Trading Pro Review: Pros, Cons, and Scam Alerts

Trading Pro Review for 2026 with updated data on licenses, leverage, and user complaints from Malaysia, Indonesia, and beyond. Read our verdict now.

简体中文

繁體中文

English

Pусский

日本語

ภาษาไทย

Tiếng Việt

Bahasa Indonesia

Español

हिन्दी

Filippiiniläinen

Français

Deutsch

Português

Türkçe

한국어

العربية

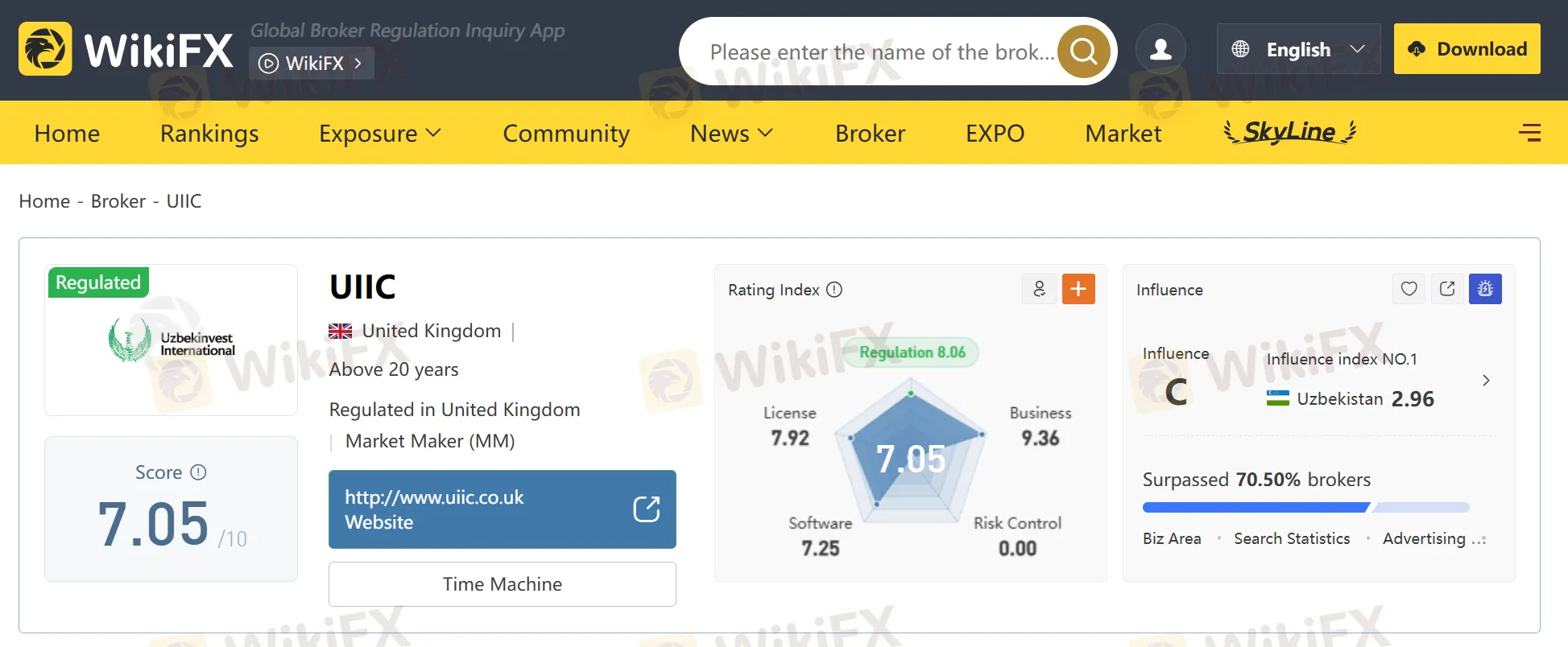

Abstract:In this article, we want to discuss the broker named UIIC, as it recently caught our eye. UIIC is a UK-based broker. This broker, registered in the United Kingdom, claims more than 20 years of operation, a long history in the financial industry, and regulatory oversight from UK authorities. But is UIIC truly safe and trustworthy? How is the regulation? Or are there red flags you should know? This article may offer you clues.

In this article, we want to discuss the broker named UIIC, as it recently caught our eye. UIIC is a UK-based broker. This broker, registered in the United Kingdom, claims more than 20 years of operation, a long history in the financial industry, and regulatory oversight from UK authorities. But is UIIC truly safe and trustworthy? How is the regulation? Or are there red flags you should know? This article may offer you clues.

UIIC (United International Investment Corporation) is a financial services provider reportedly founded in 1994, giving the firm more than 30 years of operational history. The broker operates as a Market Maker (MM) and offers various trading services such as forex, CFDs, indices, and possibly other asset classes depending on the region.

Key Facts About UIIC

At first glance, UIIC presents itself as a long-established British brokerage with strong regulatory protection. However, investors should look deeper into whether these claims are accurate and still valid.

UIIC states that it is regulated in the United Kingdom and has an FCA license.

