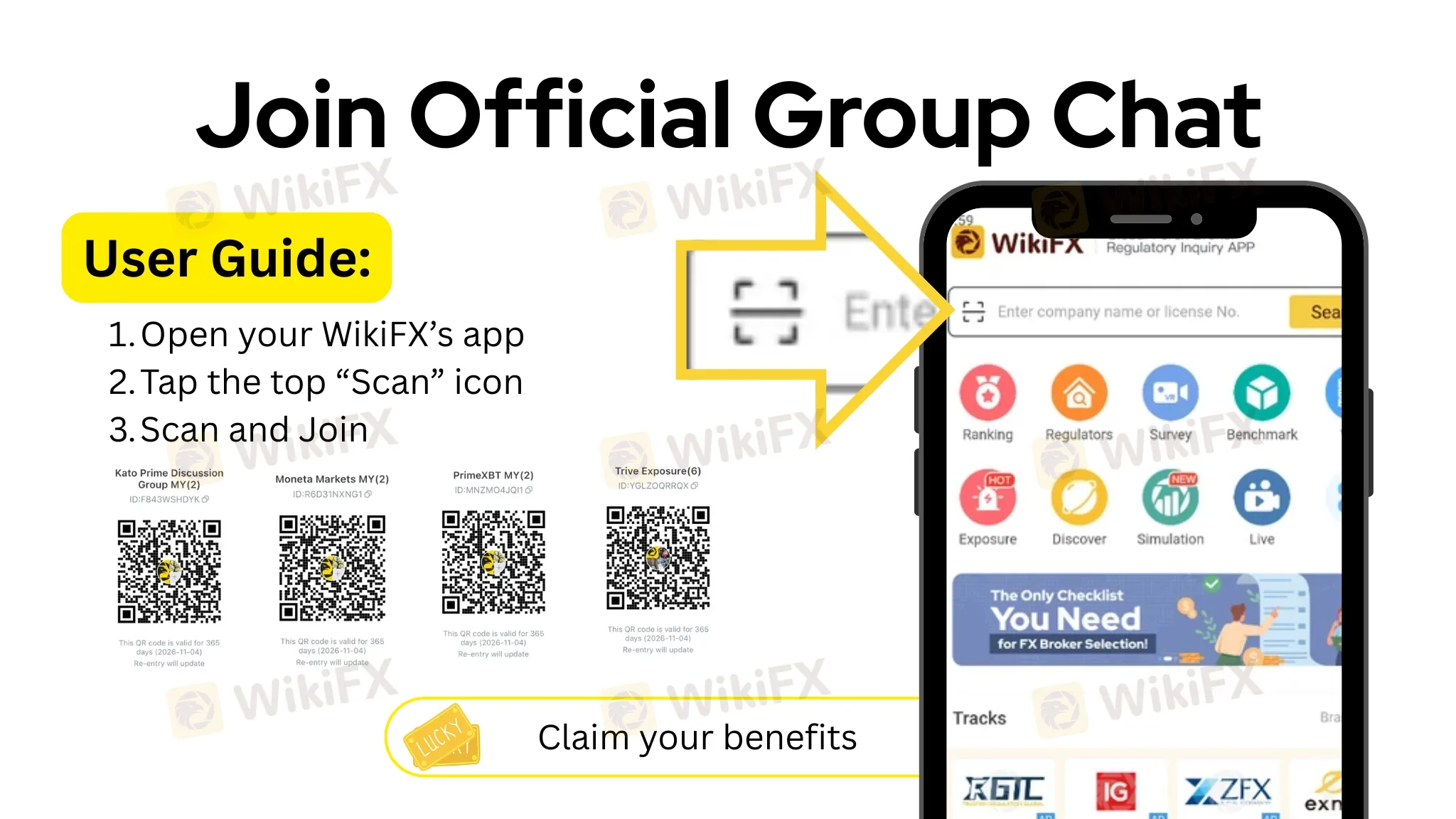

If you‘re ever unsure, give yourself five minutes before sending a single ringgit. Use the Semak Mule portal to check suspicious bank accounts. Visit the Securities Commission Malaysia (SC) and Bank Negara Malaysia (BNM) websites to confirm licences and read investor alerts. You can also use the WikiFX app to look up a broker’s regulatory status and read real user reviews. A quick check can save years of hard-earned savings.

Disclaimer:

The views in this article only represent the author's personal views, and do not constitute investment advice on this platform. This platform does not guarantee the accuracy, completeness and timeliness of the information in the article, and will not be liable for any loss caused by the use of or reliance on the information in the article.