According to the publicly available historical data, UIIC was indeed regulated by the Financial Conduct Authority (FCA) at one point.

However, traders must verify:

Address Listed

WikiFX‘s on-site verification confirms that UIIC has a physical presence at this address, strengthening the firm’s credibility.

However, regulatory status can change over time, especially with long-running brokers. Traders should always check the current FCA register to ensure that UIICs license has not been revoked, expired, or suspended.

To understand whether UIIC offers the same level of safety and transparency as a standard UK-regulated broker, its important to compare key criteria such as regulation, trading conditions, transparency, investor protection, and operational history.

Regulatory Status & Transparency

| Criteria | UIIC | Typical FCA-Regulated Broker |

| Regulation | Claims FCA regulation (must verify if still active) | Fully regulated with an active FCA license |

| Regulatory Information on Website | Limited, sometimes outdated | Clear FCA license number, registration, permissions, and legal entity |

| Compliance Reporting | Not fully transparent | Must submit regular reports to the FCA and meet strict capital requirements |

Client Fund Protection

| Criteria | UIIC | Typical FCA-Regulated Broker |

| Segregated Accounts | Not clearly stated | Mandatory – client funds must be held in segregated Tier-1 bank accounts |

| FSCS Insurance | Not clearly confirmed | Retail clients protected up to £85,000 under the Financial Services Compensation Scheme |

| Negative Balance Protection | Not explicitly mentioned | Required under UK law for all retail clients |

Trading Conditions

| Criteria | UIIC | Typical FCA-Regulated Broker |

| Leverage | Possibly higher depending on region | Capped at 1:30 for retail traders under FCA rules |

| Spreads | Can vary; MM model may offer wider spreads | Transparent, published spreads with standardized pricing |

| Order Execution Model | Market Maker (MM) | Can be MM, STP, or ECN but must disclose execution practices clearly |

Operational History & Reputation

| Criteria | UIIC | Typical FCA-Regulated Broker |

| Years of Operation | Founded in 1994 (over 30 years) | Usually 5–20+ years |

| Physical Office | Verified by WikiFX at 58 Fenchurch Street, London | All FCA brokers must have a verifiable UK physical office |

| Public Reviews | Mixed or limited | Widely reviewed and monitored on multiple platforms |

Website & Information Disclosure

| Criteria | UIIC | Typical FCA-Regulated Broker |

| Website Clarity | Limited information on accounts, spreads, and fees | Detailed, standardized, fully transparent disclosures |

| Legal Documents | May not be comprehensive | Must publicly provide Terms of Business, Risk Disclosure, Client Agreement, Execution Policy |

| Updates | Some outdated pages | Regular updates required for compliance |

Where UIIC Performs Well

Where UIIC Falls Behind

WikiFX On-Site Survey Results

WikiFX has conducted an on-site inspection of UIIC in the UK.

Key findings include:

On-site verifications do not guarantee a brokers regulatory compliance or trading fairness, but they do confirm physical presence, which many fraudulent brokers lack.

Although some information varies by region, UIIC typically provides:

1. Trading Instruments

2. Account Types

Specific account types are not publicly detailed on all regions of UIICs website, but most Market Maker brokers offer:

3. Trading Platform

UIIC reportedly supports MetaTrader or proprietary trading software. More verification is recommended depending on the official website.

4. Leverage & Spreads

✔ Pros

✘ Cons

Based on available evidence:

UIIC appears to be a legitimate broker with a long operational history and physical presence in London.

The firm has been FCA-regulated in the past, which strengthens its credibility. However, the most important step for traders is to verify the brokers current regulatory status, as licenses can change over time.

If its FCA license is still active, UIIC can be considered a trustworthy and compliant UK broker.

But if the license is inactive, traders should proceed with caution.

UIIC is a broker with a long history and a real office in London, giving it an advantage over many offshore or unregulated brokers. However, regulation and transparency remain the determining factors.

Recommended steps before opening an account:

If UIIC is still fully regulated and compliant, it may be a safe option for traders seeking a UK-based Market Maker broker.

Disclaimer:

The views in this article only represent the author's personal views, and do not constitute investment advice on this platform. This platform does not guarantee the accuracy, completeness and timeliness of the information in the article, and will not be liable for any loss caused by the use of or reliance on the information in the article.

Trading Pro Review for 2026 with updated data on licenses, leverage, and user complaints from Malaysia, Indonesia, and beyond. Read our verdict now.

Is FX SmartBull applying B-book trades instead of real trades? Does the United Arab Emirates-based forex broker imply unfair charges on profits earned on the trading platform? Does it disapprove the withdrawal request without giving valid reasons? Is your FX SmartBull withdrawal application rejected due to a trading abuse claim by the broker? These are some raging complaints against the broker’s alleged suspicious forex trading activities. In this FX SmartBull review article, we have investigated some complaints. Read on!

AMarkets Review 2026 shows no regulation, hidden risks, and unsafe trading conditions. Don’t risk your funds—choose a regulated broker today.

Read our Olymptrade Review: 57 complaints, offshore license, no regulation. Protect your funds—avoid risky brokers. Click to learn more!